RSI 101: Revealing the Special Characteristics of RSIWhy does RSI have support and resistance levels at 40 and 60?

Why does divergence happen between RSI and price?

What is RSI momentum?

All the characteristics of RSI (that I know) will be explained here.

Formula and Meaning

If you are using TradingView, you probably already know what RSI is and what "overbought" and "oversold" mean. So, I won’t repeat it here. Instead, I’ll dive deeper into the true nature of RSI, giving you a different perspective.

You can skip the mathematical formula of RSI, it’s already discussed everywhere online. Just remember this ratio table:

Here’s how I explain the table:

At RSI = 50, the average gain equals the average loss (I'll call this the buy/sell ratio). This is a balanced point. Buyers and sellers are equally strong.

At RSI ~ 60 (66.66), the buy/sell ratio = 2/1. Buyers are twice as strong as sellers.

At RSI ~ 40 (33.33), the buy/sell ratio = 1/2. Sellers are twice as strong as buyers.

At RSI = 80, the buy/sell ratio = 4/1. Buyers are four times stronger.

At RSI = 20, the buy/sell ratio = 1/4. Sellers are four times stronger.

The formula shows that when RSI reaches 80 or 20, the buyer or seller is extremely strong — about four times stronger — confirming a clear trend.

At these levels, some Trading strategies suggest placing a Sell or Buy based on the overbought/oversold idea.

But for me, that’s not the best way. The right approach is: when a trend is clearly formed, we should follow it.

I'll explain why right below.

Look at this chart showing RSI changes with the buy/sell ratio:

When RSI > 50:

When RSI < 50:

You can see that the higher RSI goes, the slower it climbs, but the high buy/sell ratio makes price move up faster.

Similarly, when RSI goes lower, it drops slower but price drops faster.

That’s why at overbought (RSI=80) or oversold (RSI=20) areas, you need to be careful. Even a small RSI moving can lead to big price changes, easily hitting your stop loss.

On the other hand, if you follow the trend and wait for RSI to pull back, you will trade safer and more profitably.

RSI Key Levels

Here are some special RSI levels I personally find useful when observing FX:XAUUSD :

(These levels are relative. They might vary with different timeframes or trading pairs. Check historical data to find the right ones for you. On bigger timeframes like M15 or above, the accuracy is better.)

RSI = 20

When RSI hits 20, sellers dominate. This confirms a trend reversal to bearish.

RSI = 80

When RSI hits 80, buyers dominate. This confirms a trend reversal to bullish.

RSI = 40

This is a sensitive level. Sellers start gaining the upper hand (sell/buy = 2/1).

If buyers lose 40, they lose their advantage.

So RSI >= 40 is "buyer territory". In an uptrend, RSI usually stays above 40.

RSI = 40 acts as support in an uptrend.

RSI = 60

Same idea. RSI <= 60 is "seller territory".

RSI = 60 acts as resistance in a downtrend.

40 and 60 are considered the key levels of RSI.

Now you guys know why RSI has support/resistance around 40/60!

RSI Range

As you know, RSI moves between 0 and 100.

Since RSI >= 40 is buyer territory, we can see the relationship between price and RSI:

When RSI stays above 40, price tends to move in an uptrend:

When RSI stays below 60, price tends to move in a downtrend:

When RSI stays between 40 and 60, buyers and sellers are balanced, and price moves sideways in a box:

When RSI is moving, It creates a RSI Range.

Whenever the trend switches between the three states — uptrend, sideways, and downtrend — a Range Shift is formed.

At first, RSI moves in 40-60 range, price moves sideways. A strong price move pushes RSI to 80. Later, RSI stays above 50, helping price grow strongly. When momentum fades, RSI returns to 40-60 and price moves sideways again.

Note:

RSI reflects Dow Theory by showing the stages of accumulation, growth, and distribution.

And as you see, when RSI touches key levels, the trend often pulls it back.

RSI Momentum

Price momentum means how fast price changes.RSI momentum represents the change in the strength between buying and selling forces.

When RSI > 50:

If price falls, RSI shows high momentum — RSI drops fast but price drops slowly.

If price rises, RSI shows low momentum — RSI rises slowly but price rises fast.

For example, at first RSI is above 50.

Price drops from (a) to (b) by 44 units, RSI drops from (Ra) to (Rb) by 25 units.

Later, RSI drops from (Rb) to (Rc) (also 25 units) but price drops from (b) to (c) by 73 units.

When RSI < 50:

If price falls, RSI has low momentum — RSI drops slowly but price falls fast.

If price rises, RSI has high momentum — RSI rises fast but price rises slowly.

RSI and Price Divergence

Divergence happens when price and RSI move in opposite directions:

Price goes up but RSI goes down, or vice versa.

Why does divergence happen?

In a strong downtrend, price forms a bottom at point (1), and RSI drops to level (r1).

When a price pullback happens, price pushes up to a peak at point (2), and RSI also bounces back to level (r2).

Because the downtrend is strong, after completing the pullback (1-2), price continues to make a lower bottom at point (3).

At this point, remember the behavior of RSI momentum when RSI is below 50:

It takes a large price drop (from 2 to 3) to cause a small RSI drop (from r2 to r3).

Meanwhile, even a small price increase (from 1 to 2) causes a large RSI rise (from r1 to r2).

Since the distance (1-2) is smaller than (2-3), but the RSI move (r1-r2) is bigger than (r2-r3), divergence is created.

Divergence shows that the current trend is very strong, not a complete signal of a trend reversal.

(I might share with you how to spot a complete RSI reversal signal in future posts.)

As shown in the example above, after forming bottom (5) and creating a bullish divergence between (3-5) and (r3-r5), price still kept dropping sharply while RSI kept rising.

In these areas, if you keep trying to catch a reversal just based on divergence, you will likely need to DCA or cut your losses many times.

That’s why the most important thing in trading is always to follow the trend.

RSI Exhaustion

RSI Exhaustion happens when RSI keeps getting rejected by a resistance or support zone and can’t break through.

After a strong downtrend, RSI recovers but stalls around the 5x zone.

It tries many times but fails, showing buying power is weakening.

Then the downtrend continues:

Exhaustion near high or low RSI levels creates stronger divergences than exhaustion in the middle range:

Double or triple tops/bottoms on RSI (M or W shapes) basically indicate RSI exhaustion.

RSI Can Identify Trend Strength

In an uptrend:

If RSI pulls back to a higher level before going up again, the trend is stronger.

The pullback should not fall too deep (below 40).

Example:

First rally: RSI drops to 60 before rising again → strong rally (273 units).

Second rally: RSI drops to 50 before rising again → weaker rally (94 units).

Same idea for a downtrend:

If RSI pullbacks to 50 then drops again, the downtrend is stronger than if it pullbacks to 60.

RSI Support and Resistance

Besides 40-60 acting as support/resistance, RSI also reacts to old tops and bottoms it created.

Why does this happen?

RSI is calculated from closing prices.

On a higher timeframe, the candle close price is a high/low or support/resistance price on lower timeframes.

When RSI moves in a trend on a higher timeframe, it maintains a buy/sell ratio, forcing lower timeframe RSI to oscillate within a range.

Example:

On H4, RSI stays above 40 → uptrend.

It makes H1 RSI move between 30-80.

Sharp RSI tops/bottoms react even stronger because they show strong buying/selling forces.

Summary

When looking at the price chart, we can see that price can rise or fall freely without any defined boundaries.

However, RSI operates differently: it always moves within a fixed range from 0 to 100.

During its movement, RSI forms specific patterns that reflect the behavior of price.

Because RSI has a clear boundary, identifying its characteristics and rules becomes easier compared to analyzing pure price action.

By studying RSI patterns, we can make better assumptions and predict future price trends with higher accuracy.

I have shared with you the core characteristics of RSI, summarized as follows:

Besides overbought (80) and oversold (20), RSI respects 40 and 60.

40 is support level in an uptrend. 60 is resistance level in a downtrend.

In an uptrend, RSI stays above 40.

In a downtrend, RSI stays below 60.

An RSI Range-Shift leads to a trend change.

RSI Divergence shows strong trends.

Double or triple tops/bottoms show RSI exhaustion → potential reversals.

The higher the RSI level, the slower it moves, but the faster the price rises.

The lower the RSI level, the slower it moves, but the faster the price falls.

A strong uptrend can be identified when RSI moves within a higher range or shows continuous bearish divergences.

A strong downtrend can be identified when RSI moves within a lower range or shows continuous bullish divergences.

RSI reacts to its old tops and bottoms.

Sharper RSI peaks show stronger selling.

Sharper RSI bottoms show stronger buying.

In the next parts, I’ll show you how to apply these RSI's Characteristics to trend analysis, multi-timeframe analysis, and trading strategies, that you might have never seen before.

I trade purely with RSI. Follow me for deep dives into RSI-based technical analysis and discussions!

Rsiexhaustion

Short setup on SPX (x2)After the most recent upward move, the SPX shows clear signs of weakness, suggesting a potential short setup.

Since mid-July, the SPX has been moving upward and it's now near its all-time high. However, the RSI Exhaustion at the bottom of the chart has significantly declined and hasn't recovered much, establishing a downtrend.

This divergence between the price and the RSI Exhaustion is the first major signal of a possible short configuration.

Three additional signs support this setup:

The RSI Exhaustion shows recent bullish exhaustion (indicated in green), signaling that further price increases are unlikely.

The price has formed a top just shy of its all-time high, as identified by the Bottoms Tops Signal indicator.

A major level has formed, as indicated by the Levels and Zones indicator. While this level turned into support, it originated as resistance and could well revert back to it should be price start to drop further.

Is the bull run over? Only time will tell, but for now, it's crucial to remain patient and always seek confirmation from the indicators.

Short setup on SPXThe SPX has experienced a significant bull run, reaching just below $5700, but is now showing clear signs of weakness, suggesting a potential short setup.

Since mid-July, the SPX has been moving sideways and is now nearly flat at its all-time high. However, the RSI Exhaustion at the bottom of the chart has significantly declined and hasn't recovered much, establishing a downtrend.

This divergence between the price and the RSI Exhaustion is the first major signal of a possible short configuration.

Three additional signs support this setup:

The RSI Exhaustion shows bullish exhaustion (indicated in green), signaling that further price increases are unlikely.

The price has formed a top at its all-time high, as identified by the Bottoms Tops Signal indicator.

A new major resistance level has recently formed, as indicated by the Levels and Zones indicator. While this level could potentially turn into support if the price breaks above it, for now, it remains a resistance, exerting downward pressure on the price.

Is the bull run over? Only time will tell, but for now, it's crucial to remain patient and always seek confirmation from the indicators.

Inverse H & S on Weekly SPX Analysis We are nearing an important event tomorrow where we will come to know about Fed funds rates and FOMC guidance for upcoming months. These events are known for creating extreme volatility. We can easily swing up and down 100- 150 points on days like these and set in motion what's to come for the next few months.

No matter how big of a volatile move we will see tomorrow in the price action, it will be a small blip on a larger timeframe and that's what we are here to analyze.

On weekly Time frame I am looking at this inverse Head and Shoulders pattern.

Let's analyze this structure based on RSI indicator.

In the main chart we can see that, since the time inverse H & S began to form, the RSI has been trading in a Rising wedge formation which is a bearish pattern. Every time we touch the top edge of the wedge, we have been getting a rejection on RSI and big move down in SPX. In the begenning of the structure and RSI we got huge moves to the downside, but those moves have been getting smaller and smaller both in RSI and Price Action. This is called compression

which is followed by explosive moves once the pattern is broken.

Last week we again got a rejection from the top edge of the wedge and have begun to move down, I have placed the measurements on the chart about how much we have been dropping every time we touch top edge of the wedge on RSI and based on the patterns in price drop and how much time it took to drop to the lower edge. We can expect a drop of about 5+ % from the current top and reach there in the next 2 to 3 weeks.

Now once we have reached there RSI will have to decide whether to bounce back up or finally break the pattern. The break to the downside has descent chances of happening as per the Rising wedge pattern rules where it says the pattern break occurs in last 33% of the structure and it looks like we should be there by end of this month. If it does break below the inverse H & S pattern will fail.

The best way to protect you from entering wrong trades : is to never be too sure about any analysis and always consider all possibilities. Following are the possibilities I see with RSI which can make or break the structure:

We must monitor all the trendlines in RSI and see what PA is doing, it may not go all the way down and bounce back up from one of the trendlines in the middle.

The following are all scenarios I am watching for the movement of RSI.

I used a simple but powerful RSI indicator to gain insight on SPX Price action. If you are not familiar with this indicator, or if you have basic understanding but want to fully understand this indicator in detail: You can ago through the post in the links below:

I have over 6 years of trading and investing experience and have learned a lot in this time. I like to share what I have learned and if you like my content and would like to learn from my experience hit like and follow me for getting notified on my trade, market projections and several upcoming tutorials on technical analysis and several technical Indicators. You can also leave a comment and let me know if you want me to analyze any specific asset or want to learn about any specific topic in the world of Technical Analysis. I Will do my best to create a post for it.

Keep learning and Happy trading All.

Breakout ahead on USDCAD After offering a great buy opportunity earlier this month the USDCAD pair is consolidating on the 60m timeframe.

Similarly, the RSI Exhaustion at the bottom is consolidating.

Both these consolidations mean that the pressure is increasing and ultimately the pair will break either to the upside (trend continuation) or to the downside (trend reversal).

Remember to stay patient and always look for confirmation from the indicators!

Breakout coming on on BTCUSDAfter offering multiple sell opportunities, the BTCUSD pair is now consolidating on the 60m timeframe.

Similarly, the RSI Exhaustion at the bottom is consolidating as well.

Both these consolidations mean that the pressure is increasing and ultimately the pair will break either to the upside (trend reversal) or to the downside (trend continuation).

Remember to stay patient and always look for confirmation from the indicators!

Possible SELL opportunity on CADJPYThe CADJPY pair might offer soon an interesting sell opportunity assuming a trend continuation scenario.

After a recent uptrend, the pair is currently moving between a major resistance (downward pressure) and a major support (upward pressure) with the latest move being a significant downtrend.

A SELL opportunity might form if:

The Breakout Pivotal Bars turn bearish (candles colored in red) in the blue circle at the top

The RSI Exhaustion becomes Bullish Exhausted (RSI line gets colored in green) in the blue circle at the bottom (around 50)

If instead, the pair starts to consolidate around the current level (moving pretty much sideways), the subsequent scenario might turn to the bullish side.

Either way, remember to do your analysis, be patient and always look for confirmation from the indicators.

LTCUSDT compressionA breakout opportunity is forming on LTCUSDT.

The pair is currently consolidating after the recent downtrend that formed several tops and offered multiple selling opportunities. Price movements are increasingly compressed and will eventually break. The same compression is building in the RSI Exhaustion indicator at the bottom.

As of now, the breakout could be either to the upside (trend reversal) or to the downside (trend continuation) so let's just wait and see when the breakout comes.

Remember to do your analysis, be patient and always look for confirmation from the indicators.

Major downtrend in SPXAfter almost two years of market exuberance due to central banks' unconventional actions, the SPX has recently entered a major downtrend which has just started.

The index has just formed a top under a major resistance and its next target is the major support level around 3200.

The RSI Exhaustion confirms the same analysis, in fact, there's no evidence of divergence and the indicator is currently "bullish exhausted" meaning that a bull run from here is extremely unlikely.

Remember to do your analysis, be patient and always look for confirmation from the indicators.

SPX looking rather badThe S&P 500 Index looks extremely overextended and a downward movement is likely going forward.

Currently, the SPX is in a very similar configuration to the pre-pandemic (late 2019 going into early 2020).

Back then the price continued to move higher forming multiple tops while the RSI Exhaustion continued to decrease and stayed mostly bullish exhausted (colored green).

As easily predictable, a significant correction took place later on and continued until late March.

At that point, the chart had completely reversed showing a rather oversold situation and forming a bottom which gave us the opportunity to reenter for a new bull run.

As of today, the SPX is back to a very similar configuration to one year ago: going forward a downward movement is likely.

One final note on the supports. There are two major supports that will sustain the price should it start to fall. However, even the highest support is pretty far away from the current price level so there's plenty of room for triggering a downward movement.

Breakout opportunity on EURUSDThe EURUSD is currently in a downward channel and two alternative scenarios are possible:

The downward channel should signal a further move to the upside. This view is supported by the fact that the pair broke up a similar consolidation in late-May/early-June and the price has increased until early September when it started consolidating. The RSI Exhaustion indicator is also supporting this view. In fact, it is increasing (diverging with the price!) and became bearish exhausted twice (colored red) in the last couple of months. A break to the upside can push the price in the 1.22-1.24 area.

On the other hand, the price could continue to consolidate for some time and eventually move down at least until the 1.115 level. In such a case we should expect to see the RSI Exhaustion decreasing, becoming bearsih exhausted (colored red), and eventually becoming oversold as well.

Among the two alternatives, the first (breakup) is the one more likely but remember to be patient and always check confirmation from the indicators!

Breakout opportunity on WTICOUSDA breakout opportunity is forming on the WTICOUSD.

The pair has seen a rather significant upmove earlier this year from around 40 to about 65. Since the spring it has been consolidating between mid 60s and the low 50s.

The price is now squeezing and the indicators we use, all confirm that a new opportunity is forming.

Remember to be patient and always check confirmation from the indicators!

Breakout opportunity on BTCUSDA breakout opportunity is forming on the BTCUSD.

The pair has seen a big upmove since earlier this year. More recently it has been consolidating between the high 13000s and the low 9000s.

Currently, the price is squeezing and the indicators we use, all confirm that a new great opportunity is coming.

Remember to be patient and always check confirmation from the indicators!

Breakout opportunity on EURUSDA breakout opportunity is forming on the EURUSD.

The pair is in a downtrend since many weeks and has offered plenty of trading opportunities. More recently it has been consolidating between the high 1.14 and the low 1.12.

Currently, the price is squeezing and the indicators we use, all confirm that a new great opportunity is coming.

Remember to be patient and always check confirmation from the indicators!

A BIG MOVE IS COMING ON EURUSDI usually post 1h charts but I think this weekly chart is very helpful to every FX trader .

EURUSD is in consolidation since last May in the 1.155–1.18 area. This situation is the prelude of a breakout and a big impulsive move coming in the second part of 2018 and possibly 2019.

The indicators are currently looking good but we need to wait and see the breakout, either up or down.

Are you of the same opinion? Feel free to share your feedback below.

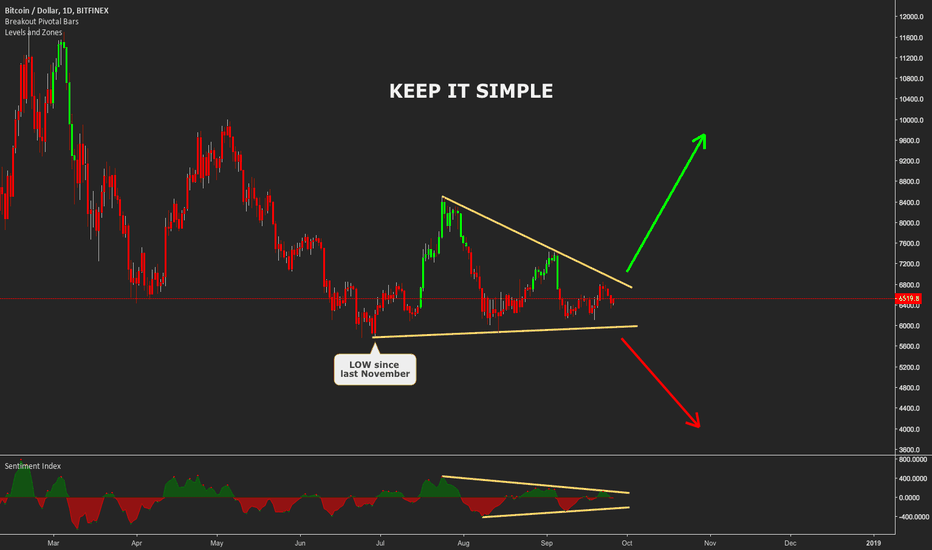

BIG MOVE COMING ON BTCUSDThe BTCUSD is due to a major move soon. The pair has been consolidating to the downside for several months now and it has been significantly squeezing until now.

During the last few months, the pair formed Lower Highs and Higher Lows, hence forming a nice pattern that is about to be broken.

The Sentiment Index is squeezing which is a great indication that something big is about to happen.

The Breakout Pivotal Bars is negative (red candles) so a breakdown seems more likely but we need to wait and see the color of the breakout candle.

Either way the price will break, we are prepared and ready to profit from the move.

Breakout opportunity on AUDUSDA breakout opportunity is forming on the AUDUSD. The pair is in a downtrend from a few weeks and has already given three very great sell opportunities. The setup was identical for all the three:

• breakdown of price

• breakdown of Sentiment Index

• opportunities below resistance

Right now the breakout could be either to the upside or to the downside so let's just wait and see when the breakout comes.

Last but not least, always check confirmation from the indicators!

HOW TO RIDE TRENDSThis educational idea refers to the last trading idea I published (linked below) and to many more I traded in the past.

The chart above shows the BTCUSD going from about 6'500 at the beginning of April up to around 10'000 in early May and all the way back down to about 6'500 in mid-June.

This idea shows how it was possible to ride the trend all the way up (4 buy opportunities) and all the way down (4 sell opportunities) with three indicators: the Breakout Pivotal Bars , the Sentiment Index and the Levels and Zones .

Here's how they work to identify setups:

Breakout Pivotal Bars

• For break-ups the candle must be coloured in green.

• For break-downs the candle must be coloured in red.

• Blue candles mean indecision so either trend continuation or imminent trend reversal. Depending on your strategy it is possible to trade them or not.

Sentiment Index

Possible situations are:

• Breakout (e.g. Bullish Sentiment in case 1 or Bearish Sentiment in case 8)

• Divergence with the price (Bullish Sentiment in case 8)

Levels and Zones

Gives a reference in real-time to where the most significant levels and their corresponding long/short zones are.

Let's see the 8 trading opportunities:

1. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

2. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

3. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + No Support nearby -> VALID OPPORTUNITY but pay attention

4. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Resistance Above -> VALID OPPORTUNITY but pay attention

5. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment (divergence in Bullish Sentiment) + Below Resistance -> GOOD OPPORTUNITY

6. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

7. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

8. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is still pretty far! -> GOOD OPPORTUNITY

ANTICIPATING THE MARKETThis idea shows how the Sentiment Index indicator clearly anticipates big shifts in the Market.

The first situation shows the EURUSD consolidating between late 2016 and spring 2017 – the consolidation was characterized by a consistent decline in the Bearish Sentiment which ultimately led to a strong uptrend until early 2018 (1500+ pips movement).

The second situation shows the EURUSD in an opposite setup – a sligthly shorter consolidation charaterized by a decline in the Bullish Sentiment and a consequent breakdown of the pair.

Predicting market moves with JUST ONE INDICATORThis idea shows how easy it was to identify a massive opportunity on BTCUSD with the Levels and Zones indicator.

Basically, after days of sideways movement, the pressure started to build up and ultimately a massive explosion took place!

First, the Resistance Level moved significantly down (hence pushing price lower), then the Support Level made its move up (hence pushing price higher). Give it a few more time for the pressure to increase further (price is forced to move into a tight channel) and then the explosion takes place.

You can find a similar setup before most of the major impulsive movements across any asset and timeframe. First, pressure builds up then, the explosion takes place!