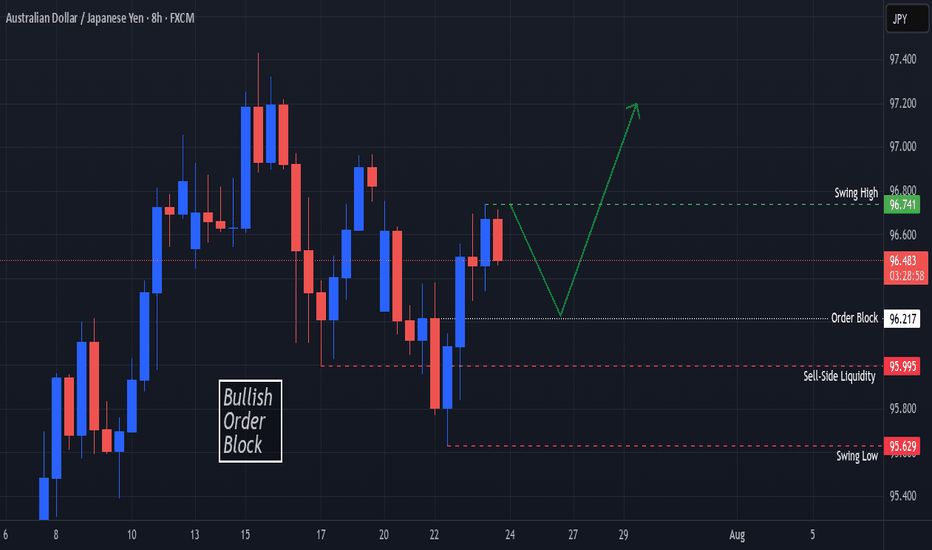

AUDJPY Bullish Order Block In SightOANDA:AUDJPY Price finds Support at the Swing Low @ 95.629 and creates a Swing High @ 96.741!

Based on the ICT Method, the Swing Low broke Sell-Side Liquidity @ 95.995 and opened up a Bullish Order Block Opportunity @ 96.217!

Price is currently working down from 96.49 at the time of publishing but once Price visits the Order Block, this could deliver Long Opportunities!!

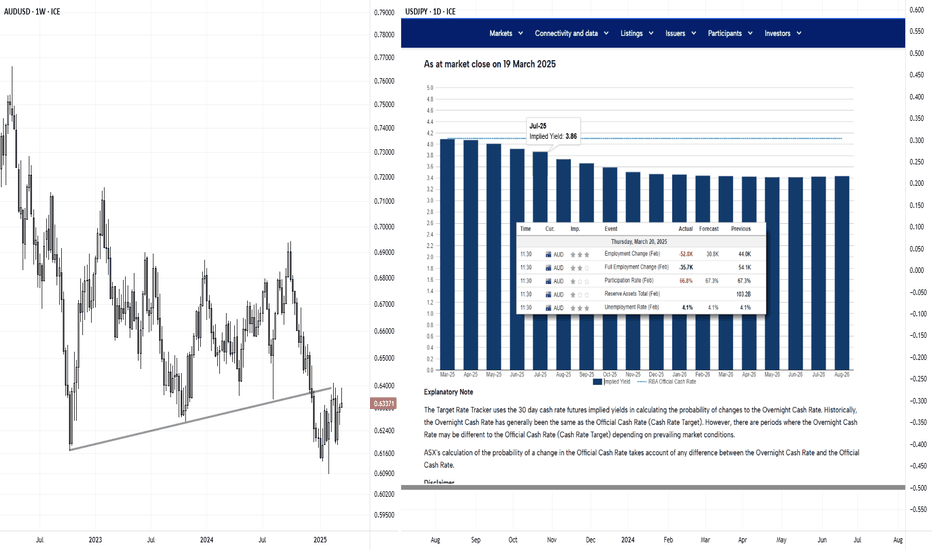

RBA

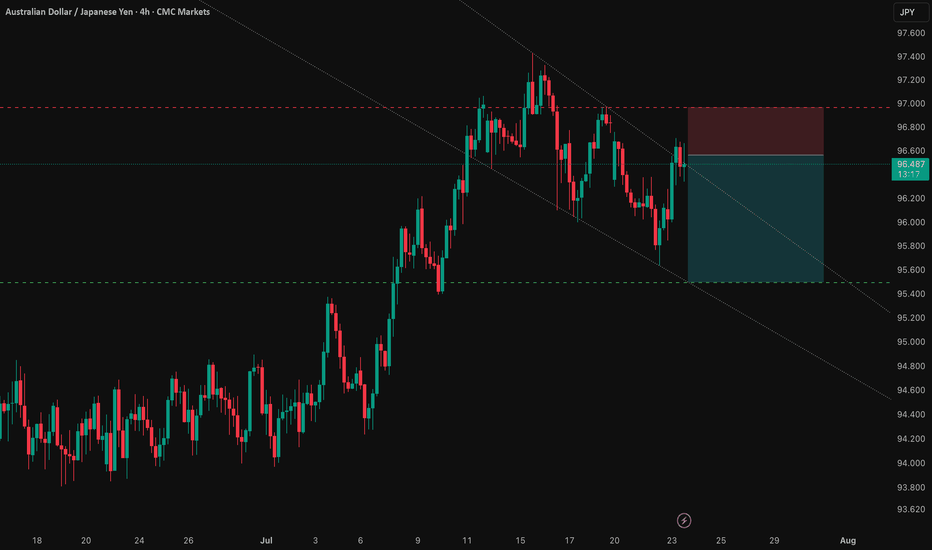

AUD/JPY: Capitalizing on the RBA-BoJ Monetary Policy GapThis analysis outlines a compelling short opportunity in AUD/JPY, driven by a powerful confluence of fundamental and technical factors. The trade is strategically positioned ahead of a key catalyst that could unlock significant downside potential.

1️⃣ The Core Thesis: A Clear Policy Divergence

The primary driver behind this trade is the stark and widening gap in monetary policy between the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ). The RBA is signaling a clear dovish pivot amid a weakening labor market, making an interest rate cut imminent. Conversely, the BoJ is in a tightening phase, creating a fundamental headwind for the AUD relative to the JPY. This divergence underpins the strategic bearish bias.

2️⃣ The Confirmation: Technical Alignment

This fundamental view is supported by a clear technical picture. The pair is in a well-defined downtrend and is currently testing a critical support level. This alignment of fundamental and technical factors presents a clear short opportunity, with the entry positioned for a breakdown below this key juncture.

3️⃣ The Catalyst: The RBA Bulletin

The immediate catalyst for this trade is the upcoming RBA Bulletin on July 24, 2025. Any dovish language from the RBA concerning Australia's economic outlook will likely reinforce expectations for a rate cut and accelerate the downward move in AUD/JPY.

The Trade Setup ✅

Here is the recommended trade setup:

📉 Trade: SHORT AUD/JPY

👉 Entry: 96.56200

⛔️ Stop Loss: 96.96386

🎯 Take Profit: 95.49900

🧠 Risk/Reward Ratio: 2.65

This setup offers a compelling risk-reward profile, capitalizing on a clear and powerful macroeconomic theme. The trade is designed to perform should the expected catalyst confirm the underlying bearish fundamentals.

Australia faces a dilemma between inflation and labor slowdown

The RBA, in its latest meeting minutes, emphasized that the recent rate hold reflects a cautious and gradual approach toward achieving its inflation target. While the central bank noted the need for further data to confirm a decline in inflation, some Board members flagged rising unemployment as a signal of potential labor market softening. Bloomberg added that Australia’s export-driven economy remains vulnerable to tariff-related uncertainties, while private demand growth remains sluggish.

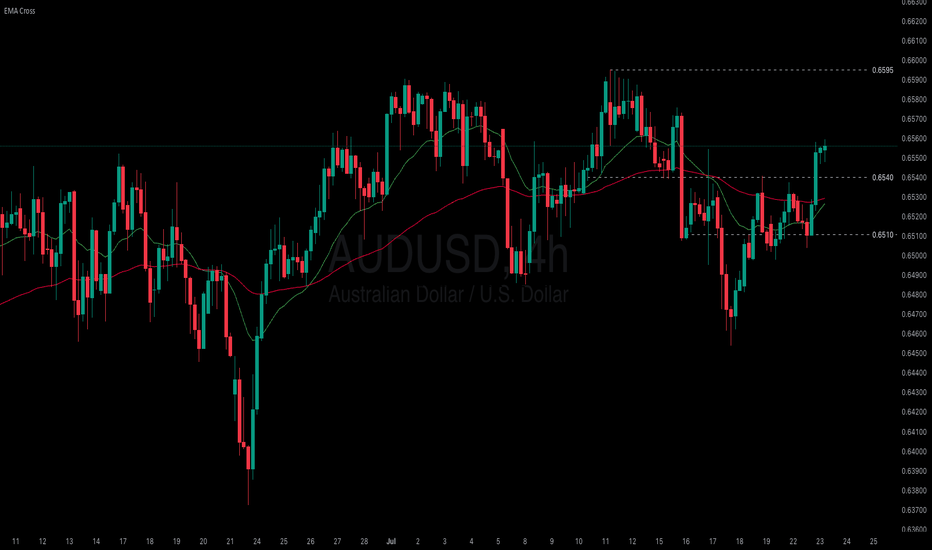

AUDUSD extended its uptrend after testing the low at 0.6455, reaching as high as 0.6560. Both EMAs narrow the gap, indicating a potential shift toward bullish momentum. If AUDUSD holds above both EMAs, the price could gain upward momentum toward the high at 0.6595. Conversely, if AUDUSD breaks below the support at 0.6540, the price may retreat toward 0.6510.

Australian dollar eyes China GDPThe Australian dollar has edged lower on Monday. In the North American session, AUD/USD is trading at 0.6555, down 0.32% on the day. The Aussie took advantage of US dollar weakness last week as it touched a high of 0.6593, its highest level since November 2024.

China's economy is expected to have grown by 5.1% in the second quarter, after back-to-back quarters of gains of 5.4%. The government's annual growth target is around 5.0%, and policymakers won't complain if this target is exceeded for a third consecutive quarter.

China's exports were up 5.8% y/y in June, above the consensus of 5.0% and well above the May gain of 4.8%. The jump in exports was driven by a trade truce with the US that lowered tariffs on Chinese goods from 145% to 55%. Still, the economic picture is uncertain as the tariff truce ends in August.

China will also release industrial production and retail sales for June, with the markets forecasting weaker numbers. Industrial production, which has been decelerating in recent months, is expected to ease to 5.6% from 5.8%, while retail sales are expected to fall to 5.6%, down from 6 .4% in May, which was the strongest level since December 2023.

Australia releases Westpac Consumer Sentiment on Tuesday, with a forecast of a 0.4% gain for July . This follows a 0.4% gain in June. Consumers remain cautious, despite the Reserve Bank of Australia's rate cut in May and lower inflation.

The RBA shocked the markets last week when it maintained the cash rate at 3.85%, as all signs appeared to point to a quarter-point cut. The RBA meets next on August 12.

AUD/USD is testing support at 0.6562. Below, there is support at 0.6550

There is resistance at 0.6570 and 0.6582

Australian dollar stabilizes after RBA's surpriseThe Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating.

The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets had priced in a quarter-point cut at 96%, but the RBA had the last laugh. For the first time, the RBA published the vote tally, which was 6-3 in favor of maintaining the rate.

The rate statement was cautious, as members said "there are uncertainties about the outlook for domestic economic activity and inflation".

Governor Bullock tried to calm the markets, saying that the decision was about "timing rather than direction" and that the Bank would "wait a few weeks" to confirm that inflation was on track to ease and remain sustainably around 2.5%. Bullock said that "we don't want to end up having to fight inflation again".

Inflation is moving in the right direction but the RBA wants to see the second-quarter inflation report on July 30, ahead of the rate decision on Aug. 12. Headline CPI in May eased to 2.1% y/y from 2.4% in April. The core rate dropped to 2.8% from 2.4% in April, the lowest rate since early 2022.

The RBA will be hoping that waiting till August will provide some clarity with regard to US tariff policy. President Trump has pledged new tariffs against various countries but this move is not expected to have much impact on Australia's economy.

AUD/USD is testing resistance at 0.6513. Above, there is resistance at 0.6541

There is support at 0.6463 and 0.6435

Australian dollar stabilizes after RBA's surprise The Australian dollar is in positive territory after a three-day skid, declining 1.5%. In the North American session, AUD/USD is trading at 0.6532, up 0.50% on the day. The Australian dollar rose as much as 0.95% earlier before retreating.

The Reserve Bank of Australia blindslided the markets on Tuesday as the central bank held the cash rate at 3.85%. The markets had priced in a quarter-point cut at 96%, but the RBA had the last laugh. For the first time, the RBA published the vote tally, which was 6-3 in favor of maintaining the rate.

The rate statement was cautious, as members said "there are uncertainties about the outlook for domestic economic activity and inflation".

Governor Bullock tried to calm the markets, saying that the decision was about "timing rather than direction" and that the Bank would "wait a few weeks" to confirm that inflation was on track to ease and remain sustainably around 2.5%. Bullock said that "we don't want to end up having to fight inflation again".

Inflation is moving in the right direction but the RBA wants to see the second-quarter inflation report on July 30, ahead of the rate decision on Aug. 12. Headline CPI in May eased to 2.1% y/y from 2.4% in April. The core rate dropped to 2.8% from 2.4% in April, the lowest rate since early 2022.

The RBA will be hoping that waiting till August will provide some clarity with regard to US tariff policy. President Trump has pledged new tariffs against various countries but this move is not expected to have much impact on Australia's economy.

AUD/USD is testing resistance at 0.6513.

Above, there is resistance at 0.6541

There is support at 0.6463 and 0.6435

AUD/USD Short: Riding the Perfect Storm to 0.6400Hello, traders! 🚀

A rare and powerful setup is forming on AUD/USD, and all signs are pointing decisively lower. 👇 This isn't just a simple technical pattern; it's a perfect storm of fundamental, technical, and event-driven factors aligning to create a high-conviction short opportunity.

If you're looking for a clean setup with a clear catalyst, this is it. Let's break it down! 🧐

The Core Thesis: Why We're Bearish 🌪️

This trade is built on three powerful pillars that are converging at the same time:

Massive Policy Divergence: 🇺🇸 vs 🇦🇺 This is the engine of the trade.

The Fed (USD): Remains HAWKISH 🦅. They are laser-focused on fighting stubborn inflation and have signaled they are in no rush to cut rates.

The RBA (AUD): Is actively DOVISH 🐨. They've already cut rates and are widely expected to cut again this week to support a weakening economy.

Result: This widening gap in interest rate policy creates a fundamental tailwind that heavily favors a stronger USD and a weaker AUD. 💸

The Dual-Catalyst Event (July 9th): 🗓️ This is the trigger.

FOMC Minutes Release: The minutes from the Fed's last meeting are expected to confirm their hawkish stance, reinforcing USD strength.

Tariff Deadline: A 90-day suspension of Trump-era tariffs expires on the same day . The base case is that tariffs will be reimposed, sparking a risk-off move in the markets.

Result: Risk-off sentiment is toxic for the risk-sensitive Aussie dollar (AUD) and a magnet for the safe-haven US dollar (USD). This is a potential double-whammy for AUD/USD. 💥

The Technical Picture is Screaming "Down" 📉

The chart tells a crystal-clear story of rejection and weakness. As you can see on the 4H chart, the price action is incredibly bearish after failing to break out higher.

The Great Wall of Resistance: Bulls threw everything they had at the 0.6590 - 0.6600 resistance zone and were decisively rejected. 🧱 This wasn't just any level; it was an 8-month high and a major long-term resistance area. A failure this strong is a huge red flag for buyers. 🛑

Momentum has Flipped: We saw classic bearish divergence on the higher timeframes, and as you can see on this 4H chart, we have now decisively broken below the recent rising channel. The path of least resistance has flipped from up to down. 👇

The Trade Plan 🎯

Here are the precise levels for executing this trade idea.

Asset: AUD/USD

Direction: Short (Sell) 📉

Entry Zone: ➡️ Look for a patient entry on a pullback to the 0.6535 - 0.6550 area. This was previous support and is now expected to act as strong resistance. We want to sell into strength.

Stop Loss: 🛑 A daily close above 0.6610 . This level is safely above the recent highs. A break here would invalidate our bearish thesis.

Target 1 (TP1): ✅ 0.6475 . This is the first logical support level. A good area to take partial profits and move your stop loss to break-even.

Target 2 (TP2): 🏆 0.6400 . This is our primary target, representing the bottom of the multi-week trading range and offering an excellent risk-to-reward ratio.

Conclusion: 💡

It's rare for fundamentals, technicals, and a major event catalyst to align so perfectly. The rejection at major resistance, combined with the powerful fundamental driver of policy divergence and the upcoming dual-catalyst on July 9th, makes this a high-conviction setup.

This is my analysis and not financial advice. Always do your own research and manage your risk carefully.

What do you think? Are you bearish on the Aussie too? Let me know your thoughts in the comments below! 👇

And if you found this analysis helpful, please give it a BOOST 🚀 and FOLLOW for more trade ideas! 👍

AUD/JPY: Rejection at Key ResistanceThis is a high-conviction short setup on AUD/JPY based on a powerful rejection pattern that has formed on the 4-hour chart. As you can see, the price spiked into the critical resistance zone between 95.00 and 95.55 but was immediately and forcefully rejected, leaving behind a long "Exhaustion Spike."

This is a classic sign of buyer exhaustion and seller dominance. It tells us that despite the recent rally, there is significant supply waiting at these higher levels. This price action provides a clear opportunity to short the pair in anticipation of a significant move down.

🏦 Fundamental Analysis

The fundamental backdrop provides a strong tailwind for this trade, with two key drivers:

1️⃣ Central Bank Divergence: The Reserve Bank of Australia (RBA) is in an easing cycle, having recently cut rates to 3.85% with more cuts expected. In stark contrast, the Bank of Japan (BoJ) is on a path of normalization, having already raised its rate to 0.50%. This divergence in monetary policy is structurally bearish for AUD/JPY.

2️⃣ Imminent Catalysts: This week is packed with event risk that is skewed to the downside for this pair. We have the RBA interest rate decision on Tuesday, July 8th , and the U.S. tariff deadline on Wednesday, July 9th . A dovish RBA or a "risk-off" move from the tariff news would likely accelerate the decline in AUD (a risk currency) and strengthen the JPY (a safe-haven currency).

📊 Technical Analysis

The price action on the chart confirms the bearish bias:

1️⃣ 4-Hour Rejection: The "Exhaustion Spike" at the 95.00 - 95.55 supply zone is the primary signal. It shows a clear failure by buyers and a strong takeover by sellers at a key level.

2️⃣ Long-Term Trend: On the daily chart, the price is trading below the critical 200-day moving average , confirming the long-term trend remains bearish.

3️⃣ Waning Momentum: There is a clear bearish divergence on the daily RSI. The price made a higher high, but the momentum indicator made a lower high, signaling that the rally is internally weak and losing steam.

📋 Trading Setup

This is a swing trade designed to capture a significant correction with a simple "set and forget" plan.

📉 Direction: SHORT / SELL

👉 Entry: Sell Limit @ 94.85

⛔️ Stop Loss: 95.60

🎯 Take Profit: 91.10

💡 Rationale: The entry is placed strategically to capitalize on a potential retest of the rejection area. The stop loss is placed safely above the rejection wick and the major resistance zone. The take profit targets the major structural support from the May 2025 lows, offering an excellent risk-to-reward ratio.

Trading the July RBA decision The Reserve Bank of Australia (RBA) will deliver its latest policy decision on Tuesday, 9 July. Markets are heavily positioned for a 25-basis point cut, which would bring the official cash rate down to 3.60%.

Major Australian banks including CBA, Westpac, NAB and ANZ are aligned in expecting a cut this month, with some anticipating further easing in August and November. A confirmed cut paired with dovish guidance could place further downside pressure on the Australian dollar, particularly against the US dollar and Japanese yen.

AUD/USD remains capped below the 0.6580–0.6600 region, with repeated rejections suggesting strong overhead resistance. A break above this zone would be needed to shift momentum higher. Conversely, a confirmed break below 0.6520 could open a move toward the 0.6450 area. Meanwhile, AUD/JPY has rebounded firmly off its May lows and is now testing resistance near 95.30. This area has repeatedly capped upside since mid-June, making it a key level to watch into the RBA decision.

Australia's CPI slows, raising rate cut expectationsThe Australian dollar is showing limited movement on Wednesday. In the European session, AUD/USD is trading at 0.6495, up 0.08% on the day.

Australia's inflation rate headed lower in May. Headline CPI rose 2.1%, after gains of 2.4% in the previous three months. This was below the market estimate of 2.3%. Monthly, CPI eased to 0.4%, driven by lower petrol and housing costs.

The key core CPI indicator, annual trimmed mean inflation, also dropped sharply, to 2.4% from 2.8%, its lowest level since Nov. 2021.

The soft inflation report has boosted the case for the Reserve Bank of Australia to lower rates at the July meeting. The markets have priced in a 90% probability of a quarter-point cut, up from 81% prior to the inflation release. The markets have priced in three more rate cuts this year, following rate cuts in February and May.

The markets are counting on the RBA to be dovish in the second half of 2025. With inflation not only within the RBA's target of 2-3% but also falling, the markets expect that the RBA will be keen to lower rates in order to preserve economic growth.

Federal Reserve Chair Powell testified before a House Committee on Tuesday and had a cautious message for lawmakers. Powell said that the Fed was committed to keeping inflation contained and that the Fed planned to maintain rates until the impact of tariffs on inflation was more clear and reiterated that inflation still remained above the Fed's 2% target.

Powell has faced blistering criticism from President Trump for not lowering rates. In his testimony, Powell said that Trump's attacks were "having no effects" on Fed policy.

AUD/USD pushed above resistance at 1.3726 and is testing resistance at 1.3727. Above, there is resistance at 1.3750

1.3713 and 1.3702 are the next support levels

Australian dollar jumps on Israel-Iran cease fireThe Australian dollar is up sharply on Tuesday. In the North American session, AUD/USD is trading at 0.6504, up 0.70% on the day.

Investors' risk appetite is higher today after Israel and Iran agreed to a ceasefire in their 12-day war. The markets have reacted favorably to lower oil prices as fears that Iran would close the Straits of Hormuz, which would have disrupted global oil supplies, have diminished. Risk appetite has returned and risk currencies like the Australian dollar have posted strong gains today.

The Israel-Iran war has triggered sharp swings in oil prices and there are fears of an oil price shock if the fragile ceasefire does not hold. An oil price shock would send petrol prices higher and boost inflation, complicating the Reserve Bank of Australia's plans to lower interest rates.

Australia CPI expected to ease to 2.3%

Australia releases the May inflation report early on Wednesday. Headline CPI has been stuck at 2.4% for three consecutive months, within the Reserve Bank of Australia's target of 2-3% and its lowest level since Nov. 2024. The market estimate for May stands at 2.3%. Trimmed Mean CPI, a key core inflation indication, edged up to 2.8% from 2.7% in April.

The Reserve Bank will be keeping a close eye on the inflation report, with the central bank making a rate announcement on July 8. The RBA trimmed rates by a quarter-point in May and has shifted to a more dovish stance - the Board discussed a jumbo half-point cut at the May meeting.

Fred Chair Powell appears before Congress today and Wednesday and is likely to defend the Fed's wait-and-see stance. The Fed is concerned about President Trump's tariffs and the Israel-Iran war threatens stability in the Middle East, hardly the recipe for further rate cuts. Still, there appears to be some dissent within the Fed, as two members, Michelle Bowman and Christopher Waller, have suggested that the Fed could lower rates as early as September.

AUD/USD is testing resistance at 0.6490. Above, there is resistance at 0.6522

There is support at 0.6400 and 0.6342

Australian inflation higher than expected, Aussie extends lossesThe Australian dollar has extended its losses on Wednesday. AUD/USD is trading at 0.6415 in the North American session, down 0.44% on the day.

Australia's inflation rate remained unchanged in April at 2.4% y/y for a third straight month, matching the lowest rate since Nov. 2024. The reading was slightly higher than the market estimate of 2.3% but remained within the central bank's inflation target of 2%-3%. Trimmed mean inflation, the central bank's preferred indicator for underlying inflation, edged up to 2.8% from 2.7% in March.

The inflation report was mildly disappointing in that inflation was hotter than expected. Underlying inflation has proven to be persistent which could see the Reserve Bank of Australia delay any rate cuts.

The markets have responded by lowering the probability of a rate cut in July to 62%, compared to 78% a day ago, according to the ASX RBA rate tracker. A key factor in the July decision will be the second-quarter inflation report in late July, ahead of the August meeting.

The Reserve Bank lowered rates last week by a quarter-point to 3.85%, a two-year low. The central bank left the door open to further cuts, as global trade uncertainties are expected to lower domestic growth and inflation.

The Federal Reserve releases the minutes of its May 7 meeting later today. At the meeting, the Fed stressed that it wasn't planning to lower rates anytime soon and the minutes are expected to confirm the Fed's wait-and-see stance.

US President Trump has been zig-zagging on trade policy, imposing and then cancelling tariffs on China and the European Union. Fed Chair Powell said at the May meeting that the economic uncertainty due to tariffs means that the appropriate rate path is unclear and that message could be reiterated in the Fed minutes.

RBA Could Still Cut Despite Higher AU CPI: AU paid in focusToday I take a quick look at Australia's inflation figures and outline why I think the RBA could still cut in July, before moving on to charts for AUD/USD, AUD/NZD, EUR/AUD and AUD/JPY.

Matt Simpson, Market Analyst at City Index and Forex.com

RBA Cuts Rates. AUD DeclinesRBA Cuts Rates. AUD Declines

Today, the Reserve Bank of Australia (RBA) decided to cut the interest rate from 4.10% to 3.85%, continuing its easing policy after a previous cut from 4.35% in February.

According to Reuters, the RBA today cited:

→ progress made in bringing inflation under control;

→ economic risks linked to the ongoing global trade war.

Although the RBA’s decision was widely expected, the Australian dollar weakened noticeably against other currencies — including the New Zealand dollar. The AUD/NZD rate fell to its lowest level in nearly two weeks.

Technical Analysis of the AUD/NZD Chart

From a technical perspective, a bearish breakout occurred:

→ below the lower boundary of the upward trend channel that began in April;

→ and below the 1.087 level, which had served as support in mid-May.

It is possible that:

→ the decline may slow around the 1.083 support zone, where strong demand was evident in the long lower wicks of the 9 May candles (marked with an arrow);

→ the 1.0870–1.0880 area will act as resistance going forward, potentially leading to a retest of the bearish breakout zone on the AUD/NZD chart.

As the market continues to price in the RBA’s decision, attention will turn to the Reserve Bank of New Zealand meeting on 28 May, where a similar rate cut could be on the table.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Australian dollar loses ground, jobs report nextThe Australian dollar has declined on Wednesday. In the North American session, AUD/USD is trading at 0.6441, down 0.45% on the day. This follows the Australian dollar's massive gains of 1.5% a day earlier.

Australia's wage growth accelerated in the first quarter. Annually, the Wage Price index gained 3.4%, up from 3.2% in Q4 2024 and above the market estimate of 3.2%. The gain was driven by stronger wage growth in the public sector. On a quarterly basis, wage growth rose 0.9% q/q, up from 0.7% and above the market estimate of 0.8%. This is the first time since Q2 2024 that annual wage growth has accelerated.

The higher-than-expected wage report comes before next week's Reserve Bank of Australia's rate decision. Currently, it looks like a coin toss as to whether the Reserve Bank will maintain or lower rates.

Australia releases employment data on Thursday. Employment change is expected to ease to 20 thousand in April, down from 32.2 thousand in March. The unemployment rate is expected to remain at 4.1%. The labor market has been cooling and if it continues to deteriorate, there will be pressure on the Reserve Bank to lower rates.

At last week's Federal Reserve meeting, Fed Chair Powell said that he would take a wait-and-see attitude in its rate policy. Trump's erratic tariff policy must be frustrating for the Fed, as it makes it difficult to make reliable growth and inflation forecasts.

This week's surprise announcement of a tariff deal between the US and China is a case in point at Trump's zig-zag trade policy. The two sides have been engaged in a bruising trade war and slapped massive tariffs on each other's products. Suddenly, the tariffs were slashed, leading to a sigh of relief in the financial markets. The deal is only for 90 days, and what happens then is very much up in the air.

Australian CPI Surprise: What It Means for the RBA & AUD/USDMatt Simpson breaks down the latest Australian inflation data and what it could mean for the Reserve Bank of Australia’s next move. Plus, we dive into the AUD/USD, AUD/CAD, GBP/AUD and EUR/AUD charts for key technical setups traders need to watch right now.

AUDUSD Bears "Flag Down" Potential OpportunitiesOn the Technical Analysis stand-point, FX:AUDUSD has been Consolidating in an Ascending Channel since the beginning of this year after having a sharp decline which started in October last year. Now the past 6 Months, Price Action seems to be forming a strong Continuation Pattern, the Bear Flag!

Based on the Retracement from the Swing High @ .6942 to the Swing Low @ .60872, Price has made a 38.2% Retracement to .64081, resulting in a False Break, pushing Price back into Pattern!

Price has been trading Under the 200 EMA since the start of the "Flagpole" and with the separation between it and the 34 EMA Band, feeds the Bearish Bias after we see Price heavily rejected after touching the 34 EMA Band!

*Once Price makes a Breakout of the Rising Support of the Channel -> Bear Flag Confirmed

*Increase in Volume after Break -> Breakout Validated

If we get a True Breakout that is Validated by the checklist of factors, we could be looking at great opportunities to take FX:AUDUSD down to the current 5 Year Low of .55063 set back in March 16th 2020 (Initial Outbreak of Covid) based on the Flagpole and Potential Extension of a Valid Break and Retest of the Bear Flag!

Now, Fundamentally what is driving the Weaker Aussie Dollar is the fear of the impact of what the US Tariffs will do to Australia's "Key Trading Partners" being China, Japan and South Korea all being high on the Reciprocal Tariff List. Because of this, the RBA has now priced in 100 Basis Points worth of Rate Cuts to come with the expectations of a "dampened broader outlook for global trade and economic growth."

www.tradingview.com

Stay Tuned!

Australian dollar rally continues, Trump tariffs loomThe Australian dollar has posted strong gains for a second straight day. In the European session, AUD/USD is trading at 0.6306, up 0.47% on the day.

The Reserve Bank of Australia maintained the cash rate at 4.10% on Tuesday, in a move that was widely expected by markets. Still, the Australian dollar reacted positively, gaining 0.48% on Tuesday.

The RBA statement noted that underlying inflation continued to ease in line with the Bank's forecast, but the Board "needs to be confident that this progress will continue" so that inflation remains sustainable at the midpoint of the 2%-3% target band. The statement said there was "significant" uncertainty over global trade developments, pointing to the threat of further US tariffs and possible counter-tariffs from targeted countries.

The central bank's decision was made in the midst of a hotly contested election campaign, and a rate cut would likely have been attacked by the opposition parties as political interference.

In a press conference after the meeting, Governor Michele Bullock acknowledged the uncertainty over the global outlook due to US trade policy but sought to assure the markets by saying that Australia was "well placed" to weather the potential storm of a global trade war.

US President Trump has not specifically targeted Australia with any tariffs but China is Australia's number one trading partner and a US-China trade war would inflict damage on Australia's economy.

The new US tariffs are expected to be announced later today and take effect on Thursday. The financial markets remain volatile as investors look for some clarity from Washington about the tariffs, as it remains unclear which countries will be targeted and the extent of the tariff rates.

RBA Holds Their Cash Rate, May Cut Neither Confirmed Nor DeniedThe RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD.

Matt Simpson, Market Analyst at City Index and Forex.com

Why the RBA should cut rates todayThe Reserve Bank of Australia should cut rates today, argues James Glynn in the Wall Street Journal .

Markets, however, expect the central bank to wait until May for its next move. RBA Governor Michele Bullock remains cautious, citing lingering inflation.

But Glynn contends that global uncertainty now outweighs the RBA’s desire to wait for marginal improvements in inflation data. That uncertainty is set to escalate this Wednesday, with the Trump administration announcing sweeping tariffs on U.S. trading partners—likely triggering retaliatory measures.

Andrew Boak, chief economist at Goldman Sachs Australia, appears to support Glynn’s view: “There are costs to waiting until May to cut. Waiting is not always a virtue.”

Is Glynn simply chasing a contrarian headline or is there actually a possibility the RBA could act today?

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com