Sugar likely going higher from hereSugar hasn't moved much in the commodity space but it looks like that's about to change

The quarterly chart is especially interesting as it's been bull flagging above a key historical level - the 18 cent mark, which also corresponds with the 50 week moving average support - so there's your risk perfectly defined. You could also argue it's flagging outside of a massive multi-decade symmetrical triangle (not as relevant imo but interesting).

SB1!

Added more sugar at 14.36We were wrong in our analysis of Sugar previously, expecting it to correct with a H&S pattern before rebounding.

It simply defy logic and continues to charge higher so we added more at 14.36 where it find some temporary support.

If nothing goes wrong, then we can expect it to continue to revisit the high of 15.38 on 18 Feb 20. So, for those who missed our earlier calls to long Sugar at 12+ , I would suggest you not to come onboard now.

Chasing high price just to take revenge of a missed opportunity is NEVER a good strategy as the risk reward ratio is not great to begin with and also , the chances of a correction is getting higher as it goes higher.

Remember, in trading/investment, leaves your egoes aside and strictly see from the logical point of view. I know, it's easier said than done. Afterall, without the emotions of greed and fear, there probably would not be profits and losses as well......

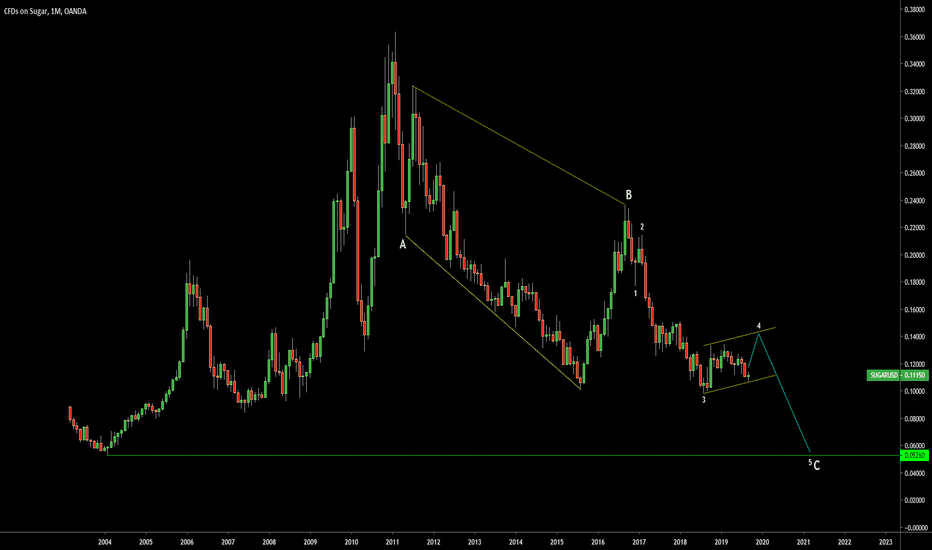

SB1! (SUGAR) BULLISHSB1! (SUGAR) is bullish. We are going for the Intermediate 5th of Primary C of the cycle be. For now, the target area is roughly $23.43 to $$24.80 which is 50% and 61.8% of fibo. This is the commodity market and in a commodity market, the 5th wave can be extended. For now invalidation level is $17.60 which is the 4th wave for now.

DISCLOSURE - Please be informed that the information I provide is not a trading recommendation or investment advice. All of my work is for educational purposes only. All labeling and wave count have been done by me manually and I will keep changing according to the LIVE MARKET PRICE ACTION. So don't bias, hope on my trade plans. Try to learn Elliott Wave or other strategies and make your own strategy. Following is not that much easy. I am not responsible for any losses if u took the trade according to my trade plans.

#SB1! #SUGAR

Long $SGG Sugar ETF at 33.50 or 10.30 #Sugar Futures Spot PriceSugar and Brazil Relationship:

Since Brazil has been the leading producer of sugarcane in the world, the value of the Brazilian Real plays a significant role in the price of sugar futures. Weakness in the Brazilian Real against the US Dollar encourages Brazil's sugar producers to boost exports. The logic is that a lower Brazilian Real incentivizes Brazilian farmers to produce more sugar to export sell for US Dollars. However, it's likely that the Brazil Real will appreciate against U.S Dollar over the next couple months based on technical analysis and possible economic intervention from the Brazilian Government.

- U.S. Dollar/Brazil Real pairing or BRB index showing many downside trend change signals here such as bearish RSI divergence since early March on Daily chart. Weekly chart showing RSI and MACD curling down from record highs with Momentum also curling down but after a double test of highs

Growing Ethanol Demand:

In July 2019, India announced they will work with Brazil on ethanol production. Using more cane in India to produce ethanol, instead of sugar, could reduce the global supply of the sweetener. 32M sugarcane could be used to produce ethanol and electricity instead of sugar in the next year. The joint venture, named BP Bunge Bioenergia, will manage 11 cane processing plants in Brazil with capacity to crush 32 million tonnes of cane per year

- Higher crude oil/gasoline prices benefit ethanol prices and may prompt Brazil's sugar mills to divert more cane crushing toward ethanol production rather than sugar production.

- India and many other countries are boosting ethanol output for sanitisers on coronavirus pandemic

Supply Curbs:

In July 2019, India, the second largest producer of sugarcane, announced they will create a buffer stock of 4 million MT of sugar for 1-year starting Aug 1 in an attempt to limit supply and support domestic sugar prices. Also, further supply disruptions are expected in India due to Coronavirus Lockdown.

- The Indian Sugar Mills Association (ISMA) reported Wednesday that sugar production in India dropped sharply by -22% y/y to 23.27 MMT during Oct-Mar

- Sugar production in Thailand, the third largest producer of sugarcane, is expected to fall 28% to a nine-year low of 10.5 million tonnes in the current crop season as drought curtails cane supplies

India Sugar Subsidies:

In August 2019, Brazil, Australia and Guatemala have complained again to the WTO to set up dispute panels to rule on India’s sugar subsidies.

- A change in WTO trade dispute status to Panel Composed on October 28th supports the global price of sugar. This news catalyst increases the possibility of removal of India sugar subsidies. If removed, India sugar stockpiles could fall thus decreasing global supply. Now in April 2020, we can assume the dispute must be in the further into review process

Real-Time CashFlo Twitter Post:

twitter.com

SB1! Futures Chart- Sugar id front of a great resistance which fights to break it. for the moment it is in a bearish phase if it doesnt break the level of (11) with power

- For the moment there is a very high probability that the market will return to test the level of (9.60) . which is going to be an important

support.

- And if ever it breack it there is an 80% probability that the market will move to (8.36)

SUGAR FUTURES (SB1!) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

SUGAR FUTURES (SB1!) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

SUGARUSD LongSugar has just broken out of a falling wedge pattern which could also be bullish flag. Nothing too complex, but I marked out where any divergences have played out coupled with the RSI > 65 signalling intermediate tops. I think sugar has anywhere from 5 to 10 percent to go up before marking another intermediate top.

For this trade, use the CANE ETF. I would suggest a stop below today's open and to just let this trade run.

Sugar: Buy Opportunity with an end-of-year horizon.Sugar has been trading within a 1M Channel Down for almost 1 full year (RSI = 40.519, MACD = -0.770, Highs/Lows = -0.1543). It is close to pricing a Lower Low, turning the current levels into a buy opportunity. Our Target Zone is 11.65 - 11.90.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.