BIG BITCOIN FALL? 🐻 ☠️Hi guys,

I know most of y'all had a probably shocking week weekend (including myself).

⚠️ We saw almost a huge fall in crypto and especially Bitcoin, but should we really be concerned and worry for the future of the market?

📍 If you are a trader and not a HODLer you should always have a Plan B, both the bear and bull market can be profitable if you know how to deal with your feelings.

⚠️ As a trader you shouldn't really care about the stock and/or crypto asset itself, you should focus on making profit and know how to deal with possible chaos.

📌 In this long term regression Bitcoin's indicator we can clearly see a possible threat to lower prices (23k-25k), however the top of the channel wasn't touched and it can be hopeful statement.

⚠️ Please keep in mind that breaking 30k strong support is not as easy as it may seem BUT EVERYTHING IS POSSIBLE

🧐 But how can we understand if this support is breakable or not?

Regression

SNXUSDT-4h : up trend channelDear Traders

using the Regression trend tool, one can see easily the uptrend channel in 4h time frame. the pitchfork also confirms it. price moves within the channel and hit the pitchfork levels well. As a result, if the price touches the mid-line and breaks it out, it will go to the top of the channel. if the price can not hit the midline of the pitchfork, it would go down sharply.

comment your ideas

Using Linear Regression ChannelsLinear Regression Channels are a great way to identify potential key levels of future price action by graphing the normal distribution of a trend.

When using the Regression Trend tool (located in the drawing panel under the “Trend Line Tools” group) two points on a trend are chosen, generally at the beginning of the trend and the end of the trend.

When the two points on the chart are chosen, the normal distribution of the dataset is calculated between the two chosen points and displayed in the form of a linear regression channel.

The center line in this channel is the Linear Regression Line or Mean, and the upper and lower lines are the Upper and Lower standard deviations from the mean as set in the tool’s settings (default settings are +2 and -2 standard deviations from the mean).

The correlation of this linear relationship is displayed as Pearson’s correlation coefficient , or Pearson’s R. This can be displayed or hidden on the chart by selecting it within the tools style menu.

Pearson’s R shows the strength of the correlation as well as its direction, with values moving between -1 and 1. As Pearson’s R moves further away from zero, the strength of the linear relationship between price and time increases. When using the Regression Trend tool, Pearson’s R will always be set as an absolute value (positive), but the direction of the trend can be visually identified.

Mean reversion

When a regression trend has a high correlation, this is due to the consistency of price action laying along the mean (center line), with fewer points moving above and below the mean line to the upper and lower standard deviation levels.

One way to trade using a linear regression channel is to trade the price action as it moves away from, and back to the mean.

As this tool is used, it is important to note that a channel graphed containing more bars and having a high correlation is more likely to have price continue in that trend than one that is graphed with only a few bars and having a high correlation.

The length of the trend should be considered when trading these channels.

With the Regression Trend tool, you can start utilizing statistical analysis in your trading strategy with only the click of a few buttons!

BTCUSDT - What will happen? Let's find out! (Bitcoin)There are 3 possible scenarios:

1. Alt season

2. Consolidation

3. Breakout

Alt season: The more the BTC dominance falls, the closer we get to the alt season. in that case, it will be time for altcoins to play the market and we will experience heavy pumps by backed coins such as ETH, TRX, XRP, BNB, and so on.

Consolidation: if the dominance stays the same we will experience a period of consolidation, which builds up the price by adding volume to the foundation and leads it to a strong pump for re-testing the resistance area.

Breakout: This might be manual. because no logical signs are backing the idea of a breakout! the price has already broken down the regression channel and even though we might be in noise right now, I still can't find any other reason for a breakout. no indicator or analysis shows any signs right now. And by "manual" I meant the word of powerful individuals on Twitter.

Also, The strongest Support area we have right now based on Fibonacci is $50K. and the next local resistance is around the $56K - $57.7K area.

[BTCUSDT] Regression! Simple but powerful 27 march 2021In bitcoin we trust! Though we've been in correction for a while, it is essential for a healthy trend. What I did was basically plotting the regression channel of each minor trend. Then by casting the minor uptrend's regression channel (shown in the chart as a wave B), we get a nice short prediction pattern which also fits to the support and resistance levels.

Learn to Read Charts (Regression & BTC)✅ What is Regression?

Regression is a statistical method used in finance, investing, and other disciplines that attempts to determine the strength and character of the relationship between one dependent variable (usually denoted by Y) and a series of other variables (known as independent variables).

The general form of each type of regression is:

Simple linear regression: Y = a + bX + u

Multiple linear regression: Y = a + b1X1 + b2X2 + b3X3 + ... + btXt + u

✅ We can use linear regression in both Bullish and Bearish markets. All you need is the center and you can easily find the tunnel (channel) for forecasting. Also, you shouldn't let the noises distract you because they might make you misread your highs and lows.

In other words: The tunnel (channel) of your linear regression works as dynamic support and resistance.

✅ TradingView lets you use the Regression Trend for fast and easy forecasting. You can find it in the toolbar beside your chart.

LTC short and upLike we see in the graphics LTC hit the roof bouncing down %10 with the possibility of bouncing up (green)

or keep in regression % 21 till the 0.618 of fibo in the weekly like it did before(orange).

Personally I'll wait how the market behave before to open a new position.

Have a good trading and stick to the plan.

Dont forget thumbs up if like the idea.

Highly speculative Ethereum logarithmic regression curveHere is why Winklevoss brothers estimated high prizes for ethereum in bullrun peak.

Do remember to start taking profits / liquidity as we approach the target bubble.

As Ethereums progression reachhes 2.0 (small steps), things are gonna get excited!

Oil- long position triggeredPrice has found support at above neckline of head and shoulders (H&S more apparent on lower timeframe but easily seen on rsi). Rsi also find support at neckline. (You can read Rsi same as price action in most cases). Now middle of regression line (dashed black line)is support. Green arrow is proposed path to 1st target and second red arrow proposed path of breakdown of up wedge

Also see link for details about long trigger

Please give thumbs up if you find this interesting.

BTC Prize speculation using prize peaks during previous bullrunsConsider taking some profits in the coming summer.. there will be bear year after this run.

Also possible altcoin fluctuation, maybe possible to make gains after bitcoin has reached its peak.

But everything will fall drastically after semester.

Sorry strange english, my native finnish brains make Ralli-finglish sentences.

DOT- Thriving ecosystemDOT is no Ethereum killer as many of its parachains within the ecosystem are using Ethereum blockchain and not native to DOT. Nonetheless, it is quickly becoming the force to be reckoned with acting as a base layer for many interesting use cases within the DeFi space.

On of my potential long-term plays in crypto. Good time to continue to accumulate at various support lvls as BTC continue its retracement.

Not investment advice. Do you own due diligence.

BTC: Daily - Buying the dipFor those bullish on bitcoin and wanting to buy the dip, you now have a window of opportunity. It's unknown how much longer this will last, but HODLer's always win in this game. Ichimoku indicators are all bullish (white line above price, blue over red, and price above cloud.) There is no significant weak spots in the cloud (green shaded area). 40-45k seems to provide the best support areas with that being 50% and 61.8% retracement levels. These retracement levels also mean a longer consolidation period for dip buying. The regression trend (blue and red shaded area) is strong at 94.4% and shows that a correction will likely end around the bottom end of this channel. It also lines up with the bull trend line (thick blue) and should be monitored closely. Any big break on the downside of the cloud and bull trend line could indicate a move into a bear market.

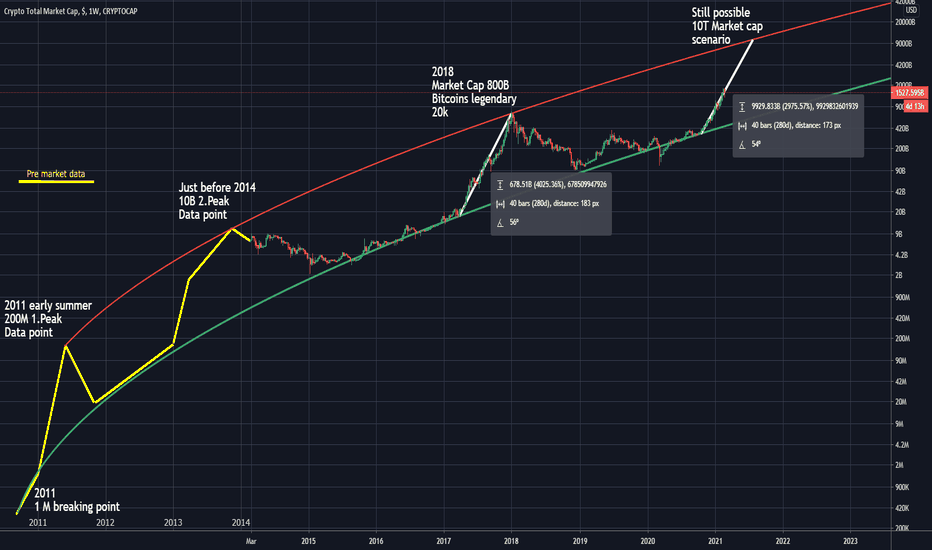

Bitcoin regression to hit $1-5 million within 12 years Was Jack Dorsey correct in predicting "bitcoin would likely become the single global currency within 10 years, “but it could go faster.” back in 2018?

Trolololo's famous 2014 regression predicted a price of $100,000 for bitcoin by July 2021 after correctly predicting a price in excess of $10,000 in 2017. The $100k target remains to be achieved, but seems likely based on current trends and momentum.

Bitcoin logarithmic power law predicts a Bitcoin price by 2032 of at least $1 million and as high as $7 million by 2032, which would put bitcoin in a similar ballpark in terms of total market as of Gold.

Based on "final" destinations and measuring the power law channel based on previous tops, a high of between $95k-150k is possible to estimate for the current halving cycle, assuming the cycle high is complete before the end of 2021, with a cycle low excpected between $20k and $50k before 2024.

Short ES on center regression channel. If ES breaking below central regression channel (white solid line) then go short on retest of white line. Look at confirm indicators. Headed below ATR (green line) Rsi to break below 50. Be careful though because this is a line and could go long again. Only enter if 4h tf low is below center white line. Otherwise you do not enter. If shorting but turns to be false breakdown then do opposite and go long. Because then I think we go to again new all time high.

ZUO Daily BreakoutZUO is beginning to breakout on the daily chart from the long term bearish trend line (purple) after crossing over the 200 period MA (yellow line). There is plenty of support from ichimoku clouds (green shaded area). The regression channel (red and blue shade) shows a 96% correlation which indicates this is a strong bullish trend (thick blue line). Bulls should be looking to buy on a red day that comes close to this trend line. The next key level of resistance is around 17, and should be monitored to see if the price can successfully break above. Historically, ZUO has played in very tight range bound areas.

When will it be time to pause the GME? #stocksThis recent move in GME has be extraordinary to say the least but what matters now is when to temporarily put the controller down and take a break. On a short term basis I am watching the regression channel from the past two days. While we remain in the channel the game is still on but below the channel means its time to rest your fingers