Raydium

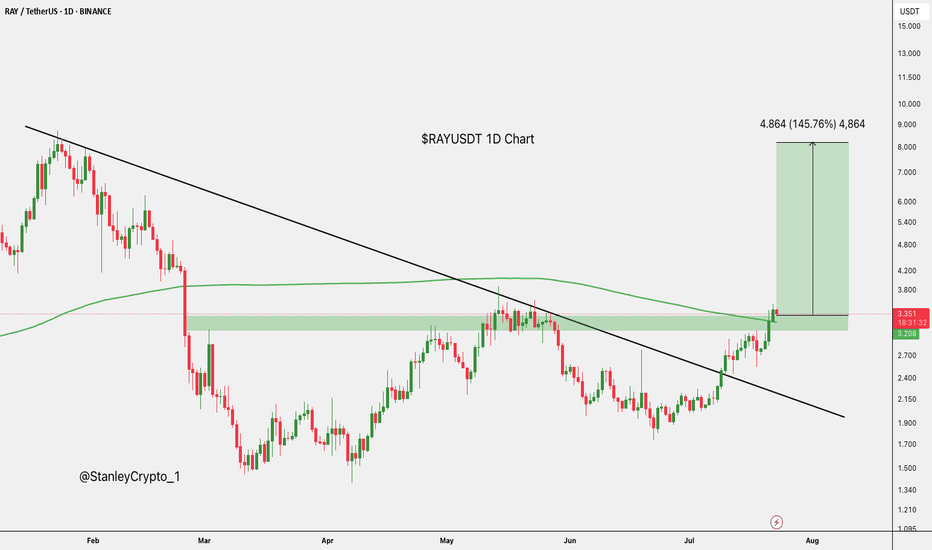

RAYSOL/USDT – READY TO BLAST OFF? PRIME LONG SETUPThis is where smart money is likely to reaccumulate before pushing price higher.

We're targeting internal liquidity levels and prior highs with a clean risk-reward structure.

Confirmation can come from a bullish reaction or engulfing candle within the zone.

Entry Zone: 2.25 – 2.28

Targets:

TP1: 2.365

TP2: 2.485

TP3: 2.660

Stop Loss: 2.151

DYOR:

This idea is for educational purposes and reflects a personal trading plan.

Always do your own research, use strict risk management, and wait for confirmation before executing.

#RAYDIUM #RAY #RAYSOL #RAYUSDT

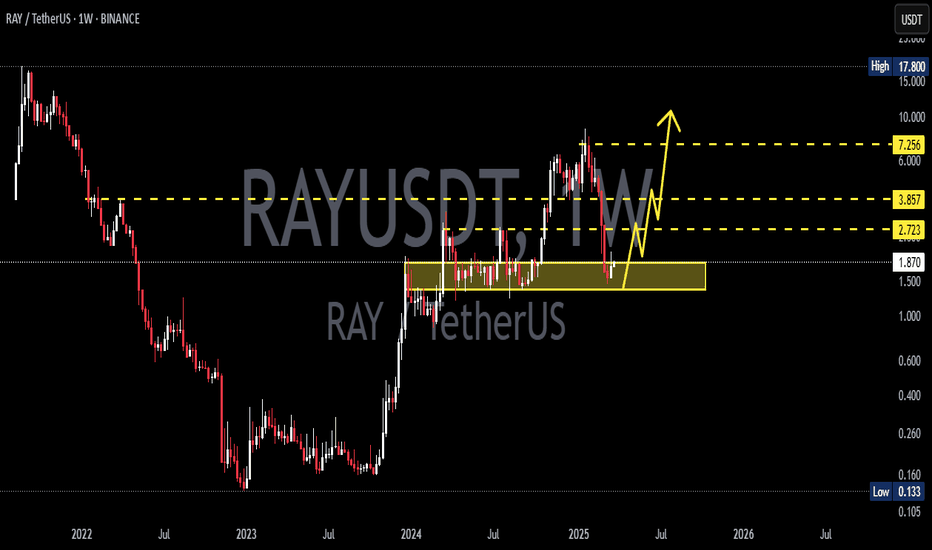

Raydium Medium Sized +545% Wave Mapped (Trading Strategy)This is one of those pairs that grew in astonishing ways since late 2023. Raydium managed to grow by 5,372% from October 2023 through January 2025. Simply amazing. I was very surprised when I found this pair as it moved beyond all expectations.

The last advance was preceded by a six months long consolidation phase. The whales used this period to accumulate. When one phase is long, the next one is short. This means that RAYUSDT can start to grow soon. This is based on the law of alternation.

Needless to say, the chart is full of higher lows and the action continues to be strong. I am tempted to open some LONGs.

This is a solid trade setup. It has low risk vs a high potential for reward.

This one can turnout into something good but please keep in mind that we have a little over two weeks before the market becomes full time bullish. Right now it is still early for the upcoming bullish wave. The reason I am all in now is because my group likes to enter early. Some other people prefer waiting and confirmation. We like early because it allows for maximum profits potential. The risk is higher but also the reward.

If you are uncertain or have doubts, you can always wait. The thing about Crypto is that when it moves it does so strongly, by the time we have confirmation the market is always several levels up. It can make a huge difference.

How you approach the market depends on your trading style, your risk tolerance, your capital, your goals. If you want to get in and get out, it is wise to wait until the action is hot. If you want relaxation, peace of mind and easy profits, it is better to buy and hold. If you have lots of time and energy to invest in this game, you can use all the different methods at the same time; a stack for long-term, a stack for passive hold, a stack for short-term and another portion of your capital for leveraged trades. It is also smart to leave some funds behind because good opportunities come out of nowhere. If we have funds available just because, we might end up with something that does better than our best choice.

It is a big game. It can be entertaining and profitable. There is lots to learn as well. You cannot hide here, if your ego is too strong, you will see the results in your funds. If you cheat yourself, if you lie to yourself, you will know it because your money will be gone. If you are honest with yourself and accept your mistakes, the market will give you as much as you can take.

Namaste.

Breaking: Raydium ($RAY) Reclaims $2 PivotRaydium's ( NASDAQ:RAY ) which is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX)'s native token has reclaimed the $2 pivot albeit the crypto market is in a general market correction.

The asset surge 6%, and is gearing up for a breakout to the $3 resistant as a breakout above the $2.3 region would cement the grounds for a bullish continuation move to the $3 point.

Unlike any other AMMs, Raydium provides on-chain liquidity to a central limit orderbook meaning that funds deposited into Raydium are converted into limit orders which sit on Serum’s orderbooks.

With the RSI at 60, Raydium is poised for the breakout move as momentum builds up.

However, should NASDAQ:RAY fail to pull up the stunt, a consolidation move to the $1.8 support point will be vehemently tested.

Raydium Price Live Data

The live Raydium price today is $1.99 USD with a 24-hour trading volume of $98,068,751 USD. Raydium is up 1.71% in the last 24 hours, with a live market cap of $578,910,409 USD. It has a circulating supply of 290,814,662 RAY coins and a max. supply of 555,000,000 RAY coins.

Raydium RAY price analysisNot so long ago, we published an idea on #OM and wrote that MM holds the price well

And here's what happens when MM lets the price go "free floating" and stops pushing it up on the example of #RAY

If OKX:RAYUSDT fails to consolidate above $4 in the near future, there may be another wave down, and the price of #Raydium may drop to around $1.5

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Breaking: Raydium ($RAY) Surge 15% TodayRaydium an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX) saw its native token NASDAQ:RAY surge 15% today amidst general market volatility.

The asset while trading at the $6- $8 axis just a month ago lost almost 80% of total value plummeting from a high of $8 to almost $1.5 causing panic selling behaviour. But momentum is brewing up.

A move above the 61.8% Fibonacci retracement point could catalyse a bullish move for NASDAQ:RAY with a move to the 1-month high resistant. Similarly, with the RSI at 60, NASDAQ:RAY might experience a temporary cool-off a move that might lead to a consolidatory move to the 1-month low that is not too far from the current market price.

Raydium Price Live Data

The live Raydium price today is $1.86 USD with a 24-hour trading volume of $260,230,671 USD. Raydium is up 15.98% in the last 24 hours, with a live market cap of $541,218,025 USD. It has a circulating supply of 290,847,971 RAY coins and a max. supply of 555,000,000 RAY coins.

#RAY/USDT#RAY

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 4.10

Entry price 4.46

First target 4.60

Second target 4.75

Third target 4.92

TradeCityPro | RAY: Key Levels and Market Scenarios Unfolding👋 Welcome to TradeCity Pro!

In this analysis, I’ll be reviewing the RAY coin, which belongs to the Raydium project—one of the leading DEXs on the Solana network, processing a significant volume of transactions on the chain.

📅 Weekly Timeframe

On the weekly chart, we observe a strong uptrend that began at 0.162. The first leg of this rally pushed the price to 2.724, followed by a correction, and then another leg extending to 7.215. Currently, the price is consolidating near this resistance level.

🔍 The 7.215 level coincides with the 0.618 Fibonacci Extension, making this a crucial Potential Reversal Zone (PRZ). If this level is broken, the next bullish leg could begin, with a minimum target of 15.803. The next major resistance aligns with the 1.0 Fibonacci level at 21.995. If the uptrend continues beyond this point, further targets will be identified in future analyses.

🕯 On the downside, considering the declining volume and shrinking candlestick size, the probability of a correction is notable. The first support level to watch is 2.724. Additionally, the RSI is hovering near a critical support at 58.34—if this level breaks, the likelihood of a correction increases.

🔽 The next and most significant support level is 0.94. If the price falls below this point, it could signal a shift in the high-wave cycle, leading to a significant downtrend.

📅 Daily Timeframe

On the daily chart, the latest bullish leg started at 1.399 and extended to 6.363. The price is currently ranging between this resistance and the 4.352 support level, which also aligns with the 0.236 Fibonacci retracement, making it a key PRZ in this timeframe.

✨ Yesterday’s candlestick showed a sharp downward move accompanied by panic selling, followed by a recovery back toward the 6.363 resistance.

🔼 For a long position, the first breakout trigger would be 6.363, which I consider the primary trigger. The next breakout level is 8.090, but this was formed due to a fake move. If you miss the breakout above 6.363, you could consider entering upon the breakout of 8.090.

📉 However, yesterday’s volatility liquidated many long positions, causing significant fear among buyers. As a result, there are currently fewer buy orders in the support zones, which could allow the price to continue its downward move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

If the RSI breaks below 38.94, the probability of a corrective move increases. In such a scenario, the price could retrace to key Fibonacci levels such as 0.382, 0.5, and 0.618. A deeper correction could lead to the 2.724 support level, and if this level breaks, the market trend could turn bearish for an extended period.

Raydium (RAY) Defies Market Trends, Hits 4-Year HighRaydium’s native token, RAY, is stealing the spotlight as it climbs to its highest price since 2021, bucking the broader market downturn. Over the past 24 hours, RAY has emerged as the top gainer, fueled by increased trading activity and strong demand.

A closer look at the RAY/USD one-day chart highlights bullish momentum. The Chaikin Money Flow (CMF) indicator, sitting comfortably above the zero line at 0.23, signals robust buying pressure. If this trend continues, RAY could challenge resistance at $8.96. Breaking past this level might push the token to $11.05, setting its sights on the all-time high of $17.80.

However, the bullish outlook comes with caution. A surge in sell-offs could derail RAY’s ascent, causing it to dip below the support zones of its Ichimoku Cloud. In this bearish scenario, the token might slide back to $4.30.

As the native token of the Solana-based automated market maker (AMM) Raydium, RAY is leveraging its role in the DeFi ecosystem to fuel its rally. Will this momentum hold, or will the market pullback catch up? For now, RAY is a standout performer in an otherwise bearish market.