BTCUSD: Liquidation likely over...I'm calling the bottom here, after all the liquidation that followed the failure of my last 3-day timeframe signal, as price moved back below the stop loss @ 10986, the selling accelerated until it reached the climax an hour ago.

It's likely that the drop was caused by the Plkus Token scammers, as I was discussing with a client of mine. They are chinese and most likely sold BTC and other coins for USDT to sell the coins for cash in Russia.

I'm long from 9700, added some margin here.

Best of luck,

Ivan Labrie.

Rgmov

BTCUSD: 3D Timeframe signal confirmed...If we hold up from here, and don't go below 10769, we will likely hit one of the targets shown by the blue arrows on chart.

$Bitcoin is acting strong, showing signs that the long term 2-Month timeframe signal is still calling the shots. Over time, price may go as high as $280000 by late 2020, if it doesn't go back below 6481.

Bullish fundamentals are being front ran for a long time, since price started basing near 3500, after bottoming in December 2018. Expectations of institutional money coming to $BTC paired with the intrinsic bullish qualities of monetary policy and POW secured blockchain, which allow us to have a digital gold alternative, a store of wealth and a tool to avoid money controls, among other things...A major disrupting force, considering the huge amount of money that travels between borders and to tax havens, just to name one use case of the tech...

Libra was named by many as a bullish catalyst for $BTC -wrongly-, but it's now clear governments can't stop Bitcoin, unlike it. The accumulation base that started way ahead of the Libra news had nothing to do with it, clearly.

Do your due diligence, regarding safe guarding your coins, but, don't miss out on this buying opportunity.

Cheers,

Ivan Labrie.

$SPY: Market bottomed a day ago...The long term trend is up until 2021, the intermediate term trend in the 2 month timeframe is about to confirm a new bull market like the one that came after Trump's election in 2016...Interestingly the top of this trend will be at the same time the yearly trend ends. The move that came out of the 1998-2011 consolidation will technically last until 2021. There's a huge amount of trends in different markets with the same time duration, all ending by 2021. Not sure what to make of it, but I'm sure we will see a big move in stocks and $BTCUSD, between now and then. I'd err on the bullish side.

The return of stocks vs bonds makes stocks too attractive in the long term, with yields dropping to negative everywhere, there's no other place for money to go, once US treasury bonds yield 0% after inflation as well. For now, yield differential made UST attractive for foreigners, but that might change if rates drop further. Maybe we go back to QE?

For now, the logical thing to do seems to be buying quality names, low debt, high earnings yield stocks, and own some $BTC.

Best of luck,

Ivan Labrie.

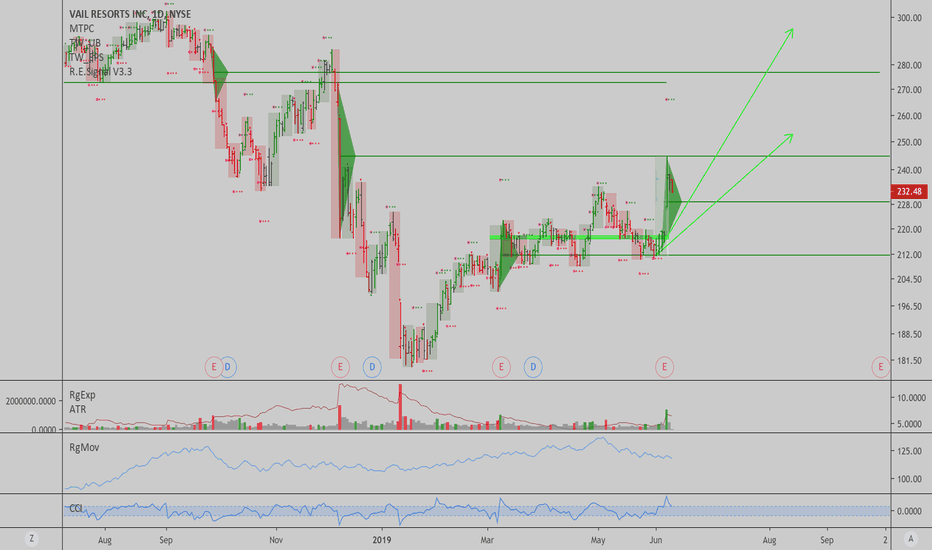

MTN: Vail Resorts has a nice weekly trend...I like the chart here, $MTN has some nice upside potential, both from a technical and valuation stand point.

As long as prices don't slide below $216, we can expect a 10 week rally from here, reaching prices as high as $295 possibly.

Best of luck,

Ivan Labrie.

XAUUSD: Weekly target exceeded, 2M trend activeGold surged and moved past the first weekly target, but there's time left until the week starting on August 19th, to move higher. The 2 month per bar timeframe shows the clearest trend signal, which is the one calling the shots it seems, in the big picture. The targets are on chart, in blue, as long as we hold over 1276.51, for the next 24 months, Gold can rally higher and higher, towards 1588, at the very least. This makes any daily or weekly oversold situation and interesting buy entry, once it's clear sellers are exhausted after any short term decline.

RgMov in the long term chart broke the all time high reached in 2011 in $XAUUSD, this is a really significant strength signal, and I think this might be the start of an even larger trend in gold, so I'm keen on buying big into it during July-August, if we do retrace.

Gold mining and physical gold ETFs will be extremely profitable to long once we get the next retrace. I'll be watching attentively...My clients will get the best possible long entry, with the highest risk/reward and win rate once I'm confident we have it.

Cheers,

Ivan Labrie.

TTGT: Strong relative strength and good growth potential...The chart here is very interesting in $TTGT, I think it can rally explosively from here onwards.

There's an active yearly trend that aims for lofty targets, with target #1 being quite realistically within reach during 2020.

I'm long here, looking to ride the trend from here onwards.

Cheers,

Ivan Labrie.

$BTCUSD: Guess for posterity...I'm holding a long term spot position in $BTCUSD, chances are the 2-Month timeframe trend pans out favorably overall. If that is the case, we may reach as high as 280k by the time it ends near 2021. It is a 16 month trend, with 14 months left in it. Valid as long as we hold over 6481. The biweekly timeframe formed a base and subsequent trend signal which kickstarted the rally we had so far, but since then, the pace of reaccumulation and trending sped up, with very clear and logical trends being spotted in the 3-Day timeframe. I think this is a good sign, since the longer term trend should hold the market together for the most part, until we hit the target when time expires or sooner.

It should be extremely hard for anyone who missed this move to pay up for $Bitcoin, the trend will whipsaw people when they FOMO in, but not fall low enough to ever please dip buyers, or to let those who missed it buy at a cheap enough price for them to be content. This is how trends work. Smart money is heavily invested and shaking people out left and right.

Best bet is to buy when it looks ugly but it WON'T be easy. And if you're in, HODL. Volatility of this market is big but the fundamental case for $Bitcoin is a great one and technicals are spot on for a massive rally.

Best of luck to all my followers and clients who have been trading with me since a long time ago.

Cheers,

Ivan Labrie.

Under Armour: Great brand, huge long term bullish trend...I think $UA is acting very strong here, it managed to shake me out of a long position at break even 2 months ago, but after July's surge, a long term Time@Mode trend signal kicked in. Upside in the stock is tremendous, adventurous traders could follow this monthly trend going long around here, or lower, with a rather tight stop @ 20.23. A larger wiggle room would be better for more conservative traders (and thus smaller size, with up to 2% risk if stopped out), setting stops under 18.92.

The trend will remain valid for the next 12 months, after which it might start a large scale consolidation or correction. There's a chance it builds a new trend signal over time and just move higher and higher for a long time (think $AMZN, as pointed out by @timwest in the Key Hidden Levels chatroom today...buying it at $10 a share, when it was cash flow positive ended up being an insanely good long term investment...).

Best of luck if buying into it here, whatever your risk profile is.

Cheers,

Ivan Labrie.

ETHXBT: Scariest chart ever...I set an alert here to monitor this chart, if $ETHBTC were to fall below 0.02405, things could turn from bad to worse in the ratio chart.

I'm currently long $ETHUSD, and waiting to exit in profit, and I think at one point during July we may get a retracement in crypto markets accross the board...I also think $ETHUSD can confirm a monthly uptrend during July, so I will carefully watch how chart patterns and sentiment evolve over time from here onwards. We need to be aware of this trend signal in the monthly ratio chart as well...positioning of crypto portfolios might be better off if there is exposure to $BTCUSD, and not only alts (even though $ETHUSD will likely perform well).

This chart shows the doomsday scenario for altcoin holders, where NO single altcoin beats $BTCUSD ever again...IF this trend signal confirms, odds of that happening will be 70%, for as long as price doesn't go back up, and above the levels specified on chart. USD wise we can make profits in alts, specially in solid ones like $ETHUSD, but they might end up falling short compared to $Bitcoin. Since most people have been stuck on long alt positions since 2017 (where altcoins surged like never before), this chart signal actually working is a very real contrarian scenario.

Keep this in mind...

Best of luck,

Ivan Labrie.

BTCUSD: No position for now is safer...The biweekly timeframe trend expired, and price corrected 25% in a single day right after. I think there might be some profit taking and a shakeout might take place, until liquidity steps back into the market. The recent claim of a huge short position at Finex should have been followed by a wave of buying since the trader obtained the proceeds of the short sale in USD (around 220 million), but instead we get more selling. An inverted price axis shows a bearish picture, further confirming me of stepping back from Bitcoin for the time being and waiting to buy back on dips during July or August. The 2 Month timeframe bar formed a Range Expansion pattern last month, and usually these were followed by 30-50% retracements during previous bullish trends.

Since the 2 Month timeframe trend is up, I'm biased towards going long for the longer term, but in the short to intermediate term I see risk in being positioned. I'm currently hedged, and waiting to cover shorts lower to buy back spot Bitcoin positions and add margin longs once more.

Cheers,

Ivan Labrie.

GIS: Strong weekly trend possible...$GIS offers a very interesting chart setup here, weekly might erupt into a fierce rally, so buying it after confirmation would prove tremendously profitable if it holds up after earnings. I'd wait for the report to buy it on dips after earnings are out of the way but you could accumulate it during a couple weeks, on dips as well. The sector is the least popular amongst analyst, as pointed out by @timwest.

Since I think Gold has likely peaked, it's likely to see stocks grind higher, for longer than most expect and finding the best chart patterns amongst the least popular stocks is the best way of profiting from this juncture.

Cheers,

Ivan Labrie.

Gold expressed in Yuan: Trend is up in the quarterly timeframeBut due to retrace here likely...The retrace to come will be a great buying opportunity in Gold, the Yuan chart is an interesting way to look at it, given the activity of chinese capital flows. I'm following the Hong Kong activity closely, specially interesting to observe developments regarding the extradition laws in the former British colony. Recently, protesters dissuaded the government to move forward with this law, so for now, things didn't escalate, but I'm sure chinese money is likely to flow out of the country gradually, towards gold and possibly crypto, before things get harder for them to escape via HK.

Keep an eye on this chart, a retrace in it will bring a great trading opportunity, and it will likely occur once commercial gold traders approach net long or flat positioning once again.

See related ideas for more info.

Cheers,

Ivan Labrie.

SNE: Potential long term bottom here...Very interesting spot to go long #SNE, I think it could be a major bottom in the stock.

Best of luck,

Ivan Labrie.

DXY: Neutral until the dam breaks...The end of the 90s dollar rally could have been anticipated by anyone using Time@Mode techniques to read the charts.

Back then, the last active trend signal in the quarterly timeframe had expired right at the very top of the move, before prices moved lower until 2008. A similar trend can occur in the not so distant future, since the bullish trends are over, but we still don't have a confirmed down trend signal either.

A key price level is the 91.83 zone, what I'd call a Maginot line...If, and when, the dollar index moves below this level, price can swiftly move lower for a long time. Until that happens, choppy market action is more probable than a steady down trend.

There's no active uptrend currently, so the path of least resistance is sideways until support breaks.

For it to break, a major macro and geopolitical catalyst must occur, otherwise, we can expect the status quo to hold.

The accumulation of gold reserves by many countries is an interesting fact, the push by Facebook to launch an SDR like stable-coin, backed by reserves of multiple foreign currencies, which apparently has some ideological backing by the IMF and other entities, is also noteworthy.

In this no growth enviroment, trends aren't likely to trigger easily, we should monitor the emerging markets, China, Brazil, and Argentina come to mind. Argentina and Brazil are on the brink of possible labor reforms, that could spark growth, from the depths of hell where their economies sit.

Until a very evident catalyst occurs, we won't have an easy to trade trend in the Forex market. So, don't be in a rush to jump into any FX, gold, or commodities positions yet. These factors I mention are of long term nature, over time, things will become clearer and we will have the chance of trading when odds and risk/reward favor doing it.

I've decided to watch for long entries in Gold, but we need a correction in it to enter longs again. Currently, it's quite probable to see the stock market break the ATH and go higher for a while, before any sizeable correction can occur, sentiment just doesn't favor any other direction. Gold sentiment and charts indicate we will retrace once again, after hitting the 1358 resistance from the daily high of the Brexit day.

Either short gold, long stocks or wait in cash until we can buy Gold again, way lower. If it were to fall below 1246, then the quarterly trend in it failed -once again-. Unless that happens, any sizeable dip will lead to a rally once more.

Best of luck to us all,

Cheers.

Ivan Labrie.

ARGT: Trend is upMacri's counter offensive move, in response to Cristina Kirchner's presidential formula strategy was a brilliant one, picking Pichetto as his Vice-President for the upcoming October elections. Pichetto is a man from the Peronist party, but who is not afraid of bipartisan politics in Congress, and who wants to work for the President in Congress, and not force government shutdown. Many dislike this trait of his, but him being a strong defender of small and medium enterprises, and most likely helping Macri lead the country towards proper capitalism, with some luck, is what got investors bullish again.

The $USDARS pair dropped rapidly, and the 2-Week timeframe uptrend signal I had forecasted in it failed. The Dollar didn't hit 49-50 in time, despite the Central Banks pathetic actions in the last year, and Macri's political antics might have turned the trend in it for the next 16-19 weeks. $USDARS might sink towards 37 again, if things go really well.

If Cristina were to win, Alberto Fernandez is a man who might keep her extreme pseudo-socialist ways in check, or at least this is what investors seem to think, given the reaction of markets to the formula. Hopefully, whoever wins, stops the ridiculous spending, and insane taxing, which is choking anyone trying to build ANY kind of business here...since small and medium sized enterprises are the main sources of jobs in the country atm. This might help the currency do better, and reduce inflation. For this, government needs to reduce its size, which is not too likely to occur if Peronists win this time around, but also not extremely likely to occur if Macri is elected again, either.

My reccomendation is to not own too many Argentinian assets, overall, but I'm slightly optimistic going forward.

Best of luck to us all,

Ivan Labrie.

ETHUSD: Ethereum is being accumulated...The weekly trend in #ETH has been very strong so far, and as bullish fundamentals develop, big players are accumulating coins even at these price levels. Monthly charts are already ready to trigger a long term uptrend that can propel #ETHUSD towards $5523, or even $110k-ish over time. Weekly charts have been in a stable Time@Mode trend, which both hit the target, and did so right on time, which shows strength is with the buyers.

Lately, dips have been bought, despite people's fear of a larger fall, and despite dip buyers who missed out on the previous run wanting to buy even lower than what price ever gets to (most I heard want $200 or $220, so these price levels are NOT likely to be hit again -at least until these buyers change their mind-).

Best of luck,

Ivan Labrie.

XAUUSD: Gold bottomed here, longer term trend remains up...I like the odds in buying Gold here. We started buying it yesterday, near the lows, today gives further confirmation as miners surged, and preciouis metals are posting new daily highs as well. Quarterly timeframe is in an uptrend as long as Gold holds over 1245 ish.

Best of luck,

Ivan Labrie.

XAGUSD: Silver bottomed here likely...I think Silver might have bottomed and might be about to resume the weekly bullish trend. This could evolve into a way larger move.

I'm long Gold and miners, not silver yet, but I think it's at a low risk spot to start accumulating positions over a few days.

Best of luck,

Ivan Labrie.

USDCNH: Weekly downtrend expirations...Weekly T@M signals imply $USDCNH might be basing before rallying from this juncture. Will be interesting to monitor developments in this pair, as fundamentals present complex issues, related to trade talks with the US and the price of commodities as well.

The largest distribution pattern led to a signal that exceeded the target, but ran out of time, followed by a smaller distribution pattern, which is 1 week before its time expiration. IF price doesn't go any lower, odds are this pair bottomed here and will retest recent highs, and possibly trend even higher over time.

Best of luck,

Ivan Labrie.

TSLA: Weekly downtrend expires next week...I think a drop after earnings would be a low risk buying opportunity in $TSLA. Longer term trends remain up, and sentiment is close to a massive bottom around these parts, and given fundamentals for the company becoming better and better over time, I want to buy when it falls...

Best of luck,

Ivan Labrie.

TSLA: RgMov shows sentiment bottomed, long term buying op$TSLA offers a long term buying opportunity here, I'm long from around these parts with a 10% allocation and no stop loss currently. I'd reccomend exposures between 5 and 10%, but you could make the position bigger if you only hold few stocks in your portfolio. In my case I split funds between crypto, stocks and FX/Commodities accounts, and I'd reccomend you to do the same to maximize returns.

Best of luck,

Ivan Labrie.

XAUUSD: UpdateWe will rebuy our #XAUUSD position soon, weekly chart indicates a new trend signal is now active, looking to add on dips from here onwards, nice upside potential, for both weekly and quarterly charts. The Q1 close confirmed a quarterly explosion pattern trend signal, which implies we may go towards really lofty targets by Q1 2021 or sooner. Target #1 is visible here, targets #2 and #3 have lower odds but also possible and sit at 2082.53 and 2692.72 respectively.

I'm long $GOLD (Barrick) as well, holding it for as long as possible, most likely until we anticipate some kind of major retrace...same is true for $XAUUSD, since the trend may last for a year, I will try to reduce drawdowns from simply holding a long open from here until Q1 2021, shorting when necessary or adding longs on short term entries as well but without closing our base position.

Best of luck,

Ivan Labrie.