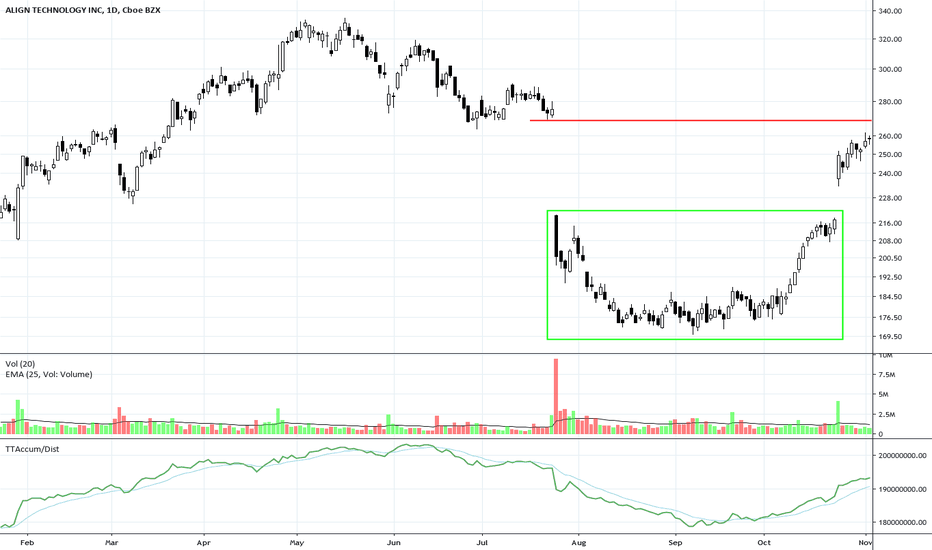

Resistancelevel

BTC market update 22.01 - bullish descending triangle ?Hello guys,

We are seeing a slight reversal in the BTCUSD trend since we touched $28,800 during the Asian session.

All eyes on the $32,000 horizontal level - previous support on the daily timeframe, now could be te turned into resistance in combination with the 4-hour chart 200-day EMA.

If surpassed, then this will open the door for recovering to the $34,800 -$35,000 area.

Down, at $30,750 we see the lowest candle close on the 4-h chart, which should now act as a support.

In the meantime, it is worth noting that there is a reversed descending triangle bullish pattern on the lower timeframes that might result in a continuation of the uptrend.

Stay safe,

Best Regards

TRXUSDT bounced on a daily trendline 🦐TRXUSDT bounced on a daily trendline after a nice bull run.

IF the price will break a monthly resistance we can see another bull impulse

According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

Still Bullish Whilst Support HoldsAfter price made a break higher and through the multi-year resistance level price action on the daily chart of Gold has stalled.

Price has formed multiple inside bars and has not been able to break the high of the daily candle from 8 sessions ago.

This market looks bullish whilst the support continues to hold, but the near term support does look important.

If this support level can hold for a major push through the consolidation resistance zone, then we could see a much larger leg higher and further bullish trading opportunities.

Quick Look At The State Of BitcoinBitcoin has performed exceptionally well so far this year (and will continue to do so in the long run).

You can see Bitcoin is up almost 40.5% for the year.

From here we have two more key levels to break before we test the S2F model's price prediction. (Stock to flow)

Paul Tudor Jones announced he was bullish on Bitcoin.

The halving date is May 12, 2020.

I expect a pull back due to increased selling pressure as unprofitable miners sell their reserves (either to stay afloat, meet their contractual obligations, or to invest in capital expenditures to reach profitablility again, i.e purchase next generation mining eqiupment, ect.).

After the miner capitulation, I believe we will test the two key resistance levels before finally breaking above around Q4 2020 or Q1 2021.

Keep your hands strong!

CTXS at Strong ResistanceCTXS has risen with momentum to challenge its previous all time high resistance level. It is currently in a retracement that has been triggered by High Frequency Trader selling. Support is weaker at this price level.

BITCOIN in critical support area it's been so much since we are waiting BTC to explode like a rocket to the moon and beyond, but in the end the chart is the only one with the final word. Now the price is in a critical support level with has been held as support and resistance in the past. I don't have a bias right now, so let's wait for the next move.

In regular forex pairs I trade intraday and 5 minutes timeframe, I have found BTC to be more a swing trading thing, at least for me and my trading style. Next target is above 19.000 IF it holds 3200 level, if it goes below that level then we will have a new target. COINBASE:BTCUSD

CELG Shifts SidewaysCELG hit a strong resistance level after a 3-week momentum trend. This resistance is strong. The consolidation has Professional Trader footprints.

Hawaiian Holdings Triple MacD Bearish DivergenceGood evening ladies and gents, another trade set up here. HA in a Rising Wedge pattern which is inherently bearish inside of a bearish trend as well. You are showing Daily Triple Bearish Divergence on the Oscillators. Common exit targets of a wedge are between the .382 and .618. Although, I usually take my profit at the 50% retrace and the .618. I may save a small amount just in case we test critical support at the bottom. I would like to state that this trade set up as a lot but the only variable it's lacking right now is the fact that you are not overbought on the daily rsi. It does have room to run up on the RSI, although you do not always hit it.

Join our Free Telegram Channel: t.me

We are a new community growing day by day in hopes to accomplish a trading premium group by December 1st of 2019.

Subscription options are $15 a week, $50 a month or $500 a year. These are extremely cheap options compared to most other premium groups! We give the best possible technical analysis with a touch of art work to it hence the name "ChArtWorks" ;). "We remove the hard work from your end and just give you the trade set ups."

50% off all Contracts for Military Veterans and Active Duty Service Members, just provide your DD214 or Military ID for proof of Status. Discharge Type is completely confidential and does not need to be shared. I am a Marine Vet myself and I will not share any information regarding Military status with anyone else.

CELG Bottom Completion Tests Higher ResistanceCELG completed a long-term bottoming formation in June and recently moved up to challenge a higher resistance level.