Stock reversal After the stock was sharply falling, the significant volume came out, - that's the first sign of the trend stalling. Then the reversal pattern appeared, which got confirmed by the big white candle that closed above January high (marked as bright green). I was a bit late as I didn't manage to catch the market closing, so I tried to get in at the opening on the following day.

1)Stop loss is under recent lows.

2)Profit target is around the beginning of the sharp decline.

Reversalzone

WATCH EURAUD 30M FOR REVERSAL OR CONTINUATION Price has two resistance levels to decide to either reverse bearish or continue bullish. (162.00 & 162.11)

If continuation long watch for a Break-Hook_Go candle pattern on a 5m, 15m or 30m chart.

If reversal short watch for an engulfing candle, evening star, inside candle railroad candle reversal patterns

on a 5m, 15m or 30m chart.

Continuation TP levels will be 100%, 127.2% and 161.8% fibs.

Reversal TP levels will be -23.6%, -61.8% and -127.2% fibs.

Find your SL on the other side of the reversal or continuation point.

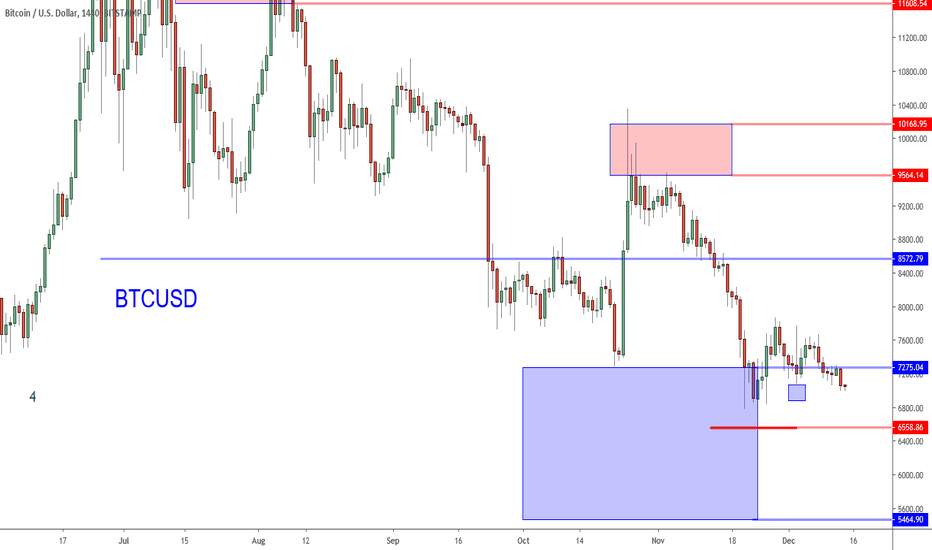

Bitcoin: Adjusting To Out Of Play But Bullish Location.Bitcoin is stuck, but before you get too bearish, it is worth noting WHERE it is stuck. The 7K level is a minor support, but it is within a very broad support zone of 7275 and 5464. In the middle of the zone is the 6558 reversal zone boundary. These levels and areas are not made up, or randomly selected. They are a result of previous price action and are proportional to relatively broad movements in Bitcoin. The purpose of this article is to point out how we are interpreting recent price action, and adjusting in terms of strategy.

1. 7275 to 5464 is relative to the .618 of the 3150 to 14K impulse structure. This is a typical retrace are for corrective waves to complete (particularly Wave 2). The movement from 14K to 6800 is a corrective consolidation that we interpret as a Wave 2.

2. Lower highs continue to be established, but lower lows are not. The 6750 (recent swing low) is NOT that much different from 7250 (previous swing low). A bearish trend is defined by a series of lower highs AND lower lows. Until a major new low is established, the risk of short squeeze is HIGH.

3. In order for bearish momentum to take hold, and FOLLOW THROUGH, a decisive close above 7875 would provide confirmation. UNTIL this occurs, buy signals carry less weight.

4. In range bound, lack of follow though environments, particularly at attractive accumulation levels (like 7275 to 5464), position trades are much more efficient compared to swing trades. As long as the sizing is carefully managed, it is less likely to get shaken out or stopped out as a result of random price noise. Also if a short squeeze develops out of no where, there is no missing out on the move.

5. Bearish momentum usually unfolds QUICKLY and makes progress. Bitcoin is struggling to go lower just as much as it is to go higher. This is NOT characteristic of a bearish trend. (Want to see a recent bearish trend? See stock ticker CGC).

6. Price can test 6550 or even the 5500 level and STILL establish a broad HIGHER LOW formation. 3150 is the reference point. As long as Bitcoin maintains some stability in this range, it is offering wholesale prices. Keep in mind, this perspective is NOT for small time frame strategies that utilize time frames less than 8 hours.

We recently entered a swing trade at 7550 and got stopped out at 7025. After taking a few stops in a row, it is easy to lose confidence in a strategy, but that is the common mistake that leads to strategy jumping and inconsistency over the long term. How come we don't change our swing trade strategy? Well, because it has proven itself across multiple markets like stocks and forex. When a market is out of play, no strategy will work, and that is precisely why we trade price MOMENTUM, no matter what market.

Just like markets, strategies also go in and out of favor. While there is not enough momentum for swing trades at the moment, position trading or inventory management is still attractive (high probability location + strategic sizing) because it does not require such precise timing, momentum or attention. Is it possible for Bitcoin to go back to 3K? Sure and that is the risk you MUST accept and adjust for when managing inventory. How do you think the institutional players do it? By obsessing over 1 hour charts?

Bitcoin: Bearish All You Want, These Are Wholesale Prices.Bitcoin breaks the 8K support, takes out the previous 7290 low and pushes into the 7275 to 5464 broad support zone. What does this price action mean in terms of the bigger picture and is there still a buying opportunity here? In a recent video, I pointed out that we treat trend and momentum as two separate elements when we evaluate Bitcoin for trade possibilities. And from that perspective, here are some points to consider as Bitcoin continues to sell off.

1, The 7275 to 5464 broad support zone is proportional to the impulse structure defined by the 3150 low to 14K high. This location is most attractive for much longer time horizon strategies like position trades (hold for weeks to months), BUT price action is not yet supportive.

2. Price has now made some progress (continuation of broad Wave 2 beginning from 14K peak) by taking out the 7K level, which increases the possibility of further weakness. Is this a trend? On the short term, we can now say yes BUT do not lose site of the fact that price is in a location where it can complete the Wave 2 corrective consolidation. This is still a very high risk location for swing trade shorts.

3. 6558 is an extreme reversal boundary that is proportional to the recent short squeeze off of the 7290 level. IF price establishes a reversal pattern around this area, it will offer a high probability, high potential swing trade opportunity based on our strategy. This will not be apparent on smaller time frames. There is some evidence of buying in the form of the long tail on Friday's candle.

4. The break of the inside bar low at7102 has generated a sell signal and triggered further bearish momentum continuation. This type of price action is best for very short time frame strategies such as day trading. The advantage is you can take quick profits without being exposed to the broader location risk, but do not get carried away with unreasonable price targets. 5K is possible but much less probable. A drawback to day trading is it requires an enormous amount of attention, and the ability to be extremely decisive and mentally flexible at the same time. The smaller the time frame, the faster things change.

5. Be careful to not mix time frames. Do not project swing trade targets while justifying day trade risk. Chasing profits is not an objective. Know the type of trade you are entering before you enter it. We define our objectives by time frame, and only consider swing and position trades (day trades are not within the scope of our long only strategy).

6. There are two potential trade opportunities in this general location: A bullish reversal for a swing trade long and accumulating more inventory (risk managed by size). In terms of inventory, there are two ways to go about it: 1) aggressive which means step in front of the market now and be prepared for further selling (pain) or 2) WAIT for evidence of stability in the form of buying activity such as pin bars, double bottom, higher low, etc.

When it comes to swing trades, especially when we stick to only one side of the market (long only), these situations are very easy because there is NOTHING to do but wait for a reversal setup. It is NOT about when, it is all about IF. We make no predictions, have no opinions or expectations when it comes to short term market timing. Either the market aligns with our rules and let's us play, OR it doesn't.

In summary on the time frame that we operate within, it can be argued that the short term trend and momentum are aligned. While these elements do not fit within the rules that govern our swing trades, we are open to accumulating Bitcoin at these unusual and attractive prices for the long term (position trade) . These are the kind of situations that we WAIT months for, and because we were careful to preserve our capital throughout this corrective consolidation, we have the resources available to expand our inventory at wholesale prices, not retail.

eros. reversal looksmy idea going forward into Wednesday. may come sooner or later. the overreaction to that news...25million. compared to there estimated mrkt cap of close to 1billion. do some dd the only did 2.5% against their actual worth and sp goes down about 50%...easy dip buy. if presented tomorrow with 1.60s don't miss them IMO

AUDJPY - SHORT CONTINUATIONWe are still short this market whilst JPY is still showing strength and AUD at the opposite extreme. However, watch this market in the next few weeks for signs of reversal when the 71.00 zone has been reached.

A big change in risk would be needed to move this market beforehand.

reversal or downtrend ????In the chart there is a yellow zone. Trend touch that zone several times, and reverse.

Now it's time to follow the trend if it's reverse or go down.

If candle close below the yellow zone, that's the confirmation to go down. Otherwise it will reverse.

Let's watch ,...............

Bullish on BTC on retest of 61.8% level: LongerTermTarget@16800.Started buying in a little earlier at ca. 9888 after the breakout from the upper trend line from my previous analysis and subsequent finding support at the 50 sma.

Will buy in more after successful bullish retest again at ca. 61.8% level of the specific fib. level drawn (see previous chart above for more details on this).

Might start feeling more neutral again if it falls below the 50 sma, and bearish again (with ca. 8400 USD target) if it pierces back below the fluoropink trendline (with considerations to volume and RSI as well + looking at the DIFFERENTIAL-FUSIONGAPS oscillator for an update on the price-momentum development, and the DOUBLE-DIFFERENTIAL FUSIONGAPS oscillator on the price acceleration detail).

My much earlier analysis seems to indicate that BTC might drop to as low as 8400USD,

however, everyone is expecting that.

So given that the FUSIONGAPS oscillator confirms that this is currently a bullmarket

Plotted with log(y) axis. Note that for the latest updated version of my FUSIONGAPS oscillator series, the positive/negative axis have since been flipped.

i.e.

+ the fact that everyone else seems to have derived similar price targets and is waiting for that to happen, I believe it is more likely to front run than overshoot -- to deny most people a chance to successfully buy in at the the expected retracement level before the price continues its "overall" macro upward trend. :)

BTC [i]low volume[/i] breakout. Will it hold?RSI looking bullish in (1D) chart, but bearish at shorter time-scale charts.

Appeared to find support at the 61.8% level of the specific fib-retrace drawn -- where I've used the 6195 USD level as the bottom instead (which was the level that was held in a long painful sideways trend before the massive dump around 14thNov18 all the way down to 3kUSD) and also where the bottom of the long wick on 17thMay19 again very briefly tested before price strongly moved further up.

BTC low volume breakout of resistance trendline. Will it hold?

FUSIONGAPS {FG} and DIFFERENTIAL FUSIONGAPS {DFG} oscillators looking bullish.

There was a 50/15 sma Death Cross on 26Jul. but a reversal (Rev) looks imminent.

i.e. the Low Reversal "LoRev" signals have already been triggered at lower time-frames.

Because of the low volume breakout of the resistance, will not be in a hurry to buy in.

Will instead wait for the "50/15LoRev" to trigger on the (1D) chart in my FUSIONGAPS {FG} oscillator, confirming a significant momentum turnaround; with the price continuing to remain higher than the previous resistance line (and not fall back lower), before making a move.

Just my own personal opinion. Not an investment/trading/financial advice.

How to use my FG oscillator in conjunction with DFG oscillatorLooks like BTCUSD still have a little bit further down to go, but is winding up for a next significant pump.

DEMO of the use of my FUSIONGAPS (FG) and DIFFERENTIAL FUSIONGAPS (DFG) scripts, with my LIVIDITIUM indicators set.

Not a financial/trading/investment advice. Exercise your own judgement and take responsibility for your own trades. ;)

See also:

If you like this set of indicators, and it has benefited you in some ways, please consider tipping a little to my HRT fund. =D

cybernetwork @ EOS

37DzRVwodp5UZBYjCKvVoZ5bDdDqhr7798 @ BTC

MPr8Zhmpsx2uh3F5R4WD98MRJJpwuLBhA3 @ LTC

1Je6c1vvSCW7V2vA6RYDt6CEvqGYgT44F4 @ BCH

AS259bXGthuj4VZ1QPzD39W3ut4fQV5giC @ NEO

rDonew8fRDkZFv7dZYe5w3L1vJSE51zFAx @ Ripple XRP

0xc0161d27201914FC0bAe5e350a193c8658fc4742 @ ETH

GAX6UDAJ52OGZW4FVVG3WLGIOJLGG2C7CTO5ZDUK2P6M6QMYBJMSJTDL @ Stellar XLM

xrb_16s8cj8eoangfa96shsnkir3wctdzy76ajui4zexek6xmqssweu85rdjxrt4 @ Nano

~JuniAiko

(=^~^=)v~

CAD/CHF - Time to pull the trigger!My apologies for such a saturated chart.

For me, this bullish trend is ending very soon. We can see that the price is losing strength as it approaches to the weekly resistance. It also got over the 0.76 just for 20 pips and immediately reversed. Zoom in on last pullback and pay attention to the volume traded. You can see the bearish candles have more weight and for me this is a signal that the price is already getting into a bearish zone! Inside the upward channel we can find an ascending wedge which is also another reason to think price can strongly reverse.

Also check ADX is showing that the trend is losing strength and RSI almost breaking its upward trend.

This all is happening in the 78.6% level (red Fibonacci levels) of the last downward impulse which make me think we might be facing the formation of a new downtrend so we are going to place our (first) target on the 50% (blue Fibonacci levels)which is casually a psychological number 0.74

So, why the massive stop?

I strongly believe price must reverse very soon but there is still a chance for an unexpected last impulse which I am going to use to keep going short in order to get more profit.

Keep in mind that counter-trend trades are highly risky and adding more trades when price is not reversing as expected makes it way more risky!

I hope my analysis is useful for your next trades

Don't forget to hit the like button, I really appreciate it

Follow me for more ideas

100% Forex Market

Brent Oil Breakout or reversion? Day one analysisOANDA:BCOUSD

Yesterday was the big day I was expecting with a 360 degrees daily swing, starting with a bullish attempt of 120 pips from 62.5x to 63.7x and a final fall of 200 pips.

It validates how critical is that area for both Bulls and Bears to shape the following trend of Brent Crude Oil.

I mentioned on my daily chart analysis yesterday an area of interest from 62.50 to 63.80. We almost covered entirely that price range. Even if Buyers managed to rescue the quotation back to the yesterday market start, the length of the downside wick on that 4H chart indicates the strength of the selling pressure.

Despite that Hammer candle, a new attempt below the 62.50 is likely today.

Let's consider that second day if Buyers will be able to reinitiate a new bullish attempt.

6 minuet update and discussionBASIS.. Uptrend reversal potential still in play. Looking at 14 days to find reversal emergence.

Alt market should be heating up very nicely and even if we get hit with 5 % TOP COIN drop days there will be opportunities for recovery.

BTC Target 3650 within 14 days.

Fairly strong support backing up sideways action within 10% swing from current position.

QQQ: Check The Roadmap. Major Support Test.The Nasdaq may look ugly, BUT pay more attention to where it is on the road map. IF a reversal materializes at the current level, it can establish a double bottom. If it pushes lower into the mid 153's, it will be within a high probability reversal zone. What does all this mean? It is high risk to be short at current levels. We are looking for relatively strong stocks for possible swing trade longs.