TradeCityPro | VETUSDT The Best Entry Opportunity Awaits👋 Welcome to TradeCityPro Channel!

Let’s dive in and analyze one of the veteran coins in the cryptocurrency space, VET, which has a high potential for movement. Together, we’ll identify its entry triggers.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

In the weekly time frame, VET is one of the coins that’s in a relatively good position compared to other altcoins. While most altcoins have recorded new lows, VET has never lost the 0.01430 level!

After being supported at 0.01922 and closing a green weekly candle, we experienced an upward move. Currently, we’re stuck at the resistance of 0.03176, and it seems we’re pulling back to this resistance.

📉 Daily Time Frame

In the daily time frame, after an upward wave that didn’t quite reach the 0.09 resistance, a fake candle occurred, and we entered a box between 0.04197 and 0.05253. Seller presence and a rejection from the middle of the box led to losing the 0.04197 support.

After breaking this support, we experienced a sharp decline. When we reached the 0.01925 support, the bearish momentum hit its lowest point, and we saw reactions from buyers, leading to an upward move.

Currently, we’re below the key resistance at **0.03233**. After breaking this level, we can expect a sharp upward move. You can take a position in both **futures and spot**, with the safest stop loss for your buy at 0.01925

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Riskmangement

Two Shots at NQ: Because One's Never EnoughAlright, here’s the game plan – because let’s be honest, the market loves nothing more than pretending to break out, then snapping back just to mess with us.

🔥 The Setup:

I’m eyeing the Micro E-mini Nasdaq-100 Futures (June 2025), and I’m giving myself two shots at this breakout. Yeah, I know – ambitious. But the market’s been playing hard to get lately, so I’m hedging my enthusiasm.

💡 Why Two Long Entries?

Because, let’s face it, the first entry will probably get stopped out. I like to think of it as a “testing the waters” trade. If it works, great – I’m a genius. If not, well, it was just practice.

First Entry (The Optimist):

I’m jumping in if it breaks out, keeping the stop tight – because nothing says confidence like a cautious stop loss.

Second Entry (The Realist):

If the first entry faceplants, I’ll wait for the market to freak out and then calm down. Then, I’ll slide back in when it looks like it’s actually serious this time.

🧠 Managing the Chaos:

Short-Term Target: The last high – because if it doesn’t clear that, what’s the point?

Long-Term Target: The equal move – assuming the market doesn’t chicken out halfway.

Stop-Loss: Snug and sensible, because I’d rather not watch my account do a disappearing act.

Take profit targets are set where the equal move would complete – assuming the market cooperates for once.

💭 The Thought Process:

I’m not here to pretend I can predict the future – if I could, I’d be on a yacht, not posting on TradingView. But this setup gives me two chances to be right, which is at least one more than usual.

🔥 Your Thoughts?

If you’re also giving your trades a second (or third) chance, drop a comment. Or just let me know how your latest breakout fake-out went – because misery loves company. 😅

Why Financial Clarity Comes Before Any Forex Trade?Before any strategy or setup, I ask one thing: is my personal financial foundation strong enough to support this trade?

In this reflection, I explore the direct impact that personal finance management has on trading performance — not as an abstract idea, but as a daily reality. When financial clarity is missing, emotional decision-making creeps in. When it’s present, I trade with more patience, discipline, and perspective.

This is not trading advice. It’s a caution to those who see trading as a way out, rather than something built upon stable ground.

Guess what? I am on a Demo Account. I will keep on trading on a Demo Account until I know that I have a solid risk management plan and a trading methodology that both will give me consistent profits.

The whole Idea with personal finance management in forex trading is to know whether you can afford trading and once you know the answer to that what is your game plan.

Just a quick hint.. If your answer is no; meaning that today you cannot afford trading, don't be discouraged, there is still a plan that can be designed. Actually, I think the ones who cannot afford trading are in a better positions than those who can.

The ones who cannot afford trading today, can easily start learning without having the itch to open a live account.

TradeCityPro | INJUSDT Ready for a Big Move?👋 Welcome to TradeCityPro Channel!

Let’s dive in and analyze one of the popular crypto projects, INJ, which has a high likelihood of movement, and check our entry triggers together.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

On the weekly time frame, I see that the seventh period is stable, INJ, and compared to the majority of altcoins that have their own low price levels, it is in a better space and is engaged in its own supports!

After breaking the primary trend ceiling, namely 9.28, we experienced a sharp upward movement and formed a historical ceiling at $53, and after forming a distribution box and breaking the important floor of 16.20 and pulling back to it, we experienced a continued decline.

We have now reached support again, which was previously a very important resistance, and now, as a result, it is probably not lost, but the weekly candle is a very good and bearish candle! Don’t forget to save your profit, your strategy booklet, and your positions, otherwise, you will have made a 450% move without adding anything to your capital!

📉 Daily Time Frame

On the daily time frame, our trend is completely bearish as you can see, and the events are completely accompanied by the formation of a downward bottom and top, but we are likely to suffer for a while.

After getting rejected from 34.16 and forming a box between 20.16 and 25.93 and losing the bottom, it made a move and then while pulling back with low volume and the next conversion to red, it became an inverted Sharpe, we experienced a decline!

After breaking the daily trendline, which was also an important trendline, its trigger at 8.48 was broken, and we are currently engaged with the resistance at 10.47, and the next and most important trigger, so to speak, is after breaking 10.47, and you can even have a spot buy with this level!

🕓 4-Hour Timeframe

In the 4-hour time frame, we are also ranging between the box of 9.24 to 10.41, and practically, whichever side we break, we can say we can take its position and go along with it!

📈 For a long position, the trigger is completely clear, and after breaking 10.41, make sure to take a long position, and you can even open a position before this trigger breaks with the presence of momentum in lower time frames!

📉 For a short position, we have just formed the support at 9.24, and if we bounce from this support and hit a lower high, or better yet, get rejected before 10.41, we go for a short position and a break of 9.24!

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | ENSUSDT Huge Breakout Coming? 👋 Welcome to TradeCityPro Channel!

Let’s dive in and analyze one of the DeFi coins, ENS, together. It’s been performing well recently and has some exciting news!

🌐 Bitcoin Overview

Before starting the analysis, I want to remind you that, as per your request, we’ve moved the Bitcoin analysis from the main section to a separate daily analysis. This allows us to discuss Bitcoin’s status in more detail and analyze its charts and dominance together.

This is the general analysis of Bitcoin dominance, which we promised to cover separately and analyze in longer timeframes.

📊 Weekly Timeframe

In the weekly timeframe, ENS is one of the bullish coins in the market with a promising outlook. It began its main upward movement before the start of 2025, back in late 2023.

After breaking the 9.99 level, we entered the main uptrend, and we can say that we broke the market cap ceiling, achieving a new ATH market cap.

We’re also riding a bullish curved line that acts as support. If this line is broken, it signals a weakening of the main uptrend. A drop below 15.90 would indicate a trend change in the MWC (Market Wide Correction).

Currently, our key weekly support has shifted. We were supported at 13.15, easily moving past this level. Our spot exit trigger is now 13.15, whereas last week it was 15.90.

📈 Daily Timeframe

In the daily timeframe, after a rejection from the ATH at 47.68, we entered a range box between 30.75 and 37.77. After some weak movements toward resistance, we saw a corrective wave.

Following a daily engulfing candle that covered the previous three candles, we experienced a sharp downward wave to 13.49. After that, seller pressure seemed to fade, and buyers stepped in. After a fake breakout at 13.49, we saw a move up to 18.41.

Additionally, the trendline formed during the recent declines in this chart was broken after the support at 13.49. However, since the trigger hasn’t been activated yet, we’re not acting on this trendline for now. But if 18.41 is broken, you could consider a risky spot buy.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Optimal Position Size May Reduce RisksOptimal Position Size May Reduce Risks

Position sizing in trading is a crucial yet often overlooked aspect of risk management. It's the art of determining how much capital to allocate to each trade, balancing the potential for effective trading with the need to protect your investment. This article delves into the principles of position sizing, offering insights into how traders may optimise their strategies to potentially reduce risk and maximise their trading opportunities.

What Is Position Sizing in Trading?

Position sizing, or trade sizing, is a fundamental concept in trading that determines how much capital is allocated to a specific trade. This process isn't about maximising profits; it's crucial for managing risk. The right position size may minimise the potential loss on each trade relative to the overall capital, potentially ensuring that a single loss doesn't significantly impact the trader's account.

In essence, determining trade sizes is a balancing act. It involves calculating the appropriate amount to invest based on various factors like account size, risk tolerance, and market conditions. This calculated approach contrasts sharply with random or emotional decision-making, where the size of a trade might be based on a hunch or a desire to recoup losses.

The Role of Leverage in Position Sizing

Leverage in trading is comparable to a double-edged sword. It allows traders to control larger positions with a smaller amount of capital, effectively amplifying both potential returns and risks. When a trader employs leverage, they borrow capital, increasing their trading power.

However, when combined with strict position sizing and stop-loss placement, leverage serves a different role. It doesn't necessarily increase the risk but rather reallocates capital more efficiently.

For example, if someone uses leverage to open a position, they're required to commit only a fraction of the trade's total value, known as the margin. If they’re risking 1% of their account balance on a single trade and never move their stop loss, the trader’s loss is limited to this 1%, regardless of how much leverage they use. The only difference is that lower leverage uses more capital for margin and vice versa.

Key Factors Influencing Position Size

When it comes to determining the right position size in trading, two key factors come into play, both crucial for tailoring risk management to individual needs:

- Risk Tolerance: Every person has a unique comfort level with risk. Some might be inclined to use a larger proportion of their account balance on a given trade, accepting higher potential losses for greater potential gains, while others may prefer a more conservative stance, prioritising capital preservation.

- Market Volatility: The level of volatility in the market significantly influences position sizing. In highly volatile markets, where price swings are more pronounced, reducing position size can be a prudent strategy to potentially limit exposure to sudden and severe market movements.

Calculating Optimal Position Sizes

Understanding how to calculate position sizes is a cornerstone of effective trading. The process involves several steps that balance risk management with the potential for returns. Here’s a detailed breakdown:

- Determining Risk Tolerance Per Trade: First, decide what percentage of your trading capital you are willing to risk on a single trade. A common guideline is the 1% rule, meaning if you have $10,000, you will lose no more than $100 per trade.

- Setting a Stop-Loss Order: This is a predetermined point where a losing trade will be closed to prevent further losses. The stop-loss is set based on market analysis and does not exceed the risk tolerance.

- Calculating the Risk per Share/Unit: Subtract the stop-loss level from the entry price. For example, $50 (entry price) in the stock market - $45 (stop-loss) equals a $5 risk per share.

- Determining Position Size: Divide the dollar amount you’re willing to risk by the risk per share/unit. Using the $100 risk on a $10,000 account, divide this by the $5 risk per share: $100/$5 = 20 shares. Thus, you should buy 20 shares to stay within your 1% limit.

As a result, if your stop-loss is triggered, you’d only lose 1% of your total capital.

Position Sizing Strategies

In trading, there are two commonly used position-sizing strategies:

- Fixed Percentage Model: This strategy involves risking a fixed percentage of the total trading capital on each trade. For example, one might consistently risk 2% of their capital per trade. This method automatically adjusts the dollar amount at risk based on the current account size, potentially ensuring that losses are proportionate to the account's value.

- Dollar Amount Risk Model: Here, traders potentially lose a set dollar amount on every trade, regardless of the account size. For instance, a trader may decide to risk $500 on each trade. This model is simpler and easier to manage, especially for traders with less experience, but doesn't adjust for changes in the total account value, which could be a drawback as the account grows or shrinks.

The Impact of Position Sizing on Trading Performance

Optimal position sizing is risk-reducing and plays a critical role in a trader's overall performance. By allocating the right amount of capital to each trade, they potentially can manage potential losses more effectively, preserving their trading capital over the long term. This approach is believed to help traders be sure that a series of losing trades does not significantly deplete the account, allowing them to remain in the market.

Moreover, optimal position sizing may contribute to emotional stability. Traders are less likely to experience extreme stress or make impulsive decisions when they know their risk is controlled and losses are within acceptable limits. This psychological benefit cannot be overstated, as a calm and focused mindset is essential for making rational trading decisions.

The Bottom Line

In essence, mastering position sizing is key to balancing potential gains with prudent risk management. Remember, optimal position sizing is about protecting your capital while maximising opportunities and is a valuable tool in long-term, sustainable trading.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

TradeCityPro | MNTUSDT The Best Coin for Short Positions👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of the popular DeFi coin that’s active on the Mantle chain—where they’re running multiple airdrops and utilizing it for fees. Let’s break it down and analyze it together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

After hitting 1.4077, which was our previous ATH, there were practically no buyers present here, preventing us from breaking this key ceiling and moving upward.

Additionally, after the rejection from this high and an engulfing of the previous two candles, it’s safe to say our upward movement has concluded, and we’re now heading into at least a period of correction. This has already started as we’ve entered a resting phase from the prior trend.

However, after breaking 0.9030 coinciding with the news of the Bybit hack and the theft of Ethereum and its coins by North Korean hackers we experienced a sharp drop. Given that Bybit held a large volume of this token, the decline was even more pronounced.

📉 Daily Timeframe

In the daily timeframe, after the rejection from 1.4077 and a deep drop, we moved upward again. This time, we hit resistance at 1.2353 multiple times, but nothing happened buyers couldn’t push above this level.

With this lack of buying pressure, sellers stepped into the market. We then formed a support at 1.0102, but after breaking it along with the hack news we saw a sharp drop down to 0.06552! This level is highly significant!

It’s important because this was previously a key resistance, and after breaking it earlier, we kicked off our main uptrend. So, it’s a critical support now, and it won’t break easily! However, if this support does fail, we’ll likely see a drop to 0.5340.

For buying, it’s not a good time yet. But if we get support at 0.6552 with a strong daily candle, we could consider a buy. Alternatively, wait for a box formation and structure. Our current entry trigger would be a break above 0.8464. For selling, my stop loss would be below 0.5340.

🕓 4-Hour Timeframe

In the 4-hour timeframe, after a rejection from 0.8492, we moved down to 0.6539, where we’re currently ranging around this support. A break of this level could set up an excellent short position opportunity.

For a short position, breaking below 0.6539 offers a clean and complete trigger, allowing us to capitalize on this move.

For a long position, we have a couple of scenarios: a fake breakout of the critical 0.6539 support or a break above the 0.6716 trigger could justify opening a long. While there are better coins for longs, a break of the ceiling with higher highs and lows could also warrant a long position.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | AVAXUSDT Watch the Altcoins!👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of one of my favorite coins, which is likely to make a move this week. Let’s break it down and take a closer look together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly timeframe, the AVAX chart is one of the smoothest and most technical charts I’ve seen—support and resistance levels work like a charm, and price patterns are fairly predictable.

After getting rejected at the key resistance of 53.62—a historically significant level—sellers stepped in, pushing us into a deep correction. The failure to break this level was partly because we didn’t enter overbought territory on the weekly chart.

For buying, the weekly chart is currently very bearish, so jumping in now isn’t logical. However, a break above 53.82 would be our most reliable trigger for an upward move. For exiting, if we drop below 21.02, I’d personally cash out. If we climb back above 21.02, I’d buy again—this time with fewer AVAX but the same USDT amount to manage risk.

📉 Daily Timeframe

In the daily timeframe, after a rejection at 53.96 that led to a correction, it seemed likely we’d test this resistance again. However, after the rejection, we broke below 44.21, forming a price range box.

Right now, we’re not paying much attention to resistance levels. Our trendline is showing lower highs but flat lows, indicating that our movement is driven by the trendline rather than traditional support and resistance.

With that in mind, a break of the trendline could spark a move, but we still need a trigger. The 22.71 level is our breakout trigger—not just a resistance. If we break it, we could enter a buy with a risky stop loss at 16.00. Confirmation would come from a spike in volume. For selling, if we get rejected at the trendline and break below 16.00, I’d personally exit.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice—always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | VETUSDT Keep an Eye on the Charts!👋 Welcome to TradeCityPro Channel!

Let’s dive into the days when the world is buzzing with interesting events—countries are forming alliances, and news of Trump’s tariffs to negotiations is everywhere. You need to keep a sharp eye on the financial markets and your assets!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

After the bullish move from the 0.01963 support, we got rejected at 0.08271, essentially wiping out the entire move and fully retracing our steps.

We’ve now returned to the 0.01963 support, where we’re forming a solid green indecision candle, backed by noticeable buying pressure. This level has shown a strong reaction, acting as a reliable support.

This could serve as a decent buy trigger with low risk, offering a good entry point. Personally, though, I’m holding off on buying until we see stronger momentum in the chart and market, and until Bitcoin dominance experiences a deeper pullback.

📉 Daily Timeframe

In the daily timeframe, VET is among the coins that have faced a brutal sell-off! From its last peak, it’s dropped roughly 77%, and those without proper risk management have likely been wiped out.

After forming a support box between 0.04224 and 0.05298, we saw a fakeout above the box, signaling further downside. The last time we held support at 0.04224, we couldn’t reach the box’s ceiling, leading to a sharp drop. But after hitting 0.01942, the price has calmed down a bit.

For buying in spot or even futures positions, we’d need a break of the trendline and its trigger at 0.02352 to confirm entry, given the trendline’s retracement nature. If we get rejected from this trendline, a short position in a lower timeframe could make sense. Should 0.01942 break, the downtrend will likely continue. For spot entry confirmation, a surge in volume and a break above 48.68 RSI would be a strong signal.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Mastering Volatile Markets: Why Reducing Position Size is Key █ Mastering Volatile Markets Part 1: Why Reducing Position Size is Key

Trading is always challenging, but how do you navigate today's markets? That's a whole different level. Today, we'll move away from the usual "Trump's tariffs are horrendous" discussions. We'll instead focus on how experienced traders profit in the current volatile market.

Right now, we're seeing extreme volatility across many assets. It's not uncommon for markets to move 3% to 10% in a single day , and for indices like NAS100 (Nasdaq), intraday swings of 300 to 500 points can happen in just 5 to 30 minutes.

This can seem like bad news, but as Warren Buffet said in 2008, "In short, bad news is an investor's best friend."

Volatile markets can shake even experienced traders — but they don’t have to. With 16 years of trading experience , we’ll show you exactly how to approach conditions like these with confidence and clarity.

█ Reducing position size is the key to surviving volatility:

The most critical adjustment in a volatile market is reducing position size.

Why? Because when the market moves faster and with bigger swings, your potential risk per trade automatically increases. The key is to keep your d ollar risk the same — even when volatility is exploding.

⚪ Let's take a look at how position size changes when markets change:

2 Weeks Ago — Stable Market:

NAS100 average move per trade = 50 to 100 points

Risk per trade = 100 points = $500 risk (for example)

Position Size = 5 contracts

Today — Volatile Market:

NAS100 average move per trade = 300 to 500 points

To maintain the same $500 risk per trade → Position Size = 1 contract

⚪ The Benefit:

With a smaller position, you can still earn the same profit because the price is moving much more. At the same time, your risk stays controlled , even in these wild markets.

This is exactly how professional traders survive and thrive in volatile conditions — by adjusting to what the market is giving them.

⚪ What Happens If You Don't Reduce Size?

Let's say you keep the same position size as in stable markets, but now the market moves 300-500 points against you instead of 50-100. Here's how it plays out (example):

In Stable Markets (NAS100 average move: 50-100 points):

Position Size: 5 contracts

Risk per contract: $10 per point

Risk per trade: 100 points x $10 x 5 contracts = $5,000 risk per trade

In Volatile Markets (NAS100 average move: 300-500 points):

Position Size: 5 contracts (unchanged)

Risk per contract: $10 per point

Risk per trade: 500 points x $10 x 5 contracts = $25,000 risk per trade

Without reducing position size, your risk increases dramatically as the market moves wildly. As a result, your losses will skyrocket when the market moves against you.

█ Summary:

Huge volatility = Smaller position size

Same risk = Same profit potential

Trade smarter, not bigger

This is rule number one when navigating wild markets like the ones we have today.

█ What's Coming Next in the Series:

Part 2: Liquidity Is the Silent Killer

Part 3: Patience Over FOMO

Part 4: Trend Is Your Best Friend

Stay tuned for the next part — and remember, adapting to volatility isn't just about managing risk, it's about mastering the market!

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

TradeCityPro | MNTUSDT Effects of the Bybit Hack👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of the popular DeFi coin that’s active on the Mantle chain—where they’re running multiple airdrops and utilizing it for fees. Let’s break it down and analyze it together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

After hitting 1.4077, which was our previous ATH, there were practically no buyers present here, preventing us from breaking this key ceiling and moving upward.

Additionally, after the rejection from this high and an engulfing of the previous two candles, it’s safe to say our upward movement has concluded, and we’re now heading into at least a period of correction. This has already started as we’ve entered a resting phase from the prior trend.

However, after breaking 0.9030—coinciding with the news of the Bybit hack and the theft of Ethereum and its coins by North Korean hackers—we experienced a sharp drop. Given that Bybit held a large volume of this token, the decline was even more pronounced.

📉 Daily Time Frame

In the daily timeframe, after the rejection from 1.4077 and a deep drop, we moved upward again. This time, we hit resistance at 1.2353 multiple times, but nothing happened—buyers couldn’t push above this level.

With this lack of buying pressure, sellers stepped into the market. We then formed a support at 1.0102, but after breaking it—along with the hack news—we saw a sharp drop down to 0.06552! This level is highly significant!

It’s important because this was previously a key resistance, and after breaking it earlier, we kicked off our main uptrend. So, it’s a critical support now, and it won’t break easily! However, if this support does fail, we’ll likely see a drop to 0.5340.

For buying, it’s not a good time yet. But if we get support at 0.6552 with a strong daily candle, we could consider a buy. Alternatively, wait for a box formation and structure. Our current entry trigger would be a break above 0.8464. For selling, my stop loss would be below 0.5340.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

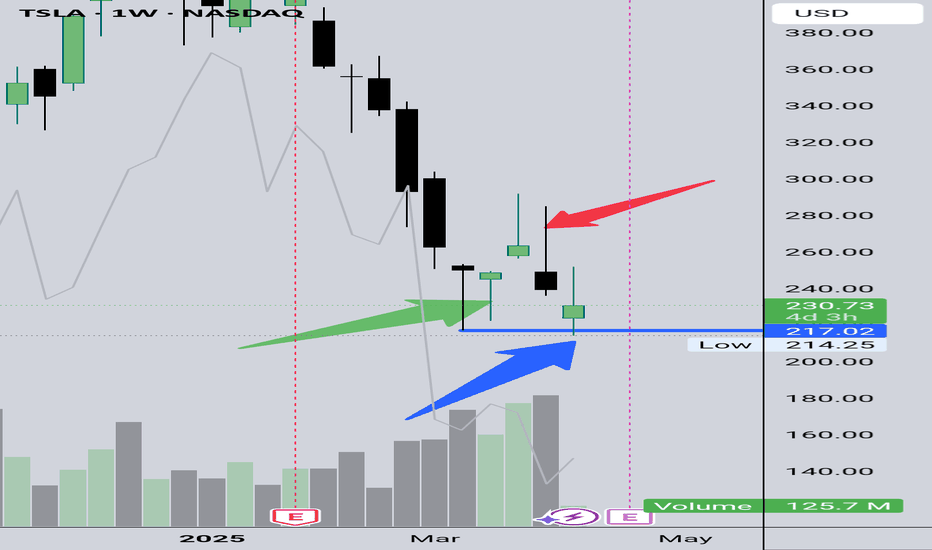

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

A Practical Framework for Overcoming Fear in Trading“Fear is not real. The only place that fear can exist is in our thoughts of the future. It is a product of our imagination, causing us to fear things that do not at present and may not ever exist. Do not misunderstand me, danger is very real, but fear is a choice.” - Will Smith, After Earth

Although I firmly agree with this statement, I also have to acknowledge that while fear is a choice, it’s also a biological response to perceived threats like uncertainty, lack of control, and experience.

When faced with these threats the brain activates the amygdala which triggers the fight or flight response releasing hormones like cortisol and adrenaline, preparing the body to respond quickly and instinctively.

If left alone, traders consumed with fear will either seek to take vengeance against the markets, typically referred to as “Revenge Trading” or they’ll hesitate when taking the next position fearing that it would be a repeat of the last. Either way, it never ends well.

In today’s article we’re going to be breaking down fear both figuratively and literally, by gaining a deeper understanding on how it works and what steps we should take to overcome it.

Three Types of Fears in Trading:

Now I’m sure most of you reading this article are familiar with the three types of fears related to trading, so I’ll go through these quite briefly but for those of you who might not be that familiar I’ll leave a short explanation for each of the fears highlighted.

Fear of Missing Out (FOMO):

The apprehension of missing profitable opportunities leads traders to enter trades impulsively without proper analysis, often resulting in poor outcomes. Traders experiencing FOMO generally find themselves in trading signal groups or rely on social media for direction, see my previous article on Trading Vs. Social Media

Fear of Losing Money:

The anxiety associated with potential financial loss can cause traders to exit positions prematurely or avoid taking necessary risks. This fear is closely linked to loss aversion, where the pain of losing is felt more intensely than the pleasure of equivalent gains.

Fear of Being Wrong:

The discomfort of making incorrect decisions can deter traders from executing trades or cause them to hold onto losing positions in an attempt to prove their initial decision was right.

In many respects, traders try to deal with these fears directly but usually without much success. This is because they’re treating the symptom but not the cause.

In order to deal with any of these fears either independently or collectively you’d need to first learn to become comfortable in three very specific areas.

Uncertainty - At its core, trading is a game of probabilities, not certainties. Certainty in trading comes only when you’re able to shift your focus from the outcome of any one trade to your ability to take any one trade regardless of the outcome. Remember, it's not your job to predict the future, rather you should prepare for it.

Past Losses - The outcome of one trade has absolutely no impact on the outcome of the next, and the best way to deal with past losses is to embrace the lessons that came with it.

Lack of Control - Although we cannot control the outcome of a trade, we do control the type of trade we take. We can control when we enter, exit, and how much we risk, which when examined closely carries far more significance than merely seeking to control the outcome.

Debunking The Biggest Myth In Trading

If you won then you were right, if you lost then you were wrong. This is the biggest myth in trading today and one of the main reasons why so many traders chose being right over being profitable.

Instead of accepting a loss, they’ll remove whatever stop loss they had in place in the hope that the market will eventually turn in their favor, refusing to accept that they may have been wrong.

There are very good reasons for this type of behaviour which is tied directly to our identity, social belonging and self-worth. When we’re faced with the possibility of being wrong our intellect, competency and self-image is challenged.

In order to protect ourselves from this challenge, we begin to resist any new information that could conflict or even threaten our existing belief, creating discomfort even when the evidence is clear.

This can trigger emotions like anxiety and avoidance behaviour which can show up in the form of hesitation, overthinking, or avoiding placing trades altogether. However, I’m about to share a framework with you that will help you overcome the fear of being wrong and instead of avoiding it, if you follow this framework, you’ll begin to embrace it.

3 Step Process To Profit From Being Wrong

In trading Losses are inevitable. In fact, some of the most successful traders lose far more times than they actually win, and yet they’re still able to make money. This is because you don’t need to be a winning trader in order to be a profitable one.

It’s under this principle that you’ll apply the 3 step process to profit from being wrong.

1. Reframe “Wrong” as “Feedback”

Generally being wrong comes with consequences, in trading those consequences comes in the form of losses. However, you determine how much you’re willing to lose on any given trade. This means that because you control how much you’re willing to lose, you ultimately control the consequences.

The market is a nearly endless pool of trade opportunities and no one trade can determine the outcome of the next. Therefore, a losing trade cannot mean you were wrong, because as long as you still have capital to trade there is another opportunity lining up.

Instead, what the losing trade does uncover is the market conditions in relation to your plan. It’s at this point where you review your initial analysis and see if anything has changed. If nothing changed, then it's likely you may have gotten in a bit too early and you’d just have to wait for the next setup.

However, upon your review, you discover the market conditions have changed, and you now have to re-evaluate your approach, then this is the feedback the market is giving you. This is what it means to take feedback from the markets and this is what it takes to be profitable instead of being right.

2. Separate Identity From Outcome

The mistake many trades tend to make is measuring their success on the outcome of a trade. This is a recipe for disaster because in order for them to feel successful they’d have to win every single time.

This of course is impossible, instead I’d encourage you to separate yourself from the outcome of the trade and focus on just trading. There are only one of three outcomes you can experience in a trade. 1. Loss, 2. Win, 3. Breakeven. When you’re able to accept 1. Loss then you don’t have to worry about numbers 2,3.

Because you control how much you’re willing to lose you should be able to accept what you’re willing to lose, and by accepting what you're willing to lose you’ve then separated yourself from the outcome of the trade and you can now focus on just trading.

To keep you in check with this step here is a very simple but highly effective practice:

✅ Practice saying: “This was a good trade with a bad outcome — and that’s okay.”

3. Celebrate The Process, Not Perfection

“That which gets rewarded gets repeated” If you’re only rewarding yourself when you close a winning trade then you’re simply reinforcing the notion of viewing the markets through the lens of right and wrong.

As we’ve already discovered this view is detrimental to your longevity as a trader and so I would argue that instead of celebrating a winning trade, celebrate your process. Reward yourself every time you follow your plan regardless if the trade resulted in a win, loss or breakeven.

This approach will help you improve your process which in turn will improve your overall returns and performance.

Conclusion

📣 You are not here to be perfect. You’re here to grow, to learn, and to keep showing up — fear and all.

The market rewards the trader who is calm under pressure, humble in defeat and focused on the long game.

Go into this week knowing that fear may still show up — but you’re more prepared than ever to handle it.

Let fear be a signal, not a stop sign.

You've got this. 🚀

TradeCityPro | APTUSDT The Beginning of a New Downtrend!👋 Welcome to TradeCityPro Channel!

Let's go back to the day when Trump imposed tariffs on the United States again, causing stocks and cryptocurrencies to fall and gold to rise. Let's take a look at our attractive altcoin chart

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

APT remains inside its large, volatile range, frequently bouncing between its highs and lows. However, this time, it has formed a lower high, which is not a positive sign.

Additionally, after breaking $7.78, sellers completely engulfed the weekly candle, and for the past five weeks, all candles have been red with high selling volume, confirming the downtrend.

There is no buy trigger at the moment, and I cannot recommend a buying opportunity until the market forms a new structure.

For selling, if APT drops below $4.97, it makes sense to exit and accept the loss instead of holding onto a losing position.

📉 Daily Time Frame

In the daily time frame, the power is in the hands of the sellers! After the parabolic line broke, we experienced a Sharpe decline, accompanied by the formation of a lower ceiling and floor, which has continued our downward trend.

The parabolic movement itself is a very rapid and bullish movement, and every time the price hits it, it quickly returns to its trend and is supported, but when this line is broken, that trend is practically over and we suffer, or we experience a Sharpe decline like this chart!

After the drop and the formation of a box between 5.136 and 6.491, the selling force was clearly evident in this space, because the last time we moved towards the ceiling of 6.491, we could not reach this ceiling and we were rejected earlier.

This rejection made us return to this support faster with a number of red candles, unlike the previous attempt where we moved up with a larger number of candles. Yesterday's daily candle also engulfed the previous 3 candles and is exactly ready to break 5.136.

If today's daily candle closes in the same way, the probability of a drop in the coming days will increase and increase. If you are a holder of this coin, it is logical to sell and after returning to the box and breaking its ceiling, buy with the same number of Tethers and reduce the probability of a drop and loss of capital for yourself!

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | INJUSDT Best Trade Setup of the Week?👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the most popular cryptocurrency coins, which is in a more favorable situation than the majority of altcoins together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

On the weekly time frame, I see that the seventh period is stable, inj, and compared to the majority of altcoins that have their own low price levels, it is in a better space and is engaged in its own supports!

After breaking the primary trend ceiling, namely 9.28, we experienced a sharp upward movement and formed a historical ceiling at $53, and after forming a distribution box and breaking the important floor of 16.20 and pulling back to it, we experienced a continued decline.

We have now reached support again, which was previously a very important resistance, and now, as a result, it is probably not lost, but the weekly candle is a very good and bearish candle! Don't forget to save your profit, your strategy booklet and your positions, otherwise you will have made a 450% move without adding anything to your capital!

📉 Daily Time Frame

On the daily time frame, our trend is completely bearish as you can see and the events are completely accompanied by the formation of a downward bottom and top, but we are likely to suffer for a while.

After getting rejected from 34.16 and forming a box between 20.16 and 25.93 and losing the bottom, it made a move and then while pulling back with low volume and the next conversion to red, it became an inverted Sharpe, we experienced a decline!

Currently, we are forming a box between 8.63 and 10.68, and for selling and short positions, you can do this by breaking 8.63, and for the trigger spot risk and buying, if you feel the price is good, it is better to wait for the trend to break and do the trigger at 10.68. Let it structure.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

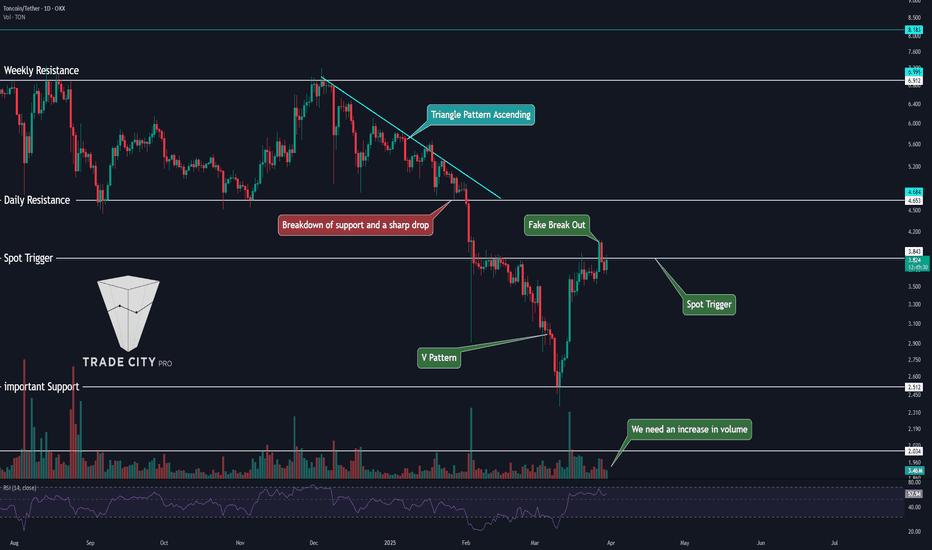

TradeCityPro | TONUSDT From Pavel’s Release to Blockchain Events👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of TON, one of the most efficient and widely used blockchain projects that is making significant waves in the space.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you that we have moved the Bitcoin analysis to a separate section based on your requests. This allows us to discuss Bitcoin’s status in more detail and analyze its charts and dominance separately.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

🚀 Pavel Durov’s Release!

Pavel Durov, Telegram’s founder, has returned to Dubai after months of restrictions in France. He was detained in August 2024 over content monitoring allegations but announced on March 17, 2025, that he has finally returned to his main residence and Telegram’s headquarters in Dubai.

Durov thanked his team and lawyers, emphasizing that Telegram had gone beyond its legal obligations. While investigations in France continue, this return could be a turning point for Telegram’s future.

At the same time, the TON blockchain is gaining attention with its NFT ecosystem, including projects like GetGems and TON Diamonds. From Telegram usernames as NFTs to event tickets, TON is building a fast, scalable, and practical ecosystem that’s making headlines.

🔍 Deep Research

In our previous analysis, we conducted an in-depth fundamental review of TON—covering team background, blockchain developments, and ecosystem growth. Since investing requires a full understanding of a project, make sure to check out the previous analysis if you haven’t already.

📊 Weekly Time Frame

TON is one of the strongest altcoins in the market right now. While most altcoins have reached or formed new lows, TON is still holding above major supports.

After forming its all-time high of $8.288, TON entered a distribution zone. Due to overall market corrections, it lost the $4.765 support, leading to a sharp drop that reached the $2.650 support an area we previously identified for entries.

This support level is crucial, as it represents nearly 50% of the chart’s structure. Additionally, the 0.786 Fibonacci level and previous long-term resistance reinforce its importance. As seen on the chart, after touching this level, TON bounced sharply.

There is no clear spot buying trigger at this time frame yet. However, if TON forms a higher low, the chart will turn fully bullish.

For exit strategies, I am currently utilizing my TON within its ecosystem (NFT trading, etc.), so I do not plan to sell unless the price drops below $1.914.

📉 Daily Time Frame

After getting rejected at $6.912, TON entered an ascending triangle pattern—which is typically a bearish continuation pattern. The chart continued forming lower highs and lower lows, indicating that selling pressure outweighed buying interest.

After breaking down from this triangle, TON experienced a sharp 50% drop from the breakout point. However, upon reaching the $2.512 support, the price suddenly pumped, partly influenced by Pavel Durov’s release and new TON blockchain developments.

Even without the fundamental catalysts, this support level was critical, and a bounce was likely. This move has now formed a V Pattern, which is bullish.

If TON breaks above $3.857, we could see further price increases, making this a potential buy opportunity. Confirmation signals include RSI entering overbought territory and increased volume.

⏳ 4H Time Frame

TON is on my watchlist for long positions due to its strong hype and ecosystem developments.

🟢 Long Position:

We are currently testing a major resistance at $4.076. If this level breaks, we can safely enter a long position. If a lower time frame trigger appears, it may be worth entering early.

🔴 Short Position:

I generally don’t recommend shorting TON, but if it breaks below $3.569, it could trigger a decent short trade. However, since TON is still ranging in the daily time frame and market volume is low at the end of the month, be cautious—unpredictable wicks are likely.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | ATOMUSDT Restarting Daily Analyses!👋 Welcome to TradeCityPro Channel!

Let's get back to our daily analysis routine starting today! From now on, I’ll be sharing daily altcoin analyses again. Today, we’re focusing on one of my favorite coins for futures trading: ATOM.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

ATOM is currently neither in a great position nor in a terrible one. Unlike some altcoins like BNB, SOL, and SUI that have moved towards their highs, ATOM hasn’t made a significant move towards $44 yet. However, it also hasn’t lost its major lows.

The strong green candle from the past two weeks bounced off the $3.728 support level, confirming that this level remains significant and won’t be easily lost. But this alone is not a reason to buy. After the candle closed, the price did not make a significant move.

If you are holding ATOM (like me, as I have staked ATOM in my wallet), I would exit below $3.728 because there is a high probability of a sharp drop toward $1.824.

For buying opportunities, setting a stop-buy order above $5.088 could be an option. We’ll discuss this more in the daily time frame section.

📉 Daily Time Frame

After bouncing off the $3.58 support, we started a bullish move but couldn’t reach $14.184. Instead, after getting rejected at $10.434, we formed a lower high and continued the price correction.

Following this rejection, we continued forming lower highs and lower lows based on Dow Theory. After breaking $5.665, which was an important support, we experienced a sharp drop, reaching the $3.585 support level. After bouncing, a V Pattern was formed.

$4.948 is an important level to watch as it triggers both the V Pattern activation and the trendline breakout.

I will only open short positions below $4.337, but I will not sell my coins unless $3.585 is broken, in which case I will exit my holdings.

⏳ 4H Time Frame

After getting rejected at $4.948, the price dropped to the $4.424 support level. Since it’s Saturday and the market is relatively slow, we might see range-bound movement around this level.

🔴 Short Position:

If $4.424 breaks and RSI enters the oversold zone with increased volume, we could see a short opportunity targeting $4.020.

🟢 Long Position:

I am currently waiting and prefer to open a long position on MKR instead. I don't want to waste the $4.948 trigger, so I will wait for a confirmed breakout before entering a position.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Mastering Risk Management in Trading: The Ultimate GuideMastering Risk Management in Trading: The Ultimate Guide

In the world of trading, success isn’t measured only by big wins but by how well you protect your capital from unnecessary losses. Risk management isn’t just a safety net—it’s the backbone of sustainable trading. In this comprehensive guide, we’ll break down the principles and strategies you need to safeguard your account while still maximizing your profit potential.

---

1. Risk-Reward Ratio: The Foundation of Every Trade

- What it is:

The risk-reward ratio is the cornerstone of every trade. It tells you how much potential reward you’re targeting compared to the risk you’re willing to take. For instance, if you risk $100 and aim to make $200, your risk-reward ratio is 1:2—a commonly accepted standard in trading.

- How to use it:

- Always predefine your risk-reward ratio before entering a trade.

- For swing traders, aim for a minimum of 1:2 or 1:3 to justify holding overnight.

---

2. Position Sizing: The Key to Survival

- Why position sizing matters:

Position sizing ensures you don’t over-leverage your account or lose too much in a single trade. Many traders fail because they bet too big and get wiped out after just a few losing trades.

- How to calculate position size:

- Use this formula:

Position Size = (Account Risk $ ÷ (Entry Price - Stop-Loss Price)).

- For example, if you’re risking $100 per trade and the difference between your entry and stop-loss is $5, your position size should be 20 units (100 ÷ 5).

---

3. Stop-Loss Orders: Your Safety Net

- What is a stop-loss?

A stop-loss is your emergency brake. It’s an order you set in advance to sell your position if the price moves against you by a specified amount.

- How to set stop-losses:

- Use technical analysis to place your stop-loss below support levels for long trades or above resistance levels for short trades.

- Avoid placing stop-losses too close to your entry point, as small fluctuations might trigger them unnecessarily.

Here you can see my ratio is on the low side so i can place a tactical TP and SL in relation to liquidity lines.

---

4. The Art of Diversification: Spreading Risk

- Why diversification works:

Putting all your capital into a single trade or instrument increases your risk. Diversification spreads that risk across multiple trades or markets, reducing the impact of any single loss.

- How to diversify effectively:

- Trade across multiple sectors or currency pairs.

- Avoid overexposure to correlated assets (e.g., don’t trade EUR/USD and GBP/USD simultaneously).

---

5. Emotional Discipline: Winning the Mental Game

- Why it matters:

Even the best trading strategy can fail if emotions like fear or greed take over. Emotional trading leads to impulsive decisions, revenge trading, and overtrading.

- How to maintain discipline:

- Stick to your trading plan, no matter what.

- Use tools like meditation, journaling, or physical exercise to manage stress.

---

6. Dynamic Risk Management: Adapting to Changing Markets

- Adjusting your strategy:

Markets are dynamic, and your risk management should adapt. Volatility can change quickly, requiring you to adjust your stop-loss distance or position size.

- Use ATR (Average True Range):

The ATR is a great tool to measure market volatility and decide how much room to give your stop-loss.

---

7. Tracking and Reviewing Your Trades

- The power of a trading journal:

Every trade is a learning opportunity. Keep detailed records of your trades, including your reasoning, execution, and results.

- What to include in your journal:

- Entry and exit points.

- Risk-reward ratio.

- Mistakes or deviations from the plan.

- Lessons learned.

---

Conclusion: Plan the Trade, Trade the Plan

Risk management isn’t just a skill—it’s a habit. By understanding your risk-reward ratio, managing position sizes, using stop-losses effectively, and staying emotionally disciplined, you can protect your capital and increase your chances of long-term success.

Take a moment to reflect: How do you manage risk in your trading? Are there areas you could improve? Start implementing these strategies today, and watch how they transform your trading results.

XAUUSD: Battle for New Highs – Bullish or Bearish?🚨 Attention Traders!🚨

🔥 XAUUSD is on FIRE! Price action is 🔥, and we're seeing a major battle at 3004 - 3014! Will it break out?

Bearish Alert 📉: If price dips below this zone, we could see targets around 2988 and 2998. Keep an eye on these support levels!

Bullish Opportunity 📈: A breakout above 2911 could lead to buying opportunities! Watch for moves above 3025 with targets at 3035 and 3050.

💬 Join the convo! Share your thoughts & strategies — let’s ride the gold wave together and catch these opportunities! 🚀✨

HMSTR Main Trend. Trader's Tactics and Risk Control 01 2025Logarithm. Time interval 1 day. A triangle is being formed, almost in the final phase of its formation. The price is in its lower zone. A breakthrough of the triangle resistance is a big pump, the minimum is its % from the base.

⚠️ It is worth noting that locally there may be a “dump” under the dynamic support of the formation for collecting liquidity. Although, in fact, this has already happened a little earlier. But, if the market allows, this can happen again. Just take this into account in your risk management.

It is worth emphasizing, for those who have tolerance, that in the center of the triangle (its integral part) a double bottom with a flat top (projection of forced actions of the market maker) has formed, which, as a rule, has a very positive effect on long-term goals (they are "not" on the chart).

There is a local correction of bitcoin and the market as a projection as a whole. A good time to accumulate altcoins . This is one of the candidates for accumulation. You can buy in parts (an acceptable average price is important):

1️⃣ That is, according to the market now, the first zone. 1/3 of the volume.

If you are afraid, then wait for a breakout of the triangle , that is, a breakout of the downtrend. You can set trigger orders for a breakout so as not to “freeze” money. If on your exchange, where you trade “dinosaur functionality” (for example, Binance), then in this zone you set a regular stop loss for buying (breakout).

2️⃣ The other part (you set trigger or limit orders) as the price decreases to collect liquidity, depending on the market situation. Zone 2 is the zone where everyone sets a stop loss, that is, everything is the other way around. It is displayed as a capitulation zone.

3️⃣ Third zone — in case of deep price slippage due to low liquidity (optional and unlikely). You simply place a grid of orders.

If you use trigger orders , which do not freeze money in the order, then you can also use this volume for a breakout. That is, resistance in the form of a triangle, and in the case of a negative scenario, key resistance levels that will form when the price falls, the breakout of which determines the trend reversal.

Linear for trend clarity and formation without market noise.

Don't get stuck in the market noise, as well as in the noise of the majority opinions, which is formed by the breath of micro-market movements and news FUD of deception, which forms the anti-logic of the market behavior at the moment, radically, to the opposite, and so many times.

If, conditionally, you are isolated from all this meaningless “important”, then as a consequence, you will have: a clear mind, a healthy psyche and many times greater profit over the distance.

Always stick to your trading plan and control risks, regardless of the news flow, and the opinions of others who want to convince you and incline you to their "correct" opinion.

Your trading plan should not change from the opinion of the majority or "unforeseen market movements".

If this is observed, then admit that you have no trading plan (hard work and intelligence), and you hope for luck, like most of those who "give to the market", and in the end you drain your life energy to the “golden Baal”. It will work once, the second time, in the end, the end is still the same - a negative sacrificial emotional explosion and devastation.

That is, your luck (Fortune-Tyche-chance) will turn away from you, and emotionally rape your psyche, empty your pocket (a resource for the realization of your desires on merit earlier), and the time previously spent on "I'll risk the last time". If a person deceives himself like this, encourages himself, then the last time turns into a trip with many alternations of stops - "good" / "a little painful", to the final stop, called — "big unbearable pain") ...

Gold Daily Bias UpdateGold Daily Bias Update

As we continue to monitor the gold market, our daily bias remains firmly bullish, driven by several key factors that suggest a continued upward trajectory.

Key Reasons for Bullish Bias

1. 1D Candle Sweep: The 1D candle has successfully swept previous days' lows, absorbing liquidity and closing above the bullish Fibonacci (FVG) level. This price action indicates a strong bullish trend, as the market has demonstrated its ability to absorb selling pressure and push higher.

2. Downside Liquidity Absorption: With downside liquidity now largely absorbed, the market is poised to target upside liquidity levels. This shift in liquidity dynamics should provide a tailwind for bullish momentum, as buyers look to drive prices higher.

3. Market Making IRL to ERL Model: Our proprietary Market Making IRL (Immediate Resistance Level) to ERL (Entry Resistance Level) Model is also flashing bullish signals. This model, which analyzes market structure and liquidity dynamics, indicates a high probability of a continued bullish trend.

Implications and Outlook

Given these factors, we remain bullish on gold and expect prices to continue pushing higher. Traders and investors should look to buy dips and scale into long positions, targeting key upside liquidity levels.

As always, we'll continue to monitor market developments and adjust our bias accordingly. For now, the technical and fundamental picture suggests a bullish outlook for gold.

Stay Tuned for Further Updates!

We'll provide regular updates and insights as market conditions evolve. Stay ahead of the curve and follow our analysis for expert guidance on navigating the gold market.

Popular Hedging Strategies for Traders in 2025Popular Hedging Strategies for Traders in 2025

Hedging strategies are key tools for traders seeking to potentially manage risks while staying active in dynamic markets. By strategically placing positions, traders aim to reduce exposure to adverse price movements without stepping away from potential opportunities. This article explores the fundamentals of hedging, its role in trading, and four hedging strategies examples across forex and CFDs.

What Is Hedging in Trading?

Hedging in trading is a risk management strategy that involves taking positions designed to offset potential losses in an existing investment. This concept of hedging in finance is widely used to reduce market volatility’s impact while maintaining the potential opportunity for returns. Rather than avoiding risk entirely, traders manage it via hedging strategies, meaning they have protection against unexpected market movements.

So, what are hedges? Essentially, they are investments used as protective measures to balance exposure. For example, a trader holding a CFD (Contract for Difference) on a rising stock might open a position on a correlated asset that moves in the opposite direction. If the stock’s price falls, returns from the offsetting position can potentially reduce the overall impact of the loss.

Hedging is common in forex trading, where traders may take positions in currency pairs with historical correlations. For instance, a trader exposed to EUR/USD might hedge using USD/CAD, as these pairs often move inversely. Similarly, traders dealing with indices might diversify into different sectors or regions to spread risk.

Importantly, hedging involves costs, such as spreads or holding fees, which can reduce potential returns. It’s not a guaranteed method of avoiding losses but rather a calculated approach to navigating uncertainty.

Why Traders Use Hedging Strategies

Different types of hedging strategies may help traders manage volatility, protect portfolio value, or balance short- and long-term goals.

1. Managing Market Volatility

Markets are unpredictable, and sudden price swings can impact even well-thought-out positions. Hedging this risk may help reduce the impact of unexpected volatility, particularly during periods of heightened uncertainty, such as geopolitical events, economic announcements, or earnings reports. For instance, a forex trader might hedge against fluctuations in a currency pair by taking positions in negatively correlated pairs, aiming to soften the blow of adverse price movements.

2. Balancing Long- and Short-Term Goals

Hedging allows traders to pursue longer-term strategies without being overly exposed to short-term risks. For example, a trader with a bullish outlook on an asset may use a hedge to protect against temporary downturns. This balance enables traders to maintain their primary position while weathering market turbulence.

3. Protecting Portfolio Value

Hedging strategies may help investors safeguard their overall portfolio value during market corrections or bearish trends. By diversifying positions or using opposing trades, they can potentially reduce significant drawdowns. For instance, shorting an index CFD while holding long positions in individual stocks can help offset sector-wide losses.

4. Improving Decision-Making Flexibility

Hedging provides traders with the flexibility to adjust their strategies as market conditions evolve. By mitigating downside risks, they can focus on refining their long-term approach without being forced into reactive decisions during volatile periods. This level of control can be vital for maintaining consistency in trading performance.

Common Hedging Strategies in Trading

While hedging doesn’t eliminate risks entirely, it can provide a layer of protection against adverse market movements. Some of the most commonly used strategies for hedging include:

1. Hedging with Correlated Instruments

One of the most straightforward hedging techniques involves trading assets that have a known historical correlation. Correlated instruments typically move in alignment, either positively or negatively, which traders can leverage to offset risk.

For example, a trader holding a long CFD position on the S&P 500 index might hedge by shorting the Nasdaq-100 index. These two indices are often positively correlated, meaning that if the S&P 500 declines, the Nasdaq-100 might follow suit. By holding an opposing position in a similar asset, losses in one position can potentially be offset by gains in the other.

This approach works across various asset classes, including forex. A well-planned forex hedging strategy can soften the blow of market volatility, particularly during economic events. Consider EUR/USD and USD/CAD: these pairs typically show a negative correlation due to the shared role of the US dollar. A trader might hedge a EUR/USD long position with a USD/CAD long position, reducing exposure to unexpected dollar strength or weakness.

However, correlation-based hedging requires regular monitoring. Correlations can change depending on market conditions, and a breakdown in historical patterns could result in both positions moving against the trader. Tools like correlation matrices can help traders analyse relationships between assets before using this strategy.

2. Hedging in the Same Instrument

Hedging within the same instrument involves taking opposing positions on a single asset to potentially manage risks without exiting the original trade. This hedging strategy is often used when traders suspect short-term price movements might work against their primary position but still believe in its long-term potential.

For example, imagine a trader holding a long CFD position in a major stock like Apple. The trader anticipates the stock price will rise over the long term but is concerned about an upcoming earnings report or market-wide sell-off that could lead to short-term losses. To hedge, the trader opens a short position in the same stock, locking in the current value of their trade. If the stock’s price falls, the short position may offset the losses in the long position, reducing overall exposure to the downside.

This is often done with a position size equivalent to or less than the original position, depending on risk tolerance and market outlook. A trader with high conviction in a short-term movement may use an equivalent position size, while a lower conviction could mean using just a partial hedge.

3. Sector or Market Hedging for Indices

When trading index CFDs, hedging can involve diversifying exposure across sectors or markets. This strategy helps reduce the impact of sector-specific risks while maintaining exposure to broader market trends.

For example, if a trader has a portfolio with exposure to technology stocks and expects short-term declines in the sector, they can open a short position in a technology-focused index like Nasdaq-100 to offset potential losses.

Another common approach is geographic diversification. Traders with exposure to European indices, such as the FTSE 100, might hedge with positions in US indices like the Dow Jones Industrial Average. Regional differences in economic conditions can make this a practical strategy, as markets often react differently to global events.

When implementing sector or market hedging, traders should consider the weighting of individual stocks within an index and how they contribute to overall performance. This strategy is used by traders who have a clear understanding of the underlying drivers of the indices involved.

4. Stock Pair Trading

Pair trading is a more advanced hedging technique that involves identifying two related assets and taking opposing positions. This approach is often used in equities or indices where stocks within the same sector tend to move in correlation with each other.

For instance, a trader might identify two technology companies with similar fundamentals, one appearing undervalued and the other overvalued. The trader could go long on the undervalued stock while shorting the overvalued one. If the sector experiences a downturn, the losses in the long position may potentially be offset by gains in the short position.

Pair trading requires significant analysis, including fundamental and technical evaluations of the assets involved. While this strategy offers a built-in hedge, it can be risky if the chosen pair doesn’t perform as expected or if external factors disrupt the relationship between the assets.

Key Considerations When Hedging

What does it mean to hedge a stock or other asset? To fully understand the concept, it’s essential to recognise several factors:

- Costs: Hedging isn’t free. Spreads, commissions, and overnight holding fees can accumulate, reducing overall potential returns. Traders should calculate these costs to ensure the hedge is worth implementing.

- Market Conditions: Hedging strategies are not static. They require adaptation to changing market conditions, including shifts in volatility, liquidity, and macroeconomic factors.

- Correlation Risks: Correlations between assets are not always consistent. Unexpected changes in relationships driven by fundamental events can reduce the effectiveness of a hedge.

- Timing: The timing of both the initial position and the hedge is critical. Poor timing can lead to increased losses or missed potential opportunities.

The Bottom Line

Hedging strategies are popular among traders looking to manage risks while staying active in the markets. By balancing positions and leveraging tools like correlated instruments or partial hedges, traders aim to navigate volatility with greater confidence. However, hedging doesn’t exclude risks and requires analysis, planning, and regular evaluation.

If you're ready to explore hedging strategies in forex, stock, commodity, and index CFDs, consider opening an FXOpen account to access four advanced trading platforms, competitive spreads, and more than 700 instruments to use in hedging.

FAQ

What Is Hedging in Trading?

Hedging in trading is a risk management approach where traders take offsetting positions to potentially reduce losses from adverse market movements. Rather than avoiding risk entirely, hedge trading aims to manage it, providing a form of mitigation while maintaining market exposure. For example, a trader with a long position on an asset might open a short position on a related asset to offset potential losses during market volatility.

What Are the Three Hedging Strategies?