btc next movebyond analysises this is what btc in my humble opinion will do in the next 6 years replicating the price patterne and going to a new all times high its not an investing idea its just my opinion and my vission about what might happen this is the future

disclamer The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

Satoshisvision

BSV - Get Ready for VolatilityBSV was extremely volatile between 2019 - 2021. But starting in June of 2021 until today, volume and volatility really dwindled throughout the bear market. However over the past 6-8 months, volume has picked up and the price is slowly breaking out of an 18month falling wedge. Cue volatility!

One piece of news that you cannot see in this chart is that Robinhood delisted BSV in mid-January and its BSVBTC pairing tumbled 40%. A bit of an overreaction in my opinion and as a result, BSV's USD gains have been minimal in comparison to other alts in the market. However, I think the shock of the BSVBTC dip is starting to wear off and I could see it regaining lost ground against BTC rather quickly, returning it to previous early January BTC levels and beyond. That would be close to a 50% gain and possibly more if BSV pumps like it has in the past. There's a bullish cross on the daily MACD as it hits the zero-line. I think BSV has entered bullish territory for the moment. As a result, I am long here in the hopes of at least a quick scalp as its recovers against BTC with the possibility of a huge return if it pumps. Let's wait and see.

Bitcoin Fibonacci Golden SectionThe upper part of the Fibonacci golden section line of Bitcoin is the future position, and the lower part is all the bottoms. At present, it is the bottom of the stage. The lower part belongs to the standby bottom. You can zoom in the icon to see the detailed price. The bottom is not the key point, but the future is 100% sure that Bitcoin will reach the upper hundreds of thousands of prices, and we will wait and see. I am Nakamoto Cong

Strong Rejection on BCH/USD At $280 - What Is Next?In this technical analysis I will show you the most important horizontal zones for BCH at the moment. After the very sharp decline that started about two hours ago I want to highlight a few scenarios. All information should be clear from the chart. In case you have any questions, feel free to let me know!

BSV flippening of BCH soon?!Usually we see the BSV/BTC pair 'pump and dump'ing. - But we are witnessing a retest of a falling wedge right now. - It might be the beginning of an (long term) uptrend here. - Considering the positive news that Binance (better said: Users that use Binances mining pool) began to mine BSV quiet extensively. (~13% of all BSV hash rate as of today).

With Binances hash rate, BSV began to surpass BCH in the total amount hash rate.

There are 2 variables left for me to really flip BCH in today's metrics. - Amount of mining nodes and block length (BCH is only 220 Blocks ahead.)

Which means BSV is undervalued and a long position could be considered here.

LONG - BSV - Trading OpportunityFTX:BSVPERP has yet to make a move, even with BTC's pump along with all the other perpetual contracts along with it. This MA50 seems like the perfect opportunity to get in before the ride.

Entry: 193.52

Target 1: 210

Target 2: 220

SL: 184.59

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgment sums (including interest thereon).

LONG - BSV - Trading OpportunityHoping this bullish divergence breaks us out from this downtrend line, and after hopefully a quick pump back to previous highs.

Entry: 278

Target 1: 309

Target 2: 318

SL: 271.49

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgment sums (including interest thereon).

SHORT - BSV - Trading OpportunityBearish divergence on FTX:BSVPERP , awaiting some confirmation before going in.

Entry: 324

Target 1: 283

Target 2: 256

SL: 344

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).

$BCHSV / USD Nailed the Golden Pocket! Could we see median hit?$BCHSV hit the Golden Pocket (fibs btw 0.65 and 0.68 retracement) with great precision! Is the a conscience? Or could we see a big move to the upside? Place your bets now traders! I would put a stop loss at ~$120.00. For a more brave trader, or with smaller positions, $115 or $100 might look like a better stop area. With this coin not being as liquid as others, it might prove easier to get stopped prematurely. Trade smart, good luck!

Don't get in a pickle!

Yo boy,

Pic

BSV - THE NEXT TARGETSHey Everyone,

After BSV successfully reached all of my previous targets, I have been waiting for the dust to settle before updating you all again.

Right now BSV is in a period of consolidation, and it is possible to trend sideways within the squiggles I have drawn, BUT this may not happen either, as we all know well that BSV is the Crypto Honey Badger and may just decide to reach for upper targets without much of a correction, and right now is holding strong against BTC being one of the only coins to be in the green today, at the time of writing this BSV has a 3.51% gain compared to BTC 2.41% Loss.

Right now I see BSV heading to retest the high before a minor correction and then should attempt TARGET 7 before a possible deeper correction within the squiggles. Corrections are needed and just add fuel to reaching upper targets. I do not recommend shorting BSV as the movements are never clearly defined. And often due to the support of the BSV community all dips are bought as quickly as they happen.

My other recommendation if you are margin trading do not over margin and only use low leverage due to the flash crash we saw on our last high. Whales are watching and will be only too eager to steal your hard earned profits. BSV is probably one of the only coins that you can leverage, that I would recommend NOT leveraging at all.

REMEMBER IF YOU ARE PRACTICING SAFE... TRADING ALWAYS USE PROTECTION

(minimize your risk, use a stop loss. Especially in Margin Trades) ALWAYS!!!!!!!!!!!!!!!!!!!

<3 Lisa

DISCLAIMER:

The Legal stuff - I'm not financial adviser. Just a few quick thoughts - remember you sit at your computer, you push the buttons...

PS make sure you give me a like, that way you get updates as I post them.... :) <3

BITCOIN CASH (SV) - BUY BUY BUY!I am back again with another market analysis. If you have no idea where I have popped up from that is ok, check out my blog which will give you a little insight into my trading journey.

LITTLE BIG MOVEMENT LATEST BLOG POST

Time for what you came for :-)

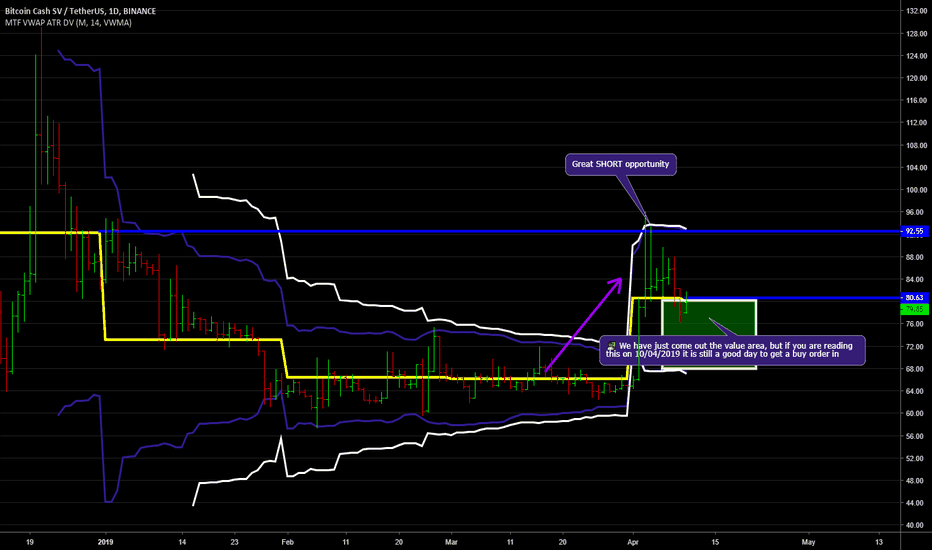

BCH/USD - Ok! before you state that I have the wrong Bitcoin Cash, I don't doubt there are debates between ABC and SV. I think that SV is true to the Bitcoin whitepaper which means in my personal opinion SV is Bitcoin Cash. Plus there is more opportunity to buy at the right value (VWAP) with BCH SV. As of writing, we are right on the VWAP level at $80.00 , and before today we had entered into the value area (GREEN BOX). There is an exciting opportunity to buy BCH SV for cheap, and I would hold this buy order for at least a 15% rise in price to $92.00. I do not doubt this current bullish trend we will break the $92.00 price, but you will need to remember that BCH ABC & SV are correlated with the FAT overpriced older brother BTC. Once BTC starts moving again, both ABC and SV will begin to rise.

"Stay away from buying BTC, my fellow readers and traders. When you look at the underlying technology BCH ABC and SV do what BTC can do, and they are valued at a much lower price. YOU HAVE BEEN WARNED" - Nathaniel

Next update will be in the coming week - Thank you for your love and support.

To make my life easier I have built a custom pine script indicator, which gives me an indication of where the value price is based on the criteria I used for my market analysis. Watch this space :-), but I think it is publicly available already, so be my guest and use or enhance the indicator. Just let me know if you make any improvements as it could help me as well.

Regards

Nathaniel - "THe BiPolar TraDer"

Little Big Movement

Craig Wright's Asic Mining Company is Blowing Up, CEO resigned, There's a lot of weird details behind this Squire mining company. They are currently in talks with coingeek to buy/merge their mining farm of 1000TH into the company. apparently this is already up and running under the coingeek umbrella.

but there's also been another side company of squire that was claiming to have the most efficient bitcoin mining prototype on the market (claiming to be about 25% more efficient/powerful then the competition).

coingeek was supposed to be the one to market/promote these miners and sell them to customers.

but that all seems to be up in the air now since apparently, the miners, no surprisingly, are not up to spec.

as a consequence, the stock price for squire mining is now in the dumps down 25% on the day to 0.19 cents CANADIAN. It reached a high of 82 cents back in September...

And the CEO just resigned. the second CEO to resign in less then a year...

www.reddit.com

Satoshi's Vision and the Bitcoin Cash 0.045 targetit all hinges on volume and fundamental events.... if coinbase unlocks their user base BSV and opens a market - - - all analysis here is out the window, because it can moon or collapse

BSV remains in a bullish cycle until the trend breaks