USDCAD: NFP price action determines key levelsEveryone involved in FX trading has their eyes peeled on price charts and fundamental data that comes out every first Friday of each month, when Non-Farm Payrolls data is made public for the month before. This creates volatility during the day, and also a very significant price level where the market reacts, either being attracted to or rejected from the level.

I've plotted these key levels on chart, with a vertical line showing the date of the NFP report. You can clearly see that when the market deviates far enough from the last key level, it will be drawn back to it over time...and that when retesting a level after moving away from it for a while, it will react when hitting it most of the time, helping us map how far and in which direction prices can move.

Right now the last short term signal in $USDCAD failed, hitting my stop loss at break even after buying the breakout at 1.31634, and briefly seeing some profit following the NFP data. The dollar is acting weak accross the board which is an anomaly, and oil regaining strength. We should focus on currencies to determine if we need to hedge our dollar exposure in the equities portfolio, since although earnings in foreign currencies would increase if the dollar devaluates it could hurt stocks' performance even during a rally.

Cheers,

Ivan Labrie.

Rgmov

TSLA: Earnings report was incredibly good...Cost cutting from Shanghai gigafactory in the order of 65%, 50% cost reduction for model Y, EPS beat, free cash flow positive and high free cash flow yield, and an increase in margins from leasing and FS and auto pilot software service income might help $TSLA going forward.

Despite the amazingly positive earnings report, the media remained negative and bearish as sh#te, which was quite surprising. I smell the short squeeze of the century in the making here.

The quarterly timeframe now flashed a new long term trend, targets are on chart, and are valid unless $TSLA were to erase this quarter's advance...Odds of that are slim, to none.

Best of luck!

Ivan Labrie.

USDCAD: Bottoming here it seems...I do like this chart a lot, weekly is oversold and sitting at a long term support level from the quarterly chart. A rebound in $USDCAD in the order of 500 pips higher is possible.

The seek for yield in a world with low or even negative rates makes this a fundamentally sound idea as well. Recently some racism related scandals came to light surrounding politicians of most parties in Canada, but the real reason for $CAD weakening is possibly related to oil losing relevance as we gradually transition to renewable energy sources, in the very long term. Probably safe to buy oversold dips going forward. You could probably borrow $CAD to long $TSLA...

Best of luck,

Ivan Labrie.

A primer on Key Earnings SupportIn this chart I'm illustrating a few trading setups that took place in $MCD following each earnings report for a year. The indicators you see in the chart are 'Average True Range' and 'Earnings Price Support' from @timwest's 'Key Hidden Levels' indicator pack.

Every time a company reports earnings, analysts, investors, portfolio managers, traders, you name it...are paying close attention on the data that comes out, and the prices that the stock is trading for at all times, this normally starts one or several days before the report, and lasts for a day or a couple days after the report. The indicator my mentor devised plots a technical level that helps us map how far prices can move, and where to seek low risk trading opportunities on subsequent retests of past reports' levels.

I use the ATR indicator to define the size of the stop losses that I use, which in turns helps me know how many shares to buy or sell when trading with this tool. To use this you need a method to determine the main trend direction, which can be fundamental or technical, or a combination of both. Time@Mode is the one @timwest created, and the one I use, which together with the proprietary indicators from the 'Key Hidden Levels' suite helps me find low risk trades that have a very good batting average.

Hope you found this post helpful, and if you did, check out my site here: www.fb.me

I offer trading signals since 2015, covering all markets I trade, or focusing only on specific markets according to each client's needs.

Cheers,

Ivan Labrie.

USDMXN: Long against support...Currently $USDMXN sits at weekly support and turning up from oversold. I'm rotating from european currency shorts to $MXN and $CAD shorts here, $USDSEK, $USDCHF, $USDEUR and $USDGBP did make us some money but they got overbought recently. $DXY is likely trending higher still, so rotating to oversold dollar pairs seems like a viable strategy here.

Best of luck,

Ivan Labrie.

BTCUSD: 2D timeframe implies the weekly downtrend is not overThis is a follow-up idea to my weekly forecast. We're curently short with expectations of price bottoming near 6404 over time.

The longer term chart signal is invalidated if prices break the 6400 support zone strongly, so once we do hit it, an immediate rebound would be good for bulls. Stop loss is 5269 for the long term long entry, once we cover shorts. If that stop is hit eventually, then Bitcoin is dead for sure...

Bakkt volume is gradually starting to pick up, my guess is it will explode once we hit the bottom. This coupled with udpates from the Mt Gox situation and other events that might happen by the end of October make me think we will see a big move. I would like to see Bakkt volume surpass CME, for a clear indication of bulls outpacing bears (since CME is cash settled futures market, it favors short selling...in fact, the ex CTFC chair Giancarlo was quoted today, saying how the Trump administration weaponized the BTC futures market to kill the bubble back in 2017, which in fact is quite feasible).

I like it when markets offer such a low risk entry, after an over extended decline, with sentiment eventually becoming one sided. Bulls seem confident in loss here, from what I gather, so sentiment confirms further downside. I'm short and hedged, looking to add to short on a small reaction, and ride it down towards the target on chart.

Cheers,

Ivan Labrie.

$OSUR: Strong base after a 49% decline...I think this is once again an interesting name to buy back here...I recall @timwest pointing it out in early 2016, near the very bottom before a huge rally. We were bullish on it at the right time, and I think it's the right time once again.

Fundamentals for the stock are a bit convoluted, with self diagnostic kits segment being highly competitive, and sales slumping, but the chart shows renewed interest in the stock from big buyers, given the accumulation base after a strong climb a month ago.

I would assume some interesting news is about to come out, that might be the catalyst to push it up from this base...

I'll be a buyer on signs of strength, if it breaks up from here soon.

Keeping an eye on it.

Cheers,

Ivan Labrie.

ARGT: Argentinian shares bottomed after the Primary electionsIt seems Argentinian stocks have bottomed here for now, after basing for 5 weeks, daily charts show some strength but there's risk going forward after the elections by October 27th. If the next president manages to surprise investors positively, the situation here might improve, and inflation drop down if the dollar is kept in check, and investments start flowing back to the region. I'm skeptical, but risk/reward favors being long from this zone, with a stop under the 22 handle.

The main problem remains being the need for labor reform, and reducing the influence of unions, and the enormous government spending, cutting taxes, and stopping the printing press...

Let's see how it goes.

Cheers,

Ivan Labrie.

ETHXBT: Ethereum likely to recover from here...I think the monthly downtrend might end up failing to reach its target, if $ETHBTC holds over 0.0213 it may go up rapidly in the next 13 days.

If it does, it could retest the monthly downtrend invalidation level, before the ratio has a chance to reach the bearish long term target I had outlined before. In that event, $ETHUSD may start to outperform $BTCUSD as both start to trend up once again.

Best of luck,

Ivan Labrie.

USDCNH: Sideways until the end of October?Weekly $USDCNH ended a trend recently, starting a consolidation period, as it has done since it bottomed this year like I anticipated. Upside movement in this pair is likely tied to money flowing outside of China via Hong Kong, which is also linked to money flows towards $BTCUSD to dodge capital controls possibly.

The next upswing in this pair hasn't yet confirmed, and it could take a few weeks to occur, which the last Time@Mode trend signal predicts will possibly happen by the end of October. The weekly has formed a new 8 week accumulation level up here (see cyan boxes), so it could flash a buy signal as soon as there is a rapid upside move in this timeframe, from next week onwards...

I'll keep an eye on this very critical pair, the current situation in Hong Kong is bound to create some shockwaves in the currency markets, and possibly crypto I think. Let's wait and see...I'm currently short $BTC, waiting for it to bottom, this pair might be a good indicator for that.

Cheers,

Ivan Labrie.

USDTRY: Monthly triangle forming, fundamentals favor upside$USDTRY is one pair that is likely to trend up over the long term, but it's currently stuck in a huge monthly triangle. Recent action is interesting since price sits at a confluence of 'inside trendlines', speed fan 75% retracement level and linear regression channel 2nd standard deviation, as well as retracing to the mid point of a recent 'Range Expansion' up day two bars back.

If buyers manage to keep prices over 5.6454, then it would be a sign of strength, since then the daily could start trending once again.

Problem is the swap costs in this pair makes it hard to trade into big trends with leverage, so you would be better off not trading it, but if you live in Turkey you might look into moving funds to USD if you earn income in TRY, unless support breaks down here, then you can probably hold off from doing so for the time being. It's a similar situation with the Argentinian currency, fundamentals of the country make the currency lose value over time...in a big way, because of the reckless financing of insane spending via money printing. A big problem in countries with corrupt governments like ours.

Best of luck,

Ivan Labrie.

BTCUSD: Long term trend is up, but a correction is on the way...Unless we erase last week's downside move, the trend is down for the next 10 weeks. Target is 6833, but might bottom higher (or lower). Watch the behavior here, since Bakkt and Binance.US did nothing for price, downside action is the next logical course of action. I flipped short after hedging spot holdings near 9687.5 today. We were long spot from 5300 to about 7000, and then back in a few times, until the most recent long entry near 9400.

Initially we caught upside from the very bottom but ended up underperforming since we moved to ETH instead of holding 100% BTC, causing my trading signals group to underperform holding BTC spot for the first time in many years. This situation might reverse going forward, since I'm confident in the ability of the methodology I learned from my mentor, Tim West, and my experience in this market to help navigate the waves in crypto markets profitably.

I did correctly identify the bearish trend in $ETHBTC after it was confirmed and it has moved down since. It will continue to move lower, I wouldn't reccomend holding on to any altcoin, and at this point not even $BTCUSD is safe for investors.

Best of luck,

Ivan Labrie.

BABA: New CEO at the helm, valuation isn't badI'm watching $BABA for an upside breakout of 179.88, which could trigger an explosive rally in the stock. Today wouldn't be a bad long entry here, with a wide stop at 163.96, but once the breakout happens, another trade with a stop at 171.43 can be placed...Upside targets are up to 276 in the long term.

Best of luck,

Ivan Labrie.

USOIL: Daily trend is upInteresting setup in $USOIL, the fall from the last top favored a bull run in stocks with a 6 month lag, as per @timwest's findings suggest (every time oil falls 25-30% it boosts earnings going forward). Monthly charts show accumulation supporting the market below, and daily confirms a trend by today's close. I think stocks are headed higher with oil here as well.

My bias is bullish in energy, oil, chip maker stocks, renewable energy related stocks, and the overall S&P500 index between now and the end of 2020 possibly. Let's see how it goes...Short term stop for oil is below last Friday's low, and short term targets are shown by the yellow boxes on chart.

Cheers,

Ivan Labrie.

NVDA: Position trade in place, opportunity to come...My clients and me have been long $NVDA from a couple days ago, before the big gap up and rally from yesterday.

The weekly chart now flashed a huge trend signal here, so catching any dip towards the buy zone on chart would be a great opportunity.

Valuation and positioning improved dramatically, after the bear market in this stock, so now we can look for buys with tremendous upside in the long term in it.

Leverage is quite low here, roughly 1.43x, whilst earning yield sits at 2.13% TTM. It's not too high, but the company has been growing EPS in the past 5 years by 52.5%, in the last year by 30.9%, while sales growth was in the order of 23.2% in the past 5 years. Price to sales is a bit rich here, same as the price to free cash flow ratio, but I'm not too concerned. $NVDA has been rallying widly, and the long term chart still points to further gains to be made. It also has correlated the bull and bear markets in $BTCUSD with some lag, so it seems likely to play catch up to $BTCUSD from here, considering all factors.

Best of luck,

Ivan Labrie.

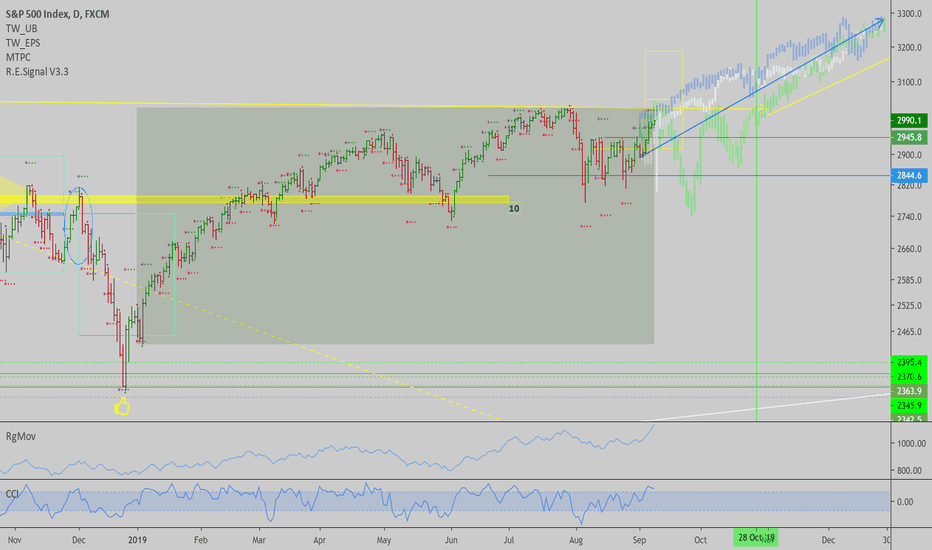

SPX: 2-Month timeframe signal will possibly trigger soon...The long term trends that were triggered on Nov 2011, Jan 2013 and Nov 2016, plotted as an overlay to the current daily chart, paint a bullish picture for $SPX and our stocks portfolio as a whole. The long term chart is about to confirm a rally, like how it did back then on those 3 occasions. If it does, we will likely be higher by the end of the year, in the order of 13% higher for the index, give or take. Corrections along the way, could be 5 days long on average, and as much as 6.4% deep, but I don't think that will be the case, since volatility in 2011 was much higher than now, and currently distorting the average correction size significantly.

With dems having lower probability of being elected, and a trade deal being closer to becoming a reality, plus negative sentiment having peaked, with Gold and Bonds hitting long term tops possibly, and everyone absolutely hating stocks...I want to be long and let things pan out, same as we do with $BTC for a while now.

Let's see how things evolve here, price action in the short term is constructive, with the daily targets show on chart (yellow boxes).

Best of luck,

Ivan Labrie.

EURSEK: Bound to confirm a bullish signal here$EURSEK 4H chart fired an uptrend 1 bar ago, the target is where the daily would trigger a Range Expansion bar today, which would in turn trigger a larger 12 day trend, if not, tomorrow's close is likely to confirm the same trend but with a higher low, above the daily mode level, where most of the accumulation took place. The trend target is the yellow box upper border, time to reach the target is the end of the box to the right. Should hit that level in time, or sooner than expected, as long as holding above the mode box (horizontal barrier below today's low roughly).

I'm working on an automated trading strategy to apply Time@Mode rules to FX and CFDs using MT4. Current testing results are good, I have a working prototype, polishing the code to have it ready to trade with full size. Once this EA is good to go I will start a PAMM account using this strategy to trade all main 1h and 4h trends in FX pairs that have fundamental and technical trends in the intermediate to long term, but from a short term perspective.

Best of luck,

Ivan Labrie.