Bitcoin Price and the Altcoin Rally: Part I Bitcoin Price and the Altcoin Rally: Part I

Interpretation:

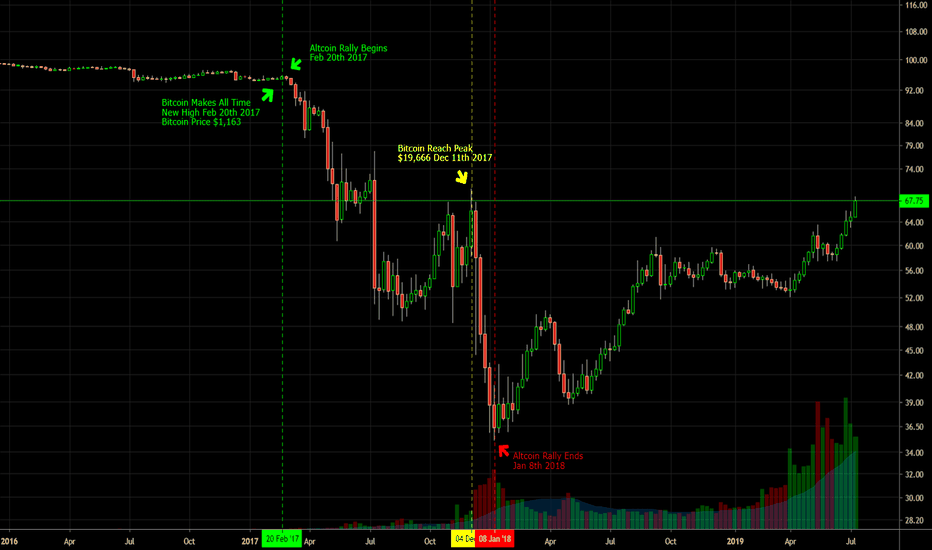

1) The green vertical line represents Bitcoin rising above its previous high (i.e., $1,163) from the 2012 Bitcoin Halving Cycle run (see ref 1 for discussion of the Bitcoin Halving Cycle). But it also reflects the beginning of the 2017 Altcoin Rally as well.

2) The yellow vertical line represents the price high (i.e., $19,666) of the 2016 Bitcoin Halving Cycle run and the beginning of the last stages of the Altcoin Rally of 2017.

3) The red vertical line represents the end of the Altcoin Rally for the 2016 Bitcoin Halving Cycle.

4) The X-axis represents time.

5) The Y-axis represents the percent of bitcoin dominance for all crypto coins. Therefore, as the percent of bitcoin dominance drops, the prices of Altcoins are rising relative to the price of Bitcoin.

Important Points:

1) The Altcoin Rally began when Bitcoin reached and surpassed the old high (i.e., $1,163) from the previous 2012 Bitcoin Halving Cycle. Induction suggests that we can expect a similar beginning of a new Altcoin Rally once Bitcoin surpasses the old high (i.e., $19,666) of the last 2016 Bitcoin Halving Cycle.

2) The timing of the last Altcoin Rally suggests that a new Altcoin Rally may last a little longer after Bitcoin has reached its peak for the current 2020 Bitcoin Halving Cycle. However, induction also suggests that this rally will end soon after and smart speculators should begin exiting alt coin positions.

3) Previous cycles and rallies suggest that Bitcoin will outperform Altcoins when the next crypto winter begins. Smart speculators should attempt to sell Altcoins early and remain in Bitcoin or cash until the next Bitcoin Halving Cycle begins in 2024, and in particular, a new high in Bitcoin is reached for the 20224 Bitcoin Halving Cycle.

4) Similar to my prediction of the timing of the 2020 Bitcoin Halving Cycle bull run (i.e., see ref 1), I expect market participants to front run the Altcoin Rally. Specifically, I think we may see a start to the Altcoin Rally as early as a price of $15,000.00 per Bitcoin, with an increasing probability as we approach a price of $17,500 per Bitcoin. I personally will have my Altcoin portfolio ready for the Altcoin Rally at a price of $17,500 per Bitcoin.

Further Altcoin Rally Analysis:

1) The important questions are “Why did the Altcoin Rally begin when it did?”, and “Why was this rally so pronounced, intense, and abrupt?”.

I attempt to answer these questions using a rhetorical analysis of the potential cognitive states of market participants. A rhetorical analysis is an empirical examination of the plausible and probable arguments available to actors in a given context to justify and or criticize actions and or judgments about reality. For example, prior to a new all time high in Bitcoin, it is relatively easier for bears to argue that the current rally is a “dead cat bounce” or just a lull in the current bear market. However, as prices approach the all time high this argument becomes harder and harder to make both internally (i.e., justifications and/or rationalizations we provide ourselves) and externally (i.e., linguistic statements we share with others). Similarly, bullish arguments become easier to develop and deploy as prices rise and approach the all time high. In short, as price rises, we see a decrease in the production and persuasiveness (i.e., perceived rationality) of bearish arguments and an increase in the production and perceived rationality of bullish arguments. These changes become more pronounced and intense as we approach new all time highs.

Moreover, I theorize that something very different happens once we break or get very close to the all time high. Specifically, I think a symbolic “big bang” or rhetorical critical mass moment is reached where the rhetorical dynamics governing bullish rationality reach a criticality. The cognitive or persuasive potential of bullish rhetorical arguments expand violently and exponentially, while the rationality and plausibility of bearish arguments collapse suddenly and dramatically. Once the old high is breached, it becomes untenable to make the bearish argument that we are still in a bear market. Market participants making such arguments appear both irrational to others as well as themselves. The rhetorical resources available to and marshalled for the bear case diminishes irrevocably and quickly. In contrast, bulls no longer need to expend rhetorical resources making the counter argument that the bear market is over. These freed rhetorical resources do not flow slowly and incrementally into the cognitive consciousness of market participants, but flood into the rhetorical imagination creating an argumentative echo chamber that extends and expands the cognitive horizon of what is possible and plausible. The threshold of what is reasonable falls precipitously, and in this new attention landscape, altcoins and their myriad business models and diverse future worlds appear rational and persuasive. The symbolic “big bang” shifts the cognitive arena from a presumption of “crypto currencies will not survive to” to the presumption of “crypto currencies will thrive and disrupt/transform the world”.

I will discuss these ideas further as I think more about the concept of a rhetorical “big bangs” and the creation of argumentative contexts that allow for bubbles and bull runs in general. If you are interested in this type or similar types of rhetorical analyses, please see my previous work on the Bitcoin Halving Analysis.

References

1

Rhetoric

Bitcoin Halving Reward and Price History Analysis: Part IIIBitcoin Halving Reward and Price History Analysis: Bitcoin Price Target $309,269 by Aug 2021

Interpretation:

1) The orange vertical lines are 1 year before the bitcoin halving. The next 1 year before the halving is May 2019. The bitcoin market usually starts a bull market 1 year before the halving.

2) The blue vertical lines are the bitcoin halving dates. The next halving date is May 2020. The previous halving dates were Nov 2012 and July 2016.

3) The green vertical lines are a time projection of when we should return to all time new highs based on the last bitcoin halving cycle.

4) The red vertical line prior to 2019 represent all time highs for a given halving cycle.

5) The red vertical line after 2019 is a price projection of the next new high based on the 2020 halving cycle. The high of the 2020 cycle should come on August of 2021.

6) The red horizontal line is a price prediction of the next new high of the 2020 halving cycle. The bitcoin price high prediction on Aug 2021 is $309,269

7) The white trend lines trace the projected price movement produced by the halving cycle.

9) The purple box lines trace the bitcoin bear market cycle from the high to the low and back to the old high.

10) The purple curved lines represent conservative price trajectories during the bull runs.

11) The yellow horizontal lines provide the estimates of the times between important halving cycle events. Bars represents months and D represents days.

Special Update Notes From Previous Analyses

*) I switched the blue and green vertical lines from earlier halving analyses.

**) The November 2013 vertical lines looks orange because the the yellow vertical line and red vertical line came at the same time: one year after the halving was the price high of that halving cycle.

Important Points:

1) The bitcoin halving cycle doubles the cost of production: the same energy and computational power produces only half the number of bitcoins . Read "A Cost of Production Model for Bitcoin" by Adam Hayes for a primer on the importance of the halving cycle for understanding the value of bitcoin .(Ref 1)

2) The bitcoin price drop in the first bitcoin cycle was 86%. If we have a similar decline this halving cycle, then bitcoin can drop to $2606.62 before May 2019 and the next 2020 halving cycle.

3) I believe that the bull run starts one year before the halving because miners stop deploying new computational capital/power in anticipation of the doubling of future production costs.

4) Bitcoin price accelerates up into the halving, and one year after, as market participants engage in price discovery under a new cost of production regime. The market over shoots and we crash in the 3rd year of the cycle. Specifically, we run in 2011,2012, 2013 and crash in 2014. Similarly, we run in 2015, 2016, 2017, and crash in 2018. Therefore, I propose that we run in 2019, 2020, 2021, and crash in 2022. This analysis may also partially explain the crash of 2010.

5) Finally, these halving dates reflect perfect symbolic singularities. Symbolic singularities are discursive/argumentation phenomena where market participants have foreknowledge of market moving events e.g., presidential elections, Olympic events, earnings reports, etc.. Certain classes of symbolic singularities have a bullish bias, such as when limited cognitive/market attention is distributed over under attended assets e.g.,

a) the HGP or Human Genome Project’s (Ref 2) claim that it would map the human genome before 2000 led to the genomic/biotech bubble of the late 1990s.

b) the Chinese Olympics of 2008 as a showcase of China's arrival on the global economic stage and the ensuing 2006/2007 Chinese bubble.

Further Bitcoin Mining Analysis:

1) The difficulty (Ref 3) of mining a bitcoin block is adjusted by the bitcoin code every 2016 blocks. This averages out to adjustment every two weeks. The mining difficulty normally follows the hash rate very closely.(Ref 4) When the hash rate declines the difficulty declines. When the hash rate rises the difficulty increases. When the average cost of mining falls below the cost of production,(Ref 5) marginal or high cost miners begin to take mining rigs offline. This causes the hash rate to fall and thus a fall in the difficulty of mining a block. Those mining rigs that remain and continue to mine usually have a competitive advantage and experience an increase in profitability as competing mining rigs leave the mining process. This process also works in reverse as price rises. Interestingly, where mining at a loss causes price suppression in most commodity markets, rational miners will continue to mine bitcoin at a loss to accelerate the time to the next difficulty adjustment and thus drop the cost of mining. This creates a theoretic game of “chicken” where every miner hopes that every other miner will take their mining rigs offline first.

2) Bitcoin price fluctuates far more than bitcoin mining costs (e.g., rent, wages, computer equipment, energy, etc.,). This creates a reflexive or self-reinforcing positive price dynamic where increases in price leads to further increases in price during booms and declines in price lead to further declines in price during crashes. The largest and most constant factor shaping bitcoin price is the sale of bitcoin by miners to meet the cost of production. In the current Bitcoin Halving Cycle, 12.5 bitcoins are produced every ten minutes, 1800 per day, 54,000 per month.(Ref 6) Within a boom or rising price environment, miners need to sell less bitcoin every month to meet their costs. Every month the supply of bitcoin available for sale decreases and this leads to future price increases. In contrast, within a crash or falling price environment, miners need to sell more bitcoin every month to meet their costs. Every month the supply of bitcoin available for sale increases and this leads to future price decreases. Once this price dynamic begins from the bottom of a crash or the top of a boom, it accelerates until the reflexive price dynamic switches back to the previous reflexive price dynamic.

3) What causes the switch in this reflexive price dynamic at the bottom or top of the Bitcoin Price Halving Cycle? I am researching this important question right now. My preliminary thoughts suggest at least two critical factors that require further analysis.

a) The first factor is fundamental - the critical mass of marginal miners entering or leaving the bitcoin mining process long enough to allow for the difficulty rate to encourage or discourage new entrants into the mining space. Once the rise in bitcoin price is greater than the price miners need to sell bitcoin to meet their costs, demand will begin to outstrip supply and higher prices will lead to higher prices. Conversely, once the decline in bitcoin price is less than price miners need to sell bitcoin to meet their costs, demand will begin to fall behind supply and lower prices will lead to lower prices. Knowing the average production costs of marginal miners as well as the bitcoin reserves of weak and strong participants in the mining community should shed light on the probability of critical mass miner capitulation and/or entry.

b) The second factor is rhetorical/psychological - miners’ foreknowledge of the bitcoin halving cycle itself. Specifically, miners know from the bitcoin code an approximate date where the costs of producing a bitcoin is going to double. This knowledge is a symbolic singularity or rhetorical/psychological trigger for miners that shapes miners estimates of their ability to play and win the “game of chicken” with other miners. Miners at the margin surmise that they are not going to survive the current bitcoin halving cycle and those more established and efficient players surmise they will survive the cycle. This knowledge/belief shapes miners’ decision to remain in the game or capitulate. Historically, the time frame of one year before the halving has resulted in the bottoming of the market and the beginning of a new rising price dynamic. In addition, anticipation of this rising price dynamic may also encourage miners with bitcoin reserves to decrease their selling of bitcoin thus increasing the rise in bitcoin price.

References

1 www.economicpolicyresearch.org

2 en.wikipedia.org

3 en.bitcoin.it

4 www.theblockcrypto.com

5 coinshares.co.uk

6 www.quora.com

Bitcoin Halving Reward and Price History Analysis: Part IIBitcoin Halving Reward and Price History Analysis: Bitcoin Price Target $404,626.62 by Jan 2022

Interpretation:

1) The orange vertical lines are 1 year before the bitcoin halving. The next 1 year out from halving is May 2019. The bitcoin market usually starts a bull market 1 year out from the halving.

2) The green vertical lines are the bitcoin halving dates. The next halving date is May 2020. The previous halving dates were Nov 2012 and July 2016.

3) The blue vertical lines are a time projection of when we should return to all time new highs based on the last bitcoin halving cycle.

4) The red vertical line is a time projection of the next new high based on the 2020 halving cycle. The high of 2020 cycle should come on Jan 2022.

5) The red horizontal line is a price prediction of the next new high of the 2020 halving cycle. The bitcoin price high prediction on Jan 2022 is $404,626

6) The yellow trend lines trace the projected price movement produced by the halving cycle.

7) The purple box lines trace the bitcoin bear market cycle from the high to the low and back to the old high.

Important Points:

1) The bitcoin halving cycle doubles the cost of production: the same energy and computational power produces only half the number of bitcoins . Read "A Cost of Production Model for Bitcoin" by Adam Hayes for a primer on the importance of the halving cycle for understanding the value of bitcoin.(Ref 1)

2) The bitcoin price drop in the first bitcoin cycle was 86%. If we have a similar decline this halving cycle, then bitcoin can drop to $2606.62 before May 2019 and the next 2020 halving cycle.

3) I believe that the bull run starts one year before the halving because miners stop deploying new computational capital/power in anticipation of the doubling of future production costs.

4) Bitcoin price accelerates up into the halving, and one year after, as market participants engage in price discovery under a new cost of production regime. The market over shoots and we crash in the 3rd year of the cycle. Specifically, we run in 2011,2012, 2013 and crash in 2014. Similarly, we run in 2015, 2016, 2017, and crash in 2018. Therefore, I propose that we run in 2019, 2020, 2021, and crash in 2022. This analysis may also partially explain the crash of 2010.

5) Finally, these halving dates reflect perfect symbolic singularities. Symbolic singularities are discursive/argumentation phenomena where market participants have foreknowledge of market moving events e.g., presidential elections, Olympic events, earnings reports, etc.. Certain classes of symbolic singularities have a bullish bias, such as when limited cognitive/market attention is distributed over under attended assets e.g.,

a) the HGP or Human Genome Project’s (Ref 2) claim that it would map the human genome before 2000 led to the genomic/biotech bubble of the late 1990s.

b) the Chinese Olympics of 2008 as a showcase of China's arrival on the global economic stage and the ensuing 2006/2007 Chinese bubble.

Further Bitcoin Mining Analysis:

1) The difficulty (Ref 3) of mining a bitcoin block is adjusted by the bitcoin code every 2016 blocks. This averages out to adjustment every two weeks. The mining difficulty normally follows the hash rate very closely.(Ref 4) When the hash rate declines the difficulty declines. When the hash rate rises the difficulty increases. When the average cost of mining falls below the cost of production,(Ref 5) marginal or high cost miners begin to take mining rigs offline. This causes the hash rate to fall and thus a fall in the difficulty of mining a block. Those mining rigs that remain and continue to mine usually have a competitive advantage and experience an increase in profitability as competing mining rigs leave the mining process. This process also works in reverse as price rises. Interestingly, where mining at a loss causes price suppression in most commodity markets, rational miners will continue to mine bitcoin at a loss to accelerate the time to the next difficulty adjustment and thus drop the cost of mining. This creates a theoretic game of “chicken” where every miner hopes that every other miner will take their mining rigs offline first.

2) Bitcoin price fluctuates far more than bitcoin mining costs (e.g., rent, wages, computer equipment, energy, etc.,). This creates a reflexive or self-reinforcing positive price dynamic where increases in price leads to further increases in price during booms and declines in price lead to further declines in price during crashes. The largest and most constant factor shaping bitcoin price is the sale of bitcoin by miners to meet the cost of production. In the current Bitcoin Halving Cycle, 12.5 bitcoins are produced every ten minutes, 1800 per day, 54,000 per month.(Ref 6) Within a boom or rising price environment, miners need to sell less bitcoin every month to meet their costs. Every month the supply of bitcoin available for sale decreases and this leads to future price increases. In contrast, within a crash or falling price environment, miners need to sell more bitcoin every month to meet their costs. Every month the supply of bitcoin available for sale increases and this leads to future price decreases. Once this price dynamic begins from the bottom of a crash or the top of a boom, it accelerates until the reflexive price dynamic switches back to the previous reflexive price dynamic.

3) What causes the switch in this reflexive price dynamic at the bottom or top of the Bitcoin Price Halving Cycle? I am researching this important question right now. My preliminary thoughts suggest at least two critical factors that require further analysis.

a) The first factor is fundamental - the critical mass of marginal miners entering or leaving the bitcoin mining process long enough to allow for the difficulty rate to encourage or discourage new entrants into the mining space. Once the rise in bitcoin price is greater than the price miners need to sell bitcoin to meet their costs, demand will begin to outstrip supply and higher prices will lead to higher prices. Conversely, once the decline in bitcoin price is less than price miners need to sell bitcoin to meet their costs, demand will begin to fall behind supply and lower prices will lead to lower prices. Knowing the average production costs of marginal miners as well as the bitcoin reserves of weak and strong participants in the mining community should shed light on the probability of critical mass miner capitulation and/or entry.

b) The second factor is rhetorical/psychological - miners’ foreknowledge of the bitcoin halving cycle itself. Specifically, miners know from the bitcoin code an approximate date where the costs of producing a bitcoin is going to double. This knowledge is a symbolic singularity or rhetorical/psychological trigger for miners that shapes miners estimates of their ability to play and win the “game of chicken” with other miners. Miners at the margin surmise that they are not going to survive the current bitcoin halving cycle and those more established and efficient players surmise they will survive the cycle. This knowledge/belief shapes miners’ decision to remain in the game or capitulate. Historically, the time frame of one year before the halving has resulted in the bottoming of the market and the beginning of a new rising price dynamic. In addition, anticipation of this rising price dynamic may also encourage miners with bitcoin reserves to decrease their selling of bitcoin thus increasing the rise in bitcoin price.

References

1 www.economicpolicyresearch.org

2 en.wikipedia.org

3 en.bitcoin.it

4 www.theblockcrypto.com

5 coinshares.co.uk

6 www.quora.com

Bitcoin Halving Reward and Price History AnalysisBitcoin Halving Reward and Price History Analysis: Bitcoin Price Target $404,626.62 by Jan 2022

Interpretation:

1) The orange vertical lines are 1 year before the bitcoin halving. The next 1 year out from halving is May 2019. The bitcoin market usually starts a bull market 1 year out from the halving.

2) The green vertical lines are the bitcoin halving dates. The next halving date is May 2020. The previous halving dates were Nov 2012 and July 2016.

3) The blue vertical lines are a time projection of when we should return to all time new highs based on the last bitcoin halving cycle.

4) The red vertical line is a time projection of the next new high based on the 2020 halving cycle. The high of 2020 cycle should come on Jan 2022.

5) The red horizontal line is a price prediction of the next new high of the 2020 halving cycle. The bitcoin price high prediction on Jan 2022 is $404,626

6) The yellow trend lines trace the projected price movement produced by the halving cycle.

7) The purple box lines trace the bitcoin bear market cycle from the high to the low and back to the old high.

Important Points:

1) The bitcoin halving cycle doubles the cost of production: the same energy and computational power produces only half the number of bitcoins. Read "A Cost of Production Model for Bitcoin" by Adam Hayes for a primer on the importance of the halving cycle for understanding the value of bitcoin.

www.economicpolicyresearch.org

2) The bitcoin price drop in the first bitcoin cycle was 86%. If we have a similar decline this halving cycle, then bitcoin can drop to $2606.62 before May 2019 and the next 2020 halving cycle.

3) I believe that the bull run starts one year before the halving because miners stop deploying new computational capital/power in anticipation of the doubling of future production costs.

4) Bitcoin price accelerates up into the halving, and one year after, as market participants engage in price discovery under a new cost of production regime. The market over shoots and we crash in the 3rd year of the cycle. Specifically, we run in 2011,2012, 2013 and crash in 2014. Similarly, we run in 2015, 2016, 2017, and crash in 2018. Therefore I propose that we run in 2019, 2020, 2021, and crash in 2022. This analysis may also partially explain the crash of 2010.

5) Finally, these halving dates reflect perfect symbolic singularities. Symbolic singularities are discursive/argumentation phenomena where market participants have foreknowledge of market moving events e.g., presidential elections, Olympic events, earnings reports, etc.. Certain classes of symbolic singularities have a bullish bias, such as when limited cognitive/market attention is distributed over under attended assets e.g.,

a) the U.S. government's claim that it would map the human genome before 2000 led to the genomic/biotech bubble of the late 1990s.

b) the Chinese Olympics of 2008 as a showcase of China's arrival on the global economic stage and the ensuing 2006/2007 Chinese bubble.

I will discuss my research into rhetorical finance further in future posts.