SANDUSDT Breaks Major Downtrend – Golden Pocket Retest!

Technical Analysis:

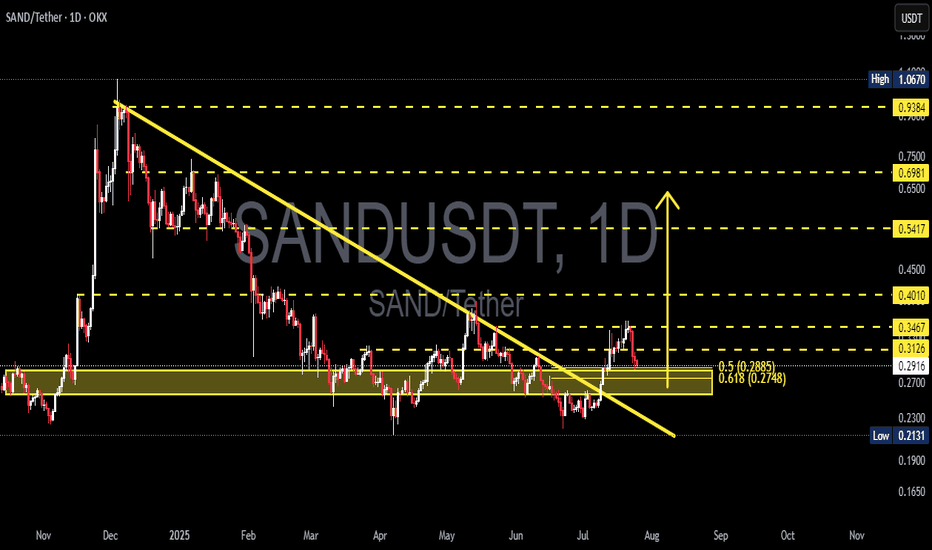

SAND/USDT has successfully broken out of a descending trendline that had been capping the price since late 2024. The breakout occurred with increased volume, signaling strong buyer interest.

Following the breakout, price rallied and is now retesting a key support zone, which includes:

A demand zone (yellow box) between 0.2748 - 0.2885, aligning with the Fibonacci Golden Pocket (0.618 - 0.5)

A solid horizontal support around 0.2913

Fibonacci retracement levels are clearly defined:

0.3126

0.3467

0.4010

0.5417

Up to major resistance near 0.9384

---

Bullish Scenario 🟢:

If the price holds above the Golden Pocket zone and prints bullish confirmation (such as a bullish engulfing or hammer candlestick), then further upside potential is likely:

1. Initial targets: 0.3126 and 0.3467

2. Mid-range targets: 0.4010 and 0.5417

3. Long-term potential: 0.6981 and possibly the major resistance at 0.9384

Stronger confirmation would come from a daily candle closing above 0.3126.

---

Bearish Scenario 🔴:

If price breaks below the 0.2748 zone, it could indicate a failed breakout, potentially leading to:

1. Initial support: 0.2700

2. Deeper pullback zone: 0.2131 (previous low)

3. Potential fakeout of the trendline breakout

A daily close below 0.2748 would strongly validate the bearish setup.

---

Chart Pattern Overview:

Descending Triangle Breakout already confirmed

Price is now in the retest phase of the breakout

The Golden Pocket Fibonacci zone is the crucial point of trend continuation or reversal

---

Conclusion:

The breakout from the long-standing downtrend marks a strong shift in structure. However, a successful retest at the Golden Pocket will be key to confirming further bullish continuation. If buyers defend this zone, SAND is likely to print a higher low and resume its upward move.

#SANDUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #FibonacciLevels #TrendlineBreakout #GoldenPocket #BullishSetup #BearishSetup

Sandusdtsignal

SAND/USDT at Critical Support Zone – Rebound Potential?Detailed Technical Analysis:

The SAND/USDT weekly chart shows the price currently hovering around a historically strong support zone between $0.20 – $0.25. This yellow-marked demand area has been tested multiple times since 2021 and has consistently prevented further downside, making it a crucial decision point for both bulls and bears.

🟢 Bullish Scenario:

If the price manages to hold this key support and prints bullish price action (e.g., a bullish engulfing or hammer candlestick), a reversal is likely. The projected upward path on the chart outlines the next key resistance levels:

1. $0.3710 – Initial resistance.

2. $0.4500 – First major breakout confirmation.

3. $0.5825 - $0.7000 – Mid-term resistance cluster.

4. $0.8218 - $1.3530 – Longer-term targets if bullish momentum sustains.

Bullish Confirmation:

Weekly candle close above $0.37

Breakout with strong volume beyond $0.45

🔴 Bearish Scenario:

If the price breaks below and closes under the $0.20 support zone, it would signal a bearish continuation, with possible downside targets at:

1. $0.14 – Minor historical support.

2. $0.09 - $0.075 – Extreme low support region and historical bottom.

Bearish Confirmation:

Weekly close below $0.20

Strong breakdown volume without immediate bullish rejection

📊 Chart Pattern Overview:

✅ Triple Bottom / Accumulation Zone:

The current support area resembles a potential triple bottom structure or long-term accumulation phase. If confirmed, this pattern could mark the beginning of a new bullish cycle.

🧠 Conclusion:

SAND is at a make-or-break level. As long as the price holds above the $0.20 - $0.25 support zone, bullish recovery remains a valid possibility. However, a breakdown below this level could trigger a significant bearish move.

#SANDUSDT #CryptoAnalysis #AltcoinSeason #TechnicalAnalysis #BullishScenario #BearishScenario #CryptoTrading #PriceAction #SupportResistance #TripleBottom

sand idea"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SAND/USDT Technical Analysis - Potential Bullish OpportunitySAND/USDT has exhibited a notable XABCD harmonic pattern formation, coinciding with a pivotal support level. This suggests a potential bullish reversal from point D, indicating favorable trading opportunities for discerning investors.

Harmonic Pattern Analysis:

The XABCD harmonic pattern observed in SAND/USDT signals a systematic price structure characterized by precise Fibonacci relationships. The completion of this pattern at point D suggests a high probability of trend reversal, presenting an optimal entry point for bullish positions.

Key Support Area:

The convergence of the XABCD pattern with a key support area strengthens the bullish bias, reinforcing the significance of the anticipated price movement. This confluence enhances the reliability of our analysis and underscores the importance of the identified entry level.

Entry Strategy:

We recommend initiating long positions near the price level of 0.5053, strategically aligning with the completion of the harmonic pattern and the established support region. This entry point offers favorable risk-reward dynamics and positions traders advantageously for potential upside movements.

Risk Management:

To mitigate downside risks, it is prudent to implement a stop-loss order near 0.3532. This predefined exit point safeguards capital and preserves trading discipline, ensuring minimal losses in the event of adverse price fluctuations.

Profit Targets:

Our profit-taking strategy encompasses two distinct targets to capitalize on the anticipated bullish momentum. The initial profit target (TP-1) is set at 0.6584, representing a conservative approach to securing gains. Subsequently, the secondary profit target (TP-2) is identified at 0.8115, offering the potential for extended profitability as the uptrend unfolds.

Conclusion:

In conclusion, the technical analysis of SAND/USDT reveals a compelling bullish outlook, characterized by the formation of a XABCD harmonic pattern and the confluence with a key support area. By adhering to the suggested entry, stop-loss, and profit-taking levels, traders can optimize their trading strategy and capitalize on the anticipated price appreciation.

Disclaimer:

This analysis is based solely on technical indicators and historical price data. It is imperative to conduct thorough risk assessments and exercise prudent risk management practices when executing trades in the financial markets.*

SAND/USD - Bullish Potential Identified at Key Support ZoneKey Support Area Analysis:

SAND/USD is currently positioned at a critical support level, historically significant as a former resistance zone. This level also coincides with the 4-hour trendline, reinforcing its importance in our analysis.

Bullish Outlook:

Considering the convergence of support factors, our analysis suggests a bullish bias for SAND/USD from this juncture.

Trade Recommendations:

Entry Point:

We recommend taking entry near 0.59085, aligning with the support zone and anticipating the initiation of a bullish move.

Stop Loss:

To mitigate potential downside risk, it is prudent to set a Stop Loss near 0.5350, strategically placed below the support level.

Take Profit Targets:

We propose the following Take Profit levels:

- TP-1: 0.6487

- TP-2: 0.7038

- TP-3: 0.7600

These targets are derived from technical analysis and represent potential areas of resistance where profit-taking could be considered.

Risk Management:

It is essential to adhere to sound risk management principles, including proper position sizing and adherence to the predetermined Stop Loss level.

Conclusion:

In conclusion, the technical analysis suggests a favorable risk-reward opportunity for a bullish move in SAND/USD, with clear entry, exit, and risk management parameters outlined. Traders should monitor price action closely and adjust their positions accordingly as the market evolves.

SAND/USDT Shows a bouncing from the support, Back to upward ??💎 Paradisers, #SAND has recently exhibited notable market dynamics, demonstrating resilience with a bounce from the support area.

💎 The historical pattern suggests that when SAND reaches this level, it tends to bounce, indicating strong support. If SAND also manages to break out of the bullish pennant pattern, it could signal a continuation of the upward movement toward the strong resistance area.

💎 However, if SAND breaks below the support area, it could signify a bearish momentum, potentially leading to further downward movement towards the next support level at $0.464.

💎 It's crucial for SAND to bounce from the support area and reclaim the price above this level to maintain its upward trajectory. Failure to do so could result in continued downward movement.

MyCryptoParadise

iFeel the success🌴