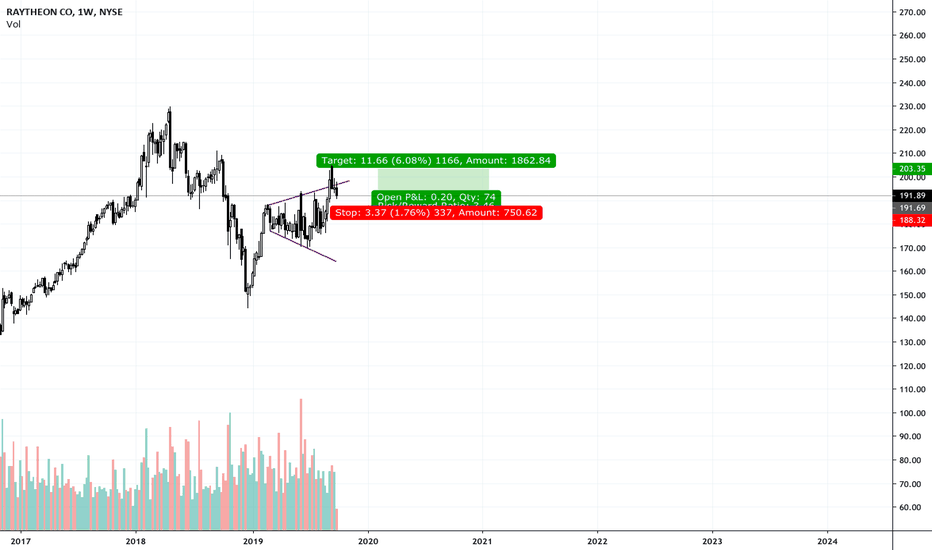

RTX Bullish Cypher, Dave Portnoy is early! I seen the executive president of DDTG global global global grab some RTX so I checked the chart. Thought I spotted a bullish cypher, and measurements line up.

I think Davey is a little early on the long. My play will be a scalp short of the break of (B) for a position reverse at the multi level confluence (D) point (entry long). Typically the take profit long would be C to D retrace of .382 and .618, but I will leave half on for trend continuation higher.

Raytheon

RAYTHEONSo this is more about finding a way to write all my calls and ideas and be accountable.

But I see a broadening wedge on Raytheon , I would hope RTH, would go above the top line and use that as support,

The current geopolitical environment with Iran , is one of the reasons why I think RTH, may be a semi-ok play

I feel more can happen that would make a RTH, bull case then bear case

I want to let this trade play out, before October 14th -> Trade talks

But if the position is in profit on Friday I make just bank it and leave

I will reconsider my position at 188, I have no hard stop, if only RTH goes down to that level and it isn't a entire market move , that is a situation I will reconsider my original thesis.

Going on my previous notation of October 14th

I will be looking at Brexit on October 31st If it happens to see how I play my open positions,

-> I'd rather be out during those events and see what happens

BULLISH SECTOR! HUGE CONTRACTS! BUYOUT COMING!KRATOS DEFENSE & SECURITY SOLUTIONS

This is a rare opportunity to get in on the ground floor of a potentially MASSIVE run to between $20 and $30 a share especially with all the turmoil in the world combined with a massive multi-billion dollar increase in Military Spending by this administration.

KTOS, within the last few months, has landed gigantic contracts, one of the contracts could fetch the company upwards of $10 BILLION in equipment/service revenue.

Investors Business Daily ranks KTOS extremely HIGH:

E.P.S: 76 (Anywhere between 75 to 99 is a solid company/e.p.s rating)

Group RS Rating: A-

Accumulation/Distribution Rating: B+

Composite Rating: 89

Timeliness Rating: A

Institutional Ownership: 90.86%

On 12/06/2018, just 11 days ago, a buyout rumor hit the wires and the stock spiked.

Since that rumor, the stock has settled back down.

This company CANNOT and we think WILL NOT last by itself without being purchased by another larger company.

Our contact on Wall Street tells us talks are ongoing for a full takeover at between $20 and $25 a share.

Go back and look at the recent contracts and the value of them within the last few months, you will be amazed.

We finished adding to our large position today.

2.5 Million Shares Long

Average Cost: $12.44

THE STOCK IS A BARGAIN AT CURRENT LEVELS!

Raytheon - Buy The Dip - Sell the TrendRaytheon had a nice earnings beat and the price took a tumble. Hopefully we will see a return to the previous growth trend (shown with Linear Regression @ 250 four-hours).

I've seen two articles on Seeking Alpha screaming the same thing I am:

BUY THE DIP!

The 'rate of change' graph shows RTN rate of change vs. SPY rate of change. It's just a script I'm working on right now.

SeekingAlpha articles:

seekingalpha.com

seekingalpha.com

Drums of War ?Good morning traders,

Sad start of the week, with another terrorist attack in London. Stand together.

This is added to the conflict in Middle East , Qatar breached diplomatic relations with its counterparties in the gulf region, presumably due to support of terrorism.

Reviewing military-related stocks, they are very bullish. Is this drums of war symptom ? Or just trending like rest of the market ?

In any case, have a great trading week , in peace.

Josep Pocalles

Time 2 short RaytheonRaytheon stocks after 2009 went sky high. Time has come to short them soon!!!!!

Raytheon - $RTN - Possible longRaytheon is in oversold territory with a nice pin bar on the daily chart.

High volume on the rejection from 120 (strong psychological number and previous resistance)

After hours dipped to 118.5 but has since move back up to 120.48 in pre-market.

Entry order above yesterdays high. Target 128.