Rolls Royce - Are You Ready For The Ride?Hello everyone, if you like the idea, do not forget to support with a like and follow.

RRU formed an inverse head and shoulders pattern , but it is not ready to go yet.

Before we buy, we want the buyers to prove that they are taking over again. You don't want to buy a bearish market right?

Trigger => Waiting for a momentum candle close above the neckline to buy. (gray area)

Meanwhile, until the buy is activated, RRU would be overall bearish and can still trade lower.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Rollsroyce

How to Draw Support & Resistance Lines for StocksIn this video I use simple easy to learn processes to mark out support and resistance levels. And importantly analyse if buyer or sellers are currently in control of the market.

If you have found this useful then please like the post, follow my page and share with any friends you think will find it useful.

ROLLS ROYCE price analysis - take-off with 70% profit?Hello everyone,

Today I want to share my thoughts on Rolls-Royce.

- I'm not really a fan of a shoulder-head-shoulder formation, but this time the targets just fit too perfectly in a fundamentally friendly market environment

- The price is about to break out of the bottom formation

- I expect a dynamic breakout

The plan

- Enter on a weekly close above the upper trendline, or on a retest after the breakout

- Trade to the golden pocket of the last correction

- Almost 70% profit seems possible without touching the downtrend

With this in mind,

Good luck $ Keep it simple

Max

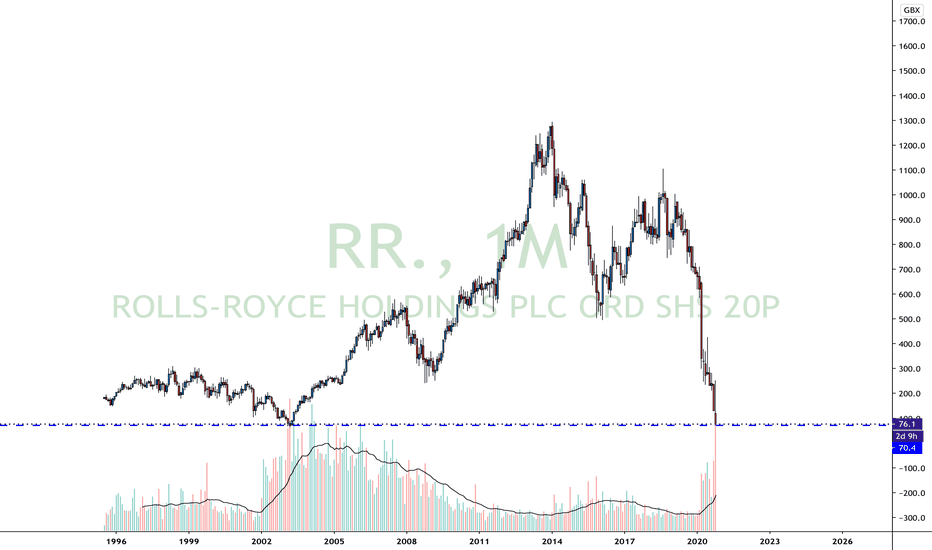

Long Term Analysis on Rolls RoyceLSE:RR. OTC:RYCEY

Looking at RSI trendline, support trendlines, volume, the stock looks like it is preparing to go somewhere.

The last Impulse wave began in October 2020 and ended in December 2020.

I believe we are about to complete the correction we are in since December 2020, and preparing for another move up in the near term.

Rolls Royce - Do Not Miss The Big Opportunity in RRThis is at strong support both technically and psychologically as it is at £1. I do not expect this to drop anymore from here, if it does then a quick bounce back should be expected as can be seen on the 21st December 2020. I have set TP at the previous high of 146.45 and then another target at 164 if it breaks the previous high.

Rolls Royce Entry ( Long term)We can see a nice range where RR is in at the moment, this is the same range from a small period in 2015.

We also see a small compression in the last weeks. This could result in an impulse.

Because of the third lockdown in UK we expect an impulse going down, touching the support level around.

3 Entry's:

1)If you don't want to miss it out, you can open an aggressive entry around 103.

2) If you are looking for a safe entry you can also enter around the support level (88)

3) The third entry is around 67 , also the bottom green line, in a worst case scenario it possibly can drop this low.

Keep in mind there is a small chance that it will hit that level again.

#TradingTipsUK

#TradingTipsTA

Rolls Royce Stock Analysis HOLDThe Rolls-Royce (LSE:RR) share price has slumped to 84p. Today’s share price crash is due to over 6bn new shares hitting the market.

Since each share now represents a far smaller slice of ownership of Rolls-Royce, they are all worth less today compared to yesterday.

If you have 300 existing shares, for example, you have the right to buy 1,000 new shares at 32p.

By buying all your rights for a total price of £320, you now have 1,300 shares and own the same percentage of the company as you did before the rights issue.

Rolls-Royce’s £2bn cash call has been “overwhelmingly” backed by shareholders, unlocking a rescue package totalling £5bn.

Investors supported the 10-for-3 rights issue in which they can buy new shares at 32p - a 41pc discount.

Agreeing to the rights issue allows Rolls to access £2bn of bonds it has sold, and the Government has backed a potential £1bn of further debt.

RR - ROLLS ROYCE Technical AnalysisPrices have been moving inside the channel and now that the prices are closer to the top resistance level the following Options canbe possible: (hold before going for one of the below options)

Option 1 - 50% Only if the resistance level of 2.40 Pound will be broken

Option 2 - 50% Only if the resistance level of 2.40 Pound will NOT be broken

A Breakout of a support/resistance line could be considered valid only if the close price of a daily candlestick for at least two consecutive days is below/above the support/resistance level