XRP/USD Chart Hack – Rob the Market Before the Bears Do🏴☠️💸 XRP/USD Crypto Market Heist Plan: Thief Trader Style 💰📈

"Break the Vault, Rob the Trend – One Candle at a Time!"

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

To all fellow money makers, day robbers & chart thieves... welcome to the vault!

We’re diving into the XRP/USD (Ripple vs. U.S. Dollar) with a bold Thief Trading™ Strategy, blending technical mastery and market intuition.

📊 THE PLAN: Rob the Resistance – Swipe the Highs

🔥 Based on Thief Trading-style TA & FA combo, here's the master heist setup:

Long Bias ⚔️

Target: The High Voltage Resistance Zone

Status: Overbought + Trap Level = High Risk, High Reward

Market Mood: Bullish but risky – consolidation & reversal zones ahead

Crowd Behavior: Bearish robbers strong above, but we strike below

🧠 Thief Wisdom:

“The vault's open, but not every vault is unguarded. Wait, plan, attack with strategy.”

📥 ENTRY PLAN

The Heist Begins at the Pullback...

Use Buy Limit Orders (Thief Style: DCA / Layering)

Entry Zones: Near recent swing lows or within 15–30 min pullbacks

Let the price come to your trap – precision is our weapon

🛡️ STOP LOSS STRATEGY

Guard Your Loot – Always Secure Your Exit

SL Example: 2.8500 (3H TF swing low)

Customize SL based on:

⚖️ Your lot size

🎯 Risk tolerance

🔁 Number of entry layers

Remember: We don’t chase losses – we protect capital like it's gold

🎯 TARGET

Final Take-Profit: 4.0000

But hey… Thieves escape before alarms ring!

💡 If momentum slows, don’t be greedy. Exit smart, exit rich.

📡 FUNDAMENTAL + SENTIMENTAL OVERVIEW

The bullish bias is supported by:

📰 Macro Events

📊 On-Chain Signals

📈 COT Reports

🔗 Intermarket Correlations

📢 Sentiment Analysis

👉 Stay updated with the latest data — knowledge is the thief’s ultimate tool.

⚠️ TRADING ALERT – News Can Wreck the Heist

To survive news spikes:

🚫 Avoid entries during high-impact releases

📉 Use trailing SL to protect your open profits

🛑 Adjust exposure during uncertain volatility

❤️ SUPPORT THE CREW – BOOST THE PLAN

If this plan added value, hit the 🔥BOOST🔥 button.

It helps grow the Thief Trading Team, and together we rob smarter, not harder.

💬 Drop your feedback, thoughts, or charts below – let’s build the crew!

💎 Every candle tells a story. We don’t follow the trend – we rob it.

💣 Stay alert, stay rogue, and I’ll see you at the next market heist.

💰 Until then… chart smart, trade savage. 🐱👤💵

Rippleusd

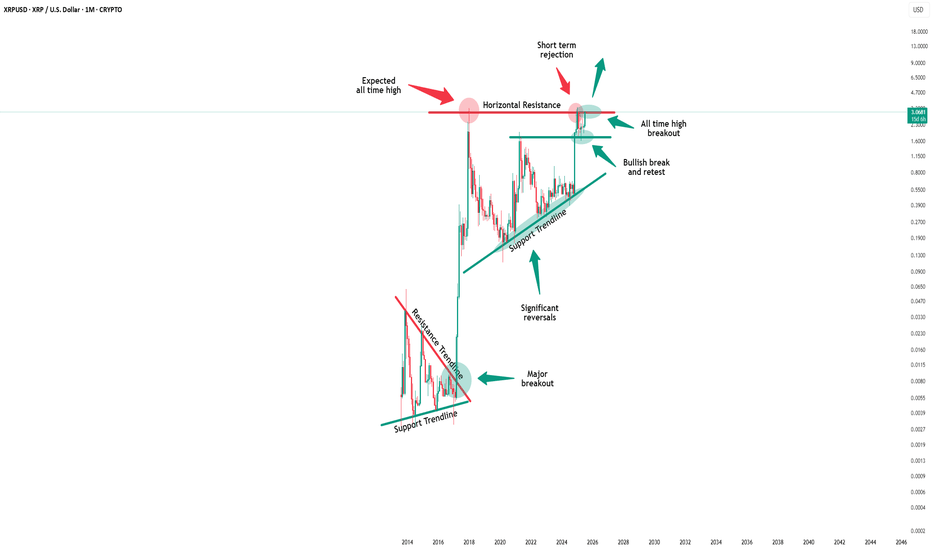

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

SwingTraderPhil

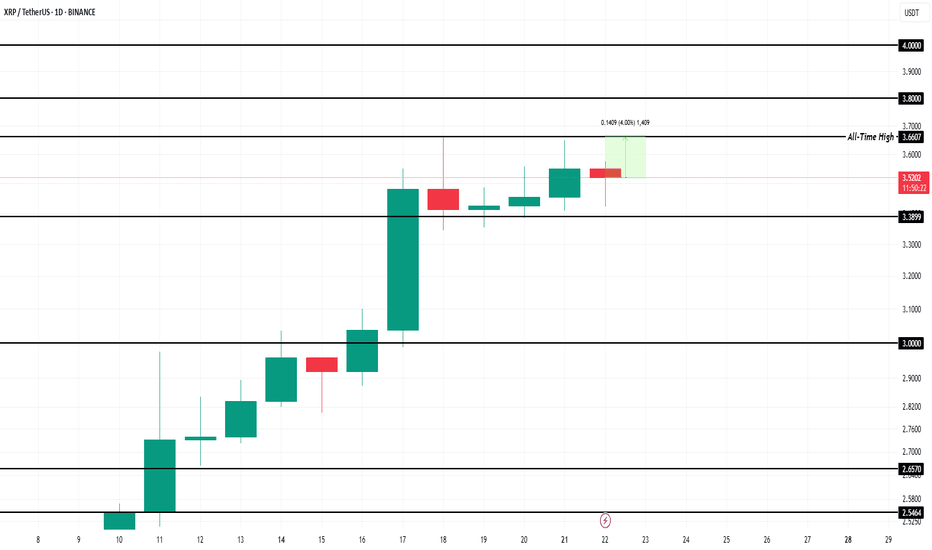

XRP Price Reversal Likely After $2.81 Billion Selling In 7 DaysBINANCE:XRPUSDT is currently trading at $3.48, only 4% away from its all-time high . Over the past week, exchange wallets saw an influx of nearly 450 million XRP, valued at more than $2.81 billion . This spike in supply indicates that holders are moving their assets to sell, usually a bearish indicator in market cycles.

Despite the proximity, BINANCE:XRPUSDT price is showing signs of weakness and is clinging to the $3.38 support level . Without renewed buying interest, this support may not hold much longer.

If investor selling continues, BINANCE:XRPUSDT could fall through $3.38 and test the $3.00 support . A drop to this level would erase the recent gains and confirm a near-term bearish reversal. The loss of $3.00 could signal a longer consolidation phase or deeper correction.

However, if market participants absorb the sold supply and restore demand, BINANCE:XRPUSDT could rebound quickly . In this scenario, the altcoin might surpass $3.66, breach $3.80, and aim for $4.00 . Such a move would invalidate the bearish outlook and set a new all-time high.

XRP Eyes Explosive Growth: A Path to $10 and a 2025 "Euphoria PhThe cryptocurrency market is charged with renewed optimism, and much of the focus is now turning to established digital assets like XRP. After a prolonged period of consolidation, a powerful combination of bullish technical indicators, evolving market dynamics, and a compelling value proposition is fueling forecasts of a significant price surge. Market analysis now points to a potential future where XRP could trade in the $6 to $10 range, a move that hinges on Bitcoin achieving a landmark price of $144,000.

Adding to this momentum, detailed chart analysis suggests that XRP may be on the cusp of entering a "euphoria phase" between August and October of 2025, a window that could see unprecedented growth. As market leaders Bitcoin and Ethereum become increasingly expensive for the average investor, a strong argument is emerging that XRP currently offers a superior entry point, blending high potential with accessibility. This convergence of factors is positioning XRP as a token to watch, with many believing its next major bull run is not a matter of if, but when.

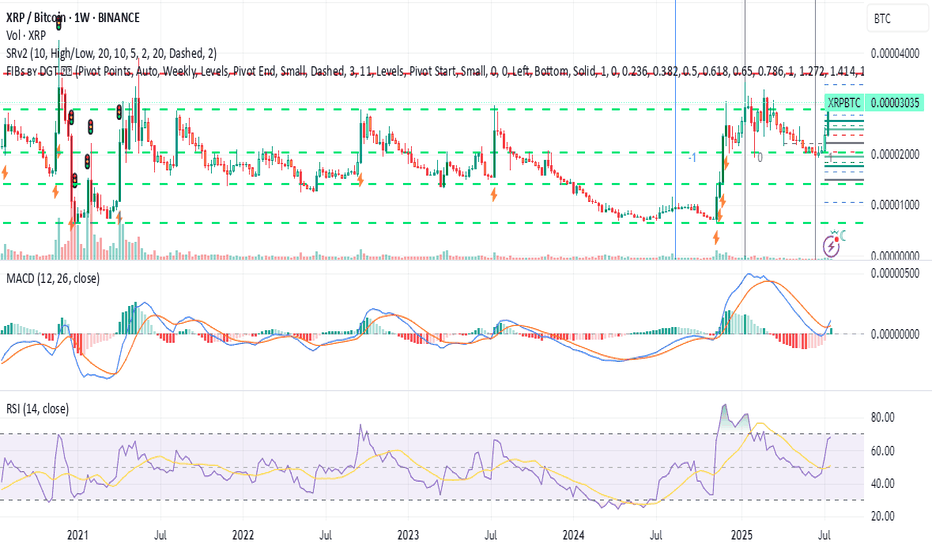

The Bitcoin Catalyst: Charting XRP's Trajectory to $10

A significant component of XRP's bullish outlook is directly tied to the performance of Bitcoin. The relationship between the two assets, often measured by the XRP/BTC trading pair, is showing signs of a historic shift. Technical analysis of the XRP/BTC monthly chart reveals that its price is coiling tightly just below a critical resistance level. A definitive monthly close above this threshold would represent a major technical breakout, signaling a powerful reversal of its long-term trend against Bitcoin. Such a move would be the first of its kind since 2018 and could unleash substantial upward momentum.

Should this breakout on the XRP/BTC chart materialize, technical projections indicate an initial move toward a higher valuation, with a primary target zone identified. If this rally in the trading pair coincides with Bitcoin’s price climbing to the projected $144,000 level, the math translates to a U.S. dollar valuation for XRP of between $6 and $10. The timing for such a move is projected for late 2025, assuming Bitcoin’s own bull run accelerates as anticipated.

The XRP/USD chart independently supports this constructive outlook. A recent weekly close above a key price level has flipped several long-term indicators to a bullish stance, generating a classic breakout signal. Using standard technical projection models, such as Fibonacci extensions, price objectives for XRP now stand at approximately $4.53, $6.31, and even as high as $9.22. The journey to these targets, however, remains heavily dependent on the broader market strength led by Bitcoin. A stall in Bitcoin's advance would likely moderate the upside potential for XRP.

The "Euphoria Phase": Why Late 2025 Could Be Explosive

Beyond its relationship with Bitcoin, XRP's own price chart is signaling immense latent potential. After trading within a defined range for years, the token is now exhibiting powerful bullish signals on its weekly chart, suggesting a breakout from a multi-year consolidation pattern is underway.

Several key technical indicators are aligning to confirm the start of a new, sustained uptrend. A clear bullish crossover on the weekly Moving Average Convergence Divergence (MACD) indicator—a trusted measure of market momentum—has already occurred. At the same time, the Relative Strength Index (RSI) is climbing steadily but has yet to enter the overbought territory that has historically marked the peak of major cycles. This indicates that there is still significant room for price appreciation before the rally becomes exhausted.

A critical psychological and technical price level now stands at $5. A firm weekly close above this mark would be a monumental event, likely triggering a wave of intense buying pressure and shifting market sentiment from simple optimism into full-blown euphoria. If this breakout is confirmed, the next macro price targets are projected to be in the $8 to $11 range, levels consistent with the price action seen in XRP's previous parabolic advances. Based on historical cycle patterns and the current technical structure, this explosive phase could unfold between August and October of 2025.

The Value Proposition: Why XRP Stands Out in a High-Priced Market

As Bitcoin and Ethereum command prices that put them out of reach for many new participants, a psychological barrier to entry has formed. It is in this environment that XRP’s unique market position becomes a powerful advantage. The investment case for XRP is straightforward and highly attractive to first-time crypto buyers who may be experiencing "sticker shock" from the market leaders.

With its high market capitalization and global recognition, combined with a low per-unit price, XRP presents an appealing proposition. This dynamic, often referred to as "unit bias," makes investors feel they are getting better value by being able to purchase a larger quantity of tokens. This behavioral pattern has historically driven significant retail inflows into assets perceived as more affordable.

This appeal is not merely psychological. XRP is underpinned by a clear and functional use case: facilitating fast, low-cost cross-border payments. The XRP Ledger’s ability to settle international transactions in seconds for a fraction of a penny provides a fundamental strength that distinguishes it from purely speculative assets. This utility, aimed at disrupting the enormous traditional finance market, offers a layer of long-term credibility. The broad distribution of XRP across millions of digital wallets highlights its widespread accessibility and deep retail base, a demographic that could be instrumental in fueling its next major run.

A Prudent Perspective

Despite the compelling bullish case, it is essential to approach these forecasts with a clear understanding of the risks involved. The cryptocurrency market is defined by its volatility, and price targets are speculative projections, not guarantees. XRP's path is still influenced by external factors, most notably the ongoing regulatory landscape, which could have a significant impact on its future.

Furthermore, the most optimistic scenarios for XRP are heavily reliant on Bitcoin maintaining its powerful upward trajectory. Any weakness in the flagship cryptocurrency would undoubtedly impact the entire altcoin market, including XRP. While the technical and fundamental outlook appears increasingly bright, a disciplined and well-researched approach remains the cornerstone of navigating this exciting but unpredictable market.

XRP's New Dawn: Beyond Bitcoin, Towards a Double-Digit Horizon

The cryptocurrency landscape is witnessing a seismic shift, and at its epicenter is XRP. In a stunning display of market dominance, the digital asset has embarked on a historic rally, fundamentally altering its perception and potential. Leaving the market's traditional bellwether, Bitcoin, in its wake with a colossal 277% outperformance over the past year, XRP has shattered its previous records. The token recently soared to a new all-time high of $3.66, pushing its market capitalization beyond the monumental $210 billion mark for the first time. This explosive growth, fueled by a confluence of regulatory triumphs, institutional validation, and overwhelming market momentum, has ignited the community and brought a once-fanciful question to the forefront of serious financial discussion: Is a $10 valuation the next logical destination for XRP?

This article delves into the multifaceted narrative behind XRP's meteoric ascent. We will dissect its remarkable outperformance against Bitcoin, explore the pivotal legal and regulatory victories that cleared its path, analyze the flood of institutional capital now entering the ecosystem, and examine the technical and on-chain data that suggests this rally may have only just begun.

Chapter 1: A Declaration of Independence - XRP's Decoupling from Bitcoin

For most of its existence, the cryptocurrency market has marched to the beat of Bitcoin's drum. Its price movements dictated the sentiment and direction for nearly all other digital assets. The year 2025, however, will be remembered as the year XRP declared its independence. The asset's 277% yearly surge against Bitcoin is not a mere statistical anomaly; it represents a fundamental rerating by the market, a recognition of XRP's unique value proposition, which is now unburdened by past uncertainties.

This divergence is starkly visible in recent trading. During the month of July alone, XRP appreciated more than 35% against Bitcoin, a powerful indicator of shifting capital flows and investor preference. While Bitcoin's narrative remains firmly rooted in its identity as "digital gold" and a hedge against inflation, XRP's story has evolved into one of proven utility and regulatory legitimacy. This newfound clarity has allowed its price to reflect its potential as a bridge currency for global payments and a cornerstone of a new, more efficient financial infrastructure.

The psychological impact of this rally has been profound. Prominent personalities like Dave Portnoy have publicly lamented selling their XRP holdings prematurely, echoing a sentiment of regret that is likely widespread among investors who exited their positions during the long years of legal ambiguity. This fear of missing out, while a potent market force, is not the sole driver of the current momentum. The rally is built upon a much sturdier foundation of institutional adoption and clear fundamental catalysts, suggesting a more sustainable trend than the speculative frenzies of the past.

Chapter 2: The Victory Lap - Regulatory Clarity as Rocket Fuel

The single most significant factor unlocking XRP's potential has been the definitive conclusion of its long and arduous legal battle with the U.S. Securities and Exchange Commission (SEC). The lawsuit, initiated in late 2020, had acted as a lead weight on the asset, alleging that Ripple's sales of XRP constituted an unregistered securities offering. This created a cloud of regulatory risk that kept many institutional investors and potential partners on the sidelines, particularly in the United States.

The tide began to turn with a landmark court ruling that determined XRP, when sold on public exchanges to retail customers, did not meet the definition of a security. This decision was a watershed moment, providing the legal clarity the secondary market desperately needed. The final chapter of this saga unfolded in 2025 as the SEC opted to drop its appeal and the parties moved to finalize a settlement. This resolution effectively ended the years of uncertainty that had suppressed XRP's value and stifled its adoption in the U.S.

This legal victory could not have come at a more opportune time. It coincided with a broader, increasingly constructive regulatory climate in Washington. The successful passage of several crypto-focused bills through the U.S. House has signaled a move towards establishing clear rules of the road for the digital asset industry. This favorable regulatory tailwind has not only vindicated Ripple's long-standing arguments but has also paved the way for the development of regulated financial products built around XRP, transforming it from a legally contentious asset into a compliant component of the future financial system.

Chapter 3: The Wall Street Endorsement - The Influx of Institutional Capital

With the legal clouds parted, the floodgates for institutional capital have swung wide open. The most tangible evidence of this is the enthusiastic race to launch XRP-based Exchange-Traded Funds (ETFs). An ETF is a mainstream investment vehicle that allows investors to gain exposure to an asset like XRP through their traditional brokerage accounts, representing a critical bridge between the worlds of crypto and traditional finance.

Financial services giant ProShares has led the charge, successfully launching a leveraged XRP futures ETF. The approval of such a sophisticated product by regulators is a powerful endorsement, signaling a high degree of comfort with XRP's market structure and legal standing. ProShares is far from alone; a veritable who's who of asset managers, including Bitwise and 21Shares, have also filed applications for their own XRP-based funds. The sheer volume of these filings from established Wall Street players underscores a deep and proactive institutional belief in XRP's long-term potential.

This institutional stampede is further reflected in the booming derivatives markets. Daily trading volume in XRP futures has swelled to over $235 million, while open interest—a measure of the total value of active contracts—has soared to a record high. This is the unmistakable footprint of large, sophisticated investors using these markets to speculate on and hedge their exposure to XRP. The recent price surge was amplified by a significant "short squeeze," where traders betting against XRP were forced to buy back their positions at higher prices, adding further fuel to the rally. This is not the behavior of a retail-driven fad; it is the mechanics of a market now dominated by serious institutional demand.

Chapter 4: Reading the Digital Tea Leaves - On-Chain and Whale Activity

A deeper look at the blockchain itself provides further compelling, if nuanced, insights. On-chain data reveals a fascinating dynamic among the largest holders of XRP, colloquially known as "whales." On one hand, there have been significant transfers of XRP from Ripple co-founder Chris Larsen to centralized exchanges, a pattern that often precedes selling. Throughout 2025, Larsen has moved hundreds of millions of dollars worth of the token, which could be interpreted as early insider profit-taking.

However, this potential selling pressure has been more than absorbed by a much broader trend of accumulation. Market data clearly shows a steady pattern of buying by other large, institutional-grade investors. It appears a new class of whales is confidently accumulating any supply that becomes available, creating a powerful and sustained tailwind for the price.

Adding a layer of data-driven optimism is the Market Value to Realized Value (MVRV) ratio. This advanced metric, which compares XRP's current price to the average acquisition cost of all coins in circulation, recently flashed a signal that has historically preceded enormous rallies. The last time this particular indicator showed a "golden cross," it heralded a massive 630% surge in XRP's price. While past performance is no guarantee of future results, this historical precedent provides a powerful data point that aligns perfectly with the bullish fundamental narrative.

Chapter 5: Charting the Uncharted - Price Analysis and Future Targets

The culmination of these powerful catalysts has produced breathtaking price action. In a single 24-hour period, XRP's price leaped by 22%, decisively breaking its former all-time high and entering a phase of pure price discovery. Technical analysts have described the move as a textbook breakout following a long period of accumulation, a pattern that often leads to powerful and sustained upward trends.

With no historical resistance levels overhead, analysts are now turning to technical patterns and Fibonacci extension models to project potential future targets. A prominent "bull pennant" formation on the price charts suggests an astonishing long-term target of $14. More immediate, conservative targets are clustered around the $4.00 and $4.80 levels, which many believe are well within reach if the current momentum is maintained.

This brings the conversation to the ultimate question of a double-digit valuation. Can XRP realistically reach $10 or beyond? A growing chorus of analysts believes it can. Projections for the coming years vary, but many models point to a future where XRP trades comfortably in the double digits. Forecasts for 2030 range from a conservative $4.35 to more aggressive targets of $16, $22, and even higher. These predictions are not based on pure speculation but are rooted in the assumption that the institutional adoption unlocked by ETFs and Ripple's expanding global payment network will continue to drive demand and utility.

Conclusion: A New Era for XRP

XRP's recent performance represents more than just a bull run; it signifies a fundamental transformation. It has emerged from a crucible of legal and regulatory challenges not merely intact, but stronger, more resilient, and with a clear mandate in the world's most important financial market. This hard-won victory has unleashed a powerful synergy of positive forces: the validation of institutional capital, the tailwind of a favorable regulatory environment, and the overwhelming evidence of bullish technical and on-chain metrics.

Its decisive outperformance of Bitcoin marks a coming-of-age moment, proving that a digital asset with clear utility and legal standing can forge its own path and command its own powerful market narrative. While the future in any financial market remains unwritten, the convergence of factors supporting XRP has never been stronger. The conversation has irrevocably shifted. The question is no longer if XRP can reclaim its former glory, but rather how high its newfound momentum can carry it. For a rapidly growing number of investors, analysts, and institutions, the $10 price target has evolved from a distant fantasy into a plausible, and perhaps even imminent, reality.

XRPUSD - Why I see that Ripple even higherMedianlines, aka "Forks" have a simple but effective ruleset inherent. These rules describe the movement in certain situations. And of course, the most probable path of wher price is trading to.

Here we a rule in play that projects more movement to the upside, even if BTCUSD has had a strong pullback to the south.

Let's see:

If price is closing above a Centerline, then chances are high that it will retest it. If it holds and starts to continue it's path (to the upside), then the next target is the U-MHL, or the Upper Medianline Parallel, was Dr. Allan Andrews named it back many decades ago.

So, there we have it.

Chances are high that Ripple will reach new highs, with a final target at the U-MLH.

"XRP/USD: Bullish Raid Alert! Ride or Escape Fast!"🚨 XRP/USD HEIST ALERT: Bullish Loot Grab Before the Escape! (Thief Trading Style) 🚨

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Thief Trading Strategy Activated! 🔥

Based on ruthless technical + fundamental analysis, here’s how we SWIPE THE LOOT from XRP/USD (Ripple vs. Dollar). Follow the chart’s Long Entry blueprint—our target is the high-risk YELLOW ATR ZONE (overbought, consolidation, potential reversal). Beware of traps! Bears and cops lurk here, but we strike smart.

🏴☠️ ENTRY:

"Vault’s cracked—bullish loot is FREE GAME!"

Buy Limit Orders preferred (15-30 min timeframe near swing lows/highs).

Aggressive? Swipe instantly—just mind the cops (liquidity traps).

🛑 STOP LOSS (Save Your Loot!):

Swing Thieves: 4H recent wick low ($2.1500).

Risk Tactics: Adjust SL based on your trade size, orders, and guts.

🎯 TARGETS:

Main Take: $2.5400 (or escape earlier if momentum fades).

Scalpers: Longs ONLY! Trail your SL—no greedy holds!

💣 KEY DRIVERS (Why This Heist Works):

Bullish momentum brewing (check fundamentals, COT, on-chain data 👉go ahead to klick 🔗).

NEWS ALERT: Avoid fresh trades during high-impact news—protect open positions with trailing stops!

💥 BOOST THIS HEIST!

Hit 👍 LIKE, 🔔 FOLLOW, and 💬 COMMENT to fuel our next robbery plan. Together, we steal the market’s cash—EVERY. SINGLE. DAY.

📢 Final Warning: Markets shift FAST. Stay sharp, adapt, and CASH OUT BEFORE THE COPS ARRIVE.

🤑 Stay tuned—more heists incoming! 🐱👤🚀

XRP/USD: "Bandit’s Breakout" – MA Confirms the Profit Raid!🔥 XRP/USD HEIST ALERT: The Bullish Bank Robbery Plan (MA Breakout Strategy) 🔥

🌟 Attention, Market Pirates & Profit Bandits! 🌟

"The best traders are just thieves with a calculator."

🚨 Mission Brief (XRP/USD):

Based on Thief Trading tactics, we’re plotting a bullish heist on Ripple. High-risk, high-reward—police traps, fakeouts, and overbought zones be damned!

📌 ENTRY ZONE (Breakout or Pullback Heist)

"The heist begins at MA breakout!"

Buy Stop: Above 2.2200 (confirmed candle close).

Buy Limit: Near swing lows (15m/30m pullback).

🚨 Set an ALERT! Don’t miss the breakout.

🛑 STOP LOSS (Escape Route)

"No stop loss till breakout—then hide it like stolen cash!"

Thief SL: Nearest swing low (3H candle wick) ~2.1000.

Rebels adjust at own risk—your funeral, not mine. 😎

🎯 TARGETS (Profit Hideouts)

First Escape: 2.2400 (scalp & run).

Swing Bandits: Ride longer (trail SL advised).

⚡ SCALPERS’ NOTE:

Longs ONLY. Rich? Go all-in. Broke? Join swing heists.

Trailing SL = Your getaway car.

📡 MARKET CONTEXT (Why This Heist?)

Bullish momentum + consolidation breakout play.

Fundamentals? Check COT, on-chain, macro trends (check everything here 👉🔗🔗).

🚨 NEWS WARNING (Avoid Police Raids)

Avoid new trades during high-impact news.

Trailing stops = Your invisible cloak.

💥 BOOST THE HEIST!

"Like & Boost this idea—strengthen our robbery squad! More alerts = more stolen profits. 🚀💰

Next heist coming soon… Stay greedy, thieves. 😈

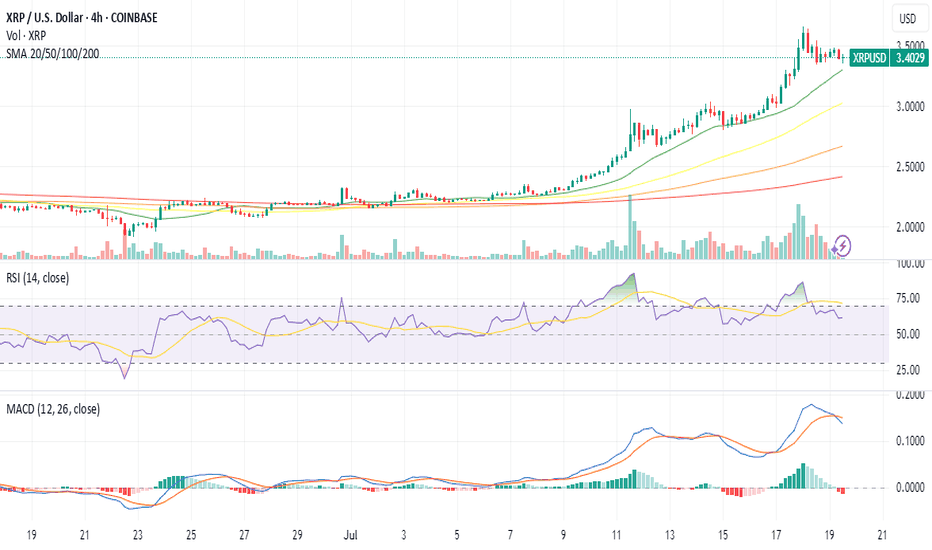

Ripple - Expecting Bullish Continuation In The Short TermH4 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

XRP: A Trader's Gambit or an Investor's FortuneXRP at the Crossroads: A Trader's Gambit or an Investor's Fortune?

The digital asset XRP currently finds itself in a fascinating and precarious position, presenting a narrative so divided it could belong to two entirely different assets. For the short-term trader, the charts are painting a picture of tension and potential reversal, a technical puzzle where a wrong move could be costly. For the long-term investor, the horizon holds the promise of a revolutionary technology poised to disrupt a trillion-dollar industry, with price targets that seem almost unimaginable from today's standpoint. This analysis delves into this profound dichotomy, exploring the immediate bearish signals that tempt traders to short, while simultaneously mapping out the ambitious, utility-driven path that could lead XRP to astronomical new heights.

The Short-Term Squeeze: A Technical Tightrope Walk

Observing XRP's recent price action is like watching a high-stakes chess match. The token has demonstrated a textbook reaction to a critical trendline, a move that likely ensnared traders who were too quick to bet on a price collapse. By bouncing precisely where technical theory suggested it might, it "trapped" these early sellers, forcing them to reconsider their positions as the price stabilized and began to creep upward.

Following this maneuver, the price has embarked on a cautious ascent from the $2.20 support zone. As of early July, XRP has managed to climb above the $2.2320 mark and is holding its ground above the 100-hourly Simple Moving Average, both of which are constructive short-term signals. The immediate focus has now shifted to a key resistance level at $2.285. A decisive break above this ceiling could signal that the bulls have taken control, potentially triggering a new wave of buying pressure.

However, a significant hurdle lies in wait. On the hourly chart, a short-term contracting triangle has formed, with its upper boundary creating firm resistance at the $2.280 level. Such patterns are known to be harbingers of volatility; they represent a period of consolidation and coiling energy before the price makes a powerful move in one direction. While a breakout to the upside is possible, the bearish case remains equally compelling.

This bearish outlook is centered on a previously marked supply zone that the price is now approaching. A supply zone is an area on the chart where a glut of sell orders is historically clustered. If the price pushes into this zone without first building a stronger foundation of support by drawing in buying interest (grabbing liquidity) from lower levels, it risks hitting a brick wall. The selling pressure could overwhelm the buying momentum, leading to a swift and strong rejection. For traders anticipating this outcome, it presents a prime opportunity to initiate a short position, betting on a significant price decline. The level of $2.28 is therefore not just a resistance point; it's a critical battleground that will likely dictate the next major directional move.

The Long-Term Vision: The $35 Moonshot Fueled by Global Remittances

To truly understand the fervent belief held by long-term XRP holders, one must look beyond the flickering candles of the hourly charts and focus on the asset's fundamental purpose. The most powerful bullish argument for XRP is not based on technical patterns, but on its potential to fundamentally reshape the global remittance market.

The remittance industry—the process of individuals sending money across borders to their families—is a colossal and ever-growing sector of the global economy. Projections indicate that this market will swell from nearly $800 billion to over $1.06 trillion by 2029. For decades, this system has been notoriously inefficient, characterized by exorbitant fees that eat into the funds sent home and settlement times that can stretch for days, leaving families waiting for critical support.

This is the problem that Ripple, the technology company behind XRP, was designed to solve. By utilizing XRP as a neutral bridge asset, Ripple's payment network can facilitate cross-border transactions in a matter of seconds, not days. The cost of these transactions is a tiny fraction of what traditional banking intermediaries charge. This value proposition of speed and savings is not merely theoretical; Ripple has been actively forging partnerships to implement this technology in key remittance corridors, including those connecting to Mexico, the Philippines, Brazil, and nations in the Middle East.

The audacious price prediction of $35 per XRP stems from a model that quantifies this potential. The logic unfolds as follows: if XRP were to successfully capture a significant portion, say 25%, of the projected $1.06 trillion remittance market by 2029, the network's intrinsic value would be immense. Applying a valuation multiple similar to those of established payment processing giants, the network could be valued at over $500 billion. With a circulating supply of approximately 60 billion tokens, a simple calculation yields a fundamental value of around $8.90 per XRP.

However, the cryptocurrency market is driven by more than just underlying utility; it is heavily influenced by demand, speculation, and investor sentiment. The model accounts for this by applying a "demand premium." If widespread adoption and recognition of XRP's role create a surge in demand, this could act as a multiplier on its fundamental value. A 4x demand premium, a figure not uncommon during crypto bull markets, applied to the $8.90 base valuation, is what brings the target to an eye-watering $35.56. This forecast, while undeniably ambitious, is anchored in the tangible prospect of solving a multi-trillion-dollar real-world problem.

Bridging the Gap: Catalysts for a New Era

The journey from a price of around $2.22 to a potential $35 is long, and its success hinges on several critical factors. A major cloud that long hung over XRP was its legal battle in the United States, which created uncertainty and stifled institutional adoption. However, significant legal victories have provided much-needed regulatory clarity, affirming that XRP itself is not inherently a security. This has been a pivotal de-risking event, opening the doors for financial institutions to begin integrating and utilizing the asset with newfound confidence.

The next major potential catalyst on the horizon is the approval of a spot XRP Exchange-Traded Fund (ETF). Following the successful launch of ETFs for other major cryptocurrencies, many in the industry see an XRP ETF as a logical next step. Such a product would be a game-changer, providing a regulated and easily accessible bridge for a vast pool of capital from traditional finance to flow into the XRP market. It would allow pension funds, asset managers, and retail investors to gain exposure to XRP through their standard brokerage accounts, potentially triggering a massive wave of demand.

Of course, the path is not without its challenges. XRP operates in a competitive environment, with other blockchain projects and even modernizing traditional systems like SWIFT vying for a piece of the cross-border payments pie. Continued innovation, network growth, and the expansion of strategic partnerships will be paramount to securing its market position.

Conclusion: A Dichotomy of Destiny

In its current state, XRP embodies the dual nature of the cryptocurrency market. It is at once a playground for nimble traders, who see the immediate risks and rewards in its tight price consolidation, and a beacon for long-term visionaries, who see the blueprint for a future global financial standard. The bearish case for a short-term rejection from the $2.28 supply zone is technically sound and warrants caution. A failure to break through this level could easily send the price back down to retest lower supports.

Simultaneously, the long-term bullish thesis is one of the most compelling in the entire digital asset space. It is not built on hype alone, but on a clear and demonstrable utility aimed at a vast and inefficient market. The prospect of a $35 XRP is a testament to this potential.

Ultimately, the decision of whether to view XRP as a short-term trade or a long-term investment is a reflection of one's own timeline, risk tolerance, and belief in its underlying technology. XRP is at a critical inflection point, and whether it succumbs to short-term pressures or breaks free to pursue its grander ambitions will be a defining story in the continuing evolution of finance.

XRP Alert: $3 Bets Dominate as Massive "Wedge" Pattern SignalThe Anatomy of a Sleeper Awakened: Analyzing the $3 XRP Bet and the Decisive XRP/BTC Technical Pattern

In the relentless and often forgetful cycle of the cryptocurrency market, assets can fall into long periods of dormancy. They become laggards, overshadowed by newer, faster-growing projects, their communities tested, and their price action a flat line of disappointment on a chart full of parabolic curves. For years, XRP has been the quintessential example of such an asset. Plagued by a protracted legal battle with the U.S. Securities and Exchange Commission (SEC) and consistently underperforming its large-cap peers, it became the subject of both unwavering belief from its dedicated "XRP Army" and derision from the wider market.

However, the quietest corners of the market often hide the most tension. Beneath the surface of sideways price action, a confluence of powerful forces is beginning to emerge, suggesting that this slumbering giant may be on the verge of a violent awakening. This shift is not signaled by mainstream headlines or celebrity endorsements, but by the sophisticated and often predictive language of derivatives markets and inter-market technical analysis.

Two specific, potent signals have captured the attention of astute market observers. The first is a stunning development in the XRP options market, where call options with a $3 strike price are inexplicably dominating trading volumes. This is not a modest bet on a 20% gain; it is an audacious, seemingly irrational wager on a 500-600% price explosion. The second is a multi-year technical pattern on the XRP/BTC chart—a massive falling wedge that suggests XRP is coiling for a major rally, not just in dollar terms, but against the market's undisputed king, Bitcoin.

This analysis will conduct a deep dive into these two phenomena. We will dissect the implications of the $3 options bet, exploring the psychology and mechanics behind such speculative fervor. We will then meticulously break down the XRP/BTC wedge pattern, explaining its significance as a measure of relative strength and its potential to unleash a powerful wave of capital rotation. Finally, we will connect these market signals to the underlying fundamental drivers—the aftermath of the SEC lawsuit, Ripple's ongoing business development, and the broader market cycle dynamics—to construct a holistic thesis. While the road ahead is fraught with risk and uncertainty, the evidence suggests that the narrative surrounding XRP is undergoing a seismic shift, moving from a story of legal battles and stagnation to one of profound, speculative optimism.

________________________________________

Part 1: Decoding the Options Market Frenzy - The Audacity of the $3 Bet

To the uninitiated, the options market can seem like an esoteric and complex casino. In reality, it is a sophisticated mechanism for hedging risk and placing directional bets, and the data it generates provides an invaluable window into the collective mind of the market. The current activity in the XRP options market is not just a flicker of interest; it is a roaring fire of speculative conviction centered around a single, audacious number: $3.

Understanding the Language of Options

Before dissecting the significance of this event, it is crucial to understand the basic mechanics at play. A call option gives the buyer the right, but not the obligation, to purchase an asset at a predetermined price (the strike price) on or before a specific date (the expiration date).

For example, a trader buying an XRP call option with a $3 strike price is betting that the price of XRP will rise significantly above $3 before the option expires. If XRP were to reach, say, $4, the trader could exercise their option to buy XRP at $3 and immediately sell it for $4, pocketing the difference.

The key takeaway is that these options are leveraged instruments. A trader can control a large amount of XRP for a small upfront cost (the premium). However, if the price of XRP does not exceed the strike price by the expiration date, the option expires worthless, and the trader loses their entire premium. This makes buying far out-of-the-money (OTM) call options—where the strike price is significantly higher than the current market price—an extremely high-risk, high-reward strategy.

The Significance of the $3 Strike Price

The current market price of XRP hovers around $0.50 to $0.60. A $3 strike price, therefore, is not a bet on incremental gains. It is a bet on a monumental, life-changing rally of approximately 500%. This is what makes the situation so extraordinary. The fact that this specific strike price is the most traded in terms of volume indicates a massive concentration of speculative interest.

This phenomenon can be interpreted in several ways:

1. Extreme Bullish Conviction: The most straightforward interpretation is that a significant number of traders, from retail speculators to potentially larger funds, harbor a deep-seated belief that a major catalyst is on the horizon. This could be related to a final, favorable resolution in the SEC case, a major partnership announcement by Ripple, or the anticipated effects of a full-blown crypto bull market lifting all boats, with XRP expected to be a primary beneficiary. They are willing to risk a small premium for a chance at an exponential payout.

2. "Lottery Ticket" Mentality: A more skeptical view is that these are akin to lottery tickets. The premiums on these far OTM options are relatively cheap. A trader might spend a few hundred dollars on $3 calls, fully accepting that they will likely expire worthless. However, in the infinitesimally small chance that XRP does experience a black swan event to the upside, that small investment could turn into tens of thousands of dollars. It is a bet on volatility and a low-probability, high-impact event, rather than a nuanced analysis of fair value.

3. Potential for a Gamma Squeeze: This is a more complex but critical possibility. When a large number of call options are purchased, the market makers who sell these options are left with a short position. To hedge their risk, they must buy the underlying asset (XRP). As the price of XRP begins to rise and approach the strike price, the market makers' risk increases exponentially, forcing them to buy more and more XRP to remain hedged. This reflexive loop—rising prices forcing more buying, which in turn pushes prices even higher—is known as a gamma squeeze. The massive open interest at the $3 strike, while currently far away, builds a foundation of potential explosive fuel. If a rally were to gain serious momentum and push past $1, then $1.50, the hedging pressure on market makers would begin to mount, potentially turning a strong rally into a parabolic one.

4.

Analyzing the Volume and Open Interest

"Dominating trading volumes" means that more contracts for the $3 strike are changing hands daily than for any other strike price, whether it's a more conservative $0.75 or $1.00 call. This indicates active, ongoing betting. Open interest, on the other hand, refers to the total number of outstanding contracts that have not been settled. High open interest at the $3 strike signifies that a large number of participants are holding these positions, not just day-trading them. They are maintaining their bet over time, waiting for the anticipated price move.

The sheer concentration of both volume and open interest at such a high strike price is a powerful sentiment indicator. It tells us that the "smart money" or, at the very least, the most aggressive speculative capital, is not positioning for a minor recovery. It is positioning for a complete and total repricing of the asset. While this does not guarantee the outcome, it creates a self-fulfilling prophecy dynamic. The knowledge that this much speculative interest exists can itself attract more buyers, who want to front-run the potential squeeze.

________________________________________

Part 2: The Technical Tale of the Tape - XRP/BTC's Coiled Spring

While the options market provides a glimpse into the speculative sentiment surrounding XRP's dollar value, a far more profound story is being told on the XRP/BTC chart. This trading pair is arguably one of the most important long-term indicators for any altcoin, as it measures its performance not against a fiat currency, but against the crypto market's center of gravity: Bitcoin.

The Crucial Importance of the XRP/BTC Pair

When XRP/USD rises, it can simply mean the entire crypto market, led by Bitcoin, is in an uptrend. However, when XRP/BTC rises, it signifies something much more powerful: XRP is outperforming Bitcoin. This means that capital is actively rotating out of the market leader and into XRP, seeking higher returns. A sustained uptrend in the XRP/BTC pair is the hallmark of a true "altcoin season" for that specific asset and is often the precursor to the most explosive, parabolic moves in its USD valuation.

For the past several years, the XRP/BTC chart has been a painful sight for XRP holders. It has been in a brutal, grinding downtrend, meaning that even when XRP's dollar price rose, holding Bitcoin would have been a more profitable strategy. This long period of underperformance, however, has forged one of the most powerful bullish reversal patterns in technical analysis: a falling wedge.

Anatomy of the Falling Wedge

A falling wedge is a technical pattern that forms when an asset's price makes a series of lower highs and lower lows, with the two trendlines converging. The key characteristic is that the lower trendline (support) is less steep than the upper trendline (resistance).

• Psychology Behind the Pattern: The pattern represents a battle between buyers and sellers where the sellers are gradually losing their momentum. Each new push lower by the bears is met with more resilience from the bulls, and the price fails to fall as far as it did previously. The contracting range signifies that volatility is decreasing and energy is being stored. It is a period of consolidation that often precedes a major trend reversal. The bears are getting exhausted, and the market is coiling like a spring.

• The Breakout: The bullish signal is triggered when the price breaks decisively above the upper trendline (resistance) of the wedge. This breakout indicates that the balance of power has finally shifted from the sellers to the buyers. A valid breakout is typically accompanied by a significant increase in volume, confirming the conviction behind the move.

• Price Target: Technical analysts often measure the potential price target of a wedge breakout by taking the height of the wedge at its widest point and adding it to the breakout point. Given that the XRP/BTC wedge has been forming for several years, its height is substantial, suggesting that a successful breakout could lead to a rally of 200-300% or more against Bitcoin.

Analyzing the XRP/BTC Chart

The multi-year falling wedge on the XRP/BTC weekly and monthly charts is a textbook example of this pattern. It encapsulates the entire bear market and period of underperformance since the previous cycle's peak. The price has been tightening into the apex of this wedge for months, signaling that a resolution is imminent.

A breakout from this pattern would be a technical event of immense significance. It would signal the end of a multi-year bear market against Bitcoin and the beginning of a new cycle of outperformance. Traders and algorithms that monitor these patterns would interpret it as a major "buy" signal, potentially triggering a flood of new capital into XRP.

This technical setup provides a logical foundation for the seemingly irrational optimism seen in the options market. The traders betting on $3 XRP are likely looking at the XRP/BTC chart and seeing the same thing: the potential for a violent and sustained reversal. A 200% rally in XRP/BTC, combined with a rising Bitcoin price in a bull market, could easily provide the momentum needed to propel XRP's dollar valuation into the multi-dollar range. The two signals are not independent; they are two sides of the same coin, reflecting a deep and growing belief in an impending, historic rally.

________________________________________

Part 3: The Fundamental Undercurrents - The 'Why' Behind the 'What'

The explosive options activity and the powerful technical pattern are the "what." They are the observable phenomena. But to build a robust thesis, we must understand the "why." What fundamental shifts are occurring to justify this renewed optimism? The answer lies in a combination of legal clarity, steady business development, and predictable market cycle dynamics.

The Aftermath of the Ripple vs. SEC Lawsuit

The single greatest cloud hanging over XRP for years has been the SEC lawsuit, filed in December 2020, which alleged that XRP was an unregistered security. This created massive regulatory uncertainty, leading to its delisting from major U.S. exchanges and causing institutional capital to shun the asset.

In July 2023, a landmark summary judgment was delivered by Judge Analisa Torres. The key takeaways were:

1. Programmatic Sales of XRP on exchanges do not constitute securities transactions. This was a monumental victory for Ripple and the XRP community. It provided the legal clarity that exchanges needed to relist XRP, and it affirmed that for the average retail buyer, XRP is not a security. This removed the primary existential threat to the asset.

2. Institutional Sales of XRP were deemed securities transactions. This was a partial victory for the SEC, but it was confined to Ripple's direct sales to institutional clients in the past.

While the case is not fully over—with final remedies and penalties for institutional sales still being determined—the market has correctly interpreted the main ruling as a decisive win. The risk of XRP being declared a security across the board has been neutralized. This clarity is the single most important fundamental catalyst. It allows exchanges, investors, and partners to engage with XRP with a level of confidence that was impossible just a few years ago. The market is now looking past the remaining legal wrangling and focusing on the future.

Ripple's Unwavering Business Development

Throughout the entire legal battle, Ripple, the company, never stopped building. Its core mission is to use blockchain technology to improve cross-border payments, a multi-trillion dollar industry ripe for disruption. XRP, the digital asset, is central to its flagship product, Ripple Payments (formerly On-Demand Liquidity or ODL). This service uses XRP as a bridge currency to enable instant, low-cost international payments without the need for pre-funded nostro/vostro accounts.

Ripple has been steadily expanding its payment corridors, securing licenses in key jurisdictions like Singapore, Dubai, and Ireland, and forging partnerships with financial institutions around the globe. Furthermore, the company is actively involved in the development of Central Bank Digital Currencies (CBDCs), piloting its technology with several nations.

The recent announcement of a Ripple-issued stablecoin pegged to the U.S. dollar further expands its ecosystem. This move positions Ripple to compete in the massive and growing stablecoin market, leveraging the XRP Ledger's speed and efficiency.

This steady, behind-the-scenes progress provides a fundamental anchor to the speculative bets being placed. Unlike many crypto projects that are built on hype alone, Ripple has a real-world use case, a functioning business, and a clear strategy for capturing a share of the global payments market. The resolution of the SEC case allows this fundamental value proposition to finally come to the forefront.

The Inevitable Laggard Rotation

Finally, the optimism surrounding XRP can be explained by classic crypto market cycle dynamics. A typical bull market cycle follows a predictable pattern of capital rotation:

1. Bitcoin Leads: Capital first flows into Bitcoin, the market's most established and trusted asset.

2. Rotation to Ethereum: As Bitcoin's gains begin to slow, profits are rotated into Ethereum, the leading smart contract platform.

3. Large-Cap Altcoins: Capital then flows from Ethereum into other large-cap altcoins.

4. The Laggard Rally: Finally, in the latter stages of a bull run, traders seek out assets that have underperformed, or "lagged," the market. These laggards, often older coins with strong communities, can experience explosive catch-up rallies as a flood of speculative capital seeks the next big move.

XRP is the archetypal laggard. It has massively underperformed both Bitcoin and Ethereum for years. The bets being placed now—both in the options market and on the XRP/BTC chart—are a clear anticipation of this final, powerful stage of the market cycle. Traders are positioning themselves to front-run the great capital rotation into one of the market's most well-known but long-neglected assets.

________________________________________

Part 4: A Sobering Perspective - Risks and Counterarguments

No analysis would be complete without a balanced look at the potential risks that could invalidate the bullish thesis. While the confluence of signals is powerful, success is far from guaranteed.

1. The Options Trap: The most obvious risk is that the $3 call options are simply a mirage. The vast majority of far out-of-the-money options expire worthless. This could be nothing more than a wave of irrational exuberance from retail traders that ultimately amounts to nothing, leaving a trail of lost premiums.

2. The False Breakout: Technical patterns can fail. The XRP/BTC wedge could experience a "fakeout," where the price briefly breaks above the resistance line only to be aggressively sold back down, trapping hopeful buyers and resuming the downtrend.

3. Lingering Legal Headwinds: While the main ruling was a victory, the final penalty in the SEC case could be larger than anticipated, generating negative headlines and creating short-term selling pressure. Any future regulatory actions targeting other aspects of the crypto space could also have a chilling effect.

4. Adoption and Competition: Ripple's success is not preordained. The cross-border payments space is fiercely competitive, with traditional players like SWIFT innovating and other blockchain projects vying for market share. The ultimate success of Ripple's business model—and by extension, the utility-driven demand for XRP—is still a long-term question.

5. Centralization and Supply Concerns: A long-standing criticism of XRP is the centralized nature of its ledger and the large portion of the total XRP supply held in escrow by Ripple Labs. While Ripple has a predictable schedule for releasing this escrow, it represents a potential source of selling pressure and a point of concern for those who prioritize decentralization above all else.

Conclusion: The Convergence of Evidence

The case for a significant XRP rally is a tapestry woven from multiple, converging threads of evidence. It is not based on a single indicator but on a powerful confluence of speculative sentiment, technical structure, and fundamental catalysts.

The frenzied buying of $3 call options is the market screaming its ambition, a raw and unfiltered signal of extreme bullishness. It is a bet not just on recovery, but on a complete paradigm shift in the valuation of XRP. This audacious sentiment finds its technical justification in the multi-year falling wedge on the XRP/BTC chart—a coiled spring of potential energy that, if released, would signal a historic rotation of capital into the long-suffering asset.

Underpinning these market signals is a strengthening fundamental picture. The crucial legal clarity from the SEC lawsuit has removed the single greatest obstacle to XRP's progress, allowing the market to finally price in the steady, persistent work Ripple has done in building a global payments network. Combined with the predictable dynamics of a crypto bull cycle, where laggards eventually have their day in the sun, the stage appears to be set.

The journey to $3—and beyond—is still a marathon, not a sprint. It is fraught with the risks of failed patterns, expiring options, and the inherent volatility of the crypto market. However, for the first time in years, the narrative is not one of defense but of offense. The signals are clear: the market is no longer asking if the sleeper will awaken, but is now placing massive, leveraged bets on the magnitude of the roar it will make when it does. The current moment represents the starting gun, and for traders and investors who have been watching from the sidelines, the race for XRP's repricing may have just begun.

Crypto breakouts: Bitcoin, Ethereum, and Solana lead the surgeJune brought a wave of positive sentiment to digital assets. Despite global uncertainty, major cryptocurrencies continued their upward movement. Investors are once again turning to decentralized assets amid expectations of a Fed rate cut and an increasingly fragile macro backdrop.

Key moves this month :

• Bitcoin (#BTCUSD) +4.6% — Strengthened by a weaker dollar and renewed institutional interest. JPMorgan projects $150,000 by 2025.

• Ethereum (#ETHUSD) +3.8% — Gains on ETF optimism and rising DeFi activity.

• Solana (#SOLUSD) +6.1% — In the spotlight due to network scalability and new Web3 partnerships.

• Ripple (#XRPUSD) +2.4% — Rebounding after positive developments in the SEC case and potential global alliances.

• Dogecoin (#DOGUSD) +5.2% — Community-driven momentum and fresh public support from Elon Musk.

Underperformers:

• Litecoin (#LTCUSD) –1.8%, Cardano (#ADAUSD) –2.2% — Profit-taking and lack of new drivers weighed on prices.

• Polkadot (#DOTUSD) –3.1% — Weak on-chain metrics and fading interest in cross-chain solutions added pressure.

According to FreshForex analysts, the crypto market is entering a recovery phase. Signals from the Fed hint at upcoming rate cuts, while interest in decentralized projects and crypto ETFs is rising. Market leadership by #BTC and #ETH reflects growing confidence, while altcoins continue to follow the broader upward trend.

XRP to $3? Searches Surge as Whale Activity Hints at Price Boom

XRP, the cryptocurrency developed by Ripple Labs, has long been a subject of intense speculation and debate within the crypto community. Despite facing regulatory hurdles and market volatility, XRP has maintained a dedicated following, fueled by its potential to revolutionize cross-border payments. Recently, searches for "XRP to $3" have surged, reflecting renewed optimism among investors as the token exhibits signs of increased whale activity, institutional buying, and rising retail interest.

This article delves into the factors driving the renewed interest in XRP, examining the recent price movements, whale activity, and technical indicators that suggest a potential surge to $3. We will analyze the significance of the breakout above $2.20, the consolidation phase below this level, and the potential for XRP to reach $3.40. Furthermore, we will explore the factors that could either support or hinder XRP's ascent, providing a nuanced perspective on the potential for this cryptocurrency to reach new heights. By synthesizing these insights, we aim to offer a comprehensive overview of the factors that could shape XRP's price trajectory in the coming months.

Whale Activity and Institutional Buying: A Bullish Signal?

One of the key factors driving the renewed interest in XRP is the observed increase in whale activity. Whales, defined as individuals or entities holding large amounts of a particular cryptocurrency, can have a significant impact on market prices due to their ability to execute large buy or sell orders.

Recent data suggests that whales have been accumulating XRP, with whale-to-exchange transfers dropping to zero. This indicates that whales are not selling their XRP holdings, but rather holding onto them or even buying more. This accumulation by whales is often seen as a bullish signal, as it suggests that they believe the price of XRP is likely to increase in the future.

In addition to whale activity, there are also signs of increasing institutional buying of XRP. Institutional investors, such as hedge funds, asset managers, and corporations, are increasingly allocating capital to cryptocurrencies, including XRP. This increased institutional adoption can drive up the price of XRP and provide a more stable foundation for its long-term growth.

Breakout Above $2.20: A New Support Level

Another factor driving the renewed interest in XRP is the recent breakout above $2.20. This breakout is significant because it confirms a new support level for XRP. A support level is a price level at which buyers are likely to step in and prevent the price from falling further.

The breakout above $2.20 suggests that there is strong buying pressure for XRP at this level. This buying pressure could be driven by a combination of factors, including whale activity, institutional buying, and rising retail interest.

Consolidation Below $2.20: A Pause Before the Next Rally?

After breaking out above $2.20, XRP has entered a period of consolidation below this level. This consolidation phase is a normal part of the market cycle, allowing the market to digest the recent gains and prepare for the next leg up.

During the consolidation phase, the price of XRP is likely to fluctuate within a narrow range. This fluctuation can create opportunities for traders to buy low and sell high, but it can also be a period of uncertainty for investors.

The key question is whether the consolidation phase is a temporary pause before another rally or a sign that the breakout above $2.20 was a false signal. If the price can hold above $2.20 and eventually break out above the upper resistance levels, it would confirm the validity of the breakout and increase the likelihood of XRP reaching $3.

Potential for XRP to Reach $3.40: A Technical Target

Several analysts have suggested that XRP could potentially reach $3.40 in the near future. This target price is based on technical analysis, which involves studying price charts and other market data to identify patterns and predict future price movements.

One of the technical indicators that suggests a potential rally to $3.40 is the bull flag pattern. The bull flag is a bullish continuation pattern that signals a continuation of an existing uptrend. If XRP can break out above the upper trendline of the bull flag, it could potentially reach $3.40.

Another technical indicator that suggests a potential rally to $3.40 is the Fibonacci retracement levels. Fibonacci retracement levels are horizontal lines that are drawn on a price chart to identify potential support and resistance levels. If XRP can break above the Fibonacci retracement levels, it could potentially reach $3.40.

Technical Indicators: CMF and MACD Show Bullish Momentum

In addition to the bull flag pattern and Fibonacci retracement levels, other technical indicators also suggest that XRP is poised for a potential rally.

The Chaikin Money Flow (CMF) is a technical indicator that measures the amount of money flowing into or out of an asset. A positive CMF value indicates that money is flowing into the asset, which is a bullish signal. The CMF for XRP is currently positive, suggesting that there is strong buying pressure for the cryptocurrency.

The Moving Average Convergence Divergence (MACD) is a technical indicator that shows the relationship between two moving averages of an asset's price. A bullish MACD crossover occurs when the MACD line crosses above the signal line, which is a bullish signal. The MACD for XRP is currently showing a bullish crossover, suggesting that the cryptocurrency is poised for a potential rally.

Factors Hindering XRP's Ascent

While there are several factors that suggest XRP could reach $3 or even $3.40, it is important to acknowledge that there are also factors that could hinder its ascent.

• Regulatory Uncertainty: XRP has faced regulatory challenges in the past, and ongoing regulatory uncertainty could dampen investor sentiment and prevent the cryptocurrency from reaching its full potential. The lawsuit filed by the Securities and Exchange Commission (SEC) against Ripple Labs continues to cast a shadow over XRP's future.

• Market Volatility: The cryptocurrency market is known for its volatility, and sudden price swings could wipe out gains and deter investors.

• Competition: XRP faces competition from other cryptocurrencies and traditional payment systems.

• Demand Fades: If demand for XRP fades, the price could fall back to previous support levels, such as $1.54.

XRP Bulls On Alert: 'This Trendline Is Everything'

Despite the potential challenges, XRP bulls remain optimistic about the cryptocurrency's future. Many analysts have emphasized the importance of a key trendline, stating that "this trendline is everything." This trendline represents a critical support level that must be maintained for XRP to continue its upward trajectory.

If XRP can hold above this trendline, it would signal that the bullish momentum remains intact and that the cryptocurrency is on track to reach its potential targets. However, if the price breaks below this trendline, it could indicate that the bullish momentum is fading and that a further correction is likely.

XRP Price Prediction: Possible Bullish Moves Ahead

Based on the current market conditions, technical indicators, and whale activity, there are signs that suggest possible bullish moves ahead for XRP. However, it is important to remember that the cryptocurrency market is inherently unpredictable, and there is no guarantee that XRP will reach $3 or $3.40.

Investors should carefully consider the risks involved and conduct thorough research before making any investment decisions. It is also important to diversify your portfolio and avoid putting all of your eggs in one basket.

Conclusion

Searches for "XRP to $3" have surged, reflecting renewed optimism among investors as the token exhibits signs of increased whale activity, institutional buying, and rising retail interest. The breakout above $2.20, the consolidation phase below this level, and the potential for XRP to reach $3.40 are all factors that have contributed to this renewed interest.

However, it is important to acknowledge that there are also factors that could hinder XRP's ascent, such as regulatory uncertainty, market volatility, and competition. Investors should carefully consider the risks involved and conduct thorough research before making any investment decisions.

Ultimately, the future of XRP's price will depend on a complex interplay of technical factors, market sentiment, and fundamental developments. By staying informed and using proper risk management techniques, investors can position themselves to potentially profit from XRP's continued growth and success. As always, remember to consult with a qualified financial advisor before making any investment decisions. The potential for XRP to reach $3 offers a tantalizing glimpse of potential gains, but prudent analysis and risk mitigation are essential for navigating the volatile world of cryptocurrency.

XRP Price Soars Past $2.15: Next Stop $2.38? XRP Price Prediction: What’s Next After Breaking $2.15 Resistance?

Ripple’s XRP has been making waves in the cryptocurrency market, recently breaking above the critical $2.15 resistance level and surging nearly 8% in the last 24 hours to trade at $2.18. With a further 9% climb in recent sessions and open interest jumping to $3.77 billion, the coin is showing strong bullish momentum. Analysts are now eyeing targets of $2.33 and even $2.38 in the near term. But what lies ahead for XRP after this breakout? Is this the start of a sustained rally, or could resistance at higher levels cap the gains?

________________________________________

XRP Price Action: Breaking Key Resistance at $2.15

XRP’s recent price surge has caught the attention of traders and investors alike. After trading in a consolidation range for weeks, the cryptocurrency initiated a fresh increase from the $1.92 zone, gaining momentum as it approached the $2.00 level. A significant development came when XRP broke above a key bearish trend line with resistance at $2.00 on the hourly chart of the XRP/USD pair (data sourced from Kraken). This breakout was followed by a decisive move past the $2.15 resistance, a level that had previously capped upward movements.

Currently, XRP trades above $2.18, sitting comfortably above the 100-hourly Simple Moving Average (SMA), a widely watched indicator of short-term trend direction. The price action over the last 24 hours shows an 8.2% increase, with some sessions recording gains as high as 14%, particularly following geopolitical developments like the Iran-Israel ceasefire, which boosted risk assets across markets. This recovery from the $1.90 low demonstrates strong buying interest and renewed confidence in XRP’s potential.

The immediate question for traders is whether XRP can sustain this momentum. The next resistance zone lies between $2.20 and $2.33, with some analysts even targeting $2.38 based on rising open interest and market volume. A close above $2.18 in the coming hours could signal the start of another leg up, while failure to hold this level might see a pullback toward $2.10 or lower.

________________________________________

Technical Analysis: Bullish Indicators and Key Levels to Watch

To understand XRP’s potential trajectory, let’s dive into the technical indicators and key levels shaping its price action.

Support and Resistance Levels

• Support: The $2.10 level, previously a resistance, now acts as a near-term support alongside the 100-hourly SMA. A break below this could see XRP test the $2.05 zone, with further downside potential to $1.92 if bearish pressure mounts.

• Resistance: The immediate hurdle lies at $2.20, a psychological barrier that has historically posed challenges. Beyond this, $2.33 emerges as a critical target, as breaking this level could confirm a short-term bullish continuation. Analysts also highlight $2.38 as a feasible target if momentum persists.

Moving Averages and Trend Indicators

XRP’s position above the 100-hourly SMA is a bullish sign, indicating that buyers are in control of the short-term trend. Additionally, the price recently crossed above the 50-hourly SMA during its 14% surge, further reinforcing the bullish outlook. The convergence of these moving averages suggests that a golden cross—a bullish signal where a shorter-term average crosses above a longer-term average—could be forming on lower timeframes, potentially attracting more buyers.

Relative Strength Index (RSI)

The RSI on the hourly chart currently sits around 65, indicating that XRP is approaching overbought territory but still has room to run before reaching extreme levels (above 70). This suggests that the current rally could extend further, provided no major negative catalysts emerge.

Volume and Open Interest

One of the most encouraging signs for XRP bulls is the surge in trading volume and open interest. Open interest in XRP futures has jumped to $3.77 billion, reflecting growing speculative interest and confidence in further price gains. High volume accompanying the breakout above $2.15 adds credibility to the move, as it indicates genuine market participation rather than a low-liquidity pump.

Symmetrical Triangle Pattern

On the longer-term charts, XRP has been forming a 334-day symmetrical triangle, a consolidation pattern often preceding major breakouts. Analysts predict that this pattern could resolve between July and September 2025, with potential targets ranging from $2 to $5 depending on the direction of the breakout. The recent move above $2.15 could be an early indication of bullish intent, though confirmation of a full breakout from the triangle remains months away.

________________________________________

XRP Price Prediction: Short-Term Outlook (Next 24-48 Hours)

Given the current momentum, XRP appears poised for further gains in the immediate term. Analysts predict a potential 7% move toward $2.33 within the next 24 hours if the price maintains its position above $2.18. This target aligns with the upper boundary of the recent trading range and represents a key Fibonacci retracement level from the prior downtrend.

However, traders should remain cautious of the $2.20 resistance zone, where selling pressure could emerge. A failure to close above this level on the hourly or 4-hour charts might trigger profit-taking, leading to a pullback toward $2.10 or $2.05. On the flip side, a decisive break above $2.20 with strong volume could pave the way for a test of $2.33 and potentially $2.38 in the coming days.

________________________________________

What XRP Users Are Talking About This Week: Rumors, Predictions, and Debates

The XRP community has been abuzz with discussions this week, fueled by the coin’s impressive price action and broader market developments. Here are some of the key topics dominating conversations on platforms like Twitter, Reddit, and crypto forums:

1. Geopolitical Impact on XRP: The recent Iran-Israel ceasefire has been credited with boosting risk-on sentiment across markets, including cryptocurrencies. Many XRP holders believe this event contributed to the 14% surge that saw the price reclaim $2.00, with some speculating that further de-escalation could drive additional gains.

2. Regulatory Clarity for Ripple: Ongoing debates about Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) continue to influence sentiment. While a resolution seems closer than ever, with rumors of a potential settlement circulating, uncertainty remains a key concern. A favorable outcome could act as a major catalyst for XRP, potentially pushing it toward new highs.

3. Adoption and Utility: XRP users are excited about Ripple’s continued partnerships with financial institutions for cross-border payments. Recent announcements of pilot programs in new regions have fueled speculation that increased adoption could drive organic demand for XRP, supporting long-term price appreciation.

4. Price Predictions: Community predictions range from conservative targets of $2.50 in the near term to more ambitious forecasts of $5 or higher by the end of 2025. Much of this optimism hinges on the symmetrical triangle breakout expected next year, as well as broader market trends like the Bitcoin halving in 2024.

These discussions highlight the mix of optimism and caution within the XRP community. While the recent breakout has bolstered confidence, many users remain wary of external factors like regulatory developments and macroeconomic conditions that could impact the coin’s trajectory.

________________________________________

XRP Climbs 9% as Open Interest Jumps to $3.77B: Eyes $2.38 Target

XRP’s 9% climb in a recent session, coupled with open interest soaring to $3.77 billion, underscores the growing interest from both retail and institutional traders. Open interest represents the total value of outstanding derivative contracts, and its sharp increase suggests that market participants are betting on continued price movement—likely to the upside given the current trend.

This surge in open interest aligns with XRP’s break above $2.15, reinforcing the notion that the rally has strong backing. Analysts now eye a $2.38 target, which corresponds to the 61.8% Fibonacci retracement level from the previous major swing high to low. Achieving this target would require sustained buying pressure and a break above the $2.33 resistance, but the current market dynamics suggest it’s within reach if no major sell-offs occur.

However, high open interest also introduces the risk of volatility. If the price fails to break higher and sentiment shifts, a wave of liquidations could amplify downside moves. Traders should monitor funding rates on futures platforms to gauge whether speculative positions are becoming overly leveraged, as this could signal an impending correction.

________________________________________

Ceasefire Boosts XRP Recovery: Bullish Continuation

Above $2.33?

The geopolitical landscape has played a surprising role in XRP’s recent recovery. Following a low of $1.90 amid broader market uncertainty, the announcement of a ceasefire between Iran and Israel injected optimism into risk assets, including cryptocurrencies. XRP responded with a 14% jump to reclaim the $2.00 level, a move that has since solidified with the break above $2.15.

This recovery highlights XRP’s sensitivity to external catalysts. While technical factors like resistance levels and chart patterns drive day-to-day price action, macro events can act as significant tailwinds or headwinds. If the ceasefire holds and global markets remain stable, XRP could see continued buying interest from investors seeking exposure to high-growth assets.

The key level to watch now is $2.33. A break above this resistance with strong volume could confirm a short-term bullish continuation, potentially targeting $2.38 or higher. Conversely, if geopolitical tensions resurface or broader market sentiment sours, XRP might struggle to maintain its gains, with $2.10 acting as the first line of defense.

________________________________________

When Will XRP Price Hit All-Time High? Timeline Revealed

XRP’s all-time high (ATH) of $3.84, reached during the 2017-2018 bull run, remains a distant target for many holders. However, recent technical developments and market trends provide clues about when the coin might approach or surpass this level.

Symmetrical Triangle Breakout: July–September 2025

As mentioned earlier, XRP has been forming a 334-day symmetrical triangle on the weekly chart, a pattern characterized by converging trendlines as price swings narrow over time. Such patterns often precede significant breakouts, with the direction determined by market sentiment at the time of resolution. Analysts predict that this triangle could break between July and September 2025, offering a window for a major price move.

If the breakout is bullish, targets range from $2 (a conservative estimate based on prior resistance) to $5 (a more optimistic projection based on the triangle’s height). A $5 target would represent a new ATH, surpassing the 2018 peak by over 30%. This scenario assumes favorable market conditions, including a broader crypto bull run potentially triggered by the Bitcoin halving in 2024.

Factors Influencing an ATH

Several factors could influence whether XRP reaches a new ATH within this timeline:

• Regulatory Resolution: A positive outcome in Ripple’s SEC lawsuit could remove a major overhang, unlocking significant upside potential.

• Market Cycles: Crypto markets often follow cyclical patterns, with bull runs occurring every 3-4 years. If 2025 aligns with the next cycle peak, XRP could ride the wave to new highs.

• Adoption Growth: Increased use of XRP for cross-border payments through RippleNet could drive organic demand, supporting a higher price floor.

• Macro Environment: Favorable economic conditions, such as low interest rates or stimulus measures, could boost risk assets like XRP.