Reversalpoint

PERHAPS... USDCAD LONG FORECAST Q2 W21 D23 Y25PERHAPS... A REVERSAL BACK TO THE HTF 50EMA's

USDCAD LONG FORECAST Q2 W21 D23 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily Order Block

✅Tokyo ranges to be filled

✅15' order block identified

✅Weekly 50 EMA

✅Daily 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF (1W) – Preparing for a Potential ReversalThe chart shows strong bearish momentum, but price is approaching a potential demand zone, though it hasn't fully tested it yet. The main focus is on the 0.8080–0.8095 area, aligned with the 0.618 Fibonacci level — a key point where a bounce may occur.

Key Levels:

🔹 Buy Zone #1: 0.8080–0.8095

→ 0.618 Fibonacci, previous consolidation, and a potential reversal point

🔹 Buy Zone #2: 0.7780–0.7800

→ 0.786 Fibonacci, deeper support and lower boundary of the structure

Scenario:

The current structure hints at a possible W-pattern formation after a dip into the demand zone.

If the bullish scenario plays out, potential recovery targets include:

→ 0.8300–0.8500 – initial correction targets

→ 0.8770 – major resistance (Fibo 0.236)

Alternative View:

If price breaks below the 0.7780 level, the structure would shift bearish — next area of interest could form below 0.75.

USDCHF is in a wait-and-watch zone. The downward move continues, but key levels (especially 0.8080 and 0.7780) are worth watching as potential demand zones. There’s a high probability of a technical bounce or reversal setup developing once these zones are tested.

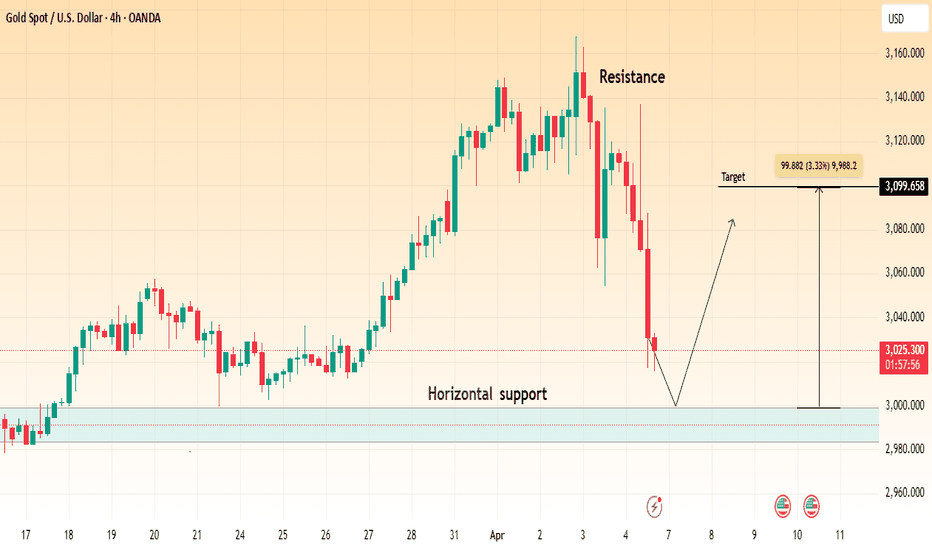

"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

GBPCAD Analysis - Bearish - Trade 06GBPCAD Analysis Overview

---

1. Seasonality

GBP: Seasonality indicates a **sell** signal for GBP in the first week of December.

CAD: Seasonality suggests a **strong buy** signal for CAD.

Seasonality Bias: Sell GBPCAD

---

2. COT Report

GBP:

COT RSI: 52 weeks at 30%, 26 and 13 weeks at bottom.

COT Index: 3-year at 50%, 1-year at 30%, indicating weak positioning for GBP.

Net Non-Commercial: Decreasing, showing a bearish sentiment.

CAD:

COT RSI: 52, 26, and 13 weeks at 20% and increasing, showing bullish momentum.

COT Index: 3-year and 1-year at 20% and increasing, aligning with a buy sentiment.

Net Non-Commercial: Increasing, with a positive bias.

COT Bias: Sell GBPCAD.

---

3. Fundamental Analysis

Leading Economic Indicators:

GBP: Decreasing, signaling economic weakness.

CAD: Increasing, pointing to economic strength.

Endogenous Factors:

GBP: Decreasing, aligning with a sell sentiment.

CAD: Increasing, further supporting a buy stance.

Exogenous Factors:

GBPCAD exogenous signal indicates a buy CAD, sell GBP sentiment.

Fundamental Bias: Sell GBPCAD.

---

4. Technical Analysis

RSI Divergence: Bearish divergence identified, indicating potential downside movement.

Breakout Indicator: A red arrow confirms bearish momentum on key breakout levels.

Resistance Zone: Price is currently at a strong resistance zone, showing rejection patterns.

Technical Bias: Sell GBPCAD.

---

Final Bias: Sell GBPCAD

The alignment across seasonality, COT data, fundamental indicators, and technical analysis strongly supports a sell setup for GBPCAD.

AUDNZD Analysis - Bullish - Trade 07AUDNZD Analysis Overview

---

1. Seasonality

AUD: Strong **buy** signal for the first week of December, suggesting upward momentum.

NZD: Range-bound signal, indicating weaker performance compared to AUD.

Seasonality Bias: Buy AUDNZD.

---

2. COT Report

AUD:

COT RSI : Decreasing from the top but still indicates bullish positioning.

COT Index : Near the top, signaling strong institutional interest in AUD.

Net Non-Commercial : Increasing, aligning with a buy sentiment.

NZD :

COT RSI : At the bottom (0%), but overall positioning is weak.

COT Index : Bottomed at 0%, reflecting limited institutional support for NZD.

Net Non-Commercial : Decreasing, suggesting bearish momentum.

COT Bias: Buy AUDNZD.

---

3. Fundamental Analysis

Leading Economic Indicators (LEI) :

AUD : Increasing, pointing to improving economic conditions.

NZD : Increasing, but weaker overall impact compared to AUD.

Endogenous Factors:

AUD : Mix to decreasing, but seasonal strength supports AUD’s buy case.

NZD : Increasing, but weaker compared to AUD.

Exogenous Factors :

AUDNZD exogenous signal supports a buy AUD, sell NZD bias.

Fundamental Bias: Buy AUDNZD.

---

4. Technical Analysis

RSI Divergence: Bullish divergence spotted on the 4H timeframe, signaling potential upward movement.

Parallel Channel : Price is at the bottom of a bearish parallel channel, indicating possible reversal to the upside.

Daily Support : Currently holding above a strong daily support zone, reinforcing the bullish setup.

Technical Bias: Buy AUDNZD.

---

Final Bias: Buy AUDNZD

All factors—seasonality, COT data, fundamentals, and technicals—align in favor of a BUY setup for AUDNZD. This pair shows potential for upward movement, supported by strong economic and technical signals.

Bullish Setup or Bearish Breakdown Ahead?OANDA:GBPUSD - 1Hr Chart

Price: 1.26202

After analyzing the chart, we found RSI in the extreme oversold zone on higher timeframes. Currently, the price is trading above support at 1.25732, which we anticipate as a potential bullish reversal point. However, strong resistance at R1 (1.26953) may cause consolidation and pullbacks around this level. After consolidation, we expect the price to break R1, with the next resistance target at R2 (1.28174). R2 is also a strong resistance, so price may stall and pull back here as well. A breakout above R2 would target the major resistance at 1.29395.

On the other hand, if the bearish pressure persists and price breaks below support at 1.25732, a further decline could bring the price to 1.25122.

Key Levels:

Support: 1.25122

R1: 1.26953

R2: 1.28174

Major Resistance: 1.29395

Remember to follow your risk management for long-term success.

Happy trading!

NQ Power Range Report with FIB Ext - 9/11/2024 SessionCME_MINI:NQU2024

- PR High: 18847.75

- PR Low: 18826.25

- NZ Spread: 48.0

Key schedule economic events

08:30 | CPI (3x)

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

18400 pivot back towards Keltner average cloud

- Maintaining Friday's 9/6 range

Session Open Stats (As of 12:25 AM 9/11)

- Weekend Gap: N/A

- Session Gap 7/24: -0.32% (open > 19946)

- Gap 10/30/23 +0.47% (open < 14272)

- Session Open ATR: 395.12

- Volume: 30K

- Open Int: 241K

- Trend Grade: Bull

- From BA ATH: -10.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 17533

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

BTCUSDAfter doing top-down analysis I can see that we've hit the monthly resistance level and was unable to break through it. Although major influencers and government official have spoken about FUSIONMARKETS:BTCUSD going to ATH's as of right now it's not happening. We are in a premium array so i'm looking to short sell for a bit.

Tesla - Fakeout leading to a -50% drop?NASDAQ:TSLA is currently trading at a key inflection level, forming a trend for the next years.

Within a couple of hours, an entire stock can reverse and fundamentally change its trend. Tesla is still retesting a multi-year resistance trendline and is down about -8% today. If this selloff continues and Tesla rejects the resistance trendline with a massive bearish wick, then we will most likely see a correction back to the lower support of the descending triangle pattern.

Levels to watch: $240, $120

Keep your long term vision,

Philip - BasicTrading

Gold Hits Record Highs! Skyrocket Further or Sharp Reversal?4-Hour Time Frame Analysis:

Higher Highs (HH) and Higher Lows (HL): The chart displays a clear upward trend with higher highs and higher lows. This indicates a bullish market structure.

Ascending Channel: The price is moving within an ascending channel, showing a steady increase in value.

Key Levels:

1-Hour LQZ / Reversal: 2429.940

4-Hour LQZ / Reversal Point: 2391.394

Potential Take Profit (TP) Levels:

TP 1: 2319.385

TP 2: 2288.085

TP 3: 2267.832

Current Price Action: The price has reached the upper boundary of the ascending channel, suggesting a potential reversal or breakout. Traders should watch for confirmation before taking action.

1-Hour Time Frame Analysis:

Higher High (HH): Similar to the 4-hour chart, the 1-hour chart also shows a higher high, indicating a bullish trend continuation.

Ascending Channel: The price is respecting the ascending channel, reinforcing the bullish sentiment.

Key Levels:

1-Hour LQZ / Reversal: 2429.940

4-Hour LQZ / Reversal Point: 2391.394

Current Price Action: The price is at the top of the ascending channel. Traders should look for signs of a reversal or a breakout above this level to gauge further price movements.

15-Minute Time Frame Analysis:

Ascending Channel: The 15-minute chart shows a detailed view of the ascending channel with the price closely following this structure.

Key Levels:

1-Hour LQZ / Reversal: 2429.940

4-Hour LQZ / Reversal Point: 2391.394

Current Price Action: The price is currently at the top of the channel, suggesting a potential short-term reversal or continuation depending on the breakout direction.

Summary:

Bullish Trend: All three time frames show a clear bullish trend with higher highs and higher lows.

Ascending Channel: The price is moving within an ascending channel on all time frames, which supports the bullish outlook.

Key Reversal Zones: Pay attention to the 1-hour and 4-hour LQZ / Reversal points at 2429.940 and 2391.394 respectively.

Potential Reversal: The price is currently at the upper boundary of the ascending channel on all time frames. This indicates a potential reversal if the price fails to break out. Traders should wait for confirmation before entering trades..

June seasonality pivot approachingOne of my big technical analysis passions is time analysis and time cycles, and I tend to follow them closely. Some of these are very helpful when in combination with other TA, to find reversal points at any given time frame, even though I don't do intraday trading, so I focus on big swings, though bigger time frames.

Bitcoin's periodicity is remarkable, and we can generally find important pivots points during seasonality shifts. One of these season shifts occur in June and has been occurring for the last few years, marking the start of important swings. This seasonality shift is generally very powerful and has the power to mess with some other lower time frame cycles, such as the 60 day cycle, so at this specific time of the year we should expect some LTF cycle non-sense. This seasonality pivot is expected around mid June, so a lower low is expected around that time.

Around the seasonality pivot we can look for price targets with other techniques. Past 45º trendlines, and Elliot wave theory targets are some of my favourite ways to find support levels. As of now, my pivot projection lies at mid June within the 50-55k range. More accurate EW targets can be determined once the current high is confirmed.

Shorting USDCNH: Seizing the Opportunity Amidst Long Position...🚨 Shorting USDCNH: Seizing the Opportunity Amidst Long Position Surge 🚨

In this video, I explain why I'm shorting USDCNH due to a significant return of large long positions that we haven't seen in a long time. The 60-day bullish run seems to be over, and we're anticipating a potential drop.

Key points covered:

Analysis of the surge in long positions and its implications

Why the recent 60-day bullish trend is likely ending

Insights into the expected drop and its potential speed

Strategic approach to shorting USDCNH in this unique market scenario

While no one, including myself, can predict exactly how long this drop will last, I believe it will be quick. Join me as I break down the current market dynamics and share my strategy for capitalizing on this potential drop.

Don't forget to like, comment, and subscribe for more trading insights and expert analysis. Let's navigate this market opportunity together! 🚀💹 And remember to hit the Boost Button on this video to support our Trading View community!

Disclaimer: Forex trading involves significant risk and is not suitable for every investor. Carefully consider your financial situation and risk tolerance before entering any trade. Always perform your own research and seek advice from a licensed financial advisor if needed.

Bullish move on reversalPoints of Ethics :-

1) Strong selling at level 441 if price Falls below this level lower level AT 408.30 can be seen and also we have strong buying area at the same level AT price 408.30 so we can see another reversal for the price to move near resistance around 496 to 517

2) If the price does not cross 438.40 then we can see further reversal and we can go long with the target between 75 to 80 points, 496 to 517 considered as retracement zone we also have small resistance near 441 so we can plan our trades accordingly as per the levels

3) short term time period of 30 days

Reversal seen at support on monthly candle , price is forming a descending pattern, be cautious.

*** Views are personal and not a advise, DYOR ***

IoTeXUSDT - Trendline Breakout Idea ! Hey guys! It's been over 100 days that IoTeX has been in a downtrend. This could be yet the bottom to be confirmed. We need a good breakout of the trendline to the upside with nice strong volume otherwise this could go back into ranging more for a long time or even continue falling despite the bullish bounce off this key monthly level.

TRADING PLAN AS FOLLOWS:

First we need to see a solid trendline breakout.

First TP would be 0.020 a psychological level. However, it could get pierced through so we need to monitor price action once it gets there.

My desired level is the weekly mean reversion area where price has struggled in the past and it's also a key flip zone but in the weekly timeframe. This area has been a magnet for price so it could get there again. TP here would be around 0.02470 - 0.02680

If the trendline breakout fails, close position at breakeven IF price goes sideways and no direction whatsoever or it hits stop loss.

I suggest to SPOT rather than futures as this is a counter trend trade set up. Risk is higher unless you follow rules strictly per your plan.

Hope you find analysis useful!

Kina 🙏

NQ Power Range Report with FIB Ext - 11/10/2023 SessionCME_MINI:NQZ2023

- PR High: 15254.75

- PR Low: 15223.75

- NZ Spread: 69.5

No key economic events

Apparently Powell brought in enough interest to break the green streak

- Open interest and volume increase

- Finding inventory below prev session low

Evening Stats (As of 1:35 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Gap 8/2: -0.33% (open > 15807)

- Gap 7/20: -0.11% (open > 15939)

- Session Open ATR: 234.25

- Volume: 33K

- Open Int: 268K

- Trend Grade: Neutral

- From ATH: -9.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 15247

- Mid: 14675

- Short: 13531

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.