RAD - Lower LowsRAD is acting extremely bearishly

Printing lower lows is very bearish

This is the weekly timeframe and possibly will see a bounce at the price label

Riteaid

RAD Q4 buying means 2023 Q2 selling for multiplesThis is chart analysis only, the business fundamentals feel distressed to me however this is a meme stock and it can easily run up

Buying today under $4.20 seems decent but i think there will be lower lows soon

RAD Swing Trade Setup LongNYSE:RAD

RAD is the Rite Aid drug store chain0 being in healthcare and

consumer staples it is relatively resilient in a recessionary context.

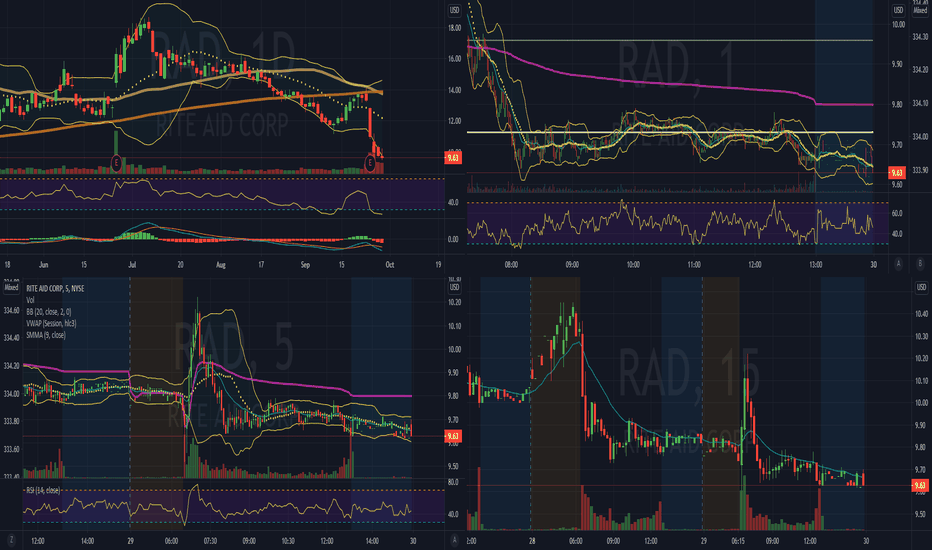

On the Chart, RAD is at swing lows sitting on support with

25% upside potential. The RSI indicator shows an impending

K & D line cross under the histogram.

A recent triple top helps mark the resistance while an

earlier double bottom shows the support. The order block

indicator provides confirmation.

I see this as nearly ready for a swing-long entry.

What is your opinion?

RAD - Strong Horizontal BottomA double bottom is forming on RAD which is aligning nicely with prior points of aggressive support

2W timeframe

RAD (Rite Aid) AnalysisIn this analysis I am suggesting that the downward channel that has formed will break down

This breakdown may end at the dotted black line under the channel

The green rectangles are historical points of support, currently price is very close to this level

I think it will go lower, briefly.

RAD - WEEKLYRAD

ENTRY = 13.35 - 13.70

1st Target = 14.25

2nd Target = 15.75

3rd Target = 16.90

4th Target = 17.87

HODL Target = 20+

______________________________________________________________________________________________________________________

This content is for informational, educational and entertainment purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

$RAD At an important area of contention$RAD At an important area of contention. I'll be watching closely for a break above. I'm liking the setup if it can close above resistance.

It is a $RAD WIN! Hi everyone, to follow up from my last video what an awesome trade. If you held RAD from the mid $9.50's and got in today's announcement with the acquisition we got a 8% upside move. Acquiring a company for 90+million just demonstrates the strength of the company. I mentioned the $10.50s-$11 would come and I would be looking for an exit. I still expect the stock to rebound here back to $11 in the coming days. NYSE:RAD

Good time to accumulate Rite Aid $RAD? Rite Aid got double whammed last week. First with terrible earnings and the next day with a downgrade. The stock has traded the last three sessions with a floor around $9.60s. At open at the stock flushed and quickly hit the high from yesterday before selling off. If you are one for a long, I would hold RAD for a $11 move within the next week. At this price level which we saw in the March lows, we should start to see a recovery this week. I bought a bunch of $11 Calls for the end of November.

RAD | Strong support at $9.50 | Oversold | Tangible StapleWhere are you spending your money during COVID? Where can you get a COVID test? Where do you get your medicine? Where can you go to get a cheap doctor visit? Where can you buy alcohol and tobacco?

Rite Aid (RAD) is a yes to all of the above. They aren't going anywhere.

The RSI is maxing out (Oversold) on all charts and it is near all time lows.

If you want to chase growth and tech stocks right now at expensive option prices good luck. I enjoyed the ride down in March and the ride up, but I am hopping off that train and looking for value. Rite Aid = Value. Long options are super cheap out through 2023. Very safe and profitable trade IMO.

$RAD Rite Aid approaching inflection point$RAD Rite Aid approaching an inflection point. Risk/reward here looks enticing. Downside risk appears limited.

Betting on the trendline holding with 7/17 $15.00 calls for ~$0.80

Target: $16.00 by mid-July

Note: Educational analysis, not investment advice.

Walgreens Monthly Chart $WBAIs it me or is it CRAZY to see Walgreens is down over 60% in the last 4 years. From a contrarian investors POV this could be signaling a great opportunity to get long and collect dividends while this is trading back at discount prices in the 2000's - 2013 price channel. I have no doubt that Walgreens will be around in 5 years as its been in business since 1901.

I find it absurd that WBA is STILL dropping while more people than ever are in need of prescriptions, immunizations and health care products. In 2019 they filled over 1 billion prescriptions (including immunization)

So with all this in mind, I have no doubt Walgreen will eventually see a bounce above $50 but back up to $90 might be a stretch at this moment in time.

Latest 10Q

www.sec.gov

RAD BULLISH Elliot wave & price predictionRAD has broken resistance around 13,50-14,00$ illustrated in my earlier post and engaged Elliot wave 5. According to Elliot wave theory, wave 5 will reach near one of the three prices shown on the chart before the 27th of april.

Good luck to you all and happy grindin'

Flipped Long on $RADvery strong bounce off of ~$6.50 support. Is this the start of a macro bull cycle for RiteAid as history showed?

$RAD got rejected hard at ~$10 I flipped short just in time earlier this morning. I think RiteAid will definitely test $6 daily support as best case scenario. Worst case scenario imo is $4.50-5 and then it hits that yellow monthly trend-line.

RiteAid is about to explode Pretty self explanatory, strong reaction to the upside every time it touched yellow trend line. looks like it is setting up to do that within this month or the next.

Rite Aid potential bounce backRAD has been profiting of Amazon using it's stores. Which is basically saving the company.

RAD is finding support again around $6.4, not getting to oversold levels! (RSI(10) < 30)

Be mindful that today's volume is below the average volume (which is a bearish sign on a pullback). Important to check today's price & volume at close.