Sbinlong

SBIN--Test of Supply is Needed??Observations::

price clears all the demand zones on bottom side...

now price is coming back to test the previous demand zone may acts supply zone

or to test strong fall area to again fall...

POI are marked on the chart please look at these areas...for sell

Keep track these levels. 580 and 590 Zone

SBIN--Bullish Outlook to Long ??Observations:: SBIN

--->> Price is trading in a channel...

if we see the difference between the HH is decreasing gradually...

which is a sign of reversal in this stock...

clearly price created a gapdown as well, indicating a bearish sign....

we are clearly in an uptrend, price tries to go upside from 570-555 range,

but that not move too much..only 20-30 points we can expect.

Look for buy when price comes back to the below levels,

We have a demand zone,@540 levels, and strong movement to the upside is observed at 530 levels,

if we enter long in this area we will ride the trend again and only be exited at 630 levels only.

Keep a note on this levels, and also track this levels.

SBIN--Drop base drop formation??Observations::

This is a continuation post to my previous post about SBIN::

Consolidation Happens between the demand zone and supply zones. Price restriction is happens between the zones.

While breaking the previous demand zone, price leaves a supply zone @586-590 range,

if price wants to test this supply zone and falls below or continue to fall down.

A Drop -Base-Drop is going to be observed, we have left with drop formation, if price breaks the smaller trendline will observe a fall towards target 1 and target2.

keep track this instrument.

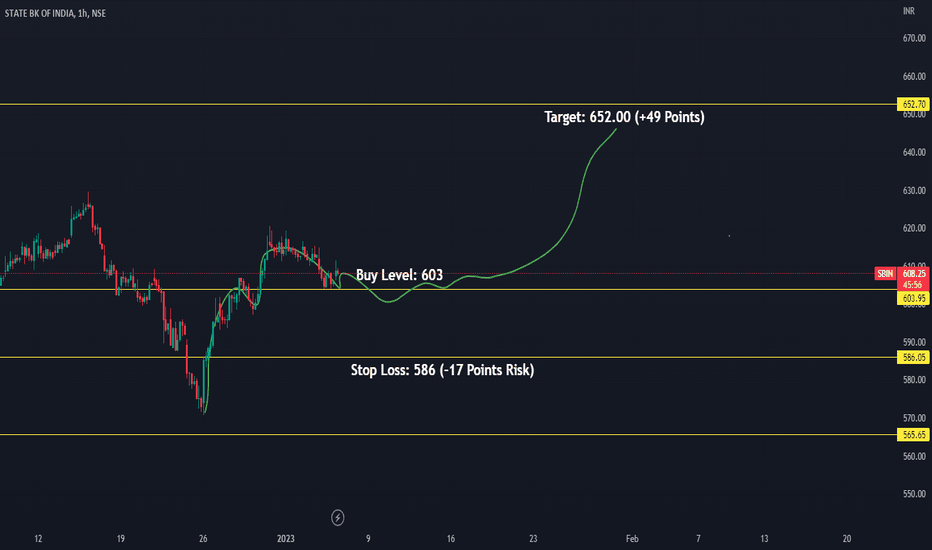

SBIN Conditional Buy levels 28.03.2023This is conditional buy view on NSE:SBIN . If 45min candle closed above 515, we can make a entry with stop loss of 507. My expected upside target will be 528.00. It would be positional trade for 1-2 days.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

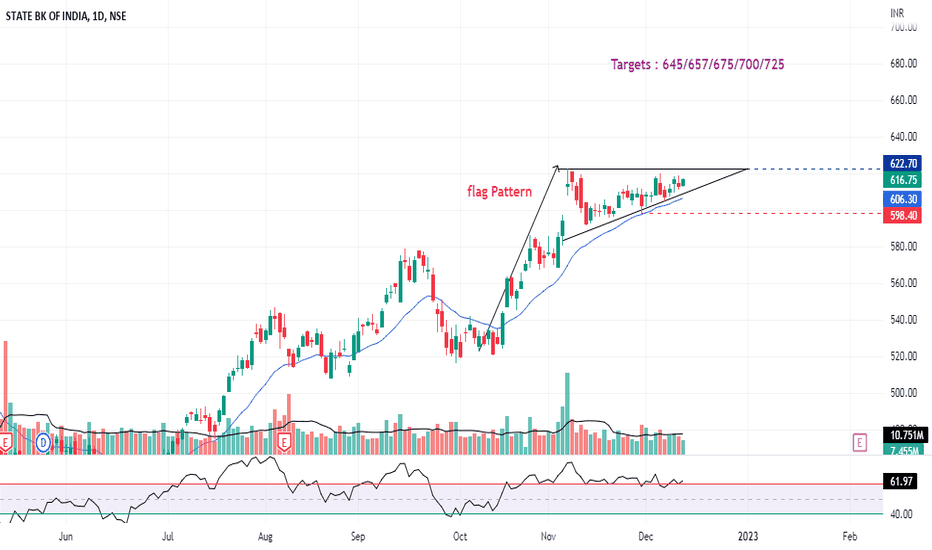

SBIN : Breakout Candidate (Flag Pattern)#SBIN : King of PSU Banks in a kind of Flag structure, Breakout Candidate Soon.

Good Strength in all 3 Time Frame (D/W/M)

Banking Sector will Grow as long as Indian Economy grows.

Take 10% & keep Trailling.

Happy Trading !!!

Keep Sharing, Loving & following to Learn more.

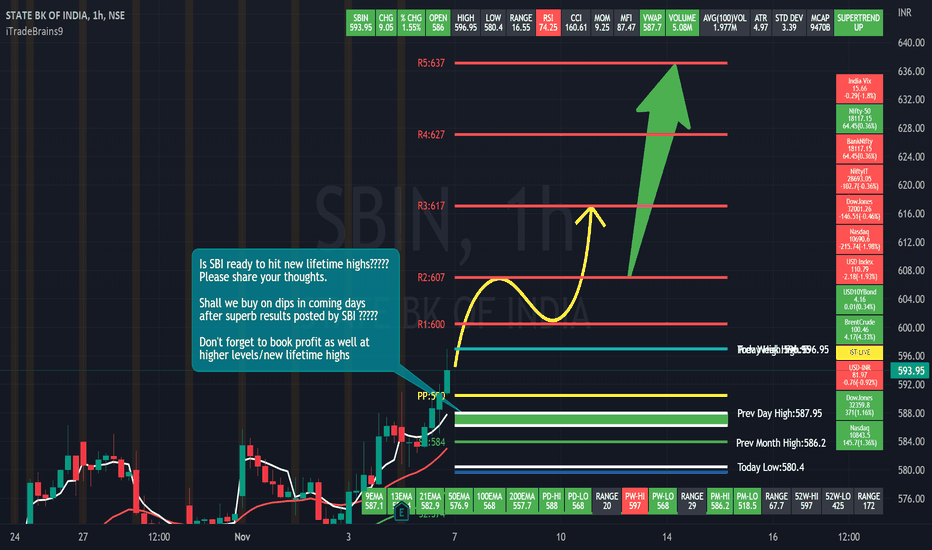

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.

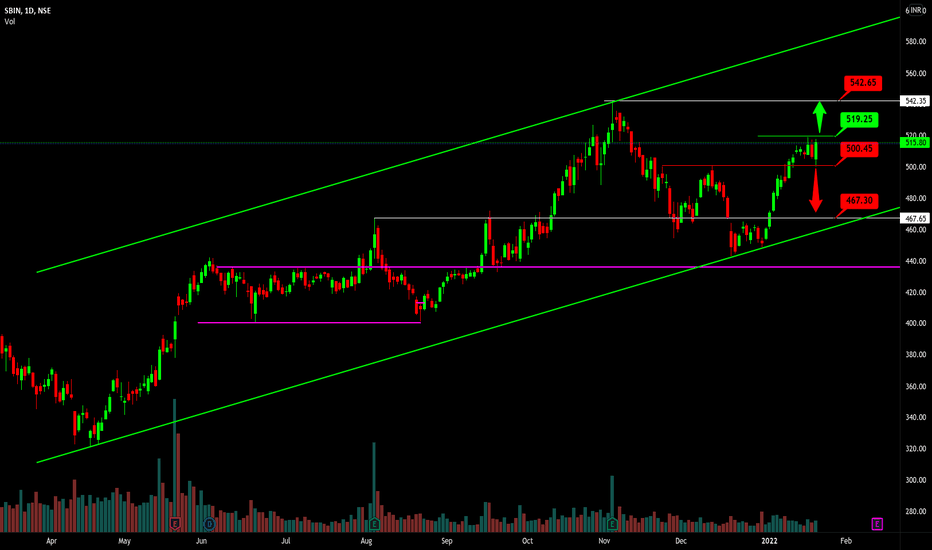

SBI reached near monthly resistanceDear traders, I have identified levels based on my analysis, major support and resistance levels. Please note that I am not a SEBI registered member. Information shared for educational purpose. Please do take trade based on your own analysis and risk-taking abilities. Never ever worked with fixed mindset. Any news/result data may change the direction of the trend instantly. Focus on learning so you can take correct/better decision based on your analytical skills. PLEASE NOTE THAT NO ONE CAN BE 100% CORRECT EXCEPT GOD. OVERALL, WE SHOULD BE ABLE TO CLOSE IN PROFIT EVEN IF WE ARE 50% CORRECT WITH RISK REWARD RATIO 1:2.

SBI reached near monthly resistance. Is it a good time to book profit?

Have I booked profit ? Yes, I booked it today and now I will wait for buying on dips opportunity.

Many Thanks, Have a profitable day ahead!

BUY SBIN AROUND 432-433 TGT 465/520 SL BELOW 398It is making a morning star pattern and taking the support of 50 week moving average. Looks good for a short term buy, especially when the government is planning to speed up bad bank process, also the previous quarterly results were good and the stock didn't make any wild move yet.