Ruble

Price of the epidemic, the Fed and BoE decisionsYesterday, investors felt less relaxed and confident than it was on Tuesday. The VIX index stopped pouring, gold even rose by the end of the day, the Russian ruble returned to decline, as did oil. That is, everything is back.

Investors can understand: the number of deaths continues to grow rapidly, as does the number of cases. As a result, the current epidemic has already exceeded the 2003 SARS epidemic in scale. But events are still developing.

Yes, China is doing everything possible and impossible to stop the epidemic: closing transport links, prolonging holidays, isolating entire cities - all this has a well-defined economic price.

ING experts believe that this could cost China a loss of 0.3% of GDP growth in the 1st quarter of 2020.

So for now, we are only strengthening our desire to buy safe-haven assets, stock market assets and other risky assets such as the Russian ruble.

In addition to reports on the situation with coronavirus, the main event of the day yesterday was the announcement of the decision of the Federal Open Market Operations Committee. As expected, they did not change the bid. Of interesting and important. The Fed has extended repos at least until the end of April this year. That is, the markets will continue to fill in with money, which in itself is an occasion for dollar sales in the foreign exchange market.

Today, the Fed will intercept the baton of the Bank of England. Despite the fears of some investors that the Central Bank will reduce the rate at the meeting, we believe that the monetary policy parameters will remain unchanged. Given that the pound has dipped quite well recently, today we will buy it against the dollar. But with mandatory small stops because surprises, although unlikely, are possible.

In addition, the US GDP data will be published today. This is the final reading, so no surprises should be expected, but the indicator is important in itself, so you need to follow it up.

ridethepig | RUB Market Commentary 2020.01.09Here markets are starting to see shorts pick up momentum, this has been a very very easy ride so far since our initial entry (see diagram):

Oil has drastically sold off, and risk sentiment in the M.E is fading. While we failed to clear 70 we managed to unwind some at 65 on the Iran spike. No reason to change course here yet, market sits itching to breakdown. Remain on the sell side.

Tracking closely for the flush in USDRUB to 60 with NFP tomorrow to kickstart the next iteration in flows. For the flows: Sell LMT Entry 61.2 | TP 60.0 | SL 62.0

... It is the same story in EURRUB as we complete the final few ticks:

GL those trading RUB into NFP.

Expectations for 2020 Caution is required from the thin market perspective also we expect an increased likelihood of volatility explosions on the market.

As we turn to 2020, the year promises to be extremely difficult and eventful. Whether this year will be a year of crisis, we will see, actually we would bet on a crisis. In this regard, we expect massive sales on world stock markets, which will be accompanied by an increase in demand for safe-haven assets. So purchases of gold and the Japanese yen in 2020 will continue to remain relevant.

"Deal of the Year" for us will be sales in the US stock market. But on this occasion, we have another review, where we describe in as much detail as possible why 2020 should be the year of the collapse of the US stock market (well, or at least, the time for a full correction on it).

As for the foreign exchange market, a lot of trades will depend on the actual development of events: what the Fed will want?, whether a full-fledged crisis or recession will occur in the world?, how the elections in the USA will end?, etc. Therefore, for now, we will not make any guesses, but we will note one deal that has, in our opinion, the maximum chances to get profit. It's about buying the British pound. 2020 should be the year when Brexit “ends”. And according to the “soft” scenario. Accordingly, the growth potential of the pound is measured in hundreds of points, and according to our estimates, pared with the dollar, it may well exceed 1.40. That is, from current prices it is about 1000 pips.

Another promising trade in the foreign exchange market, the sale of the Russian ruble. Its current strengthening of the ruble should not be intimidating or perplexing. On the contrary, this is just a great opportunity for sales. Yes, probably you will need to hold the position for more than one week or even a month. But we have practically no doubts about its positive outcome.

And a few words about oil. Its growth potential due to the new OPEC + deal is not fully exhausted. But in general, we tend to begin to build a medium-term short position, starting the first round of sales already at current prices. Why? the expectation of serious problems in the global economy. Recession or toward recession will be a serious blow to demand in the oil market, which will invariably provoke a drop in quotations. Also, on the supply side, 2020 could be a watershed. Russia is talking about a possible exit from OPEC + due to the need to fight for market share. If this happens, then sales on the oil market can not be avoided. Therefore, those who are ready to be in a position for several months can join us and start selling oil.

Europe is “disappointing”, we trade with oscillatorsMonday turned out to be a relatively calm day for the foreign exchange market. The euro and the pound could not reach Friday's peaks, due to the weak macroeconomic statistics.

For example, in Germany, the PMI in the manufacturing sector fell to its lowest level in the last couple of months and amounted to 43.4. This confirms that the largest eurozone economy is experiencing serious problems. Recall, any index value below 50 means that activity in the manufacturing sector is declining.

Germany is not an exception. Weak data came from both France and the UK. According to PMI, manufacturing activity in Britain is at its lowest level over the last 7 years. The PMI in the manufacturing sector in the UK came out at 47.4 pips (analysts expected 49.2).

In general, the lack of growth of the euro and the pound against the background of such data is quite logical.

On the other hand, this is not a reason to refuse to buy EURUSD and GBPUSD. All we need is statistics on industrial production in the United States come out weak. Well, for the pound it would be nice if the data on the labour market did not disappoint.

In general, today we are not expecting any revelations and strong directional movements. In our opinion, the best trading tactics for today is oscillatory trading. So we trade with RSI or Stochastic or you can choose another one.

Once again, we draw attention on extremely attractive positions for sales of the Russian ruble.

WAVES/BTC 15m (Binance) Forming bullflag & ready to bounce againLooks like the resistance at 0.0000828 BTC is holding that retracement.

Keep on eye on that possible breakout or leave a Stop Market Buy!

Entry= 0.0000860

Take Profit= 0.0000921

Stop Loss= 0.0000799

Risk/Reward Ratio= 1:1

WAVES/BTC 12H (Binance) Falling wedge fakeout and back, uptrend?WAVES is getting ready for uptrend, don't miss that opportunity to enter with BTC for mid term.

Plus, it's a Russian technology and Ruble (RUB) trading pairs have been added in Binance, could be the cause of the recent pump in lower timeframe!

Entry= 0.0000740 - 0.0000760

Take Profit= 0.0000799 - 0.0000849 - 0.0000899

Stop Loss= 0.0000699 or less

Risk/Reward Ratio= 1:1 - 1:2 - 1:3

I will publish a weekly analysis later for long term where a huge falling wedge is forming with USDT...

EXPRESS Long-term and medium-term forecast for USDRUBEXPRESS Long-term and medium-term forecast for USDRUB

Dear friends,

This idea is open and published as part of my content promotion. I draw your attention to the fact that from 11.11 all forecasts are only in the closed channel.

At the moment, there are already reviews on GOLD, EURUSD, S&P 500

I hope you find this idea useful and support it with your like.

EXPRESS Long-term and medium-term forecast for USDRUB

Most likely scenarios:

Global scenario

- movement within the bull channel

Weekly TF

- movement within the descending channel.

Daily TF

- the most likely target for bulls before the end of the year is 64.50 - 65.20 rubles

The key change scenario is the red line.

The exit below will mean an appreciation of the ruble shortly, with a possible minimum of 62 rubles (see red arrows)

If the current scenario continues, the maximum will be around 65.50 rubles for 1 USD (see grey arrows).

Full analysis for the next year will be possible to do only at the close of the December candle.

Good luck to everyone and good profits!

Yours faithfully,

Michael @Hyipov

=================================================== ======

Like and subscribe if you liked the material

I will be glad to any message.

Thank you very much

Everyone GTI

Dear Friends, I remind you that this is only my personal view of the market, which I share with you. I do not guarantee profits. Only you make the final decision and all the risks associated with it.

In Soviet Russia, Money Buys YOU! - (USDRUB)Hello Traders!

The Ruble has been in a steady uptrend for a while now.

It's no secret that Russian debt, lowest of developed nations (Roughly $200B) is so low now that Russia claims to have enough cash on hand to cover their debts completely. After the last Russian economic crisis, policies under Putin have sought to eliminate debt and generate faith in the economy.

I believe strong fundamentals combined with positive technicals create here a wonderful long opportunity! We can start layering in immediately. Even TD9 shows an imminent buy opportunity.

Be careful of manipulation!

Stay safe and good luck traders.

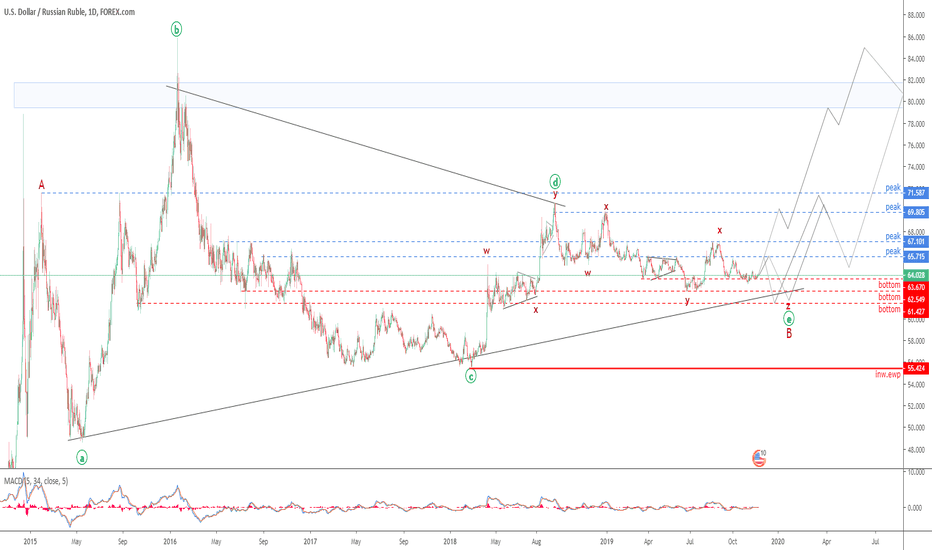

USD/RUB - EXIT from the global triangle soonSince 2016 we have been watching at the forming of the global triangle. Now the price is ready to show a quit from it. Try to seize this moment and catch it!

Target above 67.2 is 74.1, stop 65.1 (Risk/Reward Ratio - 2.75)

Target below 63 is 59.2, stop (Risk/Reward Ratio - 1.41).

Markets recovering, and we sell almost everythingThis summer can not be called calm. Nonetheless, increased volatility and uncertainty are advantages. There are excellent trading opportunities every day, of course, if you understand what happens in the financial markets.

Recall China lowered the value of the Yuan below its 7 to 1 peg against the dollar in response to a new series of U.S. tariffs. China Halts U.S. Agriculture Purchases. China has chosen the most painful points for Trump. The result was a sharp increase in demand for safe-haven assets, so those of our readers who heed our recommendations should have made good money buying gold and the Japanese yen.

However, the value of gold and the Japanese yen, in our opinion, is too high. Yes, and the VIX Fear index dynamics. (decreased by more than 20% of the maximum marks achieved after Trump's decision to raise tariffs) suggests that the worst is over so far. So this week we will sell both gold and the Japanese yen. Since such a decision runs counter to the current the market will, we fix each position with hard stops.

Friday appeared extremely “bad day” for the pound. Last week, the pound was consolidating in the region of 1.21-1.22 ( GBPUSD), gradually “compressing the spring”. As a result, UK GDP growth for the second quarter decreased (expected zero growth), as industrial production in June. The UK GDP growth rate has not crossed the negative zone since 2012. So when the GBPUSD is lower than 1.21 is a trend. Our trading position on the pound has not changed much - we continue to keep its medium-term purchases, but on the intraday basis go against the market and take extra minutes is not worth it. So for now, GBPUSD is below 1.21 so its short-term purchases you should probably wait with. A return above 1.21 will be a signal for its purchases.

As for the upcoming week, on Tuesday, we pay attention to statistics on the UK labor market and consumer inflation in the United States, on Wednesday to the Eurozone GDP and inflation in the UK, on Thursday we monitor data on retail sales in the US and the UK, and on Friday we fix profit. So it won’t be boring. We continue to work and earn.

Our trading activity for today will be exclusively bearish: we sell gold and the Japanese yen; We sell the Russian ruble and oil.

EURRUB | A Possible Mid-Term BUY Area.Hi,

Slowly I start to add some mid-term (weeks, months) trading & investment opportunities into my TradingView account.

The first one which looks technically pretty nice is EURRUB. Pretty soon you can start building your long position on EURRUB and it starts from the round number 70. Obviously, do your own research, read fundamentals and etc.

Technical criteria are:

1. Previously worked resistance becomes support.

In 2017, this level worked 2 to 3* times as a resistance level. Actually, it has worked also as a support level - in 2016 July and 2015 October-November

2. The round number 70 should act as a support level

3. The black trendlines make this wide support area much stronger

4. Weekly EMA200 acts as a support level.

5. Minor trendline (blue) third touch matching exactly with the blue box. This minor trendline is also a lower trendline from the bullish chart pattern "Falling Wedge". It is just information because patterns are only then valid when the breakout has occurred!

6.(!) Wait for a bullish candlestick formation to be more secure.

As said, do your own research and if this matching with mine then you are ready to build your long position!

Please, take a second to support my effort by hitting the "LIKE" button, it is my only fee from You!

Best regards,

Vaido

Trade like a boss ;)I have 5 trade ideas. Just look at this movements.

At the end I will talk about the positions .

1. FX_IDC:EURUSD look at that. EURUSD disaster.

A little bit deeper.

What trend is it?

Deeper.

Waves...

So, we are somewhere in 3 in 3 in 3. This type of waves means a deep collapse with a very sharp structure.

And... I will take leveraged short position on EUR. Details at the end.

2. Another disaster. Welcom, BINANCE:BTCUSDT .

Without a doubt, we are in a global c wave. Below you can see my full Elliot Wave structure of global b, that I am so missing about...

Guess what? We finished this wonderful rally and future year will be boring and red.

Now we somewhere in c...

Bye, bye, brother ;(

So, another short, guys.

3. Honestly, do not like shorts. It will be better with some tasty longs in my bag. Look at that guy.

Did you see it? Amazing formation. Bet, it will be huge rally ;) And... Yes, it's time for disappearing correlation between BINANCE:ETHUSD and BINANCE:BTCUSDT . Crazy moment :)

Look at that one more time.

Looks nice. One more position in my bag.

4. This guy makes me sad. Just no comments.

Thanks for that opportunity Mr. ...

5. And only lucky ticket can make my bag absolutely ready for fly ;)

Huge volume spike, yes? Bottom is near or... Just lucky ticket, ok? ;)

Resume

My positions will be:

1. 5.35/10 of bank 3 leveraged short on EURUSD and 1 leveraged long USDRUB.

Entry points: 1.118-1.11/63-64

No stop loss.

Targets: 1.02/0.9/0.86 | 100/120/160

This positions go together because a short position on the EURUSD blocks negative USDRUB swaps.

2. 2/10 of bank 3 leveraged short on BTCUSD.

Entry points: now! 9550-9000 I hold 3 leveraged short from 10400 from my last idea.

No stop loss.

Targets: 8000/6000/4000/1000/600

3.1/10 of bank 2 leveraged long on ETHUSD.

Entry points: 185-175.

No stop loss.

Targets: 400+ and ATH later

4. 0.75/10 of bank on buy AMPBTC.

Entry points: 90-10.

No stop loss ;)

Targets: unlimited ;)

Thanks, good luck, guys ;)

Prepare for US GDP, ECB results and Fear IndexAt yesterdays' meeting, the Governing Council of the European Central Bank (ECB) decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. Nevertheless, the comments from the Central Bank turned out to be very dovish, opening the way to further monetary easing in September. For the euro, of course, this is not a positive sign.

However, we do not throw the euro under a bus yet, because next week’s meeting of the Federal Reserve will likely mark the beginning of a prolonged period of lower interest rates, in our opinion, this event is more important than words about future easing (in the battle of facts with expectations, we will give preference to facts). Also, the euro is supported by the head of the European Central Bank, Mario Draghi, who said that officials had not discussed the rate cut. Our position is unchanged - we buy EURUSD with current price with stops lower than 1.11.

The data on the US GDP for the second quarter will be published today. GDP probably expanded 1.8% in the second quarter, down from 3.1%. If the growth is 2.2-2.5%, then the dollar, perhaps, is not in danger until Wednesday. But if 1.8%, it cannot avoid sales.

So, dollar current price seems to us extremely attractive for its sales.

Meanwhile, the VIX Index ( it is also known by other names like "Fear Gauge" or "Fear Index) dropped to Multi-Year Lows. That is, traders and investors have calmed down. That calls into the question the safe-haven assets growth demand and explains yesterday's weakness of the yen and gold. Given then the level of volatility in gold has increased, we prefer to trade with the Japanese yen. Its purchase against the dollar is still relevant for us.

Our trading recommendations for today: We will continue to look for opportunities for selling the dollar across the foreign exchange market entire spectrum, buying the pound against the dollar as well as against the euro, selling oil and the Russian ruble, and also buying the Japanese yen against the dollar. As for gold, in the oversold we buy and in the overbought area we sell gold.

The Gold Rush, pound success & our recommendations for todayRay Dalio is the founder of the world's biggest hedge fund firm, Bridgewater Associates, which manages $160 billion. An American

businessman with an estimated net worth of $16.9 billion. He recently has published a quite interesting essay on his LinkedIn account. Ray

Dalio thinks the current era of low interest rates and quantitative easing might be coming to an end, paradigm that could see escalating

conflict between capitalists and socialists is simple - gold. “I believe that it would be both risk-reducing and return-enhancing to

consider adding gold to one’s portfolio,” the billionaire founder of investment management firm Bridgewater Associates said in a 6,000-word

essay posted on LinkedIn.

The logic of his thinking is approximate as follows. The debt market is becoming less and less investment attractive due to the low

profitability caused by the ultra-soft monetary policy of the leading central banks. As a result, it is quite logical to assume that they

want to redirect their capital from the debt markets to others. But the problem of many countries is that they freeze to debt markets

forming the Ponzi, which is based on the constant debt refinancing. If investors stop lending money the currencies and stock markets will be

among the victims.

The stock market bubble will burst under such conditions, therefore, it is necessary to seek alternatives. According to Dalio, gold is

ideal for investing - this will, on the one hand, reduce risks, and on the other, increase profitability.

Yesterday turned out to be quite successful for the pound buyers. The reason for the growth was unexpectedly good UK retail sales outcome:

+ 1.0% m / m, with the forecast of -0.3% m / m. As well as comments from the main representative of the European Union at the Brexit

negotiations, Michel Barnier, who said that the EU is open to negotiations about the Irish border status. Our position on the pound

today is unchanged - we are looking for points for its purchases.

Our other trading recommendations: we continue to look for opportunities to sell the dollar, oil and the Russian ruble. Gold has

definitely climbed high so today we will sell it.

As for Friday, your attention should be paid to Canadian Retail Sales, as well as The Michigan Consumer Sentiment Index .