REZUSDT at a Critical Point– Testing a Major Long-Term TrendlineComplete Analysis:

The REZUSDT pair is currently showing a highly compelling setup, as price approaches a long-term descending trendline that has held since May 2024. This is a pivotal moment that could dictate the next significant move—either a bullish breakout or a bearish rejection continuation.

---

📉 Pattern and Structure

The chart is forming a large Descending Triangle pattern, with the descending trendline consistently pushing the price lower for over a year.

Price is now nearing a key horizontal resistance at approximately 0.01826 USDT, which also intersects with the long-term trendline.

The lowest support level sits at 0.00698 USDT, marking the bottom from a major previous decline.

---

📈 Bullish Scenario

If the price successfully breaks and closes above the trendline (~0.01826 USDT), then:

The next potential upside targets could be:

0.03254 USDT

0.04627 USDT

0.06289 USDT

This breakout could signal a trend reversal in the medium term, especially if accompanied by strong volume.

---

📉 Bearish Scenario

However, if the price gets rejected at this resistance area:

It could pull back toward:

The minor support at 0.01200 USDT

The major support at 0.00698 USDT

A rejection at this trendline would confirm the continuation of the bearish descending triangle pattern, which traditionally favors further downside.

---

🧠 Conclusion:

REZUSDT is currently in a make-or-break zone. The market’s reaction to the descending trendline will be crucial in determining the next move. Traders should monitor volume and wait for a solid candle confirmation before entering any position.

#REZUSDT #CryptoAnalysis #TechnicalAnalysis #AltcoinBreakout #DescendingTriangle #CryptoTrading #TrendlineBreak #SupportResistance #REZAnalysis #BreakoutWatch

REZ

REZUSDT Forming Falling WedgeREZUSDT is showing encouraging signs of a trend reversal as it forms a clear falling wedge pattern — a technical setup well known for signaling potential bullish breakouts. This classic pattern suggests that sellers are gradually losing their grip while buyers are starting to step in at key support levels. With good trading volume backing the recent price action, the conditions look increasingly favorable for REZUSDT to break out above resistance and move into a strong upward trend.

Market analysts expect a significant upside potential for REZUSDT, targeting gains in the range of 140% to 150%+. This projection aligns with historical performance of falling wedge breakouts, where initial buying momentum often triggers a chain reaction of short covering and new buy orders. As more traders and investors take notice of this pattern, the chances of sustained bullish momentum grow even stronger, making this pair one of the more promising opportunities in the current crypto landscape.

Furthermore, investor sentiment around REZUSDT is beginning to strengthen as the project gains visibility and trading communities highlight its technical setup. With interest building and the broader market searching for reliable breakout setups, REZUSDT could become a focal point for traders looking for high-reward scenarios. Keep a close watch on breakout confirmation and any surge in volume, as these will be critical signals that the wedge is playing out according to plan.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

This Hidden Altcoin Could Explode—But Only If THIS Level Holds!Yello Paradisers, have you seen what’s quietly brewing on REZUSDT? A high-probability bullish reversal setup is forming, and if this level holds, it could lead to one of the cleanest altcoin plays we’ve seen recently. This isn’t just about one signal—REZUSDT is showing a rare confluence of bullish indicators that deserve your full attention.

💎Currently, REZUSDT is moving within a descending channel while printing a bullish divergence on momentum indicators. At the same time, a textbook W-pattern has just formed, and what makes this even more significant is that it’s happening right at a support zone. This triple confluence—descending channel, bullish divergence, and W-pattern at support—is increasing the probability of a bullish breakout in the coming sessions.

💎From an entry perspective, those looking for more favorable risk-to-reward (RR) could benefit from a deeper pullback. That would offer a higher probability setup and tighter risk management. However, for aggressive or short-term traders, the current level still offers a 1:1 RR, which, while not optimal, is acceptable under strict trade management and position sizing.

💎That said, there’s a critical invalidation point that must be respected. If the price breaks down and closes a full candle below the support zone, it would invalidate the entire bullish structure. In such a case, the only professional move is to stay out and wait for cleaner confirmation or a better-developed setup. There is no room for hope in trading—only strategy and discipline.

🎖Strive for consistency, not quick profits. Trade smart, Paradisers. This setup could be a gift for the patient and a trap for the impulsive. The key is always the same—discipline, patience, and strategic execution. Stay sharp, stay focused, and keep protecting your capital.

MyCryptoParadise

iFeel the success🌴

#REZ/USDT#REZ

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, this support at 0.01570.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.01760

First target: 0.01850

Second target: 0.01965

Third target: 0.02125

$REZ breakout alert!! AMEX:REZ breaking out of a strong downtrend!

After months of consolidation and lower highs, AMEX:REZ just flipped a major descending trendline resistance into support 💥

Now trading above it with strong momentum (+9.6%) and eyes set on the key targets:

📍 First Target: $0.0218

📍 Second Target: $0.0293

📍 Final Target Zone: $0.0405–$0.0407

This move confirms a shift in trend, and opportunities like these don’t come often.

Watch the retest zone closely and manage risk accordingly.

Let the breakout begin!

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

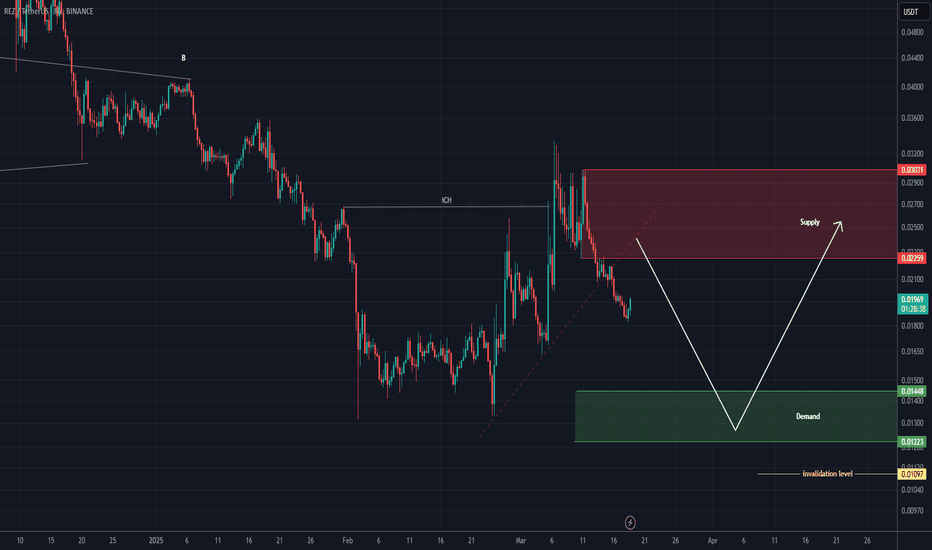

REZ Analysis (8H)After the iCH formed on the chart, it seems we are in parts of wave C, which, after absorbing liquidity from lower areas, could push the price upward and complete the bullish segments of wave C.

We are looking for buy/long positions around the green zone; however, reaching this area might take some time, so this asset should be kept on the watchlist.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

REZ Sell/Short Setup (4H)We don’t have a bearish iCH on the chart yet for the substructure to turn bearish, but the price has reached a strong supply zone. Additionally, the lows of recent candles have all been lower than the previous ones, suggesting a potential move to the downside.

Targets are marked on the chart.

A 4-hour candle closing above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

REZ - Bullish Indeed!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈REZ has been in a correction phase and it is currently approaching the lower bound of the its rising green channel.

Moreover, the red zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of a demand zone and lower green trendline acting as a non-horizontal support.

📚 As per my trading style:

As #REZ approaches the blue circle, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

#REZ (SPOT) IN ( 0.02950- 0.03750) T. (0.16600) SL(0.02862)BINANCE:REZUSDT

#REZ/ USDT

Entry ( 0.02950- 0.03750)

SL 1D close below 0.02862

T1 0.04600

T2 0.06600

T3 0.12000

T4 0.14500

T5 0.16600

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA

REZ. Coin Stabilizing Post-Listing: Potential for Upside.BINANCE:REZUSDT 1D

The coin experienced a steep and prolonged decline after listing, eventually finding a bottom and gradually starting to recover. Currently, the price is in consolidation but made an attempt to break upward, which, unfortunately, was unsuccessful. The price encountered resistance (selling pressure) at the $0.06682 level, leading to a continuation of the correction.

In the short term, I expect the correction to continue toward support levels near our pending orders (yellow horizontal lines: $0.03600 - $0.03130), followed by a bounce (buybacks) and further upward movement.

DYOR.

Renzo (REZ)REZ Analysis

🔹 Overall Status:

After an initial drop, REZ coin has been fluctuating within a range box (yellow zone) between 0.03070 - 0.05034 and has recently broken above the upper limit of the box, moving upwards. Currently, the price is pulling back to this broken range zone.

🔹 Key Levels:

1️⃣ Support Levels:

Bottom of the range box: 0.033 - 0.030

0.618 Fibonacci retracement: Current potential support area

2️⃣ Resistance Levels:

Daily resistance zone (red): 0.065

Bullish Targets:

First Target: 0.17279 - 0.21604 (1 Fibonacci level)

Second Target: 0.40065 - 0.50092 (1.618 Fibonacci level)

Third Target: 2.09323 - 2.61712 (2.618 Fibonacci level)

🔹 RSI and Entry Signals:

RSI is currently in an ascending channel on the daily timeframe and is at the bottom of the channel, suggesting potential support and continuation of the uptrend.

A move of RSI into the overbought zone, along with a breakout of key resistances, could signal a stronger entry point.

🔹 Scenarios:

✅ Bullish Scenario:

If the price stabilizes above the 0.065 daily resistance (red) with increasing trading volume, a move towards Fibonacci targets becomes more probable.

⚠️ Bearish Scenario:

If the price fails to stabilize above resistance, a correction towards the range box bottom (0.033 - 0.030) could occur.

🔹 Trading Volume:

Monitoring the increase in volume when breaking the daily resistance is crucial, as it could signal a sharp move.

🔹 Conclusion:

Safe Entry: After price stabilizes above the red resistance zone with increased volume.

Risky Entry Zones: Near the range box support levels and 0.618 Fibonacci retracement.

📊 Confirmations:

Breakout of daily resistance with high volume

Support from RSI at the bottom of the ascending channel

Reaction to Fibonacci levels

🔑 Recommendation: Always prioritize capital management. Set a stop-loss at the breakdown of the 0.030 support zone.

#REZ (SPOT) IN (.052- .058) T. (.166) SL(.05045)BINANCE:REZUSDT

#REZ / USDT

Entry (.052- .058)

SL 4H close below .05045

T1 .067

T2 .082

T3 .120

T4 .144

T5 .166

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ

REZUSDT Rectangle Pattern!REZUSDT technical analysis update

REZ has formed a rectangle pattern and has been trading within this range for the last 20 days. The price is now moving towards the resistance of the box for a potential breakout. Once the breakout is confirmed, we can expect a strong bullish move in REZ.

Regards

Hexa

Rez accumulation zones IAP model for altcoins after listing! Watch the main zones for accumulation BINANCE:REZUSDT

Possible Targets and explanation idea

➡️IAP model for altcoins! Looking in to accumulation zones for Renzo

➡️Check the chart and titles on zones

➡️Im waiting order flow step by step to first zone to buy.

➡️Only 10% coins unlocked and now its 1b supply

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

REZ analysis (4H)From where we entered "start" on the chart, the REZ correction seems to have started.

The pattern seems to be a diametric.

Now it looks like REZ is going to complete the F wave of this diametric.

If the price reaches the red range, we will look for sell/short positions.

Closing a daily candle above the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

RENZO $REZREZ

Renzo (REZ) is a project aimed at simplifying and improving the user experience in the EigenLayer ecosystem. As an interface to EigenLayer, Renzo secures actively verified services (AVS), offering more attractive returns than traditional Ethereum staking. By abstracting away the underlying complexities, Renzo enables seamless collaboration between users and operators of EigenLayer nodes.

The Renzo protocol is governed by the REZ token, which is backed by the Liquid Restaking Token ezETH. This governance structure allows the community to be involved in the decision-making processes that determine the future of the Renzo ecosystem.

How it works

For every LST or ETH deposited on Renzo, it mints an equivalent amount of $ezETH.

Renzo is designed to be the primary inbound / outbound for Ethereum restacking, utilizing a combination of smart contracts and operator nodes to provide the best risk / reward redistribution strategy.

Roadmap

Here are some key highlights from the roadmap updates from April 30, 2024:

Renzo is introducing new utilities for the AMEX:REZ token, giving users more ways to maximize their rewards.

The Renzo team is working on a withdrawal option for ezETH, which is expected to be available soon.

A second season of the AMEX:REZ rewards program will be launched, providing token holders with additional ways to earn rewards.

The Renzo team is focused on building the #1 restacking protocol and has announced plans to introduce new features and services to improve the user experience.

The Renzo community will have the opportunity to participate in monthly community meetings where they can discuss Renzo roadmap updates, ongoing audits and withdrawals.

Renzo is offering AMEX:REZ rate increases for holders and first season airdrop participants, providing additional incentives for token holders.

The Renzo team is working to improve the product and focus on Renzo's competitive advantage in the liquid restocking market.

Renzo plans to hold regular community meetings to interact with the community and provide updates on the progress of the project.

These updates indicate that Renzo is actively working to improve its platform, introduce new features and engage with the community to drive adoption of its liquid restacking protocol.

Team

The Renzo team consists of experienced professionals who are dedicated to building a reliable and user-friendly platform. Lucas Kozinski, James Poole and Kratik Lodha are the co-founders of Renzo.

Lucas Kozinski is a computer science graduate specializing in distributed systems and blockchain technology. He has previously worked on developing decentralized applications and has extensive experience with security protocols.

James Poole is an experienced entrepreneur and blockchain enthusiast. He has been involved in several blockchain projects and has a deep understanding of the technology and its potential applications.

Kratik Lodha is a software engineer with experience in smart contracts and blockchain architecture. He has worked on various blockchain projects and has a strong interest in decentralized finance (DeFi).

All of these individuals bring a wealth of experience and knowledge to the project, ensuring that Renzo is well positioned to achieve its goals and deliver value to its users. In addition, the Renzo community actively engages with the team and provides valuable feedback. The team holds regular community meetings to update the community on the progress of the project and answer any questions.

Overall, the Renzo team is committed to building a strong and transparent project that benefits its users and contributes to the growth of the cryptocurrency ecosystem.

Tokenomics

REZ will play an important role in the Renzo ecosystem. REZ will be used for governance purposes, allowing token holders to vote on proposals and initiatives related to the Renzo protocol.

Renzo has allocated 32% of the total REZ to the community, of which 7% will be distributed to Season 1 participants and 5% to Season 2 participants. This allocation is based on users' accumulated ezPoints, which are earned for participating in the Renzo ecosystem.

The Renzo protocol is focused on the long-term growth of the protocol and its community. To align long-term incentives with the Renzo community, a vesting schedule will be applied to the largest airdrop recipients. If a qualified user decides to leave the ezETH ecosystem early, their unspent rewards can be distributed to other loyal users to increase the proportion of loyal airdrop users who continue to participate.

The Renzo Labs team and advisors who worked on the protocol to bring ezETH to market will receive 20% of the REZ. This allocation is subject to a 1-year cliff vesting followed by 1-year linear monthly vesting.

The Renzo Foundation will receive 12.44% of the REZ, which will be used to fund initiatives that expand the scope of $ezETH, such as further development, risk assessment and auditing.

Renzo has also allocated 2.5% of REZ's volume to the Binance Launch Pool and 1.5% to liquidity.

Audit

The Renzo protocol underwent a competitive audit conducted by Code4rena, culminating in the announcement of the winners on June 3, 2024. The audit was aimed at ensuring the highest security results for the Renzo protocol. The winners of the Renzo competitive audit were the LessDupes team, receiving nearly $24,000 from the prize pool. Code4rena congratulated Renzo for its strong commitment to security.

It's worth noting that Renzo is transparent about its security measures and takes steps to ensure the safety of its users' funds. The protocol has been vetted by reputable firms and has implemented robust security protocols to protect against potential vulnerabilities.

Github

From a developer's perspective, the Renzo protocol has a number of features that make it an interesting project to work on. The protocol abstracts away all complexity from the end user and allows for easy collaboration between users and EigenLayer node operators. This means that developers can focus on building applications on top of Renzo without worrying about the complexities underlying EigenLayer.

Overall, the Renzo protocol provides an interesting opportunity for developers to build applications on top of EigenLayer. The protocol abstracts away complexity and provides easy interaction between users and node operators. However, developers should keep security issues in mind and take them into account when working on the Renzo protocol.

Conclusion

The Renzo protocol has attracted significant investment, including a partnership with Connext and backing from Binance Labs, Figment Capital, SevenX, IOSG and Paper Ventures, indicating a growing interest in EigenLayer restacking.

Overall, Renzo is a great project that simplifies Ethereum restacking and offers higher returns than traditional staking, and will be a great Ethereum staking tool for institutional investors once Ethereum ETFs are adopted. I have not added an asset to my portfolio at this time. I am monitoring accumulation and looking to build up positions at the lower boundary of the channel or on a channel breakout.

Best regards EXCAVO