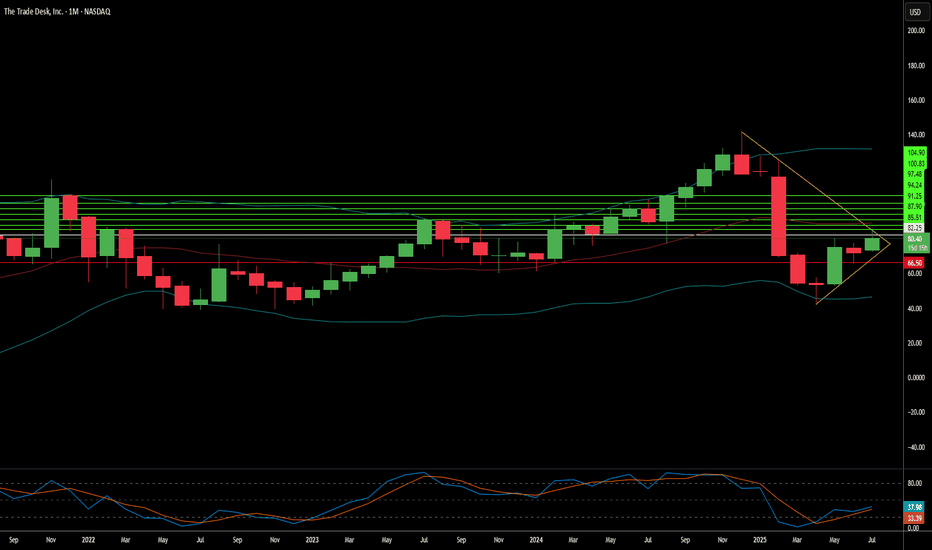

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion validates TTD's market importance and enhances its visibility and liquidity. This artificial demand floor, coupled with TTD's $37 billion market capitalization, underscores its growing influence within the financial landscape.

Beyond index inclusion, TTD benefits from a significant structural shift in advertising. Programmatic advertising is rapidly replacing traditional media buying, expected to account for nearly 90% of digital display ad spending by 2025. This growth is driven by advertisers' need for transparent ROI, publishers avoiding "walled gardens" through platforms like TTD's OpenPath, and AI-driven innovation. TTD's AI platform, Kokai, greatly lowers acquisition costs and enhances reach, resulting in over 95% client retention. Strategic partnerships in high-growth areas like Connected TV (CTV) further reinforce TTD's leadership.

Financially, The Trade Desk demonstrates remarkable resilience and growth. Its Q2 2025 revenue growth of 17% outpaces the broader programmatic market. Adjusted EBITDA margins hit 38%, reflecting strong operational efficiency. While TTD trades at a premium valuation - over 13x 2025 sales targets-its high profitability, substantial cash flow, and historical investor returns support this. Despite intense competition and regulatory scrutiny, TTD's consistent market share gains and strategic positioning in an expanding digital ad market make it a compelling long-term investment.

SAAS

Datadog's S&P 500 Entry: A New Tech Paradigm?Datadog (DDOG), a leading cloud observability platform, recently marked a significant milestone with its inclusion in the S&P 500 index. This pivotal announcement, made on July 2, 2025, confirmed Datadog's replacement of Juniper Networks (JNPR), effective before the opening of trading on Wednesday, July 9. The unscheduled change followed Hewlett-Packard Enterprise Co.'s (HPE) completion of its acquisition of Juniper Networks on the same day. The market reacted robustly, with Datadog shares surging by approximately 9.40% in extended trading following the news, reaching a five-month high and underscoring the anticipated "index effect" from passive fund inflows. Datadog's market capitalization, approximately $46.63 billion as of July 2, 2025, significantly exceeded the updated S&P 500 minimum threshold of $22.7 billion, effective July 1, 2025.

Datadog's financial performance further solidifies its position. The company reported $762 million in revenue and $24.6 million in GAAP net income for the first quarter of 2025. For the full year 2024, Datadog generated $2.68 billion in revenue. While the document suggested a cloud observability market valued at "over $10 billion," independent verification from sources like Mordor Intelligence indicates the "observability platform market" was valued at approximately $2.9 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 15.9% to reach $6.1 billion by 2030. Other analyses, like Market Research Future, project the "Full-Stack Observability Services Market" to be $8.56 billion in 2025 with a higher CAGR of 22.37% through 2034, highlighting varying market definitions. Datadog operates within a competitive landscape, facing rivals such as Elastic and cloud giants like Amazon and Microsoft, alongside Cisco, which completed its acquisition of Splunk on March 18, 2024.

The S&P committee's decision to include Datadog, despite other companies like AppLovin boasting a higher market capitalization of $114.65 billion (as of July 2, 2025), underscores a strategic preference for foundational enterprise technology addressing critical infrastructure needs. This move signals an evolving S&P 500 that increasingly reflects software-defined infrastructure management and analytics as a core economic driver, moving beyond traditional hardware or consumer-facing software. While Workday's inclusion was cited as occurring in 2012 in the original document, it was added to the S&P 500 effective December 23, 2024, preceding its significant growth in the enterprise SaaS sector. Datadog's ascension thus serves as a powerful signal of the technological segments achieving critical mass and institutional validation, guiding future investment and strategic planning in the enterprise technology landscape.

Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345—Or Even $3.45

Imagine going back in time to 2016 and buying Bitcoin at $345. Most people didn’t believe in it. They thought it was too risky, too early, or just plain irrelevant. Today, Bitcoin is trading in the six figures. The opportunity was historic.

Now, there’s another chance brewing—and it’s quietly sitting in front of us.

That opportunity is Reploy AI ($RAI).

🚀 What is Reploy AI?

Reploy AI is a micro-cap artificial intelligence (AI) project focused on decentralizing the compute layer that powers AI training and inference. It’s building a distributed AI network that connects GPU resources with developers and businesses in need of scalable AI infrastructure. Think of it as the decentralized AWS + OpenAI — built from the ground up for speed, accessibility, and equity.

It’s early. But the fundamentals, vision, and market positioning are explosive.

💰 Let’s Talk Numbers: The Bitcoin Comparison

Right now, Reploy AI ($RAI) trades at a tiny market cap—roughly $3 million at the time of writing.

If $RAI hits a $1 billion market cap, that’s a 31,000% return.

Yes, 31,000% — not a typo. That’s a 310x gain.

That would be like buying Bitcoin at $345, before it ran to over $100,000.

If $RAI grows into a $10 billion AI ecosystem, it would be like snagging Bitcoin at just $3.45.

Let that sink in.

🌐 Why This Could Actually Happen

AI Is the Next Internet

The world is undergoing an AI revolution. But centralized giants (like OpenAI and Google) dominate access. Reploy offers a decentralized, censorship-resistant alternative — and the market desperately needs it.

Micro Cap = Maximum Asymmetry

Unlike hyped-up billion-dollar AI tokens, Reploy is still undiscovered. Small caps like this can explode with just one partnership, listing, or viral catalyst.

Strong Tokenomics & Ecosystem Design

RAI has a deflationary supply structure, utility-driven demand, and real infrastructure use cases tied to decentralized compute, developer tooling, and enterprise deployment.

It’s Not Just Hype. It’s Being Built.

Reploy isn’t vaporware. The team is shipping code. The platform is live. And the network of compute contributors is growing.

⚠️ Of Course, This Is Risky

Yes, it’s still early. Yes, micro-cap tokens carry real risk. But so did Bitcoin when it was $345. So did Ethereum when it was $7.

The difference is this: most people only see opportunity when it’s already gone.

This isn’t financial advice. But if you’ve ever wished for a second shot at catching a generational trend early—this might be it.

🧠 Final Thought

In crypto, the biggest returns come from spotting the future before it’s obvious.

Buying $RAI at today’s price could be your version of buying CRYPTOCAP:BTC at $345—or even $3.45. The only question is: will you see it in time?

📈 DYOR. Stay sharp. Think long-term. And don’t miss what might be the next breakout in AI + crypto.

$GTLB: AI SaaS Software stock for tactical and long-term tradeIn this blog space we focus a lot on the AI trade. Be it semiconductors, AI powered Cybersecurity, AI Powered Fintech or just the industry itself, but we have not quietly focused on the AI Software stocks. The second and third derivatives of the AI trade will be more on the software space than Semiconductors where most of the future value will be accrued. Now within the AI Software space we have discussed NASDAQ:CRWD strike as one of our favorites, but can there be other names which can give us a lot of Alpha in the near and long term?

In my opinion NASDAQ:GTLB is one such stock. Gitlab provides software developers productivity tools to develop software faster, better and securely. Coming back to the technical below we can see that lately the stock is stuck within the upward sloping channel on the weekly chart since the bear market lows of 2023. If we plot the Fib retracement level from the all-time highs to the all-time lows, we can see that on the weekly chart it is stuck below the 0.236 Fib level with an oversold RSI. But the recent price action indicates that even if we touched the lower bound of the price we saw after April 4 Lib Day lows, we are still holding an RSI of 41 indicating seller exhaustion. So, the next levels in the chart are 52 $ then 67 $ and then 80 $ in the medium term, which is well within the parallel channel.

Verdict: NASDAQ:GTLB target prices are 52 $ then 67 $ and then 80 $. Can be held for long term returns.

Toast, Inc. (TOST) – Powering the Future of RestaurantsCompany Snapshot:

Toast NYSE:TOST is cementing its position as the go-to restaurant operating system, offering integrated solutions for payments, POS, inventory, and guest engagement—all tailored for food service businesses.

Key Catalysts:

Recurring Revenue Powerhouse 💸

ARR hit $1.7B in Q1 2025 — up 31% YoY

SaaS-driven model provides high visibility and stickiness

Expanding Client Base & Network Effects 📈

Serving ~140,000 locations, up 25% YoY

More locations = richer data + stronger product improvement + increased client lock-in

Enterprise-Grade Momentum 🏢🍔

Wins with Applebee’s (~1,500 locations) and Topgolf demonstrate Toast's scalability

Validates ability to support complex, high-volume operators

Operating Leverage in Motion ⚙️

As ARR scales, margins improve—positioning Toast for profitable growth over time

Investment Outlook:

✅ Bullish Above: $37.00–$38.00

🚀 Target: $60.00–$62.00

📈 Growth Drivers: Enterprise adoption, recurring revenue, SaaS scale, network effects

💡 Toast is becoming the digital backbone of modern restaurants—serving up growth with every seat. #TOST #SaaS #RestaurantTech

VERT AI 2025 Bull Run Price Target: $10 ($1B Market Cap)If you know anything about Vertical SaaS. Vertical AI is a mega bullish AI trend.

This is the basis of an entire B2B ecosystem that will generate fees but make small businesses extremely efficient and innovative while making non-tech businesses tech-enabled.

This easily goes to a $1 Billion Market Cap or $10 per token in 2025.

FRESHWORKS ($FRSH): DRIVING AI-POWERED GROWTH IN SaaSFRESHWORKS ( NASDAQ:FRSH ): DRIVING AI-POWERED GROWTH IN SaaS

1/7

Revenue Growth: Freshworks just posted $194.6M in Q4 2024 (+22% YoY), with full-year revenue hitting $ 720M (+21% YoY)! ⚡️

Growth is fueled by new customer wins and the rising AI demand in customer service, sales, and IT solutions.

2/7 – EARNINGS BEAT

• Non-GAAP EPS: $0.14 (beat by $0.04) 💰

• Operating profit for FY2024 doubled to $ 99M from $ 44.5M in 2023 🔥

• FY2025 guidance: Revenue $ 809M–$ 821M (12–14% YoY growth) 🚀

3/7 – CASH FLOW & PROFITABILITY

• Free Cash Flow margin at 21% in Q4—showing major profitability strides 💸

• Shifting from less profitable past to a more robust, scalable business model 🏆

4/7 – SECTOR SNAPSHOT

• Competes with Salesforce, HubSpot, Zendesk in the SaaS arena 🌐

• Enterprise Value to Revenue ratio is on the lower end—could be undervalued given its growth 📈

• Mid-market & SMB focus → niche advantage vs. pricier enterprise solutions

5/7 – RISK FACTORS

• Market Competition: Big fish (Salesforce) + fresh entrants (Zendesk) 🏦

• Customer Acquisition: High marketing costs, must maintain ROI 🤝

• Economic Sensitivity: Downturn = possible budget cuts on software 💼

• Tech Shifts: Rapid AI innovation—no resting on laurels! 🤖

6/7 – SWOT HIGHLIGHTS

Strengths:

• Strong AI-driven revenue growth

• Wide product portfolio (sales, IT, support, etc.)

• Growing customer base & retention ✅

Weaknesses:

• Less profitable historically (though improving)

• Revenue heavily reliant on core products 😬

Opportunities:

• Expand into untapped global markets

• Double down on AI for new revenue streams 🌍

Threats:

• Market saturation & intense competition 🏁

• Data privacy regs could disrupt operations ⚖️

7/7 Freshworks: undervalued gem or just another SaaS player?

1️⃣ Bullish—AI + mid-market niche = unstoppable! 🏅

2️⃣ Neutral—Need more proof of profitability 🤔

3️⃣ Bearish—Competition & economy hold it back 🐻

Vote below! 🗳️👇

$FROG - About to fly! 129% Upside potentialNASDAQ:FROG

As I've been calling out for the past month Tech Services and SaaS companies are the next phase of Ai and very hot right now based on the massive moves after meh to good earnings from the likes of NASDAQ:TEAM NASDAQ:MNDY NYSE:NET NASDAQ:CFLT

I believe this trend continues and this small 4B Mkt Cap company could really get going after earnings on Thursday!

- CupnHandle forming while Bull Flag breaking out

- Two year trendline is our safety net

- Massive Volume Shelf with GAP

- H5 Indicator made bullish cross and is GREEN

- WCB has formed

PTs: $43/ $57/ $67/ $84

NOT FINANCIAL ADVICE

Can AI Redefine How We Agree?In the digital transformation landscape, DocuSign is not just maintaining its lead in electronic signature solutions but is actively redefining how businesses manage agreements through artificial intelligence. With the introduction of its Intelligent Agreement Management (IAM) platform, DocuSign has ventured into a new era where AI streamlines every aspect of contract management, from drafting to data extraction and negotiation, ensuring that agreements are executed and strategically optimized.

The IAM platform's impact is evident in its rapid adoption and the positive market response, with financial analysts from JMP Securities setting an optimistic price target of $124. This enthusiasm is backed by DocuSign's financial performance, projecting a revenue growth to $2.96 billion in fiscal 2025, alongside an 80.2% gross profit margin. Such figures underscore the company's operational efficiency and its ability to sustain high profit margins, even as it expands its service offerings.

Moreover, DocuSign's strategic focus on international expansion and leadership enhancements under CEO Allan Thygesen is poised to cement its market position further. With international revenue growth at 17% and a Net Revenue Retention rate reaching 100%, DocuSign is not only maintaining but also enhancing customer relationships. The company navigates a competitive environment with tech giants by leveraging superior integration and compliance features, eyeing a significant $50 billion market opportunity split between e-signature and contract lifecycle management.

As we look to the future, DocuSign's journey from an e-signature specialist to an AI-driven agreement management leader challenges businesses to rethink their approach to contracts. The company's ongoing innovation in AI promises to unlock new efficiencies and insights from agreements, potentially revolutionizing business operations across various sectors. This evolution poses opportunities for growth and challenges in maintaining market leadership, making DocuSign's narrative one of inspiration and strategic curiosity.

MULTIBAGGER Series - Stock 3Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Zaggle Prepaid Ocean Services Ltd. Zaggle builds world-class financial solutions and products to manage the business expenses of corporates, SMEs, & Startups through automated and innovative workflows. It is at an intersection of SaaS (Software as a service) and Fintech. It has made strategic alliances with many other companies. The company has an esteemed list of corporates like Tata Capital, Inox, NSDL, DBMS, Wockhardt, Yes Bank, Greenply, etc. It has also made an agreement with VISA and the deal is valued at approximately $20 million over the next five year.

The company has shown more than 10x growth in both sales and profit made in the past 4 years. Last year sales was 776 cr and profit was 44 cr. The quarterly sales and profit is also continuously increasing and the company is expected to grow at a good pace from here. They have made visionary targets for the year 2025. Ace investor Ashish Kacholia has also invested in this company.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

My TOP10 project list - pick number 1/10 (new set up)Hello my friends,

This was my first top 10 crypto pick back in November 1st 2023 !

I personally entered this trade on 25th September 2022 (at 0.015 cents) but felt sufficiently confident to publish it only 1 year later.

It had a great run in April this year, it even touched 10 cents. However the best is yet to come.

TODAY it has reached the same price level as 9 months ago (white circle) !! God or bad ?

Now it is a great time to buy with a better risk reward level.

From the 10 cents level, it has crashed all the way back to 0.023 cents.

However the breakdown was recently confirmed as F A L S E breakdown (blue circle), similarly as it did in March 2024 before the run up.

This is an extreemely bullish price action !

I personally think that we could see the 0.3186 level this year (which would be a 10 x from here).

Not financial advice. It is just my personal view on the current set up.

ANSS AnSys The Software Simulation Engine For Everything AI Ansys, Inc. is an American company based in Canonsburg, Pennsylvania. It develops and markets CAE/multiphysics engineering simulation software for product design, testing and operation and offers its products and services to customers worldwide.

Opening positions under $220 and attempting to hold for $300

Meet the worst performing industry in the bear marketThis chart shows RingCentral, Bandwidth, and Twilio. I have actually wrote about Twilio a few times because its sell-off has been especially pronounced.

In some respects, Twilio is one of the poster childs of the recent bear market mania among high flying tech names.

Nonetheless, not that I am a knife catcher all that much, but more-so the extent of this crash in communication and tech companies that have become essential tools in all digital aspects of life, it's hard to ignore a sector like this. I partly think the sell-off is as intense as it is because no one actually knows what these companies do!

A quick background on what they do...

When Zoom connects video & voice calls, there's a company working behind the scenes to ensure those communications are running as smoothly as possible.

When Apple sends you a two-factor text message to secure your account, there's a company working behind the scenes to connect that information.

When an internal team conducts a conference call on their private network or in the office, there's a product behind the scenes connecting all of them.

When someone calls a customer support line, and gets routed based on the information they need, there's a company working behind the scenes to connect that information.

These companies are largely responsible for the majority of that infrastructure. Without them, the connectivity among apps, calls, texts, emails, and notifications would be a fraction of what it is today. Our capabilities would be greatly reduced.

Nevertheless, it's hard for me to ignore these companies and these industries from RNG to TWLO and BAND.

I bought a small chunk of BAND recently and that's my full disclosure. I'll sell the trade at a loss if it goes back below $13.50 and I'll take gains if it goes back to $28.00 per share (the recent highs - possible double top formation).

So with that being said, those are my thoughts currently...

Amplitude: 2021 IPO Comeback Kid $AMPL $COIN $SNOWDoesn't look like there are many buyers for $AMPL, a peer of $COIN $SNOW 2020-2021 IPO cohorts, though business results look promising in the long-term.

I'd say anything above $10 is a good entry for this as a long-term tech stock that can outperform in future cycles.

Amplitude Inc (NASDAQ:AMPL)

The 8 analysts offering 12-month price forecasts for Amplitude Inc have a median target of $17.50, with a high estimate of 20.00 and a low estimate of 15.00 . The median estimate represents a +32.28% increase from the last price of 13.23.

In the chart above, I have 3 bullish scenarios. All 3 are negated if the price drops below $10

As of now, it looks like there's still a lot of post-IPO sell pressure and aside from price defense at $10 late this year, not much new insti investor interest.

"We're so early!" - Famous Last Words

Are cloud computing companies offering a second bite Are cloud computing companies offering a second bite at the cherry?

On 18 December 2022, Jason Lemkin posted a blog titled “Right Back to Where We Were 3 Years Ago.” It caught my attention or those of us who have been following the performance of software-as-a-service (SaaS) cloud computing companies. It tells us, quite clearly, that the impact of the ‘pandemic pull-forward’ of demand for software consumption is completely removed from the 3-year performance number.

To us, it means that it is time to ask a simple question: is the market giving us a ‘do-over’, meaning that we can now access companies at something similar to ‘pre-pandemic’ levels, or is the jig up and the cloud business model doomed to fade away into the sunset?

SaaS companies have evolved significantly since 2019

In Figure 2, we wanted to look at valuation over the same period. Even if the share price performances of the underlying companies have run up and then fallen back in most cases—leading to the observed performance of the BVP Nasdaq Emerging Cloud Index—we have not been seeing companies reporting widespread negative year-over-year revenue growth. Instead, we’ve tended to see the revenue growth ranges shifting downwards, with the median figure for the Index now closer to the 30% level, whereas it was higher than 40% for a period of time ending roughly one year ago.

If prices have dropped but sales have continued to grow, it’s possible to see that the valuation opportunity at present is better than it was in December of 2019, 3-years ago. In Figure 2, we see that the price-to-sales ratio was 7.0-8.0x during this period, whereas presently it is below 4.5x. We agree that these stocks should be less expensive today, in that the risk today is higher and the cost of capital is also higher. We can’t know with certainty if the current price levels perfectly encapsulate this risk, but it is simply important to know that the risk does look like it is being accounted for.

In our opinion, within software-as-a-service companies, one must always marry looking at valuation with looking at revenue growth. Many of these firms, as yet, do not carry through positive net income to the bottom lines of their income statements, so if one can look at a reasonable fundamental, sales seems to make the most sense at this point in the development of the megatrend. We do view this as a megatrend, which means the time horizon we are thinking about is not the next 12 months or couple of years, but something that should unfold over a decade.

Growth, on the other hand, has come down more slowly than valuation. Now, this is ‘revenue growth’, not earnings growth or cash flow growth, but we note that companies are still growing, and some are still delivering results ahead of Wall Street’s expectations. If the Nasdaq 100 is growing something close to 10% and the BVP Nasdaq Emerging Cloud Index is growing something close to 30%, is this a worthwhile trade-off? The Nasdaq Index represents, predominantly, proven, established businesses, with some of the world’s most valuable companies, measured by their market capitalisations, getting the top weights. This risk profiles of these groups of stocks should be quite different, but if we are able to think not of the next 12 months but rather the next 10 years, does the difference in risk potentially make sense?

We do feel comfortable to conclude there is a better chance to make sense at the present valuation trade-off than it did at the near-term market high observed in November 2021, even if it’s impossible to know the future with certainty.

Where the rubber meets the road: what do SaaS companies do?

In our opinion, no discussion of cloud computing or SaaS companies is complete without giving some treatment to what the companies do. SaaS is just a business model—a way to provide/consume software that competes with other ways to provide/consume software. Do people prefer subscription models, or would they want to go back to a world where they need to buy a DVD and physically hold and use their own copy? If the software is necessary and valuable, and the company can execute their strategy, we have confidence in the long term. If, on the other hand, the software is discretionary and more ‘nice-to-have’ than needed, then there could be more risks. We see the following functional groupings as a starting point:

Cybersecurity: companies like CrowdStrike, SentinelOne, Cloudflare, Zscaler and Darktrace focus on cybersecurity. Subscribing to cybersecurity protection makes sense because we know that the attackers are always evolving. Stagnant protection would eventually lead to limited protection. Many SaaS cybersecurity firms are not necessarily trading at single digit price-to-sales multiples, but it’s also the case that cybersecurity has received massive attention from investors in 2022, largely due to the Russia/Ukraine conflict.

Software development: companies like Twilio, Atlassian and New Relic are involved with running platforms useful to software development. Twilio and Atlassian have faced challenges in their share price performance during their most recent quarterly earnings reporting periods. However, we believe that the service they provide for software development remains critical.

Business services: a company like Bill.com is very interesting, in that it is an example of a service that helps small and mid-sized firms manage their expenses. It’s a good case to remember because companies will tend to employ services like this to create efficiencies and save costs and time. We couldn’t ever say this company (or others like it) would be immune to recessionary pressures, but we find it important to note that it also may not be the first subscription to cut either.

Cloud computing and software-as-a-service companies do not have long histories of operation where we can look back at their performance during the Global Financial Crisis of 2008-09, and we’d have to assume that, if they were around in 2001 and 2002, their performance as the ‘tech bubble’ burst would have been significantly negative. To say these companies are completely resilient to recession is not a thesis that has been proving out in 2022. However, we’d note that their revenues are still growing, so it’s not the case either that these companies immediately reverted to negative revenue growth and collapsing fundamentals. If people view this as a megatrend, as we do at WisdomTree, the current period in the coming months could be a much more interesting entry point than anything we have seen recently, even if near-term performance could still be challenging.

$MDB: Very interesting setup, weekly+daily trends are upThis one has potential to be an extremely powerful move if we don't get some unexpected bearish shock after FOMC this week. Certainly worth a shot considering the weekly and daily trends are up here, and stop is rather tight just under $197.86 when upside is potentially up to $300 over time.

Best of luck!

Cheers,

Ivan Labrie.

Cloud computing: what are the big players telling us?Each earnings season, we become accustomed to certain patterns. One pattern involves the biggest tech companies reporting earnings before many other smaller and medium sized firms. In what we know is a very difficult economic backdrop, it’s important to look for signals that some of the world’s largest companies are giving us.

Additionally, since Microsoft Azure, Amazon Web Services, and Google Cloud are three of the world’s largest providers of public cloud infrastructure, it’s possible that these reports contain details about how companies are spending more broadly on technology. Combining the annual revenues of just these businesses (recognising that they are each part of larger companies) we see spending on cloud infrastructure annually in the hundreds of billions of dollars.

We believe that there is a difference between these three large public-cloud infrastructure providers and the much greater number of far smaller Software-as-a-Service (SaaS) providers. These three firms, for instance, are a major part of most market capitalisation-weighted benchmark indices. They are at a point in their life cycles where they should exhibit sensitivity to broad, global economic activity and growth expectations.

What can they tell us? The most important thing that we think the results of the big public-cloud providers can tell us regards trends in broad-based information technology spending on cloud computing. Eventually, the enterprise market will have ‘moved to the cloud’ and the growth rates of these large players should drop significantly. We are not yet there so, in this type of environment, we really want to see the resilience of cloud spending in the face of a tougher economic backdrop. There haven’t been that many economic slowdowns since the genesis of the cloud business model, and there certainly haven’t been sustained periods of inflation or central bank tightening.

What don’t they tell us? The smaller SaaS providers tend to help their customers with much more specific business initiatives. It may be accounting, compliance, cybersecurity, data analysis…the list is becoming endless. These companies are more idiosyncratic, in that their individual results do not translate to broad trends as clearly as the biggest company results would. However, we might see strong spending in cybersecurity, for example, and this may not be as clearly visible in the results of the biggest companies.

Our initial sense is that it is important to remember that, in many cases, businesses transitioning to the cloud is done to create efficiency and to accomplish more while investing either less time, less money or less of both. We think that this overall trend will continue, but it likely won’t continue at the rates seen in recent years if the global backdrop is characterised by a deteriorating economic picture. It’s also the case that many cloud-focused companies have seen their share prices drop significantly in 2022. This doesn’t mean that all the risk is ‘priced-in’ by any means, but it does tell us that the valuation risk of the space is lower relative to the much higher valuations seen towards the end of 2021.

Microsoft

Microsoft is a leader in the cloud space, and it’s important to note that the Azure infrastructure platform is one piece of the overall ‘Intelligent Cloud’ effort. Most attention goes to the year-over-year revenue growth rates, so it is instructive to first ground any discussion in some of the recent quarterly figures, which are shown in year-over-year terms for Azure specifically below1:

30 September 2021: 50%

31 December 2021: 46%

31 March 2022: 46%

30 June 2022: 40%

30 September 2022: 35%

It also helps to look at the overall revenue base to help ground any further thoughts about reasonable growth. While the quarterly results do look at more than the pure Azure revenues, broadening the picture to ‘Intelligent Cloud’, we see that Microsoft’s Intelligent Cloud revenue was $16.91 billion as of 30 September 2021, and that this figure increased to $20.33 billion as of 30 September 2022. This is a quarterly figure, and it is beginning to be quite large, so part of the growth rate deceleration that we may be seeing could be attributed to the size and scale of these figures.

Analysts are seeing Azure customers very focused on optimising their cloud workloads, which helps them to save money, and it’s also the case that there is evidence that customers are pausing on new workloads. It is reasonable to think that, in an environment of slower economic growth, consumption-based business models like public cloud infrastructure may indicate shifts in customer-behaviour toward more essential workloads2.

Amazon

Amazon Web Services (AWS) is the leading public cloud infrastructure platform based on market share, often cited as having a figure around 40% of the total. If we consider the year-over-year growth rates from recent quarters3:

30 September 2021: 39%.

31 December 2021: 40%

31 March 2022: 37%

30 June 2022: 33%

30 September 2022: 27%

Similar to the case of Microsoft, we are seeing decelerating growth rates. However, if we look to 30 September 2021, the trailing 12-month net sales for AWS was at $57.2 billion, and this same figure as of 30 September 2022 is $76.5 billion. These are getting to be quite large numbers.

Also similar to the story with Microsoft, enterprise cloud customers are looking to reduce costs within the AWS ecosystem. Analysts are continuing to note the long-term potential and how this differs from the situation within the shorter-term macroeconomic backdrop4.

Alphabet—Google Cloud in focus

Google Cloud, within Alphabet, does trail both Microsoft Azure and AWS in terms of market share, but Alphabet as a whole runs a formidable, cash-rich business, so they have been known to make large, splashy deals to gain high-profile cloud customers. If we note the year-over-year growth figures5:

30 September 2021: 45%

31 December 2021: 45%

31 March 2022: 44%

30 June 2022: 36%

30 September 2022: 38%

The growth rates are similar to what we noted with Microsoft Azure and AWS, but the dollar figures are much lower. As of 30 September 2021, the quarterly revenue from Google Cloud was reported at $4.99 billion, and then as of 30 September 2022, this figure had grown to $6.87 billion.

It is notable that, while Microsoft and Amazon saw quarter-to-quarter decelerations in growth rates, Google Cloud is cited as a bright spot of growth acceleration in Alphabet’s results. However, we note that Alphabet’s core business was certainly not immune to deteriorating economic conditions, and that the revenue figures are growing from a smaller overall base.

Conclusion: the economy matters but this is not the year 2000

The primary conclusion that we reach at this point is that economic conditions do matter for cloud computing companies. We have already seen their share price performance for 2022; it is crystal clear that market participants have re-assessed the appropriate valuation multiples for these firms considering higher inflation and higher interest rates. We will be watching closely to see how much revenue growth these companies can maintain as they continue to report earnings for the period ended 30 September 2022. The biggest companies, so far, have reported a range of 27% to 38%. It clearly isn’t the euphoric environment of 2020 any longer, but we don’t think it appropriate to say a ‘tech bubble is bursting’ either.

Sources

1 Source: Microsoft’s First Quarter Fiscal Year 2023 Results, 25 October 2022. Revenue figures presented in the generally accepted accounting principles (GAAP) format.

2 Source: Sills, Brad & Adam Bergere. “Expected Azure decel likely temporary, cyclical; model largely derisked.” Bank of America Securities. 26 October 2022.

3 Sources: Amazon’s Quarterly Earnings Conference Call Slides for the specific periods ended: 30 September 2022, 30 June 2022, 31 March 2022, 31 December 2021 and 30 September 2021. The revenue growth figure is taken as the year-over-year growth without foreign exchange adjustment.

4 Source: Post, Justin & Michael McGovern. “Expecting Less this Holiday.” Bank of America Securities. 28 October 2022.

5 Sources: Alphabet’s Quarterly Earnings Announcements which specify the revenues from different business units on a quarterly basis for the periods ended: 30 September 2022, 30 June 2022, 31 March 2022, 31 December 2021 and 30 September 2021. Percentage growth is calculated directly from the figures that Alphabet reports for Google Cloud, all in USD terms.

VMW VmWare Appealing again near $100 tech blue chip“The internet was supposed to liberate knowledge, but in fact it buried it, first under a vast sewer of ignorance, laziness, bigotry, superstition and filth and then beneath the cloak of political surveillance."

VMware, Alibaba Cloud introduce next-generation public cloud service

SA NewsYesterday, 8:55 AM6 Comments

Intel CEO visits Taiwan Semiconductor to ask for additional capacity: report

SA NewsFri, Apr. 08104 Comments

ABNB Large Base Formation We're witnessing some relatively volatile price action after ABNB reported solid Q3 earnings. I believe ABNB is a disruptive play on innovation that everyone should hold in their LT portfolio, with accelerating EPS and increasing market share within the hospitality industry.

Technically speaking, the price action for ABNB keeps returning to its broad base on the daily timeframe and bouncing every time. I like watching this base for solid entry points/DCA on my position.

Just my personal opinion, not investment advice.

$MIME: Email Security While Trust In Big Tech Wanes?As distrust in big tech continues with FB making new lows and cyber security stocks continue to reach out for new highs, the tech hangover from COVID looms large. Mimecast I believe will ultimately find themselves on the right side of technology trends in the future while the rest of the world figures out how invasive they want their online communications to be and how comfortable they are with companies hanging onto their data.