Sbin

SBIN levels for 08/05/20251. Trend Overview (Multi-Timeframe)

Daily (D): Bullish

4H (4-hour): Bullish

1H, 15M, 5M: Bearish

🔎 This suggests a short-term correction or pullback within a longer-term uptrend.

2. Price Action

Current Price: ₹777.50

Recent High Rejection Zones:

₹784.50 – ₹787.00 (resistance)

₹810.10 (resistance)

₹829.00 – ₹835.50 (stronger resistance zone)

Support Zones:

Immediate support: ₹774.00

Next supports: ₹741.00 and ₹731.10

📉 The price is hovering just above a support zone at ₹774.00, having recently rejected from the resistance zone near ₹784.50.

3. Candlestick Patterns & Structure

Lower highs and lower lows are visible in the short-term, confirming the bearish structure on intraday timeframes.

A small consolidation or base building is occurring around ₹774.00, which may act as a launch point for a move in either direction.

4. Key Levels to Watch

Level (INR) Type Implication

784.50–787.00 Resistance Selling pressure seen here

774.00 Support Holding this could trigger bounce

741.00 Support Breakdown target if 774 fails

810.10 Resistance Reversal zone if price recovers

5. Market Bias

Bias: Cautiously Bearish in short term, unless price reclaims and sustains above ₹787.

A break below ₹774 may accelerate selling toward ₹741.

On the other hand, a bounce and break above ₹787 may indicate a short-term reversal back to ₹810.

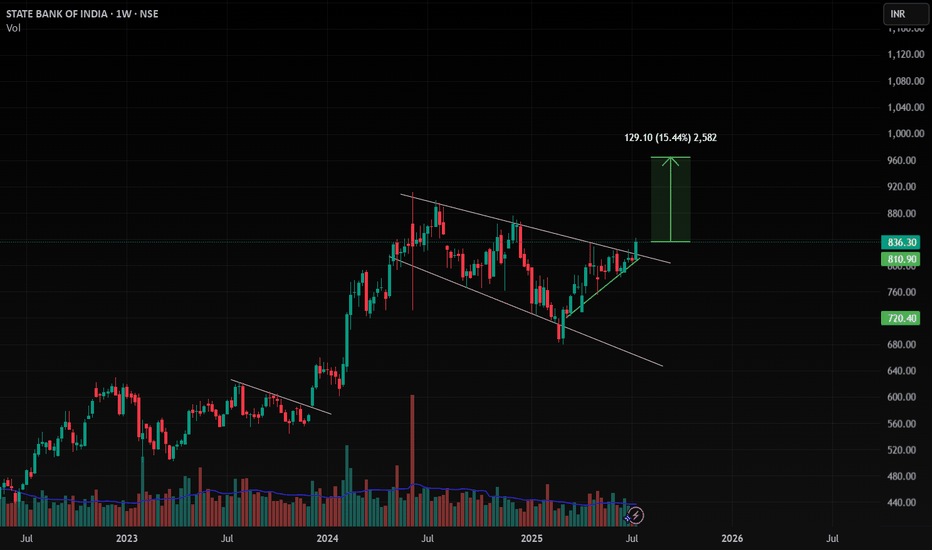

SBIN Breakout Alert | Strong Volume + RSI Confirmation🔍 Chart Analysis Summary

Pattern: Stock has broken out of a clear consolidation range (highlighted in blue), suggesting bullish momentum.

Volume Spike: Notable surge in volume (blue arrow), confirming the breakout strength.

RSI: RSI has broken above the 60–65 zone, indicating strong bullish momentum.

Price Action: The breakout occurred above ₹775–₹780 resistance, now acting as support.

🟢 Recommendation: BUY

Action Level (INR)

Buy Above ₹785–₹790 (on minor dips or current price)

Target 1 ₹835

Target 2 ₹875

Stoploss ₹755 (below the breakout support zone)

for educational purposes only

SBIN - Inverted Head and Shoulder - BreakOut- DailyThe chart clearly depicts Inverted Head and Shoulders (H&S)**, which is a **bullish reversal pattern**. Here's the updated analysis for **SBIN (State Bank of India)**:

---

### 🧠 **Pattern Recognition: Inverted Head & Shoulders**

- **Left Shoulder**: Formed in **early February 2025**

- **Head**: Deeper low formed in **early March 2025**

- **Right Shoulder**: Higher low formed in **early April 2025**

- **Neckline**: Around **₹785**, which has just been **broken on strong volume**

This pattern often marks the end of a **downtrend** and the beginning of an **uptrend**.

---

### 📏 **Measured Move Target**

- Neckline Breakout Level: ₹785

- Depth (Head to Neckline): ₹104.75

- **Target = ₹785 + ₹104.75 = ₹889.75**, which aligns almost exactly with the marked level of **₹888.90**

---

### 🔍 **Volume Confirmation**

- Volume has **increased notably** on the breakout candle, which is a **key confirmation signal** for H&S patterns.

---

### 🧱 **Support and Resistance**

- **Breakout support (neckline)**: ₹785

- **Next resistance levels**: ₹888.90 → ₹912

- **Downside support zones**: ₹775, ₹680 (head base), and major at ₹620.70

---

### 📌 **Summary**

- ✅ **Inverted Head & Shoulders** pattern confirmed

- ✅ Breakout above neckline with volume = bullish

- 🎯 **Target**: ₹889 (approx 11.5% upside from breakout)

- 🔄 Watch for potential retest at ₹785 for a low-risk entry

---

SBI Breaks Head and Shoulders Pattern on 4H Chart – Time to Buy?SBI Breaks Out of Head and Shoulders Pattern – Pullback Entry Opportunity at ₹876

State Bank of India (SBI) has been forming a classic Head and Shoulders pattern on the 4-hour timeframe, and it has now successfully broken below the neckline, signaling a potential bearish move ahead.

From a trading perspective, this breakout could present an opportunity for short sellers. A pullback or retest of the neckline around ₹876 could be an ideal entry point for those looking to ride the trend. If the pattern plays out as expected, downside targets are seen in the ₹845–₹850 range.

As always, traders should monitor price action closely during the retest and manage risk accordingly, as false breakouts are always possible, especially around key levels.

SBI: Inverse H&S BreakoutThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in SBI, with a neckline at ₹783, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. The target price for this breakout is ₹900 calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss at 730 to manage risk in case of a failed breakout.

SBIN : at Wave C completion zoneSBIN Analysis (20th Dec 2024)

The chart of SBIN (State Bank of India) illustrates an extended retracement to mitigate liquidity, a failed breakout (BO), and a corrective wave completion. Let us dive into a step-by-step educational breakdown of actionable levels.

Current Structure:

The price has recently formed a corrective wave structure (A-B-C) and is trading near a potential demand zone around 818-834.

The first target zone lies between 850-852. Further breakout could lead to an extended target between 900-912.

The stop-loss is below 814, where failing the deep retracement may result in bearish continuation.

Action Plan:

Buying Opportunity: Consider entering near 818-834, as this aligns with the golden retracement zone. This is a low-risk entry given the confluence of previous support and corrective wave completion.

Targets: Book partial profits around 850-852. If momentum sustains, trail stop-loss to 845 and aim for 900-912 as the extended target.

Stop Loss: Place a stop-loss below 814 to manage risk. A failure here could invalidate the setup, resulting in further downside risk.

Risk-Reward Ratio: Buying around 830 with a target of 850 (initial) and 900 (extended) offers a risk-reward ratio of approximately 1:3, making it a favorable trade setup.

Key Educational Note:

Green trendlines denote bullish movement, while red illustrates potential bearish risks. The yellow trends indicate a sideways range, highlighting consolidation zones.

Disclaimer: This is not financial advice. Always consult with a SEBI-registered advisor before trading. Like and share if you find this analysis helpful!

SBIN Long for Swing PositionOverview: SBIN has been in a downtrend on the 4-hour timeframe but recently bounced from the key support level of 775. The price faced strong resistance at 795, which was a critical level for any upward movement. However, SBIN has now broken through this resistance with solid bullish momentum and has reached 805. This former resistance level is likely to act as a new support if the price comes back for a retest.

Trade Plan: Keep a close watch on the 795 support level, especially on a lower timeframe like the 15-minute chart. If the price shows bullish signs around this level, consider buying a small position and holding it for a potential swing trade. The target for this trade would be 900 or higher. On the other hand, if the price fails to hold the 795 support and breaks below, the next area to watch would be 774. If bullish signals appear at 774, it could be a good opportunity to add to the position for another swing trade. However, if the price continues to decline and doesn't hold this level either, it may be wise to wait and look for a better entry at 726 or exit with a stoploss below 775.

Conclusion: If the swing high of 805 is broken, open a long position with the trading plan mentioned above. I'll keep you updated on further price action as it develops.

Please let me know which stock do you want me to do analysis on. Write down any doubts or thoughts in the comment section and please hit the boost to show support and follow for more update.

State Bank of India (SBI) – Bullish Reversal Setup State Bank of India (SBI) – Bullish Reversal Setup with Inverse Head and Shoulders Pattern

SBI is currently forming a classic Inverse Head and Shoulders pattern on the daily chart, a strong indication of a potential bullish reversal. The neckline, located at ₹826.45 , is the critical level to watch. A successful breakout above this level could trigger upward movement towards ₹880 and ₹911 , with volume confirmation needed to validate the move.

Technical Highlights :

Inverse Head and Shoulders Pattern: The formation of this pattern suggests a trend reversal from bearish to bullish. The price is consolidating just below the neckline at ₹826. A close above this could indicate further strength.

Support and Resistance: Immediate resistance is at ₹826.45 , followed by targets at ₹880 and ₹911 . On the downside, the stock finds support at ₹790 and ₹762 , which could act as stop-loss zones.

Volume Profile : High activity in the ₹790 - ₹826 range signals strong buying interest. A breakout above this range could push the stock into the next major volume zone around ₹880 .

Moving Averages: The stock is trading above its 20-day, 50-day, and 100-day moving averages , confirming a bullish bias in the near term.

RSI (Relative Strength Index) : RSI is neutral around 50, signaling consolidation. A push above 60 would confirm bullish momentum in line with a potential breakout.

Outlook:

Bullish Scenario : A breakout above ₹826 could open the door for a move toward ₹880 and ₹911. Traders should look for volume confirmation to ensure the breakout's sustainability.

Bearish Scenario: Failure to break above ₹826 could lead to a pullback toward support at ₹790, with ₹762 being the next key level on the downside.

SBI appears poised for a breakout, making it an attractive opportunity for traders looking for a bullish reversal setup.

SBIN Long Trade setup in 15m TF using RisologicalSBIN Long Trade setup in 15m TF using Risological

SBIN profit target 1 done!

The dotted line on the Risological swing trader acts as the trailing stop of the trade.

The trade looks good and should reach the Target 4 within a few days, unless there is a bad reversal.

So, keep a close watch on the trailing stop and trade safely.

SBIN upside target 840, 850State Bank of India may see good bullish momentum this week, the stock is on a bullish breakout on the daily chart, breaking which could show the stock a good rally. This stock can also see targets up to 840. The stock has also closed with a gain of five percent in today's session. The stock has also seen a bullish engulfing candlestick pattern on the daily chart indicating a good uptrend in the stock.

SBIN: Watch for Breakout - Bullish or Bearish?

Bullish Breakout Level: Above ₹832.15

Potential Upside: Targeting ₹899

Bearish Breakout Level: Below ₹794.75

Potential Downside: Targeting ₹731.10

Critical Juncture: The stock is at a key decision point. Monitor closely for a breakout in either direction to plan your trade.