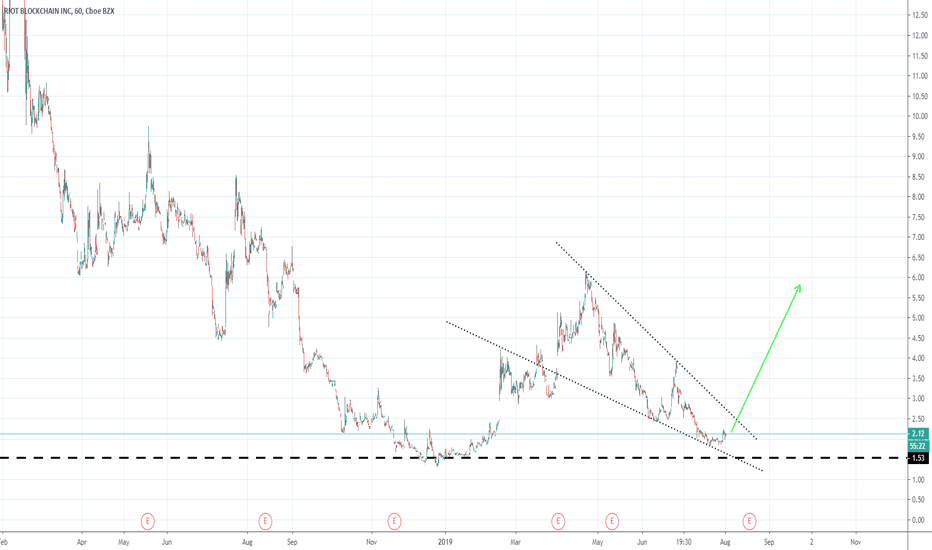

RIOT about to break within 3-4daysHello everyone, this is my first analysis of RIOT,

I'm not an experience trader, but i want to share you my idea.

Based on my analysis prediction, from the photo i believe that we are about to have a bull run after a breakout that should happen within 3-days from now.

Get in around $1.32-1.42, cause this is currently our main support.

>>first resistance lvl is $1.55,

>>and 2nd resist lvl is $1.64.

I could be wrong, but feel free to comment your suggestions.

Thanks,

AznMessiah

RIOT

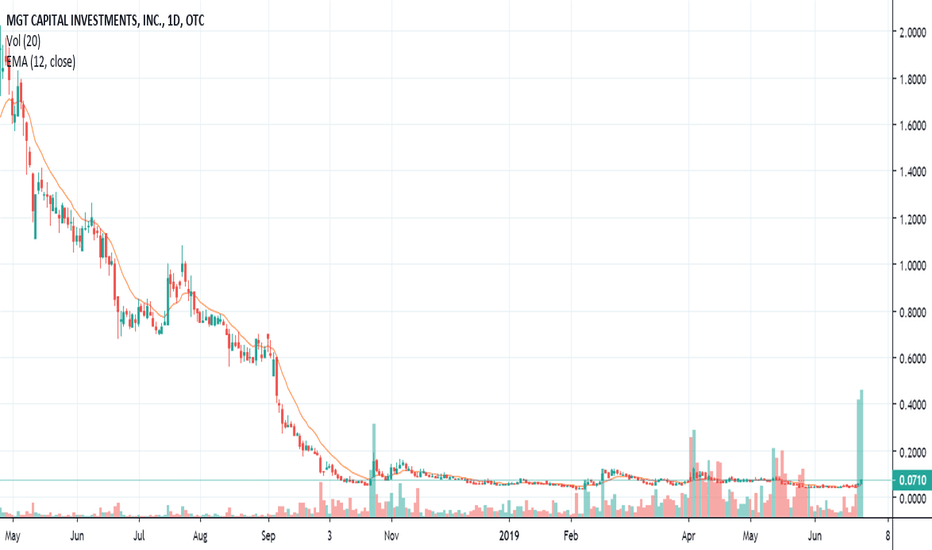

Entry 1/2, BITCOIN SYMPATHY MOVER. HIGHLY MANIPULATEDLow float, highly manipulated. We will see all the pump and dumpers chase this bitcoin run. The first players was CLCI, going up several 100%. There will be many more

Bitcoin Down Big, But OSTK Green. Massive Volume Spikes. LongThe fact that all the other bitcoin stocks are down says a lot about the strength of OSTK. Looks great for an entry today. Medium size, 1/2 -- now

Will be updating with more details

Manipulation Play. High Range, and Sellers Gone. BlockchainWe see some blockchain announcements over horizon with this stock. Highly manipulated with a low float.

Look at that chart!!!

‘424B1’ on 4/16/19

"We plan to use the blockchain technology to provide authentication capabilities for luxury goods, using cryptographic NFC chips and a decentralized marketplace".

Samuel Lim 559,298 20.5%

Chua Kee Lock 535,406 19.8%

Jeff Richards 378,383 14.0%

Don't have time to post all the details

RIOT BLOCKCHAIN... CURRENTLY BEST CRYPTO EXPOSURE ON NASDAQ??Hello,

I just wanted to point out that with all the ETF delaying nonsense... that's fine.

We have a crypto asset to speculate that's already traded on the NASDAQ.

AND one thing to consider is these "crypto" stocks are few and far between.

This fact alone will cause speculators to throw cash at them that are stuck trading in traditional markets, and their options are... BASICALLY RIOT. lol

I myself have a PCRA. If you don't know what that is, basically it's my retirement account essentially a 401k that my company is matching 5% monthly on.

Since I'm a crypto maximalist and believe in all things crypto, plus my company is matching my investments, I'm going all in on RIOT.

I have been all in, all year, and so far I'm up over 100% in my 401k, and will continue this strategy all year, every pay check dollar cost average in.

I would like to look at anyone's 401k held at the company, I highly doubt anyone has traded and can prove such returns.

It's just not possible really. Unless you HELD CRYPTO!!!!!!!!!!

So, for those interested, here is RIOT Blockchain if you haven't been informed.

Basically the only crypto related stock traded on the NASDAQ.

It gets respectable volume, and follows the market almost identically.

One of the exciting parts is when the stock market closes on Friday and crypto booms on Saturday and crushes all weekend.

You have piece of mind Saturday and Sunday knowing RIOT is going to blow up and you get to sit back and watch the cash flow in.

AND those Mondays are usually good days to sell.

Jus' Sayin!

- CA$HLESS

RIOT 10% decrease then 45% increase... Rate Adjustment Level 3.70 usd I'm waiting for the rate to return to this level. This represents a decrease of nearly 10%. Then I expect a stronger rise. The rise target price is 5.35 usd. 45% increase from the correction level. The rise can be quick and instantaneous. My assumption is based on the slope of the ATR axis in this range.

RIOT - So fuckedRIOT puts have been doing awesome the past week :)

Why is RIOT a piece of shit and why should you short it?

Well, namely they fund their operations through share dilution. Management is also highly inexperienced.

Oh, and I think they defaulted on a loan or something? I know they gave a lender a whole bunch of cheap warrants to exercise around the middle of June.

Target down to the Gann line.

See you below $2

RIOT - at a tipping point?RIOT, one of the few crypto plays available through NASDAQ. Options trading too.

Looking at the Martin trend, you can see RIOT turned bearish late last week following the news of Bitcoin/Tether fraud. (Old story)

Stoch and RSI both say buy but our momentum indicators say sell.

I bought some $5.50 and $5.00 RIOT puts last week that are already in the money. But it might not be a bad idea to snag some $5.50 calls expiring this week if they can be had cheap.

RIOT - Waiting to test support.RIOT made a big move up with good volume and then started to retrace. I'm looking for a 50% retrace to 3.06 or 61.8% to 2.82, both of which line up with previous support/resistance levels. 2.50 is also in the cards with possible support from the 26 and 50 EMAs. A bounce from any of these levels should send us back toward the 4.00 range. Breaking that level means its a long way down.