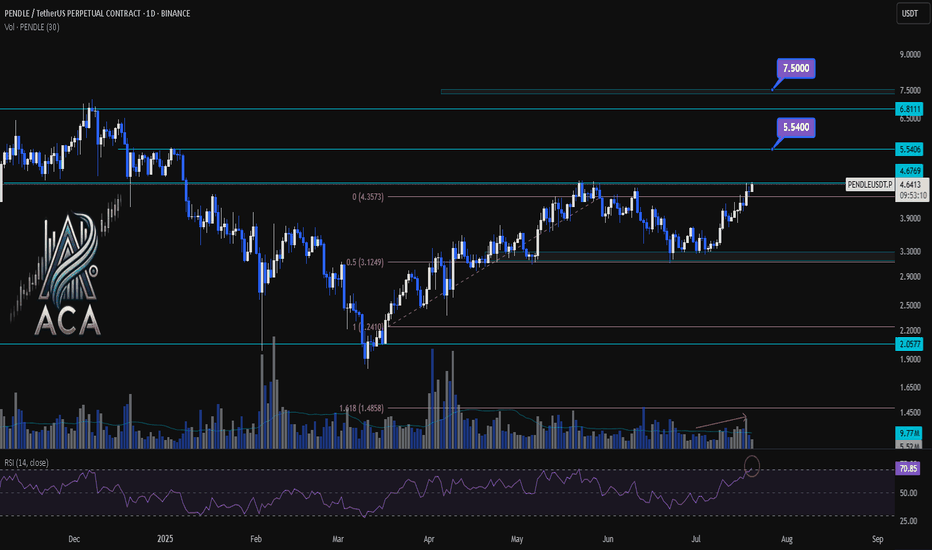

PENDLEUSDT 1D Chart Analysis|Bullish Breakout Eyes Higher TargetPENDLEUSDT 1D Chart Analysis | Bullish Breakout Eyes Higher Targets

🔍 Let’s break down the PENDLE/USDT daily chart, focusing on breakouts above key resistance, Fibonacci retracement dynamics, RSI momentum, and volume confirmation for a comprehensive bullish setup.

⏳ Daily Overview

PENDLE has staged a powerful recovery after pulling back to the 0.5 Fibonacci retracement level (around $3.12). Price is now testing the critical $4.68 resistance—the ceiling from the last corrective wave. RSI has jumped above 71, entering the overbought zone, a classic precursor to strong momentum moves. Volume is rising as bulls attempt a breakout, confirming participation behind the price action.

📈 Technical Convergence and Trend Structure

- Fibonacci Structure: The correction held the 0.5 retracement, a textbook bullish reversal zone in rising trends.

- Resistance Breakout: Price is challenging the $4.68 resistance. A daily close above, especially with high volume, would confirm the breakout and trigger bullish continuation.

- RSI Indicator: RSI has cleared the 70 mark, reinforcing strong momentum. Overbought RSI often supports further rallies when backed by breakout moves and rising volume.

- Volume Confirmation: Volume surged as PENDLE reclaimed lost ground and is now accelerating into the resistance test, suggesting trend conviction and confirming the move.

🔺 Bullish Setup & Targets

- First target: $5.54 — the next resistance based on historical supply and Fibonacci extension.

- If macro conditions like interest rate cuts align, the next potential target: $7.50 — the major extension target where price discovery is likely.

- Key trigger: A strong daily (or weekly) close above $4.68, combined with breakout volume, is likely to ignite the next leg up.

📊 Key Highlights

- Correction held at the 0.5 Fibo, signaling trend health and resetting momentum.

- A bullish daily structure aligned with a weekly breakout confluence.

- RSI and price action both making new local highs — strong uptrend indication.

- Volume confirming the move—a real breakout is underway, not a false start.

🚨 Conclusion

PENDLE/USDT looks primed for continuation higher. The blend of a successful 0.5 retracement retest, breakout attempt above $4.68, robust RSI, and volume surge all point to bullish follow-through. Watch for a confirmed close above resistance as the catalyst for further upside, with $5.54 and $7.50 the next logical targets if momentum persists.

Rsi14

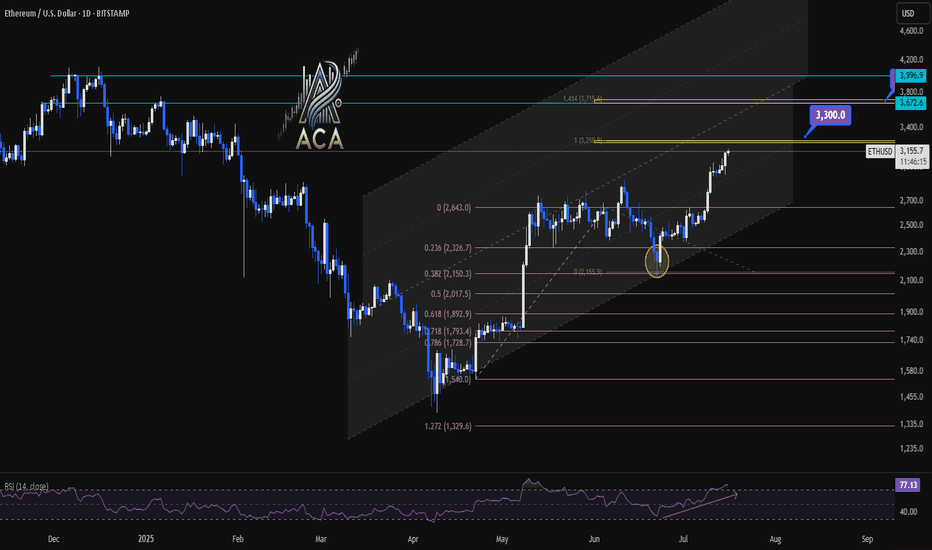

ETHUSDT 1D Chart Analysis | RSI Strength & Fibonacci TargetsETHUSDT 4H Chart Analysis | RSI Strength & Fibonacci Targets in Play

🔍 Let’s break down the latest ETH/USDT setup — bullish momentum is building with confluences pointing toward key upside targets.

⏳ 4-Hour Overview

Ether continues climbing within a well-defined ascending channel, with recent candles holding above mid-level support. Price is pressing higher from a clean bounce at the 0.5 and 0.618 Fibonacci retracement zone ($2,017–$1,899), signaling the correction has likely ended.

📉 Fibonacci Levels & RSI Confirmation

- The strong recovery aligns with rising volume and a bullish structure.

- RSI is pushing into overbought territory (above 73), often a sign of strength during trends—not exhaustion.

- ETH is now positioned for a breakout continuation move if momentum holds.

🎯 Bullish Targets Ahead

- Immediate resistance: $3,300 (1.414 Fib extension + historical supply)

- Next major target: $3,700 (1.618 extension + upper channel confluence)

- Pullback zones: $2,950 (mid-channel) and $2,017 (Fib support base)

📊 Key Highlights:

- Price is respecting the rising channel structure — higher lows, higher highs in play.

- Volume supports the breakout narrative, rising on green candles.

- RSI breakout supports trend continuation, not exhaustion.

- Targets at $3,300 and $3,700 remain actionable on a confirmed breakout.

🚨 Conclusion:

ETH is showing a multi-variable bullish setup with clear continuation potential. A strong move above $3,300 could quickly send price toward $3,700. Pullbacks to $2,950–$2,017 could offer high-risk/reward re-entry zones. Momentum favors bulls — stay alert.

RSI 101: The Secret of RSI’s WMA45 Line and How to Use ItIn my trading method, I use the WMA45 line together with RSI to help spot the trend more clearly.

Today, I’ll share with you how it works and how to apply it — whether you're doing scalping or swing trading.

Why WMA45?

WMA (Weighted Moving Average) is a type of moving average where recent prices are given more importance.

WMA45 simply means it takes the average of the last 45 candles (could be 45 minutes, 45 hours, or 45 days depending on your chart).

Because it moves slower than RSI, it helps reduce the “noise” and gives you a better idea of the real trend.

This idea is not new — many traders have tested RSI strategies also use this line. I just applied and adjusted it in my own way.

👉 How to set it up on TradingView (very simple):

What WMA45 Tells You

Trending

This line shows you the overall direction of the market:

📉 If WMA45 is going down, the price is likely going down.

📈 If WMA45 is going up, the price is likely going up.

Also, the steeper the line, the stronger the trend is:

Looking at the example above, the WMA45 line starts from the same level in two different phases, but the slope is different. The steeper line shows a larger price range.

This happens because the price was more volatile, which caused the RSI to move more sharply, and that, in turn, made the WMA45 slope steeper.

In multi-timeframe analysis, when the trend on the higher timeframe is strong (shown by a steep WMA45 line), the RSI on the lower timeframe will usually move within a tighter range and react more accurately to key levels.

If you’re not sure what these key RSI levels are, check out my previous post here:

For example, in a strong downtrend on H1, RSI on M5 might not even reach 50:

✅ What does this mean for trading?

Use WMA45 on higher timeframes to define trend bias.

On lower timeframes, watch RSI responses at key zones for optimal entries.

When holding positions, WMA45 helps determine whether to stay in the trade.

Moving Sideways

Here’s something important to note: when WMA45 is flat, RSI will keep crossing back and forth over it.

Depending on where WMA45 is flat, RSI tends to move within that range and creates different sideways price patterns. Here are the main types:

Around 50 → price moves in a box: According to RSI theory, the 50 level is the balance between buyers and sellers. RSI fluctuating around this causes price to move sideways in a rectangular box range.

Above 50 → price goes up in a rising channel: Above 50 is where buyers dominate sellers. RSI operating in this zone will continually create bullish candles pushing the price upward.

Below 50 → price goes down in a falling channel: Below 50 is where sellers dominate buyers. RSI in this zone will consistently form lower highs and lower lows, pushing the price downward.

Trend Reversal of WMA45

WMA45 is calculated from the average of 45 candles, so it's almost impossible for it to reverse direction suddenly. When it's sloping (trending), it takes time for RSI to fluctuate enough to "flatten" it before it can reverse.

As shown in the example, after WMA45 slopes up, before it turns downward, RSI must cross back and forth through it to reduce the steepness => flatten it => then reverse.

Does this align with Dow Theory? It represents the phases: Trend > Sideway > Trend. Sideway is when the WMA45 line is flattened.

✅ What does this mean for trading?

After a trend forms, if you want to enter a counter-trend trade, patiently wait for WMA45 to flatten to confirm the previous trend has ended.

Dynamic Support and Resistance

In addition to being a trend indicator for RSI, WMA45 also serves as a dynamic support/resistance level for RSI.

You will often observe RSI reacting when it encounters the WMA45 line.

In an uptrend, WMA45 acts as support for RSI.

In a downtrend, WMA45 acts as resistance for RSI.

Notably, if the reactions occur at higher RSI values, the resulting price support is stronger. Conversely, if reactions happen at lower RSI values, the price is pushed down further.

In the above example, in the first reaction around RSI 60s, RSI dropped by 9.6 points and price dropped by 12 points. In the second reaction at RSI 40s, RSI dropped similarly, but the price dropped by 25 points.

✅ What does this mean for trading?

You can use WMA45 as an entry zone for your trade: Wait for reactions with WMA45 on the higher timeframe, then switch to a lower timeframe to find a trade entry.

Use WMA45 as a take-profit or stop-loss level: For a short trade near WMA45, you can stop out if RSI crosses above it.

When monitoring these reactions, pay attention to the number of reactions—more reactions require more caution in trading.

Some Trade Setups Using WMA45 and RSI

1. Intraday trading

Trend: Follow the trend on the H1 chart.

Entry zone: At WMA45 of H1.

Entry confirmation: 2 methods:

On M5: when WMA45 of RSI is already flattened, and RSI has crossed above WMA45.

On M5: when a divergence appears in RSI.

2. Scalping

With the RSI’s reaction to WMA45, even on smaller timeframes (M1, M5), you can scalp when RSI touches WMA45.

When WMA45 has a slope and RSI returns to touch it, you can enter a trade with SL behind the candle close (10–20 pips to avoid stop hunts and spread), and TP to the nearest peak.

As mentioned, the first touch gives the best reaction.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

RSI 101: Revealing the Special Characteristics of RSIWhy does RSI have support and resistance levels at 40 and 60?

Why does divergence happen between RSI and price?

What is RSI momentum?

All the characteristics of RSI (that I know) will be explained here.

Formula and Meaning

If you are using TradingView, you probably already know what RSI is and what "overbought" and "oversold" mean. So, I won’t repeat it here. Instead, I’ll dive deeper into the true nature of RSI, giving you a different perspective.

You can skip the mathematical formula of RSI, it’s already discussed everywhere online. Just remember this ratio table:

Here’s how I explain the table:

At RSI = 50, the average gain equals the average loss (I'll call this the buy/sell ratio). This is a balanced point. Buyers and sellers are equally strong.

At RSI ~ 60 (66.66), the buy/sell ratio = 2/1. Buyers are twice as strong as sellers.

At RSI ~ 40 (33.33), the buy/sell ratio = 1/2. Sellers are twice as strong as buyers.

At RSI = 80, the buy/sell ratio = 4/1. Buyers are four times stronger.

At RSI = 20, the buy/sell ratio = 1/4. Sellers are four times stronger.

The formula shows that when RSI reaches 80 or 20, the buyer or seller is extremely strong — about four times stronger — confirming a clear trend.

At these levels, some Trading strategies suggest placing a Sell or Buy based on the overbought/oversold idea.

But for me, that’s not the best way. The right approach is: when a trend is clearly formed, we should follow it.

I'll explain why right below.

Look at this chart showing RSI changes with the buy/sell ratio:

When RSI > 50:

When RSI < 50:

You can see that the higher RSI goes, the slower it climbs, but the high buy/sell ratio makes price move up faster.

Similarly, when RSI goes lower, it drops slower but price drops faster.

That’s why at overbought (RSI=80) or oversold (RSI=20) areas, you need to be careful. Even a small RSI moving can lead to big price changes, easily hitting your stop loss.

On the other hand, if you follow the trend and wait for RSI to pull back, you will trade safer and more profitably.

RSI Key Levels

Here are some special RSI levels I personally find useful when observing FX:XAUUSD :

(These levels are relative. They might vary with different timeframes or trading pairs. Check historical data to find the right ones for you. On bigger timeframes like M15 or above, the accuracy is better.)

RSI = 20

When RSI hits 20, sellers dominate. This confirms a trend reversal to bearish.

RSI = 80

When RSI hits 80, buyers dominate. This confirms a trend reversal to bullish.

RSI = 40

This is a sensitive level. Sellers start gaining the upper hand (sell/buy = 2/1).

If buyers lose 40, they lose their advantage.

So RSI >= 40 is "buyer territory". In an uptrend, RSI usually stays above 40.

RSI = 40 acts as support in an uptrend.

RSI = 60

Same idea. RSI <= 60 is "seller territory".

RSI = 60 acts as resistance in a downtrend.

40 and 60 are considered the key levels of RSI.

Now you guys know why RSI has support/resistance around 40/60!

RSI Range

As you know, RSI moves between 0 and 100.

Since RSI >= 40 is buyer territory, we can see the relationship between price and RSI:

When RSI stays above 40, price tends to move in an uptrend:

When RSI stays below 60, price tends to move in a downtrend:

When RSI stays between 40 and 60, buyers and sellers are balanced, and price moves sideways in a box:

When RSI is moving, It creates a RSI Range.

Whenever the trend switches between the three states — uptrend, sideways, and downtrend — a Range Shift is formed.

At first, RSI moves in 40-60 range, price moves sideways. A strong price move pushes RSI to 80. Later, RSI stays above 50, helping price grow strongly. When momentum fades, RSI returns to 40-60 and price moves sideways again.

Note:

RSI reflects Dow Theory by showing the stages of accumulation, growth, and distribution.

And as you see, when RSI touches key levels, the trend often pulls it back.

RSI Momentum

Price momentum means how fast price changes.RSI momentum represents the change in the strength between buying and selling forces.

When RSI > 50:

If price falls, RSI shows high momentum — RSI drops fast but price drops slowly.

If price rises, RSI shows low momentum — RSI rises slowly but price rises fast.

For example, at first RSI is above 50.

Price drops from (a) to (b) by 44 units, RSI drops from (Ra) to (Rb) by 25 units.

Later, RSI drops from (Rb) to (Rc) (also 25 units) but price drops from (b) to (c) by 73 units.

When RSI < 50:

If price falls, RSI has low momentum — RSI drops slowly but price falls fast.

If price rises, RSI has high momentum — RSI rises fast but price rises slowly.

RSI and Price Divergence

Divergence happens when price and RSI move in opposite directions:

Price goes up but RSI goes down, or vice versa.

Why does divergence happen?

In a strong downtrend, price forms a bottom at point (1), and RSI drops to level (r1).

When a price pullback happens, price pushes up to a peak at point (2), and RSI also bounces back to level (r2).

Because the downtrend is strong, after completing the pullback (1-2), price continues to make a lower bottom at point (3).

At this point, remember the behavior of RSI momentum when RSI is below 50:

It takes a large price drop (from 2 to 3) to cause a small RSI drop (from r2 to r3).

Meanwhile, even a small price increase (from 1 to 2) causes a large RSI rise (from r1 to r2).

Since the distance (1-2) is smaller than (2-3), but the RSI move (r1-r2) is bigger than (r2-r3), divergence is created.

Divergence shows that the current trend is very strong, not a complete signal of a trend reversal.

(I might share with you how to spot a complete RSI reversal signal in future posts.)

As shown in the example above, after forming bottom (5) and creating a bullish divergence between (3-5) and (r3-r5), price still kept dropping sharply while RSI kept rising.

In these areas, if you keep trying to catch a reversal just based on divergence, you will likely need to DCA or cut your losses many times.

That’s why the most important thing in trading is always to follow the trend.

RSI Exhaustion

RSI Exhaustion happens when RSI keeps getting rejected by a resistance or support zone and can’t break through.

After a strong downtrend, RSI recovers but stalls around the 5x zone.

It tries many times but fails, showing buying power is weakening.

Then the downtrend continues:

Exhaustion near high or low RSI levels creates stronger divergences than exhaustion in the middle range:

Double or triple tops/bottoms on RSI (M or W shapes) basically indicate RSI exhaustion.

RSI Can Identify Trend Strength

In an uptrend:

If RSI pulls back to a higher level before going up again, the trend is stronger.

The pullback should not fall too deep (below 40).

Example:

First rally: RSI drops to 60 before rising again → strong rally (273 units).

Second rally: RSI drops to 50 before rising again → weaker rally (94 units).

Same idea for a downtrend:

If RSI pullbacks to 50 then drops again, the downtrend is stronger than if it pullbacks to 60.

RSI Support and Resistance

Besides 40-60 acting as support/resistance, RSI also reacts to old tops and bottoms it created.

Why does this happen?

RSI is calculated from closing prices.

On a higher timeframe, the candle close price is a high/low or support/resistance price on lower timeframes.

When RSI moves in a trend on a higher timeframe, it maintains a buy/sell ratio, forcing lower timeframe RSI to oscillate within a range.

Example:

On H4, RSI stays above 40 → uptrend.

It makes H1 RSI move between 30-80.

Sharp RSI tops/bottoms react even stronger because they show strong buying/selling forces.

Summary

When looking at the price chart, we can see that price can rise or fall freely without any defined boundaries.

However, RSI operates differently: it always moves within a fixed range from 0 to 100.

During its movement, RSI forms specific patterns that reflect the behavior of price.

Because RSI has a clear boundary, identifying its characteristics and rules becomes easier compared to analyzing pure price action.

By studying RSI patterns, we can make better assumptions and predict future price trends with higher accuracy.

I have shared with you the core characteristics of RSI, summarized as follows:

Besides overbought (80) and oversold (20), RSI respects 40 and 60.

40 is support level in an uptrend. 60 is resistance level in a downtrend.

In an uptrend, RSI stays above 40.

In a downtrend, RSI stays below 60.

An RSI Range-Shift leads to a trend change.

RSI Divergence shows strong trends.

Double or triple tops/bottoms show RSI exhaustion → potential reversals.

The higher the RSI level, the slower it moves, but the faster the price rises.

The lower the RSI level, the slower it moves, but the faster the price falls.

A strong uptrend can be identified when RSI moves within a higher range or shows continuous bearish divergences.

A strong downtrend can be identified when RSI moves within a lower range or shows continuous bullish divergences.

RSI reacts to its old tops and bottoms.

Sharper RSI peaks show stronger selling.

Sharper RSI bottoms show stronger buying.

In the next parts, I’ll show you how to apply these RSI's Characteristics to trend analysis, multi-timeframe analysis, and trading strategies, that you might have never seen before.

I trade purely with RSI. Follow me for deep dives into RSI-based technical analysis and discussions!

RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

GOLD - Day Trading with RSI 04/03/2025FX:XAUUSD

Daily Timeframe (D1): Still in a strong uptrend, with RSI and both moving averages are pointing upwards. The WMA45 is above 60.

4-Hour Timeframe (H4): RSI is positioned between the resistance created by WMA45 (current price around 3152) and the RSI 60 support level (current price around 3121).

1-Hour Timeframe (H1): The WMA45 is trending upward, supporting the bullish trend.

Trading Plan: BUY

Entry Zone:

When the RSI on the M15 timeframe is supported at the 50 or 60 levels.

Entry Confirmation:

When M5 completes a wave, or a divergence appears.

Or even when M1 shows divergence.

Stop Loss:

20–30 pips below the M5 low.

Take Profit:

100 pips or R:R ≥ 1:1.

Or when M5 completes its own uptrend.

But be careful when RSI on H4 reaches its own WMA45.

You can check out the indicators I use here: tradingview.com/u/dangtunglam14/

GOLD - Day Trading with RSI 04/02/2025

Weekly and Daily Timeframes (W & D):

GOLD is still in an uptrend, as the RSI's WMA45 is still hovering near the 70 level, and RSI remains above both of its moving averages.

H4 Timeframe:

This timeframe is currently showing a correction. However, it's not yet considered a downtrend because the WMA45 is still in the high region, close to the 70 level. But, RSI has dropped below the WMA45.

At present, the RSI on H4 is facing dynamic resistance from the WMA45 above and has support around the 4x level (43-48). The corresponding temporary price levels are approximately 3128 (resistance) and 3088 (support).

This end-of-uptrend correction on H4 could lead to high price volatility. GOLD may move within a 300–400 pip range (between the resistance from WMA45 and the RSI support around the 4x zone).

H1 Timeframe:

Currently in a downtrend, as RSI is moving below both of its MAs, and the WMA45 has a noticeable downward slope.

H1 also has RSI support at the 30 level (temporary price ~3086) and resistance at WMA45 above (temporary price ~3130).

Since we’re focusing on intraday trading, priority is given to the H1 trend.

Figure 1

Trading Plan: SELL

Entry Zone:

When RSI on M15 approaches upper resistance: levels 50–55 or 65–70.

Confirm Entry:

Conservative/Safe approach: when M5 ends its uptrend and reverses (see example in Figure 1 – M5 ends uptrend when RSI crosses below both MAs).

Or when bearish divergence appears on M5.

Or even earlier, when there’s divergence on M1 and M5's WMA45 flattens out.

Stoploss:

20–30 pips above M5’s recent peak.

Or if RSI on M5/M15 breaks through its previous high.

Take Profit:

100 pips or R:R >= 1:1.

Or when M5’s downtrend ends (when RSI crosses above both MAs).

You can check out the indicators I use here: www.tradingview.com

GOLD - Day Trading with RSI 04/01/2025FOREXCOM:XAUUSD

D and H4 Timeframes:

GOLD is in a strong uptrend.

RSI is operating around the 80 level, indicating that buying pressure is 4 times stronger than selling pressure.

Priority: Trade in the direction of the trend on higher timeframes.

H1 Timeframe:

GOLD is showing signs of a correction: EMA9 has crossed below WMA45, and RSI is positioned below the two MA lines.

Given the current slope of WMA45 on the H4 RSI, this correction is considered minor for now.

Intraday Trading Plan:

Entry Strategy:

If H1 continues to correct: Look for buy entries when RSI H1 reaches previous RSI lows (zones 44, 55).

If H1 breaks the current high (level 3128): Look for buy entries when RSI M15 reaches previous RSI lows (zones 30–40).

At these levels, RSI M5 should end its downward wave (e.g., forming a double-bottom pattern on RSI) or show a price-RSI divergence before entering a buy trade.

Stop Loss (SL):

Set SL 20–30 pips below the entry point's low on the M5 timeframe.

Take Profit (TP):

Follow an R:R ratio of at least 1:1.

Or, take profit when M5 ends its bullish wave:

If RSI M5 forms a double-top pattern or

If RSI M5 crosses below WMA45.

Partial profit-taking is recommended at different stages to optimize returns.

📌 Refer to my scripts for pre-configured RSI indicators. 🚀

Cup and Handle Breakout in PETRONETPETRONET has formed a classic Cup and Handle pattern on the hourly chart, signaling a potential bullish breakout.

Pattern Breakdown:

Cup Formation: A smooth rounding bottom from ₹310 to ₹337, indicating strong accumulation.

Handle Formation: A slight retracement near ₹330, forming a consolidation zone before the breakout.

Indicators:

RSI: Currently above 70, showing bullish momentum.

Volume: Increased significantly, confirming buying pressure.

Key Levels:

Breakout Level: ₹337

The price has broken above this resistance, confirming the breakout.

Targets:

Target 1: ₹350

Target 2: ₹360

Stop-Loss: Below ₹330 (handle low).

💡 Disclaimer: This is for educational purposes and not financial advice. Please perform your due diligence before entering any trade.

BTC Short Trade Opportunity and SetupBYBIT:BTCUSDT.P / BYBIT:BTCUSDT / CRYPTO:BTCUSD Bitcoin/BTCUSD has recently hit the resistance level of a pattern that has generally held true since mid March 24 (4 preceding resistance and support confirmations).

Furthermore, it has started a return downward move following on from a 3 day filter for confirmation of the resistance level (an example of how a 3/5 day filter is an important tool for crypto trading).

Additionally:

The RSI resistance level of 70 has been recently reached and the RSI is trending downwards - a usually statistically significant indicator

The downward return move is supported by reasonable (although not enough on it's own) volume

A 3 bar pattern (downward move, pause, further downward move for confirmation)

A rate of change approaching and trending negative

A MACD also approaching negative

It's always important to assess the risk that might prove the thesis wrong. And they are:

Today's candlestick pattern is close to a dragonfly, i.e. there might be a return upwards move imminent (although this is unlikely to constitute a beginning of a move beyond the previous high as an actual dragonfly candlestick is at the end of a downtrend)

The MACD is trending down but has not actually turned negative yet, i.e. it is a bit early to say this indicator is stating a downward trend

The ROC hasn't turned negative yet either (but is trending downwards for sure)

This all leads to the following conclusion: For those with a high enough risk appetite (and usually crypto traders are those with the highest :-)) this is a good entry point for a short trade.

Using the (admittedly early but still reasonable) trend for the past three days to determine the final take profit point of 45500 (blue arrow) by approx. 19 Nov 24, the following can be set as a guide for a trade:

Entry: Now or latest tomorrow in case today's candlestick is an indicator of a minor move upwards

SL: $70,500

TP1: $63,450 - based on the first potential moving average being a resistance (200 MA)

TP2: $60,500 - based on the previous move's consistent (and twice confirmed) low

TP3: $54,500 -based on a previous historic low (i.e. psychologically important price point) which also acts as a confirmation of support to a previous move

TP4: $45,500 - The approximate price point of an estimated downward trend

Exit date (independent of TP level): 19 Nov 24

NOTE: the 19 Nov date here is important. It is the forecasted date by which the current downward price trend would linearly reach the support level. This date would be used as a checkpoint to exit the entire trade to safeguard against the normal, usually dramatic and beyond rational calculation price gyrations of crypto.

Symmetrical Triangle Formation in CAMS – Awaiting BreakoutOverview:

CAMS is currently forming a symmetrical triangle on the daily chart, a classic continuation pattern. This pattern typically indicates a period of consolidation before the next significant move, and given the stock’s strong previous uptrend, there is a potential for an upward breakout. However, the symmetrical triangle is neutral until confirmed, so both bullish and bearish breakouts are possible.

Pattern Breakdown:

The triangle is defined by point A (around 4900 INR), where the stock reached a high, and point B (around 3850 INR), marking the recent low. The price has been forming lower highs C (around 4600 INR) and higher lows D (around 4200 INR) as it tightens into the apex.

This contraction in price is a sign that the market is undecided, but once it breaks out of the triangle, a directional move is expected.

Key Observations:

RSI Oscillator:

The RSI, set to a period of 14, is hovering around the neutral zone (~50). This shows that the stock isn’t currently overbought or oversold. A move above 70 or below 30 could signal a strong trend in the direction of the breakout.

Volume Decline:

As the triangle develops, volume has been tapering off, a typical characteristic of consolidation. A significant volume spike will be key in confirming the breakout direction.

Breakout Levels:

Upside Breakout: A break above point C (around 4,600 INR) could trigger a bullish continuation, given the previous uptrend. Traders should wait for confirmation via price action and volume.

Downside Breakout: A breakdown below point D (around 4,200 INR) could signal a bearish reversal, especially if accompanied by increased volume.

Final Thoughts:

Symmetrical triangles can break in either direction, so it's crucial to wait for confirmation. Given the prior bullish trend in CAMS, there's a greater probability for an upward breakout, but the possibility of a downside move can’t be ruled out. Patience is key—monitor the volume and price action carefully for a strong breakout signal.

Disclaimer :

This is for educational purpose only. I am not SEBI registered advisor. Take advice from financial advisor before investing.

SMR approaching DCA opprtunityNYSE:SMR is approaching a potential entry point for the start of a DCA strategy for a long term hold.

SUMMARY

Wait to see where the price moves. Using a combination of RSI reaching 30 and the price falling to (with a 3 day filter) around $4 or if the price continues to fall then around $2 (another 3 day filter at this level too), begin entry with a DCA strategy. Alternatively, if the price rises above $6, after a 3 day filter, begin DCA. If the price starts forming a flag between $5 and $5.80, enter once RSI has reached 30 (for those with a higher risk appetite can just use the RSI as an indicator) or await a range breakout/down to either enter at the $4 or $2 or $6 level as described above with or without a three day filter.

The price was seeing exponential growth in the leadup to the latest quarterly earnings report and popped a few days after. However, the price has subsequently fallen back down and now seems to be forming a pattern.

It is unknown really what caused the price to jump. And there has not been any significant insider trading on the day (or lead up to the day) where the price recently peaked.

The company itself has a healthy balance sheet and debt/equity ratio. It is still in the growth phase as they build somewhat emerging tech (nuclear power is established but their approach to providing customers modular smaller power stations is unique) and a large part of their customer base is still a maturing market (power hungry data centres wanting their own onsite nuclear power source, particularly those now being setup for providing AI). The company's income statement reflects this as net income over the recent years remains negative and is also not showing an upwards trajectory.

With this in mind this would be a stock for a long term hold with a DCA investment strategy until, whichever comes first, either a total dollar figure invested is reached or the company becomes long term profitable (i.e. exits the growth phase).

With the recent price fluctuations it is crucial to not enter too early as due to the immature nature of the industry and company, the price also has a high likelihood of remaining at a low level for quite some time. However, a DCA entry opportunity is also forming based on one of the 3 of the more likely price trend scenarios described in the chart. Details on these are as follows.

Scenarios 1 and 2:

Wait to see which way the price begins to move and see if it falls to one of the two support levels identified, make use of the RSI to identify the optimum entry point. If the price falls to $4, add in a 3 day filter to see if the price doesn't fall further and likewise add in a 3 day filter if the price continues to fall from $4 to $2. If the RSI has reached 30, and the 3 day filter has shown that $4 or $2 were a support level begin DCA. If the price continues to fall below 2, halt the DCA to see where the price becomes stable and then restart once the RSI starts trending upwards again.

Scenario 3:

If the price begins ranging between $5.30 and $5.80, depending on risk appetite, begin DCA once the RSI reaches 30 or starts trending upwards. If the price breaks out above $6, then add in a 3 day filter to ensure the breakout wasn't a false dawn, and start the DCA investment independent of where the RSI is.

A 456 day bubble corrected to -84%, an air of Déjà Vu !!This is the synthesis of my previous publications!

Here are all the common points between:

- the Ultimate Dip of January 14, 2015 ($ 160)

- and the last known Dip of December 15, 2018 ($ 3200)

-85% retracement from ATH $ 1175>160, same as $ 19930>3200

-45% retracement since the previous ATL $ 250>160, same $ 5775>3200

455 days since takeoff at $ 160>160, same as $ 3200>3200

Rebounding below 78.6% Fibo to $ 160, same to $ 3200

with rebound on MA200 to $ 160, same as $ 3200

with rebound of RSI14 < 30 to $ 160, same as $ 3200

At the crossroads of level 4 support

with 2x1 fan resistance

on the GANN Square at $ 160, same $ 3200

See related ideas for more details on these indicators ;)

CAUTION: This is not an investment advice

Do not follow any "prophet", invest only what you are willing to lose

$ 6000 this end of the year for a new ATH in 2020, complements !Additional informations for my idea of October 12, 2019 (see Related Ideas) on Bitcoin :

1) 200-day Mobile Average (MA 200) as a bounce zone this year end at $ 6,000.

2) Descending Triangle of my previous idea replaced by a Bearish Parallel Channel: what I interpret as being a big Bullish Flag under construction, like those of the previous 2 speculative bubbles, also represented on this chart. These Flags were only pauses in the overall Bullish Trend, having each time experienced their Dip in contact with MA 200.

3) Repetitive cycle of the RSI 14 alternating overbought and oversold zones as a trend reversal signal confirmation indicator.

RSI 14 to 60 = sign of Bull Trap for the end of April?My previous publications provide for 6 months a Bull Trap close to ~ $ 6k

The situation of RSI 14 similar to that of the 2015 Bull Trap post-Downtrend seems to be an additional indicator that this risk is imminent

Some reminders:

I recall that the bullish influence at the output of the symmetrical triangle (see my previous publications) is technically complete.

Only the current presence of an ascending triangle, who is a continuation pattern (see my previous publication), can hope for a $ 6k, but nothing more.

On the other hand, the spectrum of the historical resistant oblique, although crossed, remains strong, among other indicators already detailed previously (MA crossing...)

DISCLAIMER: Invest only what you can afford to lose. Do not listen to any "prophet".

Beware of your own emotions potentially disconnected from the market reality (panic / euphoria ... FUD / FOMO)

Long trade w/ 4 entries, NZDUSD 4hNZDUSD is trending up, with EMA 25/50/100/200 showing uptrend, as well as RSI trending up, MACD having a reduction of short pressure and SM is trending up with higher tops and higher lows. As such I will enter one position at .696, as well as a three orders at fibonacci level 38.2, 50 and 61,8. These fibonacci levels are close to the EMA levels, which should provide extra support. TP is aimed at previous top, which is .705.

Entry 1: .696

Entry 2: .694

Entry 3: .69

Entry 4: .687

TP: .705