Ripple-btc

Ripple ....mehwere going down , not enough volume, and were still correlated to the entire crypto market, plus the ripple corporation is extremely shady with the partnerships they are making and whether or not they will be using the xrp token or just another ripple labs type of tech that has practically nothing to do with xrp.What are your thoughts on ripples utility? please share in the comments below thnx!!!!!

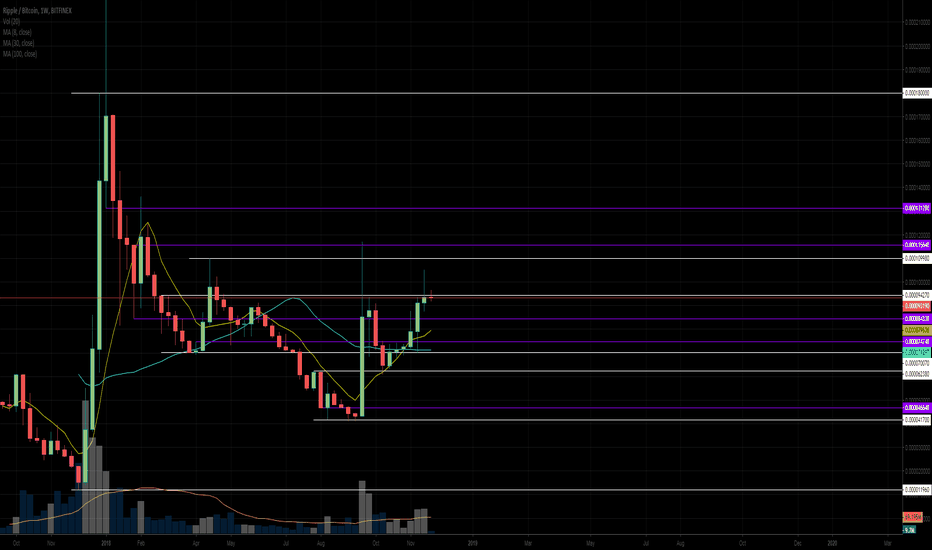

XRP / BTCXRP is fighting to keep the current white montly line as a decent support, if the price can stay up im looking for an entry on the white line, with a tight stoploss underneath.

Looking for an exit at the first purple weekly resistance, our when im happy :)

Wanna learn at an institutional level, and learn advanced methods, for free. Too often people are paying good money to learn bad trading.

If you wanna join a professional community, where you can learn from our professional traders, feel free to come over to our Discord server, free videos lessons and a good community in how trading really works.

Give it a shot, its free!

discord.gg

XRPUSD | 10-20% Head and Shoulders Short OpportunityWatch for this head and shoulders opportunity on the 4HR XRPUSD pair!

The red line is confirmation/trigger of the pattern with targets at 31 cents and 28 cents respectively. The idea becomes invalidated above 38 cents.

Be cautious of the support at 34 cents which could prompt a fakeout!

***This is not investment advice and is simply an educational analysis of the market and/or pair. By reading this post you acknowledge that you will use the information here at YOUR OWN RISK

XRP - about to bust a nut to 16300?XRP looks primed to explode higher for it's 5th wave, only is where the bulls put it.

Red target is a nice profit but results in wave invalidation/failure so that won't do. Best to go for that green box. That's where Ripple wants to be.

I'm expecting a breakout within the next 24 hours, 48 tops.

Look for "resistance" around morning star candle high. My friend Elliot says we'll punch right through.

$XRP - Bears loosing steam - Triple Bottom - New Impulse?The EW count is, well... not countable right now imho. On one hand we should be in Wave 4 of a bullish series, but this deep retrace of Wave 3 is highly abnormal. The smaller dashed line (red) I plotted yesterday is proving to be a solid support area as it has been tested twice over the last 24 hours. A break and close below this would be a bearish signal. A break below the thicker dashed line (red) would be a confirmation that the bearish trend has resumed.

The Bearish series I plotted yesterday also has its problems as Wave 3, as it were, printed as the price dipped slightly below the low at (1) and the pattern doesn't lend itself to a proper count, mainly because Wave 3 cannot be the shortest wave in the series.

In my biased opinion, as I hold a significant amount from 0.31, all this points to weakness from the Bears and a whole lot of indecision in the market. This doesnt mean that Bulls are winning, but maybe starting to.

To be clear, Wave 5 of the bullish series can extend beyond the 1.272 fib ext, but thats not typically XRP behavior. This would mean we would see the series end with a slight poke above Wave 3 at 0.46, which has happened many times this year, before the retrace back to 0.37-39. If Wave 5 does extend we would be looking at 0.49-53 with the Monthly S1 at 0.51195 coming into play.

$XRP - Bullish EW Impulse Series Faltering Maybe those of us who believe in Ripple are not well loved by Santa... but push on as we must because there is no longer an alternative.

Wave 3 only hit the 1.0 fib ext of Wave 1, getting blocked by the Monthly HA Pivot. Wave 4, as it is, has retraced most of Wave 3. This is not normal and in fact, since Wave 2 was a complex wave Wave 4 should have been a simple wave. Instead, there are serious indications that we might be resuming the downward trend. At this point, even if Wave 5 did make a new high it would be limited by a number of technical restrictions and we would be better off just restarting the count here.

BEWARE! It is entirely possible that right now you are seeing the start of Wave 3 in a new bearish impulse wave, with Wave 5 ending below 0.30.

I break below 0.34167 should confirm that the bearish trend has resumed. The failure of the bearish impulse series spells impending doom.

Keep faith as we have printed a double bottom and this series, assuming a new bearish series, would end up printing a 3rd test of the bottom with the current math.

For the record, I am still holding from 0.31.

XRP READY TO CAUSE RIPPLESXRP BRIEF INTRA-DAY BREAKDOWN

Since giving the long call for XRP at 0.28$ and stating that this will hold as a firm floor, we have seen the spike to just below our initial stated final target for XRP at 0.41 (we only spiked to 0.405$ in reality) and thus our target was not fully achieved. This is just an update of the situation, in line with our BTC analysis.

What can we see on the daily charts for XRP ?

- We can see that we had a rejection from 0.405$ after completely demolishing all our upward targets thus far. Now, looking at the daily, we can see that if we close above 0.38280$ at the end of the day, then its very likely that we will certainly go on to test the 0.43$ previous price floor and that should temporarily hold as a price ceiling for XRP. It is possible that we can/will be able to see wicks to as high as 0.45$ and in reality this would be good from a TA perspective because it would mean a rejection from 200 ema on the DAILY timeframe.

- Looking at our momentum indicators on the daily such as RSI, we can see that we have successfully seen rejections from the thick blue trend line drawn on RSI and we are due to meet that line on daily RSI at the 83 level. None the less, we can see that on RSI/ROC we are near a previous blue trend line, which was previously a supporting structure that was broken downwards of and should now hold as a ceiling structure to knock us back down to at least 54 level on RSI/ROC in reality and if this level does not hold, then my initial thoughts of a meltdown from 0.45$ to 0.25$ could well be true as support would only be found at the 47-40 level on daily RSI/ROC.

What can we see on the 4 HOURLY charts for XRP ?

- We can see that all momentum indicators such as RSI/ROC are at resistance levels currently and XRP is really trying to hold on to the 0.377$ support level. None the less, I believe our RSI/ROC indicator will break down as will price and we will see this indicator on the 4 hourly charts break down to the 60 level in order to use the blue trend line on this indicator as support and it has historically held up as a support and resistance zone. This should correlate with support being found at 0.36-0.35$ from a downward break at 0.40$. On RSI stand alone momentum indicator, we can see that real support zones lie at the 45 level on RSI for the 4 hourly - again more reason for a meltdown to 0.36$ before an upward test of 0.41$-0.43$ with 0.43$ as a conservative target on the intra-day and 0.45$ being an unconservative but common sense target because EMA lies there on the daily.

- Lastly, why 0.36 as expected support…. Simply because EMA 200 on 4 hourly chart is showing support at this level and thus anyone in the trade from 0.28$ SHOULD PLACE SL IN PROFIT FOR THIS TRADE AT 0.35-0.34$.

What can we see on the 1 HOURLY chart for XRP ?

- On the 1 hourly chart for XRP we can see that XRP is holding on to final straws of support at 0.366$ with weak bearish candlesticks.

- We can also see that we have been rejected from the 60 level on RSI/ROC and this level is known to be a resistance which knocks us back down to the infamous support zone on 1 hourly RSI/ROC at 40-47 level! Again correlating with our top down analysis and when price reaches this accumulation zone on the hourly, we will probably be at 0.36$. We can also see that RSI is making its way to support levels at 29 RSI level and here we should find upward support again.

- On the hourly, we can see that REKT could be caused with a retest of 0.39$ before slight meltdown to 0.36$ as RSI/ROC currently showing tendency to do repetitive retests of 60 level before rejection to 40-47 level on this indicator.

Big question of the day for XRP - is 0.52$ possible from our 0.28$ entry ?

- Definitely, this will be confirmed with a break of 0.43-0.45$ resistance zone and previously this range (specifically 0.43$ was a price floor and now should hold up well as a price ceiling) but if BTC tests our maximum upward targets of 4.4-4.7k, then it is possible for a retest of previous highs at 0.52$ before any significant crash to our next downward target of 0.25$ comes.

- What is the only thing stopping us ? DAILY SEEMS VERY FATIGUED ON THE DAILY CHARTS AND MOMENTUM INDICATORS SEEM EXHAUSTED AT THE MINUTE.

- THIS ALL TELLS US THIS AINT NO BULL RUN, THIS IS ALL MEDIUM TERM UPWARD MOVEMENT BEFORE THE NEXT SALE IN PRICE.

PLEASE SEE RELATED IDEAS DOWN BELOW ;) & don't forget to stay up to date with our calls by following our Instagram and telegram channels down below AND ON OUR TRADINGVIEW PAGE - CALL AFTER CALL CORRECT!

$XRP - RSI Breaks Down - Triangle Space LeftLike all of you, I have been watching the chart intently for the last 6 days, waiting for some indication of the next impulse wave.

At the moment, the 4H RSI just broke down past a supporting trend-line, and with the rest of the market falling faster than Ripple currently, all indications point downward.

There is hope though.. there is still space left within the triangle to maintain the sideways movement for another two days.

The problem with this though is that while the technical indicators have been going up, the price has not. This means that basically the spring has reloaded for a push downward.

I wonder though, I see everyone calling for more downward movement, so doesn't it stand to reason that the market will reverse upward since the masses are generally wrong?

A break below 0.29 will be pretty bearish and for now its holding. A break above 0.32 would be bullish.

Keep in mind that while the lesser degree wave has completed its correction, for the most part, the higher degree wave hasn't achieved a 0.262 fib retrace to 0.35. If we assume the move downward was the end of Wave 5 of both the lesser and higher degree wave, then we are due for a retrace.

Bitcoin Bounce Time? 5.3K IncomingHey boysss

After a rough couple weeks for bitcoin I believe we are heading for a little bounce before a greater dump to around 2.8k

Everyone and their dog is talking about 3k bitcoin and that normally means we will do the opposite. Major media channels have been saying bitcoin is dead which is always a good indicator to go long

This setup is starting to look like the fractal from July and I am looking for a nice move up

The 50 daily EMA has been acting like a strong resistance over the last few months so I am expecting a stop off at that point

Take care lads and have funnn :)))!

Weekend sell off''s and losingI just read an article written by a journalist who said "Bitcoin went from 5.5k to 19.5k in just 33 days inn 2017, not impossible in 2019."

Talk about speculation. He spoke of an ETF , yet pointed out that Bitcoin ETF's have been rejected 9 times. He noted that there is one under review. I am sure that the recent performance of BTC will have an impact on THAT decision.

He spoke of day trading Bitcoin , which if you have been trying to do , chances are you are very , very disappointed and less wealthy for all the work and anxiety. He failed to point out the lower lows and lower highs all year long. Failed to point out that this correction is another in a series , and was smaller only because it has devalued so much already.

He's a dreamer , and in this case, sadly - not the only one. People keep at it because in many cases they are growing obsessed with making their money back. F.O.M.O. with BTC SHOULD be DEAD by now.

During this recent correction, without knowing the name of every alt-coin out there, Ripple weathered it best, making a full recovery as of this writing , has grown in market capitalization past ethereum again , quite possibly for good. Many tokens are de-coupling from ETH, which has also devalued profoundly over the past year , along with BCH and too many others to mention. There are tokens that lost ALL value , and no longer exist, though this can in part be attributed to everyone wanting their own coin (i.e. Mayweather etc.)

Ripple, the worlds second largest crypto by market capitalization , is growing in value. I am not making it a secret that I am VERY bullish on Ripple , and I am not alone in that. It's an inexpensive token with so much potential and viable use cases that actually EXIST.

A journalist on CNBC Africa said to "dump BTC and BCH and put all of our money into Ripple." I don't advise putting all of your money into anything except possibly a good vault, however I believe that Journalist is on to something. Ripple's growth can be helped if people stop with the weekend sell off patterns that pervade almost every crypto. If people stop selling at a loss because it's Sunday , or because the rest of the herd is.

Any smart investor has learned not to go all in at any price ,, and price drops can be handled with money in reserve , so as to not only average things out , but to purchase at a better rate. Ripple can be scary for the same reason it can cure f.o.m.o.; price drops below your buy in look scary, because they are proportional to it's current, low price. Don't succumb to that fear. Carefully map out your strategy , holding funds in reserve to buy even at a recent low point. Don't sell it unless you need that money NOW , and if you do you have no business in the crypto space.

Let Ripple be the instrument of that amazing rise I paraphrased earlier in regard to BTC . From 5k to 19.5, even if it did happen , is a 4 fold increase at best. Ripple , if treated as an investment, has the potential to blow up like amazon , netflix , airbnb and every other stock you wish you bought 10 years ago. A blatant , obvious cure for the crypto blues is at hand. It is up to the community what to do.

Maybe NOT sell because it's Sunday , or BTC reaches a new, lower high , or for any other reason than needing the money..... and perhaps we will see what I am talking about. Ripple did break North of a very friendly pattern today, briefly , but it is Sunday and sell off time. Maybe stop doing that, and buy in more when the price lowers.

WE are the force that caused BTC to skyrocket. Now, nursing your wounds, an inexpensive and attractive opportunity beckons. Heed the call.

*OPINION*

Fortune favors the brave.

Caveat Emptor.

Bitcoin, Ethereum, Ripple & Trading This ChopWe have seen a relatively sideways market for a while now. As a trader I need to trade the market being presented to me rather than the market I want to see. This is why I have adjusted some of my targeting methods over the last week. Small profits are still profits.

I hope this helps

TA on XRP/BTCDid a TA on XRP against BTC. I think XRP is overbought/overvalued right now because the market cap went up significantly within a short period of time. That said, it went below the consolidation point at the end of the triangle. Right now, I think its highly volatile and XRP price is very dependent on the PR/news releases right now. Being overvalued, I would recommend exiting at least half of the positions if you are holding any and let the other half roll potentially.

XRPBTC [Daily] Why Im NOT bullish Ripple (yet) ?Some may call me crazy but I'm not bullish here yet. Looks like we may see repaint of one of the previous patterns ( visible on the chart ). My favorite is the first one from the left, means we may see attempt to break higher followed by sell-off. What I'm trying to say is that I would try to avoid to chase price here.

XRPBTC- Long BINANCE:XRPBTC

After some consolidating price action for two days. Price has finally broken out of the consolidation zone and price went to the 9K resistance and was rejected

Since then it has retraced to the 0.618 fib level and has been holding.

We can expect a retest of the 9K resistance

Breaking the resistance is not out of the question

Go long @ 8.5K

TP: 9.4K

SL: 8.2K