ZM: Zoom has officially topped...Short it.I'm short $ZM since earlier today, I believe it has peaked here. Investors are likely to take profits now that competition has increased dramatically for them.

They thrived when the world was locked down due to the threat of COVID-19, but now that vaccines will be widely available and distributed globally very soon, holding shares has become extremely risky. I'd urge everyone holding to sell and buy something oversold with proceeds...If interested in knowing what to buy now, contact me.

A short here has very low risk, I think it can last for a long time falling, so do your own due diligence with sizing to not risk more than 1-2% if it goes against you by 3 average ranges.

Cheers,

Ivan Labrie.

Rgmov

SSRM: Interesting valuation and chartSSR Mining has a very interesting setup here, both a quarterly and also a daily signal warrant a long entry here. If the quarterly signal pans out, initially we'd target $16.50 by Q4 2020, but eventually, this could make price trigger further quarterly confirmation for bulls, potentially pushing price to even higher levels, circa 28.31.

Free cash flow is an important metric in the mining business, and in the case of $SSRM, it is at a very healthy levels relative to the market cap. This allows them to have sufficient leeway to pay workers (and avoid the problems with the work force South African miners had recently, for instance), expand into new projects and maintain their currently exploited mines, among others.

Going back to the technicals at play, the current correction in the daily timeframe and reaction to quarterly support paves the way for a very high reward to risk long trade. There's a few different ways to decide on a stop loss distance and position sizing, but in general, for equities I try to give them enough room for the trade idea to pan out favorably, before being forced to bail on a trade or being stopped out prematurely.

Best of luck,

Ivan Labrie.

RDY: Top candidate to go long indian shares...$RDY has a very strong monthly trend that is currently active, and also a strong daily chart, showing a trend is now active. We can go long risking a fall under the red line on chart, if aggressive, following the daily signal but aiming to capture the monthly trend as well. This would be a huge reward to risk position if it were to pan out favorably for us.

I see the $INRUSD chart as significantly strong, and similar to the period from 2016 to 2018, and $RDY has a good valuation here, as well as substantial growth potential going forward. Free cash flow yield is 7.93%, EPS growth is positive in the last quarter and in the last year, and they are not too indebted, the company certainly has good liquidity and sales are steadily albeit modetly growing.

Best of luck,

Ivan Labrie.

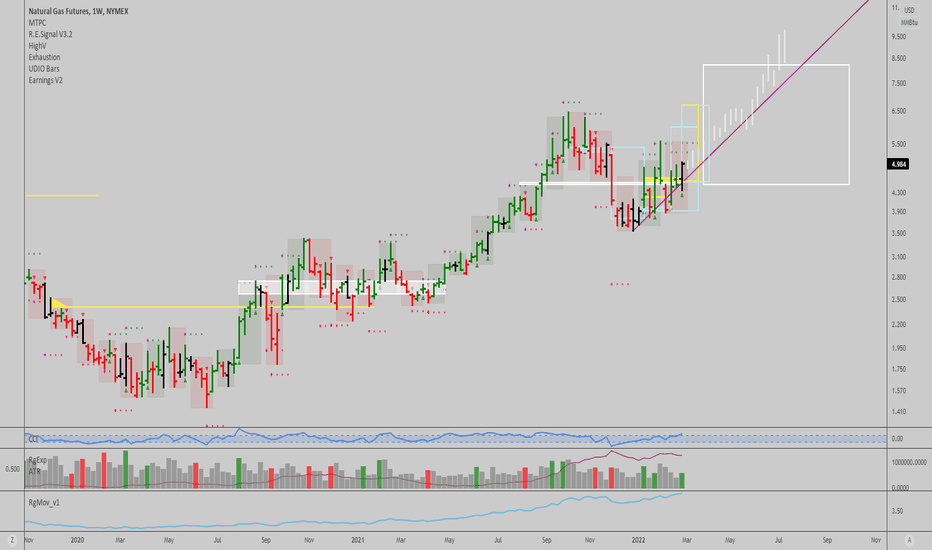

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

$TSLA: Held the S&P500 inclusion level$TSLA has a bottom signal in the daily here, I'm long as of yesterday, time and price target is shown in yellow. Until the next earnings report, price might glide higher. Considering the $TWTR merger, risk of Elon needing to sell more shares is a scary but not impossible bearish catalyst that could rain in the bull's parade soon. Partnering with a PE firm would be a safer bet for $TSLA shareholder's cardiac health, but it's not yet clear what route Elon will go with yet. Earnings might not look too great this quarter, considering Elon's recent sayings about new factories still being a source of losses for the company (clearly gonna be a negative factor until they produce at full capacity, not a demand problem yet). Also have to factor in risk from recent down time in Shanghai due to lock downs and potential impact of the economy on sales with rising inflation and fuel prices affecting consumers. This last point might be what Elon talked about when referring to the economy being at risk of entering a recession soon. I'm sure that if a recession occurs, $TSLA might stay sideways or go lower over time until the market bottoms. To be safe, I'll only trade the stock in the short term. I don't see a huge reward to risk trade in long term exposure to the stock here, all things considered. Long term technical targets are all reached, and price has formed a bearish trend signal in the weekly/biweekly/monthly timeframes, with only the daily trend reversing now.

Best of luck,

Ivan Labrie.

$AMZN: Down trend slowing down...There's a possibility of further downside for $AMZN over time, but currently, price action and the drop in commodities suggest that $AMZN is likely to go higher for a while.

Until the next FOMC meeting, market participants might bet on a Fed pivot taking place sooner rather than later, given the drop in commodities suggesting inflation might be under control already.

I personally think what comes after it is a recession, particularly if the Fed stays in the same hawkish course for longer...For now I'm out of bearish positions and went long using options in a few select names, as well as stock positions in names like $TWTR and $TSLA, etc.

Upside here is good, see the yellow boxes for time and price targets in the immediate short term. What comes after this relief rally until mid to late July is to be seen. Will know more when we get there.

Best of luck!

Cheers,

Ivan Labrie.

#TSLA: Likely bottomed and is about to rally over 1kI'm long $TSLA for a few days already, and it is coiling for a massive move up in my opinion, as many fundamental catalysts are lining up in the coming weeks and months. I can see a resumption of the big uptrend that kicked in after basing during late 2019. Sentiment has turned pretty grim as the stock corrected and lagged $Nasdaq, and investors seemed pessimistic regarding Elon's foray into crypto, as well as prospects for China sales, and Model Y sales in Europe, as new competition arrives in the market in droves. The thing is, competition is actually far behind in range and specs, and $TSLA has a solid lead for the most part despite the bears' insistence on pointing out the risks in the bull case. Things will start falling into place going into the next quarterly report, and after we hear the deliveries number soon.

It has been a long time since I could recommend buying into $TSLA with this level of conviction, but I think the time to be positioned is now, specially considering the pivot away from value stocks and inflation bets that is causing tidal waves in the macro picture now, since FOMC last week. I'm looking forward to $TSLA announcing having sold their $BTC position in the next report, as well as keen on seeing what the up coming AI day event has in store for the stock.

Best of luck,

Cheers.

Ivan Labrie.

#SPX: Potential forecast if we hold support here$SPX confirmed a bullish signal today, after it was evident selling had been absorbed systematically by long term investors since September 4th until today. This buying puts a floor on the market here, and potentially offers a solid support level if retested once prices move higher, if they do hold here for a couple weeks.

A new weekly signal can trigger by the week starting Sep 28th, and we have many short term charts in certain tech stocks showing bearish signals, while a lot of other stocks -energy, travel, hotels, to name a few- have bullish signals, so a sideways index here would not be too crazy.

Once we confirm a new bullish signal we could project a rally over 3684, at least, provided we get bullish confirmation next.

I'm holding both bullish and bearish positions in individual stocks, as well as some insurance using derivatives as well, but should we get a bullish swing once again, the bullish signals will far outweigh any potential loss I might have to deal with from bearish setups. That's the beauty of stock picking, many times you can find good trades that might not correlate the index at all times, or even afford the luxury of trading both long and short positions in different stocks.

Stimulus talks need to progress for the rally to continue, so I will be keeping an eye on those developments going forward.

Best of luck!

Ivan Labrie.

SLV: Buy and hodl 10 yearsThis is the lowest risk idea to hold for a decade here and add to it from savings or profits generated in other shorter term accounts...Ideal fit for a long term account, to simply sit in it and add gradually, never selling until this pans out. I'd say this has 10% downside risk due to the monthly chart structure, but upside is enormous.

Cheers,

Ivan Labrie.

$BTCUSD: Update - 2w uptrend confirmed!I outline time duration and potential upside for the current trend signal in this chart, I had described this possibility in my previous publication. As a positive, we have pretty pessimistic wall of worry kinda sentiment now, and odds of a rally are big with this timeframe being in control of most of the major swings historically in $Bitcoin. Moving below 47k would invalidate this analysis likely.

Let's see how it goes, best of luck!

Cheers,

Ivan Labrie.

SPY: Sentiment resetIn this chart I plotted the period following a sub 25% AAII bulls reading, followed by a sharp rise to 55% bulls at the peak in April 2021. We now reset back down to sub 25% this week, so we might be watching a 'coiled spring' situation in equities. This is not so easily seen in $SPY as the $AAPL performance as of late distorts how equities acted for the majority of people. I included the performance of my trading strategy in the period of rising sentiment, and during the last period with deteriorating sentiment. I expect to make outsized gains again as we get a period of steady trends once more. Note I actually caught the bottom in Nasdaq overall, but the gains from that outperformance round were retraced recently with a series of short term losses.

Best of luck, try to milk the good times ahead. Outsized gains away, potentially.

Cheers,

Ivan Labrie.

KWEB: China tech bottomed?I think it's either the bottom or very close to it. Worth taking a punt here, risk 3 average ranges down and go for the gold .

Let's see how this one works out, I'm not risking big on China overall, but from a contrarian standpoint it is really interesting as to pass on it here. It will be more confirmed once the daily chart flashes a bottom signal, this would take a couple weeks, after not falling lower.

Cheers,

Ivan Labrie.

$BTCUSD: Daily trend is now up again potentially....This means we have a chance of triggering a 2 week timeframe uptrend signal if price breaks over 53k ish before Jan 3rd. The 2 month timeframe trend, which has historically drove $BTCUSD's main cycle suggests the market is bullish until May 2022, and the current juncture allows for a move up to confirm, which would last until mid May give or take. This is a good confluence of short, mid and long term timeframes, paired with a low risk technical entry to rejoin the trend. Definitely worth a shot, since the minimum upside we get is a move to 58.3k by Jan 1st, which in itself is a trade with over 5 to 1 reward to risk. A move under 47k would nullify this theory and suggest the scenario where price grinds down towards 21k is in the cards...

There's additional support from the yield curve slightly steepening as of late, with 10 year yields looking ready to climb back up, and Crude oil bottoming potentially, same as equities overall. Manchin negotiating is a different thing than altogether rejecting the Build Back Better plan, which was what the market was pricing in. Omicron being a mild disease for the vaccinated, and the US not closing schools of businesses is a lot less worse than what the market feared too. Perhaps this recent weakness was merely rolling of options and hedges forward into the future, as we had a huge amount of options and futures expirations last Friday, which sent shockwaves across markets even into Monday's price action. With that out of the way, the market caught a bid, and liquidity started to return. Seeing $VIX move lower under 20.49 next would be extra positive.

Keep an eye out for my Twitter updates, as I post content there regularly, more often than publications themselves. I'll try to update this one as we go forward while the trade is valid.

Cheers,

Ivan Labrie.

$GBPUSD: Upside to 1.3875...The Pound has triggered a bottom signal, in both the daily and weekly timeframe, right after seeing the 1st rate hike across developed nations since the Pandemic started. Weekly charts point to a rally towards 1.3875 within the next 11 weeks, and the daily chart has a buy signal right here. I'm long with a stop below 1.31625, aiming to capture the weekly move here, if possible. Don't risk over 1% in the position, I'd say. Calculate the sizing carefully. Risk management is key to stay in the game until we strike gold with a good trade.

Cheers,

Ivan Labrie.

BIIB: Biogen, low risk long term buyReward to risk long term in $BIIB is very attractive here. I've gone long via a calendar spread before the latest FDA approval news, which turned out like a good long position when Biogen's Alzheimer's drug Aduhelm received accelerated approval. Following this, related companies which also have Alzheimer's drugs pending approval (like $LLY) received a dramatic boost. In the case of $LLY, their drug was approved as well a few days later. Both charts are very strong in the long term, showing signs of yearly uptrends present, indicating a multi year rally in these stocks is possible.

Accelerated approval means that the FDA approves the drug due to the possibility that it may provide therapeutic benefit to patients even though there is some uncertainty about the drug’s clinical benefit.

Aduhelm is the first therapy approved for Alzheimer’s disease that is directed at the underlying pathology itself (the presence of amyloid beta plaques in the brain). The clinical trials were the first to show that a reduction in these plaques is expected to lead to a reduction in the clinical decline of this form of dementia.

There is a lot of debate regarding the drug's price tag, as well as the clinical benefit it may or not provide, but I think it's a reasonable bet to make here, from a technical and fundamental standpoint. Valuation wise, the company has very low long term debt to equity, high free cash flow yield and a high earnings yield (trailing twelve months), earnings growth has been negative in the last year, but positive in the previous five years. There is a lot at stake with Aduhelm's potential success, so, don't risk more than you can afford to lose, consider that the yearly uptrend is invalid if price moves below 243.58 to define your position sizing based on your risk appetite.

Cheers,

Ivan Labrie.

$USDCAD: Lagging oil...I plotted inverse oil here vs $USDCAD, it seems there's a nice opportunity for a big short to close that spread. I'm long $CADJPY and short $USDCAD from earlier today, now made some time to post the weekly signal in $USDCAD, which is cooking here. If price breaks 1.24603, a weekly down trend with a target @ 1.16536 will be active, predicting a 18 week decline is setting up. Stop loss for this setup should be a bit above the light red horizontal line on chart.

Best of luck,

Cheers.

Ivan.

BTCUSD: Update, CME is the driving force here...I found the culprit of my confusion regarding the last upswing in $BTCUSD, the spot chart has become unreliable compared to the CME futures chart, at least when it comes to Time@Mode analysis. Finer details of how weekly bar ranges look, impact the analysis outcome. I missed a signal indicating that we could go long, like 4 weeks ago, and given sentiment didn't think it made sense to get a signal targeting new all time highs either. In the CME chart we see a clearly expired monthly trend, and a clean weekly down swing which has panned out. As well as a new weekly upswing currently taking place. I suspect the outcome of regulatory uncertainty will be that price remains sideways/down and price doesn't make new highs for a long time. Regulations won't come into play after 2023, so perhaps a bit before that, the market will move out of this sideways state. It is unclear when we will have more clarity regarding the final decision in the infrastructure bill, but market participants will be monitoring it closely.

I think my main long term view is correct, that a long term trend ended, and now we either go sideways or down for a similar amount of time as previous bear markets, roughly until April 2022, this is also in line with expectations from monthly T@M signals in the CME chart here presented. As for the daily and weekly uptrend, there is a big resistance cluster above, and a weekly level that should hold, around 50k. I don't think price can jump over that barrier easily.

Daily trend expires by Friday, weekly expires in two more Fridays after. Let's keep an eye on developments here, I anticipate this market will be driven by institutional portfolio managers rebalancing, which likely will contribute to price being stuck in a sideways range until there is regulatory clarity in the future. This will also help sentiment cool down, as it is I can't fathom price going into a steady uptrend and reaching 80-100k or whatever.

I hope you feel as relieved as me, after figuring out this puzzle. Take it easy, we will have a ton of time to analyze and think about this market's trend. Price won't deviate far, specially not up, I am pretty sure of that now. Even more so than before.

We can trade the daily signals as they form, up and down, but definitely don't fomo in and buy all in and expect unreasonable moves (same can be said for shorting, trade small or don't trade).

Cheers,

Ivan Labrie.

#OIL: Huge uptrend potential in oil hereI think we are ready for the next big rally in oil, this will cause a dramatic effect on inflation and affect earnings negatively going forward long term. I think it could reach as high as over $100 a barrel by mid August here. If so, the impact on the economy would be very large, with a delay of 6 months according to research by my mentor, @timwest

With the Iran deal on the horizon, and the recent turn of events in the OPEC meeting, supply is going to be lower than demand and the US might be at risk of losing their energy independence that Trump had achieved during his tenure (also of note is the recent ESG activist shareholder movement, really concerning for the future of investment in increasing supply to meet demand from shale companies in the US).

Consider the return to normal in air travel as a factor here as well, no one is really prepared for a move like this, and most media talking heads are repeating like parrots that inflation will be transitory, as if they were under the govt's payroll. Nasty turn of events indeed, but a good opportunity for those long value and commodities.

Cheers,

Ivan Labrie.

$BABA: It's time, load up the truck...I think $BABA likely bottoms around here, the 14 week down trend signal that predicted this decline reached its final week and price will gap down into long term support from the all time 25% speed line for the whole advance from the bottom to the top. Sentiment had reached critical levels for equities last week already, and there's a path out of this mess with Evergrande possibly under control and most investors liquidated out of this stock, reaching lows not seen since 2019. Valuation is interesting now, so, it seems like a good play to try and knife catch this one. I once tried with the $KWEB etf which had completed a similar down trend recently, which led to a rapid rebound rally but that rally was faded after I took profits, and prices retraced back near the bottom on the back $BABA's continued weakness.

The time is likely now, to try and fade this largely hyped fall, after most people trying to catch the bottom gave up already. Let's roll!

I risk 1 average true range down, below this support level here, I will then monitor daily charts for a bullish trend signal after basing, to accumulate more shares and trail my stop loss higher.

Cheers,

Ivan Labrie.

$AUDJPY: Potential long signal once againI think we are about to experience a strong reflationary wave once again, we have crypto, commodities, equities, preparing to rally in a big way, and the Aussie-Yen forming a monster base. The setup here is to buy if price breaks out forming a larger range upside move vs the last daily true range (when measured from the last close to the upside). This would get my R.E.Signal indicator to flash a green triangle underneath the daily bar, would mean we are about to start a steady trend from here. We can define risk and set a stop not too far below, which is graphed on chart. The signal might not trigger in the next daily bar, but if it does, the price for entry and stop in this chart would be valid.

I'll update this as the chart takes form. I anticipated fireworks in my previous $SPY publication, alerting of a broad sentiment reset forming, which should prepare us mentally for another huge 'winning' wave.

The last strong trend we had was after the Pfizer vaccine announcement, when we made an absolute killing with value stocks and financials. Now we have the Merck pill announcement, potentially triggering another round of reopening optimism, setting the stage for economic recovery, the first phase of which would be reflation.

Cheers,

Ivan Labrie.

$EURCHF: Bottomed here...I think we have a decent trade with something between 3:1 and 5.28:1 RR here. I'm long here since the hourly is bottoming, and daily charts hit long term support, while being close to exhausting the last daily down trend signal that was active. Technically, this is a very strong mean reversion possibility and we have the backing of the Swiss National Bank which could stop the decline intervening in the market around here...

Best of luck,

Cheers.

Ivan.

#ZB: T-Bonds bottomedI think we have a low risk bottom signal here, it fits with my view of rotation back into growth names since the value stocks rally we had since the #PFE vaccine announcement. Today's CPI data gave investors some peace of mind it seems. I'm long growth and a few select equity ideas already, but a bond futures or #TLT options position might be a good proposition as well here.

Best of luck,

Ivan Labrie.

#WMT: Buy the dip...There is a monthly and weekly uptrend in $WMT, and I like the reward and odds here vs the risk. I'm long using long term OTM call options here (June 2022 $165 calls), risking a palatable amount on call premium. Doing this, you can look into selling shorter duration calls periodically, or going short stock against the position to try and make the trade risk free. It's a good strategy if you have a knack for trading, while riding a big trend.

I like the fact that Ray Dalio recently lost a big pension fund from his list of clients, and one of his top holdings is $WMT...as a bit of contrarian color. Alternatively you can trade this one with shares, as a long term position with no stop, it should work if it holds over $142-140, the signal implies a rally over $167 by May 2022, perhaps can reach target #2 at $198.

My last trade was the yellow box you see on chart, a daily signal which generated a bigger monthly trend trigger. This entry now is the optimal entry to rejoin the trend (near my original entry). I sold the shares near the highs already.

Cheers,

Ivan Labrie.