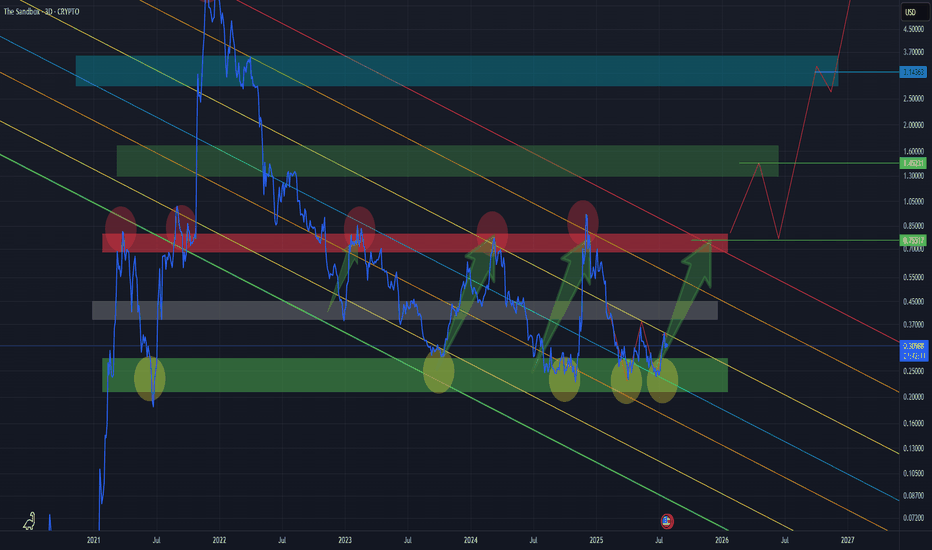

THE SANDBOX mid - to long - termThis might seem obvious to some, but it’s worth emphasizing —

📌 When analyzing charts like this, switch to a Line Chart instead of Candlesticks.

Why?

It filters out market noise and shake-outs

You can clearly see how price respects key zones and levels

Candles often distort the picture with wicks — line charts show the real body movement

Bullish Setup:

Market has printed a clean W-bottom, confirming bullish intent.

We are currently retesting the neckline of the pattern — a common and healthy move before continuation.

A successful retest could lead to an impulsive move upward toward target zones.

🎯 Target Zones:

Green zone (top) — this is the maximum target in the current structure.

Anything above the red line already carries increased risk, and should be approached with caution.

Above green zone = extreme risk / high-probability rejection unless backed by strong fundamentals.

Sandbox

#SAND/USDT#SAND

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2790, which acts as strong support from which the price can rebound.

Entry price: 0.2828

First target: 0.2890

Second target: 0.2971

Third target: 0.3048

SANDUSD: The recovery back to 1.07350 has started.Sandbox (SANDUSD) is marginally bearish on its 1D technical outlook (RSI = 43.227, MACD = -0.001, ADX = 35.488) as it dropped below its 1D MA50 again. However, the breakout over its 5 month LH trendline has already happened and calls for a long term recovery. As you can see the Fibonacci retracement levels form fairly symmetric Resistances with the previous LH levels, so we expect them one by one to get filled (final TP = 1.07350).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

TradeCityPro | SAND: Critical Support Test After Pullback👋 Welcome to TradeCity Pro!

In this analysis, I want to review the SAND coin for you. It’s one of the most popular Metaverse projects, widely recognized and among the top in its category.

✔️ This project’s coin currently holds a market cap of $693 million and ranks 91st on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see on the 4H chart, after a bullish leg that pushed the price up to 0.3140, a correction phase began. Following the break of 0.2903, the price has now corrected down to 0.2714.

🔍 If this 0.2714 level breaks, the price could continue down to the support at 0.2437 — so a break below 0.2714 would be a valid short entry.

👀 Personally, I prefer waiting for the price to first bounce off 0.2714, move upward, and print a lower high relative to 0.2903, then break 0.2714 on a second attempt. In that case, the short setup becomes much more reliable.

🔽 That said, even if the level breaks now without a bounce — since RSI is already near the oversold zone — I’ll still open a short. If RSI enters oversold, it could lead to a sharp drop.

⚡️ One negative factor for short positions is that volume has been decreasing since the price started correcting from 0.3140, which isn't a good signal for further downside — there’s a divergence between price and volume.

📈 However, that’s a positive signal for potential long positions. When volume drops during a correction in an uptrend, it shows buyers still have control. As long as this divergence persists, the uptrend is more likely to continue than to reverse.

📊 For long positions, if buying volume enters the market and the price holds above 0.2714, you can enter based on lower-timeframe structure breaks. The main long entry will be confirmed once the price breaks above the 0.3140 high.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

SANDBOX: $0.55 | Waiting for RESETthe metaverse ahead of its time

where market discounted the 10year reality in just 24 months after launching

very well regulated float gradually increasing

as the original investors finally unloads holdings

COST of OGs $0.003 to $0.005

Stabilization for buy back should be at $0.18 and all the way to $0.07

kinda like cardano or doge where at sub .10 cents DEALERS or BROKER custodians

began ACCUMULATING heavily for that next Bull RUN

#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy

SANDUSDT.P SWING Long AMD Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP ))

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

By scratching the price and time bar, you can see the big picture and targets.

Note: The price can go much higher than the second target, and there is a possibility of a 50%-100% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

$SAND Sandbox Over 70% Retracement... Ready for Higher?NYSE:SAND Sandbox has committed a over 70% retracement after superbuy signal from a height of approximately $1

Current Price: $0.36

Price action is forming a Falling Wedge and Bullish Divergences Spotted also

Expecting a retest of previous supports - now resistances at 0.41, 0.54, 0.7, 0.82, 0.96

#sand Invalidation is at under 0.3

Is There Hope for Sandbox ($SAND) or Is The Gameverse Dead?The Decline of NYSE:SAND : A Look at Its Current State

Once a shining star in the play-to-earn (P2E) gaming and NFT ecosystem, Sandbox ( NYSE:SAND ) has seen a staggering decline from its all-time high of $8.44 to a mere $0.34 at the time of writing. This sharp drop has left investors and gamers questioning the future of metaverse gaming and the sustainability of blockchain-based virtual worlds.

Despite recent hype around Web3 gaming and metaverse adoption, the broader NFT and P2E sectors have remained relatively muted, contributing to NYSE:SAND ’s price drop. However, does this spell the end for The Sandbox, or is a reversal on the horizon?

Technical Analysis

The Relative Strength Index (RSI) currently sits at 23, indicating that NYSE:SAND is in heavily oversold territory. Typically, an RSI below 30 suggests that an asset is due for a rebound, as selling pressure diminishes.

The daily chart is forming a rising wedge pattern, which is a traditionally bearish formation. If the pattern holds, further declines could be expected. However, the $0.39 pivot zone is a critical resistance level. Should NYSE:SAND manage to break above this level, it could spark a campaign towards the $1 mark, a move that would be monumental for the token.

Currently, NYSE:SAND is down 7.27% on the day, with a 14% decline over the last 24 hours. The lack of bullish momentum suggests that investors remain hesitant about a potential comeback. However, if volume spikes and momentum shifts, a short-term recovery could be on the table.

Market Data & Sentiment

- Current Price: $0.3487

- 24-Hour Trading Volume: $113.85 million

- Market Cap: $859.36 million

- Circulating Supply: 2.46 billion NYSE:SAND

Despite the downturn, The Sandbox maintains a top-100 ranking in the crypto market, proving that it still holds relevance. The challenge now is for the platform to reignite user interest and expand beyond its current stagnation.

The Road Ahead: Dead or Dormant?

While the NFT and metaverse hype has faded, it doesn’t necessarily mean the sector is dead. Innovation, adoption, and strategic partnerships could breathe life back into NYSE:SAND and other metaverse tokens.

TradeCityPro | SAND: Analyzing the Key Support & Resistances👋 Welcome to TradeCity Pro!

In this analysis, I will review the SAND coin. The Sandbox project is one of the largest metaverse projects in crypto, and during the previous bull run, it received significant attention from market participants. Recently, with Bitcoin’s latest upward move, SAND experienced a growth of nearly 300%.

📅 Daily Timeframe: Corrections and Key Supports

As mentioned, the daily timeframe shows a strong upward trend, which extended up to $0.9327. After reaching this level with significant volume, the price entered a corrective phase.

🔍 Currently, the price has corrected to the $0.5414 level, a critical support zone overlapping with the 0.5 Fibonacci level. This creates an important support range between the 0.5 and 0.618 Fibonacci levels. It appears the price is forming a base in this area to potentially regain bullish momentum and start the next leg upward. However, the possibility of a trend reversal and further decline also exists.

📊 In recent candles, buying volume in the market increased. However, with the release of yesterday’s news favoring the US dollar, nearly all assets, including US stocks and crypto, experienced declines. SAND also followed this trend with a red daily candle, engulfing the previous bullish candle.

🧩 It’s possible for the market to form a range box between $0.5414 and $0.6983, setting up a new bullish or bearish structure. Given SAND’s recent 300% growth, the likelihood of forming a bullish structure is higher. However, this is only a possibility, and we need to wait for the market to establish a new structure.

✨ The RSI oscillator is also within a box between 41.60 and 61.04. Breaking either of these levels could introduce momentum into the market. Overall, the current market volume still favors buyers.

📈 Long Positions:

The first trigger for a long position is $0.6983, which is considered a risky trigger. However, the rejection candle from yesterday adds importance to this level.

The main trigger is $0.93277, which is the major price ceiling. If this level is broken, the next resistance will be at $1.4155.

📉 Short Positions:

The first support zone is the range between 0.5 and 0.618 Fibonacci levels, as marked. If this zone breaks, the price could see the next corrective leg down to $0.4042.

If this level is broken, it would suggest the bullish trend has ended, with subsequent targets at $0.3068 and $0.2342.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Sand 4h - Accumulation RangeREMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , SAND is trying to remaning in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on it if the 0,65usd resistance its broken and became a support.

SANDUSDT Trade LogSAND is showing strong potential for growth with recent market activity. This could be an excellent opportunity to buy and hold for the mid-to-long term. The metaverse and gaming narratives are gaining traction again, and SAND could be a key player.

Recommendation: Accumulate and hold. Watch for further confirmation of bullish momentum.

The Sandbox (SAND)SAND/USDT Analysis 📊

Recently, SAND has demonstrated significant performance, managing to shift its trajectory from a descending channel and reach the top of an ascending channel. Below is a more detailed analysis of the current situation and potential scenarios:

⚖️ Current Situation:

Breakout from the Descending Channel: SAND has exited the descending channel and is currently undergoing a pullback. This move started from the support zone (0.19 – 0.23 USD).

Current Correction: The upward wave has corrected to the 0.5 Fibonacci zone (0.45 – 0.49 USD). This level is a key zone for the continuation of the trend.

Red Resistance Zone: The price is currently facing significant resistance in the range of (0.8 – 0.99 USD). A successful close above this level is crucial for the continuation of the uptrend.

🔍 Upcoming Scenarios:

Bullish Scenario:

If the price manages to break and sustain above the red resistance zone (0.8 – 0.99 USD), the following targets become achievable:

1.618 Fibonacci: 1.41 – 1.69 USD

2.272 Fibonacci: 2.42 – 2.9 USD

2.618 Fibonacci: 3.94 – 4.98 USD

High volume entry during the breakout of the red resistance zone is essential.

Bearish Scenario:

If the price fails to break through the red resistance zone, a deeper correction is likely:

0.618 Fibonacci level: 0.4 – 0.43 USD

Green PRZ Zone: If the 0.618 Fibonacci level is lost, the price might drop to this zone, which includes daily resistance and the middle line of the channel.

⚙️ RSI Indicator:

RSI Support: The trendline connecting the RSI lows can serve as support during a price correction. The range (33.88 – 39.26) is key for RSI support.

Entry into Overbought Zone: RSI movement towards the overbought zone can push the price toward higher targets. Overextended zones (86.33 – 92.15) are accessible.

RSI Middle Line: This line could act as support and help stabilize the uptrend.

⚡️ Key Points:

Red Resistance Zone (0.8 – 0.99 USD): Sustaining above this zone is crucial for the continuation of the uptrend.

Formation of Strong Bullish Candles and Significant Volume: Strong bullish candlestick formations and a sharp increase in volume can confirm the breakout of this resistance.

Volume Consideration: High volume entry during the breakout of the resistance zone is a positive signal.

Price Behavior at the 0.5 Fibonacci Level: This level serves as the primary initial support.

PRZ Support Zone: In case of a correction, this zone (overlapping with daily resistance and the middle line of the channel) could prevent further price declines.

🔔 Summary:

The technical analysis of SAND indicates that after breaking out of the descending channel, the price is at a critical stage. A breakout above the red resistance zone (0.8 – 0.99 USD) could open the path for higher targets. However, traders should pay close attention to price behavior around key support and resistance zones and should not neglect risk management.

🟠 Practical Suggestions:

For Entering a Trade: Wait for a breakout of the red resistance zone along with high volume.

Risk Management: Diversify your capital into multiple parts and set stop-loss orders below key support levels.

Stay Updated: Given the constantly changing market conditions, staying updated with new analyses is essential.

⏰ Stay tuned for the next updates!

SAND tends to finish wave c before going up.As I can see right now, SAND is going down, forming the five waves of wave (c). If we count the waves, we will be in the third wave of wave c. If this is right, then we want wave 4 and 5 which will be ended around 0.59. Then it will be completed the correction wave to be ready for going UP!

The Sandbox ($SAND): Leading the GameFi and Metaverse RevivalThe GameFi and Metaverse sectors are roaring back, with The Sandbox ( NYSE:SAND ) at the forefront of this resurgence. After a prolonged downtrend, NYSE:SAND has staged a remarkable comeback, surging 292% in just over two weeks. Starting from $0.20, it touched nearly $1 before consolidating around $0.75, currently down 3%. This rally has reignited interest in GameFi projects, positioning NYSE:SAND as a key player alongside Decentraland (MANA), Gala (GALA), and Axie Infinity (AXS), which have also seen significant gains.

Fundamental Catalysts

Several factors underscore NYSE:SAND ’s impressive performance. On-chain data reveals a surge in daily transactions, reaching 11,597—the highest in the past week. This spike indicates growing investor confidence and heightened network activity. Additionally, the rise in exchange withdrawals suggests that long-term holders are moving their tokens off exchanges, signaling a bullish sentiment and reduced sell pressure.

The Sandbox ecosystem has also benefited from renewed interest in the Metaverse and GameFi sectors, as projects with tangible utility and strong communities attract capital during this market phase. This broader revival aligns with the resurgence of decentralized applications and virtual worlds, where NYSE:SAND remains a prominent utility token.

Technical Outlook

From a technical standpoint, NYSE:SAND has broken out of a long-term falling wedge pattern—typically a bullish reversal signal. This pattern had previously led to a 75% decline, but the recent 292% surge marks a significant recovery. The breakout has set the stage for potential further gains, with the next target at $1.40. However, caution is warranted as the Relative Strength Index (RSI) is currently in overbought territory.

A retracement to the 38.2% Fibonacci level could provide a strategic entry point for investors looking to capitalize on the next rally. This correction would be healthy, allowing NYSE:SAND to build a stronger foundation for its upward trajectory.

Broader Market Dynamics

NYSE:SAND ’s performance is closely linked to the broader cryptocurrency market, particularly Bitcoin ( CRYPTOCAP:BTC ). As CRYPTOCAP:BTC eyes the $100,000 milestone, altcoins like NYSE:SAND often mirror its movements. A sustained Bitcoin rally could propel NYSE:SAND toward its $1.20 target and beyond, especially as the GameFi narrative gains traction.

The recent surge in Metaverse-related tokens reflects a growing consensus that virtual worlds and decentralized gaming will play a crucial role in the next phase of blockchain adoption. The Sandbox’s strong fundamentals, combined with its active development and partnerships, position it well to benefit from this trend.

Investor Takeaway

The Sandbox’s rally is more than just a technical bounce; it represents a fundamental resurgence in the GameFi and Metaverse sectors. Investors should monitor key support and resistance levels, stay attuned to Bitcoin’s movements, and watch for signs of continued on-chain strength. NYSE:SAND ’s journey from $0.20 to nearly $1 is a testament to its potential, and the path to $1.40 and beyond could be within reach if the current momentum holds.

#SAND/USDT#SAND

The price is moving in a bearish channel on the 12-hour frame, and it adheres to it well, and the price rebounded from the green zone

After rebounding from a significant decline, it is expected that the downward gap will be filled

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is expected to break higher to support the rise

Entry price is 0.4430

The first target is 0.5300

The second target is 0.6094

The third goal is 0.7113

#SAND/USDT#SAND

The price is moving within a bearish channel on a 4-hour frame and is strongly committed to it.

We have a support area at 0.4200 and we bounced from it at the lower border of the channel

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum

Entry price is 0.4350

The first target is 0.4650

The second target is 0.4802

The third target is 0.4950

SANDUSD heading towards the double bottom neckline/channel toptl It appears the gaming/metaverse cryptos have been awakened as they all appear to be getting a nice pump today while the rest of the market appears to be consolidating. Sand has a channel (in dark bluish purple) and a double bottom currently in play. The breakout targets for both are roughly in the same price zone. *not financial advice*