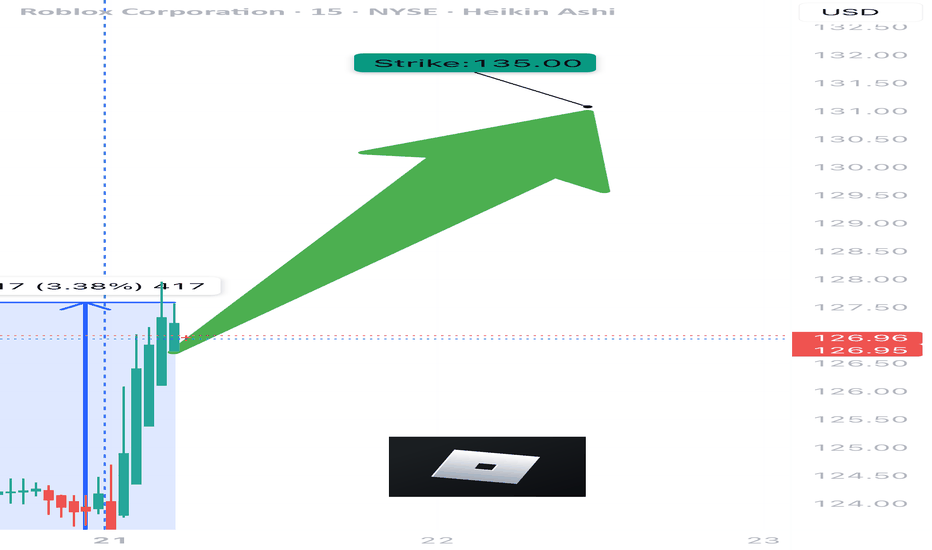

RBLX WEEKLY TRADE IDEA – JULY 21, 2025

🎮 NYSE:RBLX WEEKLY TRADE IDEA – JULY 21, 2025 🎮

📈 RSI MAXED. Volume Pumped. Call Flow on 🔥

This is a full-send momentum setup.

⸻

📊 Trade Setup

🔸 Direction: Long Call

🎯 Strike: $135.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.63

🎯 Profit Target: $1.25 (💯%)

🛑 Stop Loss: $0.30 (~50% risk)

📈 Confidence: 🔵 85%

🕰️ Entry Timing: Market Open Monday

📦 Size: 1 Contract (2–3% of account)

⸻

🧠 Why This Trade?

✅ Daily RSI: 84.9 / Weekly RSI: 89.5 → 🔥 Overdrive

✅ Volume = 1.5x last week → Institutional buildup

💥 Call/Put Ratio = 3.42 → Unusual bullish options flow

📉 VIX at 16.7 → Smooth gamma conditions for calls

🧩 5/5 Momentum Signals Confirmed across models

⸻

⚠️ Key Risks to Watch

• RSI = 🚨 Overbought → Monitor for fakeouts

• Exit by Thursday to dodge Friday decay trap

• Watch news headlines – unexpected events can swing this

• Be ready to scale profits early if $137–138 tested quickly

⸻

🛠️ Execution Strategy

🔹 No spreads. Naked call only for max gamma upside

🔹 Trail profit >30% if price spikes early

🔹 Keep stop hard at $0.30 to guard against fade

⸻

🏁 Final Word:

This is a textbook breakout + flow setup.

Let the call ride early-week momentum, but exit smart before theta kicks in.

NYSE:RBLX 135C — Risk $0.30 to Target $1.25 🚀

Don’t chase. Enter clean. Manage tight.

⸻

#RBLX #OptionsTrading #CallOption #WeeklyMomentum #BreakoutTrade #UnusualOptionsActivity #TradingViewIdeas #BullishFlow #InstitutionalOrderFlow #Roblox

Rblxlong

Roblox | Where Kids Thrive, Stocks Pump and Gamers High FiveRoblox Economics: Teaching 13 Year Olds How to Out Monetize Wall Street

RBLX surges 50% since our first signal so let’s explore its potential upside

From PlayStation to Paychecks: How Roblox Gamified the Economy

From hosting virtual concerts with millions of participants to offering user generated games rivaling major studios, Roblox has evolved into a cultural phenomenon nearly 20 years after its PC debut. It is reshaping the social gaming and entertainment landscape.

CEO Baszucki Says Roblox Saves Lives; Haters Say It Destroys Wallets!

Founder CEO David Baszucki shared:

“Our mission is to connect 1 billion people with optimism and civility. This resonates deeply with me, as several parents have told me their children’s lives were saved through connections made on Roblox”

Roblox was already a standout in last year’s Future 50 ranking for its unique value. Currently, over 3 million creators develop games and experiences using Roblox Studio, its proprietary development tool. The platform’s economy thrives on its in-game currency, Robux, rewarding creators based on user spending. For instance, Uplift Games, a Roblox-exclusive studio, supports a 60 person team.

Two core growth drivers

-Content loop:High quality content attracts users, who then inspire the creation of even more content.

- Social loop:Increased participation enhances the platform's appeal to new users.

Exploring Roblox’s Expanding Universe

-User Generated Content (UGC):Like YouTube, Roblox empowers creators of all skill levels to share their visions.

- A Growing Metaverse:Beyond gaming, it hosts virtual events and educational activities, positioning itself as a hub for social interaction.

-Broadening Demographics: Once dominated by young users, Roblox now attracts older audiences. In Q3 2024, users aged 13+ made up 60% of its user base, up from 57% the previous year.

Roblox by the Numbers

-Daily Active Users (DAUs):89 million, up 27% YoY, with strong growth in APAC (+37%) and a 59% rise in Japan.

-User Engagement:20.7 billion hours logged, growing 29% YoY.

-Q3 Bookings:$1.1 billion (+34% YoY), reflecting robust user spending.

-Regional Bookings:North America (62%) and Europe (19%) dominate.

The October 2023 PlayStation launch doubled Roblox’s console presence, boosting both users and bookings. To attract console studios, Roblox announced a 70% revenue share for items priced $49.99 or higher, aiming to encourage premium content.

Challenges and Opportunities

-Short Seller Allegations: In October, Hindenburg Research accused Roblox of inflating metrics and neglecting child safety, highlighting its ongoing unprofitability. Despite initial concerns, the claims lacked substantial evidence.

-Profitability Issues: Operating margins remain negative (-30%), with high infrastructure, safety, and AI costs. Expense management is critical for turning a profit.

- Advertising Growth: Partnerships with DoubleVerify and Shopify pave the way for in-platform ads and merchandise. With users averaging over two hours daily, this represents untapped potential.

-Virtual Economy Improvements: Enhanced discovery features increased payers by 30% to 19 million, with a 6% rise in bookings per DAU.

- Cash Flow Strength: Free cash flow hit a record $218 million (+266% YoY), driven by efficient cost management.

- Stock-Based Compensation (SBC): SBC equals 29% of revenue, diluting shares (~3% annually). While common in tech, this high level raises concerns for long-term investors.

Future Outlook

Roblox raised its FY bookings guidance to $4.36 billion (+24% YoY). Achieving sustainable growth while tackling profitability challenges, content moderation, and investor dilution will determine its long-term success. The company’s ability to navigate these issues will shape its legacy in gaming and beyond.

RBLX - UniverseMetta - Analysis#RBLX - UniverseMetta - Analysis

Exit from a protracted sideways trend and consolidation beyond the upper boundary of the channel, which may indicate potential growth to levels of 105 per share. Also, on the monthly timeframe, you can see an exit from a triangular formation with the formation of a 3-wave structure. The nearest target is 60. Then you can consider the levels by targets. It will also be possible to increase purchases during correction and retest of the support level.

Target: 60 - 105

RBLX - Price Targets & Stop Loss📈 What’s up investors! 📉

Welcome back to another one of

💡“Mike’s Ideas”.💡

I post as I find signals… these signals are based on the personal rules I have built and follow in order to make up what I call the “SST Strategy”. Follow for more ideas in the future!!

I have 4 levels marked and colour coded on the Chart.

These levels are:

⚪ White = Entry Point

🔴 Red = Stop Loss

🟢 Green = 1.2:1 Risk Reward Ratio

🟡 Yellow = 1.5:1 Risk Reward Ratio

🔵 Blue = 2:1 Risk Reward Ratio

👀 So what are we looking at today…!!!

🚨( RBLX ) Roblox Corporation🚨

Roblox Corporation develops and operates an online entertainment platform. The company offers Roblox Studio, a free toolset that allows developers and creators to build, publish, and operate 3D experiences, and other content; Roblox Client, an application that allows users to explore 3D digital world; Roblox Education for learning experiences; and Roblox Cloud, which provides services and infrastructure that power the human co-experience platform. It serves customers in the United States, the United Kingdom, Canada, Europe, China, the Asia-Pacific, and internationally. The company was incorporated in 2004 and is headquartered in San Mateo, California.

Roblox breaking out? Roblox

Short Term

We look to Buy at 35.79 (stop at 30.79)

We look to buy dips. The trend of higher lows is located at 32.90. Previous resistance level of 36.00 broken. Posted a Double Bottom formation. Further upside is expected although we prefer to set longs at our bespoke support levels at 36.00, resulting in improved risk/reward.

Our profit targets will be 52.84 and 66.00

Resistance: 53.00 / 70.54 / 75.00

Support: 36.00 / 22.50 / 15.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Roblox Analysis and Market Prediction Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

RBLX stock has been having a great Bullish movement in the last 2 weeks where the price jumped up from the $82.23 and reached $140.55 level today, That is a 70.9% increase in under 3 weeks.

The long and short-term trends are both positive. This is looking good!

RBLX is currently making a new 52 week high. This is a strong signal. The S&P500 Index however is also trading near new highs, which makes the performance in line with the market.

Possible scenarios for the market :

The market today started on a higher level at the $140 level and dropped after hitting the resistance line located at $139.10. We could be seeing a small correction for the market that could reach the $119.78 support or even the $111.69 level, But looking at the stock from a technical point of view we notice that a lot of the indicators are giving Bullish signs, which means we will probably see a battle happening at the $119.78 level between the Bears and the Bulls and the winner will determine the outcome for the market.

If the Bulls were able to gain control back then we will see the price bounce from that level and reach the $140 level again before going even further to the resistance level at $160.64.

If the Bears were able to hold control then we will be seeing the second support at $111.69 being reached before the price go back into a Bullish trend.

Technical Analysis Show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish Sign)

2) The RSI is at 71.06 trading in the overbought zone, which could indicate a small drop.

3) The ADX is at 52.22 showing a super trendy market with a positive crossover between DI+ and DI-

Support & Resistance points :

support Resistance

1) 129.44 1) 139.10

2) 124.16 2) 143.48

3) 119.78 3) 148.76

Fundamental point of view :

The Revenue has grown by 118.98% in the past year. This is a very strong growth! An Altman-Z score of 18.05 indicates that RBLX is not in any danger for bankruptcy at the moment.

Roblox is also creating a $10 million fund dedicated "to bringing high-quality educational experiences to Roblox and to support educators in using Roblox Studio in their classrooms". The company has major plans to use Roblox Studio to help teach "computer science, design, and development courses" to millions of children.

Roblox plans on expanding the whole economic system that was built around gaming into other economic activities like "high quality immersive brand advertising that is native and authentic". Advertising is only the start because ultimately shopping in virtual stores could make its way on to the Roblox platform.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

RBLX don't miss the breakout!RBLX 4HR Chart

---------------------

TA

Nice bounce off 74-75 level with a nice retrace to the .618 of may lows & june highs (63.97-103.92). Filled the gap at 76.33 w/ a nice symmetrical triangle setup. Strong movement started today for breakout to the upside for a confirmed reversal. 76-78 dip I'd look to go long, targeting 100+.

Key Levels

Support: 74.60, 76.36, 79

Resistance: 82.45, 89, 93.50, 95.95, ATH

Ways to play:

1. Shares

2. Atm/ otm calls 2 weeks+ exp. contracts

volatile ticker and able to play 1-5 points otm, the further the strike I do recommend more time

RBLX back to retest 100! RBLX Daily TF

Roblox on discount, as price continues to drop due to a decline in active users. After a massive rally to ATH its only right we see a pullback before the rocket takes off again. Has a bit more room for a golden retracement to .618 level (76.96). Wouldn't jump the gun on calls just yet unless downtrend is broken which signals reversal or we get a dip to 76 level.

Targets: 90, 103, 117

Trade idea:

76-80 scale in month out calls atm/otm, full entry on the breakout of downtrend

Shares - safer option as well