Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

Rocketlab

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

Rocket (RKLB) From Launch Innovator to Space Systems PowerhouseCompany Evolution:

Rocket Lab NASDAQ:RKLB is transforming into a vertically integrated space and defense systems company, leveraging its launch heritage to build long-term, diversified revenue streams.

Key Catalysts:

Rapid Launch Cadence 🛰️

3 Electron launches in 24 days demonstrate operational agility and scalability.

Meets rising demand for high-frequency satellite constellation deployments.

Strategic GEOST Acquisition 🛡️

$275M deal expands into electro-optical and infrared payloads, key for defense/ISR.

Boosts margin profile, backlog durability, and government contract appeal.

Validated Execution & Recurring Revenue 💼

100% mission success rate and multi-launch contract with Japan's iQPS reinforce credibility.

Positions RKLB for long-term cash flow stability and multiyear contract wins.

Investment Outlook:

📈 Bullish above $23.00–$24.00, backed by high reliability and strategic expansion.

🎯 Price Target: $42.00–$43.00, reflecting an expanding TAM, defense sector momentum, and vertically integrated execution.

🌠 RKLB is no longer just reaching orbit—it's building the infrastructure of space. #RKLB #SpaceStocks #DefenseGrowth

ROCKET LAB establishing its long-term Support to $32.00It's been too long (September 30 2024, see chart below) since we last took a trade on one of our stock gems, Rocket Lab (RKLB), which smashed through our $14.50 Target:

The price is now trading sideways for the past 2 weeks, establishing the 1D MA50 (blue trend-line) as the new Support. Having made the Trade War bottom on its 1D MA200 (orange trend-line), it got its much needed overbought technical harmonization and created new long-term demand.

The pattern is similar to the 1D MACD Bearish Cross in late May 2024, which also made the price trade sideways before eventually almost testing the previous Resistance. As a result, we expect to see $32.00 in July before the stock breaks to a new All Time High.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

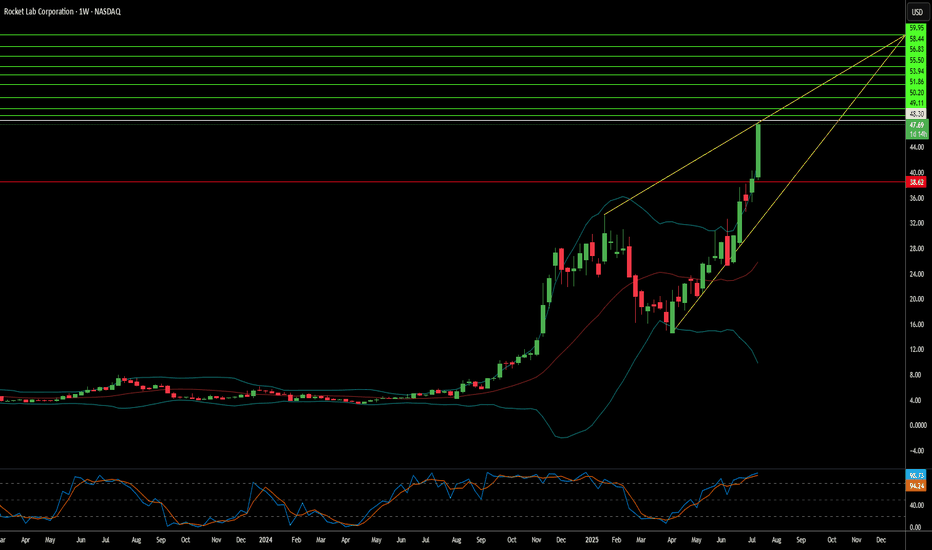

ROCKET LAB: Channel Up aiming at $78.RKLB turned marginally neutral again on its 1W technical outlook (RSI = 47.190, MACD = 1.683, ADX = 38.570) as it basically remains flat for the past 3 weeks. Since the price is not that far off the 1W MA50, we believe that's the (long term) bottoming process of the 1 year Channel Up. We are also a little bit over the 0.382 Fibonacci retracement level and once the process is over we expect the new bullish wave to target the -0.382 Fib extension (TP = 78.00) as the top of this Cycle.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

RKLB Rocket Lab USA Options Ahead of EarningsIf you haven`t bought RKLB before the previous earnings:

Now analyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 21.5usd strike price Calls with

an expiration date of 2025-3-7,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKLB Rocket Lab USA Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $2.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ROCKET LAB Time the next pull-back and buy.Exactly 4 months ago (May 29, see chart below) we gave the ultimate long-term buy signal on Rocket Lab (RKLB) when it was trading at $4.39 and eventually not only did it return us +100% profit by hitting our $8.75 Target but even broke above the 2-year Higher Highs trend-line and Resistance 1:

It is now confirmed that the stock has broken into a new Bull Cycle and won't (most likely) continue to follow the accumulation pattern of the previous 2-year Ascending Triangle. This is also evident on the 1D RSI, which is rising on a Channel Up.

In our opinion it will continue the pull-back buy low sequence that started in July. The next key Resistance is the 0.618 Fibonacci, above which we expect the next short-term correction to start. Our intention is to buy again at 9.15 or if we see 2 red 1W candles first.

Our next Target will be 14.50 (the 0.786 Fib).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ROCKET LAB has started a new 9-month correction phase.Rocket Lab USA (RKLB) topped on August 19 after a more than +100% rise from the bottom that eventually reached the top of the Sine Wave count and as a result even though it failed to reach our $8.75 mark (Target 2), we will take profit on the last buy signal we issued (May 29, see chart below):

As you can see by the Sine Waves, RKLB is repeating a 2-year cyclical pattern (since the June 30 2022 bottom), which every time it provides a buy opportunity that delivers a little over +100% return (3 times so far within this time span).

Now that we got our +111% rise, we expect a new multi-month correction phase to start, initially in the form of a Channel Down (red). The previous correction phase lasted for 9 months and the one before for 10 months, before the +100% rallies commenced.

As a result, we are far away from a buy opportunity at the moment and the best course of action is to short below even the 1D MA200 (orange trend-line). Our Target is $4.35, the middle of the High Volatility Zone, which is located just above the (green) Support Zone, where our next long-term buy will be.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Rocket Lab’s Stock Surge: A Successful Launch Drives MomentumRocket Lab USA, Inc. (NASDAQ: NASDAQ:RKLB ), a prominent player in the space industry, experienced a significant surge in its stock price, driven by the successful completion of its latest mission in collaboration with Capella Space. On Thursday, Rocket Lab's stock soared by an impressive 12.55%, continuing its upward trajectory with a further 5.34% increase in Friday's premarket trading.

A Week of Success

This week has been remarkable for Rocket Lab (NASDAQ: NASDAQ:RKLB ), with the stock consistently rising as the company solidifies its reputation as a leader in launch services and space systems. The catalyst behind this surge is the successful deployment of a Capella Space satellite using Rocket Lab's Electron rocket. This mission, aptly named “A Sky Full of SARs,” marked Rocket Lab’s 52nd Electron launch and was carried out from their Launch Complex 1 on New Zealand’s Mahia Peninsula.

The mission involved deploying Capella’s latest synthetic aperture radar (SAR) satellite, part of its third-generation Acadia series, into a low Earth orbit. This satellite is a crucial component of Capella’s Earth-imaging constellation, providing high-resolution radar imagery for various applications. Rocket Lab’s ability to deliver precise and reliable launches continues to attract major satellite operators, strengthening its position in the global space industry.

Building Momentum

Rocket Lab’s partnership with Capella Space dates back to August 2020, with this recent mission being the fifth in their multi-launch contract. Over the years, Rocket Lab (NASDAQ: NASDAQ:RKLB ) has proven its capability to meet the growing demand for satellite deployment, consistently delivering successful missions that meet the specific needs of its clients. The company’s CEO, Peter Beck, emphasized Electron's role as a "reliable constellation builder," enabling operators like Capella to expand their satellite networks effectively.

The momentum doesn’t stop here. With nine successful launches already this year, Rocket Lab (NASDAQ: NASDAQ:RKLB ) is on track to achieve its busiest year yet in 2024. The upcoming months are set to be equally exciting, with multiple launches planned, including a record ten-launch contract with Japanese Earth observation company Synspective.

The Road Ahead

Investors are closely watching Rocket Lab (NASDAQ: NASDAQ:RKLB ) as it continues to secure high-profile contracts and deliver on its promises. The company's ability to maintain a steady launch cadence while securing new business partnerships signals strong growth potential. As Rocket Lab (NASDAQ: NASDAQ:RKLB ) prepares for its next mission, set to be announced in the coming days, the anticipation is building, with market participants eager to see if the company can sustain its current momentum.

Technical Outlook

Rocket Lab (NASDAQ: NASDAQ:RKLB ) has experienced a noteworthy increase in its stock price, showing a rise of 5.45% during premarket trading on Friday. This upward movement suggests a positive sentiment among investors and could signify robust interest in the company’s activities. Currently, the Relative Strength Index (RSI) stands at 65, which indicates that the stock may be slightly overbought at this moment. Nevertheless, the RSI also suggests that there is still potential for ongoing growth in the stock, as it remains within a range that could foster further gains in the near future.

In conclusion, Rocket Lab’s stock surge is a reflection of the company’s consistent performance and strategic growth in the space industry. With successful missions like "A Sky Full of SARs," Rocket Lab is not only proving its technical prowess but also positioning itself as a key player in the rapidly expanding space economy. As the company continues to execute on its ambitious plans, investors and industry watchers alike will be keen to see what the future holds for Rocket Lab and its stock.

RKLB Begins Uptrend

RKLB received a reaction from the support level it has been testing for 2 years and managed to break the downtrend it has been in for the last year.

I bought at 4.65 and I plan to add if it gives me the opportunity to buy again below 5 dollars.

The first target is 7.6. If it exceeds this level, the next targets are 10 and 14 dollars.

ROCKET LAB 1st 1D Golden Cross in 1 year!Rocket Lab (RKLB) is up heavily following our last buy call (May 29, see chart below) and is approaching our $5.50 short-term Target:

Since however the Lower Highs trend-line is now a bit lower and the medium-term pattern since April's bottom emerged as a Channel Up (dotted), we lower this short-term Target to $5.35.

The key development of the week though is none other than the formation (today) of the 1st Golden Cross on the 1D time-frame in 1 year (since June 20th 2023). As a result, we don't expect the rally to stop there but instead to accelerate tiwards the 2-year Higher Highs trend-line. This is a seasonal rally that RKLB has done in the past two years during July-August. Our long-term Target is 8.75.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ROCKET LAB Bullish break-out imminent.Rocket Lab USA (RKLB) has completed a Bull Flag pattern (green Channel), trading right below the 1D MA200 (orange trend-line), which has been its long-term Resistance since January 24 2024. Based on its 2-year Cyclical pattern, the stock should surge aggressively if it breaks above the 1D MA200.

The 1D RSI is posting the exact same formation it had during the break-outs of May 2023 and July 2022. All formed after strong rebounds within the Support Zone.

In any case, our medium-term Target $5.50, which will be a test of the Lower Highs trend-line, similar to June 07 2023.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ROCKET LAB: Very strong long term buy opportunity.RKLB is almost oversold on the 1D timeframe (RSI = 31.788, MACD = -0.150, ADX = 26.851) which makes it an automatic technical buy for the long term. Besides that, the price has entered the long term Support Zone that commenced on the June 30th 2022 Low. The pattern is identical to the March-May 2023 bottom. Once the 1D MA50 breaks again, we expect a very aggressive rally. Target 1 on the LH trendline (TP1 = 5.50) and long term Target 2 near the HH and 1.236 Fib (TP2 = 8.75).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ROCKET LAB on an accumulation zone, +100% profit potential.Rocket Lab (RKLB) just formed a Death Cross on the 1D time-frame, almost a full month after rebounding near the 1.5 year Support Zone. This is technically an Accumulation Zone that the stock tends to make on that Support Zone before starting a parabolic Rally to the Higher Highs trend-line.

In fact it was the 1D Death Cross formed on March 15 2023 that started the previous Accumulation Phase, which resulted into a +114.46% really. As a result, we expect this Phase to last until the end of March maximum, and then start a parabolic rally. Assuming each rally is by +10% stronger than the previous (1st +105.08%, 2nd 114.46%) then we estimate the next one to be around +125%. This will make a perfect test of the 8.75 April 21 2022 High.

Notice how each rally peak is very efficiently depicted by the tops of the Sine Waves. Also during each Accumulation Phase, the 1D RSI forms a Bullish Divergence on Higher Lows.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

🚀 Rocket Lab (RKLB) 🚀 Rocket Lab (RKLB) achieved ten successful launches in 2023 and secured a $515 million US government contract, leading to a 22% surge in shares.

The company's success contributes to a 40% increase in shares this year, maintaining a bullish sentiment with an upside target of $7.50-$8.00 and support at $4.00-$4.10. 📈🛰️

#RKLB #StockMarket

ROCKET LAB can give +100% return. Best stock opportunity now?Rocket Lab USD (RKLB) has been consolidating for exactly one month (blue Arc pattern) after touching the Higher Lows Zone and now uses the 1D MA50 (blue trend-line) as its Pivot. We can see the very same consolidation pattern during the previous two market Lows (April - May 2023, June - July 2022), which gave enormous rallies of +114.46% and +105.08% respectively.

Similar with today's pattern, each bottom was priced on a 1D RSI Higher Lows sequence, which is a major Bullish Divergence. As a result we consider this one of the best high cap stock buy opportunities at the moment, and aim for at least a +105.08% rise, targeting $8.20.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇