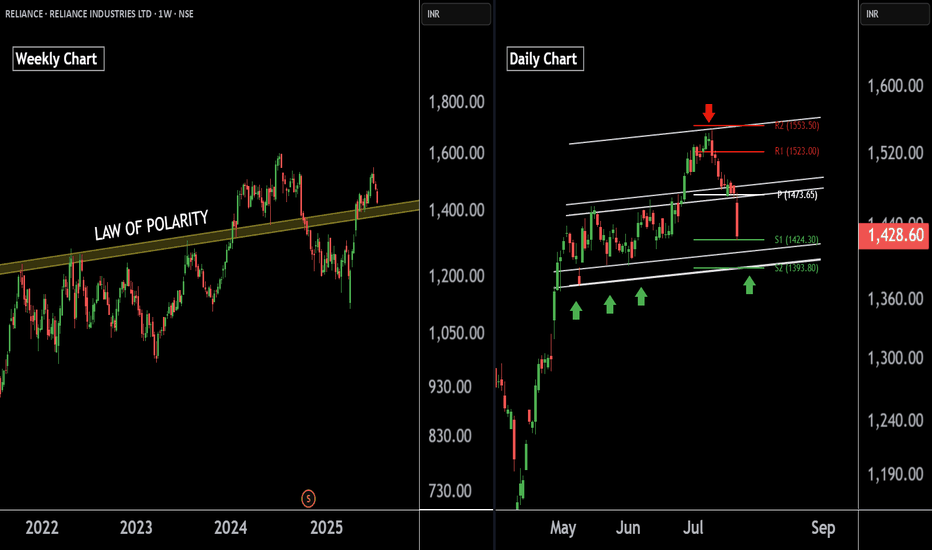

Reliance Industries — Preparing for the Next Bullish Leg !!There are two charts of Reliance Industries — one on the weekly timeframe and the other on the daily timeframe.

On the weekly timeframe:

Reliance industries is trading near (LOP), with a key support zone in the range of 1385–1400.

On the daily timeframe:

Reliance industries is moving in well defined parallel channel with support zone near at 1400-1410.the stock is also taking support at pivot levels S1 and S2, positioned between 1393 and 1422 levels.

If this level is sustain then we may see higher prices in Reliance industries.

Thank You !!

Reliancelong

RELIANCE : Completing correction, ready to bounce back🚀 Trading Opportunity: Reliance Industries Ltd. (NSE: RELIANCE) -

⏱️ Timeframe: 1 Day (1D)

💰 Current Price: ₹1,175.60

🎯 Swing Target Zone: ₹1,374 - ₹1,565 🏆

🛡️ Support Level: ₹1,182.10

🛑 Stop Loss: ₹1,159.00 (Day Close Below) 📉

🔍 Wave Analysis:

📈 The chart indicates a completed corrective wave (primary) 5 on the daily chart. This suggests a potential end to the downtrend and the start of an upward move.

🔄 We observe a corrective wave (A), followed by a potential reversal at (B), and a completed intermediate correction wave 5.

💥 The breakout at point (2) signals the start of wave (C), aiming for the swing target zone of ₹1,374-₹1,565. 🎯

💪 Current support near ₹1,182.10.

⚠️ Daily close below ₹1,159.00 invalidates the wave count and the setup. ❌

📊 Strategy:

✅ Entry: Enter near current market prices (around ₹1,175.60). 🛒

🔒 Risk Management: Set stop loss at ₹1,159.00 (daily close) to limit downside. 📉

💸 Exit: Aim for profits within the swing target zone of ₹1,374-₹1,565, aligning with the wave (C) target. 🏆

#Trading 📈 #StockMarket 💰 #RELIANCE 🏭 #TechnicalAnalysis 🧐 #Investing 💼 #ElliottWave

⚠️ Disclaimer: I am not a financial adviser; please consult one. Don't share information that can identify you. ⚠️

RELIANCE : BET ON FNO AND SWINGTechnical Analysis of Reliance Industries on 1-Hour Chart

Overview of the Chart

The chart represents Reliance Industries on the 1-hour timeframe , highlighting key concepts such as CHoCH (Change of Character), demand zones, and the golden retracement zone.

Tools Used:

Price Action : Key highs/lows, retracement zones.

Demand Zones : Mitigated demand areas.

Golden Retracement Zone : Optimal entry for Wave B based on Fibonacci levels.

Swing Target : Projected target for Wave C.

Key Levels and Concepts Explained

Extended Retracement Zone (Deep Retracement): ₹1,261.20 – ₹1,252.70

This zone marks a potential support area for buyers after a correction in Wave A to B.

Buying Tip: Look for reversal signs in this zone.

Stop Loss: Below ₹1,252.70 to manage risk effectively.

Golden Retracement Zone (Wave B): ₹1,241.30 – ₹1,261.20

Located at the 61.8% Fibonacci retracement level, a high-probability area for a reversal upward.

Buying Strategy:

Enter within this zone if price shows bullish signs like engulfing patterns or pin bars.

Stop Loss: Just below ₹1,241.30.

Target: Swing high at ₹1,341 – ₹1,354 (Wave C).

CHoCH Zones:

Failed CHoCH: Price rejected near ₹1,273.75 and corrected lower.

Demand Zone: Strong demand needs to emerge at ₹1,261.20 for a reversal upward.

Tip: Look for bullish confirmation near demand zones or the golden retracement.

Swing Target Zone: ₹1,341 – ₹1,354

Represents the projected target for Wave C if the retracement zone holds.

Partial Profit Tip: Book profits near ₹1,341 – ₹1,354 and trail stops for further upside.

Stop Loss Strategy

Stop Loss on Failure: Below ₹1,241.30.

If price closes below this level, the bullish setup is invalid, and traders should exit to limit losses.

Buying Tips at Key Levels

Primary Buy Zone: ₹1,241.30 – ₹1,261.20 (Golden Retracement)

Look for bullish confirmation like pin bars, engulfing candles.

Stop Loss: Below ₹1,241.30.

Target: ₹1,341 – ₹1,354.

Aggressive Buy Option: ₹1,261.20

Scale into positions near mitigated demand with tight stop losses.

Key Observations

Wave Structure: Price is in Wave B (corrective phase), aiming for an upward Wave C.

Demand Zone: Buyer defense at the golden retracement confirms bullish outlook.

Risk Management: Always use stop losses to avoid significant drawdowns.

Summary of Key Levels

Key Levels Actions

₹1,241.30 – ₹1,261.20 Buy Zone (Golden Retracement)

Below ₹1,241.30 Stop Loss

₹1,341 – ₹1,354 Swing Target Zone

By following this plan, traders can align with price structure, optimize risk-to-reward, and trade effectively.

BUY RELIANCE ABOVE 1280Reliance formed a strong bullish candle near previous low and looks like a double bottom. Reliance looks a good buy if sustains above 1280 for the Targets of 1320, 1350 and 1400 until 1215 in intact on the downside.

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

The Next Chapter for Reliance...?Reliance has demonstrated a significant shift in its price action by breaking out of the prevailing downtrend. This is an important indicator as it suggests potential momentum for upward movement. Following this breakout, the stock has successfully retested the downtrend line, confirming its strength and validity.

Currently, it is trading within a critical support range between 1280 to 1290 rupees. This level has historically provided a foundation for price stability, indicating that there is buying interest around this area.

There are three compelling reasons to consider entering a long position at this juncture:

1. **Break of the Trendline**: The breach of the downtrend signifies a potential change in market sentiment, which can often lead to further gains.

2. **Successful Retest**: The fact that Reliance has tested the broken trendline and held suggests that the previous resistance is now acting as support, which increases the likelihood of upward movement.

3. **Maintaining Support Levels**: The stock's ability to stay above the significant support range of 1280 to 1290 rupees indicates strong buying pressure. It reflects investor confidence and may serve as a psychological barrier against further declines.

Given these factors, now may be an opportune moment to consider a long position in Reliance.

Elliott Wave Outlook for RELIANCETechnical Analysis of Reliance Industries (RELIANCE) based on Elliott Waves

This analysis is based on Elliott Wave Theory and is for educational purposes only. It does not constitute financial advice. Investing involves risk, and past performance is not indicative of future results. Always consult with a financial advisor before making any investment decisions.

Elliott Wave Analysis

The provided chart of Reliance Industries (RELIANCE) outlines a potential Elliott Wave pattern within a 1-hour timeframe. Elliott Wave Theory suggests that financial markets move in predictable and repeatedly patterns based on investor psychology.

Key Observations:

1. Impulse Wave: The primary uptrend appears to be an impulse wave, a five-wave structure.

Wave 1: The initial uptrend from the low point.

Wave 2: A minor correction or pullback.

Wave 3: A strong extension of the uptrend.

Wave 4: A smaller correction.

Wave 5: The final wave of the impulse, often ending with a climactic price movement.

2. Corrective Wave: The current downward movement was a zigzag corrective pattern.

Wave A: The initial decline.

Wave B: A minor retracement.

Wave C: The expected continuation of the downward trend.

Potential Scenario:

If the current corrective pattern zigzag finishes here or near, then further wave ((3)) is to start post completion of wave (C) of ((2)), and it would not go sudden upside, because any impulse wave unfolds in five subdivisions, so wave (1) of wave ((3)) can start any time post completion of wave (C) of wave ((2)).

Note: This analysis is based on a specific interpretation of the Elliott Wave pattern. Other analysts might have different interpretations. It's crucial to use multiple tools and indicators to confirm your analysis.

Additional Considerations:

Fundamental Analysis: Consider factors like company earnings, industry trends, and economic indicators to support your technical analysis.

Risk Management: Always use stop-loss orders to limit your potential losses.

Diversification: Don't put all your eggs in one basket. Diversify your investments across different assets.

Remember: Elliott Wave analysis is a complex tool that requires practice and experience. It's essential to approach it with caution and always consider the potential risks involved in trading.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Reliance Looking Good...Buy REL at current level and all dips

Target1 - 3000

Target2 - 3200

Target3 - 3627 (if close above 3210)

Disclaimer :-

I am not SEBI registered. The information provided here is for education purposes only.

I will not be responsible for any of your profit/loss with this channel suggestions.

Consult your financial advisor before taking any decisions

RELIANCE (Reliance Industries Limited) - Swing TradeClosing Price: ₹2,972.1

Change %: 1.74%

Volume: 7,304,130

High: ₹2,984.45

Reliance Industries, a market heavyweight, saw a 1.74% increase, closing close to its intraday high. The considerable volume signifies robust investor confidence. Given Reliance's diversified business portfolio and market influence, the stock is likely to maintain its upward momentum, making it an attractive swing trade option.

Kindly conduct thorough analysis and consider market conditions before making any trading decisions.

RELIANCE--Rising Wedge??Rising wedge bearish pattern is observed in this stock..

This stock is showing strong bullishness from the demand areas at 2600 levels.

A strong bullishness is observed after broken the trendline previously

and a continuous move is identified.

So look for long in this stock from the demand Areas.

Reliance--S/R levelsI am sharing the important levels of Support and Resistance. These levels plays a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

Reliance--Bulllish or Bearish??This stock is completely bullish now,a strong break above the major resistance is observed recently. Strong bullish move is observed from 2500-2600.

Price is likely to test this demand zone again.

On topside price is facing resistance in the form of trendline.keep looking for buy when price tested these levels.

If consolidation happens on topside price is likely to continue moving upside chances or more.

Reliance--Resistance @2400 ??I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

RELIANCE--@ Strong Demand??The stock price is now enters in demand zone, where price is strongly moved to the upside...

Find long opportunity in this demand area...

on top side we have a trendline acting as a resistance...

so be careful with this resistance, may have a chance of pushing the price down...

keep safe....

Note:: There is no guarantee that this zone push the price up...sometimes it opens below and continue to down...so careful here.

RELIANCE--Near Its Demand Zone?? look for buy when price test this demand Zone.

I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support.

The information provided on this platform/website/blog is for informational purposes only and should not be considered as financial or investment advice. It is not intended to be a substitute for professional financial advice or consultation.

The content presented here is based on personal opinions, analysis, and research, and it may not always reflect the most current market conditions or regulations. Investing in stocks, bonds, commodities, or any financial assets carries inherent risks, and individuals should conduct their own due diligence and consult with a qualified financial advisor before making investment decisions.

Past performance is not indicative of future results. The value of investments can go up or down, and there are no guarantees of profit or protection against loss in the stock market.

We do not endorse, recommend, or promote any specific stocks, securities, or investment strategies. Readers and users of this information are solely responsible for their investment decisions and should consider their own financial situation, risk tolerance, and investment goals.

Trading and investing in the stock market can involve substantial risk, and it is possible to lose more than your initial investment.

We make no warranties or representations about the accuracy, completeness, or reliability of the information presented. We disclaim any liability for any loss or damage arising from the use of this information or reliance on it.

Please be aware that regulations and tax laws related to investments may vary by jurisdiction, and it is essential to understand and comply with the specific rules and regulations applicable in your location.

By accessing and using this platform/website/blog, you agree to this disclaimer and acknowledge that you have read and understood the information provided herein. It is your responsibility to review and accept the terms of use and privacy policy of this platform/website/blog.

This disclaimer may be updated or modified without notice, and it is your responsibility to review it periodically for any changes.

RELIANCE--Head & Shoulders Pattern ??After a strong trending movement from few weeks,

price is near its resistance level,

now it is in the form of Head and Shoulders pattern..which is a reversal pattern..

wait until price breaks the Neckline and retest...then will enter for Short side...

keep track this for Short side, if breaks neckline...until wait and watch.