Rbi

NIFTY 50 ANALYSIS ON RBI'S MEETINGmarkets fell, indicators supporting!!

rising wedge pattern is formed.

RSI will react in the same way as there previous ones are.

markets will reach its bottom point of its crucial trend line support, and will start moving up the next week. this week's was a crucial point, as FED'S meeting led to fall in our markets, and a further fall due to RBI's announcement. markets will be correcting till the decision comes, hence this two days, markets will reach 16520.

BANKNIFTY levels, RBI likely to Announce Repo Rate tomorrowWelcome to BANKNIFTY Futures and options

and optionchain data analysis for friday...

🛑 RBI will likely to announce Repo and interest Repo rates tomorrow morning at 10AM, due this major event volatility will likely toincreases,

◽ Right now every traders eye is on RBI

◽ Banknifty weekly pivot is at 37500

◽And monthly pivot is at 37300,

🛑 if we see day frame chart of BANKNIFTY currnetly trading above 21Day , 50 Day , 100 Day moving averages

🎯 Key levels to watch out for day trader

🛑 Major resistance zone for BankNifty is at 38050-38100 ( if see the option chain data on call 38000 CE strike holding more number for short position which will act as strong resistance area to bank Nifty )

◽ If market breakout resistance then we can see Target of 38300

◽ Whenever until breakout that resistance level don't trade

◽ Stop loss will be 37950

◽If gap down or slight gap up happens then 37900 will be resistance zone

🛑 Major support level for BankNifty

◽ Support level for nifty lies at 37550-37460

◽ Whenever until breakdown this level don't take a trade

◽ if Market successfully breakdown this level then we can take a trade

◽ And we can see the Target 1 will be 37300

◽STOP loss will be 37550

🛑 levels for banknifty futures will be also same

◽Go long on banknifty Futures if it breakout the resistance ie . 38050-38100

◽ Don't short the market until below the 37500

Don't take a trade if market open above or below our levels bcz market don't like gaps let the market to consolidate first and then take a trade

If you like it do follow for more

have a nice day 😊

Expiry day Blueprint for BankniftyBanknifty has shown resilience to FII selling, RBI announcement today seems to have altered the nature of market. However not much has changed we presume three possibilities around which a probable expiry day plan can be traced.

A strangle of 33100CE and 32800 PE trading around 373 a pair seems a good bet to ride tomorrow .

All the best

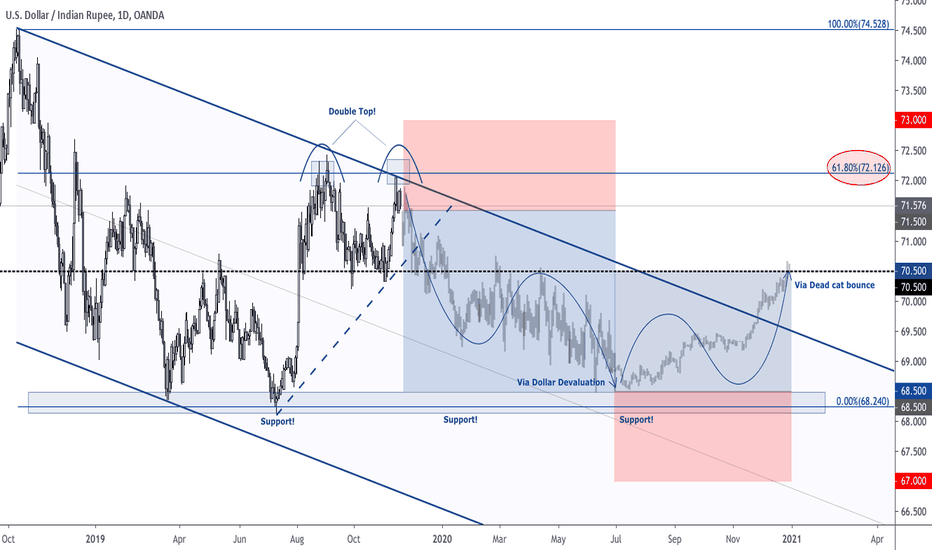

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

Brexit, trade wars, oil and ruble problems April 12, 2019 is the official Brexit date. There are two options: leaving without a deal (both are afraid of it, Britain and the EU, therefore, we regard this outcome as highly unlikely) or a delay. In our opinion, the second option is alternative. It is all about the terms. The EU summit will show whether it takes a year, as the EU wants, or a couple of months, as the Britain wants. Our trading tactics are unchanged so far - we buy a pound on descents.

Trade negotiations between the US and China over the end of the trade wars continue. This week promises to be quite intensive in terms of the negotiation process. Recall that the completion of trade wars is viewed by markets as positive for the world economy as a whole and for individual markets (commodity, stock) in particular.

Oil has reached its maximum in the last 5 months. The reasons for this we have already listed. The main thing is the OPEC + No.2 agreement, which provides for an artificial supply reduction in the oil market by 1.2 million b / d. In addition, a sharp drop in the level of mining in Venezuela and problems in Libya only only thrown oil on the flames. The result - the growth of oil quotations despite an increase in the production of shale in the USA. We continue to look for points for asset purchases on the intraday basis with small stops.

We recommend yesterday’s ruble appreciation in the foreign exchange market as a pretext for its selling. “Deadly” sanctions are already under consideration by Congress. Recall that one of the main strikes from the new package will impact banking system. Analysts of Raiffeisen bank calculated the total volume of problem assets on the balance of credit institutions of the Russian Federation in 2019 exceeded 10 trillion (problematic is considered “mortgage with indicators of impairment”, which include bad, toxic and simply non-performing loans). The coverage ratio of bank reserves of problem debts is only 54%, i.e. the amount of uncovered problem assets is estimated at 4.7 trillion rubles. The banks will not be able to cover this hole with their own capital - it simply will not be enough. Thus, the banking system is more vulnerable than ever, and sanctions may well destroy the delicate balance and lead to collapse. In this light, we recall our basic recommendation to sell the ruble at every available opportunity.

We want to highlight a recommendation on the dollar sales, as well as purchases of gold.

Notice issued by Delhi High Court to RBI and OthersA petition filed by Kali Digital EcoSystem cryptocurrency startup based in Ahmedabad in Delhi High Court and High Court issued a notice to The Union of India through Secretary, Ministry of Finance, GST council and Reserve Bank of India (RBI).

Read More- Notice by Delhi High Court to RBI

Bank Nifty Oversold BankNifty has taken a near 20% hit since the beginning of this year due to bearish economic outlook as well as a massive burden of 7 lakh crore + NPA. The budget has been published and the government has pledged to recapitalize PSUs by a measly 25k crore for now. I believe that the banking sector is yet to see its real lows however for the time being a stabilization in sentiment and a retrace from the fear induced overselling should push banknifty closer to the 15.5k range before it makes its next leg down. There is also a possibility that it can break out of this downwards channel and test supply zone at 17k depending on sentiment in the coming months. Within 2 years I expect banknifty to reach lows well below 10k.

First TP 14.8. Second TP 15.5. Third TP 17k. SL @ 12.6

Bank Of Baroda LongAs RBI is facing tremendous pressure to bail out PS/Corporate banks I believe that we will slowly begin to see a short term correction in the bank sector. I expected BOB to either break out and test supply zone at 190 before potentially making another leg up. The second scenario is that the bearish sentiment forces BOB to test demand zone at 100-120 before it continues to test the supply zone. This is big short term reversal point for BANKNIFTY. RR at this level is high.