#RLC/USDT#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.995.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 1.028

First target: 1.063

Second target: 1.102

Third target: 1.152

RLCBTC

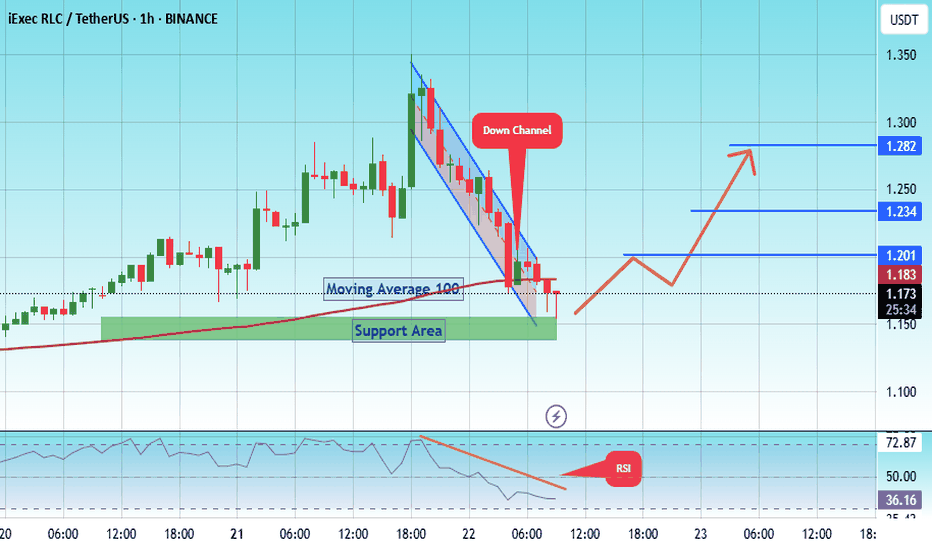

#RLC/USDT Pump Anticipated#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.155.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.143, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.170.

First target: 1.200.

Second target: 1.234.

Third target: 1.282.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.13

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.15

First target 1.17

Second target 1.20

Third target 1.25

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.98

Entry price 2.08

First target 2.19

Second target 2.28

Third target 2.38

$RLC Just broke out of it's Falling Wedge iExec RLCGETTEX:RLC has been on a down trend for Months!

Current Price: 1.73

Price action has continued in it's falling wedge for months and recently just broke out of it!

Expecting Price Action to continue upwards.

#RLC Targets: 2.09, 2.53, 2.96

This Idea Invalidates under 1.64

#RLC/USDT#RLC

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.40

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.61

First target 1.70

Second target 1.82

Third target 1.96

#RLC/USDT#RLC

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 1.95

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 2.00

The first goal is 2.20

Second goal 2.32

Third goal 2.47

RLC short setupFrom where we entered "start" on the chart, RLC correction seems to have started.

It appears to be completing a bearish triangle now.

We will look for sell/short positions in the red range.

The target can be the green box.

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#RLC/USDT#RLC

The price is moving within a falling channel on a 1-day frame, which is a retracement pattern

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum

Entry price is 3.20

First goal 4.09

Second goal 4.48

Third goal 5.05

RLC/BTC - iExec RLC: SuperTrend BBand Breakout◳◱ On the $RLC/ CRYPTOCAP:BTC chart, the Supertrend Bband Breakout pattern suggests an upcoming trend shift. Traders might observe resistance around 0.00004961 | 0.00006085 | 0.00008093 and support near 0.00002953 | 0.00002069 | 0.00000061. Entering trades at 0.0000428 could be strategic, aiming for the next resistance level.

◰◲ General info :

▣ Name: iExec RLC

▣ Rank: 287

▣ Exchanges: Binance, Kucoin, Hitbtc

▣ Category/Sector: Services - Shared Compute

▣ Overview: The iExec network provides computational resources to decentralized applications that wish to use them. The medium of exchange for the computational resources to be used must be paid using the RLC token. For example, if someone wished to run a decentralized application, without using typical computational resources from the likes of AWS, Azure, or any other big tech cloud provider, they can rent computational resources from the iExec network. The iExec network is comprised of Desktop Grid computing, also known as “volunteer computing”, where unused computational resources on the network can be used by applications, and platforms alike. All payments for computational resources utilize the RLC token as the medium of exchange.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.0000428 ₿

▣ 24HVol: 7.619 ₿

▣ 24H Chng: 9.072%

▣ 7-Days Chng: 0.54%

▣ 1-Month Chng: -29.42%

▣ 3-Months Chng: 47.55%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.00004961 | 0.00006085 | 0.00008093

◢ Support: 0.00002953 | 0.00002069 | 0.00000061

◱◳ Indicators recommendation :

▣ Oscillators: SELL

▣ Moving Averages: BUY

◰◲ Technical Indicators Summary : NEUTRAL

◲◰ Sharpe Ratios :

▣ Last 30D: -3.60

▣ Last 90D: 1.85

▣ Last 1-Y: 0.68

▣ Last 3-Y: 0.62

◲◰ Volatility :

▣ Last 30D: 1.21

▣ Last 90D: 1.56

▣ Last 1-Y: 1.02

▣ Last 3-Y: 1.43

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.64 - Bullish

▣ Reddit sentiment score is 0.36 - Bearish

▣ In-depth RLCBTC technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

#RLC/USDT#RLC

The price moves in a triangle pattern on a 1-hour frame

It is expected that the triangle will be penetrated upward with stability above the Moving Average 100

We have strong support to rely on at the lower border of the triangle

Also we have oversold on MACD

Current price 2.36

The first goal is 2.47

The third goal is 2.55

Third goal 2.66

#RLC/USDT#RLC

The price broke the descending triangle upwards on a 4-hour frame

Drawing support from the green support area

We have support from the RSI indicator

We have a higher stability of Moving Average 100 that supports the rise

Expected to rise on targets

Entry price 2.38

The first goal is 2.45

Second goal 2.52

The third goal is 2.60

RLC - An Unconventional Trade Opportunity - For Brave-hearted #RLCUSDT Analysis

Description

---------------------------------------------------------------

+ RLC is presently consolidating near the resistance zone, displaying a consolidation pattern akin to its previous two consolidations.

+ Although this pattern may seem unconventional for trading, I maintain optimism regarding RLC's potential to adhere to this pattern and progress towards the next target.

+ Should this pattern persist, I intend to enter a long trade with a target set around 5.762. + Consider following this trade if you're willing to assume some risk in pursuit of substantial profits.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 3.870

Stop Loss: 3.383

------------------------------

Target 1: 4.191

Target 2: 4.490

Target 3: 4.996

Target 4: 5.762

------------------------------

Timeframe: 1D

Capital: 1-2% of trading capital

Leverage: 5-15x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

RLC is definitely bullishWe have had an ascending channel that broke the bottom once but it was faked out and again the price returned to the ascending channel that I marked on the chart.

On the bottom of the white boxes, they show the overflow that the candles have done well.

From where I entered START, the upward movement has started. We have bullish CH and BOS on the chart and the candles have respected the demands well.

Above we have a liquidity pool that I specified with $$$. The candles are going to clean this pool in the first step.

I marked the TPs on the chart.

I also marked a FLIP LINE on the chart that I use for my loss limit. When 1 daily candle closes below this line, the analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

RLC buy/long setupHi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the RLC symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#RLC/USDT#Rlc

Rlc has been trading in a bearish channel since May on a 3-day frame

The downtrend has now been broken

It is possible to enter from the support area identified around the price of 0.95 $.

With a target of 1.70 $, an increase rate of 180%.

This rise is fueled by the recent rise of Bitcoin

It should be noted that there may be a retest of the downward trend again before the upward trend

This is supported by oversold MACD

#RLC/USDT Trade Setup (SPOT). 500%+ Potential.#RLC :- One of my altcoin bags.

Breaking out in htf.

The structure looks lucrative.

Entry: $1.22 to $1.48 (SPOT ONLY)

TARGETS:-

Short and Mid-term:- $1.95, $2.45, $3.2

Long Term:- $8.20 to $10

Stop Loss:- Try to DCA in the dips, I am not using any SL right now because it is on the spot.

My average entry is around $1.22

DCA on retest.

#Crypto #BTC

RLC LOOKS BEARISH (1D)Hi, dear traders. how are you ? Today we have a viewpoint to SELL/SHORT the RLC symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

RLC ANALYSIS (1H)Hi, dear traders. how are you ? Today we have a viewpoint to SELL/SHORT the RLC symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

RLC/USDT Forms Falling Wedge Pattern with Strong Support!💎 RLC/USDT exhibiting a falling wedge pattern on the price chart which indicates a period of consolidation before a potential upward breakout.

💎 One key aspect of the falling wedge pattern is the presence of a strong support level. The price of RLC has consistently found support near a specific price point, which has prevented further downward movement.

💎 If the downward support is breached, meaning the price drops below this level and fails to recover quickly, it would invalidate the falling wedge setup.

💎 A break below support could signify a change in market sentiment, potentially leading to further downward pressure on RLC.

💎 However, as long as the strong support level holds, the falling wedge pattern remains valid and suggests a potential bullish move.

Disclaimer: This is Not Financial Advice ❗️ Trade at Your Own Risk ⚠️