XAGUSD SILVER TRNs60.00

57.74

54.74

52.08

50

46.87

44.98

42.08

38.35

36.19

33.50

31.37

30.66

30.10

28.88

25.67

23.10

19.00

16.40

12.00

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

Reversalzone

XAUUSD GOLD TRNs2151.42

2102.49

2030.86

2006.40

1980.17

1955.72

1931.24

1906.00

1882.32

1857.86

1808.93

1752.78

1746.49

1719.18

1654.53

1562.00

1475.72

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

ADAUSD TRNs UpdateAdded more TRNs to the upside

1.2278

1.2442

1.2610

1.2776

1.2943

1.3108

1.3330

1.3440

1.3618

1.3784

1.4011

1.4277

1.4603

1.4870

1.5410

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

UNIUSD TRNs49.31

47.31

45.96

44.82

42.58

40.34

39.42

37.12

35.75

33.91

32.08

29.78

27.70

25.77

23.39

22.11

18.10

15.87

12.00

9.15

6.00

3.70

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

DOTUSD TRNs64.00

63.00

60.00

54.10

49.35

48.61

47.22

46.52

45.13

43.70

39.05

35.45

33.50

30.70

28.20

25.15

22.60

15.82

14.11

11.88

10.59

6.00

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

LINKUSD TRNs15.28

17.20

19.60

22.49

23.66

24.95

25.70

27.48

28.91

30.70

31.42

32.73

33.60

34.91

35.81

36.69

37.29

38.41

39.47

40.01

40.55

42.14

43.21

44.32

45.01

46.95

47.09

47.90

48.16

50.00

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

ETHUSD TRNs1540.00

1658.64

1773.95

1866.13

1913.90

1968.47

2027.27

2105.27

2244.06

2351.53

2406.25

2530.00

Who Am I To Develop an Indicator?

I must admit that once I developed these areas of Resistance and Support, I could not faithfully trade them. I had no real confidence in the levels because I created them. In order to gain confidence, I had called up several traders from different bank trading desks (all given different currency TRNs as not to skew the data) and asked them to evaluate these pivot points I was using. The positive feed back was overwhelming. All traders wanted to know how to calculate them. Many were using with Fibonacci Levels and Pivot levels to fortify Resistance and Support levels. When asked what service I was using to obtain these levels I then revealed I derived them. Still in disbelief as to their validity I kept asking my fellow traders “Do You See What I See?” Most replied “Of Course” and “Are You Blind?” to the most assuring “ Hey just keep calculating and Giving them to me, they are a great incite.” Their replies to my question convinced me to finally have faith in my indicator. Over time you will also see the power in these points to help you make educated trading decisions that lead to low risk, less confusion and superior profits.

All the Best

LONG OPPORTUNITY ON EURUSDWASSUP GUYS, JUST WANNA SHARE WITH YALL THIS OPPORTUNITY ON EURUSD IF IT TRIGGER...

PRICE IS TESTING TREND CHANNEL LINE AND WE CAN GET A LONG OPPORTUNITY SINCE WE GOT A WEDGE PATTERN ON SMALLER TIME FRAMES TOO...

I BEEN STUDYING AL BROOKS AND A MAJOR TREND REVERSAL IS HAPPENING ON THE 5 MINUTES CHART SO THIS IS REALLY INTERESTING.

$ZM Has Come Into Support Area - Reversal WatchLook at how the price on $ZM reacted when CCI previously broke into the green box. I would add this one on my watch list for the reversal. Especially if it trades above $342.

If this occurs, my price target is $375 then $389. I've marked some key pivot areas on the chart to watch intraday.

If price opens below $336, you can take a short trade to the support level below. However, I would not take it with RSI being so low.

AUD/JPY Price Trap IDEA* Break & Retest(1)

- Wait for BREAK of resistance (ceiling)

- Wait for RETEST (where price closes above the previous level of resistance)

- Once price CONFIRMS resistance as a new support floor, IT IS SAFE TO ENTER.

(2)

- Wait for a BREAK of support (floor)

- Wait for RETEST (where price closes below the previous level of support)

- Once price CONFIRMS support as a new resistance (ceiling) IT IS SAFE TO ENTER.

(3)

*ENTRYS ON 15min Time Frame

(4)

Harmonic Scanner is calling a 'buy' 1 hour timeframe, potential 140 pips

(5)

Risk Management

0.01 per £100

0.02 per £200

0.03 per £300

0.04 per £400

0.10 per £1000

(5)

30 pips TAKE PROFIT

30 pips STOP LOSS

1:1

**FULL RISK DISCLOSURE: Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is no guarantee of future results**

Strong Evidence of Time Zone ReversalsAs you can see, the initial wave top uptrend high from the march low was reversed at 56 bars. The next movement from the june high to the july low was 32 days (23 bars). The following movement from the july low to the august high was, again, 32 days (22 bars). Both 32 day movements were a part of the redistribution phase of a price correction in XOP's components. The downtrend movement, again, had a minor uptick at 32 days; however, this price correction downtrend then continued further on to 56 bars. At 56 bars, a clear double bottom reversal pattern that conformed to commonly agreed upon percentages appeared. The drop from the 32 uptick down to the initial bottom was approximately 19% which fit between the normal 10-20% drawdown of a double bottom. The second bottom at 56 bars was approximately 2% lower than the initial bottom which fit within the maximum +/- 4% of a double bottom pattern. This pattern signifies a reversal of the downtrend, and was last seen in the month of March.

If we are to take this pattern at face value, since news and market geometry should not change dramatically any time soon, a 101 bar uptrend and consolidation phase began on last Thursday's trading. We, then, should look for a long position for another 21-22 bars (30 more days/November 30th). We could short into the middle of the 22-23 bar or 32 day (16 days/December 16th) consolidation phase, where a small inverse-head and shoulders pattern should appear. Again, we, could look for a long position for the 56 bar uptrend(Plus 16 days or half of the uptick within the consolidation phase), at which point, we could short again for another 32 days. Please notice, I have circled each possible reversal point and color coded them to either gains (green) or losses (red).

I also wanted to point out that there is a time correlation to 45 bars and the completion of the 56 bar trend reversal phases. As you can see, the first difference in bars was 11, the second was 22, the third then should be 33, and presumed completion of this cycle would then be 44. One more time correlation which I have yet to key out is the 57 day time zone from low to low. I have included it within the analysis because somewhere within the following unfolding trading days, I am sure this pattern will also become clear. It appears, so far, that the pattern could be 57 day, 57 days, 22 bars, 22 bars, 22 bars, ....??? Once the next uptrend and consolidation phase is finished, I am sure this time zone correlation will become clear.

Finally, the entire cycle take 360 days. This time frame is important because it is the 2.5 multiple of the universal harmonic 144, or the 30th multiple of 12. The time frame also corresponds to a perfect 2pi circular revolution of the unit circle with a radius of 1; furthermore, it signifies the 2pi period of a wave function. It is my belief that the 2 different time zone correlations described above are different wave patterns that both exist in correlation and interference to one-another within this perfect circle and wave period.

We Should Hit ATHs Soon. Stimulus?It has been a very long time since Intermediate wave 5 failed to move above the peak of Intermediate wave 3. With it being 2020 and the world on fire, maybe this is the exception. IMHO I doubt it. Wave 3 peaked in early September at 3588.11. I project not only will our current wave 5 surpass that, but my projection has the top around 3639. This is not unrealistic. The crazier part of the forecast is this top occurring before election day, more specifically around October 29. This is not much time considering about 75 hours of trading will occur between my marked end of Minor wave 4 on October 15. Minor wave 3 moved 45 hours. The ratio of Minor wave 3 hours to the projected Minor wave 5 hours is 0.6. This is just slightly below the average and median relationships for these waves which is around 0.73-0.83. This could also mean Minor wave 5 lasts less than 75 hours, give or take a few trading days.

The target levels are still in line with those I projected months ago. I do not necessarily see a top above 3664, but we should get above 3610. The highest frequency of data points for a top are around 3639 so this is my official target.

A potential contributing factor to such a run over a short amount of time could be actual passage of stimulus by the Congress, or continued hopium that finally fails to deliver by election day.

On a side note I have Apple running up and above at least 133, possibly 140. When will both of these runups occur, around October 29. The close of trading on October 29 coincides with Apple's earnings call (my initial take is earnings may be much worse than expected). The drop I have occurring after this date will be massive (about 750 points on the S&P 500 Index). Likely contributors are election "surprise", delayed election results, legal fighting/winner uncertainty, failed stimulus and lame duck politicians, COVID 2.0/flu season, even more rioting, war in the world, or some other black swan.

But don't worry, the drop will be temporary. I am forecasting a bottom somewhere in Q1 of 2021 and then ATHs again. I will keep posting updates as more waves are completed (or I think they complete and scrape egg off my face).

xauusdclear daily reversal levels, im looking for the lowest "strong reversal" level and highest "strong reversal" level. Copy and paste the reversal zones and see how price respects those levels in the future. Use trend lines for trend confirmation! FOLLOW the trend always! Also watch for divergence at those levels! OH YEAH FINAL CONFIRMATION!!! FIBONACCI SENSEI!!!!!!

BKNG Headed to retest 50DMA firstNice little chart on booking to watch.

Got the gap up serving as support, showing so already, indicated by the dashed line.

This is coming right into the 50DMA if we keep moving sideways.

The 2 hourly chart showing three black crows coming down, looking like likely movement to the downside in the immediate future.

Should be found by support at 50 DMA and will watch for reversal DOJIs and spinning tops to indicate reversal off this point.

If it breaks through the 50 DMA support will be looking at the next gap support shown by lower dashed line and this coming into the 200 DMA to find sturdy support on the bottom channel.

Previous recent highs as resistance and above that previous gap down indicated by solid white line as upper resistance.

Looking for a 61% retracement off our newly forming lows to the previous recent high as a sturdy target, right now looking around 1865 to be determined in coming days when we find reversal.

We’re also 5-6 days into a pull back cycle, typically these pull back cycles look to run 5-8 days before reversal.

#NASDAQ35000hat

Market Trying to ReverseWe discussed this market last week and the important intraday resistance level we were hunting short trades.

After selling off twice at this level, price is now once again looking to make another test.

Looking at the longer-term charts the trend is clearly lower and this level looks key.

This market is now attempting to make a reversal back higher and a break of this resistance would be the first step to watch for.

Thanks for your like and support.

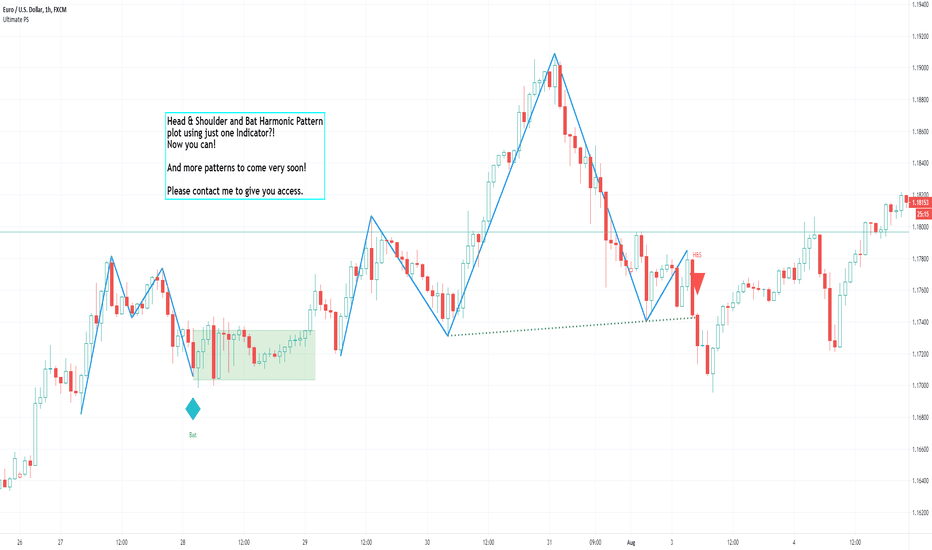

Harmonic and Chart Patterns in ONE IndicatorChart Patterns and Harmonic Patterns using just ONE indicator!

This is a automatic scanner for well know patterns like Head and Shoulder to get started. I'm planning to add more patterns in the near future. It works as follows:

1. Is going to plot the pattern on the chart, lines in blue

2. Is going to show you when the pattern has finished to form, triangles and diamonds

3. It is possible to get an alert when the pattern has form

For example: is going to give a possible entry when the price has broken the trend line of the two shoulders if we take the Head and Shoulder pattern as an example.

Please let me know in the comments if you would like to have more patterns.

======================================================

This versions supports:

1. Head And Shoulder Pattern

- Show possible entries when the trend formed by the shoulders has been broken

2. Bat Harmonic Pattern

- Show Possible Reverzals Zones in green or red boxes

- Alerts when any pattern has form

- Can be used on any instrument

======================================================

======================================================

Next Versions:

- All the harmonic patterns

- Triangles

- Elliot Waves impulses

- Double Top and Bottom

- Triple top and bottom

- Rising and Falling Wedge

- The cup and the handle, etc

- ABCD pattern

Let me know in the comments if you would be interested in something like this please. I'll appreciate your feedback.

thanks

FCPO TRADING : 109) REVERSAL IS CONFIRMED...?this is the 109 trade frm haidojo trading...another important support - 2625 is broken! according to my thumb-of-rules, this is a confirmation shift of trend...it has as high as 70% accuracy...so wat say u...? uptrend persists? confirmation shift-of-trend...? welcome to leave ur message in the comment column below...

My strategy has changed frm long when retrace to short when rebound...the resistance level shall be watched...

overhead resistance : 2625-2630

higher resistance : 2670-2700

current support : 2574-2560

lower support : 2474

GBPAUD! BIG Battle between the bulls and the bears coming up!Previously, the bulls have won the last couple battles pushing hundreds of pips against the trend. Price is nearing 2 forms of structure, one being the top of the down trending channel and the other being previous resistance. We will have to wait and see how price reacts to these structures to take out next position or close out current longs. Regards of the winner i could see 2 possible scenarios. A break and retest to continue a bullish victories, or reinforcements arrive for the bears and we get a rejection similiar to the one that happened last time price met this trendline.

FCPO TRADING : 94) POSSIBLE FORMATION OF "HEAD"

hi, this is trade 94) frm haidojo trading...ok, this is not the common head in "head-and-shoulder" pattern...but it is the "head" in a trend...

at least temporary reversal of trend...but in order to confirm a reversal, it has to form some kinda gap down...or hovering in tight range for at least another day...another thing is, 2 things happened today...1) the resistance 2691 is hit today (yes, look at the pinbar)

2) support region, 2626-2630 is tested today...

in order to reverse the bearish sign, the resistance 2690 has to be broken to confirm the continuation of uptrend...

higher resistance : 2690-2700

current support : 2625-2630...

lower support : 2565-2575

critical support : 2517 -2520

market might have come to a resistance level and likely to have reversed...

PS : I forget to put in the chart, thr is a bearish divergence in the chart...sori...

WARNING : this is juz a trading idea...trade at your own risk!

**your "LIKE" and "FOLLOW" are my main source of motivation to continue posting more valuable contents...TQ**

SHORT SPX = 5 Days Close at or above the OUTER BBObvious rising channel that is STEEP and prices have gone parabolic recently. This is shown in the 5 of the recent days at or closing above the outer BB. This pattern reverts to the mean of EMA 39 in >90% of cases. Occasionally prices rise a several more days before turning down but usually they do not. Expect to SHORT tomorrow at ~3200 and expect TP of 2950ish.