BTC/USDT big height 13.07Hello everyone, let's look at the BTC to USDT chart on a one hour time frame. As you can see, the price is moving above the local uptrend line.

When we unfold the Fib Retracement tool, we see that the first support in the near term is $31084, the second is $30816, then the third at $30603 and then the fourth at $30396.

Looking the other way, we see that the price has hit a very important resistance at $31,520, when it breaks it, we can see an increase towards a very strong resistance at $32,643.

The CHOP index indicates that the energy is exhausted, the MACD confirms the ongoing uptrend, and the RSI has crossed the upper limit, which may soon change the trend to a downward one.

Resistence

Review Chart DOT/USDT 4HHello everyone, I invite you to review the DOT chart in pair to USDT. First, we will use the blue lines to mark the downtrend channel where the price is moving in the upper range. And when we turn on the EMA Cross 200, we see that the price has stayed on this line, which indicates that the uptrend that was started earlier is being maintained.

Moving on, we can move on to marking support areas when we start a larger correction. And here the first support is at $4.98, then we can mark the support zone from $4.58 to $4.25, however, when the price falls below this zone, we can see a drop to around $3.93.

Looking the other way, we see that the price has reached an important resistance zone from $ 5.35 to $ 5.65, which so far has no strength to break. However, if it manages to exit the descending channel upwards and break through the resistance zone, the next resistance will appear at $6.04, and then the price can move towards the resistance at $7.20.

Take a look at the CHOP index, which indicates that the energy is starting to regain strength, the MACD indicates that we are in a local uptrend, while the RSI is back to the middle of the range, which gives room for the price to go a little higher.

NZDCAD - Bearish Head and Shoulders📉Hello Traders👋🏻

On The Daily Time Frame The NZDCAD Price Reached A Strong Resistance Level📈

Currently, The Price Formed a Head and Shoulders Pattern📉

The Neckline is Broken🔥

So, I Expect a Bearish Move📉

i'm waiting for a retest...

-----------

TARGET: 0.80770🎯

___________

if you agreed with this IDEA, please leave a LIKE, SUBSCRIBE or COMMENT!

BTC/USDT Review long-term 1DIntervalHello everyone, let's look at the BTC to USDT chart on a single day timeframe. As you can see, the price has moved above the downtrend line.

After unfolding the trend based fib extension tool, we see that the first support is at $30078, the second at $29174, the third at $28446, and then there is a strong support zone from $27717 to $26665.

Looking the other way, first resistance is at $31,313, second at $32,289, third at $33,082, then there is a strong resistance zone from $33,882 to $35,002.

The CHOP index indicates that there is a lot of energy to move, the MACD indicates a return to the downtrend, and the RSI is in the upper part of the range, which may affect the price rebound.

LTC/USDT Review 4H Analysis Hello everyone, welcome to the LTC review on a four-hour interval. Currently, with the help of blue lines, we will mark the downtrend channel, from which the price is fighting for an upper exit.

Now let's move on to marking the support spots for the price and we see that the price is currently holding a very strong support at $94.76, however when it leaves the support below, we can see a drop to the second support at $82.24.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the first resistance is at $99.53, then we have the second resistance at $104.49, and then price needs to break a strong resistance zone of $108 to $112.

The CHOP index indicates that most of the energy has been used, the MACD is struggling to return to the local uptrend, while the RSI is moving in the lower part of the range, which may also affect the reversal of the uptrend.

BNB/USDT 1DReview Resistance an SupportHello everyone, welcome to a review of the BNB vs. USDT pair, taking into account the one-day timeframe. First of all, using the blue lines, we can mark the sideways trend channel in which the price is currently approaching its upper limit.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark support, and here we will first mark the strong support zone from $234 to $228, however, if the price falls below this zone, we can see a drop to around $220.4.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we see that the price is moving towards the upper border of the channel, where we have a strong resistance zone from $244 to $250, only when we exit it upside, we can attack the resistance at $256.8.

Index CHOP indicates that there is still energy to continue this movement. The MACD indicator, despite corrections in the channel, maintains an upward trend. On the other hand, on the RSI we approached the middle of the range, despite everything we can see an attempt to attack the first resistance zone.

In Downtrend Channel | Short BiasWeekly Chart

Chiliz ( BINANCE:CHZUSDT ) has broken down the support level ($0.0811) and closed below that level. That red candle shows strong selling pressure with RSI Oversold.

I expect CHZ will down more leg to around $0.04

Chart 4H TF

Chiliz's in triangle pattern. If price can breakout, CHZ can retest Previous Ascending Trend Line.

Wait and see

XRP/USDT Review 1DayInterval Hello everyone, I invite you to review the BNB chart on a one-day timeframe. As we can see after defining the uptrend line, the price has fallen slightly below, but remains close to this line.

Let's start by marking the support areas for the price and we see that first we have a support zone from $0.45 to $0.42, which is holding the price so far, but if the zone is broken, the next support is at $0.39.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the price is currently bouncing off the $0.48 resistance. Then we can mark a resistance zone from $0.51 to $0.52, and a second very strong zone from $0.54 to $0.57.

The CHOP index indicates that a lot of energy has been collected, the MACD is struggling to return to the uptrend, while the RSI has a further rebound, which may positively affect the change of the price direction to an upward one.

⭐️ Support And Resistance | Definition & Strategies ⭐️Support and resistance levels are fundamental aspects of trading, holding significant importance in various financial markets, including the dynamic forex market. These critical levels signify specific price zones on a chart where buyers and sellers actively participate, exerting influence on market movements. Consequently, comprehending the impact of support and resistance levels is crucial for traders seeking to make well-informed decisions and capitalize on trading opportunities. This comprehensive article aims to explore the significance of support and resistance levels, delve into methods of correctly identifying and drawing them, outline effective trading strategies, and present techniques for filtering out false signals. Armed with a comprehensive understanding of these concepts, traders can elevate their trading proficiency, potentially leading to improved profitability and success in the forex market.

Support and resistance levels act as psychological barriers, reflecting the collective behavior of market participants. Support represents a price level where buying pressure tends to overcome selling pressure, causing prices to reverse direction and rise. On the other hand, resistance signifies a price level where selling pressure typically surpasses buying pressure, leading to price reversals and declines. These levels are formed based on previous market reactions, such as historical highs and lows, trendlines, and chart patterns. Traders consider support and resistance levels as critical reference points, as they help identify potential entry and exit points, define risk and reward ratios, and anticipate market reversals or continuations.

To accurately identify and draw support and resistance levels, traders employ various techniques and tools. One popular method is the swing high and swing low approach. Traders identify significant peaks (swing highs) and troughs (swing lows) on a price chart and draw horizontal lines connecting them. These lines act as reference levels, indicating potential areas of support and resistance. Additionally, trendlines can be utilized to identify dynamic support and resistance levels, providing insights into the overall market trend.

Once support and resistance levels are identified, traders can implement effective trading strategies to capitalize on these market dynamics. One common approach is to buy at support and sell at resistance. When prices approach a support level, traders anticipate a price bounce and look for buying opportunities. Conversely, when prices approach a resistance level, traders expect a potential price reversal and consider selling or shorting the asset. This strategy allows traders to enter trades with favorable risk-reward ratios, aiming to capture price movements away from support or resistance levels.

What is it exactly a Support and Resistance ?

Support and resistance levels represent crucial price clusters where buyers and sellers engage in competition.

A support level denotes a specific price point where the demand for an asset becomes sufficiently strong to halt further declines in its value. As the price approaches the support level, it is reasonable to expect an increase in buyer activity and a decrease in seller activity, resulting in higher buying volume and reduced selling volume.

When the price reaches the support line, there is a high likelihood of a rebound occurring, as this line establishes a significant psychological low within the market.

Support levels essentially "support" the price, preventing it from continuing its downward trajectory.

It's important to note that support and resistance levels are not fixed points. Prices may approach these levels with slight deviations, either falling just short of reaching them or temporarily dipping slightly below the line.

If the price successfully breaks through the support line and proceeds to decline, it undergoes a transformation and assumes the role of a resistance level.

Use of the Resistances on Bearish trend.

Use of The Supports on Bullish trend.

Use of Support and Resistance on Sideways / Range market.

Resistance levels are the opposite of support. These marks appear when supply becomes equal to demand. The logic here is that as the resistance level is approached, the volume of buyers decreases, while the volume of sellers gradually increases. At the point where the balance is reached, the price will stop, and further growth will stop.

The resistance level is always above the price. The name also speaks for itself. This mark is as if restraining the price from further growth by resisting it.

How To Trade On Support And Resistance Levels:

Trading based on support and resistance levels is a popular approach within the forex trading community. These levels represent specific areas on a price chart where the market tends to reverse or consolidate, presenting potential opportunities for buying or selling. To effectively trade support and resistance levels, follow these steps:

- Identify significant support and resistance levels: Analyze historical price data to locate areas where the price has previously reversed or encountered difficulty in breaking through. This can be done by observing swing highs and swing lows, trendlines, Fibonacci retracement levels, or horizontal price levels.

- Mark the identified levels on your chart: Once you have identified key support and resistance levels, mark them on your chart. This visual representation helps you recognize the areas where potential trading opportunities may arise.

- Monitor price reactions: Keep a close eye on the price as it approaches the support or resistance levels. Look for indications of a potential reversal or a breakout from the level. These indications can include candlestick patterns, chart patterns, or the signals from indicators that suggest a shift in market momentum.

- Confirm with additional indicators: While support and resistance levels can be traded on their own, it can be beneficial to use supplementary indicators or tools to validate your trading decisions. For instance, you can employ oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) to assess overbought or oversold conditions.

- Define your entry and exit points: Once you have identified a potential trading opportunity based on support and resistance levels, establish your entry point, determine a suitable Stop Loss level (to limit potential losses), and set a take-profit level (to secure profits). Technical analysis, such as considering the distance between the entry point and the nearest support or resistance level, can help determine these levels.

Manage your risk: Proper risk management is crucial when trading support and resistance levels. Consider implementing appropriate position sizing, setting Stop Loss orders to protect against excessive losses, and maintaining a favorable risk-to-reward ratio. This approach ensures that even if some trades are unsuccessful, your overall trading strategy remains profitable.

Practice and refine your strategy: Mastery of support and resistance trading comes with practice and experience. Begin by testing your approach on a demo account or using backtesting software to evaluate its performance based on historical data. Refine your strategy based on your observations and gradually build your confidence.

Support And Resistance Trading Strategies

Support and resistance trading strategies offer various approaches to capitalize on price dynamics around these key levels. Here are several common strategies employed by traders:

Breakout Strategy:

This strategy involves trading the breakout of support and resistance levels. When the price surpasses a resistance level or falls below a support level, it indicates a potential continuation of the prevailing trend. Traders can initiate a long position after a resistance breakout or a short position following a support breakdown. Setting a Stop Loss order below the breakout level helps manage risk.

Bounce Strategy:

With the bounce strategy, traders anticipate price bounces off support and resistance levels. When the price approaches a support level, traders can enter long positions, placing a Stop Loss order below the support level. Conversely, when the price nears a resistance level, traders can go short, setting a Stop Loss order above the resistance level. The expectation is that the price will reverse from these levels, presenting profitable trading opportunities.

Range Trading:

Range trading occurs when the price fluctuates between a support and resistance level. Traders can exploit this by buying near the support level and selling near the resistance level. To enhance range trading, traders identify the range boundaries and employ technical indicators such as oscillators to assess overbought and oversold conditions within the range.

Pullback Strategy:

In this strategy, traders wait for the price to retrace to a support or resistance level after a breakout. The idea is to enter trades in the direction of the breakout once the pullback is complete. For instance, if the price breaks above a resistance level, traders wait for a pullback to the support-turned-resistance level before initiating a long position.

Confluence Strategy:

This strategy combines support and resistance levels with other technical indicators or chart patterns to increase trading probabilities. Traders search for instances where multiple factors align, such as a support level coinciding with a trendline or a Fibonacci retracement level. This convergence of factors strengthens the signal for potential trading opportunities.

How To Filter False Signals ?

Filtering out false signals when trading support and resistance levels can indeed be challenging. However, there are several strategies you can employ to increase your accuracy and minimize the impact of false signals. Here are some helpful tips:

- Confirm with multiple indicators: Relying on a single indicator can lead to false readings. To enhance the reliability of your analysis, consider using multiple indicators that complement each other. Look for indicators that align with your support and resistance levels, such as trendlines, moving averages, or oscillators. When multiple indicators converge and provide consistent signals, it strengthens the confirmation for potential trading opportunities.

- Analyze price action: Study how the price behaves around support and resistance levels. Look for clear and decisive price movements, such as strong breakouts or bounces, accompanied by significant volume. False signals often exhibit choppy or erratic price action, lacking conviction. By analyzing price action, you can gain insights into the strength or weakness of support and resistance levels.

- Consider multiple time frames: Analyze support and resistance levels across different time frames. Levels that hold on higher time frames carry more significance. Focus on levels that align and hold on multiple time frames, as they are more likely to attract market participants and generate reliable signals. The confluence of levels across different time frames increases the validity of the signals.

- Monitor the market context: Consider the broader market context, including the overall trend, market sentiment, and significant news or events. Support or resistance levels that align with the prevailing trend and market sentiment are more likely to generate valid signals. Conversely, levels that conflict with the trend or market sentiment may produce false signals or indicate potential reversal points. Understanding the market context can help you filter out false signals.

- Be patient and selective: Avoid jumping into trades based on every touch of a support or resistance level. Exercise patience and wait for strong confirmation signals before entering a trade. Look for price rejections, candlestick patterns, or breaks with high volume and momentum. Being patient and selective in your trades increases the probability of accurate signals and minimizes the impact of false signals on your trading.

- Implement proper risk management: Effective risk management is crucial to mitigating the impact of false signals. Set appropriate Stop Loss orders to limit potential losses if a trade goes against you. Consider using Trailing Stops to protect profits as the trade moves in your favor. By managing your risk properly, you can protect your trading capital and minimize the adverse effects of false signals on your overall trading performance.

By incorporating these strategies into your trading approach, you can enhance your ability to filter out false signals and increase your accuracy when trading support and resistance levels. Remember to practice, adapt to changing market conditions, and continuously refine your trading strategy.

Conclusion :

Support and resistance levels are crucial elements in the forex market, exerting a significant influence on price movements and market dynamics. These levels represent areas where supply and demand imbalances occur, leading to trend reversals, consolidations, breakouts, and impacting market psychology.

Correctly identifying and drawing support and resistance levels is vital for traders as it helps them identify potential buying and selling opportunities. Traders can utilize various trading strategies to capitalize on these levels. Breakout strategies involve trading the breakouts of support or resistance levels, while bounce strategies focus on trading price bounces off these levels. Range trading strategies take advantage of price oscillations within established support and resistance boundaries, while pullback strategies involve trading in the direction of the breakout after a price retracement.

However, it's essential to filter out false signals to avoid erroneous trading decisions. This can be achieved by using multiple indicators that complement each other and provide confirmation signals. Analyzing price action helps in understanding the strength or weakness of support and resistance levels. Considering different time frames allows traders to identify levels that hold significance across various intervals. Assessing the broader market context, including the overall trend and market sentiment, helps to avoid false signals that conflict with the prevailing market conditions.

Additionally, exercising patience and selectivity when entering trades ensures that traders wait for strong confirmation signals before taking action. Implementing proper risk management techniques, such as setting appropriate Stop Loss orders and employing position sizing strategies, protects traders from excessive losses and manages risk effectively.

By incorporating these principles into their trading approach, traders can navigate the complexities of support and resistance levels and increase their chances of success in the forex market.

Bitcoin is testing an old key levelINDEX:BTCUSD is slowing down on the 31943$-28932$ zone, because is going in the proximity of an old key level on the Weekly chart, if it breaks over the zone can we probably expect INDEX:BTCUSD to go to 40k or even 50k or even more. Not in the short term but if INDEX:BTCUSD break over can expect before the end of the year a good price hike.

Let me know what you think about it.

BNB Review 4HInterval Looking at BNB vs USDT, also on a four-hour timeframe. First of all, using the blue lines, we can mark the downtrend channel from which the price went up.

As we can see from the unfolding of the fib based trend extension tool, the price stays just above the first support zone from $247 to $242, however, when the price falls below this zone, we can see a drop around the second strong zone from $234 to $229.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we have the first very strong resistance at the price of $ 253, only when the price positively tests it should try to attack the level of $ 261.

When we turn on the EMA Cross 10 and 30, we can see the confirmation of the uptrend. The CHOP index indicates that we have a lot of energy for the next move. The MACD indicator struggles to maintain a local uptrend. On the other hand, on the RSI we are moving in the upper limit, but we have some space for the price to try to attack the first resistance.

UBER ShortEarning 5/2/2023 (Positive)

Open GAP and ran into Supply Zone, breakout and pullback

Short Sell 37.5

Stop 42.6 -- next supply zone

Target 30, 24

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

ETH/USDT Short-Term 3.07.2023Hello everyone, let's look at the BTC to USDT chart on a 4-hour time frame. As you can see, the price has broken out of the local downtrend line.

After unfolding the trend based fib extension grid, we see that there is a first support zone from $1953 to $1946 ahead of the price, and then we have a second strong support zone from $1928 to $1914.

Now let's move on to the resistances and we see that the price did not stay above the first resistance zone from $1961 to $1970, it was rejected, further resistance is at $1979 and the third resistance is at $1993.

Looking at the CHOP indicator, we see that the energy is gaining strength, the MACD is trying to maintain the local uptrend, and the RSI has rebounded from the upper limit of the range, which may give a moment of rebound for the price.

FTM/USDT 4H ReviewHello everyone, let's look at the FTM to USDT chart on a 4-hour timeframe. As you can see, the price has broken out of the local downtrend line.

Let's start with the support line and as you can see the first significant support is at $0.25, then we have the second support at $0.20 and then the third support at $0.16.

Looking the other way, we can determine a significant resistance zone that the price has to face from $0.35 to $0.39, only when we move up from this zone, the price can move towards resistance at $0.46.

The CHOP indicator indicates the ending energy, which gives small price movements, the MACD tries to return to the local uptrend, while the RSI after a visible rebound, we have an attempt to return to the uptrend.

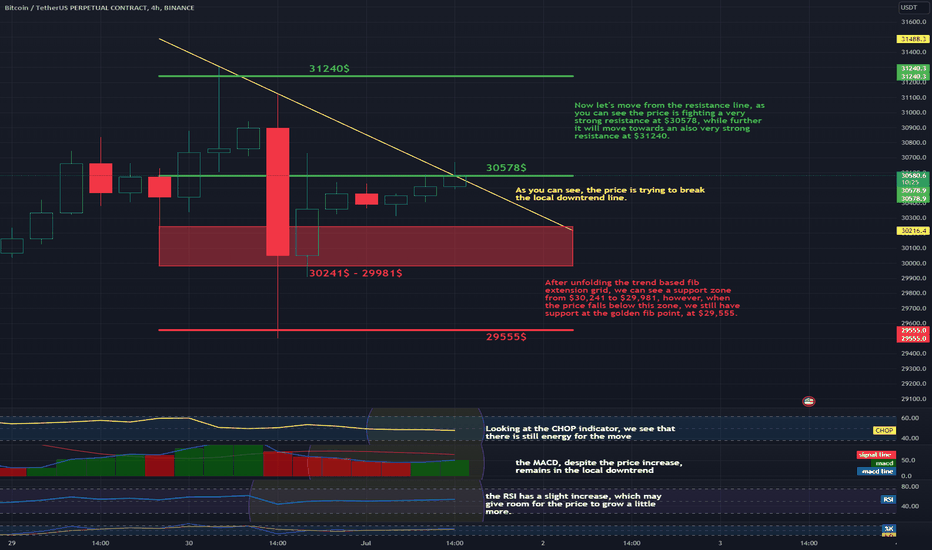

BTCUSDT 4H Interval ReviewHello everyone, let's look at the BTC to USDT chart on a 4-hour timeframe. As you can see, the price is trying to break the local downtrend line.

After unfolding the trend based fib extension grid, we can see a support zone from $30,241 to $29,981, however, when the price falls below this zone, we still have support at the golden fib point, at $29,555.

Now let's move from the resistance line, as you can see the price is fighting a very strong resistance at $30578, while further it will move towards an also very strong resistance at $31240.

Looking at the CHOP indicator, we see that there is still energy for the move, the MACD, despite the price increase, remains in the local downtrend, and the RSI has a slight increase, which may give room for the price to grow a little more.