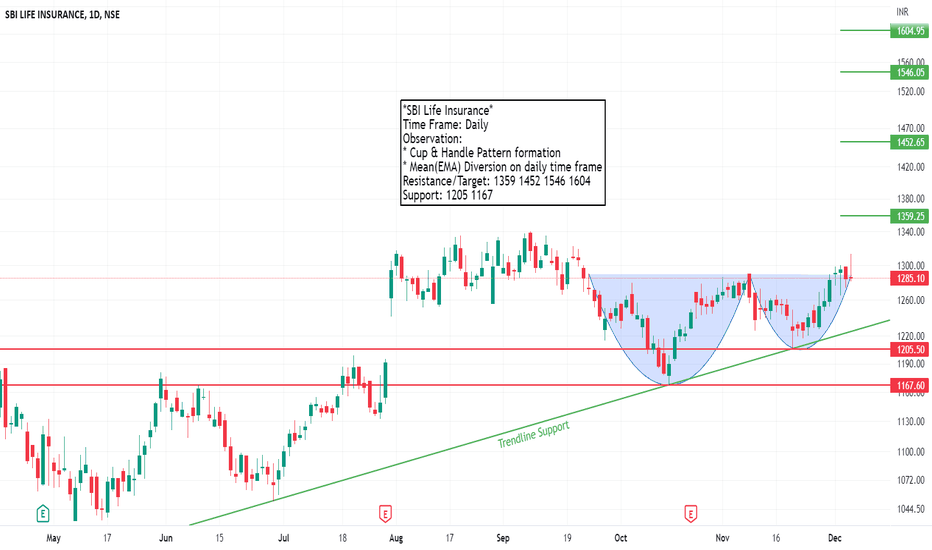

Sbilifeinsurance

SBI Life Insurance Co. Ltd. - Technical Analysis UpdateSupport and Resistance Zones:

1.Key Support Zone: ₹1,385-₹1,463

This zone aligns with the Fibonacci 0.236 retracement level and the recent reversal point, making it a strong support.

2.Immediate Resistance Levels:

₹1,555 (Fibonacci 0.382 retracement).

₹1,630 (Fibonacci 0.5 retracement).

₹1,705 (Fibonacci 0.618 retracement), a crucial level to watch.

3.Fibonacci Retracement Levels:

The stock has retraced sharply from its high of ₹1,943 and is showing signs of reversal near the 0.236 Fibonacci level. A breakout above ₹1,500 could confirm bullish momentum toward higher Fibonacci levels.

4.Volume Analysis:

Volume appears to be increasing near the support zone, indicating buying interest from market participants.

The Volume Profile indicates strong accumulation between ₹1,400-₹1,500.

5.Moving Averages:

The stock is attempting to reclaim the 20-day EMA as a dynamic support.

A crossover above the 50-day EMA could signal further bullish strength.

6.RSI (Relative Strength Index):

RSI is recovering from oversold levels, indicating a possible trend reversal. A move above 50 would strengthen the bullish case.

7.Projection:

If the stock sustains above ₹1,463, it could aim for ₹1,555 in the short term and ₹1,705 in the medium term.

A break below ₹1,385 would invalidate this view and could lead to further downside.

Conclusion:

SBI Life Insurance is poised for a potential bounce-back. Traders can consider entries near the ₹1,450-₹1,470 range, targeting ₹1,555 and ₹1,705 with appropriate stop losses below ₹1,385.

SBILIFE- Swing-Bullish-Get Set Go!!

09.08.2024

Buy 1727

Target 1805

Stoploss 1662

Risk Reward: 01:01

1. Good engulfing pattern followed by good recovery with previous resistance breakout

2. Rejection from Resistance turned to support zone

3. 21 EMA Rejection & good FVG at same zone

4. Very good uptrend

5. RSI is strengthening. Volumes are contributing well

SBILIFE- Good bullish momentum expected-Swing trade NSE:SBILIFE

Buy Above 1500

Target 1- 1565

Stop-1437

Daily & Weekly Inside candle breakout

Downward range ended & retesting successfully completed

EMA Rejections & crossover

Good volumes from last two days

Trend rejected from 0.5 Fibonacci & Above 0.382

SBILIFE Breakout done after a Good Consolidation.

Volume looks good too.

Above all EMA.

Good for Short term and Long term.

Do Like ,Follow ,Comment for regular updates...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

SBILIFE - Bearish ViewSBILIFE - Elliott Wave count

the market seems like completed all 5 impulses and has begun correction. wave A expected to hi t the target of 1250 range.

Please note that this information is for educational purposes only, and it is crucial to trade with caution.

NSE:SBILIFE NSE:SBILIFEZ2023 BSE:SBILIFE

#SBILIFE... Looking good 16.05.23#sbilife.. ✅▶️

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a huge movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

SBILIFE - long viewThe stock has created a good base at the level range of 1016 levels.

As you can see the stock has taken support around this area and moved upwards.

It reached a high of 1293levels before crumbling to huge selling pressures.

The stock is trying to make its way back to the top.

I have presented my views on the chart with levels that can help you take your trades.

Thanks & Regards,

If you feel you can make use of my views and put them to good use, request you to kindly revert with feedback/suggestion/improvement

SBILIFESbi life bouncing back from a strong support zone.

It is a risky trade as the market is still not looking to move upwards.

But good to add some quantities with limited risk and keeping strict STOPLOSS of around 1085 levels.

Trade safe. Manage risk. Be profitable.

Please follow us for more simple trading analysis and setups. Also let me know in the comment in case you have any queries.

Disclaimer :- This is just my view. Please analyze charts yourself and then decide to take any trades.

#28 SBI Life InsuranceNSE:SBILIFE

Reason Being:

1. Higher High Pattern Formation

2. Rising RSI and Above 60 Level

3. Breakout with Heavy Volume

View Negated Below: 914 in weekly closing Basis

#Disclaimer: I'm not a SEBI Registered Research Analyst, These are my views, please consult your Investment Advisor before buying and selling any position. This is just for Education Purpose.

if you liked it please don't forget to follow me