Sbiindia

SBI -IS it Ready to take deep dive again ?? what are your views In the previous post we talked about sbi heading towards 140 levels and its almost near those levels.

Now 143-140 is an important zone for the stock, if this zone doesn't take the price up, chances are stock is getting ready to take a deep dive again.

Investor stay away from the stock, its not a cheap bargain yet and let the stock settle and make its way.

SBIN BANK MID TERM - LIKELY BOUNCE FROM THIS 5 YEAR SUPPORT ZONESBIN chart looks bullish for midterm trade holders likely to bounce to 250 levels in the next few months.

Perfect at the support zone fo 150.

Targets can be around 190 levels for short term traders,

MIDTERM: 230 -250 in the next few months

SBI | Still showing weakness | Downtrend continuesFriends, please support this idea with LIKE if you find it useful.

Downtrend continues. Use the pullback to get in.

Thank you for your support, I appreciate it.

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

SBIN Showing Bearish Trend for Long Term investmentDont take any new entry in SBIN if you bought already then must use Stop loss 225.

if cames any good news for banking sector then you can some good movement otherwise Trend is Bearish .

Banking sector is not Right Time For investment wait some Years.

SBIN Very Good Opportunity Between 140-150.

Stay Tuned.......!!

Learn Here , Earn EveryWhere

Buy SBI....purely technical viewSBI is range bound for the last three weeks between 222 to 235. Any breakout on either side would be fast and furious. Trendline support is at around 220 and 21 Day simple moving average is at 226. Taking into consideration some positive bias, one can keep stop loss at 219 and maintain the long position for a short term target of 242 and medium term target of 255.

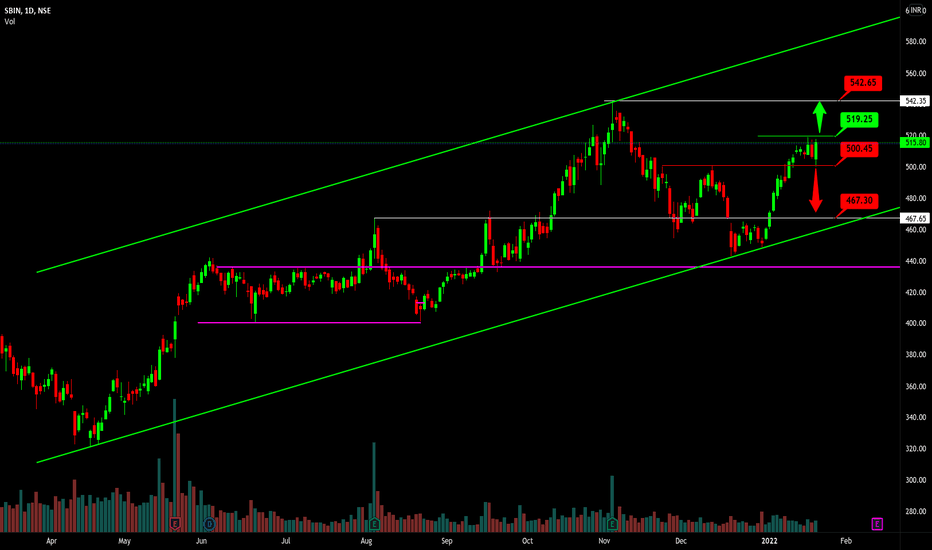

SBI Counter Trend Trade : Risky Plan Hey Guys,

Happy Monday.. Only we traders have the guts to say Happy Monday instead of Monday Blues :P

So lets jump to our analysis and why I am planning for an counter trend trade in SBI.

This is one of my favorite setups to trade, No matter what others say or think...I am deeply in love with counter Trend bcos it makes us analyze various reasons to enter trade & I like that analyzing part very much.That's why its My Favorite setup.

When you take a look at chart we can see there is an ABCD pattern which ends up right in our marked resistance zone. As of now market is 5mins away from opening, while I post SBI price may be away from our zone if gapup/gapdown happens today.

Do we have only ABCD pattern no not at all ? If we look on eagle's view we have Bearish Bat & Bearish Gartley also which I have drawn as two patterns in above chart. And this Gartley beauty comes across our resistance zone synchronized with ABCD pattern. I will be shorting SBI, only small positions in Gartley/ABCD zone and some more when bearish bat completes if Market moves in bullish trend.

Just one thing before we wind up, Countering trend is risky and people don't like to do, so only if you are aggressive trader take this idea and trade SBI, else I strongly advice you to keep this idea in radar n watch the trade, bcos staying away from trade is better than losing money in trade with high risk.

Do Me a favour guys, Hit that Like button to show your support which keeps Me motivated to post more...

Thanks to everyone of you !