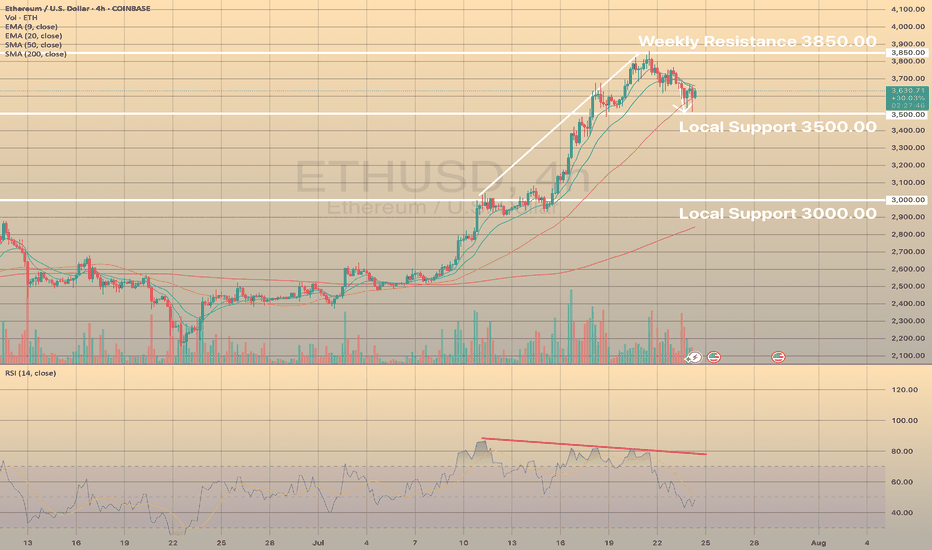

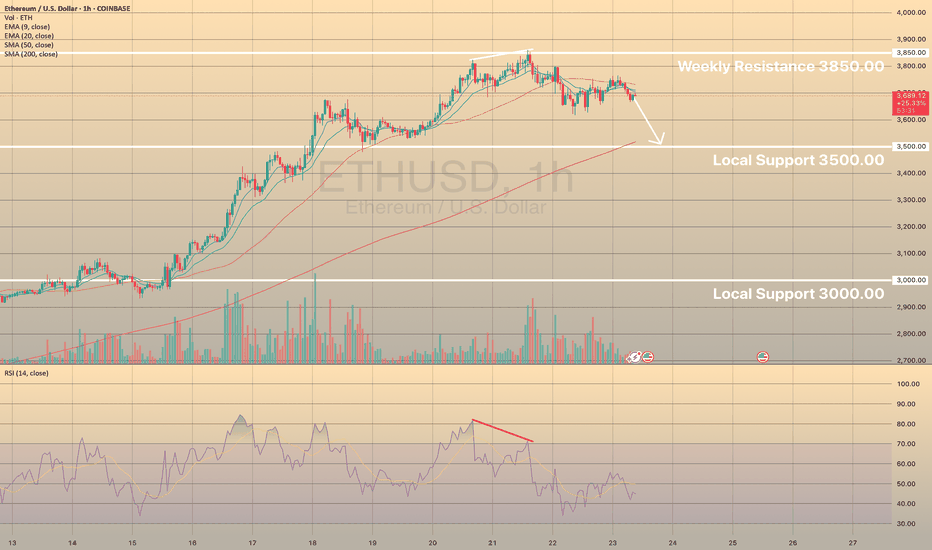

ETHUSD, XRPUSD - BEARISH DIVERGENCE SUCCESSFULLY WORKED OUT

ETHUSD, XRPUSD - BEARISH DIVERGENCE SUCCESSFULLY WORKED OUT

On these 2 graphs you may observe ethereum and ripple declining after strong bearish divergence showed up on both of these instruments. Here, the bearish divergence proved to be a success. In both cases the price has almost reached first targets: 3,500.00 for ETHUSD and 3.00000 for XRPUSD.

What will be next?

It looks like downwards correction still persists and we may observe some deeper than now decline with possible targets of 3,000.00 for the ETHUSD and 2.60000 for the XRPUSD.

Resistanceandsupport

ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00

The ETHUSD has hit some resistance at around 3,850.00 this week. But it's since pulled back from that level, which might be a sign of a cooling trend. That's backed up by the RSI going bearish.

Right now, the price is below the 50 SMA on the 1-hour chart, indicating a mid-term downtrend.

We could see the price find some support at 3500.00 or so. Additionally the SMA 200 lays nearby, providing extra support here.

XRPUSD - BEARISH DIVERGENCE DESPITE STRONG BULLISH PRESSUREXRPUSD SIGNALS BEARISH DIVERGENCE DESPITE STRONG BULLISH PRESSURE. WHAT TO EXPECT?👀

Ripple has been moving bullish since July 9, the same as the ETHUSD, reaching the 3.60600 resistance level. Strong bearish divergence on RSI is observed.

What is the bearish divergence?

Bearish divergence is a technical analysis pattern where the price makes higher highs in an uptrend, but a momentum indicator (e.g., RSI, MACD) forms lower highs, signaling weakening bullish momentum and a potential downward reversal. To trade, identify the divergence in a clear uptrend with the indicator showing lower highs (e.g., RSI above 70). Sell or short when the price confirms a reversal (e.g., breaks below a support level or trendline) with increased volume. Set a stop-loss above the recent high. Target the next support level.

Here the closest support level is local support 3.00000. is the price drops below the EMA20 on 4-h chart, there are high chances of reaching this level.

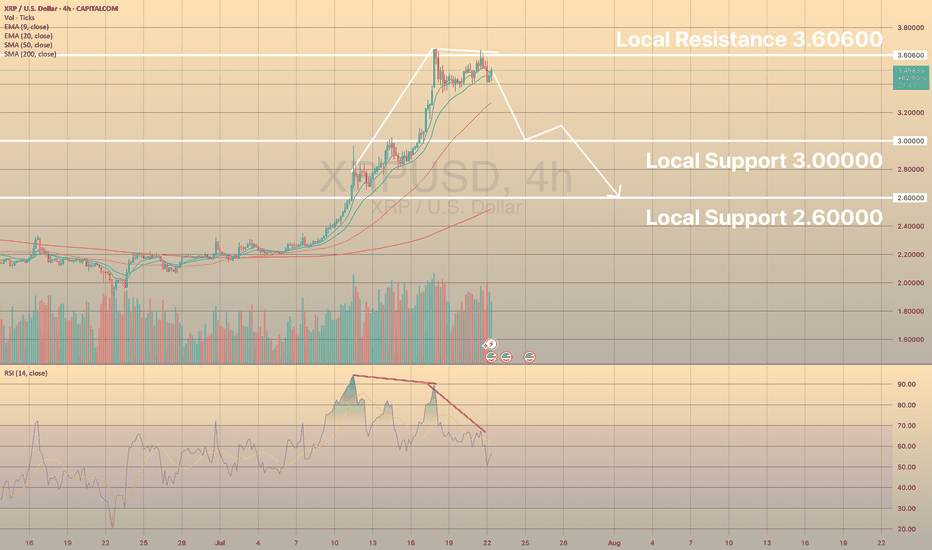

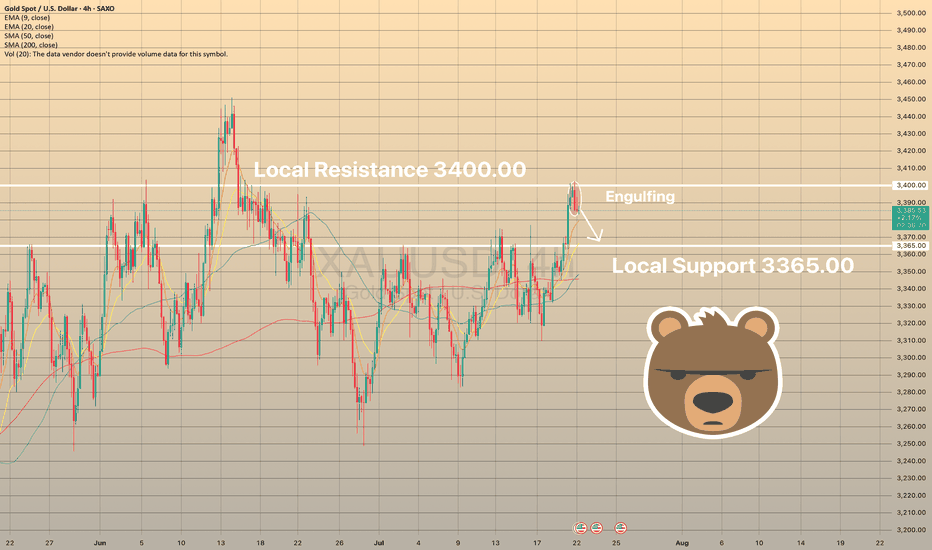

XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?

XAUUSD has been trading bullish within the last day. The price touched the resistance level of 3,400.00. As a result, the bearish engulfing pattern has formed on 4-h chart.

An engulfing pattern is a two-candle reversal pattern where a smaller candle is followed by a larger one that completely covers it, indicating a potential shift in the trend. A bullish engulfing pattern, which signals a buy signal, occurs in a downtrend when a small red candle is followed by a larger green candle. A bearish engulfing pattern, which signals a sell signal, occurs in an uptrend when a small green candle is followed by a larger red candle. To trade, identify the pattern in a clear trend with high trading volume on the engulfing candle. Enter a buy position (for a bullish engulfing pattern) or a sell/short position (for a bearish engulfing pattern) after the engulfing candle closes, confirming a rebound from support or resistance. Set a stop-loss below the low of the bullish engulfing candle or above the high of the bearish engulfing candle. Aim for the next support or resistance level or aim for a 1:2 risk-reward ratio.

So, here I expect the price to move down towards local support of 3,365.00, where supposedly, the price will start to consolidate.

EUR/USD - Is the uptrend about to end?The EUR/USD currency pair has demonstrated a consistent uptrend on the 4-hour chart for approximately two weeks. This sustained bullish momentum has captured the attention of traders and analysts alike, who are now questioning whether the pair can maintain its upward trajectory or if a retracement is imminent as it approaches significant resistance levels.

Rising wedge

A closer examination of the price action reveals that EUR/USD has been advancing within a rising wedge formation. This technical pattern is generally considered bearish, as it often precedes a reversal or a breakdown rather than a continued rally. Rising wedges are characterized by converging trendlines, with price making higher highs and higher lows at a diminishing rate, which typically signals waning bullish momentum and a potential for sellers to regain control.

Strong resistance

Recently, the pair encountered a notable resistance zone around the 1.141 level. Upon reaching this area, EUR/USD faced a rejection, resulting in a pullback from its recent highs. While there is a possibility that the pair could make another attempt to test this resistance, the initial rejection suggests that the upward move may be losing steam. As a result, the likelihood of a retracement has increased, especially given the bearish implications of the rising wedge pattern.

Support/target zone

If the pair does indeed correct lower, a logical target for a cooldown would be the green support zone near 1.127. This level has previously acted as a strong support area, and it could serve as a foundation for buyers to step in once more, potentially setting the stage for another move higher. Until the resistance at 1.141 is decisively broken, caution is warranted, and a period of consolidation or a pullback towards support appears increasingly probable.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

BTC - Will the trend continue?Since the beginning of April, BTC has been on a notable upward trajectory, showing impressive strength with minimal retracements. This sustained momentum has captivated market participants and built a narrative of continued bullish pressure. Along this journey, BTC has carved out two distinct consolidation zones, periods of relative price stability, characterized by equal highs and lows. Each time, these consolidations were followed by a decisive breakout to the upside, reinforcing the prevailing bullish sentiment in the market.

Another consolidation phase

At the present moment, BTC appears to be entering yet another consolidation phase. The price is coiling, showing signs of compression that often precede significant moves. This naturally leads to the question: are we about to witness another breakout to the topside, continuing the pattern established over the past several weeks?

Bullish scenario

In a bullish scenario, a breakout to the upside would likely see BTC pushing towards the 106,000 level. This zone is a key target for traders watching in this consolidation. Should momentum carry the price beyond this threshold, Bitcoin would be well-positioned to challenge its all-time high near 109,000. A clean move through these resistance levels could spark a new wave of optimism, potentially attracting fresh capital into the market and confirming the strength of the current uptrend.

Bearish scenario

However, it’s important not to ignore the risks. The bearish scenario involves BTC breaking down below the current support zone, which sits around the 101,000 mark. A decisive move beneath this level would undermine the bullish structure and signal a shift in market sentiment. In this case, Bitcoin might find itself revisiting the 97,000 to 98,000 range, an area that previously acted as resistance during the last consolidation phase and may now serve as a potential support zone if tested from above.

Conclusion

In essence, the market is at a critical juncture. BTC’s recent behavior suggests a buildup toward a significant move, but the direction remains uncertain. Whether it continues its march toward new highs or corrects to retest lower levels, this period of consolidation is likely to define the next phase of Bitcoin’s trend. Traders and investors alike are watching closely, as the next breakout, up or down, could set the tone for the weeks to come.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

XAUUSD - Short Trade after Resistance Test ($3,005 - $3,010)Short after Resistance Test ($3,005 - $3,010)

📌 Entry: Sell within the $3,005 - $3,010 range if there is a clear rejection and price weakness.

🎯 Take-Profit 1: $2,985 (immediate support)

🎯 Take-Profit 2: $2,970 (recent lows)

🛑 Stop-Loss: $3,015 (above resistance)

🔹 Probability: High – Confirmed by weak volume on rallies and strong resistance.

Trade Rationale:

Key Resistance Zone ($3,005 - $3,010): This level has historically acted as a supply zone, where sellers step in to push prices lower. If price action shows rejection (e.g., wicks or bearish engulfing candles), it confirms a high-probability short setup.

Weak Volume on Rallies: Volume analysis suggests that bullish momentum lacks strong participation. A rising price with decreasing volume often signals an exhaustion of buyers, increasing the probability of a reversal.

Technical Indicators Align:

RSI (Relative Strength Index): Overbought or showing bearish divergence, signaling potential downside pressure.

MACD (Moving Average Convergence Divergence): Losing bullish momentum or forming a bearish crossover, indicating potential for a pullback.

Donchian Trend & Moving Averages : Price is testing upper Donchian bands and key moving averages are suggesting overextension.

Risk-Reward Ratio:

> The stop-loss at $3,015 ensures protection against false breakouts.

> The first take-profit ($2,985) targets the nearest support, locking in quick profits.

> The second take-profit ($2,970) aligns with recent swing lows, maximizing the downside potential.

Final RRR (TP2) is 1 : 3,4

Conclusion:

A rejection from the $3,005 - $3,010 resistance zone presents a solid short opportunity, backed by weak bullish momentum, technical confluence, and favorable risk-reward. If the price fails to break higher and shows signs of rejection, this trade setup has a strong probability of success.

⚠️ Final Warning: Trading involves significant risk, and past performance does not guarantee future results. Always use proper risk management and never trade with money you can't afford to lose. This analysis is for educational purposes only and not financial advice.

What do you think about this setup? Would you take this trade? Drop your thoughts in the comments! 👇

Resistance and support zonesI drew these support and resistance zones or supply zones and buy zones that I think are good places to put sell positions and buy positions when price does touch these areas, the timeframe is 1 hour so these should be pretty respected zones and great areas to sell and buy from.

Swing Trading Signals, Momentum Patterns: TPRLuxury fashion brands are popular for speculation heading into the holidays.

With a few points to the bottom completion resistance, NYSE:TPR has a swing trading entry signal, 2 in a row now. Resting days that create a narrow consolidation can be powerful momentum-building patterns for short-term trading.

Swing trading, rather than day trading, these setups can net better profits. Position trading needs to wait for a stronger support level to build for an entry, which usually occurs when the bottom formation completes.

ETH 1H Review Be careful!Hello everyone, I invite you to review the chart of ETH in pair to USDT, also on an hourly interval. In the first place, we can mark the downtrend channel, however, we are currently moving in a sideways trend channel in which the price is still holding.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the support, and as you can see the first support is the zone from $1841 to $1829, then we can mark a very strong support zone from $1780 to $1714, when the price falls below this zone we can see a drop around $1626.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we see a strong resistance zone from $1,894 to $1,947, then we have resistance at $1,984, and then the price needs to break through the $2,031 resistance to continue up.

When we turn on the EMA Cross 200, we see that the price made an attempt to return to the uptrend, but it failed and we quickly fell below the ema cross 200.

The CHOP index indicates that the energy is almost depleted, the RSI has a strong rebound but there is still room for us to go lower, the STOCH index indicates that the energy is depleted at the moment so we can see a temporary sideways trend.

BNB/USDT 4HInterval Review CHARTHello everyone, welcome to the BNB to USDT chart review on a four-hour timeframe. We will start by selecting the uptrend channel in which the price is moving at the lower border, locally we can see that we managed to get out of the downtrend line at the top.

When we lay out the Fib Retracement grid, we see that the price stayed in the strong support zone from $241 to $236 and has now moved above it, however, when the direction of the price changes and the zone is broken, we still have very strong support at $229 and then level of $221.

Looking the other way, we see a third approach to resistance at $245, then we can see a rapid rise to a strong resistance zone from $248 to $251, when it breaks out higher, we have resistance at $255, then at $261 $.

The CHOP index indicates that there is energy to be used, the RSI is moving in the upper part of the range, and what's more, we can see that downward movements on the indicator give a larger correction than upward movements. On the STOCH indicator, we are approaching the upper limit, which may also affect the upcoming price rebound.

LTC/USDT Review 4H Hello everyone, I invite you to review the chart of LTC in pair to USDT. Let's start by marking the local downtrend line with a yellow line as we can see the price is about to try to break this line.

Moving on, we can move on to marking support areas when we start a larger correction. However, here we see that the price is at the upper border of the $93 to $87 strong support zone, when the price falls below this zone, the next support is at $80.

Looking the other way, we can mark the first support at $98.99, then we have a strong resistance zone from $105 to $109, only after an upward exit from this zone, the price will move towards resistance at $114.87.

When we turn on the EMA Cross 50 and 200, we can see that the price is moving just below the EMA Cross 200 and is close to an uptrend, which would indicate a return to the uptrend.

The CHOP index, which indicates that we have a lot of energy for the upcoming move, the MACD remains in the local uptrend, while the RSI has a visible increase, but there is room for the price to go a little higher in the coming hours.

ETH/USDT 4HInterval ReviewHello everyone, I invite you to review the chart of ETH in pair to USDT, also on a four-hour interval. First, we will use the yellow line to mark the local downtrend line from which the price is moving sideways.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the support, and as you can see, we first have a support zone from $ 1904 to $ 1868 where the price is currently located, but when we go lower, the next support is at $ 1825.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first strong resistance at $1932, and then the price will have to break through the strong resistance zone from $1970 to $1997.

The CHOP index indicates that there is a lot of energy for movement. The MACD indicator is close to turning into a local uptrend. On the other hand, on the RSI we moved back to the lower end of the range, which may give room for price increase.

Gold (XAUUSD) Commodity 02/07/2021Technical Analysis :

As you can see, Gold has moved in the ascending channel. After finishing its Bearish Divergence moving, We believe that XAUUSD is accumulating and consolidating on the 61.8% Fibonacci level and get ready to shoot for the defined targets and the targets are defined with Fibonacci projection of the impulsive waves.

ATOM 1D ReviewHello everyone, I invite you to review the ATOM chart in pair to USDT, on a one-day timeframe. First, we will use the yellow line to mark the uptrend line on which the price is currently based.

Moving on, we can move on to marking support areas when we start a larger correction. And here the first support is at $8.81, and then it is worth marking the support zone from $7.89 to $7.26.

Looking the other way, we see that the price has turned around at the resistance of $ 10.29, when it manages to break it, we have a strong resistance zone from $ 11.06 to $ 11.56, only after a positive upward exit and testing the resistance will the price be able to keep going up.

Please look at the CHOP index, which indicates that we have a lot of energy for the upcoming move, the MACD indicates a downtrend, while the RSI is in the process of rebounding, and looking at the energies and the MACD, we can expect a price drop.

ADA 4HInterwal Resistance and SupportHello everyone, I invite you to review the ADA chart in pair to USDT, also on a four-hour interval. First of all, using the blue lines, we can mark the local downtrend channel in which the price is currently moving.

Now let's move on to marking the places of support. And as you can see, we have the first support at $0.29, then we have a support zone from $0.27 to $0.26.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first significant resistance at $0.33, and then the price needs to break the resistance zone from $0.35 to $0.37.

The CHOP index indicates that there is a lot of energy harvested. The MACD indicator indicates a transition to a local uptrend. On the other hand, on the RSI we are in the middle of the range, which makes it difficult to turn the direction of the price, but adding the collected energy and entering the uptrend on the MACD, we can see an attempt to increase the price.

BTC Daily Review 4HIntervalHello everyone, I invite you to review the current situation on the BTC pair to USDT, taking into account the four-hour interval. First, we will use the yellow line to mark the downtrend line from which the price has moved sideways.

Now we can move on to marking the places of support in the event of a correction. And here, in the first place, it is worth marking support at $29248, but when we go lower, we still have a strong support zone from $28696 to $28266.

Looking the other way, in a similar way, using the trend based fib extension tool, we can determine the places of resistance. And here the first resistance is at $30,242, then we have the resistance zone from $30,758 to $31,114, however, before any major increases, the price must break the resistance at $31,581.

Please pay attention to the CHOP index which indicates that there is a lot of energy for the upcoming move, the MACD indicator indicates entering a local uptrend, while the RSI is moving in the lower part of the range, which may bring the price up in the coming hours.

BTC/USDT 1Hinterval support and resistanceHello everyone, let's look at the BTC to USDT chart on one hour time frame, the price is trading below the local falling trend line.

To check the supports, we will use the trend based fib extension tool and as you can see, the first significant support is at $29,481, and then we have strong support at $29,306.

Now let's move on from the resistance line, as you can see the price fights the resistance at $29783, then we have a strong resistance zone from $29930 to $30038 and then resistance at $30172.

The CHOP index indicates that there is energy for further movement, the MAC maintains a downward trend, and the rsi is moving under the downtrend line, only when we exit it can we see the price increase.

Hello everyone, I invite you to review the BNB/USDT 4H ChartHello everyone, I invite you to review the BNB chart against USDT, also on a four-hour timeframe. First of all, using the blue lines, we can mark the uptrend channel in which the price is currently moving in the lower part, it is also worth marking the local downtrend line with the yellow line.

Now let's move on to marking the places of support. We will use the trend based fib extension tool to mark support, and first we will mark a strong support zone in which the BNB price is currently located, but when it falls below this zone, the next support is at $ 233.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first strong resistance at the price of $ 249, and then it is worth marking a very strong resistance zone from $ 257 to $ 262, only when the price breaks out of it and then positively tests, we will see further increases.

The CHOP index indicates that the energy has been used. The MACD indicator maintains an ongoing downtrend. On the other hand, on the RSI we have a strong rebound to the lower part of the range, which creates room for a future price increase, but it is worth being careful because there is room for the price to go a little lower.

ETH/USDT Daily Review 4HIntervalHello everyone, I invite you to review the chart of ETH in pair to USDT, on a four-hour interval. First, we will use the yellow line to mark the downtrend line from which the price went up. It is also worth mentioning that after turning on the EMA Cross 200, we can see that the moving average of 200 held the price before falling further.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the supports, and as you can see, we have the first support at $1843, the second support at $1801, and then we can mark a very strong support zone from $1760 to $1701.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here the first strong resistance that the price is currently fighting is $1882, then we can mark a very strong resistance zone from $1944 to $2030, and when it manages to break out above, the price will be able to move towards the resistance at the previous high of $2140.

The CHOP index indicates that there is still energy to continue the movement. The MACD indicator confirms the local uptrend. On the other hand, the RSI is moving around the middle of the range, which may indicate that there is still room for the price to break out of the first resistance.

BNB Short-Term Review Resistance and Support Hello everyone, let's look at the BNB to USDT chart on a single day timeframe. As you can see, the price has fallen below the local uptrend line.

Let's start by setting the support line and as you can see the first support that is currently holding the price is $234.5, then the second is at the price of 232.5$, and then the third at the price of 230.9$.

Now let's move on to the resistance and trump BNB first has to break the zone from $237 to $238, then there is resistance at $239.5.

Looking at the CHOP indicator, we see that there is some energy left for the move, the MACD indicates an attempt to return to the local uptrend, and the RSI has approached the middle of the range, but there is still room for the price to rise.