"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

Reversalpattern

Reversal Trade - Godfrey PhilipGodfrey Philip

This stock is forming good Weekly Tighter Close. Let's wait & check out how it behaves this week.

17 Feb Week Rejection is alarming.

No follow through to that rejection in last week. This week is defending last weekly low so far.

Highly Risky Trade, Rs.600, I am targeting 10% i.e. 24 Feb 25 Weekly High.

This is not a Buy Reco, Do your own Diligence. This is purely for educational purpose.

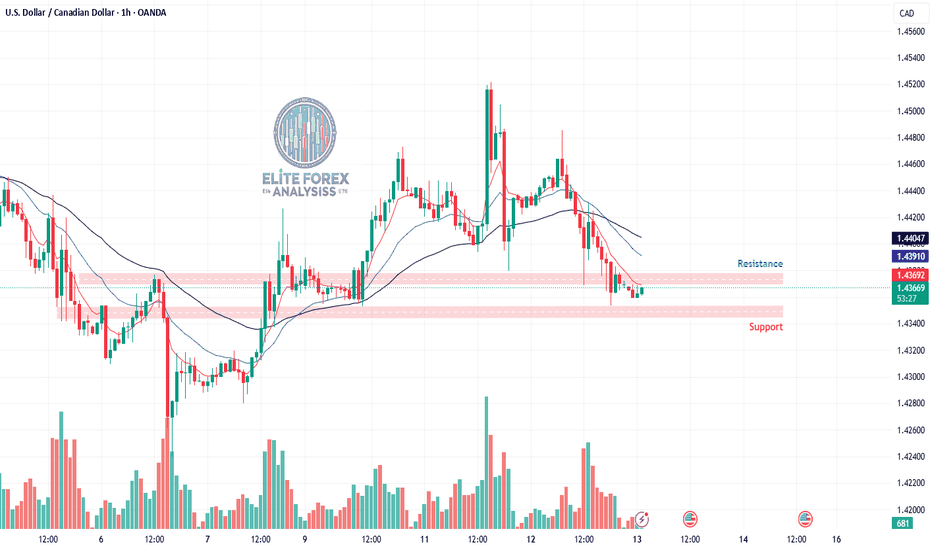

USDCAD Trade Idea (1H Chart Analysis)**USDCAD Trade Idea (1H Chart Analysis)**

**Market Structure:**

- The price is in a **downtrend** on the 1H chart, with lower highs and lower lows forming.

- It is currently testing a **key support level** around **1.4350**.

- The **50 EMA (black line) is above the price**, confirming bearish momentum.

- The recent candles show **decreasing volume**, indicating possible consolidation before the next move.

**Trade Plan**

**Scenario 1: Bearish Breakdown (Sell Trade)**

📉 **Entry:** Below **1.4350**, after a strong bearish candle closes.

🎯 **Target 1:** **1.4320** (previous minor support)

🎯 **Target 2:** **1.4280** (stronger support zone)

🛑 **Stop Loss:** **1.4375** (above recent lower high)

📊 **Risk-to-Reward Ratio:** 1:2 or better

**Confirmation:** If price breaks 1.4350 with strong volume, it signals continuation of the downtrend.

**Scenario 2: Bullish Reversal (Buy Trade)**

📈 **Entry:** If price **bounces from 1.4350** and forms a strong bullish engulfing candle.

🎯 **Target 1:** **1.4395** (previous resistance)

🎯 **Target 2:** **1.4415-1.4420** (major resistance zone)

🛑 **Stop Loss:** **1.4335** (below recent low)

📊 **Risk-to-Reward Ratio:** 1:2

**Confirmation:** A strong rejection from 1.4350 with bullish volume indicates potential reversal.

**Final Thoughts**

- **Bias:** Bearish unless we see a clear reversal signal at 1.4350.

- **Watch for a breakout or bounce at key levels before entering.**

- **Always use risk management** – never risk more than 1-2% per trade!

Diamond Pattern Trading: How to Spot and Trade This SignalSome patterns scream for attention, while others sneak up on traders who aren’t looking closely. The diamond pattern is one of those sneaky ones—a formation that hints at a brewing reversal but requires a sharp eye to catch. Let’s dive into what this pattern looks like, how it forms, and the best strategies for effectively trading diamond top patterns and diamond bottom patterns.

What Is a Diamond Pattern?

The diamond pattern is a reversal chart pattern that occurs after a strong trend, indicating a potential shift in market direction. It forms when price action expands and then contracts, creating a shape that resembles a diamond.

This pattern is rare compared to triangles or head and shoulders formations, but it often signals significant price moves when it appears. There are two types of diamond patterns:

Diamond Top Pattern – A 🐻 Reversal Pattern That Appears After an Uptrend.

Diamond Bottom Pattern – A 🐂 Reversal Pattern That Forms After a Downtrend.

These patterns can help traders identify potential turning points and prepare for a change in trend.

How to Identify a Diamond Pattern in Trading?

To spot a diamond pattern trading setup, look for the following characteristics:

Broadening Formation: The price action initially expands, creating higher highs and lower lows.

Narrowing Structure: After the expansion, the price contracts, forming lower highs and higher lows.

Symmetrical Shape: When trendlines are drawn connecting the highs and lows, they create a diamond shape.

Breakout Point: The pattern is confirmed when the price breaks out of the structure, either to the upside or downside.

While it might resemble a diamond quilt pattern or diamond tile pattern on the chart, the key difference is its role as a market reversal signal.

Diamond Top Pattern: Bearish Reversal

A diamond top pattern forms at the peak of an uptrend and signals that bullish momentum is weakening. Traders often look for a downside breakout to confirm the reversal.

How to Trade a Diamond Top Pattern:

Identify the diamond formation after a strong uptrend.

Wait for a breakout below the lower trendline with increased volume.

Enter a short position once the breakout is confirmed.

Set a stop-loss above the recent high.

Target price: Measure the height of the pattern and project it downward.

This pattern suggests buyers are losing control, and a downtrend will likely follow.

Diamond Bottom Pattern: Bullish Reversal

A diamond bottom pattern appears at the end of a downtrend, indicating a potential shift to bullish momentum.

How to Trade a Diamond Bottom Pattern:

Identify the diamond shape forming after a downtrend.

Wait for an upside breakout above the upper trendline with strong volume.

Enter a long position once the breakout is confirmed.

Set a stop-loss below the recent low.

Target price: Measure the pattern’s height and project it upward.

This pattern signals that selling pressure decreases, and buyers may take control.

Why the Diamond Pattern Is Important for Traders

Reliable Reversal Signal. The diamond pattern trading setup strongly indicates trend reversals.

Clear Entry and Exit Points. Well-defined breakout levels make risk management easier.

Works in Different Markets. Whether trading stocks, forex, or crypto, the diamond pattern remains effective.

Final Thoughts

The diamond pattern is a rare but powerful tool that can help traders confidently spot trend reversals. Whether you’re trading a diamond top pattern for bearish setups or a diamond bottom pattern for bullish breakouts, understanding this formation can give you an edge in the market.

So, traders, have you spotted a diamond pattern trading setup recently? Share your experiences and strategies in the comments!

Different Types of W Patterns and How to Trade ThemHello dear KIU_COIN family 🐺 .

Recently, I decided to provide some educational content for you, my dear audience, and introduce some essential and basic trading terms.

Here’s what you should know: In these lessons, we will cover three different seasons:

🔹 Season 1: Reversal and continuation patterns.

🔹 Season 2: How to use RSI and other indicators to find good entry points.

🔹 Season 3: Definitions of Fibonacci and seasonality in trading.

Stay tuned for valuable insights! 🚀

✅ For the first section of 🔹 Season 1 , I’ll be covering W patterns— a well-known bullish reversal pattern :

As you can see in the chart above, we usually have three types of W recovery patterns , which are the most important ones for us. However, in this section, we just want to get a general understanding of them. In the upcoming section, we will learn how to trade them and explore how they actually appear on the chart and the story behind them !

✅ This is the first and most common type of W pattern:

✅ This is the second type of W pattern:

✅ This is the third type of W pattern:

Ok, guys; I think this is enough for today, and I hope you enjoyed this educational content. However, don't forget to ask your questions below and support me with your likes and follows for more of this content. 🐺🔥

NVIDIA (NVDA) - Failed Bear Flag, Bullish Reversal in Play📉 Failed Bear Flag Pattern

NVDA initially formed a bear flag, with a strong downward flagpole followed by consolidation in an upward-sloping channel. However, instead of breaking down as expected, the price reversed at the lower boundary, signaling bulls absorbing selling pressure.

📈 Breakout Potential

The recent impulse move out of the flag formation aligns with a Wave 1 breakout, confirming a potential bullish trend. If the Wave 2 retracement holds above previous lows, NVDA could see a strong Wave 3 rally towards $130-$140.

🔍 Key Resistance & Confirmation Levels

Immediate resistance around $122-$124 (previous highs & bear flag upper boundary). A break above $124 with volume could trigger further bullish momentum. Downside risk remains if NVDA re-enters the bear flag below $115.

🚀 Bullish Bias Unless Invalidated

Given the failed bear flag breakdown and Elliott Wave structure, the bias shifts bullish towards higher highs. Watch for strong follow-through on Wave 3 to confirm this setup.

📊 Trade Plan:

Entry: On pullbacks above $118-$120

Target: $130-$145

Stop: Below $115

💡 Let me know your thoughts! Do you agree with this bullish outlook?

Don't forget,

Patience is Paramount.

NVDA Topping PatternUnlike the previous call, I made in NVDA that was corrective.

This double-top pattern is signaling a reversal pattern.

From a trading perspective, this is a great risk/reward setup that is relatively simple. A CRACK! here will likely lead to at least the right side filling, with the potential deeper pullback (reversal)

If on the other hand, it pops above recent highs then no trade or an easy stop out.

As you all know I don't do targets, I think they are silly and only used to pretend one has such insight not only can they call the move but also a "target" too. Yeah well, I'll leave that to the "experts" ;)

Bulls don't be a dick for tick.

Shorts take some early profits to improve cost basis but let this one ride!

"Ronin (RON) Gearing Up for a Massive Reversal – $10 in Sight?" The chart of Ronin (RON/USD) shows key technical levels and indicators suggesting a potential reversal from the current order block zone. Here's a structured analysis:

1. Current Market Structure & Order Block Potential

Price: $1.619 (as per the chart)

Support Zone: Around $1.50–$1.60, marked by a blue order block, indicating a potential demand area.

Resistance Levels:

$2.00 (200 EMA resistance)

$2.50 (previous liquidity zone)

$3.50 & $4.50 (major resistance levels)

Above $4.50, the price could experience strong upside momentum towards $8 or even $10.

2. Moving Averages (EMA)

50 EMA (yellow) at $1.833: Currently acting as resistance.

200 EMA (pink) at $2.005: A crucial breakout level for confirming a bullish reversal.

3. RSI (Relative Strength Index)

Current RSI: ~39.78 (neutral to slightly bearish).

Oversold Region (~30 RSI) is close, suggesting a potential bounce.

Confirmation: RSI crossing above 50 will signal strength in momentum.

4. Key Triggers for Bullish Reversal

✅ Rebound from the current order block (~$1.50–$1.60)

✅ Break and hold above 50 EMA ($1.83) and 200 EMA ($2.00)

✅ Volume increase to confirm buying interest

✅ RSI pushing above 50-60 range

5. Potential Targets & Pathway

1️⃣ Short-term target: $2.00 (EMA 200 resistance)

2️⃣ Mid-term: $2.50 and $3.50 (historical liquidity zones)

3️⃣ Long-term: $4.50 (breakout level, unlocking $8–$10 potential)

Final Thoughts

If the order block holds, we could see a bullish reversal leading to higher highs.

A break below $1.50 may invalidate this setup, leading to a bearish continuation.

Volume confirmation and market sentiment will play a key role.

ON Semi is fundamentally undervalued and ready for a reversalTechnical View

NASDAQ:ON ON bounce off from a bigger support area from 2022 at around $53 building an ascending triangle. We have a gap above our current price (which can function as a magnet for the stock price). A smaller resistance at $60 might be our first target and the bigger resistance at $77 could be our final target resulting in 36% ROI. The trade would be invalidated below $50. Since this is a bigger swing trade, I would not put my SL to close to the current stock price. If you’re interested why this is a mid- to long-term swing trade read the fundamental information below.

Support Zones

$50-53

Target Zones

$60

$77

Fundamental View

ON Semiconductor concluded the third quarter of 2024 with revenue amounting to $1,762 million, reflecting a 2% increase from the second quarter but a -19.2% year-over-year decline. Nevertheless, the revenue for the quarter exceeded the consensus estimate by 0.70%. The most significant revenue losses were observed in the industrial end-market, with figures reaching $439.90 million compared to the average estimate of $464.97 million, marking a -28.6% decrease.

The gross margin experienced a 2% improvement, now constituting 45.4% of total revenue. Looking ahead, the acquisition of GlobalFoundries’ New York plant is anticipated to enhance the company's chip production capabilities. This facility is expected to maintain consistent production costs while simultaneously increasing production efficiency, in anticipation of a future rise in demand.

The stock has decreased by 11.26% on a year-to-date basis, with a reported trailing twelve months (TTM) earnings per share (EPS) of $4.03. Management has reported having over $1 billion in free cash flow and plans, according to Barron’s, to utilize half of each quarter’s cash flow to repurchase shares under onsemi’s Share Repurchase Program. The reduction in investments will contribute to increasing free cash flow margins, thereby reinforcing OnSemi’s objective of returning 50% of free cash flow to investors. This, combined with a projected slight improvement in sales growth and profitability, is expected to elevate EPS to $7.11 by 2027.

Currently, the company's valuation appears reasonable, trading at a forward price-to-earnings (P/E) ratio of 13.49, which is lower than 90% of the time over the past five years and significantly beneath the S&P 500 P/E ratio as well as the industry median P/E of 25.4. Based on analysts' projections for EPS and maintaining a steady P/E ratio, the company is anticipated to reach a price of $95.91 within the next two years. While this scenario may seem overly optimistic, it is evident that the market is currently undervaluing the stock, especially when compared to its main competitors, such as Texas Instruments and Analog Devices.

Since EV is a superior trend I don’t think Trumps political decision will have an impact. In addition, “Vice President” Musk has a, let’s say, not so little interest in selling more EVs.

LXRX PENNY BIOTECH SHORT SETUPNASDAQ:LXRX

LXRX has gained over 100% in the past month

However it appears to be forming a double top

in a potential short trade setup on the two hour chart.

The K/D crossover on the hot RSI oscillator provides

confirmation.

Short Sale Volume is rising in the past two days.

Findamentals - LXRX has a new medication for heart failure

a common medical problem with a massive market

It recently launched a public offering to raise capital

to fund general operations and in doing so

diluted the share holders. The good news is

it is unlikely to do another in the near term.

An entry would be at the current price with a stop loss

above the highest volume bar on the profile.

The first target is the POC of the volume profile

about a 15% price drop . The second target is

the pivot low on August 1st for another 15% drop.

Taking of 1/2 at each target yields an expected

23% return over a period of about 5 trading days

since drops are faster than rises.

The call options of mid September have low volumes

so I will not consider them.

ASTRAL swing reversal stock is forming inside bar candle stick pattern at the support & the RSI is below 30

likely good R:R

For a successful entry, we should ideally see a strong 1day candle on our chart—it’s crucial to use that timeframe.

Following the breakout candle of inside bar, the ideal entry point would be after a consecutive candle that breaks above the previous candle

As always, remember to do your own research before making any investment decisions!

Rites BO after accumulationThe stock is showing a breakout (Bo) after accumulating at support levels.

This presents a favorable risk-reward ratio (R:R) for trading, especially with a small stop loss (SL).

Volumes are also shooting 'up.

It's worth noting that there’s a trendline that has been respected for a long time.

Breakout should be with a strong candle (TF as we used in chart); then the entry will be after the consecutive candle which should be breaching the breakout candle.

Do your own research before investing

Gold Price Analysis: Key Insights for Next Week Trading DecisionGold prices extended their rally last week, shrugging off a strong U.S. Nonfarm Payrolls (NFP) report that added 256,000 jobs in December, far exceeding expectations. The unemployment rate dipped to 4.1%, highlighting the resilience of the U.S. labour market.

Despite this, inflationary concerns persist, with consumers expecting higher prices in the coming year, as revealed by the University of Michigan sentiment survey. Meanwhile, the Federal Reserve remains cautious, with mixed signals from officials on interest rate adjustments.

This video analyzes Gold’s bullish momentum amid these macroeconomic factors and explores key zones for trading opportunities in the week ahead.

👉 What to expect:

📈 Price action insights for Gold (XAUUSD)

🔎 Key levels for swing trading setups

📊 Impact of economic fundamentals on market trends

📌 Don’t miss out—watch now

#XAUUSD #GoldMarket #FedRates #TrumpTariffs #TradingStrategy

Disclaimer Notice:

Trading in the foreign exchange market and other instruments carries a high risk and may not be suitable for all investors. The content provided here is for educational purposes only. Evaluate your financial situation and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Textbook Reversal Setup: Liquidity Zone + Channel BreakReversal Setup Analysis: HTF Liquidity Zone + Ascending Channel Breakdown

This chart highlights a high-probability bearish reversal setup based on key technical confluences. Here’s a step-by-step breakdown of the analysis:

1. High-Timeframe (HTF) Liquidity Zone (LQZ):

- The red zone marks a major HTF supply area where price previously rejected with a strong impulsive move downward. This liquidity zone is critical as it represents an area where institutional players have shown activity, creating a high-probability region for a potential reversal.

- As price approached this zone again, it did so in a corrective manner (via an ascending channel), which indicates weakening bullish momentum.

2. Impulsive vs. Corrective Structures:

- Impulsive Move: The strong move away from the HTF LQZ (highlighted earlier in the chart) confirms bearish intent, serving as a key reference point for this trade idea.

Corrective Structure: The price forms an ascending channel on the way back to retest the HTF LQZ, signaling exhaustion of buyers.

- The third touch of the channel’s trendline coincides with the HTF LQZ, adding confluence for a potential bearish reversal.

3. Liquidity Zones in Play:

- HTF Liquidity Zone (Supply): Serves as the key resistance level and primary rejection zone.

- 15-Minute Liquidity Zone (Demand): Acts as a potential target for bearish momentum post-breakdown.

- This multi-timeframe liquidity alignment strengthens the trade idea by providing clear areas of interest for entry, stop-loss, and take-profit placement.

4. Breakdown Entry and Structure:

- Entry Trigger: The trade is triggered on the break of structure, where price falls through the lower boundary of the ascending channel. This breakdown confirms bearish momentum resuming after the corrective phase.

- Stop-Loss Placement: Ideally placed above the HTF liquidity zone and beyond the third touch of the channel to account for potential fake-outs.

- Take-Profit Levels: Targets can be set near the 15M liquidity zone or prior swing lows for a solid risk-to-reward ratio.

5. Key Takeaways:

- This setup offers an excellent example of combining HTF liquidity zones, structural patterns, and market context to develop a high-probability trade idea. The rejection from the HTF LQZ aligns with the broader bearish narrative, while the ascending channel acts as a corrective structure leading to a continuation of the downward move.

- By focusing on confluence factors like liquidity zones, impulsive vs. corrective moves, and structural breaks, this trade idea demonstrates a disciplined and strategic approach to trading reversals.

Educational Insights:

- Always zoom out to identify HTF zones of significance to ensure alignment with the larger market context.

- Differentiate between impulsive and corrective structures to gauge the strength and intent of price movements.

- Use pattern confluences (e.g., ascending channels) in combination with key zones to identify high-probability entries.

- Prioritize patience and discipline by waiting for clear structural breaks to confirm your setup.

CETX I am stacking.Sold the MBIO for a fat profit to start the new year! My month is basically done! Damn it feels good!!

My crystal ball I don't have says closer to $2.6-2.2 before we get a jump but I am currently buying. Spot only. They could easily hold this down for a couple more weeks before a jump and I hope they do so I can get it on the cheap!

I do believe we will stabilize above $20 at some point this year. BUT we could also stabilize above $200.

Be safe with leverage. This stock has 30 sides to it and every damn one is covered in barbed wire or broken glass.

NOT FINANCIAL ADVICE!!!

Catch Big Reversals Like a Pro Using the GOLDEN RSIHow to Catch Market Tops and Bottoms Using the GOLDEN RSI Indicator

Trading market reversals can feel like a daunting task. But what if you had a secret weapon to help you identify tops, bottoms, and potential reversals with ease? Enter the GOLDEN RSI Indicator—a custom-built tool designed to revolutionize your trading strategy. In this tutorial, I’ll show you how to leverage this powerful indicator to spot reversal trades like a seasoned pro.

What is the GOLDEN RSI Indicator?

The GOLDEN RSI builds on the traditional RSI (Relative Strength Index) by adding optimized zones and visual signals that highlight potential bullish and bearish reversals. Unlike the standard RSI, which requires subjective interpretation, this indicator provides precise entry and exit signals by visually marking key market conditions.

How to Use the GOLDEN RSI to Catch Market Reversals?

Understand the Key Zones:

Overbought Zone (Above 80): Signals a potential market top or reversal from bullish to bearish.

Oversold Zone (Below 20): Indicates a potential market bottom or reversal from bearish to bullish.

Neutral Zone (60-40): Consolidation phase where trends are less decisive.

Spotting Bullish Reversals

When the RSI dips into the oversold zone (below 20) and begins to reverse upward, the GOLDEN RSI will highlight a Bull signal. This suggests a potential upward move, ideal for long trades.

Pro Tip: Look for confirmation with price action, such as a bullish candlestick pattern or a break of resistance.

Spotting Bearish Reversals

When the RSI climbs into the overbought zone (above 80) and starts to turn down, the GOLDEN RSI will mark a Bear signal. This indicates a potential downward move, perfect for short trades.

Pro Tip: Combine with chart patterns like double tops or bearish engulfing candles to strengthen your confidence in the trade.

The Hidden Power of Divergences

Bullish Divergence: Price makes lower lows while the RSI makes higher lows. This signals potential bullish momentum.

Bearish Divergence: Price makes higher highs while the RSI makes lower highs. This signals potential bearish momentum.

The GOLDEN RSI visualizes divergences clearly, so you can spot them effortlessly.

Use Risk Management Tools

Set stop-loss levels below recent swing lows (for bullish trades) or above recent swing highs (for bearish trades).

Use risk-reward ratios of at least 1:2 to maximize your profit potential.

Real Trade Example Using GOLDEN RSI

In the SPX 15-minute chart above, the GOLDEN RSI accurately identified:

A Bearish Reversal near the market top, as the RSI entered overbought territory and started to fall.

A Bullish Reversal as the RSI dipped into the oversold zone and recovered upward.

These signals allowed for precise entry points, minimizing risk and maximizing rewards.

Why the GOLDEN RSI is a Game-Changer

Unlike generic RSI tools, the GOLDEN RSI is designed with traders in mind. It eliminates the guesswork by providing visual cues for market reversals. Whether you’re trading stocks, indices, or crypto, this indicator is a must-have in your toolkit.

How to Get the GOLDEN RSI Indicator?

Want to try it for yourself? Head over to TradingView and add the GOLDEN RSI Indicator to your chart. Use it alongside your favorite price action strategies to take your trading to the next level.

Conclusion

Reversals can make or break a trader’s portfolio. By mastering the GOLDEN RSI, you can confidently spot market tops, bottoms, and reversals with precision. Start using this custom indicator today and watch your trading results improve dramatically!

Don’t forget to like, share, and follow me on TradingView for more tutorials like this one. Let’s catch those reversals together!

FTT Breaks Out: Bullish Trend Targets 4.00+ FTT has broken out of a symmetrical triangle and is consolidating above a key support zone.

The ascending trendline supports the bullish structure, with potential upside toward $4.00+.

The bullish trend remains intact as long as the price holds the trendline.