Microstrategy: Renewed Upside MicroStrategy has continued to face downward pressure recently but is now showing more decisive signs of an upward move. We still see greater upside potential in the current magenta wave , though we expect the peak to form below resistance at $671.32. Afterward, the bearish wave should complete turquoise wave 2—while still holding above support at $153.49. Wave 3 should then usher in a longer upward phase, with momentum likely to ease only well above the $671.32 level. At the same time, there remains a 33% probability that the stock has already entered this upward phase. In that scenario, turquoise wave alt. 2 would already be complete, and the price would move directly above $671.32 as part of wave alt. 3.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Saylor

The Bitcoin Manipulation Trick - How They Lure You Into the Trap📉 Bitcoin spends more time in deep drawdowns than at its peaks. Historically, BTC has spent over 80% of its existence trading 80-90% below its all-time highs, yet people keep falling for the illusion of wealth.

🧐 Here’s how the cycle works:

1️⃣ They drive up the price to make it enticing for new buyers.

2️⃣ You FOMO in at the highs, believing in the "next big wave."

3️⃣ Then they crash it, wiping out weak holders.

4️⃣ They keep it suppressed for years, forcing everyone out, via margin calls, financial strain, or sheer exhaustion.

5️⃣ When enough have capitulated, they restart the cycle.

📊 Historical Evidence:

- 2013 Crash: Over 400 days down 80%+ before recovery.

- 2017 Crash: Nearly 3 years below 80% of ATH.

- 2021 Drop: More than a year stuck 75% below peak.

🔎 If you’re buying now, be ready to:

⛔ Lose access to your money

⛔ Keep covering margins

⛔ Wait years for recovery, if it ever happens …

They play the same trick, every time. If you don’t recognize it, you’re just another part of the cycle. 🚀🔥

INDEX:BTCUSD NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:GOLD TVC:SILVER NASDAQ:MSTR TVC:DXY NASDAQ:HOOD NYSE:CRCL

Could Microstrategy be a 1 Trillion dollar mcap company?!Microstrategy and Michael Saylor evoke a spectrum of opinions, with analysts offering a diverse range of potential future valuations.

High risk, high reward!

The destiny of Microstrategy’s market capitalization is clearly linked to Bitcoin’s performance. The company has been utilizing debt to acquire the cryptocurrency, aiming to create significant spreads. This leverage is the reason why the stock has significantly outperformed Bitcoin throughout 2024.

I am confident that Bitcoin can indeed reach $200k, with a potential upper price target of $250K for this cycle, indicating a potentially explosive Q3 and Q4.

The lingering question is how much additional FOMO and premium Saylor can cultivate for his leveraged vehicle in such an environment?

That's why charting is such a key component to any personal investing strategy IMHO, as we navigate these markets.

Bitcoin’s Decentralization Is a Fairy TaleBitcoin was born as a revolutionary, decentralized currency, promising financial freedom and independence from traditional banking systems. Yet, as we analyze its real-world distribution, it becomes clear that Bitcoin’s decentralization is more myth than reality.

🔍 The Illusion of Decentralization

Bitcoin operates on a decentralized blockchain, meaning no single entity controls the network. However, when we examine who actually owns Bitcoin, we see a highly concentrated wealth structure that mirrors traditional financial inequality.

📊 Bitcoin’s Wealth Concentration

The top 0.01% of Bitcoin wallets control over 37% of total supply.

The top 1% of Bitcoin holders control over 40% of Bitcoin.

The top 2% of Bitcoin wallets control over 95% of total supply.

The bottom 98% of wallets hold less than 5% of Bitcoin.

The bottom 50% of wallets hold less than 0.03% of Bitcoin.

10,000 Bitcoin investors own 5 million BTC, worth $230 billion.

Institutional investors and early adopters dominate Bitcoin ownership.

This means that a tiny fraction of wallets dominate the entire market, while millions of small holders own completely insignificant amounts.

💰 Bitcoin vs Traditional Wealth Inequality

Bitcoin was supposed to be more equitable than traditional finance, but its wealth distribution is even more extreme than global financial inequality.

Bitcoin’s wealth gap is far worse than traditional financial inequality, proving that decentralization does not mean fair distribution.

📉 How Did Bitcoin Become So Centralized?

1. Early Adopters Accumulated Massive Holdings

Bitcoin’s first miners and tech-savvy investors acquired BTC when it was nearly worthless.

Many of these wallets still hold huge amounts, making redistribution difficult.

2. Institutional Investors Took Over

Hedge funds, exchanges, and corporations now control a massive portion of BTC.

Bitcoin ETFs and custodial wallets concentrate ownership even further.

3. Lost & Dormant Bitcoin Shrinks Circulating Supply

An estimated 29% of Bitcoin is lost or inactive, meaning fewer coins are available.

This makes the remaining BTC even more concentrated among active holders.

🚨 The Harsh Reality: Bitcoin Is Not Financial Freedom

Bitcoin was supposed to empower individuals, but in practice, it has become a playground for the wealthy.

Decentralization in theory ≠ decentralization in reality.

Institutional investors and exchanges hold a massive portion of BTC.

Bitcoin’s fixed supply (21 million BTC) makes redistribution nearly impossible.

Bitcoin is not the democratized financial system it was promised to be—it’s just another asset class where the rich get richer.

NASDAQ:MSTR NYSE:CRCL NASDAQ:COIN TVC:GOLD TVC:SILVER INDEX:BTCUSD NASDAQ:TSLA TVC:DXY NASDAQ:HOOD NASDAQ:MARA

BTCETH parabolic run pointing towards 100:1Historically, during bull markets, Ethereum frequently surpassed Bitcoin at various moments.

However, this time around, that trend has not materialised, leading to a decline in investor confidence.

With capital exiting the ETH market, sentiment has soured, and critical indicators are revealing significant losses.

Unless a robust bullish turnaround occurs, Ethereum's struggle may persist, as the market currently favors Bitcoin as the more secure option.

However once this parabola breaks, we could see a strong snap back reaction in favour of the more riskier #ALTS, #DEFI and #MEMES as #ETH is still the home for stablecoin issuance and still the most trusted secure smart contract blockchain available.

2️⃣ Who's Next? Or: Operation: "Saving Private Saylor2️⃣ Who's Next? Or: Operation: "Saving Private Saylor"

❗️ Disclaimer: This idea is only a part of an article with a forecast for Bitcoin and the cryptocurrency market for 2025-2028. To fully and completely understand what is being discussed here, please refer to the root idea via the link:

1️⃣ Main Idea: Analysis of US Treasury Documents

📰 Forbes: Your Cover – Our Margin Call. Saylor, Get Ready!

You've heard it, haven't you? Those stories about Forbes covers and the subsequent fall of crypto empires? It's no longer a superstition; it's, damn it, statistics:

Changpeng Zhao (CZ), Forbes, February 2018: "Binance's Crypto King!" – the headlines screamed. And what then? He served four months in prison. Well, not immediately, of course, but the "seed" of the curse was sown.

Sam Bankman-Fried (SBF), Forbes, October 2021: "The New Warren Buffett of Crypto!" – the fanfares shrieked. And what was the result? He's sitting pretty now, enjoying prison romance.

And now, our incomparable Michael Saylor enters the stage! Forbes puts him on the cover in January 2025 "Michael Saylor: The Bitcoin Alchemist"!

Why a Forbes cover is not glory but a warning for Michael Saylor (and a signal for the US government): This is not just a coincidence; it's a systemic pattern. Forbes, whether out of naivety or, conversely, subtle calculation, acts as an unwitting harbinger. They choose those who are at the peak of hype, those who have "believed in themselves" and are ready to tell the whole world about their "brilliant" strategy. And the peak of hype, as we know, is the beginning of a fall. And this is where it gets interesting. The US government, which carefully reads such magazines (after all, they write about "financial stability" and "national interests" there), sees Michael Saylor on the cover and thinks: 💭 "Well, well, this guy has accumulated half a million Bitcoins. And he's currently at the peak of self-admiration. Excellent! Get ready for 'Operation: Coercion to Stability'!"

❌ Why this cover for Saylor is not just a photoshoot, but a "liquidation marker" for the US government:

"The Forbes Curse" as a "Market Overheat" Indicator: For our financial strategists from the Treasury and the Fed, Saylor's appearance on the cover is not just a signal of "overheating"; it's a green light for activating the "Crypto-Reserve" plan. They see: "Oh, this guy got too relaxed. He has too much 'digital gold' at an average price of $74,000. And we love to buy at a discount, especially if the discount can be 'arranged'!"

Recession and Crash as "Natural Selection": Remember that TBAC in its documents constantly reminds us of Bitcoin's "volatility" and the "necessity of hedging." The perfect storm for Saylor is an "unexpected" recession in the US and a sharp stock market crash. At this moment, Bitcoin, which has always historically behaved as a "high-beta" asset (DA&TM, p. 5), will fall even faster. When BTC is in the range of $30,000 - $40,000, this will not just be a "loss" for Micro Strategy – it will be absolute financial hell for their leveraged positions, which they so "cleverly" accumulated.

Margin Calls: Music to Regulators' Ears: Saylor's average purchase price of $74,000, and Bitcoin has fallen to $30-40k? This is not just "oh, we're in the red" . These are massive margin calls and the threat of liquidation of MarginCallStrategy MicroStrategy's positions, which mortgaged its shares and Bitcoin itself to buy even more Bitcoin. The banks holding them as collateral (and which are, of course, "friendly" with the Fed) will start to get nervous. And then, as if by magic, the "saving hand" of the government will appear.

"Humanitarian Aid" (at a Bitcoin price of $30-40k.): They won't come waving checkbooks to buy Bitcoin for $100,000. They will come when Saylor is on the verge of collapse, and they will say: 💬 "Michael, we see your pain. To avoid 'systemic risk' and 'protect investors' (who are in your fund because you bought so much Bitcoin), we are ready to 'help'. We will 'acquire' your Bitcoin at a 'fair' price (which, of course, will be significantly lower than Saylor's purchase price) to 'stabilize' the situation. Naturally, this is not a purchase, but 'crisis prevention'."

Bitcoin in the "Crypto-Reserve": Mission Accomplished! Thus, the government, without directly buying a "speculative asset," will receive half a million BTC at a "bargain" price, using market crashes and financial pressure. And then they will be able to proudly declare: "We have 'digital gold' that will protect our financial system from external shocks. And yes, it is now in our hands, not some 'Alchemist's'."

✖️ The Forbes Curse: When a Magazine Becomes a Catapult for Crypto-Kings

The cover of Forbes magazine is not just paper and ink; it's the financial equivalent of an "X" on your back, appearing exactly when "Big Brother" decides you've gotten too big for your "digital gold" britches. Let's recall the chronicles of this "curse" to understand what awaits our Michael Saylor:

1. CZ (Changpeng Zhao), Binance:

▫️ Forbes Cover: Feb. 2018. Headlines trumpeted "crypto-king."

▫️ BTC Price: $11,500. The entire crypto-brotherhood rejoiced, thinking the moon-run was endless.

▫️ What happened next: By the end of 2018, Bitcoin plummeted to $3,000. A -73% drop. And Changpeng, after several years of legal battles, eventually ended up behind bars for 4 months.

2. SBF (Sam Bankman-Fried), FTX:

▫️ Forbes Cover: Oct. 2021. "The Billionaire Saving the Crypto World!" indeed.

▫️ BTC Price at the time: Around $60,000. The market was at its peak; everyone was talking about $100k, "diamond hands," and a "new financial era."

▫️ What happened next: A year later, by the end of 2022, Bitcoin was already around $16,000. A -75% drop. And Sam? Sam is enjoying government cuisine and the company of cellmates, sentenced to 25 years (but according to recent data, the term may be reduced by 4 years).

3. Michael Saylor, Micro Strategy:

▫️ Forbes Cover: Jan. 2025. Our "Alchemist" Michael, with brilliance and faith in his eyes, has concocted somewhere around half a million bitcoins and has finally received this "honor."

▫️ BTC Price: As of today, around $100k. Imagine the hype! Saylor tells everyone that "we've only just begun," that Bitcoin is "financial sovereignty" and "the future of humanity," whose price is about to fly to $500k without you! Buy now, don't miss out!

▫️ What will happen next (according to the "Big Brother" scenario): If history is not just a collection of boring dates, but a cyclical performance with notes of tragicomedy, then the following awaits us. A year after the Forbes cover, by early 2026, the price of Bitcoin in this scenario could plummet by -70% from its ATH. This means Bitcoin would be in the range of $30-40k. dollars. And what about Michael? I don't want to jinx it, but if CZ served four months, Sam will likely serve 4 years, then how long will our BTC-prophet and "crypto-Moses" get? Forty?

In conclusion: The Forbes curse is not magic; it's a harbinger of a systemic blow. So, when you see another crypto-hero on the cover of Forbes, don't rush to rejoice for him. Most likely, it's the last call before the "system" begins its complex, multi-step plan for "coercion to cooperation."

So, let's dream. No, not about flights to Mars, but about much more down-to-earth, but far more probable scenarios, where Washington finally gets its hands on "digital gold." After all, as stated in DA&TM, Bitcoin is "a store of value, aka 'digital gold' in the decentralized world of DeFi" . Well, since it's "gold," it should be in our "gold reserve," right? But to buy it directly? Oh no, that's a "speculative asset," it's "volatile" ! But "acquiring" it at a discount – that's a whole different song.

📝 The "Digital Couping" Scenario (or how to take Bitcoin without buying it on the open market):

◻️ Phase 1: Deflation of the US Stock Market Bubble

▫️ "Recession? Stock market crash? Perfect time for 'healing'!" The government and banksters will always find a way to "help" the market. If the American economy, as many are whispering now, faces a serious recession, and the stock market tumbles, then Bitcoin, as a "high-beta" asset, may well follow suit. Remember how Bitcoin reacted to "crashes" in 2017, 2021, 2022 (DA&TM, p. 5, chart). If Michael Saylor's average purchase price is $74,000 today, then a drop into the $30,000 - $50,000 range is not just a "correction"; it will be an absolute financial hell for his margin positions, which he so "cleverly" accumulated.

▫️ Margin-call for Micro Strategy. Michael Saylor didn't just buy Bitcoin; he bought it with borrowed funds, collateralizing his shares and even Bitcoin itself. In the event of a deep market downturn and, consequently, a fall in BTC's price, Micro Strategy will face serious problems servicing its debt and maintaining collateral. The banks that issued them loans (and these are, most likely, banks very "friendly" to the government) will start to get nervous. And then the most interesting part will begin.

◻️ Phase 2: "Operation: Buyout"

▫️ "An offer you can't refuse." When Micro Strategy is on the verge of default or bankruptcy due to its Bitcoin positions, "saviors" will appear on the scene – perhaps some specially created "Digital Asset Stability Fund" or even directly "government-friendly" large financial institutions that have received a "green light" and, possibly, even funding from the Fed (naturally "to ensure financial stability").

▫️ "We are not buying; we are 'stabilizing'!" They won't say: "We are buying Bitcoin." They will say: 💬 "We are preventing systemic risk! We are providing liquidity to the market during a crisis, buying back their 'high-beta' asset at a 'fair' price (which, of course, will be significantly lower than Saylor's purchase price)." And this is where the "digital gold" narrative, which has already permeated even official documents (DA&TM, p. 2), will come into play. "It's gold, and gold should be in the state reserve, shouldn't it? "

◻️ Phase 3: Nationalization of 'Digital Gold' and control over the narrative

▫️ "Congratulations, Michael, you've become a 'pioneer'!" After most of Saylor's Bitcoins are "saved," they will end up in the hands of, say, a "special depository" or a "strategic digital asset reserve." At the same time, the government will not "own" them in the traditional sense, but will "manage" them for "national interests."

▫️ "Now we have 'digital gold,' and it will work for us!" With this significant reserve of Bitcoins (576k "taken" from Saylor + 200k "confiscated" Bitcoins earlier – that's no joke), the US government suddenly becomes the largest sovereign holder of an asset that they will now officially recognize as "digital gold." This will allow them to:

▫️ Influence the market: If necessary, they will be able to use this "crypto-reserve" to "stabilize" prices, intervening in the market (for example, by selling small portions to curb too much growth, or conversely, by buying if the market falls sharply, but through their affiliated structures).

▫️ Legitimize "digital gold": If the US government has a Bitcoin reserve, then it's no longer "speculative nonsense," but part of the official financial system. This will open doors for broader institutional adoption, but on their terms.

▫️ Pump capitalization through stablecoins for national debt: A crucial strategic step will be to use this new "digital gold standard" to address the growing national debt. By aggressively legitimizing Bitcoin as "digital gold" and creating controlled mechanisms for its storage and trading (e.g., through regulated ETFs and tokenized assets), the US government will create a powerful incentive for capital inflow. In parallel, by strengthening regulation and encouraging the growth of fiat-backed stablecoins, collateralized by short-term US Treasury bonds (T-Bills), a colossal "cushion" of demand for US national debt will be created. The larger the capitalization of stablecoins, the greater the need for T-Bills to back them. The goal is to first build up a large BTC reserve, then, by boosting stablecoin capitalization, inflate the overall crypto market capitalization and the price of Bitcoin itself, to ultimately create a new powerful tool for "monetizing" or, at least, facilitating the servicing of US national debt. This will look like a brilliant financial maneuver, turning "wild" cryptocurrency into a tool for strengthening US financial stability and national security.

◽️ A rescue that looks like a robbery. So the scenario is not that the US government will "pump" Bitcoin by buying it expensively; the scenario is that they will create conditions and wait for the market to "drown" the most ambitious hodlers, and then come to the rescue to "save" their assets. And this "help" will look like the acquisition of a strategic asset at a bargain price, using existing market pressure mechanisms and crisis phenomena. This is a classic "good cop, bad cop" game, where the "bad cop" is an "unexpected" market recession, and the "good cop" is the government that "saves" assets to then use them for its geopolitical and financial interests. And all this under the guise of "financial stability" and "national security," of course. After all, who better than the government can manage your "digital gold"? Of course, no one!

❗️ Disclaimer: This idea is only a part of an article with a forecast for Bitcoin and the cryptocurrency market for 2025-2028. To learn more, refer to the root idea via the link:

1️⃣ Main Idea: Analysis of US Treasury Documents

$BTC, Bitcoin update: what is going on?🚨 Bitcoin Update: We've just seen a decent correction on CRYPTOCAP:BTC followed by a strong pump.

I’ve warned about this already — this pump is not organic. It's largely driven by institutions and Michael Saylor, using leverage.

📉 A healthy price movement should look like a staircase: move up, consolidate, reset the daily MACD, then push higher again.

Each rally should be followed by a slight pullback — that’s how sustainable trends are built.

❌ But this natural cycle is being disrupted.

Saylor and ETFs keep buying the top to prevent corrections. Some laugh and call it incompetence, but I believe it’s strategic.

These players don’t care about making money on trades.

Their goal is to inflate the value of their companies (or stock value), which are now heavily tied to Bitcoin’s price.

That’s why they don’t want BTC to consolidate.

Every time there's weakness, they step in to buy, preventing any pullback and forcing the price through resistances and fair value gaps.

🤖 The problem? Bots — which represent +80%+ of the trading volume — are not wired this way.

They sell when BTC is overbought and buy when it's oversold.

But with institutions disrupting this cycle, exchanges end up selling BTC, and whales scoop it up — leading to lower supply on exchanges.

Exchanges then have to buy BTC back at higher prices, sometimes even at a loss — often by printing billions in Tether (USDT) to compensate.

🎈 This entire mechanism is inflating Bitcoin’s price, exactly what Bitcoin maximalists want.

But it also kills the chance for an altseason, which usually comes after Bitcoin tops out.

📊 So what’s next?

Ideally, we get a consolidation to around $91K to avoid a major bearish divergence.

If BTC breaks below $90K, we could see GETTEX:82K — but given current conditions, that’s unlikely.

On the chart, RSI is high on daioly, Williams indicator is turning bearish and MACD too. These are all signs of a most needed consolidation. But as I explained, this is cancelled at the moment.

💰 Can institutions push BTC to a new all-time high?

Yes — they basically have unlimited capital and the money printer will turn back on by September.

But once again, altseason is postponed.

#Bitcoin #BTC #CryptoMarkets #MichaelSaylor #ETF #BTCAnalysis #Altseason #CryptoPump #MarketManipulation #BTCUpdate #Tether #CryptoWhales #DailyMACD #TechnicalAnalysis #CryptoInsights #Web3

Strategy $MSTR hits resistance, what will it do?

NASDAQ:MSTR has rebounded from the bottom fairly fast compared to other stocks and indexes. It's even performed better than Bitcoin itself. It is up about 65% from the low we set a few months ago. However it should be hitting heavy resistance now near 395-400 and above is only heavier resistance. It's time for a pullback and a breather for MSTR. Target is the Point of Control near $350, before going higher. However we could turn bullish again before reaching $350.

I personally know someone who played with fire by buying NASDAQ:MSTR options calls while it was dropping before, meaning he was trying to catch a falling knife and got burnt finally. He lost nearly $500,000 because of it. So I don't mess with options personally, however I will margin trade with stocks and trade futures, forex and leverage trade cryptocurrencies.

Bitcoin Dominance Keeps Climbing Despite Bearish Divergence📉 Bitcoin Dominance Keeps Climbing Despite Bearish Divergence

🚨 Since January 29, 2025, a massive bearish divergence on Bitcoin dominance ( CRYPTOCAP:BTC.D ) has been forming... yet it never materialized!

🔍 Even worse—this divergence keeps growing, meaning CRYPTOCAP:BTC.D is overbought but still pushing higher, defying all technical indicators.

💡 The March 19, 2025 FOMC Pump:

Bitcoin jumped +6% from GETTEX:82K to $86K 📈

Altcoins barely moved—most stayed stable or had a minor push 📉

This was not an organic move—it was institutional & political manipulation

⚠️ The Consequences:

Altcoins are getting wrecked—again 😤

When Bitcoin corrects, altcoins will crash harder 🚨

Bitcoin maximalists (Saylor, politicians, whales) are pushing Bitcoin at the expense of the entire crypto industry

🎭 Reality Check:

Bitcoin maximalists don’t care about crypto—they care about their own bags 💰. Their goal? Kill altcoins & centralize wealth in Bitcoin.

⏳ Until the crypto industry wakes up to this war between Bitcoin maximalists & the rest of the market, nothing will change.

Another altseason cancelled, another liquidity funnel into Bitcoin to protect institutional & banking interests.

Hopefully this bearish divergeance will finally plays out and we will see this very welcome altseason. Until then, altcoins are struggling.

#Bitcoin #Crypto #Altcoins #BTC #BearishDivergence #CryptoManipulation #AltseasonCancelled #BTCMaximalists #CryptoNews #Saylor #InstitutionalManipulation

Bitcoin, Strategy, and Michael Saylor: A Crypto Comedy Special!Buckle up, folks, because we’re diving headfirst into the rollercoaster world of Bitcoin, corporate shenanigans, and one man’s unrelenting quest to convince everyone—Wall Street, the White House, even your grandma—that digital gold is the future. Yes, we’re talking about Michael Saylor, the captain of the good ship Strategy (formerly MicroStrategy, but we’ll get to that rebrand in a sec), and his high-stakes gamble that’s got everyone clutching their wallets and popcorn 🍿. Let’s go! 🚀

Act 1: Bitcoin Goes Brrr… Until It Doesn’t 📉

Picture this: Bitcoin’s price is tumbling faster than a Jenga tower at a frat party, and the stock market’s throwing a tantrum because someone whispered “recession” in the break room. Meanwhile, Strategy—the artist formerly known as MicroStrategy—is sitting on a mountain of Bitcoin like Smaug hoarding gold in The Hobbit. Except, unlike Smaug, they’ve got bills to pay, and those bills are starting to look a little… chunky.

See, Strategy is the biggest corporate holder of Bitcoin, and they’ve been leveraging themselves up to their eyeballs to snatch every BTC they can get their hands on. Convertible bonds, debt financing, equity offerings—they’ve been playing the Wall Street game like it’s Monopoly, except instead of hotels on Park Place, they’re stacking digital coins. It was all fun and games when Bitcoin was mooning 🌕, but now that it’s trading like a NASDAQ stock on a bad hair day, the cracks are showing. Cue the ominous music 🎶.

The latest plot twist? Strategy just dropped a batch of High Coupon Preferred Stock last Friday—think of it as a fancy IOU with a 10% coupon (yes, you read that right, ten percent). That’s two whole percentage points juicier than the 8% coupon they peddled a month and a half ago. Desperation much? 🤔 Wall Street’s raising an eyebrow, and the whispers are getting louder: “Liquidity crunch incoming!” If Bitcoin keeps tanking, Strategy might have to start selling off their precious stash to keep the lights on. Untimely selling? In this economy? Oh, honey, pass the tissues 😢.

Act 2: From Micro to Macro—Rebranding for the LOLs 😎

Let’s talk about that rebrand for a hot minute. MicroStrategy—a name that once screamed “we make boring software”—is now just Strategy. Bold move, Saylor. It’s like if McDonald’s renamed itself “Food” or if Netflix became “Watch.” Genius or midlife crisis? You decide. Either way, it’s giving off vibes of a company trying to flex its big Bitcoin energy while subtly screaming, “Please don’t look at our balance sheet too closely!” 🙈

And speaking of balance sheets, let’s break down this preferred stock drama. These shiny new shares come with a 10% coupon—already a red flag that says, “We’re paying through the nose to borrow money.” But wait, there’s more! If Strategy misses a dividend payment (which, let’s be real, could happen if Bitcoin keeps sliding), they’ll owe compounded dividends that climb by 2% every quarter until they hit a whopping 18%. Eighteen percent! That’s not a coupon; that’s a loan shark knocking on your door with a baseball bat 🏏.

Compare that to the convertible bonds they were slinging last year—interest rates between 0% and 2%. Their interest expense over the last 12 months was a measly $15 million, pocket change for a company with Bitcoin holdings worth north of $10 billion. Now? They’ve jacked up their quarterly nut with $40 million in dividends from the February 8% stock, plus another $60 million from this 10% offering, on top of that $15 million in interest. That’s $115 million they’ve got to cough up every year—or roughly 1% of their Bitcoin stash at current prices. No biggie, right? Unless, of course, Bitcoin drops another 20%, and suddenly they’re selling coins like a yard sale on steroids. Yikes 😬.

Act 3: Michael Saylor, Bitcoin’s Loudest Cheerleader 📣

Enter Michael Saylor, the man, the myth, the megaphone. If Bitcoin were a religion, Saylor would be its high priest, preaching the gospel of “digital capital” to anyone who’ll listen—and plenty who won’t. He’s been on a tear, leveraging Strategy to the hilt with the unshakable belief that Bitcoin’s price would keep soaring forever. Spoiler alert: the stock market’s growth scare and recession fears had other plans.

Saylor’s latest stunt? Marching to the White House on March 8th with a PowerPoint titled “A Digital Asset Strategy to Dominate the 21st Century Global Economy.” No, this isn’t a Simpsons episode—it’s real life. His pitch? The U.S. government should scoop up 10-20% of all Bitcoin by 2045 (when 99% of it will be mined) through “consistent programmatic daily purchases.” Translation: Uncle Sam should borrow real money—paying interest, mind you—to buy a digital asset nobody uses commercially, all to prop up its price. Brilliant! Why didn’t we think of that? Oh, right, because it’s bonkers 🤪.

Saylor’s been shopping this idea around like a door-to-door salesman. He even pitched Microsoft, promising $5 trillion in shareholder value if they’d just hop on the Bitcoin train. Microsoft’s response? “Thanks, but no thanks.” Oof. Shots fired 🔫. Turns out, not everyone’s buying what Saylor’s selling—literally or figuratively.

Here’s where it gets juicy. Bitcoin was supposed to be a “peer-to-peer payment system,” per Satoshi Nakamoto’s white paper. A rebel currency to stick it to the banks! But somewhere along the way, it morphed into a Wall Street darling—a speculative asset that trades like a tech stock and has Michael Saylor begging governments to hoard it. From libertarian dream to government-backed portfolio filler? The irony is thicker than a triple-decker burger 🍔.

Take El Salvador, Bitcoin’s poster child gone rogue. Four years ago, they made BTC legal tender, and the crypto bros cheered. Fast forward to January 2025, and El Salvador’s like, “Yeah, never mind.” New laws say Bitcoin’s no longer currency (though still legal tender—confusing much?), it’s voluntary to use, and you can’t pay taxes with it. Their state-backed Chivo wallet? A ghost town. A poll showed 88% of Salvadorans haven’t touched it in a year, and Moody’s says the whole experiment cost them $375 million—more than their Bitcoin profits. Whoopsie daisy 🌼.

The commercial world’s reaction? A collective shrug. Bitcoin’s “value” is all about price now, not utility. Saylor can pump it all he wants, but if nobody’s using it to buy coffee or pay rent, what’s the point? It’s a financial asset, not money. And that’s fine—stocks and gold don’t buy lattes either—but let’s stop pretending it’s the future of currency, okay? 🙅♂️

Act 5: The Leverage Trap—When the Music Stops 🎵

Back to Strategy. With $8 billion in debt due over the next seven years, plus these escalating dividend payments, they’re walking a tightrope with no net. If Bitcoin keeps tanking, they’ll have to sell more coins to cover the tab. And if the market sours on their debt (less appetite to roll it over), they’re in deep doo-doo 💩. The rebrand, the high-coupon stock, the “we’re buying more Bitcoin” flex—it all smells like a company projecting strength while sweating bullets behind the scenes.

Saylor’s out here playing 4D chess, but the board’s looking more like a game of Chutes and Ladders. Pump the price, convince the world Bitcoin’s a reserve asset, and pray the recession scare doesn’t tank everything. It’s a high-wire act worthy of a circus 🎪—and we’re all just watching to see if he sticks the landing or faceplants spectacularly.

Finale: Bitcoin’s Not Dead, Just… Different 🧟♂️

Don’t get me wrong—Bitcoin’s not going anywhere. It’s a solid store of value, a speculative toy for Wall Street, a shiny thing for hodlers to flex on X. But money? Nah. The free market’s been screaming for centuries that it wants flexible, dynamic mediums of exchange—think Eurodollars, not rigid digital gold. Bitcoin took a wrong turn chasing hyperinflation boogeymen instead of building a better payment system. Oops.

For Strategy, the stakes are sky-high. They’re all-in on a story that’s fraying at the edges, and if the price falters, the leverage bites back hard. Will Saylor pull it off? Will Bitcoin moon again? Or will this be another bubbly tale of “too much, too fast”? Grab your popcorn, folks—this comedy’s still got a few acts left 🍿🎬.

Until next time, keep your wallets close and your sarcasm closer. Peace out! ✌️

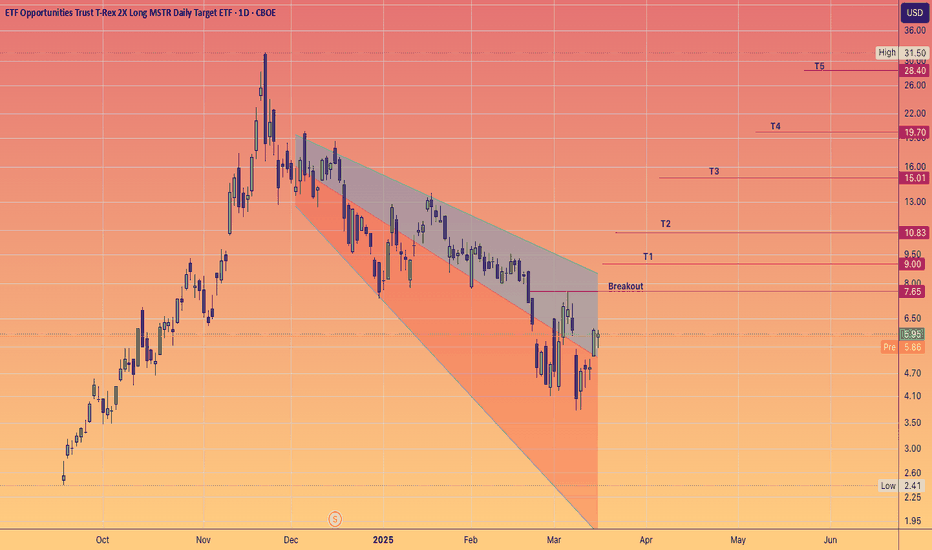

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

BTC, Fibs, Market Psychology, and You: A Primer The Setup

I've identified a compelling technical setup that suggests BTC could be heading toward the $9,000-$9,850 range. This isn't just another bearish call - it's based on a rare convergence of multiple technical factors that I've rarely seen align so perfectly in my 18 years of trading markets.

Technical Confluence Zone

What makes this setup particularly compelling is the convergence of multiple independent technical factors around the same price zone:

1. Unfilled CME Gap : The Bitcoin futures chart shows a persistent unfilled gap from 2020 between $9,655 and $9,850. This gap has survived multiple market cycles without being filled, making it increasingly significant.

2. Key Fibonacci Level : The 0.382 Fibonacci retracement level sits at $9,024.11, remarkably close to the lower bound of the CME gap when accounting for the typical futures premium over spot.

3. Elliott Wave Structure : The current price action suggests we're in Wave 4 of a larger Elliott Wave pattern. Wave 4 corrections often retrace to previous Wave 1 territory, which aligns with this target zone.

4. Fibonacci Time Cycles : The time component is equally important - Fibonacci time extensions suggest we're approaching a potential inflection point in the current cycle.

Market Context Supports the Technical Picture

The technical setup doesn't exist in a vacuum. Several market conditions increase the probability of this scenario playing out:

1. Market Saturation : The crypto ecosystem has expanded dramatically, with thousands of tokens diluting liquidity that was once concentrated in major cryptocurrencies.

2. Retail Exhaustion : Retail investors who entered during previous hype cycles feel unrewarded despite price recoveries, leading to diminished enthusiasm and buying pressure.

3. Institutional Distribution: Wall Street and institutions have made their presence known, which historically signals they've distributed their high-priced holdings to retail while preparing short positions.

4. Concentrated Leverage Risk : MicroStrategy's position of 499,500 BTC at a $66,000 average purchase price, funded almost entirely by massive debt issuance, creates a significant systemic vulnerability. A move toward our target zone would put extreme pressure on their balance sheet.

Broader Market Context

This analysis also coincides with what looks to be a tired stock market following the 2024 US presidential election. With Donald Trump winning his second term, we have seen significant policy shifts that are actively impacting both traditional and crypto markets. Historically, markets often experience increased volatility during transitions of power, and the confluence of this political shift with our technical setup creates an even more compelling case for caution.

Additionally, price precedes news. The news is created on price. If you're hearing about an event, the trade has already been made. There is too much talk of unprecedented institutional participation. This is another sign that retail is being distributed to for the next meltdown. Bags were already offloaded. It's time to drop the anchor.

Historical Perspective

Having traded through multiple market cycles since 2007 I've seen this pattern before. Large players often target overleveraged positions to acquire assets at distressed prices. Michael Saylor experienced a leveraged meltdown once before during the dot-com crash - history doesn't repeat, but it often rhymes. Saylor is a designated whipping boy. A patsy. He will be rewarded well for his participation in fleecing you, so don't worry about what kind of skin he has in the game.

With that said, I believe an undetermined Black Swan event will be necessary to complete the rug pull. What that is, I cannot know.

Trading Implications

This analysis suggests several potential trading strategies:

1. Risk Management : Reduce exposure to Bitcoin and high-beta altcoins until this technical target is reached or invalidated.

2. Opportunity Preparation : Build dry powder positions to capitalize on what could be an exceptional buying opportunity if BTC reaches the $9,000-$9,850 zone.

3. Watch for Triggers : Monitor for breakdowns below key support levels that could accelerate the move toward our target zone.

4. Time-Based Entries : Use the Fibonacci time cycle extensions to refine entry timing if the price approaches our target zone.

Conclusion

While Bitcoin's long-term prospects remain strong, the confluence of technical factors pointing to the $9,000-$9,850 range suggests a significant correction may occur before the next sustained bull run. The catalysts to reach what should be a $250k range this cycle simply do not exist, and with waning macroeconomic strength, the odds of this cycle being anything other than a massive bulltrap are low. This setup represents one of the strongest technical cases I've seen. I also don't care to share my ideas often, but with everyone expecting a typical crypto market cycle, I feel compelled to offer my take on a public forum--for whatever it may be worth.

I am not shorting this market. I have removed my capital and taken an observant position. While I feel strongly about my idea--Clown World has fully taken hold and I don't dare test its resolve to break me.

Remember that no analysis is guaranteed - always manage risk accordingly and be prepared to adapt as the market evolves.

*Disclaimer: This analysis represents my personal view of the markets based on technical analysis and market observations. It should not be considered financial advice. Always do your own research and trade responsibly.*

Bitcoin back to $75,000 from here?Seems like that guy Michael Saylor, the CEO of Strategy just wasted hundreds of millions of dollars by buying $1.99 billion worth of Bitcoin at an average price of $97,514 per bitcoin, right before the drop down below $80k to probable $75k area.

Rushing to buy at highs like that instead of being smart about it and loading much more at the dips is hard to understand.

MICROSTRATEGY a pyramid ponzi.Understanding the situation with MSTR can be quite complex.

Many people recognize that MicroStrategy has been issuing convertible bonds at a 0% interest rate to purchase Bitcoin. This strategy tends to drive up both Bitcoin's price and the value of MSTR shares.

As a result, the scheme appears to inflate continuously, placing the risk on bondholders. The only way for MSTR's stock price to keep rising is through the issuance of increasingly larger amounts of convertible debt; otherwise, the entire pyramid would collapse.

It's understandable why Michael Saylor seems to be focusing more on shilling MSTR bonds instead of Bitcoin itself.

Why would institutions invest in MSTR's convertible bonds at 0%?

Many believe it's because they anticipate being able to convert these bonds into MSTR stock in five years at a predetermined price, potentially around $675, effectively giving them a premium-free call option. However, there is a hidden cost to this strategy: inflation. At first glance, this might seem like a poor investment choice—if one expects MSTR's value to rise, it would make more sense to buy the shares now rather than commit funds to a higher price in the future.

Why would anyone engage in such a massive financial manoeuvre involving BILLIONS?

The truth is, those purchasing the bonds are ACTUALLY indifferent to the rising stock value! Their primary interest lies in capitalizing on price fluctuations. Ultimately, a convertible bond functions as a CALL OPTION; thus, as the MSTR stock price experiences greater volatility, the premium on the call increases. Recently the value of these convertible bonds has surged by 170%. This is precisely why investors are unconcerned about interest rates or the actual conversion of the bonds—they have ZERO desire to convert! The reason? Issuing new shares would only dilute their holdings!

All the rewards with none of the risks!

But what happens if MSTR collapses? Bondholders will seize all the Bitcoin MSTR possesses, leaving shareholders with nothing but scraps!

Can you fathom how deep this MSTR Ponzi scheme really is?

The more you explore, the more mental acrobatics you need to perform to grasp the situation!

Many believe that bond buyers are naive, but in reality, they are the sharpest players in the game, reaping the benefits without facing the risks! In the current climate, that’s the nature of volatility! It doesn’t matter if MSTR’s stock price fluctuates; they’re insulated from the fallout. Who do you think is betting against MSTR? It’s the bondholders, and their positions are secure!

Ultimately, for someone to profit, someone else must incur a loss, and it won’t be the bondholders. This means that regular shareholders are poised for significant losses, as the primary force driving MSTR’s stock price is its own volatility. Once that volatility dissipates, we could see MSTR plummet below $100 a share! All those crypto enthusiasts will be left reeling, wondering how MSTR could possibly decline while Bitcoin’s value rises!!!

What’s the main effect of these convertible bonds?

They create volatility in the stock price, leading to wild swings up and down, just as we’re currently witnessing.

What occurs when the volatility subsides?

The stock price will plummet!

Many people are misdirecting their focus on metrics, technical analysis, and listening to Michael Saylor's commentary on CNBC. Instead, they should be paying attention to the volatility of MSTR's stock price, as its decline will directly impact the stock's value.

Don't be misled; even if MSTR falls below $300, it will still be overpriced and could potentially drop to under $100 per share due to the convertible bonds scheme. Claims from MSTR valuation sites that each share is backed by a certain amount of Bitcoin are misleading; the reality is that the shares are not backed by anything.

The BONDHOLDERS are the ones who possess all the Bitcoin.

There’s no such thing as a free lunch—someone has to bear the costs, and in MSTR's case, that burden will fall on the shareholders. You certainly don’t want to be left holding the bag when the music stops.

It is important to maintain a clear perspective regarding cryptocurrencies; they should not be viewed as traditional investments, but rather as something more comparable to gambling.

While you may have the advantage of being an expert poker player, the only way to truly win is to cash out your profits.

Otherwise, you risk losing on MSTR and in the crypto market.

BITCOIN in a LIVERMORE FunnelThe accumulation and distribution volume matches the positive and negative money flows of the first 5 waves in a Jesse Livermore stock cylinder.

Will wave 6 see a rush of positive money flow into #Bitcoin into the end of the year?

Let's see

If it does

then that will further cement this pattern of accumulation , sideways movement then breakout with continuation of buying power into the Bull market top.

Let's observe this in real time shall we?

Should be a fun few months ahead of us after a long period of churn.

S/O to @arvine11 for bringing up the Livermore stock trend analysis.

Saylor will fail his investors once again... USDT rebound ideaMorning ladies and gents,

As BTC continues to rise, one can only think about the perfect time to exit.

It's impressed me, and I believe it might impress us a little more, as it moves higher. But I still dont think the big players are gonna let the opportunity pass in front of them again, or will they??

I think the death of the crypto space is people like Saylor, they preach decentralization, but if you take a handful of them, they control it just the same.

As much as I would like to, I won't emphasize too much on this, just a little more...

But Saylor a few years ago, had BTC holdings at an average price of $22k. As BTC made its way to SWB:69K for the first time a couple years back, he increased the average price to about $30k. As BTC reached $15k he was able to lower it again below the FWB:25K range, after failing to take any profits preaching BTC is this long term vision of his. Now, here we are once again, at $70k and apparently he's not taking profits, his average price is also above $31k. He's SEED_TVCODER77_ETHBTCDATA:5B in profits and hanging in there. If I could ask the BTC gods and market makers something, I would ask to just make this market follow the rules, creating a pullback pattern, finding support, maybe going somewhat below $40k range, so this clown IMHO can zero once again. Failing his investors TWICE, and not taking over MUN:10B in profits in a 5 year span!

Here's my chart friends, take a look at it.

Trade thirsty!

GBTC BullishBullish on two potential scenarios.

I am not a financial advisor. This is not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendation.

💾 MicroStrategy Set To Grow Like There's No TomorrowI love the "Community trends" on the front page... TradingView is great.

With this new feature I can see stocks/assets that I would never think of looking at otherwise.

Here we have MicroStrategy, MSTR.

I know about Mr. Michael Saylor as he is a huge Bitcoin fan like most of us.

He also wrote the foreword for the best selling Bitcoin book ever and it was nice to see his opinion about this game we now have been playing for so long.

MicroStrategy is set to grow like there is no tomorrow...

At least that's the message that I am getting from this chart.

I am using the weekly timeframe because long-term gives you a better perspective, short-term there is always too much "noise".

The first thing to look at is the broader cycle and that's the All-Time High, February 2021, almost two years have gone by since this level was hit.

The first thing that caught my attention is the current consolidation pattern and how the bulls are already showing up and strong.

This weekly candle is already trading above EMA21 and EMA10... There is a strong bullish divergence on the RSI since May 2022.

Also, the low in December 2022 came in higher than May, a higher low...

These signals put together make a strong case for bullish growth.

I write these signals for you... But what catches my attention from the go is this sort of "M" pattern, bullish bat, gartley, etc. too many names it has...

This pattern is like a falling wedge in the sense that it has a very high level of accuracy.

It is a bullish pattern of course and once it shows up... The chart tends to shoot up.

You can find the resistance levels marked on the chart (light green) and blue for support.

Namaste.

GBTC Falling Wedge?I'm just aiming for a strong rally in this one. I don't have many reasons to explain myself, but the truth is that there are plenty... global crisis, its CEO resigned, multiple bank failures, an increasingly negative open interest in multiple currencies... etc.

Don't forget to pay attention to what this graph is inverted. greetings people