RBLX

RBLX Roblox Corporation Options Ahead of EarningsIf you haven`t bought the dip on RBLX before the previous earnings:

Then analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the $42.5usd strike price Calls with

an expiration date of 2024-3-15,

for a premium of approximately $2.79.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Roblox Stock Soars as Metaverse Vision Pays OffRoblox ( NYSE:RBLX ), the youth-centric gaming platform, has sent shockwaves through the market with its latest earnings report, surpassing analyst expectations and painting a promising picture for its future. With a surge in daily active users and robust revenue growth, Roblox ( NYSE:RBLX ) is not just a gaming platform anymore; it's a glimpse into the burgeoning metaverse.*

Breaking Down the Numbers

In the fourth quarter of 2023, Roblox ( NYSE:RBLX ) reported a loss of 52 cents per share, beating analysts' expectations of a 55-cent loss. But what really caught investors' attention was the staggering $1.13 billion in bookings, surpassing predictions of $1.05 billion. This signifies not only a substantial year-over-year growth from $899 million but also a testament to Roblox's ( NYSE:RBLX ) ability to monetize its expansive virtual ecosystem.

Investing in the Metaverse

Roblox's ( NYSE:RBLX ) strategic investments in building its version of the metaverse are paying off handsomely. With over 5.5 million immersive experiences ranging from gaming to social gatherings, concerts, sports events, fashion shows, and even educational content, Roblox ( NYSE:RBLX ) has become more than just a gaming platform—it's a virtual universe where creativity knows no bounds.

Guidance and Outlook

Looking ahead, Roblox ( NYSE:RBLX ) is optimistic about its future prospects. The company expects to generate bookings of $925 million for the current quarter, surpassing Wall Street's target of $903 million. Moreover, its full-year 2024 forecast of $4.21 billion in bookings exceeds analyst expectations of $4.06 billion. This bullish outlook reflects Roblox's ( NYSE:RBLX ) confidence in its ability to continue attracting users and monetizing its platform effectively.

CEO's Vision

Chief Executive David Baszucki's vision for Roblox ( NYSE:RBLX ) is ambitious yet achievable. With a goal of attracting over 1 billion daily active users, Baszucki emphasizes the importance of fostering a community characterized by optimism and civility. He highlights Roblox's strong network effects, driven by content, social connections, and communication, as well as its investments in immersive experiences, advertising, and artificial intelligence.

Market Response

Unsurprisingly, Roblox's ( NYSE:RBLX ) stellar performance has been met with a surge in its stock price, jumping 11% to $45.08 in afternoon trades following the earnings report. This surge reflects investors' confidence in Roblox's ability to capitalize on the growing demand for virtual experiences and its position as a leader in the metaverse space.

Conclusion

Roblox's ( NYSE:RBLX ) latest earnings report showcases its continued growth trajectory and solidifies its position as a key player in the evolving metaverse landscape. With a rapidly expanding user base, innovative experiences, and a visionary leadership team, Roblox is poised for further success in the years to come. As the metaverse continues to capture the imagination of both users and investors alike, Roblox ( NYSE:RBLX ) stands out as a prime example of the limitless possibilities that virtual worlds offer.

RBLX Double Inside DayRBLX is looking really good after bouncing off the 200 EMA, holding above the 50 and 20 EMAs and now working on a double inside candle day. MACD about to flip bullish as well. If the market doesn't totally collapse this looks like an A+ setup to me. Targets $44 and then $48 breaking that resistance.

RBLX Roblox Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $4.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Roblox (NYSE: RBLX) RRoblox is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator of some favorable trends underneath the surface for RBLX in the report.

Price Momentum

RBLX is trading in the middle of its 52-week range and below its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some downward momentum. This is a buy opportunity for the stock.

Bullish on RBLX.

As you can see here on the 15-minute chart we are in a channel. I drew this channel on the hourly time frame. We have recently formed a double bottom on the daily chart and we had a massive green day today. I am looking for a breakout and retest on the resistance-turned-support bounce with high-volume calls. As always thank you for reading my analysis.

RBLX Inverse Head & ShouldersRoblox has seen a move higher with gaming-related stocks this week on the heels of creating an inverted head and shoulders pattern. Price is trending above all MAs(8,21,34,50,100,200) wiht the short MAs rising and crossing above the long MAs indicating a short-term bullish trend.

The PPO indicator shows the green PPO line rising and above a rising purple signal line indicating short-term bullish momentum. Both lines above the 0 level and rising indicates intermediate to long-term bullish momentum.

The TDI indicator shows the green RSI line rising and crossing above the 60 level which indicates a short-term bullish trend behind price, as does the RSI line trending above the purple signal line and trending in the upper half of the Bollinger Bands. The RSI line trending between 40-60 levels indicates an intermediate to long-term bullish trend behind price.

Assuming that price continues to move higher and closes above the neckline in the $48 area, a measured move will put our price target at $69. Measurement is taken from the lowest point of the head to the neckline which is roughly $21. Add that to anticipated opening price around the $48 above the neckline and we get $69 as our target and take profit level.

Buy price for me was at $43.34.

Stop-Loss is currently at $37.05.

I tend to wait for a close above the neckline before entering a trade, this trade was initiated a little early and prior to pattern confirmation making it a little more risky. Stop-Loss orders help to reduce risk, and on any single trade my total risk can never be more than 1% of my total portfolio; if I lose on a trade, the dollar loss can never be more than 1% of my total portfolio value.

RBLX Roblox Corporation Options Ahead of EarningsAnalyzing the options chain of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Puts with

an expiration date of 2023-6-16,

for a premium of approximately $2.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

4/17 Watchlist + NotesSPY - Last week we went 4/5 on predictions with SPY. Friday I said I wanted to see a push higher, which we did end up getting before closing as a failed 2U on the daily. The daily candle was decently neutral, but still is bearish due to it being a failed 2U. Going into Monday, I am hoping for some downside. We retraced over 50% of Thursday's range which leads me to believe we can create a compound engulfing day by breaking Thursday's low at 407.99. I am overall pretty neutral going into Monday because I think we closed strong on the week and could easily test last week's high. I think we have more reasons to be bearish on Monday though, which could make the week play out in a way where we see initial pullback or consolidation before testing weekly highs. At the end of the day, you can't and shouldn't fight the trend, so keep that in mind for the week. As we push into the 2nd half of the month, we can expect price action to be less volatile. I think this week will be very evident of whether we want to push to the 420 area, or begin a larger reversal. With the FED admitting they expect a recession in the fall/winter, I am curious to see how the markets will react as time progresses from now till the end of the year.

Watchlist:

I am starting a small challenge account this week, so the plays on my watchlists will be slightly different than my normal lists and main watches. As always though, I will keep the scanner for weekly and daily setups in the photo on my idea. Just look at potential 3-1 and potential 2-1 to see all setups. With that being said, I will keep an eye on everything on my scanners, but here is what I am specifically watching for tomorrow:

RBLX - 3-1-2 Rev strat - Bullish

PEP - 3-1 daily and 2-1 weekly - Neutral

MSFT - 2-1 Daily + Broadening Formation on the daily: Neutral

KO - 2-1 Daily + BF on daily: Bearish

PG - Same thing as KO and MSFT: Neutral

COST - 3-1 Weekly - Bearish

CAT - 3-1 Weekly - Bullish

Main Watch:

TSLA - Was last Friday's main watch. Never broke out

RBLX - This setup is really good with minimal complaints from me. RBLX has been strong these past few weeks and I think it will continue to head higher. We are also sitting on a long rising trend line on the daily. What I am looking for is for us to break Friday's high and then target the high from last thursday to create a compound engulfing candle. This setup has potential to hit all the way up in the 53-54 range on a larger time frame, but for tomorrow we have solid potential for a 2-3% move on RBLX from entry. I will make a seperate post about RBLX with my charts for it because it would be a lot to explain otherwise so be sure to check that out. My Only concern with this setup is that it may need some pullback further before heading higher to follow suit with the broadening formation. This play will really be dependent on whether we break the high or low of Friday first, and also how much RBLX reacts to market movement assuming the markets follow our bearish bias. Just a few things to consider

Previous Main Watch:

PYPL: Winner. Ran over 250% from entry. Absolute banger

TSLA: Never broke out of 3-1 so now is 3-1-1 setup. Not a win or loss.

Stats From Last Weeks Watchlists:

4/5 Spy Predictions

4/6 Main Watch Plays

Top Winner: PYPL (250%+)

Personal Stats:

2/4 On the week

Overall Green

Kept losses small and wins big. Even with a 50% win rate we were still solid green on the week. Let's do it again this week

Personal Notes from this week:

- Patience is key to success as evident by my trades this week.

- Broadening Formations are incredibly accurate on bigger scales. Cannot recommend researching Broadening Formations enough. They are a cheat code to trading

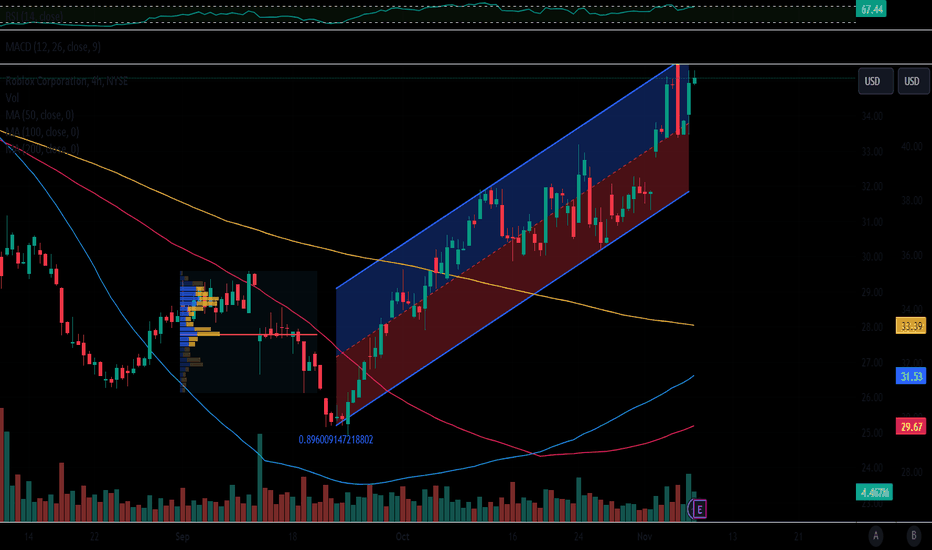

RBLX - Rising Trend Channel [MID TERM]- RBLX shows strong development within a rising trend channel in the medium long term.

- The stock is testing resistance at 47.

- Volume tops and volume bottoms correspond well with tops and bottoms in the price.

- The RSI curve shows a rising trend, which supports the positive trend.

- Overall assessed as technically positive for the medium long term.

*EP: Enter Price, SL: Support, TP: Take Profit, CL: Cut Loss, TF: Time Frame, RST: Resistance, RTS: Resistance to be Support LT TP: Long Term Target Price

Verify it first and believe later.

WavePoint ❤️