Xmoon Indicator Tutorial – Part 1 – Strategy🔻🔻🔻+ Persian version below🔻🔻🔻

📘 Xmoon Indicator Tutorial – Part 1

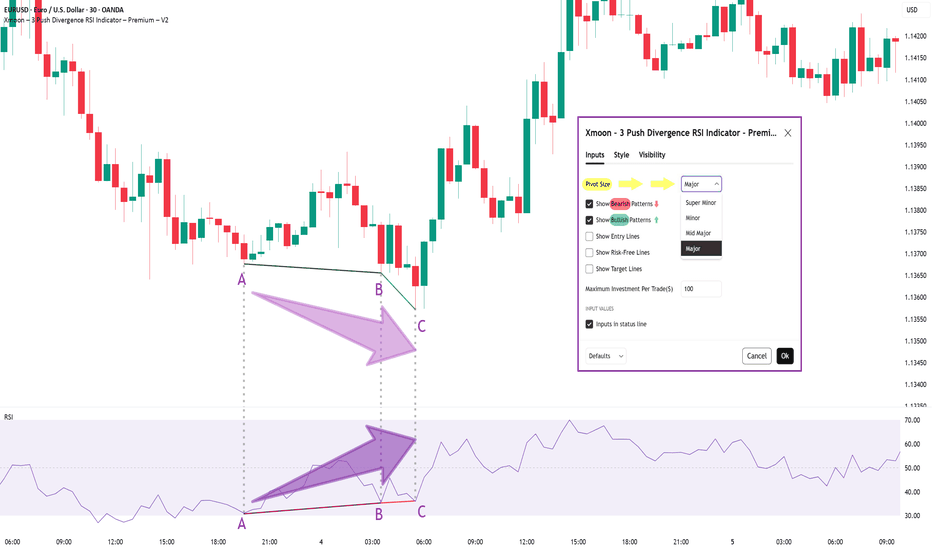

🎯 3Push Divergence RSI Strategy

🔥 The core of the Xmoon indicator

is built upon one of the most powerful strategies in technical analysis:

The advanced 3Push Divergence RSI pattern

🔁 A pattern that typically appears at key market turning points.

📉 When the price moves in the same direction three consecutive times on pivot points (e.g., making lower lows or higher highs), but the RSI shows the opposite behavior, it indicates a clear divergence !

💡 This divergence can act as a strong signal for a potential trend reversal.

🎯 The Xmoon Indicator is designed to detect this critical moment.

⚙️ Xmoon Indicator Settings Panel

The Xmoon settings panel offers the following options:

🔸 Pattern Type Selection: In the first and second lines, you can specify which type of pattern should be displayed: only bullish patterns or only bearish ones. You can also check both options.

🔸 Pivot Type Selection: From the dropdown menu, you can choose one of four pivot types:

“Super Minor”, “Minor”, “Mid-Major”, and “Major”, ordered from smallest to largest.

📌 Educational Note: The greater the distance (in candle count) between two lows or two highs, the larger the pivot is considered.

A Major Pivot is the largest among them.

✅ Larger Pivot = Higher Accuracy

❗ But naturally = Fewer Signals

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻بخش فارسی – Persian Section 🔻🔻🔻

📘 آموزش اندیکاتور ایکسمون - قسمت اول

🎯 استراتژی سهپوش واگرایی (3Push Divergence RSI)

🔥 هسته اصلی ایکسمون

بر پایه یکی از قویترین استراتژیهای تحلیل تکنیکال طراحی شده است

الگوی پیشرفته سهپوش واگرایی

🔁 الگویی که معمولاً در نقاط چرخش مهم بازار ظاهر میشود

📉 وقتی قیمت سه بار پشت سر هم روی نقاط پیوت ، در یک جهت حرکت میکند (مثلاً کفهای پایینتر یا سقفهای بالاتر میسازد) ، اما آر-اِس-آی خلاف آن را نشان میدهد، یعنی یک واگرایی آشکار رخ داده است

💡این واگرایی میتواند سیگنالی قوی برای برگشت روند باشد

🎯 اندیکاتور ایکسمون این لحظه را شناسایی میکند

⚙️ پنجره تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات اندیکاتور ایکسمون، امکاناتی در اختیار شما قرار دارند

🔸 انتخاب نوع الگو: در خط اول و دوم میتوانید مشخص کنید چه نوع الگویی نمایش داده شود

فقط الگوهای صعودی یا فقط نزولی. همچنین می توانید تیک هر دو گزینه را بزنید

🔸 انتخاب نوع پیوتها: از پنجره کشویی بالا، می توانید یکی از ۴ نوع پیوت را انتخاب کنید

پیوت ها به ترتیب از کوچک به بزرگ عبارتند از: سوپر مینور ، مینور ، میدماژور و ماژور

📌 نکته آموزشی: هرچه فاصله بین دو کف یا دو سقف بیشتر باشد (یعنی تعداد کندلهای بین آنها زیادتر باشد)، آن پیوت، بزرگتر محسوب میشود

پیوت ماژور از بقیه بزرگ تر است

✅ پیوت بزرگتر = دقت بالاتر

❗ اما طبیعتاً = تعداد سیگنال کمتر

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

Robot

Pros and Cons of Forex Trading with Robots

Hey traders,

Forex trading robots (EA) are commonly perceived as a sort of magic button. Once it is clicked, the system starts trading automagically, generating consistent profits. What can be better?

However, many pitfalls are hidden behind its simplicity.

In this educational article, we will discuss the advantages and disadvantages / pros and cons of trading with Expert Advisers (EA) / robots.

Advantages of Forex Trading Robots

Let's start with the positives ➕:

1. The first major advantage of EA is the fact that it works 24/7 , without delays and coffee breaks. Once it is launched, it will keep working till you stop it.

2. The second advantage of EA is that it is non-emotional and objective .

It strictly follows the algorithm and rules determined by a program. It is not influenced by psychological biases, making each trade extremely precise.

3. The third strength of trading robots is the processing speed and its limitless scalability . EA can monitor dozens of trading instruments on multiple time frames simultaneously, not missing any bit of information. Hence, it requires less time for decision-making and trade execution.

4. The fourth advantage of EA is the simplicity of its backtesting . Once the algorithm is written and the order of execution rules are described, it can be quickly and easily tested on a historical data.

Disadvantages of Forex Trading Robots

So far, sounds like a panacea, right?! But now, let's discuss the negatives ➖:

1. Similar to any software, app or program, the EA is vulnerable to bugs, and may occasionally lag . Therefore, it requires a constant oversight and maintenance . In order to fix the bugs and maintain that, a high level of experience is required .

One should have the advanced skills both in coding and in trading.

2. Moreover, admitting the fact that the market is constantly changing and evolving, one should regularly update the EA and adapt it.

In comparison to humans, trading robots are not learning, they do not evolve, update themselves.

3. Leaving the robot without supervision, updates and patches, it may blow the entire account in a glimpse of an eye without any embarrassment.

4. One more important thing to add about EA, is the fact that it is technical analysis based . For now, there are no solutions on the market that would allow the integration of fundamentals in the algorithm.

Unfortunately, most of the traders overestimate the strengths of trading robots, completely neglecting its obvious weaknesses.

If you decide to apply EA in Forex trading, always consider its pros and cons that we discuss in the post.

Cage Cycle Values for OmusdtCage Cycle Values: If the price is above 0.67647 (Buy Point), the price target is 1.13913, and if it is below 0.66245 (Sell Point), the price target is 0.19979. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 0.67647

Profit: 1.13913 (Will be updated if necessary in the positive direction)

Stop: 0.66245

Short Position:

Entry: 0.66245

Profit: 0.19979 (Will be updated if necessary in the positive direction)

Stop: 0.67647

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 0.67647, the Stop Loss is 0.66245, and the Take Profit is 1.13913. When the price reaches 0.66245, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 0.67647 and the Take Profit being 0.19979. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages

Cage Cycle Values for AgldusdtCage Cycle Values: If the price is above 1.6542 (Buy Point), the price target is 1.8342, and if it is below 1.6470 (Sell Point), the price target is 1.4670. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 1.6542

Profit: 1.8342 (Will be updated if necessary in the positive direction)

Stop: 1.6470

Short Position:

Entry: 1.6470

Profit: 1.4670 (Will be updated if necessary in the positive direction)

Stop: 1.6542

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 1.6542, the Stop Loss is 1.4670, and the Take Profit is 1.8342. When the price reaches 1.4670, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 1.6542 and the Take Profit being 1.4670. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages

PROPHET BOTS can 5X your Money#prophet bots is breaking out!

It's a low market cap coin approx $12M

so my price target doesn't look so ludricous now does it?!

full transparency

I just bought ... any pullback from here on in ... I will be experiencing drawdown with you as well

either way

I believe gains are still available and will be made.

I can't keep up with the rate of new coins hitting the market

feelings of being overwhelmed and left behind happen to me as much as you guys.

AI robot degen trading on my behalf is such a sexy narrative

It surely will catch on.

If u scoff at 5X

show me more .... ;)

4 Accurate Predictions Made by AI for Tesla (TSLA)In the rapidly evolving landscape of financial markets, Artificial Intelligence (AI) has emerged as a pivotal force, transforming traditional trading strategies into sophisticated, data-driven methodologies. This article delves into the role of AI in identifying and capitalizing on market trends, focusing on recent successes in detecting bearish stock patterns in Tesla (TSLA) shares. Through a detailed analysis of three distinct patterns—Cup-and-Handle Inverse, Head-and-Shoulders Top, and Broadening Wedge Ascending—this discussion illustrates how AI technologies, particularly those developed by Tickeron, are reshaping investment approaches.

The AI Revolution in Stock Market Analysis

The integration of AI in stock market analysis marks a significant shift from human-driven decision-making to automated, algorithm-based strategies. AI's capacity to process vast datasets, recognize patterns, and predict market movements is unparalleled. These capabilities enable traders and investors to make more informed decisions, often with higher accuracy and speed than traditional methods.

Tesla's Bearish Patterns

Prediction #1. Downtrend Detected

Cup-and-Handle Inverse Pattern

On December 7, 2023, Tickeron's AI advisor, A.I.dvisor, detected a Cup-and-Handle Inverse pattern in Tesla's stock, indicating a potential bearish turn. Initially priced at $242.64, the stock was monitored closely until December 12, when the bearish trend was confirmed, and a target price was set. By January 12, 2024, Tesla's stock reached the target price of $223.07, offering a 9.83% gain for those who shorted the stock based on the AI's prediction.

Prediction #2. Downtrend Detected

Head-and-Shoulders Top Pattern

Simultaneously, A.I.dvisor identified a Head-and-Shoulders Top pattern for Tesla on the same dates, with the stock also priced at $242.64. This pattern, another indicator of a potential price decline, led to a similar outcome. On January 12, the stock price hit the target of $222.45, again resulting in a 9.83% gain for traders who acted on the AI's advice.

Prediction #3. Downtrend Detected

Broadening Wedge Ascending Pattern

A more recent analysis began on December 14, 2023, when a Broadening Wedge Ascending pattern was detected in Tesla's stock, then priced at $251.05. This pattern, confirmed on January 3, 2024, signaled another bearish trend, culminating in the stock reaching a target price of $233.59 by January 9. This pattern offered traders a 6.44% gain, further showcasing AI's prowess in predicting market movements.

The Role of Tickeron Patterns and AI Robots

Tickeron's innovative approach to market analysis encompasses the development of AI robots capable of scanning the market for specific patterns. These patterns, such as the Cup-and-Handle Inverse, Head-and-Shoulders Top, and Broadening Wedge Ascending, are key indicators of potential market movements. Tickeron's AI robots not only identify these patterns but also provide actionable insights, including target prices and potential gains, thereby equipping traders with the information needed to make strategic decisions.

New Robot factory from Tickeron Trading Results for last 12 months

TSLA

AI Robots (Signals Only)

AI Robot's Name P/L

Swing trader: Downtrend Protection (TA) 73.57%

Trend Trader: Popular Stocks (TA&FA) 37.41%

Day Trader, Popular Stocks: Price Action Trading Strategy (TA&FA) 36.66%

AI Robots (Virtual Accounts)

AI Robot's Name P/L

Swing Trader ($700 per position): Hedge Fund Style Trading (TA&FA) 77.75%

Swing Trader, Popular stocks ($1.5K per position): Mixed Strategy (TA&FA) 65.65%

Swing Trader, Popular stocks ($700 per position): Mixed Strategy (TA&FA) 59.95%

Conclusion

The integration of AI in financial markets represents a paradigm shift towards data-driven investment strategies. Through the lens of recent bearish patterns identified in Tesla's stock, it's evident that AI technologies like those developed by Tickeron are at the forefront of this transformation. By leveraging machine learning algorithms and AI robots, investors can navigate the complexities of the stock market with greater confidence and precision. As AI continues to evolve, its impact on financial markets is poised to deepen, offering promising prospects for the future of trading and investment.

PYTH:TSLA

Tesla Unveils Its 2nd-Generation Optimus Robot 🤖

In the released video, the robot demonstrates capabilities such as controlled squatting, delicate egg transfer, and dancing. However, in the context of today's technological advancements, Optimus Gen 2 doesn't appear to boast any standout features.

The latest iteration of the robot is 10 kg lighter, 30% faster, a lot smoother, and equipped with tactile sensing on all fingers.

NASDAQ:TSLA may experience a surge as investors anticipate the potential impact of the new product on Tesla's revenue and market position.

Tesla is often seen as a company at the forefront of technological innovation. Successful product launches reinforce investor confidence in the company's ability to lead in multiple industries. A positive reception of the Optimus robot could contribute to increased investor confidence.

Algorithmic Trading / Robo-TradingAlgorithmic Trading: Automating Financial Markets for Greater Efficiency and Profitability

Explanation

Algorithmic trading, also known as robo trading, is a process of using computer programs to execute trades automatically based on pre-defined rules or algorithms. It has revolutionized the way financial markets operate, making them more efficient, faster, and less prone to errors caused by human emotions.

Advantages

The advantages of algorithmic trading are numerous. Firstly, it enables traders to analyze vast amounts of data and execute trades with incredible speed and precision, resulting in improved profitability. It eliminates human error and bias, which are significant sources of trading losses. Secondly, algorithmic trading allows for 24/7 trading, regardless of the trader's location or time zone, which makes it possible to take advantage of global market movements. Finally, algorithmic trading also provides a level of transparency and accountability, as trades are executed automatically, and the outcomes are recorded in real-time.

History

The history of algorithmic trading dates back to the 1970s when the first computerized trading system was developed by the NYSE to automate the execution of large trades. The system was based on the principle of matching buyers and sellers electronically, and it soon became the norm for trading in the US equity markets. However, it was not until the 1990s that algorithmic trading began to gain traction in other financial markets.

As computing power increased and access to market data improved, algorithmic trading systems became more sophisticated, enabling traders to execute trades with greater precision and accuracy. With the introduction of low-latency trading platforms in the 2000s, algorithmic trading became even faster and more efficient, allowing traders to take advantage of even the smallest market movements.

Today, algorithmic trading is used in almost every financial market, including stocks, bonds, currencies, and commodities. It is estimated that more than 80% of all trades in the US equity markets are executed by algorithms, and the trend is growing in other financial markets worldwide.

In conclusion, algorithmic trading has transformed the financial markets by improving their efficiency, speed, and profitability. It is a powerful tool for traders and investors, providing them with the ability to analyze vast amounts of data, execute trades with incredible speed and accuracy, and eliminate the emotional biases that often lead to trading losses. As technology continues to evolve, we can expect algorithmic trading to become even more sophisticated, providing traders with even greater opportunities to profit from the global financial markets.

Trading With Robots (EA) | Your Pros & Cons 🤖

Hey traders,

Trading robots are commonly perceived as a sort of magic button. Once it is clicked, the system starts trading automagically, generating consistent profits. What can be better?

However, many pitfalls are hidden behind its simplicity.

In this educational article, we will discuss the advantages and disadvantages of trading with Expert Advisers (EA) / robots.

Let's start with the positives ➕:

The first major advantage of EA is the fact that it works 24/7, without delays and coffee breaks. Once it is launched, it will keep working till you stop it.

The second advantage of EA is that it is non-emotional and objective.

It strictly follows the algorithm and rules determined by a program. It is not influenced by psychological biases, making each trade extremely precise.

The third strength of trading robots is the processing speed and its limitless scalability. EA can monitor dozens of trading instruments on multiple time frames simultaneously, not missing any bit of information. Hence, it requires less time for decision-making and trade execution.

The fourth advantage of EA is the simplicity of its backtesting. Once the algorithm is written and the order execution rules are described, they can be quickly and easily tested on a historical data.

So far, sounds like a panacea, right?! But now, let's discuss the negatives ➖:

Similar to any software, app or program, the EA is vulnerable to bugs, and may occasionally lag. Therefore, it requires a constant oversight and maintenance. In order to fix the bugs and maintain that, a high level of experience is required.

One should have the advanced skills both in coding and in trading.

Moreover, admitting the fact that the market is constantly changing and evolving, one should regularly update the EA and adapt it.

In comparison to humans, trading robots are not learning, they do not evolve themselves.

Leaving the robot without supervision, updates and patches, it may blow the entire account in a glimpse of an eye without any embarrassment.

One more important thing to add about EA, is the fact that it is technical analysis based. For now, there are no solutions on the market that would allow the integration of fundamentals in the algorithm.

Unfortunately, most of the traders overestimate the strengths of trading robots, completely neglecting its obvious weaknesses.

If you decide to apply EA in trading, always consider its pros and cons that we discuss in the post.

❤️Please, support my work with like, thank you!❤️

Advantages and disadvantages of trading robotsHello everyone

Today I want to discuss Trading Robots with you.

In trading, any trading method takes place, especially trading using a robot that is devoid of emotions and performs everything that is assigned to it with the accuracy of a tick.

Robots have many pros and cons, let's figure everything out in order.

Advantages

Speed. Any program is able to monitor more tools than a person. In addition, the program easily performs dozens of calculations and can analyze the market and make a deal in a matter of seconds, which the human brain is simply unable to do.

A trader cannot learn hundreds of strategies and rules and use them simultaneously in the market, trading manually. On the other hand, the program is able to safely use complex systems.

Accuracy. If the code is written correctly, if the strategy is well chosen, the robot will follow the rules accurately. An ordinary trader can choose the wrong tool, mix up the numbers, put a comma in the wrong place, the robot is absolutely accurate in its actions.

Fatigue and scalability. Any trader needs rest, no one is able to sit at the monitor and constantly trade correctly. Unlike a human, a robot just doesn't get tired. He is able to work all day, seven days a week and does not ask for time off. If you use a robot, you can be free all day and go about your business while the robot does all the work for you without fatigue.

Functionality. If a person finds a new strategy, he will need time to study it. And even after spending time studying, there is no guarantee that a person will understand everything that he studied the first time. But the robot will be taught easily, it is enough to write a line of code, and it will do everything, without errors, from the first time and you can add as much as you want and almost anything.

The robot is not subject to emotions. Perhaps the biggest problem of a trader is emotions. Every trader, especially a beginner, experienced strong emotions when he lost or when he earned. It will not be possible to correct your psychology and get rid of emotions in a second, but fortunately, the robot does not have such problems. The core of the robot is built on clear rules, the robot simply does not know how to deviate from them, and the robot does not know emotions. The robot doesn't care how many losing trades there were before or will be after, all it knows are the rules, and it adheres to them.

It is not easy to create a robot, but everyone can do it if they put enough effort and spend time.

Disadvantages

The complexity of making a robot (writing a program). Everyone can create a profitable trading strategy, but not everyone knows how to program and create robots. If you can program, you may have to learn a new programming language.

There is an opportunity to buy a ready-made robot or order a robot to be written to you. In the first case, you will not know what is hidden in the black box, you will not be able to configure it. In the second case, there is no guarantee that the programmer will understand your idea and do everything right.

The trading robot can only use technical analysis. A trader can read the news and understand the meaning that is hidden between the lines. The trader knows how to understand, but the robot does not. The robot understands only dry figures and therefore it uses technical analysis perfectly, but is not able to go beyond these limits.

In addition, there will be situations when you clearly see one scenario, and the robot simply does not see it. At the same time, it is impossible to stop trading the robot if it is profitable at a distance. The only thing that can be done is to analyze this situation and, if necessary, make changes to the algorithm, while carrying out the entire testing process anew.

A trading robot cannot make decisions in non-standard situations. It only fulfills the logic inherent in it, and in case of problems it will not be able to change anything.

Of course, the program can include the robot's reaction to some situations, but it is impossible to foresee everything. For example, if the Internet connection is lost, the robot will not be able to continue trading or at least close an open position. A trader trading manually, in this case, would call the broker and close the position, or restore the Internet. The computer may freeze, the program may close with an error, the broker may not accept the application or accept it, but with a long delay. The trading robot will not be able to react to all events and this may lead to unplanned losses.

The lack of emotions, one of the advantages of a trading robot, is also a minus. The robot can drain your entire capital in one day without any embarrassment. This must be taken into account when creating a robot. For example, allow the robot to trade only a part of your capital, or make it so that when a certain threshold is reached, the robot notifies you and (or) stops trading.

Conclusion

Concluding the consideration of the pros and cons of using trading robots, I want to say that the negative sides can be largely offset by a professional approach to creating a robot whose algorithm will take into account actions in non-standard situations. But at the same time, of course, there is no escape from the complexity factor in the process of creating robots, this is the main deterrent, which can only be overcome by spending considerable time on mastering programming.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

BTCUSDT - Long by Supertrend, RSI and Keltner 14 Jan, 2022- H4 timeframe: Supertrend Long.

- H1 timeframe: RSI & Keltner Channels.

...Keltner long when closes candle crossover Upper 3.

...RSI long when crossover 70.

* Open Buy when previous candle reject the Lower 1.

- Commission = 0.06% (Binance future), do not use Cross (Margin).

Elrond looking super strong agains ETHElrond not onyl strong agains USD, but also against ETH. Very bullish sign, since we are in an overall crypto bull market. I expect EGLD to outperform quite substantial.

Signal generated by my Weber Channel Signal. Might publish one day. For now I will just publish every now an then signals, when they occur.

ETHUSD - Auto trade Binance Future [SHORT] 23 Nov, 2021H4: Supertrend downtrend.

H1: Keltner down, Rsi down, Keltner color count: down.

Sell when previous OHLC4 candles crossover Lower 1 Keltner Channels.

Report: Keltner 'Upper 1/Lower 1' entries:

- 20/01/2019 - 20/11/2021

- 10/01/2018 - 01/01/2021

- 12/01/2017 - 01/01/2020

- 04/02/2016 - 01/01/2019

- 19/08/2015 - 01/01/2018

- 19/08/2015 - 01/01/2017

BTCUSD - Short signal by Supertrend & Keltner 22 Nov, 2021- Supertrend H4: Downtrend.

- Keltner channels H1: Downtrend when closes candles crossunder Lower 3.

- RSI H1: Downtrend.

>>> Wait to entry at Upper 1 (crossunder Upper 1)

* The simulation system is for reference only, true from 2013 up to now => use actual transactions. I don't know if the future holds true or not.

So you should use stop loss 1%-2%.

'buy BTCUSDT q=0.009 a=usdm' using automatic trading on Binance Future. Requirements: Pro, Pro+, Premium + Webhook accounts send signals.

Reports to all history BTCUSD (H1 timeframe)

- 01/01/2019 - 20/11/2021

- 01/01/2018 - 01/01/2021

- 01/01/2017 - 01/01/2020

- 01/01/2016 - 01/01/2019

- 01/01/2015 - 01/01/2018

- 01/01/2014 - 01/01/2017

- 01/01/2013 - 01/01/2016

- 01/01/2012 - 01/01/2015

ETHUSD - Auto trade Binance Future [SHORT] 19 Nov, 2021* Default option: trading volume based on actual capital of Binance exchange.

* Fixed Option: Fixed trading volume (0.001, 0.01, 0.1...).

>>> Auto-enter an order when the strategy has a signal, automatically close the order when the strategy closes the order.

Request:

- Account Pro, Pro+, Premium Tradingview .

- Register 1 webhook service to shoot signals through Binance exchange.

Commission: 4usd/contract (according to Tradingview Pine Wizards: Kodify).

Slippage: 2 ticks (according to Tradingview Pine Wizards: Kodify)

- Higher timeframe H4: Supertrend indicator is the main trend.

- H1 timeframe: Keltner Channels (EMA 50)

- Stoploss moving 1.2 height from Lower to Upper.

- Profit: Do not use take profit.

1. Entry 1: enter at Basis street

Keltner channel trend: bullish or bearish when the candle crosses the Upper 2 (long)/Lower 2 (short).

2. Entry 2: enter at Upper or Lower

- Keltner price channel trend: up or down when the candle crosses the Upper 2 (bullish)/Lower 2 (bearish) line

- RSI: 14 candles: increases when RSI crosses 70 and decreases when RSI crosses to 30.

3. Entry 3: Buy on the Lower and Sell on the Upper

- Keltner channel trend: up or down when the candle crosses the Upper 3 (long)/Lower 3 (short).

- RSI: 14 candles: long when RSI crosses 70 and short when RSI crosses to 30.

Advantage:

- Order processing speed is less than 1 second - 3 seconds depending on the speed between Tradingview & Webhook & Binance Future.

- Do not miss transactions while sleeping, not online.

- The transaction results are verified successfully from the beginning of the data to the present (Currently Tradingview only provides data for 2 codes BTCUSD & ETHUSD)

Disadvantages :

- Bear costs from 3 parties if there is no separate system (Tradingview user, Webhook, hiring Strategy).

- Systematic risk may not be true in the future.

Should TSLA be valued as a tech company?Most of fintwit is talking about how boring the AI day was for TSLA until they revealed they are working on a robot. Its certainly not a car!

This feels like some ploy to have TLSA be valued as a tech company.

The autonomous driving AI and now a robot AI must have Cathy Woods hoping this is the next accumulation phase.

Prediction from time traveler from 2049 FINAL WARNINGA Human being iluminaise in the dark forest, come to me to make a sacrafice.

Stay at present times to give us final warning about War and global warming.

Nowadays a beginning of new bubble taking place...

NFT of course I tell. To our planet Earth not going well.

In Cincinnati after secet meeting of iluminatii. They decide to not warn us of NFT ravages colide.

Because in late 2048 they have to merge with AI ... Make new Human race to expand in cosmic grace.

In 2031 brutal conflict going place ... 2037 Robots doing well it's hard to Spell In 2049 Skynet arrives and human history ends...

QFIHR-3990-IX the Human Hybrid Robot from the future.

Retail gamblers found the holy grail... To be a rogue trader!I just had a little look into "robots". I've known from reading some of the BIS reports that Forex quants mostly vanished after 2008.

But I wanted to go on these FX retail sites that are heavy in the "automated" very short term "trading", which is not actually day trading as they run these programs 24/24 there is no "end of the day so let's stay out of the market for 2/3 of the time to compound profits faster" 😄

Here is how I expect an exchange with an "automated" day gambler would go:

My day gambling strategy works muahahaha it does well on backtest for 1 years.

Me: "That's simply because the pair you tested it on has been trending for 1 year you numbskull"

Well you just have to apply it in the right conditions!

Me: "With your crystal ball? If you know what they are, why not just manually take 1 trade?"

Aha! Because of the power of compounding! Rather than risk 1% to make 5% I will make 2% 25 times.

Me: "Your brain on holiday? Forgot you would also compound spread costs and losses?"

Well forget it, if you rly zoom in and can't see anything it looks magical! Doesn't depend on the 1 year trend!

Me: "Then it depends on the 1 month trend?"

No! no matter what you say I have an idiotic answer!

Usually starts with "You just have to"!

I'll throw idiotic answers at you until you get bored and give up on me because I am hopeless!

Me: "Well done I give up" "Thanks for the laugh though" 😂

Take a good friend of mine, UDNCNY:

I can tell you for a fact that an "automated strategy" of the kind I am going to describe would work. Don't even need to backtest it.

The strategy is as follow: Take about any indicator (RSI, Bollinger Bands, etc). When the price goes down (< 30 RSI or lower band) then goes back up to the middle (RSI 50 or center of Bollingers) you sell. And of course the same on the opposite with buying.

Yes that strategy would work, we can quickly eyeball it:

In practice this is not even what they do. A risk-to-reward ratio as enormous as puny 1-to-1.8? That's like 1% of retail. Never!

What they do is have super distant stops, or no stops. And quickly by looking at USDCNY you understand how they can win.

Shorts at a loss are all in a pullback, and the price never goes very far, so by just waiting they will turn into winners at some point.

In my example which wasn't the best part of the USDCNY trend, there are 6 short signals, and 3 longs.

The longs that are not winners quickly, will "never" recover so they'll take a loss on a far away stop here.

But some longs are winners, and most to all shorts are winners, the smaller the reward and bigger distance the stop is, the close to 100% winrate it gets on shorts.

To sum up, with their ridiculous high winrate strategies applied in the right conditions:

- The vast majority of trades are going to be winners no matter what

- Maybe 1/3 of the losers are in the wrong direction and will be big bags

- Maybe 2/3 of the "losers" are in the correct direction and eventually will recover

These troll retail gamblers are zooming in a flower to the molecule level and wondering why it suddenly went invisible. Must be magic!

They have no clue. There is an insect on the flower, that's why you can't see the flower molecule anymore you numbskull.

This indicator strategy I mentioned works on a trend, how about a nice thick really gross sideways?

Constantly stopped! But have no worries for the retail gamblers have a trick up their sleeve!

With a very wide stop such as the risk is 20 times the size of the reward you will keep winning! Hurrah! Martingale!

And then it will start trending in the wrong direction and the clowns will get wiped out.

And I can assure you, this happens more often than 1 in 20 times 🙂

Now we are getting to my favorite part: The holy grail in the title.

I went to myfxbook take a look at system. By default they show you only the ones with positive returns, and many of those are very recent.

No no no no no. let me change that filter to at least 1 year of activity, and any returns.

What's this? More than half show red returns? Oh my that's a lot of -99% 🙂

Most people quit before getting to -99.

How about I pick one of the "winners"? Weird, why are their open trades private?

Another one. Private. Another. Private. And another, private again!

Oh I found one! TrumpBot. Interesting, that's a lot of red sir.

70 open trades, almost all in the red. USDCAD, EURUSD, USDJPY.

All EURUSD are sells, and all the ones ones are buys.

He took plenty of short term trades (well long term now as he's been holding the bag for a while) LONG on the USDOLLAR. Oh no!

Remember USDCNH? Well these bags go back to early in the USD downtrend. He's been holding for nearly a year 🙂

L - O - S - E - R

Just takes 1 L to wipe out these clowns. They can hack some site to make losses vanish, and obviously the dum dums that buy these kinds of systems are too lazy to really do their research so they never notice it, but if it's real money IT'S REALLY GONE.

There are some guys that have been struggling to make money for 20 years and have sold robots for 10.

Is it cruel if I... roll myself on the floor while I laugh to tears? 🤣

What about all these "private" systems? They're holding bags too?

There is a name for this. It starts with an F. And ends with raud.

It is the rogue traders specialty.

They do a bit more (pros), call them "hedges", manipulate accounting for example,

take opposite positions to cut their losses while keeping them secret (unrealized)...

Here is a regulator release on famous Karen Bruton, known as "the supertrader".

She was made famous by Tom Sosnoff that had her appear on his show.

The SEC fined her and a partner to over a million dollar. She lost way more than that. No jail.

www.sec.gov

Tom Sosnoff is a market maker from the 80s that created a popular trading platform that he sold,

and now teaches people to sell option spreads. With no edge or risk it will return little money, like 1%.

Karen the Supertrader got superresults by leveraging that strat. Which causes it to LOSE money.

Looks like Karen couldn't figure out high school level maths, nowadays this got to be 2nd uni year,

the levels has collapsed it's amazing, my sister aiming for med school doesn't even HAVE math classes

since 16 year old, science with no maths, genius government.

"But kids don't like it", ye so let's make them even dumber than they already are!

Yes but Karen convinced investors, and even Tom Sosnoff and his colleagues, that she made money!

Ye, just like all the myfxbook trolls. She never closed the losers.

Plenty of realized gains, and much larger unrealized losses. Pathetic.

And the flip side?

Warren Buffett has held unrealized gains on Coca-Cola since 1987.

Never held losses very long. Ever. Some uni nerd looked at it.

We know because he has to report all positions.

Losers (and crooks) hold losers. Winners hold winners. That simple.