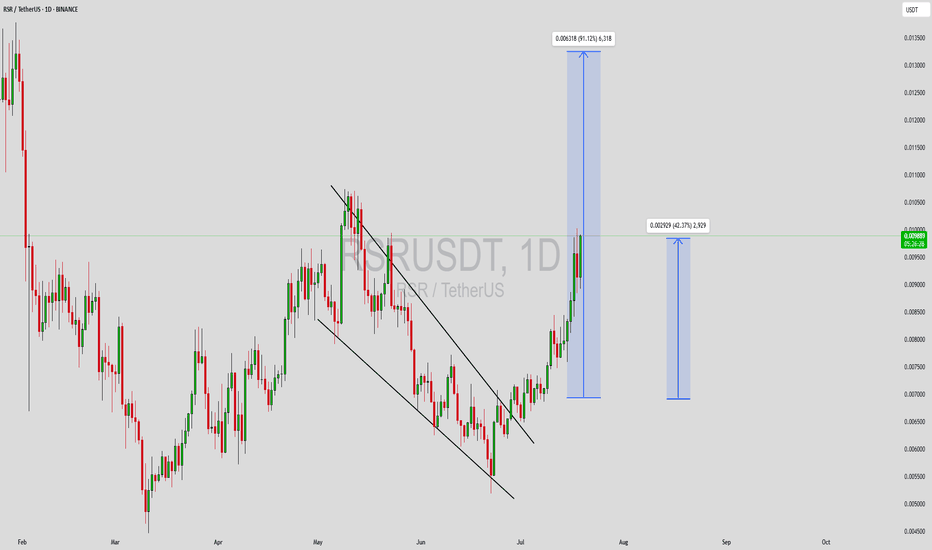

RSRUSDT Forming Bullish WaveRSRUSDT is exhibiting a clear bullish wave pattern on the daily chart, breaking out of its previous downtrend channel with strong momentum. This kind of technical setup often precedes a continuation rally, especially when paired with rising volume. The current breakout is supported by a steady increase in trading activity, indicating strong market interest and confidence from buyers. Based on this chart, there is potential for an 80% to 90% gain if the bullish structure continues to unfold as expected.

Reserve Rights (RSR) is a token with a unique use case, focused on stabilizing digital economies and supporting low-volatility assets. As crypto adoption grows in emerging markets, utility tokens like RSR are becoming increasingly relevant. This could be one of the reasons why investor sentiment is turning positive again, especially after a period of price consolidation and accumulation. If RSR can maintain its momentum, it may retest its previous highs or even reach new local peaks.

Traders and investors should watch key resistance levels closely while considering support re-tests for potential entries. The risk-to-reward ratio in setups like this tends to be favorable if volume remains elevated and broader market sentiment supports the move. Technical indicators such as RSI and MACD may also confirm the bullish bias in the coming sessions, further strengthening this setup’s credibility.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

RSRBTC

#RSR/USDT#RSR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.008441.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.008663

First target: 0.008776

Second target: 0.008922

Third target: 0.009093

#RSR/USDT#RSR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.007050.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.007100

First target: 0.007309

Second target: 0.007556

Third target: 0.007816

RSR AMALYSIS (1D)RSR has approached a valuable zone after heavy drops.

This support zone is quite large, so we have divided it into two entries.

This position is suitable for spot trading, and risk and position sizing must be managed carefully.

We will enter one entry at Entry 1 and another at Entry 2.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

RSRUSDT Analysis: Red Box Seller ZoneIn RSRUSDT, the red box indicates a zone with active sellers . This level is critical for observing potential resistance or reversals. Caution is advised when approaching this area.

Key Points:

Seller Zone: The red box marks a strong area where sellers are active.

Risk Management: Avoid premature entries; wait for confirmation signals.

Confirmation Indicators: I will use CDV, liquidity heatmaps, volume profiles, volume footprints, and market structure analysis to assess the strength of this level.

Learn With Me: If you want to master how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to identify precise zones, just DM me. I’d be happy to guide you!

Reminder: Patience and confirmation are key in such conditions. Successful trading relies on understanding market dynamics and taking calculated risks.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you! Wishing everyone success in their trades.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

RSRUSDT: Prime Demand Zone on Lower Time FrameThe blue box marks the strongest demand zone on the lower time frame for RSRUSDT. This level is ideal for potential buy entries, as it represents an area where buyers are likely to step in aggressively.

Watch for price reactions within this zone and consider lower time frame confirmations for optimal entries. Always manage risk effectively.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

Reserve Rights | RSR , Rewards & RocketsRSR Climbs the Crypto Charts While Dreaming of 2021’s Glory Days

What is Reserve Rights?

The Reserve Rights Token aka RSR is an integral part of the Reserve Protocol ecosystem, launched in 2019 to promote cryptocurrency adoption. This protocol provides tools enabling users to create and utilize stablecoins globally. The ecosystem includes the Reserve Protocol, the Reserve app, and the RSV stablecoin. Its unique dual-token mechanism aims to mitigate cryptocurrency market volatility.

RSR is an ERC20 token with a maximum supply of 100 billion.

It functions as both a utility token and a governance token for the Reserve Rights platform.

Key Features of Reserve Rights and How It Works

The core of the Reserve Protocol ecosystem is the RSV stablecoin, which is supported by fiat-backed cryptocurrencies like USDC, TUSD, and USDP. These stablecoins are managed through smart contracts called the Reserve Vault, ensuring that each stablecoin created on the platform is fully backed by a diverse mix of assets.

RSR serves as a safety net for the platform. If any RTokens (stablecoins created on the platform) default or their collateral loses value, RSR is used to recapitalize the market. RTokens are fully collateralized and can be redeemed 1:1 for their underlying assets. The supply of RSR is inversely correlated with the supply of RSV, maintaining stability and reliability.

Noteworthy Aspects of Reserve Rights

The Reserve ecosystem also features the RPay App, a crypto wallet that allows users to store, send, deposit, and withdraw assets in their preferred currency—whether fiat or crypto.

Where to Buy RSR?

RSR is available for trading on multiple centralized exchanges (CEX) and decentralized exchanges (DEXs). Popular platforms include Binance, OKX, Gate.io, and KuCoin. Prices may vary based on the exchange and market conditions

RSR, the King of Comebacks (Kind Of!)

The current price of Reserve Rights is $0.017, reflecting an 85% increase over the past 24 hours. The token reached its all-time high of $0.119 on April 16, 2021, and is now 85.6% below that peak. With a circulating supply of 53.29 billion tokens and a maximum supply of 100 billion, RSR has a 24-hour trading volume of $276 million. It is traded on 38 markets and 39 exchanges, with Binance being the most active platform. RSR's market capitalization stands at $913 million, representing 0.02% of the total cryptocurrency market.

But what the pump is this?

The recent pump in the RSR token can be attributed to several factors

1. Mainnet Launch Anticipation: The Reserve Protocol's upcoming mainnet launch is a significant milestone. This launch will enable the creation of fully collateralized stablecoins (RTokens) and introduce staking capabilities. These features are expected to drive adoption and utility, increasing investor interest.

2.Staking Rewards: The introduction of staking will allow RSR holders to earn rewards by insuring RTokens against collateral defaults. This practical use of staking within the ecosystem adds a layer of financial incentive, making the token more attractive to both new and existing investors.

3.Stable Performance During Volatility: The Reserve Protocol's stablecoin, RSV, has maintained its peg even during market volatility, showcasing its resilience. This stability has strengthened investor confidence in the broader Reserve ecosystem.

4. Partnerships and Tokenization Trends: Speculation around RSR's involvement in blockchain tokenization initiatives, potentially in collaboration with major players like Coinbase and BlackRock, has further boosted market sentiment. These developments highlight RSR's potential role in the emerging tokenized assets sector.

next targets are 0.019 and 0.025$

Learn before you earn

The crypto bull market might seem like a quick path to wealth, but without understanding the basics, it can lead to confusion or losses. Build your knowledge first to turn insights into profits and achieve your goals

RSR looks super bullish (1D)It looks like wave B is over, which was a triangle. By maintaining the green range, it can move up to the red box.

The price has entered a bullish wave C.

Closing a daily candle below the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#RSR/USDT#RSR

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in green at 0.004746

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, upon which the price is based higher at the discount

Entry price is 0.004746

The first target is 0.006078

The second target is 0.06985

The third goal is 0.008128

RSRUSDT Cup and Handle Pattern!RSRUSDT Technical analysis update

RSRUSDT price formed a cup and handle pattern at the bottom. The price broke the cup and handle pattern's neckline resistance on the weekly chart, took around 900+ days for the breakout. If the price remains above the neckline in the weekly candle close, we can expect a bullish move in the coming days.

$RSR :: Everything is indicated in the diagramReserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration.

The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

RSR buy setupThe structure of RSR is bearish, but we have a good demand at the bottom, which can be used to look for buy/long positions in the form of scalpy.

Liquidity pools are expected to be swept

Closing a daily candle below the invalidation level will violate the analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

#RSR/USDT#RSR

The price is moving in a descending channel on the 12-hour frame, about to break upward

With a strong support area in green at 0.0045. The price has already rebounded from it

We have a tendency to stabilize above the Moving Average 100

We also have a downtrend on the RSI that has been breached upward

A moderate rise is expected over 3 levels

Entry price is 0.005800

The first target is 0.00645

The second goal is 0.007450

The third goal is 0.008790

RSR/USDT 4HOUR CHART UPDATE !!Welcome to this quick RSR/USDT analysis.

I have tried my best to bring the best possible outcome in this chart.

RSR has broken out of the symmetrical triangle pattern, indicating potential upside momentum. MA 50 confirms a bullish trend, which supports a buy setup.

the explanation:

RSR, in its recent price action, has broken out of a symmetrical triangle pattern. This breakout pattern often suggests a continuation of the previous trend, potentially leading to higher prices.

Furthermore, the Moving Average 50 (MA 50) is indicating a bullish trend. The MA 50 is a widely used technical indicator that tracks the average closing prices of an asset over the last 50 periods. When the current price is above MA 50, it indicates bullish sentiment in the market.

Taking these technical signals together, there is a setup for a potential buying opportunity in RSR/USDT. Traders and investors may consider entering long positions expecting further growth in the price of RSR.

However, like any trading setup, it is essential to conduct a thorough analysis, consider risk management strategies, and closely monitor market developments.

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

RSR looks a rocketThe slightly lower RSR has formed a solid support zone. This coin is in a bullish wave C. In fact, we are now in the middle of a bullish wave C.

If a pullback is made to the green range, it is a buying opportunity.

The target is clear on the chart.

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

RSR buy setupAccording to the bullish structure of RSR, it seems that RSR intends to continue its upward path.

SWAP is a good place for buy/long positions

By maintaining the demand range, it can move towards the targets.

Closing a daily candle below the invalidation level will violate this analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

#RSR/USDT LONG#RSR

The price has been moving in a descending triangle since April 2022

We have a strong support area from which the price rebounded

The downtrend of the triangle has been broken and we are about to go up

This rise is supported by the moving average 100 break of 100.

The price is now 0.002941

First target 0.005484

Second goal 0.008678

RSR LOOKS BULLISHFrom where we entered "Start" on the chart, it looks like we had a counter triangle, but now the upper side of the triangle is broken.

We have a flip range on the chart, which we have marked with green color. From this area we can move upwards. We have included the targets on the chart. We also specified the invalidation level on the chart. Closing a daily candle below this level will violate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

RSR short and long setupThe green box is demand and the red box is supply.

In the demand range, we are looking for buy/long positions, and in the red box, we are looking for sell/short transactions.

I also specified TP

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You