Next Robinhood? TIGR, a hidden gem.We all know the story about retail going crazy on $HOOD. But what about its SEA counterpart, TIGR? Will our SEA friends follow the same trend?

With more and more retail traders rushing to the stock market, TIGR is a safe grab to get on the retail frenzy.

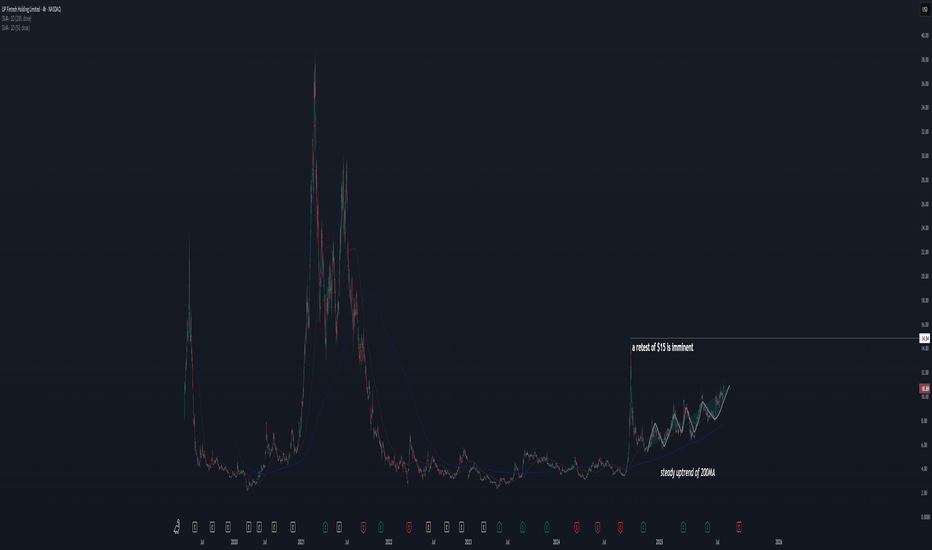

This is also supported from a technical side:

1) a zigzag pattern trending up,

2) a slow and steady uptrend of the 200MA,

3) 3 consecutive earning beats during the last 3 quarters.

All these is suggesting that a retest of the previous high at $15 will happen very soon, if not more (I think there will be more upside, but I have to wait and see how patterns develop when the previous high will be tested).

I am holding TIGR I purchased at 9.55 with a 2.3% portfolio size, with the expectation of reaching at least $15 before/around Oct.

Retailtraders

Tesla Is Retail Traders' Choice, JPMorgan Says. Are You Buying?Tesla NASDAQ:TSLA has endured a soul-crushing experience over the past three months or so. The stock is down 50% from the record high of $480 hit in December (more than $700 billion in market cap washed out). Even insiders have sold a big chunk of their holdings.

But over the past three weeks (12 trading days to be precise), investment bank JPMorgan NYSE:JPM says, retail traders just couldn't get enough of it.

Retail net buying activity in TSLA stock. Source: JPMorgan

They’ve consistently been buying the dip, and then the dip of the dip and then… you get it. Every new dip is seen as a buying opportunity to the daredevils among us who try to catch a falling knife.

In the latest issue of “Retail Radar” — JPMorgan’s weekly report revealing where the retail money is flowing — the banking giant traced a net $12.5 billion of retail cash poured into stocks or stock-related investments last week.

As much as $4.2 billion went into ETFs (diversification, nice), where a cocktail of ETFs with a broad selection of stocks took the lion’s share along with some gold ETFs . Still, the big chunk of the pie went into individual equities — $8.3 billion of cold hard cash was injected into the retail-trading darlings Tesla NASDAQ:TSLA , Nvidia NASDAQ:NVDA and other Mag 7 members.

🤿 Buying the Dip

Here’s what the bank said:

“Single stocks accounted for +$8.3B of the inflow. TSLA (+$3.2B, +3.5z) and NVDA (+$1.9B, +1.1z) collectively contributed more than half, and the rest of Mag 7 contributed another $1B. Notably, they have been buying TSLA for 12 consecutive days, adding $7.3B in total.”

The 3.5z and the 1.1z describe the standard deviation of the retail traders’ net flows compared to the 12-month average. (Keep reading, it gets even better.)

Did you hear that? Tesla dominated the charts. Day trading bros have kicked in a total of $7.3 billion into Elon Musk’s EV maker over the past 12 cash sessions. It even won some praise from JPMorgan analysts who said this endeavor represents “the highest magnitude among all past ‘buying streaks’ in over a decade.”

Here’s the best part:

“Retail investors returned as aggressive buyers on Wednesday, breaking the $2 billion threshold in the first half of the day (the 2nd time this year), and ending the day at $3.7 billion inflows (+7z),” JPMorgan noted (Wow, 7 standard deviations above the mean). “We observed their allocation into ETFs/single names are at 30/70% during a typical heavy buying day. Among single names, NVDA and TSLA led the inflows.”

JPMorgan also estimated that retail traders’ efforts to snatch the W this year are just bad.

“We estimate retail investors’ performance is down by 7% year to date (vs. -3.3% loss in S&P). Most of the drawdown came from March as they increased their holdings in Tech.”

Retail traders' performance, year to date. Source: JPMorgan

🤙 The YOLO Moment

Buying Tesla shares right now is the ultimate YOLO play. We’re only a week away before Tesla announces what’s shaping up to be the worst delivery figure in years. After a few cuts to delivery targets, considering Europe’s sales took a huge L earlier this year, analysts now predict first-quarter deliveries to land at an average of 418,000 vehicles.

Goldman Sachs NYSE:GS , for one, is bigly bearish on the number. It trimmed its target by 50,000 to 375,000 cars. If true, it would mean that Tesla’s business is shrinking by 3% compared with Q1 of 2024 when deliveries hit 387,000 units.

For the year, analysts expect sales to land anywhere between 1.9 million and 2.1 million. With looming competition in the global auto space , Tesla will need to work extra hard to meet these numbers. In 2024, Tesla rolled 1.8 million vehicles off the assembly line and into customers’ hands (down 1% from 2023).

👀 Are Retail Traders Buying the Dip?

What better place to gauge retail traders’ sentiment than the absolute best trading community out there? Let’s hear it from you — share your thoughts on Tesla! Have you been buying the dipping dip that just keeps carving out new lows? Or you’re a freshly minted Tesla bear after all the havoc and drama around Elon Musk? Off to you!

The $2680 Question: Will Gold Correct or Continue to Fall?The current chart setup for Gold is decidedly bearish: we’re seeing a breakdown through key support and a local low. This is clear and hard to miss. Retail traders are diving in, buying the dip, and they’re not in a rush to close their long positions, hoping to ride it out. This sentiment is actually quite good for the bearish trend.

That said, when we zoom out and look at the bigger picture, a potential correction to around $2680 is on the radar. It might not happen, of course; I’m not a fortune teller. But it’s definitely a possibility worth considering.

Here’s the reasoning behind this potential correction scenario:

We have a solid liquidity level where buyers could be lurking, and there were compelling visual cues to establish positions there (uptrend + buying after a pullback + following a strong bullish candle). Plus, the open data backs this up (see attached screen)

So, if we do see that correction materialize, I’ll be looking to open some shorts at that level.

$HIMS THE NEXT EXPLOSIVE RETAIL STOCK! NYSE:HIMS THE NEXT EXPLOSIVE RETAIL STOCK!

3 Reasons Why in this Video: 📹

1⃣ My "High Five Trade Setup" strategy

2⃣ Massive Cup N Handle Pattern, 88%+ measured move.

3⃣ Review my "HOMEMADE" Valuation Metric for NYSE:HIMS , showing us a fair value of $35!

Video analysis 1/5 dropping today. Stay tuned!🔔

Like ♥️ Follow 🤳 Share 🔂

X Account in Bio

Comment what stock you want to see charting analysis on below.

Not financial advice.

NASDAQ:TSLA NASDAQ:SOFI NYSE:PLTR NASDAQ:NVDA AMEX:IWM NASDAQ:QQQ AMEX:SPY NASDAQ:IBRX NASDAQ:WULF NASDAQ:UPXI #TradingSignals #TradingTips #options #optiontrading #StockMarket #stocks #Retail

SOFI LONG: SYMMETRICAL TRAINGLE BREAKOUT! 80% MOVE INBOUND! NASDAQ:SOFI LONG: SYMMETRICAL TRAINGLE BREAKOUT! 80% MOVE INBOUND!

Everything is FINALLY looking on track for NASDAQ:SOFI stock! See analysis below and my Symmetrical Triangle Breakout trade details at the bottom of the post! Not Financial Advice.

STOCHASTIC UPTREND

MACD UPTREND & BREAKOUT OVER ZERO LINE

RSI UPTREND

STOCK PRICE UPTREND

SYMMETRICAL TRIANGLE BREAKOUT

- MEASURED TRIANGLE: 727 BARS

- BREAKOUT MOVE 727 BARS HIGHER

(86.87%) $15.63

- TAKE PROFITS: TOP OF THE TRIANGLE

(39.78%) $11.70

- STOP-LOSS BELOW MA's AND VOLUME SHELF

2.5 RISK TO REWARD (15.89%) $7.04

Institutional and Retail Traders: Where the Difference LiesInstitutional and Retail Traders: Where the Difference Lies

There are many players in the financial markets who can cause changes in trend direction, but let’s focus on institutional and retail traders. This FXOpen article compares retail vs institutional trading. You’ll learn about the characteristics of these types of traders, how they affect the markets, as well as the differences and similarities between them.

What Is a Retail Trader?

Let’s start with a retail trader definition. Retail traders refer to individual traders or small investors who participate in trading for speculative purposes.

They typically trade with smaller capital and have fewer resources and less access to information than institutional traders. Retail traders often use leverage, which allows them to control larger positions with a smaller amount of capital. Leverage may increase potential returns, but it also escalates the exposure to substantial losses.

The collective impact of retail trading has grown significantly in recent years, shaping market dynamics. The rise of online platforms has democratised financial markets, allowing retail traders to participate more actively. Their collective actions can amplify market trends and contribute to increased market volatility.

How Do Retail Traders Trade?

Retail traders often engage in day, swing, and news trading. They usually rely on online resources for self-education. They may attend educational courses and use the services of mentors. They may use technical analysis, social media discussions, or market sentiment analysis to inform their decisions.

The collective power of retail trader communities, fuelled by social media discussions, can impact asset prices. The “Reddit effect” exemplifies how retail trading, through online forums, can challenge traditional market dynamics.

What Is an Institutional Trader?

What is institutional trading? Let’s first take a look at the institutional market definition. In the context of trading, the institutional market refers to the segment of the overall market where institutions and corporations manage their assets. Institutional traders buy and sell different financial instruments for the accounts they manage on behalf of others, and they handle large pools of capital. Therefore, they can influence market trends and liquidity. Their collective actions may lead to market-wide shifts, affecting prices and levels of volatility.

Examples include hedge funds, mutual funds, investment banks, endowment funds, pension funds, and insurance companies. They have different goals, for example, hedge funds pursue absolute returns, and investment banks engage in market-making and proprietary trading.

How Do Institutional Traders Trade?

Institutional trading is characterised by its scale and impact. By handling significant volumes of capital, they take advantage of access to privileged information and influence market movements. For example, in institutional forex trading, central banks have the greatest price impact in the spot FX market, followed by hedge funds and mutual funds, while regular traders have much less influence on dealer pricing.

Institutions commonly employ sophisticated strategies, such as quantitative trading and algorithmic trading. Their strategies often involve in-depth market analysis and the use of advanced instruments.

Retail Trader vs Institutional Trader: Key Differences

The primary differences between institutional and retail traders lie in factors such as capital, risk tolerance, and time horizons. These and other aspects are collected in this table:

Aspect - Retail - Institutional

- Capital - Limited capital - More capital-rich

- Price Influence - Limited influence - More significant influence

- Knowledge - Self-taught, usually from internet resources - Educated in finance or economics from college

- Trading focus - Technical systems, price patterns, indicators - Fundamentals and trading psychology

- Account - Personal accounts - Accounts they oversee on behalf of a group or institution

- Time of trading - A shorter time horizon - A longer time horizon

- Risk tolerance - Disciplined risk management, a lower risk tolerance - A higher risk tolerance, a focus on growth

- Market Access - Retail and online brokerages with standard trading instruments - More difficult instruments, including swaps

These differences profoundly impact trading strategies. Institutions can afford more complex and resource-intensive strategies, while retail traders may focus on simpler approaches. Time sensitivity, risk aversion, and regulatory constraints further differentiate their decision-making processes.

Similarities and Overlaps

While institutional and retail traders differ in many aspects, there are areas where their trading strategies may converge. Both groups may use similar trading tools and strategies, for instance, technical analysis, fundamental analysis, and algorithmic trading.

The influence of technology has also contributed to blurring the lines between these trading types. Retail traders can now access sophisticated tools, while institutions may adopt more agile and cost-effective technologies.

You may trade over 600 assets at the TickTrader trading platform using modern instruments for market analysis.

Final Thoughts

Institutional and retail traders play distinct but significant roles in the financial markets. While institutions have advantages such as access to more financial instruments and extensive resources, retail traders have the flexibility and freedom in trading decisions.

The convergence of strategies and the evolving influence of technology indicate that the landscape will continue to shift, creating new opportunities and challenges for traders across the spectrum. If you want to trade on various markets with tight spreads and low commissions, you can open an FXOpen account.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Euro Bulls Take Charge: But Are Options Traders Hiding a Secret?The euro is looking good for bulls right now. It's hit those liquid levels twice now and broken through them. The way it's crossed those levels, №1 and №2, is a sign of growth, at least for the short term.

But I can't do not noticing that the options market is putting in a drop in quotes and buying PUTS out- of- the money in this case.

For instance, on Friday someone bought $2.8 worth of PUTS at strike 1.10. I don't think anyone would throw that much money around without having some sort of prediction in mind.

However, let's not go with the crowd and turn the market upside down . The moment is clearly bullish.

The screenshot shows a bunch of different portfolio options and when they happened. They're all pretty close to the same level, around the yellow line.

TITAGARH could get a rebound from 1154-1219 levelsTITAGARH is a stock that is known to never fall much. But in the current scenario, a lot of long term investors are trapped and a lot of panic selling is seen in this stock. In my view, it may get a rebound from 1154-1219 levels once again. This level is the place where last heavy buying was observed last which created a big fair value gap in the price.

Long on USD/JPY Post-FOMC

Currently Long on UJ after FOMC, we took out low of the Asian range which led us out of a consolidation range, DXY was giving the same reaction after taking out a daily low. Potentially to turn around, but it is just an idea. I trade my plan you trade yours. I have taken out 50% of my lots on this at 1:1, and already set to breakeven. So worst case scenario I walk away with +0.50%. Otherwise I am looking for price to take out an Asian High from recent swing highs.

Silver Is Under PressureSilver has hit a support level and might even try to rebound a bit, but considering all the factors, like the recent COT report and retail traders activity, there's no way it's going to have any serious growth.

Plus, that 25-strike put that had a lot of trading in the options market is still out there and it also suggests that it could keep getting weaker.

Retail Sentiment Points to Lower Prices? If we break through that support level, we'll probably head down to 28.5 or even lower.

And the retail sentiment is also in line with this scenario.

At the moment, most are long, and short positions are starting to shrink (check out the chart).

Guys, who else sees the same level of support as us? And why? Let's discuss it

USDJPY DAILY OUTLOOK AFTER THE END OF Q1The 1st Quarter of the year has come to an end and buyers dominated the market for the past 3 months. And price closed at the previous years high. The question going into the mind of trader is, “will the bullish strength continue ? Well,to get answer to that, we’ve been able to identify couple of trend-lines & key levels to help us navigate the potential trajectory of the market. If price is able to break above 151.820 and provide one of the valid entry requirements, we’ll go long while a break below trendline and 146.740 insight a bearish sentiment.

XAU Weekly - BearishThis Week we Say OANDA:XAUUSD was Super Bullish, But is It?

gold has Engineered Liquidity up and Down, I believe its going up to Hit Retail Stop loss and then Revert to go Down .

I have noted Levels that I am interested in Chart

Another Confirmation : If you Check #Gold Seasonality, Normally OANDA:XAUUSD is Bearish in October and November !

Disclaimer : this is Just Technical Analysis, You Should never use this information for real Trading, Do your own Research.

Sincerely,

Sobhan JTN

Traders' Inverse Relationship with Breakouts⚡Retail traders often find themselves entangled in false breakouts or breakdowns. However, it's important to recognize that taking advantage of breakout opportunities isn't inherently flawed. The key lies in being mindful of the associated risks and never trading beyond what is considered an acceptable level of risk. By doing so, traders can protect themselves from unnecessary losses and navigate the market more wisely.

⚡Another crucial aspect of successful trading is planning for potential failures. While the solution seems simple – cutting losses and exiting the trade – it's essential to define what constitutes failure beforehand. Identifying these conditions before entering a trade allows traders to establish clear criteria for when it's time to step back and avoid further losses.

⚡To increase their chances of success with breakout trades, traders can consider adopting a strategy of trading pullbacks after a breakout has occurred. Typically, stocks pull back to retest their breakout levels, presenting attractive trading opportunities. While this approach can mitigate some failures, it's important to acknowledge that no trading strategy is foolproof. There may be instances where traders miss out on certain opportunities due to a lack of pullbacks, leading to feelings of "Fear of Missing Out" (FOMO). Remember, trading involves inherent uncertainties, and no strategy guarantees a 100% success rate.

⚡Lastly, traders should keep in mind that support levels offer potential buying opportunities, while resistance levels indicate potential selling opportunities. Being attentive to these key levels can assist traders in making informed decisions and improving their overall trading performance.

Regards

Do hit boost 🚀 for motivation.

GBPJPY Upside PotentialHey Traders! 👋

For Day 27/100 of our challenge, we will look at GBPJPY for upside potential this week/month

Technicals:

- Overall uptrend

- Breaking into a new high

- Currently in impulse phase

- Expecting pullback towards 174.0/5

- Targeting daily key level 176

- Idea invalid if 172.6 breaks

Other technicals:

- Seasonality forecasts more upside this month

- Retail traders at 90% short (trade against)

That's it for today! Let's start the week off well by ticking off all your trading routine tasks. I believe in you 🥂