Aeva Technologies (AEVA) – Pioneering Next-Gen LiDAR Company Snapshot:

Aeva NASDAQ:AEVA is revolutionizing perception systems with 4D FMCW LiDAR—offering instant velocity detection, high precision, and long-range sensing, setting a new standard for autonomous systems.

Key Catalysts:

Breakthrough Technology

AEVA’s proprietary 4D Frequency Modulated Continuous Wave (FMCW) LiDAR provides real-time velocity and depth data, outperforming traditional Time-of-Flight systems in accuracy and safety.

Automotive OEM Traction 🚗

Strategic collaborations are translating into production-stage contracts, marking a key inflection from R&D to scalable revenue generation.

Multi-Sector Expansion 🌐

AEVA’s sensing tech is penetrating robotics, aerospace, and industrial automation, significantly broadening its TAM and diversifying revenue streams.

Government & Aerospace Validation

Recent contract wins with defense and aerospace clients underscore AEVA’s technological credibility and commercial viability.

Investment Outlook:

Bullish Entry Zone: Above $22.50–$23.00

Upside Target: $39.00–$40.00, supported by production scaling, cross-sector adoption, and deep-tech differentiation.

⚙️ AEVA stands at the forefront of smart sensing innovation with strong momentum into high-growth verticals.

#AEVA #LiDAR #AutonomousVehicles #Robotics #Aerospace #IndustrialTech #SensorRevolution #4DPerception #FMCW #TechStocks #Innovation #SmartMobility

Robotics

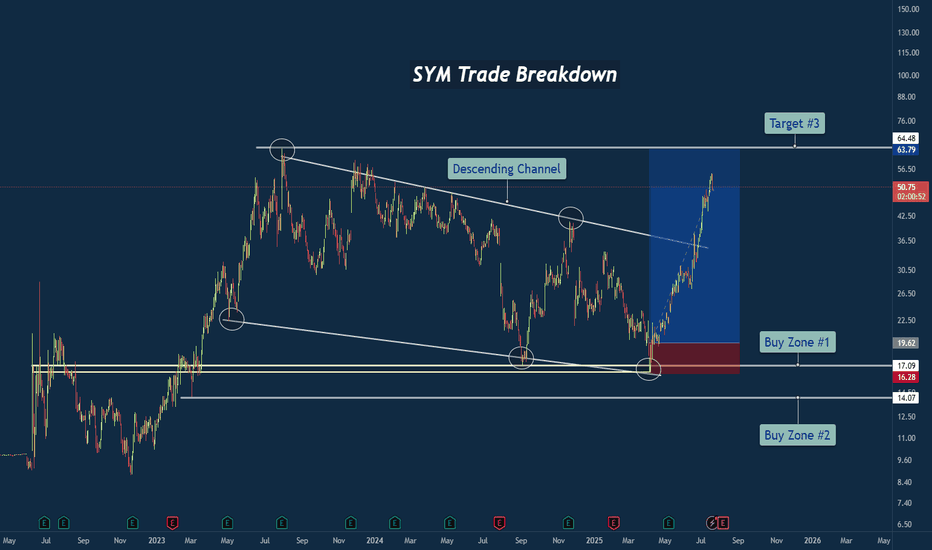

SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech

JD.cm | JD | Long at $33.16Like Amazon NASDAQ:AMZN and Alibaba NYSE:BABA , I suspect AI and robotics will enhance JD.com's NASDAQ:JD automation in warehousing, delivery, and retail. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NASDAQ:JD has a current P/E of 8.1x and a forward P/E of 1.2x, which indicates strong earnings growth ahead. The company is healthy, with a debt-to-equity of 0.4x, Altmans Z Score of 2.6, and a Quick Ratio of .9 (could be better).

From a technical analysis perspective, the historical simple moving average (SMA) band is still in an overall downtrend but starting to level out (accumulation of share area). It is possible, however, that the price may drop into the $20s to close out the existing price gaps on the daily chart as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NASDAQ:JD is in a personal buy zone at $33.16 (with known risk of drop to the $20s in the near-term).

Targets into 2028:

$44.00 (+32.7%)

$52.00 (+56.8%)

BMW: Stability, Innovation, and Opportunity in a Changing WorldIn times of market turbulence, great opportunities often lie hidden beneath temporary setbacks. Recent tariff-related ripples may have rattled BMW’s price, but for those looking to invest for the long haul, this dip is a golden opportunity to buy into one of the world’s most reliable automakers.

www.youtube.com

Resilient Amid Tariff Turbulence

Global trade frictions and tariff uncertainties have impacted many companies, and BMW is no exception. Yet, unlike many peers that retreat during such times, BMW remains steadfast—confident in its strategy and outlook. With industry insiders predicting that these tariffs are only temporary, BMW’s fundamentals remain ironclad. Its robust global presence and proactive planning have positioned it to weather these short-term shocks and bounce back stronger.

A Diverse, Future-Ready Product Lineup

While some high-profile names in the auto space chase trends with empty promises, BMW consistently delivers. Rather than focusing solely on electric vehicles like Tesla, BMW offers a balanced portfolio:

- Low-Emission Fossil Fuel Cars: Advanced, efficient engines that still serve a significant market segment.

- Hybrid and Electric Vehicles: Designed for the evolving demand for cleaner mobility, these models blend performance with environmental responsibility.

- Pioneering Hydrogen Technology: In collaboration with strategic partners, BMW is blazing a trail in hydrogen-powered vehicles—a potential game changer that ensures adaptability as the energy landscape shifts.

This diverse lineup not only meets current market needs but also positions BMW at the forefront of future mobility, delivering real, tangible products that work.

World-Class Manufacturing and Advanced Robotics

BMW’s reputation for engineering excellence isn’t just about beautiful design—it’s rooted in its state-of-the-art manufacturing. The company has embraced advanced robotics and automation, ensuring precision, efficiency, and consistent quality. With production facilities spanning the globe—including significant plants in the United States—BMW solidifies its stature as a truly international enterprise.

A Stable, Dividend-Paying Investment

In a market that often rewards volatile “meme” stocks and empty promises, BMW stands apart as a beacon of stability. Unlike Tesla, which currently pays no dividends, BMW offers a juicy dividend yield of over 5%, providing investors with regular, attractive returns. This dividend, coupled with its solid operational fundamentals, makes BMW a safe bet—one that rewards shareholders consistently even during turbulent times.

The Time to Invest Is Now

BMW is more than just a carmaker—it’s a symbol of resilience, innovation, and pragmatic progress. While market chatter may cast doubt amid temporary tariff-induced lows, the company’s diversified product mix, global manufacturing footprint, and commitment to delivering real, advanced technology create a compelling investment thesis.

For investors seeking stability, reliability, and the promise of long-term growth, BMW offers an opportunity to ride out the storm and benefit from a future where the company’s innovations in hybrids, electrics, and hydrogen continue to shape mobility worldwide. Now is the time to look beyond short-term market jitters and invest in a legacy built on quality, performance, and consistent returns.

Embrace the opportunity—BMW’s bright future is not just a promise; it’s already in motion.

XETR:BMW SIX:BMW NASDAQ:TSLA NYSE:GM NYSE:F

Nvidia $SERV'd this one! Massive move still on the table!NASDAQ:SERV

NASDAQ:NVDA selling out of this one crushed this name but...

- The CupnHandle is still intact IF this is indeed bottom.

- Volume Shelf and S/R Zone here

- Right at smoothing line which has historically held pretty well.

Only time will tell but if we come back up and break out of this CupnHandle at $24.32 we are going to...

🎯 $42

Not financial advice

Confessions from the Desk: Nvidia is Up, I Am NotIt’s Friday, the sun is shining, and Nvidia is up. Unfortunately, I am not.

Nvidia sits smugly at $137.19, while my $140 call is officially DOA—dead on arrival, with no chance of resuscitation. I’d like to say I’m surprised, but at this point, it feels like the market is just personally messing with me.

To add insult to injury, my carefully curated basket of stocks has been bouncing around like a drunk day trader on margin. One minute, I think I’m up; the next, I’m refreshing my portfolio like a gambler waiting for a miracle. Spoiler alert: the miracle never comes.

Meanwhile, Nvidia has been making big boy moves—cutting its stake in Arm Holdings, taking a bite out of China’s WeRide, and ghosting Serve Robotics and SoundHound AI like a bad Tinder date. The result? Stocks are moving, headlines are flashing, and somewhere in a penthouse office, a hedge fund manager is smirking at my pain.

Let’s break it down:

Nvidia dumps 44% of Arm Holdings – Apparently, even they have commitment issues.

Exited Serve Robotics & SoundHound AI – Serve was rolling along nicely until, well... it wasn’t. SoundHound AI got the boot, too, and its shares fell 25%. Ouch.

Pumped 1.7 million shares into WeRide – WeRide stock shot up 76%. That’s cool, but guess who doesn’t own WeRide? This guy.

Also bet on AI cloud firm Nebius – Stock rose 8%. Lovely. Again, not in my portfolio.

Now, as Nvidia makes its AI master moves, I sit here staring at my screen, watching Serve Robotics—one of my few February winners—go completely sideways. That’s right, folks. Nvidia’s got a plan, but my portfolio? It’s just vibing.

But hey, it’s Friday, the sun is out, and at least I don’t own SoundHound AI. Small wins, right?

Happy Friday

$PATH should test upper end of the range @ $21- NYSE:PATH is uniquely positioned for robotics automation which could benefit from advances in Generative AI and with launch of smarter Machine Learning & AI models.

- NYSE:PATH sits in the application layer which will provide companies to automate things with least friction while leveraging powerful models.

- NYSE:PATH is badly beaten down. However, with advancement of AI, this company could leapfrog its offering to customer

- NYSE:PATH could easily be potential acquisition by NYSE:NOW or NYSE:CRM

Nauticus Robotics, Inc. (KITT) - Long Setup | 15M Chart

The stock appears to be forming an up trend channel with HH and HL

The stock bounced off demand with increasing volume, confirming buyer strength.

Trade Plan:

Entry: ~$1.68

Stop Loss: $1.34 (Below the demand zone & invalidation level)

Take Profit Targets: $2.66 (RRR 4:1)

"It’s not whether you’re right or wrong that’s important, but how much you make when you’re right and how much you lose when you’re wrong." – George Soros

Manage risk: Stick to the plan and use stop losses effectively.

Disclaimer:

This is for educational purposes only and not financial advice. Always conduct your own analysis and manage risk accordingly before trading.

Serve Robotics (SERV) Analysis Company Overview:

Serve Robotics NASDAQ:SERV is a pioneer in autonomous last-mile delivery, leveraging AI-driven electric robots to reduce costs and emissions. With strong partnerships and financial backing, SERV is positioned to disrupt traditional delivery models.

Key Catalysts:

$450 Billion Market Potential by 2030 🌎

Serve’s $1-per-trip model could revolutionize delivery economics.

Strategic Partnerships – Uber & 7-Eleven 📦

Uber’s $11.5M investment and integration with Uber Eats enhance scale.

7-Eleven partnership strengthens Serve’s retail delivery presence.

Strong Financial Backing – Secured Through 2026 💰

$166M raised since December 2024, ensuring funding stability.

NVIDIA and Delivery Hero investments validate AI-driven robotics.

Investment Outlook:

Bullish Case: We are bullish on SERV above $14.00-$14.50, supported by disruptive potential, strategic partnerships, and financial strength.

Upside Potential: Our price target is $31.00-$32.00, reflecting market expansion, AI adoption, and industry transformation.

📢 Serve Robotics—Redefining Last-Mile Delivery. #AI #Robotics #AutonomousDelivery #SERV

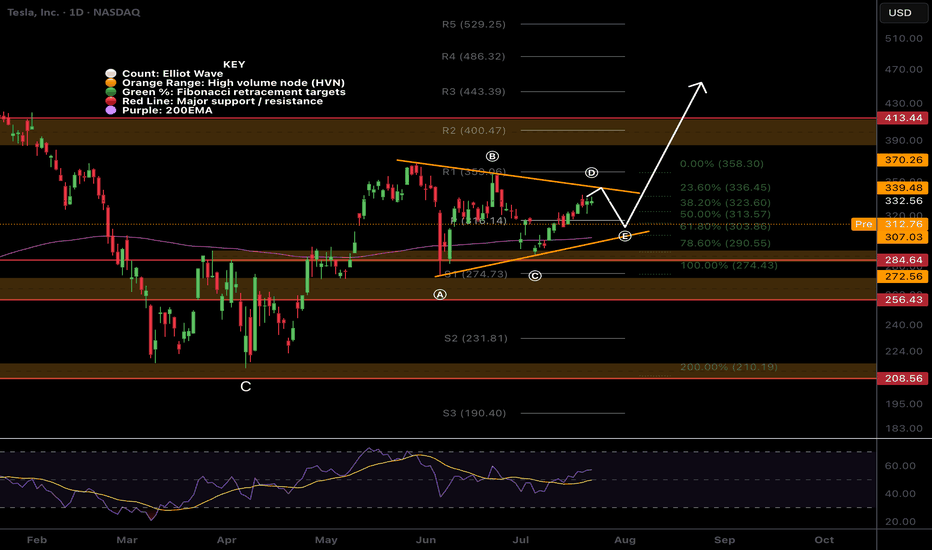

$TSLA to $500NASDAQ:TSLA

$440 is our critical price point from here. Ideally, we test trend at $386, where we will gain support to trade past $440 up to $500. Autonomy and FSD alone puts Tesla at $300. Robotics is not even part of the equation yet. The $7,500 EV tax credit is set to be removed by Trump, so as that approaches, we might see pull forward demand on the EV side of the business.

TSLA: Wave 1 complete?After a 4 year long corrective phase, we had a clear impulse move upward which signalled a clear break out, and perfectly executing the 1

618x fib extension.

It's possible we see a pull back from here as 2024 comes to a close. Final profit taking measures perhaps?

At any rate, look for supports on the way down for your buy signals. If we breach below 400, we may have the opportunity to buy as low as 300 (What a steal that would be!).

After completion of corrective sub-wave 2, the 3rd wave is typically longest and strongest and would potentially reach as high as $750+ with minimal pullback opportunities.

I believe 2025 is going a year full of surprises with many positive sentiment and catalyst's. The Department of Government Efficiency, FSD taxi's rolling out in California (🤞) and serious humanoid robot advancements, just to name a few...

2023 was the year for AI hardware, 2024 was for software, and 2025 will be for real world AI.

Best of luck, invest for the future!

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.

TSLA: 750 PT, for 2025Strictly off a long term investor perspective, and not a trade idea.

I buy companies I know will be successful in the future... And do technical analysis for fun.

We are entering in the final 5th leg of an impulse wave with a clear break on the monthly timeline out of the bull wedge pattern that has lasted 4+ years (e.g. "corrective wave 4")

If you wanted an opportunity to buy, it has been there for you for over 4 years. However, taking advantage of the final wave is upon us. Based on technical price projections (there are many), but I'm looking at the smallest projection, taking us to 750.

I believe overall, on a macro level, 2025 will be that last run in this crazy bull market and we will likely need to see a good strong correction. Not until we have had our fun first!

Do your own DUE DILIGENCE. Best of luck all...

NVDA is just getting started.

NASDAQ:NVDA

NVDA has been making headlines recently, with a significant bounce off support in the mid-90s and a successful breach of both the 100 and 50-day moving averages. This technical bullishness was further reinforced by the strong demand and growing penetration of AI into various markets.

However, the post-earnings retreat below the 50-day moving average has introduced a layer of uncertainty. While the overall technical picture remains positive, a closer look at the chart reveals an unfilled gap in the $109-$113 range. This gap represents a potential area of resistance that could hinder further upside momentum.

Filling the Gap and Reaching New Heights

If NVDA can successfully fill this gap, it could open the door for a more sustained upward trajectory. The stock's strong fundamentals, driven by the growing demand for AI and data center solutions, provide a solid foundation for continued price appreciation.

NVDA has recently broken above the upper resistance of a negative channel, but was unable to find support at these levels. Watch for this resistance to be broken again and serve as support for further upward movement.

Island Gap Potential, Dark Pool Buy Zone, HFTsThis stock has the potential to form an island gap, which are caused by High Frequency Trading activity that triggers on news. The gap down was too huge, so fundamentals are above the current price. This would be a gap UP potential at this point, to create the island gap.

The lows have been established clearly, so selling short this stock is not wise. But smaller funds and retail may try, as they tend to sell short stocks within a Dark Pool buy zone. Chaikin Osc and Money Flow Index are moving upward but the angle of ascent on price is steeper. The faster price ascent could be rapid accumulation from derivative developers.

UIPath creates software for Robotic Process Automation. It was one of the stocks discussed in the Case Study I did with my students in the summer of 2022 on the disruptive new technologies to watch over the next decade.

CSCO Layoffs Positive for the StockNASDAQ:CSCO gapped up on its earnings report even though the company has failed to reinvent and failed to change to HyperAutomation in its IT departments quickly enough.

News of layoffs is considered a positive action on the part of the officers of the corporation who are responsible first and foremost to INVESTORS and cutting costs so that the company can slowly regain revenues and earnings for dividends for INVESTORS.

Delaying layoffs, which may be kind and thoughtful for employees, is a negative for INVESTORS, namely the giant Buy-Side Institutions, because it extends and worsens the financial condition of the company.

As more and more companies buy robots/robotics and AI technology, these will reduce payroll expenses and help to control internal business inflation, which is caused mostly by rising payroll expenses with declining productivity from the workforce of the company.

This is always misunderstood by retail groups who believe layoffs are a bad thing for the "economy." The world of commerce and the financial markets is not a fair or kind place.

Is Robotics getting ready for the next move up?GETTEX:IROB has been in a strong uptrend from 2016 to 2021 with a performance of 260%. Since then it has been in a corrective movement on this. The most likely scenario (70% of the cases) is that this results in a Higher Low and another strong or weak move up. This scenario is valid as long as the price navigates above the Weekly Demand Zone.

There are now two possible scenarios. The first scenario is that the correction has already been completed with a C down in October 2023 after which the follow-up movement up has started. See the chart above.

For this scenario it is important that the price no longer closes below the Daily Demand Zone as indicated in the chart below.

As long as the price does not close below the Daily Demand Zone, the downward movement from March is no more than a corrective movement downward and a strong or weak upward move will follow. This move must generate sufficient buying interest for a strong continuation to take out the Weekly Supply Zone.

If the Daily Demand Zone is taken out at the bottom, there is a good chance that the Weekly corrective movement has not yet been completed. In that case, a C downward movement can still follow towards the Weekly Demand Zone. See the chart below for this:

The important zone to keep an eye on is the Daily Demand Zone. As long as the price moves above it, the sentiment is positive and the chance lies on the upside.

SYM to $89Overview

Consumers of artificial intelligence have garnered my attention, specifically cybersecurity and robotics automation companies. This is a hopeful attempt to obtain early exposure to industries that may thrive during the era of artificial intelligence. Symbotic ( NASDAQ:SYM ) is one of the those companies.

What does SYM do?

Symbotic Inc. utilizes artificial intelligence and robotics to enhance warehouse production. How this translated to me is that they support online shopping (ex: Amazon) by generating environments that can keep up with the demand through the use of robotic automation and artificial intelligence. This could be used in just about every business venture as a growing company will face the challenges that come with maintaining a healthy supply chain. This is why I believe Symbotic has a bright future ahead.

As of 24 July 2023, Symbotic and SoftBank ( TSE:9984 ) jointly founded GreenBox Systems LLC which aims to provide access to Symbotic's automations and software. The goal is to reduce inventory costs while simultaneously increasing capacity and management -- organization and collection. SoftBank has also vested in Symbotic with the purchase of 17.8M shares (worth $707,550,000 today) in addition to an unspecified amount of warrants covering 2% of outstanding shares. Warrants are similar to options except they are distributed to the holder directly by the underlying company.

Key takeaway: SoftBank is significantly invested in the A.I. powered robotics company.

2025 Price Target

Symbotic has been in a yearlong symmetrical triangle that appears ready for a breakout before the end of 2024. If a breakout does occur, I believe the share price will reach around $89 USD sometime in 2025. This price target was determined by utilizing uptrend Fibonacci retracement levels from the lowest and highest values of the current trading pattern.

Short-Term Price Target

A double bottom pattern appears to be forming which may see the share price diminish back to the $32-35 price range (yellow circle) in the near future. Should these price levels experience significant support, I believe the next area of significance will be the $41-42 price range (green circle). A breakout at this level may indicate a further rally.

Tesla $TSLA #TSLA #TSLT $TSLTMy plan for Tesla over the next few sessions of ideas.

Its rather clear what I'm looking for here.

I'll use NASDAQ:TSLT (leverage) to average out the larger DCA issues should it start to get away from me while using regular NASDAQ:TSLA for the main idea.

I like doing this so that it is a lot easier IMO to catch back up with the in between moves as well as have a secondary way to TP while still holding the larger position for the bigger move etc.

Profits from one can be rotated into the other making it not only your hedge but also a bit of a self sustaining play.

Should we get some sort of flash crash I'll happily take that as an opportunity to build a larger long-term play in the $75-$125 ranges.

Once they get passed this next cycle of manipulation and back to the ones who control the media and analysts pushing it we will see it blow through most of these levels with ease and back to $200+

Once we get some news one of these months/years about bigger companies buying the A.I. tech etc. we will have a whole other narrative besides selling cars and hype.

Cage Cycle Values for AgldusdtCage Cycle Values: If the price is above 1.6542 (Buy Point), the price target is 1.8342, and if it is below 1.6470 (Sell Point), the price target is 1.4670. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 1.6542

Profit: 1.8342 (Will be updated if necessary in the positive direction)

Stop: 1.6470

Short Position:

Entry: 1.6470

Profit: 1.4670 (Will be updated if necessary in the positive direction)

Stop: 1.6542

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 1.6542, the Stop Loss is 1.4670, and the Take Profit is 1.8342. When the price reaches 1.4670, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 1.6542 and the Take Profit being 1.4670. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages