SBIN : at Wave C completion zoneSBIN Analysis (20th Dec 2024)

The chart of SBIN (State Bank of India) illustrates an extended retracement to mitigate liquidity, a failed breakout (BO), and a corrective wave completion. Let us dive into a step-by-step educational breakdown of actionable levels.

Current Structure:

The price has recently formed a corrective wave structure (A-B-C) and is trading near a potential demand zone around 818-834.

The first target zone lies between 850-852. Further breakout could lead to an extended target between 900-912.

The stop-loss is below 814, where failing the deep retracement may result in bearish continuation.

Action Plan:

Buying Opportunity: Consider entering near 818-834, as this aligns with the golden retracement zone. This is a low-risk entry given the confluence of previous support and corrective wave completion.

Targets: Book partial profits around 850-852. If momentum sustains, trail stop-loss to 845 and aim for 900-912 as the extended target.

Stop Loss: Place a stop-loss below 814 to manage risk. A failure here could invalidate the setup, resulting in further downside risk.

Risk-Reward Ratio: Buying around 830 with a target of 850 (initial) and 900 (extended) offers a risk-reward ratio of approximately 1:3, making it a favorable trade setup.

Key Educational Note:

Green trendlines denote bullish movement, while red illustrates potential bearish risks. The yellow trends indicate a sideways range, highlighting consolidation zones.

Disclaimer: This is not financial advice. Always consult with a SEBI-registered advisor before trading. Like and share if you find this analysis helpful!

Sbintrend

SBIN--Bullish Outlook to Long ??Observations:: SBIN

--->> Price is trading in a channel...

if we see the difference between the HH is decreasing gradually...

which is a sign of reversal in this stock...

clearly price created a gapdown as well, indicating a bearish sign....

we are clearly in an uptrend, price tries to go upside from 570-555 range,

but that not move too much..only 20-30 points we can expect.

Look for buy when price comes back to the below levels,

We have a demand zone,@540 levels, and strong movement to the upside is observed at 530 levels,

if we enter long in this area we will ride the trend again and only be exited at 630 levels only.

Keep a note on this levels, and also track this levels.

SBIN--Drop base drop formation??Observations::

This is a continuation post to my previous post about SBIN::

Consolidation Happens between the demand zone and supply zones. Price restriction is happens between the zones.

While breaking the previous demand zone, price leaves a supply zone @586-590 range,

if price wants to test this supply zone and falls below or continue to fall down.

A Drop -Base-Drop is going to be observed, we have left with drop formation, if price breaks the smaller trendline will observe a fall towards target 1 and target2.

keep track this instrument.

SBIN--Fake Breakout @590 range.----->> after strong fall from 588-590 range, price again coming back to supply zone with consolidation to upside,

if failed to create a new high and falls below 575 range then sell for the target of 565 range.

the demand zone @ 575 range acts as support and the demand zone created at 582 becomes resistance, hence price is in consolidation.

if price consolidation to downwards price again rise from 565 range.

Monthly expiry is between 590 to 565 range.

keep track of these levels.

SBIN--Which is Support Trendline or Resistance??Observations::

the stock is trending upwards.

------>>Today SBIN is showing Bearish pressure.

-------->>Bearishness is continue or Reversal May Happen at 570 levels.

---------->>Previously A strong selling pressure is observed at 570 level ,look at the reaction at these levels to go upside or downside.

---------->>Previous Resistance if turned as Support again, price will rise.

------------>>price break and acts as resistance more fall is going to observe. keep an eye at these levels.

------>> we have a trendline support as well, keep look at these levels.

Please like, if this information is Helpful.

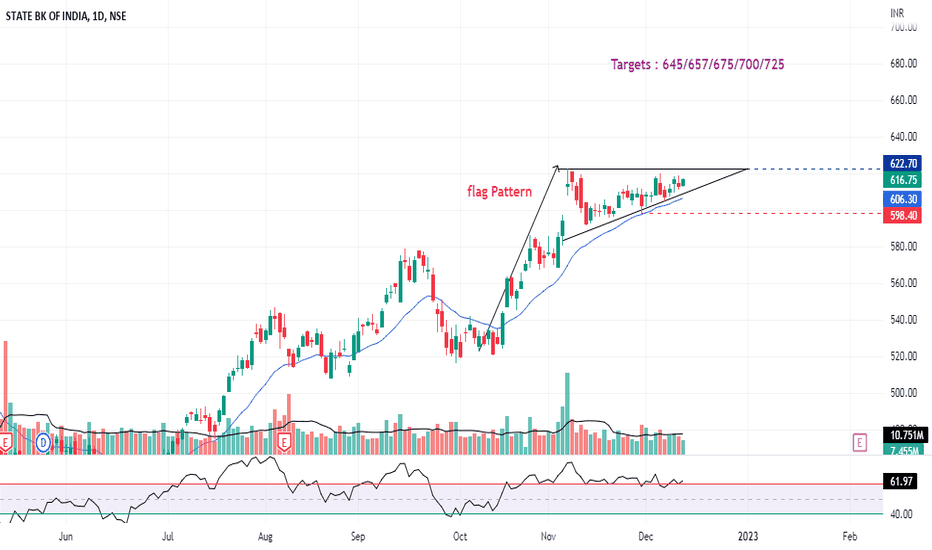

SBIN : Breakout Candidate (Flag Pattern)#SBIN : King of PSU Banks in a kind of Flag structure, Breakout Candidate Soon.

Good Strength in all 3 Time Frame (D/W/M)

Banking Sector will Grow as long as Indian Economy grows.

Take 10% & keep Trailling.

Happy Trading !!!

Keep Sharing, Loving & following to Learn more.

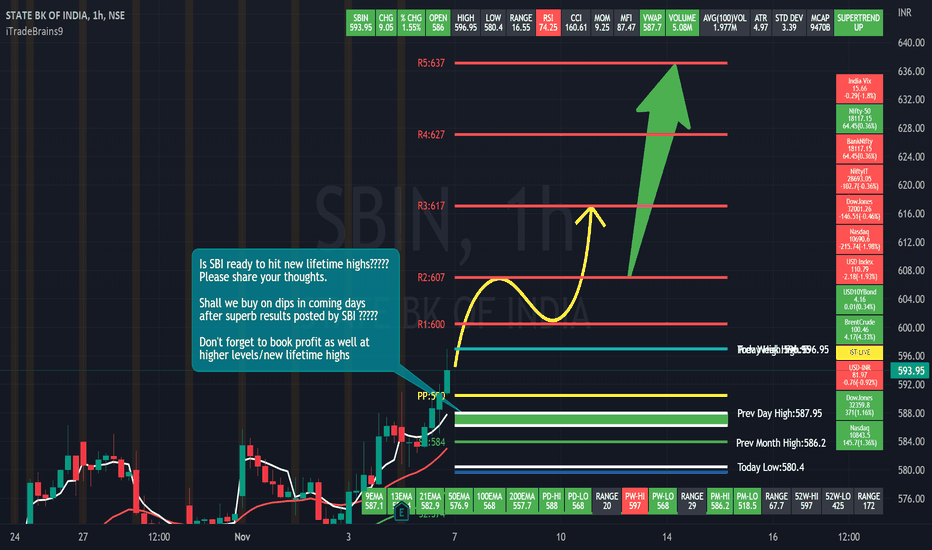

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.

SBIN | Good Short Opportunity.When it comes to the technical analysis of SBIN, you might get an impulse to the downside. Based on my technical analysis, you might see a fall to the downside. If you are going in, better find a pullback. I have marked a good entry area on the chart; you may use it as an entry area. And also don't forget to place the stop just above the entry area.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

If you find this technical analysis useful, please like & share our ideas with the community.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

SBIN | Good Sell Opportunity. Go Short!If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

SBIN | Go long | Use the Pull Back.When it comes to SBIN , the stock is still in good uptrend. Last day market closed near 460 & likely to reach 464 soon. Though it is not a good idea to take the position right now since price is too far from previous support area and it is also expensive now. I think you might get a good pull back to get in. You could use the support area to get in when price falls. When market opens next day, if the price gaps down & break S1, make sure to go long from S2; which is a demand area. Once you are in, make sure to place the stop below the nearly support area .

If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

sbin upside move we can see 300++sbin share news,

sbin share price,

sbin share latest news today,

sbin share latest news,

sbin share analysis,

sbin share news today,

sbin share price target tomorrow,

sbin share target,

sbin share buy or not,

sbi bank share,

sbin share chartink,

sbin shares,

sbin share future,

sbin share forecast,

sbin share intraday tips today,

sbin share latest news telugu,

sbin share latest news tamil,

sbin share latest news malayalam,

sbin share latest,

sbin share latest news english,

sbin share market,

sbi share news,

sbin share options,

sbin share price target,

sbin share prediction,

sbin share price target 2020,

sbin share price target 2021,

sbin share price today,

sbin share review,

sbin share result,

sbin share tomorrow,

sbin share today,

sbin share target today,

sbin share tips,

sbin share target next,

sbin share target price,