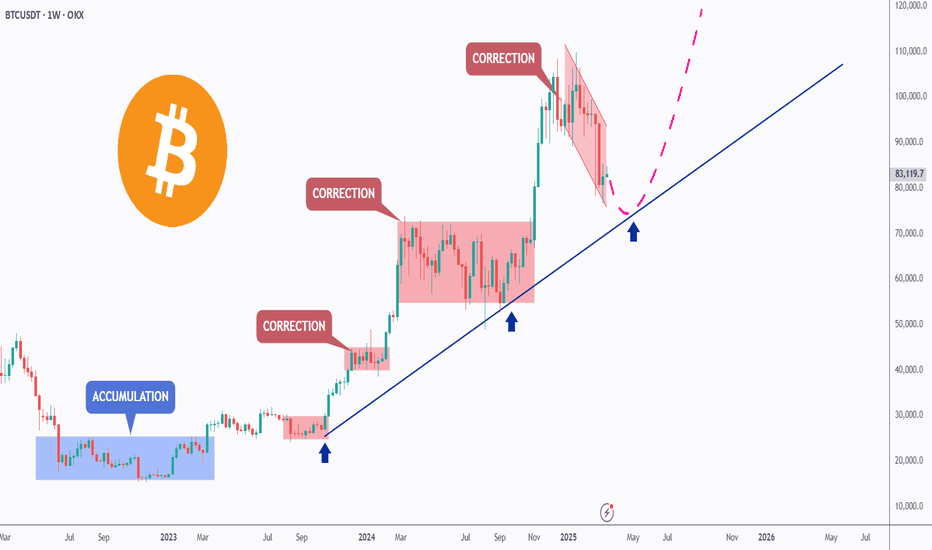

BTC - Bullish SOON!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BTC has been in a correction phase, and it feels like it's taking forever! ⏳

As long as the blue trendline holds, the overall bias remains bullish. 📈

As BTC approaches the blue trendline—perfectly aligning with a demand zone and support—we'll be watching for trend-following longs to catch the next big impulse move upward. 🚀

For now, we wait! ⏳

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Reserve

MicroStrategy another pull back before all time high?NASDAQ:MSTR analysis update..

📉 𝙇𝙤𝙣𝙜 𝙩𝙚𝙧𝙢 The weekly R5 pivot target is bold at $1500 but definitely possible as a max greed scenario when the triple tailwind of Bitcoin, SPY and Bitcoin treasury companies trends return.

📉 𝙎𝙝𝙤𝙧𝙩 𝙩𝙚𝙧𝙢 retracement is expected to end around the S1 pivot at $341 and a secondary target of $321.

Irans conflict has investors shaken and not willing to hold assets over the weekend on the fear of worse. However, if the conflict is resolved soon investors could have a great buying opportunity.

𝙏𝙚𝙘𝙝𝙣𝙞𝙘𝙖𝙡 𝘼𝙣𝙖𝙡𝙮𝙨𝙞𝙨

Price appears to have completed wave (B) of an ABC correction in wave 4. Wave C is underway with an expected thrust down (such is the nature of wave C) towards the daily S1 pivot $341. This is also the 0.382 Fibonacci retracement, a high probability area for wave 4 to end. A deeper correction will bring up a triple shield of the High Volume Node, ascending daily 200EMA and 0.5 fibonacci retracement at £321.

Daily DEMA has death crossed.

Safe trading

Gold - Correction Phase Extended!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 As per our latest Gold analysis, price rejected the $3,100 – $3,150 support zone and traded higher.

However, Gold is still in a correction phase, moving within a falling red channel.

This week, it has been rejecting the upper bound of the channel, reinforcing bearish pressure.

⛔ As long as the upper red trendline holds, the bears remain in control.

✅ For momentum to shift back in favor of the bulls, a clear break above the upper red trendline is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold's Surge: Flight to Safety or Foreshadowing Fear?🚨 Gold just saw its largest weekly inflow in history as shown in the chart by BofA Global Research. The metal is soaring above $3,400/oz while most other assets are crashing hard.

This isn't just bullish momentum — it's panic capital. When fear dominates markets, investors rush to safety. And historically, that safety has always been gold.

But here’s the catch: when fear becomes too crowded, even safe havens can become dangerous. If gold fails to hold these levels and begins to correct, it won’t be a slow bleed — it’ll be a free fall, and a lot of people will get caught.

💬 What do you think? Is this just the beginning of gold’s golden age, or are we seeing the early stages of a bubble?

GOLD HITS RECORD $3,300/OZ – WHAT IS IT TELLING US?Since 2020, stocks and gold have danced to very different rhythms. Initially, equities ran far ahead, but now… the tide is turning fast.

📉 As the equity market sinks into a bear phase, capital is pouring into gold.

Just in the last 9 months, gold has surged over $1,000/oz — a historic move rarely seen outside of crisis periods.

💬 We’ve been calling this for over a year: Gold is now the ONLY global safe haven.

US bonds are no longer the refuge they once were. Investors are voting with their wallets — and gold is winning.

Let’s put it into perspective:

➡️ Over the last 20 years:

• Gold is up +620%

• S&P 500 is up +580%

📈 Gold is trading like we’re in a modern depression — quietly pricing in risk, instability, and loss of trust in traditional instruments.

🧠 The question is no longer "why is gold rising?" — it’s "why didn’t more people see this coming?"

Is the U.S. building a crypto reserve?The United States (U.S.) is no longer just a bitcoin holder – it may be laying the groundwork for a national crypto reserve. Is this the moment bitcoin goes fully mainstream?

Strategic bitcoin accumulation?

Recent estimates suggest that the U.S. government is sitting on 200,000+ bitcoins – over $13 billion worth – mostly seized from criminal operators such as the Silk Road1. That stash makes Uncle Sam one of the largest bitcoin holders in the world. But here is the real question: what is the endgame?

Historically, seized bitcoin was auctioned off at deep discounts, flooding the market with sell pressure. This time, however, President Donald Trump’s latest executive order has put a halt to rapid liquidations, signalling a strategic shift. Instead of fire sales, the U.S. government is deliberately holding onto its bitcoin, driving speculation about a potential long-term reserve strategy.

Is this merely a temporary pause, or the first step toward establishing a full-fledged crypto reserve? While the executive order marks a clear change in approach, formally integrating bitcoin into the U.S. financial system would demand congressional approval, regulatory coordination, and a robust custody framework. The path forward is not just about policy – it is about power.

Digital gold for digital age

Crypto is not just a speculative asset anymore – it is a strategic economic lever in global power dynamics. With the U.S. dollar facing growing pressure from alternative currencies and central bank digital currencies (CBDCs), bitcoin’s appeal as a neutral, hard asset is undeniable.

Unlike traditional assets, bitcoin cannot be printed, seized by sanctions, or easily manipulated. If the U.S. sees what other nations are beginning to recognise – that bitcoin is the 21st century version of gold – it may rethink its role as a long-term reserve asset.

The conversation around crypto is no longer confined to industry circles. President Donald Trump recently issued an executive order officially recognising bitcoin as a strategic reserve asset, marking a significant policy shift. This move has sparked widespread discussion about the future role of digital assets in national reserves.

Further reinforcing this shift, the White House is set to host a Crypto Summit on March 7, where top policymakers and industry leaders will discuss digital assets. While details are scarce, this could be the first step toward formal integration of crypto into U.S. financial policy.

Meanwhile, the Federal Reserve has remained largely silent, leaving questions about its stance on bitcoin’s role in national monetary policy. Will the central bank embrace digital assets, or will it resist this historic shift?

What would it take to make it official?

Turning bitcoin into a recognised U.S. reserve asset is not just a simple executive order. It would require:

Congressional approval to classify bitcoin and other cryptocurrencies as strategic reserves.

Regulatory coordination between the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Federal Reserve, and Treasury.

A secure custody framework to manage holdings without risking security breaches or market instability.

A phased rollout – starting with bitcoin before expanding to other cryptocurrencies or beginning with small holdings before gradually increasing them.

This would not happen overnight. A realistic timeline? Years, not months. Expect feasibility studies, pilot programs, and intense political battles before crypto earns a seat next to gold in the U.S. balance sheet.

Market shockwaves

If the U.S. openly adopts bitcoin as a reserve asset, expect seismic shifts in global markets:

Sovereign bitcoin FOMO2 – other nations would likely follow suit, sparking a global race to accumulate bitcoin.

Institutional confidence surge – a U.S. endorsement would cement bitcoin’s status as digital gold, driving massive institutional inflows.

Reduced sell pressure – unlike past cycles of seized bitcoin dumps, retention would tighten supply and bolster price stability.

If this trend accelerates, we could be looking at a fundamental shift in the financial system – one where bitcoin plays a central role in sovereign wealth strategies. The question is not if, but when and how fast governments will adapt to this new reality.

The bottom line

With the world’s largest economy holding one of the biggest bitcoin reserves, the question is not just about policy – it is about power. Will this be the turning point where bitcoin cements itself as the next global reserve currency?

1 US Government Bitcoin Holdings, Bitcoin Treasuries by BiTBO (treasuries.bitbo.io)

2 FOMO = fear of missing out.

Last Leg of The Bull RunBased on historical patterns, I believe we are in the final phase of the current bull run. Analyzing previous market cycles, the peak of the 2013 bull run to the 2017 peak had a 49-month bar separation, while the 2017 to 2021 cycle exhibited a 47-month separation. Following this established “-2” pattern, the next peak is likely to occur with a 45-month separation.

Additionally, we are currently positioned within a monthly fair value gap, which could drive the market to new highs. However, I remain skeptical about the sustainability of this rally due to the impact of the U.S. crypto reserve. Institutional investors may perceive this as an opportunity for exit liquidity, aligning with the well-known market principle: "Buy the hype, sell the news."

- Gavin

do your own research

not financial advice just a speculation

BTCUSD - Fast trade idea ?Low timeframe so can be invalid very quick

I think you can expect the same Pump & Dump move on Sunday ... but in the invert way

Dump came from news and now expect a second wave, then if we can just go back above 86k6 it would kinda confirm this bringing us hopefully to "normality"

Cheers

ETH, Next Stop => $2,750Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📌 ETH rejected the lower bound of the falling channel and the $2,100 - $2,250 support zone.

What’s next?

ETH remains in a correction phase, and a move toward the upper bound of the channel at $2,750 is expected.

🏹 As it retests the support zone, we will be looking for new short-term long opportunities.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Reserve Rights $RSR Reserve Rights is used for staking to overcollateralize reserve stablecoins RTokens and govern their configuration via proposals and voting.

Team

Nevin Freeman CEO

Miguel Morel is the co-founder and CEO of Arkham. Prior to founding Arkham, Morel co-founded Reserve Protocol, a stablecoin designed for use in emerging markets and hyperinflationary economies.

and others

Investors Coinbase and Paypal, and others

TVL

Just start growing

Positioning and development RWA

Structure - We can see how this works in the chart on the left.

First, Pre-pump after pump and super-pump

This is a chart from the 2020

From a technical point of view of the project. they have made a lot of progress.

From a token point of view, they know how to make pumps

Funds are still holding the project's tokens

With a good market, they should be the leaders in the RWA sector in terms of growth performance

I have this project in my portfolio

Best regards EXCAVO

USDJPY Analysis: Potential Bullish Bias for the Upcoming Week!USDJPY Analysis: Potential Bullish Bias for the Upcoming Week (Sept 23-29, 2024)

As we look ahead to the coming week, USDJPY appears poised for a potential slightly bullish bias. This outlook is based on a confluence of fundamental factors and current market conditions that favor USD strength relative to the Japanese yen. Below is a breakdown of key drivers supporting this outlook, along with insights that could influence price action.

1. Federal Reserve's Hawkish Stance

One of the key drivers for a potential bullish bias in USDJPY next week is the persistent hawkish tone from the Federal Reserve. Although the Fed opted to pause rate hikes in September, policymakers have indicated that they are open to further tightening if inflationary pressures persist. Recent inflation data in the U.S. showed a slight uptick in the Consumer Price Index (CPI), suggesting that the Fed may still consider additional rate hikes in 2024. Higher U.S. interest rates would continue to bolster the U.S. dollar, driving demand for USDJPY as traders seek yield differentials.

2. Bank of Japan's Dovish Policy

In stark contrast to the Fed, the Bank of Japan (BoJ) remains committed to its ultra-loose monetary policy, including negative interest rates and yield curve control. The BoJ's dovish approach continues to weigh on the Japanese yen, especially in an environment where other major central banks are tightening monetary policy. While some market participants expect the BoJ to consider policy changes in the future, there have been no concrete signals indicating a shift in the near term. This widening policy divergence between the Fed and BoJ is a key factor supporting a bullish outlook for USDJPY.

3. Safe Haven Demand Waning

The yen is traditionally viewed as a safe-haven asset, particularly during periods of global market volatility. However, recent market stability, coupled with optimism surrounding global growth prospects, has reduced demand for the yen as a haven. As risk sentiment improves, investors are more likely to allocate capital into higher-yielding assets, which could further weaken the yen.

Moreover, geopolitical tensions that previously supported yen demand have eased slightly, making USDJPY more likely to drift higher in a low-risk environment.

4. U.S. Treasury Yields Rising

Another factor contributing to the bullish bias in USDJPY is the rise in U.S. Treasury yields. Higher yields on U.S. government bonds make the dollar more attractive to foreign investors, adding upward pressure to USDJPY. The correlation between USDJPY and U.S. Treasury yields is well-documented, and as yields rise, so too does the currency pair. Traders will be closely monitoring U.S. economic data next week, including durable goods orders and GDP figures, to gauge the potential for further yield increases.

5. Technical Analysis: Key Support and Resistance Levels

From a technical perspective, USDJPY is trading within a well-defined range, but with a slight bullish bias as long as it holds above key support at the 147.50 level. A break above the psychological 150.00 level could open the door to further upside, with resistance seen at 151.50. On the downside, failure to hold above 147.50 could lead to a test of lower levels around 146.00. Momentum indicators, including the Relative Strength Index (RSI), are currently neutral but leaning slightly toward overbought territory, suggesting room for further gains before a pullback.

6. U.S. Economic Data Next Week

Next week, market participants will pay close attention to several high-impact economic reports out of the U.S., including the Durable Goods Orders on Tuesday and GDP Growth on Thursday. Positive readings on these metrics could fuel further gains in USDJPY, reinforcing the bullish bias. Conversely, any disappointing data could dampen USD strength and lead to some consolidation in the pair.

Conclusion

Given the combination of hawkish signals from the Fed, the BoJ's ongoing dovish stance, rising U.S. Treasury yields, and waning safe-haven demand, USDJPY appears to have a slightly bullish bias heading into next week. Traders should watch for any shifts in risk sentiment or unexpected economic data that could alter this outlook. The key levels to watch are 147.50 for support and 150.00 for resistance.

Keywords: USDJPY forecast, USDJPY bullish, USDJPY analysis, Bank of Japan policy, Federal Reserve rate hikes, U.S. Treasury yields, Japanese yen, safe-haven demand, forex trading, USDJPY technical analysis, USDJPY key levels, USDJPY next week, trading USDJPY.

USDJPY: Slight Bullish Bias This Week? (19/09/2024)As of September 19, 2024, traders are closely monitoring the USDJPY pair for potential bullish momentum. Several fundamental factors and market conditions indicate that the pair might see a slight upward bias this week. Let’s dive into the key drivers affecting the USDJPY price action.

1. Diverging Central Bank Policies

One of the primary influences on USDJPY is the monetary policy divergence between the Federal Reserve (Fed) and the Bank of Japan (BoJ).

- Federal Reserve’s Stance: As we move into the week, the market expects the Fed to maintain a hawkish stance or at least keep interest rates elevated. Although there’s some speculation about a possible pause in future rate hikes, the Fed's priority remains controlling inflation. This higher interest rate environment in the US makes the US dollar more attractive, pushing USDJPY upwards.

- Bank of Japan’s Ultra-Loose Policy: In contrast, the BoJ continues its ultra-loose monetary policy, aiming to stimulate Japan’s sluggish economy. Despite rising inflation in Japan, the BoJ has shown little inclination to raise rates aggressively. This Interest rate differential between the US and Japan tends to weaken the yen, giving a bullish outlook for USDJPY.

2. Risk Sentiment in Global Markets

Risk sentiment plays a crucial role in the movement of USDJPY. When global markets are in a risk-off mode, investors tend to flock to safe-haven assets like the Japanese yen, strengthening it. However, recent global economic data and financial news have maintained a somewhat stable risk appetite, leaning towards a risk-on environment.

- US Economic Data: Recent reports from the US, such as better-than-expected retail sales and strong labor market data, continue to support the narrative of economic resilience. This fuels demand for the dollar and supports USDJPY’s bullish momentum.

- Global Geopolitical Risks: While geopolitical tensions in regions like Europe and the Middle East may inject some volatility, there hasn’t been a major shift toward a risk-off sentiment that would heavily favor the yen. For now, dollar strength seems to dominate.

3. Japanese Economic Conditions

Japan’s economy continues to struggle with low growth despite rising inflation. The BoJ’s consistent approach to stimulus, combined with the government's push for wage growth, has not yet translated into significant yen strength. Additionally, trade deficits in Japan, exacerbated by higher import costs, have weighed on the yen’s valuation.

Without a major shift in BoJ policy or a significant improvement in Japan's economic performance, the yen will likely remain under pressure, keeping USDJPY on a slightly bullish path.

4. US Bond Yields

US Treasury yields are another major factor driving the USDJPY. Higher US bond yields, often seen in response to tighter monetary policy and strong economic data, make the dollar more attractive to foreign investors. The upward trajectory of bond yields has been a persistent theme, reinforcing dollar strength. If this trend continues through the week, we can expect additional support for USDJPY.

5. Technical Indicators

Looking at the technical analysis for USDJPY, the pair has been trading near key resistance levels in recent sessions. If the pair breaks above these resistance zones, we could see further bullish momentum.

- Key Support and Resistance Levels: The 145.00 level has been a psychological support level for USDJPY, while 148.50 serves as resistance. Should the pair break beyond this resistance, it could trigger more buying pressure, pushing USDJPY higher.

Conclusion: USDJPY’s Slight Bullish Bias

In conclusion, the USDJPY pair is expected to exhibit a slight bullish bias this week, primarily driven by:

- Monetary policy divergence between the Fed and BoJ.

- Favorable US economic data and rising Treasury yields.

- Limited economic growth in Japan, with persistent trade deficits.

- Stable global risk sentiment supporting the dollar over the yen.

Traders should keep an eye on US bond yields, Fed comments, and any sudden shifts in risk sentiment or geopolitical events, as these could influence USDJPY’s trajectory throughout the week.

---

Keywords:

- USDJPY forecast

- USDJPY bullish bias

- USDJPY analysis September 2024

- USDJPY technical analysis

- USDJPY key drivers

- USDJPY trading strategy

- USDJPY and Federal Reserve policy

- USDJPY support and resistance levels

- USDJPY risk sentiment

- USDJPY bond yields impact

That's a wrap!! Gold analysis pre Fed, (take 2) This is a video to replace the prior video where the chart was blocked by a paper trading sign!

Same levels, bias and plans for the Fed are in this video! Please enjoy ;)

Gold is a mixed bias, under pressure while below lasty week's highs, but it will be make or break time, perhaps, with the Fed today. Let's see! Here are my levels for bulls and bears!

FOMC FORWARD GUIDANCE SINCE 2018 w/FED SPEAKERS w/SPX The chart provided visually represents the forward guidance issued by the Federal Open Market Committee (FOMC) alongside the performance of various key economic indicators and market indices. The FOMC forward guidance serves as a crucial tool for signaling the Federal Reserve's monetary policy stance and future intentions, thereby influencing market expectations and economic behavior.

By examining the interplay between FOMC forward guidance and these key economic indicators, investors, policymakers, and analysts can gain insights into the likely direction of monetary policy and its potential impact on financial markets and the broader economy.

I have also included comments from various FOMC speakers to better form a picture of the past.

Rising interest rates are not affecting Bitcoin anymore Before significant interest rate hikes, I have claimed that Bitcoin is decoupling from the rest economy (which probably happened).

However, the effect of rising interest rates still had some power over the Bitcoin in the tank.

It seems that this power of raising interest rates is diminishing for Bitcoin relative to the rest of the economy which will probably suffer quite a bit more after this post.

The chances of Bitcoin being affected by raising interest rates are becoming lower and lower.

The bitcoin community is pricing in these hikes a lot earlier than the rest of the market. The same thing happened when inflation started (2020), when Bitcoin moved significantly quicker than the CPI.

My estimate is that the Bitcoin public generally sticks (as do I) to the rule that Inflation is defined as an increase in money supply and deflation is defined as a decrease in the money supply.

These numbers are available much quicker than CPI (Consumer Price Index) which is a trailing indicator and can lag 15-24 months on average.

The same thing happened in reverse now.

One more important point is that monetary inflation is much more difficult to reverse through rising Interest rates, and the community is also aware of this. In my previous posts I have explained

how interest rates cannot curb inflation (even in theory) unless they overshoot the current CPI number, which at the time was over 9%.

Interest rates could have bigger effects at <9% rates only if they break the economy (which slowly might start happening), but this will still not be enough to reduce the money supply.

This could stop further inflation at <9% interest rates, however at the cost of economy. What they cannot do is reverse inflation, meaning that all the money that is in the system will stay in the system

and prices will not come down. Killing inflation this way will be paid for through increased poverty and decreased standard of living, until the economic growth "eats" through that "debt". Which at a

2-3% rate could take multiple years.

If we account for all of these effects and consider the Bitcoin community world views, the chance of further fall is very low, while the stock market still has a lot of down room.

Great opportunity to buy some more BTC - My take on the FED It is possible that BTC will go to 20 000 and maybe even below that, but chasing the bottom is not the smartest idea.

This is the opportunity that we've been waiting for. Everyone wanted to buy BTC if only it was a little cheaper. Well, now it is, but everyone is scared :)

The wise words of Peter Lynch are that NOBODY can predict the bottom, and nobody can predict anything within a year or two. What we can see is that Bitcoin demonstrated more than 2x higher demand than this.

Even though the Crypto market wasn't positively affected by inflation, you have to remember that in macroeconomics some trends require even years to settle even though the signs were obvious.

Everyone with some common sense could tell that inflation was going to be massive if we just looked at the money supply increase of 2020 and 2021, let alone 2022.

But what everyone forgot is that, according to Milton Friedman, real-world effects of inflation go in phases. In the first 6 months, there is some "positive" effect on the economy, due to the massive inflow of currency in the system.

Also, keep in mind that inflation is felt IMMEDIATELY in the stocks and bonds. The very second money printing starts.

But 18 months after that, the effects of inflation are first felt. Keep in mind that this statistic puts just the start of 2020 inflation at the beggining of 2022. So the inflation will keep at this pace for at least the next 2 years with yearly

inflation of 15-30%.

The fact that federal reserve is increasing interest rate will NOT get the inflation under control. Restraining inflation that way never worked long term. It can only create short term FUD and selling.

What happens with the money that people withdraw from their overinflated accounts after 2 years of 20+% gains on S&P500? They start to spend it, because inflation is not under control. What happens then? Inflation becomes even worse.

It takes some money fot the money to come back, usually a couple months to a year. The money in the system will just switch places from fictional (stocks, index and funds) into real life (food, housing, services).

90% of the money that FED has been "printing" for the past 2 years didn't even enter the real life. It was fictional. It was conserved in the markets. Real life effects therefore weren't noticable until recently, when people started cashing in.

Interest rates on bonds will NOT be enough for any average investor. Bonds are only used as a small percentage of portfolios for hedging some risks in the markets.

This text is also the reason why the FED should NEVER interfere with monetary policy, and shouldn't exist at all. All of these money printing and recession cycles are exploiting the human need to gamble. They will crash the system at random

intervals. They will overinflate it when nobody expects it. You will enter the trades even after it's been going up for too long. You probably got burned 5 times before that by trying to short it because it was rational. You can be 100% correct

and still lose money.

And you will lose money both ways.

FOMC FORWARD GUIDANCE SINCE 2018 w/SPXThe chart provided visually represents the forward guidance issued by the Federal Open Market Committee (FOMC) alongside the performance of various key economic indicators and market indices. The FOMC forward guidance serves as a crucial tool for signaling the Federal Reserve's monetary policy stance and future intentions, thereby influencing market expectations and economic behavior.

By examining the interplay between FOMC forward guidance and these key economic indicators, investors, policymakers, and analysts can gain insights into the likely direction of monetary policy and its potential impact on financial markets and the broader economy.

Currency scuffleAs you can see we prepared update for the currency agenda, we have added gd, jpy, rub, and inr to the fuse, as you can see fibonacci cycles stayed the same in the anbsence. We think or at least clearly see on a chart that rub was the most profitable currency available. In the later arrivals we will try to discover most profitable assets nominated in rubles and compare them to assets in other curencies. Feel free to read, analyse, comment and enjoy the party.

Gold climbs on global uncertaintyOvernight Gold approached the 3-month high of $1985, since June & July 2023.

This was likely due to the

- Fed chair Jerome Powell's comments which indicated that the rise in yields might lessen the need for additional rate increases. With the increasing probability of the US Federal Reserve keeping rates on hold at the November meeting, the DXY saw brief moves to the downside.

- Continued escalation in geopolitical uncertainty, as troops are reportedly gathering at the Gaza border, suggesting an expected ground invasion, financial markets are seeing a strong move toward the reserve commodity.

Do you think Gold will continue its climb higher to the key resistance of $2066?

Gold Outlook 22 March 2023Gold retraced strongly following the move to the 2000 price level. Forming a head and shoulder pattern, Gold traded down to the 1938 price level which coincides with the 61.8% Fibonacci retracement price level

The next directional move on Gold is going to be highly dependent on the volatility of the DXY, especially with the FOMC interest rate decision due.

In the short term, if the price breaks below 1933 (the 61.8% fib level), gold could continue trading lower, down to the key support level of 1914.

However, in the medium term, anticipating further DXY weakness, look for Gold to bounce either at the fib level or the 1914 support level to continue with the uptrend to retest the 2000 price level again.