RBLX Targeting the Hights--$141 Target in SightHere’s your **RBLX swing trade** rewritten for **TradingView viral style** — fast to read, chart-ready, and built for engagement:

---

## 🎮 RBLX Swing Trade Setup (2025-08-09) 🎮

**Bias:** 📈 **Moderate Bullish w/ Caution** — momentum up across timeframes, but volume is weak.

**🎯 Trade Plan**

* **Ticker:** \ NYSE:RBLX

* **Type:** CALL (LONG)

* **Strike:** \$141.00

* **Entry:** \$1.04 (open)

* **Profit Target:** \$3.85 (+270%)

* **Stop Loss:** \$0.72 (-31%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI 56.9 → neutral, falling from highs

* Multi-timeframe momentum ✅

* Volume only 1.0x avg = weak conviction ❌

* Options sentiment neutral → no big institutional push yet

* VIX 15.88 = calm enough for swings

Rblxidea

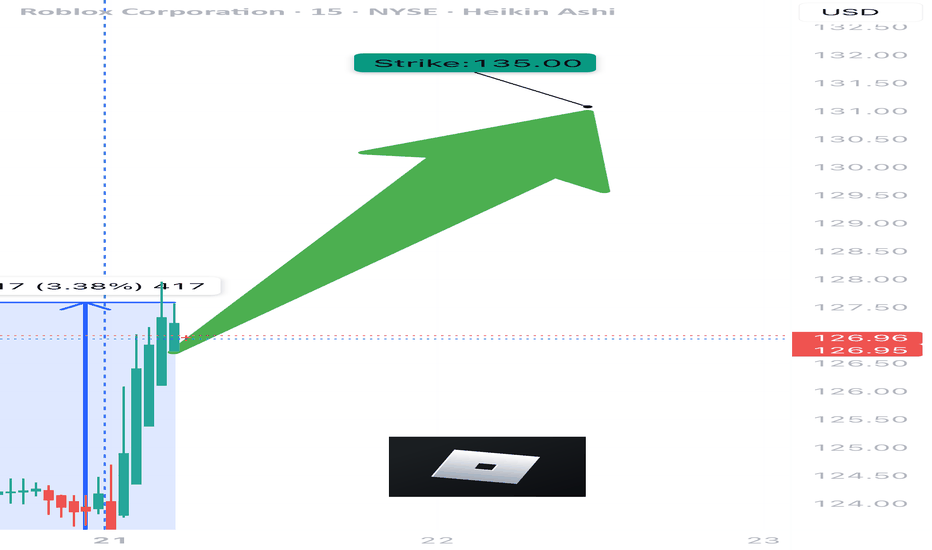

RBLX WEEKLY TRADE IDEA – JULY 21, 2025

🎮 NYSE:RBLX WEEKLY TRADE IDEA – JULY 21, 2025 🎮

📈 RSI MAXED. Volume Pumped. Call Flow on 🔥

This is a full-send momentum setup.

⸻

📊 Trade Setup

🔸 Direction: Long Call

🎯 Strike: $135.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.63

🎯 Profit Target: $1.25 (💯%)

🛑 Stop Loss: $0.30 (~50% risk)

📈 Confidence: 🔵 85%

🕰️ Entry Timing: Market Open Monday

📦 Size: 1 Contract (2–3% of account)

⸻

🧠 Why This Trade?

✅ Daily RSI: 84.9 / Weekly RSI: 89.5 → 🔥 Overdrive

✅ Volume = 1.5x last week → Institutional buildup

💥 Call/Put Ratio = 3.42 → Unusual bullish options flow

📉 VIX at 16.7 → Smooth gamma conditions for calls

🧩 5/5 Momentum Signals Confirmed across models

⸻

⚠️ Key Risks to Watch

• RSI = 🚨 Overbought → Monitor for fakeouts

• Exit by Thursday to dodge Friday decay trap

• Watch news headlines – unexpected events can swing this

• Be ready to scale profits early if $137–138 tested quickly

⸻

🛠️ Execution Strategy

🔹 No spreads. Naked call only for max gamma upside

🔹 Trail profit >30% if price spikes early

🔹 Keep stop hard at $0.30 to guard against fade

⸻

🏁 Final Word:

This is a textbook breakout + flow setup.

Let the call ride early-week momentum, but exit smart before theta kicks in.

NYSE:RBLX 135C — Risk $0.30 to Target $1.25 🚀

Don’t chase. Enter clean. Manage tight.

⸻

#RBLX #OptionsTrading #CallOption #WeeklyMomentum #BreakoutTrade #UnusualOptionsActivity #TradingViewIdeas #BullishFlow #InstitutionalOrderFlow #Roblox

RBLX - Price Targets & Stop Loss📈 What’s up investors! 📉

Welcome back to another one of

💡“Mike’s Ideas”.💡

I post as I find signals… these signals are based on the personal rules I have built and follow in order to make up what I call the “SST Strategy”. Follow for more ideas in the future!!

I have 4 levels marked and colour coded on the Chart.

These levels are:

⚪ White = Entry Point

🔴 Red = Stop Loss

🟢 Green = 1.2:1 Risk Reward Ratio

🟡 Yellow = 1.5:1 Risk Reward Ratio

🔵 Blue = 2:1 Risk Reward Ratio

👀 So what are we looking at today…!!!

🚨( RBLX ) Roblox Corporation🚨

Roblox Corporation develops and operates an online entertainment platform. The company offers Roblox Studio, a free toolset that allows developers and creators to build, publish, and operate 3D experiences, and other content; Roblox Client, an application that allows users to explore 3D digital world; Roblox Education for learning experiences; and Roblox Cloud, which provides services and infrastructure that power the human co-experience platform. It serves customers in the United States, the United Kingdom, Canada, Europe, China, the Asia-Pacific, and internationally. The company was incorporated in 2004 and is headquartered in San Mateo, California.

Roblox in expanding wedge.Roblox - 30D expiry- We look to Sell at 40.68 (stop at 43.71)

Price action has formed an expanding wedge formation.

The trend of higher highs is located at 41.00.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

The primary trend remains bearish.

Expect trading to remain mixed and volatile.

Our profit targets will be 33.33 and 31.33

Resistance: 38.00 / 40.00 / 42.50

Support: 34.00 / 32.00 / 30.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Roblox at resistance? Roblox

Short Term

We look to Sell at 51.37 (stop at 57.06)

Preferred trade is to sell into rallies. Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. A lower correction is expected. Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

Our profit targets will be 38.28 and 17.19

Resistance: 51.00 / 64.00 / 89.00

Support: 38.00 / 25.00 / 22.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Roblox breaking out? Roblox

Short Term

We look to Buy at 35.79 (stop at 30.79)

We look to buy dips. The trend of higher lows is located at 32.90. Previous resistance level of 36.00 broken. Posted a Double Bottom formation. Further upside is expected although we prefer to set longs at our bespoke support levels at 36.00, resulting in improved risk/reward.

Our profit targets will be 52.84 and 66.00

Resistance: 53.00 / 70.54 / 75.00

Support: 36.00 / 22.50 / 15.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

RBLX the Next 30 DaysI am new to this, but I really enjoy it and would love any feedback. This is not financial advice.

This analysis is based on the Elliott Wave Theory. I think you will see one more major move up before watching it fall to the ground like a dead cat. This is based on the 5-3 theory and considering that this is a psychological play more than a fundamental play it would make sense to have one more major continuation before she falls through the floor.

Roblox collapsing? Roblox

Short Term - We look to Sell at 33.44 (stop at 37.68)

Preferred trade is to sell into rallies. Price action has posted a Doji candle and confirms a possible stall in the recent move. We look for price action to stay within the channel formation today. Prices expected to stall near trend line resistance. Offers ample risk/reward to sell at the market.

Our profit targets will be 20.91 and 17.19

Resistance: 34.00 / 50.00 / 75.00

Support: 30.00 / 20.00 / 15.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

RBLX Sell-off anticipated in the Options Market !!Before placing a strangle option on this particular stock, yesterday i was monitoring the options market for a possible outcome.

And it was extremely interesting to see that the high conviction trades were slightly bearish: 5.2K Puts and only 2.3K Calls yesterday.

And guess what happened at the earnings today:

Revenue: $568 million vs $604 million expected

Bookings: $770 million vs $786 million expected

Losses per share: $0.25 vs $0.11 expected

User growth: 49.5 million daily active users vs 50.1 million expected.

So following the "smart money" wasn`t a bad idea after all. :)

Now considering that Ark Invest bought the stock lately, i think it still has potential on the long run (Ark has a 5 year term targets compared to the usual 1 year analysts ratings).

RBLX: Looks to be Basing Going into February RBLX has been hit very hard now down $79 from ATH. As growth has sold off in light of yields/rates rising, it seems to be bottoming out as as a sector.

As of close Friday, RBLX is being held down by its IPO lows of $60.46. A retake of those lows indicates a reversal and I will add to my RBLX swings for February and March OPEX. $60.46, $64.07 and $70 above.

A retest of $54 should be in hand this week and I will be looking to spec long there. Daily close under 53.63 and you can short it until it has a daily close above $53.63.

Roblox Analysis 16.12.2021Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

rblx flaggingRblx is flagging right now, also just hit a S13 on the daily, just hit a green 2 so it's a bit tricky here. At higher time frames we will get a weekly 9 next week, i'm always very careful with weekly 9s. If you have RBLX i'd definitely hang on and see how it reacts to the weekly 9 next week. I will be looking to add if it trades closer to the bottom of the flag or horizontal support (around $100-$105). This very well be getting close to a breakout of the flag, would need a daily close (or 2) out of the range.

Roblox Analysis and Market Prediction Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

RBLX stock has been having a great Bullish movement in the last 2 weeks where the price jumped up from the $82.23 and reached $140.55 level today, That is a 70.9% increase in under 3 weeks.

The long and short-term trends are both positive. This is looking good!

RBLX is currently making a new 52 week high. This is a strong signal. The S&P500 Index however is also trading near new highs, which makes the performance in line with the market.

Possible scenarios for the market :

The market today started on a higher level at the $140 level and dropped after hitting the resistance line located at $139.10. We could be seeing a small correction for the market that could reach the $119.78 support or even the $111.69 level, But looking at the stock from a technical point of view we notice that a lot of the indicators are giving Bullish signs, which means we will probably see a battle happening at the $119.78 level between the Bears and the Bulls and the winner will determine the outcome for the market.

If the Bulls were able to gain control back then we will see the price bounce from that level and reach the $140 level again before going even further to the resistance level at $160.64.

If the Bears were able to hold control then we will be seeing the second support at $111.69 being reached before the price go back into a Bullish trend.

Technical Analysis Show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish Sign)

2) The RSI is at 71.06 trading in the overbought zone, which could indicate a small drop.

3) The ADX is at 52.22 showing a super trendy market with a positive crossover between DI+ and DI-

Support & Resistance points :

support Resistance

1) 129.44 1) 139.10

2) 124.16 2) 143.48

3) 119.78 3) 148.76

Fundamental point of view :

The Revenue has grown by 118.98% in the past year. This is a very strong growth! An Altman-Z score of 18.05 indicates that RBLX is not in any danger for bankruptcy at the moment.

Roblox is also creating a $10 million fund dedicated "to bringing high-quality educational experiences to Roblox and to support educators in using Roblox Studio in their classrooms". The company has major plans to use Roblox Studio to help teach "computer science, design, and development courses" to millions of children.

Roblox plans on expanding the whole economic system that was built around gaming into other economic activities like "high quality immersive brand advertising that is native and authentic". Advertising is only the start because ultimately shopping in virtual stores could make its way on to the Roblox platform.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

RBLX BULLISH WOLFE WAVE TRIGGERThere is a wolfe wave setup on the 39 min time frame. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the green perforated line, as shown in the chart. The projected target is 80 which is expected to reach this price target within approx 39 hours (195 min x 12).