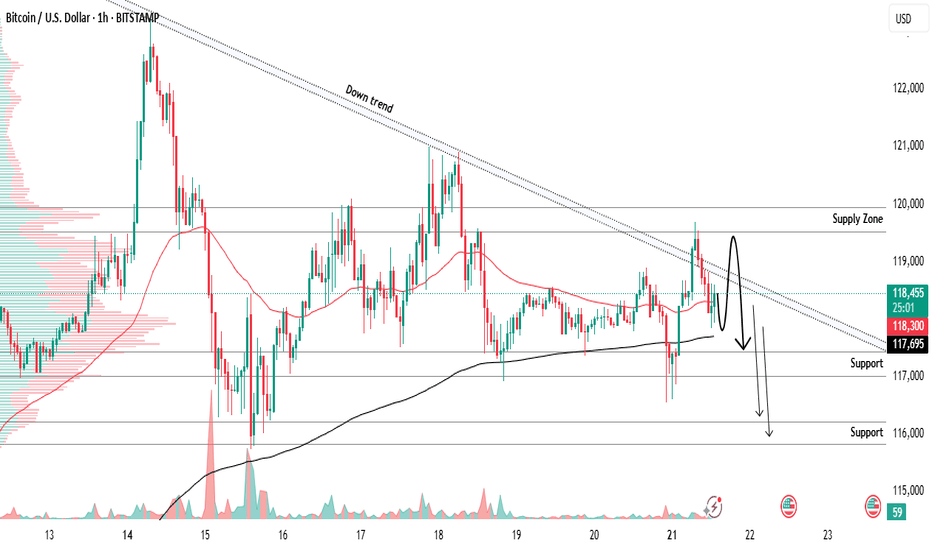

BITCOIN strong down trend selling strong from resistance 119,700📊BTCUSD Bitcoin Analysis – 1H Timeframe

Bitcoin is respecting the short-term downtrend, continuing to print lower highs and lower lows

📌Sell Setup Active:

✅Entry from the supply zone around 119,700 — price reacted perfectly with downside momentum

🎯Next Support Levels to Watch:

🔹 117,200

🔹115,900

These areas may act as short-term bounce zones or continuation areas — staying alert for reaction

🧠Risk management is key – no setup is ever 100% guaranteed! Stick to your plan

What’s your outlook on BTC in this range? Let’s discuss!

Stay sharp & informed — follow for more clean TA setups

#bitcoin #btcusd

👋Regards from expert Team

Resistance_level

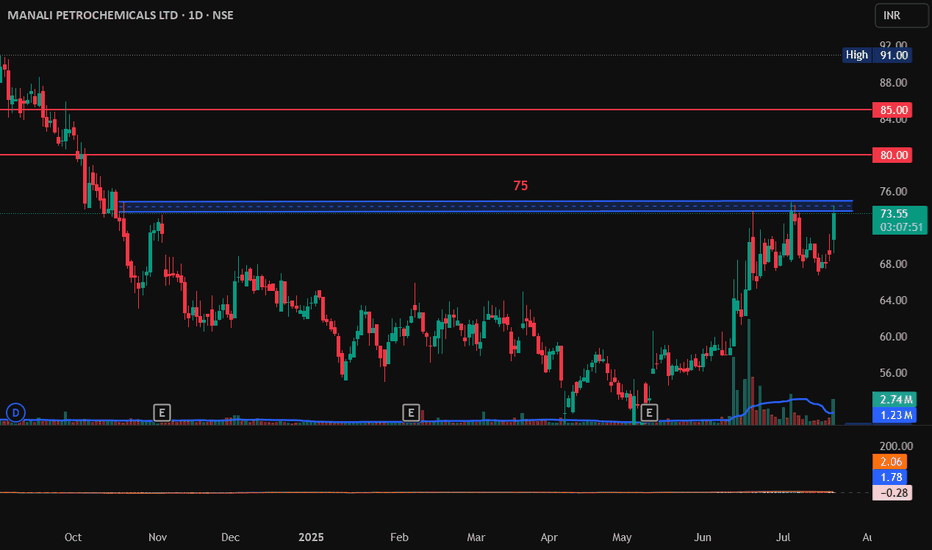

MANALI PETROCHEMICALS LTD, Breakout, LongMANALI PETROCHEMICALS LTD has raised 6% today and its near the resistance zone of 75. If it breaks this 75 and sustain it with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami.

Entry on Bullish pattern: 75

Target1: 80

Target2: 85.

SL: 70.

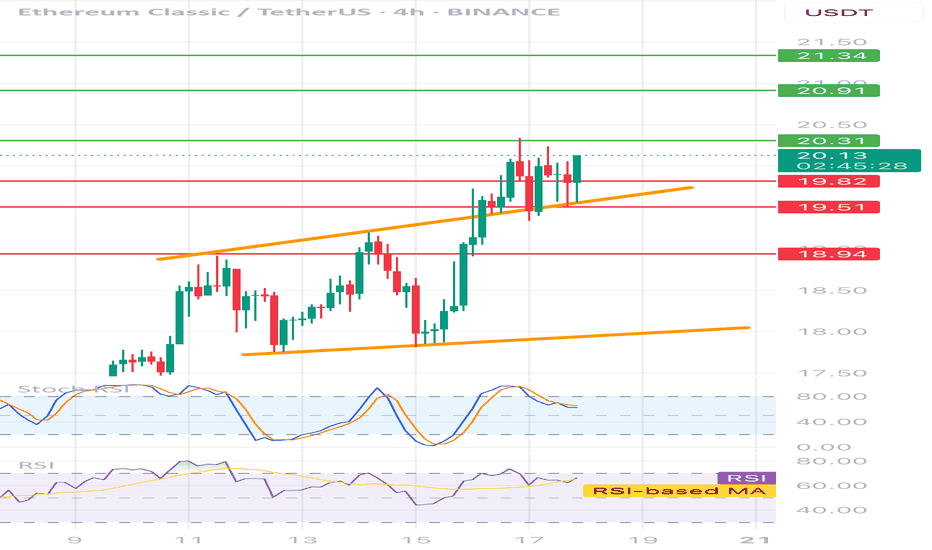

ETCUSDT 4H📊 Price:

Currently around 20.05 USDT

⸻

🔶 Technical formation:

• Ascending channel - clearly marked with two orange trend lines.

• The price is currently testing the upper edge of the channel - it is possible to break or correction.

⸻

📉 Support and resistance:

• ✅ Support:

• 19.73 (local, on the closure of the candles)

• 19.51 (technical, tested several times)

• 18.94 (stronger, historical)

• 🚫 resistance:

• 20.31 - the closest local resistance

• 20.91 - key level

• 21.34 - strong resistance from higher intervals

⸻

🔄 oscillators:

• STOCHASTIC RSI - in the inheritance phase (descent from buying), possible local decline / correction.

• RSI (14) - approx. 60, slightly positive trend, but without exaggeration - no purchase, place for further increases.

📌 Fast strategy:

• 🟢 Long: After breaking and Retescia 20.31 → TP 20.91 / 21.34

• 🔴 Short: after rejection 20.31 or the upper line of the channel → TP 19.73 / 19.51

• 📉 SL: In both cases, it is best 0.3–0.4% above the last high/low

Big Week for Markets: U.S. CPI Tomorrow – What It Means for GoldThis week is packed with news, but the main focus is the U.S. CPI report dropping tomorrow.

🗓 Key Event: U.S. CPI Report

📍 July 15, 2025 | 12:30 p.m. UTC

The CPI report measures inflation and heavily influences the Fed’s rate decisions. Last month’s CPI came in at 2.4% vs. 2.5% expected, following 2.3% vs. 2.4% in April. While it seems inflation is rising, the bigger picture shows stable annual inflation in the 2.3%–3.0% range, keeping things under control—likely the reason Trump is pressuring Powell to cut rates.

Market expects June CPI to be 2.7%.

🤔 Possible Scenarios:

1️⃣ CPI > 2.7%: Bullish for DXY 📈. The stronger the print, the bigger the spike, but I see this scenario as less probable.

2️⃣ CPI < 2.7%: Bearish for DXY 📉. We may see a USD dump, though likely shallow since CPI could still be higher than previous months.

✨ What About Gold?

I don’t expect a major reaction in gold:

✅ Higher CPI? Gold often benefits as an inflation hedge.

✅ Lower CPI? Also supportive for gold as it weighs on the USD.

🔍 Technical Outlook:

Gold has been trading within a triangle since April 22, forming lower highs and higher lows. We may currently be in Wave D (Elliott Wave), aiming toward the triangle’s upper boundary slightly above $3,400 resistance. After that, Wave E may develop – but that’s a story for another post.

MUTHOOT FINANCE at Best Resistance !! This is the Daily Chart of MUTHOOT FINANCE .

MUTHOOTFIN is currently trading near its resistance range around the 2700 range.

MUTHOOTFIN has completed its upward move as per its natural price behavior, with the rise reaching up to the 2700 range.

If This level is sustain , then we may see lower prices in MUTHOOTFIN.

Thank You !!

GBPNZD Important Resistance and SupportThe pair is heading towards the resistance at 2.363, which has not been tested by the sellers, so there are still many sellers waiting in this area. The uptrend could extend to 2.276, the highest peak of last month.

If the resistance at 2.263 cannot be broken, then 2.238 is the sideway border of the pair, which helps support the price increase. When it breaks out, it confirms a reversal to the downtrend.

The price reaction zone can be noted around 2.229 before touching the strong support zone at 2.220.

Support: 2.238, 2.229, 2.220

Resistance: 2.263, 2.276

$Eth Breaks Key Resistance! Is $4100 Coming Next? Ethereum has officially broken above its previous resistance at $2900 and is now aiming for the critical $3000 psychological level. Here's a step-by-step breakdown of what to expect next, including MACD, RSI signals, and CPI data impact.

🔹 Step 1: Breakout Confirmation

Ethereum has successfully broken above the $2900 resistance level — this area is now acting as immediate support.

🔹 Step 2: Next Short-Term Target – $3000

ETH is expected to hit the round number resistance at $3000, which is the next major level to watch. This is the first price target.

🔹 Step 3: MACD & Stochastic RSI Support Bullish Move

MACD is crossing to the bullish side, showing increasing momentum.

Stochastic RSI is also favoring bullish continuation — indicating a likely move to $3000 and beyond.

🔹 Step 4: Possible Rejection Zones

If ETH faces rejection near $3000 or $3500, especially if Bitcoin shows weakness or stalls, expect a pullback.

🔹 Step 5: Target 2 – $4100 if Breakout Continues

If ETH convincingly breaks above $3000 and sustains momentum, $4100 becomes the next major target. This level aligns with the previous high and potential macro continuation.

🔹 Step 6: Watch CPI Data Impact

A positive CPI reading will strengthen bullish sentiment and help ETH push toward $4100.

A negative CPI surprise might trigger a reversal — but even in that case, a short-term hit of $3000 remains likely.

Key Levels to Watch:

Support: $2900, $2800

Resistance: $3000 (Target 1), $3500 (Interim), $4100 (Target 2)

Ethereum's price structure looks bullish above $2900, supported by technical indicators and macro optimism. The $3000 level is within reach, and if momentum continues, $4100 is the next upside target. Keep an eye on BTC behavior and CPI release for confirmation or reversal signals.

MICROSOFT - Simple Analysis WIN ! Its Bearish Ahead ! MAGIC Microsoft - Lets explore the magic of Technical Analysis / Price action.

Microsoft is currently testing the daily resistance level and it will be more matured once the bearish candle / rejection candle is formed. We see a bearish divergence at this level which is a strong confluence for the bearish trend a head.

forgot to mention, a perfect bookish - Bearish Crab pattern is forming, which is a forming a Potential Reversal Zone (PRZ).

we expect our entry after confirmation on the break of HL - 447 level and then we can plan our TPs accordingly.

Please like and comment!

Making HH HL.

Closed at 40.45 (04-06-2025)

Making HH HL.

Bearish Divergence played well &

dragged the price from 44 - 45 to around 33.

Printed HL & started moving upside.

If 45 is Crossed & Sustained, we may witness

new Highs around 55 - 57.

However this time, Stoploss should be 33.50

on Closing basis.

$Btc Bearish Flat Pattern Forming?Bitcoin Bearish Flat Pattern Forming? Potential Short Setup to $97K-$98K if Rejected at $106K

📉 BTC recently hit a new all-time high around $112K, followed by a series of higher lows near $110K, $108K, and potentially $106K. If price gets rejected at $106K, a bearish flat pattern may play out—triggering a high-probability short opportunity toward the $97K–$98K support zone. However, a clean breakout above $107K will invalidate this setup.

Gold (XAU) Technical Analysis – Bullish SetupGold is currently trading around 3290, exhibiting strong bullish price action, suggesting a favorable environment for buyers. The current momentum indicates a potential move towards the final resistance at 3340, making this a strong buy opportunity in the short term.

Trade Setup:

Buy Entry Zones:

Current price zone: 3290

Potential dip-buy zone: 3275 (possible fakeout/retest area)

Targets:

3300 – Minor psychological resistance

3310 – Near-term resistance

3320 – Intermediate target

3340 – Final resistance & major target

Stop-Loss:

Conservative: 3265

Aggressive: 3260 (below support/fakeout zone)

Analysis Summary:

The chart suggests continued bullish momentum. A minor retracement to 3275 may occur, which would provide a second entry opportunity for buyers. As long as price holds above 3260, the bullish structure remains intact, targeting incremental levels up to 3340.

Risk Management Tip: Adjust position sizing according to risk tolerance and maintain discipline around stop-loss levels.

Let me know if you'd like this in a visual chart format or if you'd like to include moving averages, RSI, or other indicators for deeper analysis.

Wed 7th May 2025 XAU/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAU/USD Buy. Enjoy the day all. Cheers. Jim

Note: This isn’t a great setup as price is already at the previous high and the MACD is just below the zero level. But I had to take it because I am committed to my MSH (multi sequence hedging) strategy. So if you are a traditional type trader, then standing aside on this trade would probably be the smart thing to do.