EURUSD BULLISH OULOOK CONTINUESEUR is slowly gaining momentum against USD, after ECB raises borrowing cost, although the terminal rate of the currency remains unchanged and the risk for the Italian bond due to the political situation in the country.

On the other hand, USD is giving up to the EUR due to the decline of treasury yields after some concerning data regarding factory activity and unemployment benefits.

RSI's slow moving line is bouncing off the oversold zone and it's slow line is way above it. MACD histogram is also above the 0 line confirming bullish trend.

If the trend continues, it might test its previous high at 1.06, but if we see a reversal, the currency might try to test its parity again.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

RATE

EURUSD BUY short-term and sell again for long termEURUSD get some gain due the next ECB interest rate on Jul 21.

but as you know, the divergence of EUR and USD interest rate and monetary policy is high and long-term movement for this pair is still short to equal price or even lower than equal price.

So its good idea to wait and looking for low risk sell area on 1.017 and 1.0185 to the equal prices

Altcoins could see more pain as Feds keep up Interest rate hikesUsing a 4 hourly chart. Unfortunately, as we move into this bear market with all of the recession and inflation fears we will continue to see a drawdown in crypto prices. As I posted recently on a hidden bearish divergence with the Altcoin market cap chart we are starting to see a pullback already. I have a fractal for illustrative purposes only and as a visual of what can happen price-wise. Inflation numbers come out July 13th and then after this we will know how aggressive the Feds will be with the next rate hike.

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

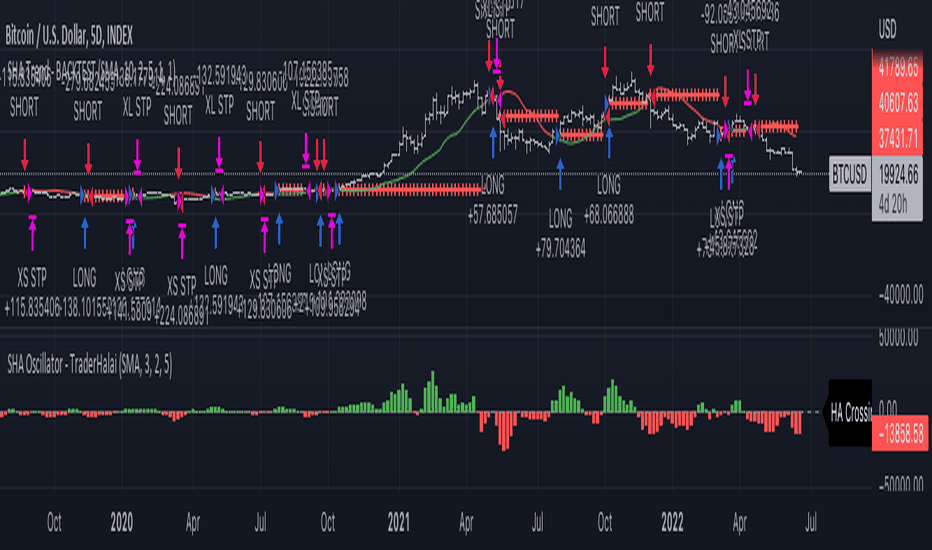

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

SPY- Potential Reversal (Update- Bullish)Following a massive head and shoulders forming, the SPY has seemingly found a bottom. Watching closely for a potential bullish reversal here as there has been quite a clear shift in momentum the past few days. The SPY is forming an inverse head and shoulders on the hourly timeframe (Not Pictured, while also forming a massive bullish harmonic pattern as well as a bullish ABCD Elliot Wave on the 4-hour timeframe (See attached chart below). This is accompanied by bullish divergence on the RSI as well as a clear increase in buyer volume relative to seller volume. Still treading lightly at the moment given broader economic conditions and very possible rate hikes by the Fed coming, however, am leaning more towards bullish than bearish at the moment. Staying hedged & scaling into long-term buying opportunities. Just some FIB levels and RSI-based supply and demand zones to keep an eye on in the meantime - (Previous Charts Attached Below)

-- 4-Hour Timeframe --

-- Previously Charted --

PSAVERT - the personal saving ratePersonal saving as a percentage of disposable personal income (DPI), frequently referred to as "the personal saving rate," is calculated as the ratio of personal saving to DPI.

Personal saving is equal to personal income less personal outlays and personal taxes; it may generally be viewed as the portion of personal income that is used either to provide funds to capital markets or to invest in real assets such as residences.

Bearish Megaphone on the SPY - UpdateJust posting another update here on the SPY- Bearish megaphone is playing out as expected but also a very big week for the markets fundamentally & technically speaking. The SPY rejected its 200day SMA today while simultaneously forming a right shoulder to complete a head and shoulders (Bearish) on the weekly timeframe. Additionally, the SPY formed a bearish butterfly harmonic pattern on the daily timeframe.

However, there does appear to be a smaller bullish falling wedge within the bearish megaphone charted above. As I see it, the SPY went to breakout from the falling wedge but got rejected by its 200-day SMA after Federal Chairman Jerome Powell stated that a 50 bps rate hike is "absolutely essential". Big tech earnings (AMZN & GOOG) have the potential to single-handedly carry the S&P 500 so will certainly be interesting to see the rest of the week as to what's to come. Some FIB levels and RSI-based supply and demand zones to keep an eye on in the meantime, bearish and hedged- (Previous Charts Attached Below)

--Previously Charted--

Winning rate (Course #1)The goal of this page is that you understand winning rate and how it works.

Your win rate is how many trades are winning trades out of all the trades. This is fairly easy and straightforward.

Did you know that you don’t need to win 100% of the time?

As a matter of a fact, I found that algos with a VERY HIGH win rate (98-99%) are the worse ones, because the 1-2 % of losing trades represent a loss that is usually equal or bigger than all the gains altogether.

See below one of my very first profitable algo. I never got that major loss with this algo, but I knew it would come. I got lucky because I stopped the algo right before a big move against me, which would have caused a liquidation event (similar to what happened to me with the PSAR bot from Swing Trade Pros, see the introduction post).

This is basically 769 trades with no loss whatsoever. June July Mid August 2021. This is great right? Yes, but I never slept well because I knew my strategy had a flaw and I could get liquidated at anytime. This algo is one of the algo I run side by side with my hands free algo. I just turn it off when I know that I am at risk of being liquidated. Or, I turn it on when I am rather confident of the direction of the market overall.

So what is the point of having a 99% win rate if the 1% loss can erase the 99% profits?

In reality you will find that most traders or strategies varies between 25% and 45% win rate. You might think how come you can be profitable if you win only 25% of the time? Hang on I will prove it to you below.

My best strategy has a 45% win rate approximately. I have great strategies with 25% win rate also. Most manual traders (no algo) are at about 30 to 35% win rate. Some of these guys on Twitter (very rare) have over 50% win rates, same as Market Cipher Crypto Face, he’s got a higher than 50% win rate I think. He is a very good trader, and this is why he’s very wealthy, because he knows how to manually trade. This benchmark should give you a good idea of what to expect.

Another thing – the higher the time frame you use, the higher your win rate. For example, Bitcoin has a tendency to go up only – at least on the macro level, let’s say on the daily time frame. So right there you have what we call an edge, this is an advantage over the market. The advantage is a higher probability to go up than to go down. Because of that, you can easily develop an EMA crossover strategy that will win more than 50% of the time! EASY!

Now if you trade on the 5 min timeframe, you literally have a 50% chance for the price to go in either direction. You can try to play the trends here and there, check the momentum, whatever, but if you have traded Bitcoin for long enough, you should know as much as me that ANYTHING can happen at ANYTIME – and even if you were over the 200 EMA, even if Market Cipher showed a bullish divergence and even if you were at a major horizontal support, ANYONE can dump the market (e.g. a whale – or Elon tweeting) and go against all the odds. Because anything can happen, it is much harder to have a really high win rate.

So how can you make money if you win only 30% of the time?

Check out the example : out of 10 trades, only 3 of them are in profit (3/10 = 30%)

Does the order of the trades change the final profit?

I shuffled the order of the trades – we can see that it doesn’t matter whether you have a losing strike or more losses before the wins, the results at the end is totally the same.

So YES you can make money and lose the majority of the time. It doesn’t take anyone a Master’s degree to understand that this is due to the relative size of the wins to the losses. This also introduces the concept of R multiple, which I cover in Tutorial 5.

Take a look below at the 10% win rate strategy.

Personally I would love to have this strategy with a 10% win rate! Imagine this is 1 day worth of trades, you end up making 2.314% ! If you do this everyday, you can almost double your money in 1 month! This is true! This is also because of compounding, which I will cover in Tutorial 2.

On this example, you can see the winner in relation to the losses, is much larger. 12% win is 12 times bigger than the average loss.

What if I don’t compound at each trade? Well in this case, you would get 3% return overall.

Before I jump into the conclusion, I want to talk about my 99% win rate strategy. Now that we have covered some examples, thing about a strategy that has a 1% win rate? QFL Luc is a great trader and in one of his videos, he talks about this guy who basically has a trading system with almost a 1% win rate. The thing is, each losses is super small. But 1 time out of 100, he gets right at a bottom or a top, and the trade goes in his favor, and he makes a huge gain, which covers for all his losses! Cool right!

Conclusion:

Most algos and manual traders have win rates in the 30-40% range.

The profitability is the result of the size of my winners as compared to the size of my losers.

“Keep your losses small and let your winners run”.

Bitcoin's Crossroad - FOMC March 2022I believe this is the only way to view what may happen in the near term future with BTC price speculation.

I know twitter is full of perma-bulls saying that 32/33k will never be seen again, they could be correct, but regardless their bias shows because they are making their decision too early...

Perma Bears said we were going to 18-14k even 11k last week on Russia Fears, and the War is turning out to be worse than expected, while the market as well as BTC has shown resiliency in the face of the worst potential conflict in the modern era... Super Power Conflict... even with Gold Spiking... BTC pumps??? (STRANGE)

We will know soon what is going to happen, but anyone calling it today is at best, an over-eager trader. This point today, makes a great short opportunity... March 15th, we will see what happens...

Buy the Rumor, Sell the News? - Goodluck!

(Near Term Short, (1-3 Days out) - 35-37k retest possible... we are at major macro resistance here...

THE 40 YEAR BEAR MARKET IN 10 YEAR TREASURY NOTE INTEREST RATEThe attached chart shows 40 years of declining 10 year rates. As we all know, that rate is the basis for mortgage rates and just about everything else. During that half cycle the housing market boomed, the stock market boomed and generally speaking, corporations and individuals prospered.

But that trend has ended.

Thursday I would have said that rates would either remain low for an indefinite period while inflation soared or rates would be raised to quell inflation. But Friday Central Banks around the world announced tightening.

The party is over!

It is time to batten down the hatches, lock in long term profits on stocks, rentals and any other investments that correlate inversely with interest rates.

Obviously the major players saw this coming and started bailing at the first of2022.

Now us little fish must do what we can to avoid losing the wealth we have.

As an aside, it was announced last year that Bill Gates was diversifying into farm land. Obviously that anticipates food shortages and inflation.............

I will post more on this once the picture becomes clearer.

midnitepoet

Rate Chart and Order 0/10 (fail)Hi,

I've just started trading on TradingView, before that was on binance. Found Binance much easier to set order but their chart is ugly. Like old pixeled screen when you zoom out and blury image.So ive actidentally failed at order ofc Limit amount wasnt executed as i wanned : D ,but its fine 30e are at stake no biggie...

So how does my chart looks. Does it make sanse ? :( :)

EURUSD wrong crash, FED not increase rate yet ,they only speak no real increase rate yet ,dont panic , mr Powell (US FED) only speak and say his idea (dont say 100% we will increase rate) and say in 2023 MAYBE we increase rate (not today ,in 2023 ) !

THERE ISNT ANY REAL ACTION behind eurusd joke crash ,nothing happend yet

apnews.com

after emotion reduce,eurusd will fly up and will start new + up trend for new high (record)

we strongly advice (after speak many pro traders in larg banks,funds) ,dont inter sell (main trend is + up) , looking for buy and hold it until new high (with sl in low)

for next days daily SMA200(orange line) in focus , it is very important,break it mean up trend started ,if you have buys , dont fear ,eurusd will fly up soon , but if it can break 1.177 big trend , hedge them with sell (lot=0.5* total buys) allow price go down,back to up (+ trend appear) then close sell frist ,then on high close buys

if you have sell , inform US10Y yeild going down, will push eurusd to up soon, so 100% put SL on day high , if eurusd go up ,never will back here again

arrow green,red= powerfull limit order place with SL=40 pip and min tp=120

good luck

A beautiful trade.A textbook trade out in the real world.

Price has been moving in a good upper channel for some time and it has reached the resistance trend line for the channel.

An extremely good chance that the price will travel down to the supporting trend line.

The stop loss is placed very tightly, if by chance it gets taken out, enter again when it retests at the above (near the blue rectangle).

However, if you wanna play conservative, go with the blue line that I drew as a small trendline, when the price touches that, look for a retest and nice bearish candle, and enter the trade with a good stop loss above the resistance level.

Never risk more than 0,5% on a single trade and stop-loss to entry when 2 RR achieved.

Nothing is guaranteed in trading but finding high possibility setups with a good probability of the trade working out may just do the job.

Audusd ...a potential to pullback on a downtrend ?How will the cash rate push AUDUSD to?

#shadowingthebigboys

#trading

#forex

If you like my analysis and it helped you ,do give me a thumbs ups on tradingview! 🙏

And if you would like to show further support for me, you can gift me some coins on tradingview! 😁

Thank you!

Tradingview Disclaimer

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

The author/producer of these content shall not and will not be responsible for any form of financial/physical/assets losses incurred from trades executed from the derived conclusion of the individual from these content shared.

Thank you, and please do your due diligence before any putting on any trades!

Super set of oscillators by Thomas DeMark!Dear friends!

I continue describing oscillators developed by Thomas DeMark.

In my previous articles, I have already explained such tools as

TD REI and TD POQ (look here ).

In this post I’ll continue describing technical tools developed by Thomas DeMark.

TD DeMarker I

I’d like to start with the TD DeMarker I indicator. It is similar to TD REI and aims to distinguish between trend and non-trend movements in the market, and then, having determined the trend, it searches for reversal points depending on how the indicator reacts to oversold and overbought levels.

Its calculation technique is very simple. TD DeMarker I compares the current and the previous trading day’s highs according to the following algorithm:

1. Calculate the TD DeMarker I numerator

• If the current bar’s high is higher or equal to the previous bar’s high, the difference is calculated and added to the numerator.

• If the current bar’s high is lower than the previous day’s high, then zero value is assigned to that bar. Next values of the difference between the highs for each bar are added to the numerator over a series of 13 consecutive bars.

• If the current bar’s low is equal or less than the previous price bar’s low, then the difference between the previous day’s low and the current low are the numerator.

• If the low of the current bar’s is greater, a zero value is assigned to the nominator at this bar. The next values of the difference between the lows for each bar are added to the numerator over 13 consecutive bars.

2. Calculate the denominator of TD DeMarker I equation

• You add the value in the denominator to the sum of the differences between the lows in the same period.

3. Calculate TD DeMarker I = divide the numerator by the denominator.

• As a result, we get a value that will move in the range from zero to 100 in the form of a fluctuating 13-period line. At the same time, the overbought zone will be above 60, and the oversold zone will be below 40.

Now, let’s find out how this indicator’s signals are interpreted

A buy signal should satisfy the following conditions:

1. DeMarker I must not be below 40 for more than 13 bars

2. The bar’s close at the signal level should be lower than the low of one or two bars ago

3. The bar’s close at the signal level must be lower than the previous bar’s open or close.

4. The open of the next bar following the assumed reversal bar must be less than or equal to the close of any of the two previous bars.

5. The asset must be trading higher than at least one of the two previous closes.

As an example, I’ll take the BTCUSD market situation that has recently occurred. It is clear from the above chart that the BTCUSD was in the overbought zone (above 60) from the start till the end of May. Afterwards, the price rolled down below 40 and the indicator entered the oversold zone.

Immediately after that, we look for a point where the bar features the low before price exits the oversold zone.

Finally, when the price went beyond the oversold zone on June 13, we can easily identify the low in the period when the ticker had been below 40, according to TD DeMarker I.

Now, we can analyze the continuation pattern based on the above conditions.

1. The DeMarker I indicator was below the level of 40 for not more than 13 bars - in our case it was only 5 days;

2. The bar’s close under the red arrow is lower than the previous bar’s low (blue dots are above than the red dotted line).

3. The close of the bar below the arrow is lower than the previous bar’s open and close (blue dots are far lower than the previous bar).

4. The next bar’s open following the reversal bar is equal to the previous bar’s close (there are no gaps).

5. The asset is trading higher than the previous bars’ close levels. Furthermore, when the indicator exited the overbought zone, the price had been already trading above all the previous bars’ close levels.

Therefore, one could have safely entered a buy trade at the current level when the new bar of June 14 opened (I marked it with a red cross in the chart).

As we already know, this signal reached the target and provided the opportunity to gain on the BTCUSD movement up to the high at 14 000 USD.

I should note that when a buy signal is not confirmed, that is, the five conditions above are not met, there is still a signal, but it is a sell signal. Although such a sell signal cannot be as strong, it can be a confirmation for bearish signals of other indicators.

There is a good example in the chart above. It displays bitcoin’s all-time high at 20 000 USD.

After the DeMarker I had been in the overbought zone for quite a long time, it moved into the oversold zone, and so, we start counting and see how long the price will be in this zone.

Finally, there is the following situation:

1. DeMarker I was not below the level of 40 for more than 13 bars, in this case it was 12. So, this condition is satisfied.

2. The close of the bar under the red arrow is lower than the previous bar’s low (blue dotetd line is below the red dotted line). This condition is also satisfied

3. The close of the bar under the arrow is lower than the previous bar’s open and close. This condition is also met.

4. The open of the bar following the reversal bar is equal the close of the previous bar (there are no gaps). This condition also confirms the bullish scenario.

5. The asset is trading above the previous close levels. This condition is not met.

It is clear from the above chart the bar following the oversold zone (marked with a red arrow) went down lower than the close levels of the previous two bars, and, moreover, it was trading below the close level of the two bars preceding the reversal bar.

Therefore, the last condition is not satisfied, and so, we have the reasons to assume that there is a real reversal of the bullish trend.

Now, let us study the sell signals.

The following conditions must be met:

1. A sell signal should meet the following conditions:

2. The indicator must be above level 60 for at least six bars.

3. The signal bar’s close must be above the previous bar’s open and close.

4. The open of the bar following the signal must be equal or higher than the close of any of the two previous bars.

5. The asset must be trading below one of the previous close levels.

As soon as all these conditions are satisfied, it can be interpreted as a sell signal.

TD DeMarker II

The above chart presents an example of the Bitcoin bullish trend reversal in December 2017, after which there started a long-tern bearish trend. Let us analyze this situation as a bearish signal. When the bar marked with a red cross was forming, the DeMarker I indicator leaves the overbought zone and goes below level 60. Therefore, it is the case for looking for a sell signal within the zone, where the price was above level 60 (the zone is highlighted with green in the chart).

The red arrow highlights the bar that closed higher than the highs of the previous two bars, and so, higher than the previous bar’s open and close (in the chart, it is marked by the purple dotted line on December 17 that is above the green line). The next bar, following the one with the red arrow, also meet the condition and opens above the close of the second-last bar. Finally, there is the trend reversal signal and the opportunity to take the profit on December 20 (it is the bar marked with the red cross in the chart). However, this indicator, like other technical tools, may send false signals. To filter the entry signal, it is recommended to apply TD DeMarker II as a supplementary tool.

TD DeMarker II

Unlike the TD REI and TD DeMarker I, which compare the price highs and lows with those of one bar ago, TD DeMarker II analyzes a number of price ratios to measure the pressure of buyers and sellers.

Let us study the calculation formula of the TD DeMarker II.

Calculate the numerator:

1. Calculate the difference between the current bar’s high and the previous bar’s close.

2. Add the result to the difference between the current bar’s close and its low.

3. Distract the previous value from the current bar’s high

4. Sum up all the values. If there is negative result, assign a zero value to it.

Calculate the denominator:

1. Add the difference between the current bar’s low and the previous bar’s close to the numerator.

2. Add the result to the difference between the current bar’s high and its close (this value defines the selling pressure).

The buy and sell signals of this indicator work under the same conditions as for the TD DeMarker I, so, I won’t enumerate them again. I have already many times mentioned that, if multiple buy or sell signals are at the same place, the signal becomes much stronger. As it is clear from the above chart, a buy signal sent by the TD DeMarker II (green cross) matches to the one sent by the TD DeMarker I (red cross), which in combination confirms the sell signal and enhances it.

TD Pressure

DeMark suggests that the price action is directly affected by the supply/demand ratio. As the price change is often preceded by a change in trading volume, DeMark suggests measuring the speed of changing in the trading volume along with the speed of price changes. In addition, according to DeMark, these parameters are more important for the current bar, rather than for the complete bars. In general, these values determine the buying pressure on the market, which is calculated by subtracting the current bar’s open from the its close and dividing the result by the price range of this bar.

The result is multiplied by the trading volume of the current period and is added as a progressive total to the indicator value.

Finally, we have an indicator that shows buying pressure. For example, if the bar’s open is equal to its low, and the bar’s close is equal to its high, then the trading volume will be on side of buyers, and the indicator will display a strong rise of buying pressure. And vice versa, if the bar’s open and close coincide, even a greater trading volume won’t affect the indicator, as the market will be balanced, and the bulls’ power will be roughly equal to that of bears.

The indicator’s band moves from 0 to 100%, and the overbought and oversold zones, like for the indicators, described above, are the zones above 60 and below 40 respectively. The buy and sell signals sent by this indicator are interpreted in the same way as those sent by TD DeMarker I and II. Besides, this indicator is also a confirming one, and when it coincides with other signals, it confirms the indicated direction.

You see in the above chart that the signal sent by the TD pressure (yellow cross) matches to the signals sent by the DeMarker I and the DeMarker II (red and green crosses respectively), which means that the sell signal is true.

TD Rate of change (TD ROC)

TD ROC is an integral component of TD Alignment but can also be used in isolation as an overbought/oversold indicator.

It is thought to be quite simple and is determined by dividing the close of the current price bar by the close of twelve price bars earlier.

Although it is pretty simple, this indicator is quite efficient. According to Thomas DeMark, the bears’ zone is below 97.5. Bulls zone is above 102.5. Therefore, when the indicator is in a narrow band between 97.5 and 102.5 the market is in balance.

So, this indicator helps you identify the market sentiment at any moment.

But this is not its primary advantage. You can employ this indicator in technical analysis and draw the common patterns and trend lines. The chart above shows how a triangle worked out. A strong momentum, marked with a red arrow, draws the indicator beyond the triangle, which means that the market lost balance and started moving in the bullish trend.

Next, after the triangle was broken out and the bullish trend started, we build trend lines according to the common rules; in the bullish trend, the trend is outlined along the support line (red line), in the bearish trend -along the resistance lines (green line).

It is clear from the chart above that the breakout of these lines and entering the bear zone send a sell signal (red cross) in early July. Afterwards, we build the trend line along the resistance levels sand expect until the price breaks it through and enter bullish zone. Finally, in the mid-July, there is such a buy signal, marked with green cross in the chart.

Next, there is a strong growth in the bullish trend that is marked with the red trend line. The breakout of this line sends a signal to take profit, and entering bearish zone again signals the trend weakness.

As you see from the chart above, the indicator broke through the green trendline in late July but it hasn’t entered the bullish zone, and so, there has been no buy signal so far.

Another signal that really matters when using this indicator is the signal of convergence and divergence.

These signals are rarely sent by this indicator, but they are usually quite accurate, especially in long-term timeframes.

There is a clear divergence in the above chart. When the price is growing, the indicator is declining, which signals the trend exhaustion. In early July, the price couldn’t break through the previous high, thus confirming the direction of the indicator (marked with a circle).

Finally, as I have already said, the indicator went down below the trend line, which sends a strong sell signal; however, as you know, the bearish correction didn’t work out, so, for an accurate forecast, it important to employ all the DeMark's tolls together.

TD Alignment

Just for this purpose, to combine all the tools together, the TD Alignment indicator was developed.

TD Alignment is a composite indicator that combines the following five TD oscillators to measure buying and selling pressure:

1. TD DeMarker I

2. TD DeMarker II

3. TD Pressure

4. TD Rate of Change

5. TD Range expansion Index (this indicator is described here)

Each of these indicators has its own distinct method of measuring overbought/oversold conditions. TD Alignment is based on the values of all the above indicators according to the principle, where the final result is determined of the number of indicators in an oversold condition, overbought and equilibrium.

In addition, to calculate the TD Alignment, there were defined the following overbought/oversold zones:

Overbought/Oversold

1. TD DeMarker I - 60/40

2. TD DeMarker II - 60/40

3. TD Pressure - 82/12

4. TD Rate of Change - 101/99

5. TD Range expansion Index - 40/-40

Therefore, when the TD DeMarker enters the oversold zone, 1 is added to the total result. If the indicator enters the equilibrium zone, between 60 -40, a zero value is assigned, if it is below 40, 1 is subtracted from the total value.

Based on the same principle, all the indicators are calculated, and finally, there is the TD Alignment value that is moving between -5 and +5. -5 is reached when all the indicators are in the oversold zone, and +5 is associated with the case when all the indicators are in the overbought zone.

Unfortunately, I failed to find the TD Alignment in free access, so I had to write everything on my own. I must admit there may be errors in calculations, nonetheless, it performs quite well during testing. As you see, the main benefit of this indicator is showing the cases when the market reaches the extremes of the overbought/oversold zones.

In the above chart, I highlighted these levels from +4 to +5 and from -4 to -5.

When the indicator reaches this zone, it is obvious that the price will start correction soon and so you should take a corresponding decision on either taking profit or entering a trade. In addition, the indicator shows the market sentiment currently dominating; if it is above zero, bullish sentiment is dominating, if it is below zero, the market is bearish.

Buy or sell signal here must meet the same 5 conditions, described for TD DeMarker at the beginning of the article, the only difference is that you need to count the number if bars above or below zero.

Based on my own experience, I would add one more condition, the sixth one, to be met for entering a buy or a sell trade. A buy/sell signal is confirmed when the TD Alignment indicator breaks through zero level (red dots) only provided that the indicator hit the overbought/oversold zone before.

In the above chart, I tried to illustrate that, after the indicator hits green or red zone, i.e. overbought or oversold zone, the sixth condition is satisfied. So, when the indicator breaks through or rebounds from the zero level, there is a buy or a sell signal (according to the market sentiment, I marked the entry signals with green and red arrows). A red thumb down marks the levels where the market doesn’t reach the zones indicated above, and so, the condition is not met and the buy or sell signal is false; I marked false signal with the red crosses in the chart.

However, not everything is that perfect, because this indicator is rather sensitive and so, it sends quite many false signals. That is why, I do not recommend employing this indicator alone, rather, it should be used together with other DeMark's tools so that it will be more efficient.

I will describe other useful DeMark's indicators and explain how to apply them to BTCUSD trading in my next articles.

Subscribe not to miss the continuation!

I wish you good luck and good profits!